TIDMCGH

Chaarat Gold Holdings Limited

("Chaarat" or "the Company")

PRELIMINARY ANNOUNCEMENT OF AUDITED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31

DECEMBER 2011

Road Town, Tortola, British Virgin Islands (1 June 2012)

Chaarat Gold Holdings Limited today publishes its preliminary results for the

year ended 31 December 2011.

Highlights for the year

* Additional drilling takes resource up 27% to over 5.5m ounces at 4.08g/t

* Permitting and construction progress at Tulkubash

* Pre-Feasibility Study for Chaarat Project demonstrates robust economics and

that Project can support production of 200,000 ounces of gold per annum

* GBP50 million fund raising in March 2011 means that the Company is fully

funded until first production

Post balance sheet

* Temporary halt to expenditure on plant whilst the Company seeks to negotiate

stable terms with the Kyrgyz authorities

* Progress continues on major infrastructure items

Dekel Golan, CEO of Chaarat, commented:

"We have made considerable progress over the year on all major items and expect

to achieve first production in 2013, albeit slightly later than expected due to

the need to negotiate stable fiscal terms with the government. We are confident

that the funds raised in March 2011 will be adequate to complete the

construction of all elements to commence production."

Enquiries:

Chaarat Gold Holdings Limited +44 (0) 20 7499 2612

c/o Central Asia Services Limited

Dekel Golan CEO dekel@chaarat.com

Linda Naylor FD linda.naylor@chaarat.com

Numis Securities Limited +44 (0) 20 7260 1000

Alastair Stratton, Stuart Skinner (NOMAD)

James Black (Broker)

Bankside Consultants +44 (0) 20 7367 8888

Simon Rothschild simon.rothschild@bankside.com

Smith's Corporate Advisory +44 (0) 20 7601 6100

Dominic Palmer- Tomkinson tomkinson@smiths-ca.com

Chairman's Report

Early in 2011 the Board of your company took a strategic decision to change the

focus of Chaarat from exploration to production.

I am pleased to report on the solid progress which has been achieved since then:

the mineralisation of the Tulkubash Zone was confirmed as extending over a

strike length of several kilometres and comprising mostly non-refractory ore;

together with additional drilling within the existing envelope on the Contact

and Main Zones, Chaarat now has more than 5.5 million ounces of gold in resource

at an average grade of 4.08g/t. The extent of known mineralisation in these

three zones points to a gold deposit considerably larger than our declared

resource.

Progress was made towards the production of gold from the mostly oxide ore from

the Tulkubash Zone with the advancement of the permitting and construction

programmes, in addition to developing the infrastructure components of the

project and completion of the design and engineering works. The raising of GBP50

million of new equity in March 2011 by way of a private placing to a spread of

London institutions means that the Company is fully funded until first

production.

In addition to the progress towards production, we also released the results of

the Pre-Feasibility Study for the whole Chaarat Project. The results

demonstrate to investors and possible future partners the broader potential of

the project and establish a framework within which the results can be improved

upon. The study showed that the project can support production of 200,000 ounces

of gold per annum based on the existing resource. With more drilling and better

understanding of the process and mining costs, we believe that there is

considerable scope for improvement on the production rate and cost.

Following the drilling in the 2011 season we were pleased to announce an

increase in the resource of 27%. Chaarat is becoming a very significant deposit.

During 2012 management's focus will be on laying the groundwork for first

production rather than on further increasing the resource base.

The political system in the Kyrgyz Republic continues to stabilise and 2011 saw

parliamentary elections which resulted in a coalition government. The

presidential election two months later promoted the incumbent Prime Minister to

President, which resulted in a reshuffle of the coalition. This process caused

delay in the review of our permit application.

At the time of writing we have called a temporary halt to expenditure on

building the process plant while we discuss with the government of the Kyrgyz

Republic a long term arrangement on royalty and taxation.

The backdrop to this is the likelihood that the new Kyrgyz coalition government

will follow the trend of governments elsewhere in seeking larger contributions

from extractive industries. The Chaarat project will not only be amongst the

first to move into production in the country, but is also of sufficient scale to

merit, on the part of both government and Chaarat shareholders, a long term

agreement that is mutually beneficial to both parties. There are presently

indications that this can be achieved. The benefits to be derived from a

certainty of the long term conditions under which the Project operates will

considerably outweigh the delay to first production and interruption to current

progress on site.

Chaarat staff have worked with determination over the year. I thank them all

for their efforts which I am sure will continue unabated as we move ever closer

to production.

