China Holds Loan Prime Rates As Expected

19 Fevereiro 2025 - 10:50PM

RTTF2

The People's Bank of China maintained its interest rates

unchanged for the fourth straight time on Thursday.

The PBoC left its one-year loan prime rate unchanged at 3.10

percent. Likewise, the five-year LPR, the benchmark for mortgage

rates, was retained at 3.60 percent. The decision matched

expectations.

The bank had reduced its both LPRs by 25 basis points each in

October 2024.

The PBoC fixes the LPR monthly based on the submission of 18

designated banks. However, Beijing has influence over the fixing.

The LPR replaced the traditional benchmark lending rate in August

2019.

Data released this month showed that bank lending surged to a

record CNY 5.1 trillion in January but largely due to the season

factor. Lending usually remains the strongest at the start of the

year.

Earlier, Capital Economics said given the pressures on bank

profitability, the PBoC is likely to prioritize lowering reserve

requirements before proceeding with more rate cuts.

The firm said the central bank will avoid a rate cut that could

trigger additional depreciation of the currency amid trade tariff

threats.

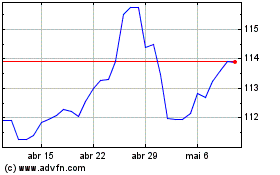

CAD vs Yen (FX:CADJPY)

Gráfico Histórico de Câmbio

De Jan 2025 até Fev 2025

CAD vs Yen (FX:CADJPY)

Gráfico Histórico de Câmbio

De Fev 2024 até Fev 2025