Pound Rises On Strong U.K. Jobs Data

10 Setembro 2024 - 3:41AM

RTTF2

The British pound strengthened against other major currencies in

the European session on Tuesday, after data showed that U.K.

unemployment rate dropped in the three months to July and the wage

growth softened to a two-year low, signaling that the labor market

conditions continued to cool.

Data from the Office for National Statistics showed that the

unemployment rate fell to 4.1 percent in the three months to July

from 4.2 percent in the preceding period. The rate came in line

with expectations.

Annual growth in average earnings, excluding bonuses, was 5.1

percent in the three months to July, as expected, but weaker than

the 5.4 percent posted in the prior period. This was the weakest

since 2022.

Earnings including bonuses climbed 4.0 percent from a year ago,

following a 4.6 percent rise in three months to June. This was also

slower than the forecast of 4.1 percent.

Further, data showed that vacancies decreased on the quarter for

the 26th consecutive period. The number of vacancies decreased

42,000 sequentially to 857,000 in the June to August period.

The British sterling held steady against its major rivals in the

Asian trading today.

In the European trading now, the pound rose to 4-day highs of

0.8426 against the euro and 1.1122 against the Swiss franc, from

early lows of 0.8448 and 1.1088, respectively. If the pound extends

its uptrend, it is likely to find resistance around 0.82 against

the euro and 1.14 against the franc.

Against the U.S. dollar, the pound advanced to 1.3108 from an

early near 3-week low of 1.3058. The pound may test resistance near

the 1.33 region.

The pound edged up to 188.11 against the yen, from an early low

of 186.98. On the upside, 190.00 is seen as the next resistance

level for the pound.

Looking ahead, U.S. Redbook report is slated for release in the

New York session.

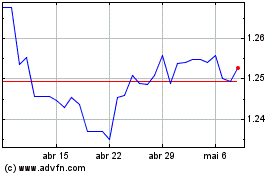

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Nov 2024 até Dez 2024

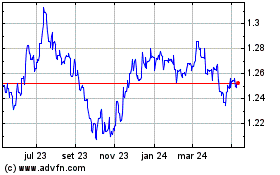

Sterling vs US Dollar (FX:GBPUSD)

Gráfico Histórico de Câmbio

De Dez 2023 até Dez 2024