Christopher Palmer- Tomkinson

Chairman

Chief Executive Officer's Report

In 2011 Chaarat continued to focus on activities to achieve our strategic target

established in 2010 to move to production.

During the year the Company continued to make progress towards its main

operational objectives of facilitating early production during 2013, increasing

and improving the resource base at Chaarat and developing Chontash into another

major deposit.

The following report records our progress to date.

Project update

The Chaarat project will be developed in two principal stages; the Tulkubash

Project, which involves the processing of oxide material, and the Kiziltash

refractory stage. At first production will be on a small scale at 1,200 tonnes

per day (tpd) which equates to 30,000 -35,000 ounces of gold per annum,

increasing to 5,000 tpd (equivalent to 180,000 - 200,000 ounces of gold per

annum) as the whole project is brought on stream.

In 2011 we completed a Pre-Feasibility Study across the entire project which

will be updated this year to reflect our improved knowledge of Chaarat. In

accordance with local requirements we also completed a Feasibility Study for the

Tulkubash Project. This will be submitted for approval to meet one of the

conditions for the granting of a mining permit.

A major refinement to our strategy, with a consequent effect on the design

process, was the decision to build the plant to process the ore from early stage

production at the same location as the plant required for full production,

rather than as a standalone in a different location. We had originally planned

to build a small modular 700-1,000 tpd plant in a separate location to precede

construction of a new facility for the larger plant. This modification of the

strategy reflected our desire to increase production from this first phase to

generate early cash flow and also to reduce the impact of the fixed costs

associated with a production rate of 5,000 tpd or more envisaged for the second

phase.

The Pre-Feasibility Study was prepared on the basis of the plant being required

to process 5,000 tpd of sulphide ore. From this full production design,

development has been planned to allow for construction to be implemented in four

phases which can be added without disrupting ongoing operations. With this

design, production and construction will commence at a production rate of 1,200

tpd of free milling ore and be increased, when funds permit and without

interruption, to process 5,000 tpd of refractory ore. This "reverse

engineering" will ensure a smooth transition between the phases with the minimum

of redundant plant and the maximum utilisation of the limited space available.

The start-up phase for 1,200 tpd of free milling ore is a conventional flow

sheet used in many gold operations. It consists of primary and secondary

crushing, milling, carbon in leach (CIL), elution, electro-winning and smelting

to produce gold doré.

This change will lower costs and facilitate a smoother increase in production.

Studies have shown that doubling production from 1,200 tpd to 2,500 tpd will

cost approximately USD 15-20 million (including the necessary additions to the

mining fleet).

Detailed engineering works have commenced and most elements of the project have

been designed. This has enabled us to issue tenders to suppliers for the power

supply, road access, processing plant, tailings facility, mining fleet,

explosive supply systems and other elements of the operation.

Permits have been granted for the construction of the power line, roads, and the

temporary camp site which will be used until the permanent camp is built.

External power supply

Power supply is critical for any mining project and fortunately the Kyrgyz

Republic is well endowed with power generation capacity. Chaarat has already

secured an allocation of 25 megawatt (MW) from the Kristal substation. We also

managed to agree with the national power company that an allocation of at least

10 MW will be made available from the Karavan substation which is much closer to

Chaarat. We are currently considering whether we should build a generating

station in the Chatkal valley, as originally planned, or build a line direct to

Karavan. We are evaluating the cost implications and establishing whether one of

the neighbouring companies may be interested in sharing this cost. Connecting

to the very low cost Kyrgyz grid supply will add significant value to the

Chaarat project by considerably reducing the operating costs of production.

Permitting

The new Kyrgyz government, formed early in 2012 after the previous Prime

Minister was elected President, is contemplating, like many governments, the

right approach towards the taxation of extractive companies. Rather than set

clear rules the government has decreed that the fiscal terms of a project will

be determined by direct negotiations between the applicant and the government.

Chaarat has decided it is better to determine the terms prior to pressing ahead

and committing the finance required to bring the project into production.

Chaarat has commenced discussions with the government and we believe that the

outcome of these discussions will be both timely and positive. We will keep

shareholders updated on progress.

We originally expected to commence mining during 2012 and produce gold in April

2013. This was always subject to having secured permits on time. We still

believe we will be producing gold during 2013 with a slight delay caused by the

requirement to negotiate an investment agreement with the government.

