Yen Rises After Ishiba Wins LDP Election

30 Setembro 2024 - 1:26AM

RTTF2

The Japanese yen strengthened against other major currencies in

the early European session on Monday, after the Japan's ruling

Liberal Democrats chose Shigeru Ishiba, a former defense minister,

as the next prime minister.

Ishiba is set to succeed current Prime Minister Fumio Kishida on

Tuesday. After winning the party's vote on Friday, Ishiba said he

would mostly continue with Kishida's approach to trying to revive

Japan's sluggish economic growth.

He had expressed support for the Bank of Japan's efforts to

normalize monetary policy after many years of keeping them near

zero percent and may consider raising corporate taxes to rise and

increasing taxes on financial assets.

He defeated Ex-Economic Security Minister Sanae Takaichi, a

proponent of monetary easing, in a runoff election.

Reports over the weekend said that Ishiba proposed October 27

for a snap election.

Data from the Ministry of Land, Infrastructure, Transport, and

Tourism showed that Japan's housing starts decreased for the fourth

straight month in August. Housing starts dropped 5.1 percent

year-on-year in August, much faster than the 0.2 percent slight

fall in the previous month. Economists had expected a decrease of

3.3 percent.

The seasonally adjusted annualized number of housing starts rose

to 777,000 in August from 773,000 in July.

Data from the Ministry of Economy, Trade and Industry showed

that the total value of retail sales in Japan was up a seasonally

adjusted 0.8 percent on month in August, coming in at 13.772

trillion yen. That's up from 0.2 percent in July and 0.6 percent in

June.

On a yearly basis, retail sales advanced 2.8 percent, beating

forecasts for 2.6 percent and up from 2.7 percent in the previous

month.

In the early European session now, the yen rose to near 2-week

highs of 158.11 against the euro, 189.57 against the pound and

168.31 against the Swiss franc, from early lows of 159.57, 191.19

and 169.81, respectively. If the yen extends its uptrend, it is

likely to find resistance around 154.00 against the euro, 184.00

against the pound and 165.00 against the franc.

Against the U.S. and the Canadian dollars, the yen advanced to

near 2-week highs of 141.65 and 104.86 from early lows of 142.85

and 105.73, respectively. The yen is likely to find resistance

around 139.00 against the greenback and 102.00 against the

loonie.

Looking ahead, the Bank of England is set to issue U.K. mortgage

approvals for August at 4:30 am ET. The number of mortgage

approvals is expected to rise to 64,000 after an increase of 61,999

in the prior month.

In the New York session, U.S. Chicago PMI for September and U.S.

Dallas fed manufacturing index for September are slated for

release.

At 8:00 am ET, Destatis releases Germany's flash inflation data

for September. Economists expect inflation to slow to 1.5 percent

from 1.9 percent in August.

At 1:55 pm ET, U.S. Fed Chair Jerome Powell is scheduled to

speak at the National Association for Business Economics event

later in the day for clues to additional rate cuts.

The Federal Reserve reduced its benchmark interest rate by 50

basis points on September 12, marking the first decrease since

2020. Traders are now positioning themselves for the U.S. central

bank to cut rates by another 75-100 bps this year.

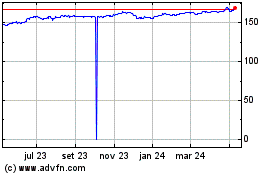

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Out 2024 até Nov 2024

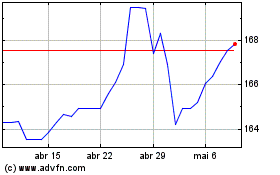

Euro vs Yen (FX:EURJPY)

Gráfico Histórico de Câmbio

De Nov 2023 até Nov 2024