Funding

As work has progressed, uncertainty over budget has decreased. Cost inflation in

the mining industry is a hot topic and many of our investors have been

concerned that we may have underestimated costs. We believe that using standard

equipment has helped us avoid the significant cost inflation which has occurred

in more dedicated highly specialised equipment, which is produced by a few large

suppliers.

We are confident that the funds raised in March 2011 will be adequate to

complete the construction of all elements to commence production at the lower

rate. We have already commenced negotiations for a working capital facility of

c$20million, which we currently intend to raise from non equity sources.

Chaarat will seek to increase its mostly free milling, open pittable Tulkubash

Reserve Base by further drilling and, if the results of the drilling are as

expected, develop a Definitive Feasibility Study underpinning a significantly

higher production rate for this phase of the project.

Additional investment will be required to achieve both an increased production

rate and access to a lower cost source of power, both of which are expected to

further improve the project's NPV. The board will consider the options

available when the results of the Definitive Feasibility Study are known. A

number of alternative financing options are available, should the board decide

to pursue the upgraded project.

We continue to strengthen and build our core management and I am privileged to

work with an exceptional team of people who continue to drive Chaarat ever

onwards towards production; for which I thank them.

Dekel Golan

Chief Executive Officer

Consolidated income statement

For the years ended 31 December

2011 2010

USD USD

Exploration expenses (5,984,284) (7,242,318)

Administrative expenses (5,278,133) (3,451,225)

Administrative expenses- Share options expense (1,590,898) (588,587)

Administrative expenses- Foreign exchange loss (331,856) (168,336)

=------------------------------------------------------------------------------

Total administrative expenses (7,200,887) (11,450,466)

=------------------------------------------------------------------------------

Other operating income 97,254 -

=------------------------------------------------------------------------------

Operating loss (13,087,917) (11,450,466)

Financial income 719,868 14,363

Taxation - -

=------------------------------------------------------------------------------

Loss for the year, attributable to equity

shareholders of the parent (12,368,049) (11,436,103)

=------------------------------------------------------------------------------

Loss per share (basic and diluted) - USD cents (5.31)c (9.12)c

=------------------------------------------------------------------------------

Consolidated statement of comprehensive income

For the years ended 31 December

2011 2010

USD USD

Loss for the year, attributable to equity (12,368,049) (11,436,103)

shareholders of the parent

Other comprehensive income:

Exchange differences on translating foreign 13,154 (143,478)

operations

=------------------------------------------------------------------------------

Other comprehensive income for the year, net of tax 13,154 (143,478)

=------------------------------------------------------------------------------

Total comprehensive income for the year attributable

to equity shareholders of the parent (12,354,895) (11,579,581)

=------------------------------------------------------------------------------

Consolidated Balance Sheet

At 31 December

2011 2010

USD USD

=-------------------------------------------------------------------

Assets

Non-current assets

Intangible assets 34,297 20,082

Mining exploration assets 8,349,367 8,349,367

Mine properties 3,949,756 -

Property, plant and equipment 2,134,419 596,502

Assets in construction 6,510,020 -

Other receivables 1,543,050 50,456

=-------------------------------------------------------------------

22,520,909 9,016,407

=-------------------------------------------------------------------

Current assets

Inventories 1,328,367 150,035

Trade and other receivables 6,521,197 1,619,590

Cash and cash equivalents 61,184,915 10,124,977

=-------------------------------------------------------------------

69,034,479 11,894,602

=-------------------------------------------------------------------

Total assets 91,555,388 20,911,009

=-------------------------------------------------------------------

Equity and liabilities

Equity attributable to shareholders

Share capital 2,504,778 1,470,339

Share premium 128,551,662 48,949,592

Other reserves 14,308,874 13,839,590

Translation reserve (1,070,180) (1,083,334)

Accumulated losses (55,420,195) (44,173,760)

=-------------------------------------------------------------------

Total equity 88,874,939 19,002,427

=-------------------------------------------------------------------

Non-current liabilities

Deferred tax 460,189 487,000

=-------------------------------------------------------------------

460,189 487,000

=-------------------------------------------------------------------

Current liabilities

Trade and other payables 1,096,066 646,788

Accrued liabilities 1,124,194 774,794

=-------------------------------------------------------------------

2,220,260 1,421,582

=-------------------------------------------------------------------

Total liabilities 2,680,449 1,908,582

=-------------------------------------------------------------------

Total liabilities and equity 91,555,388 20,911,009

=-------------------------------------------------------------------

Consolidated Statement of Changes

in Equity

For the Years Ended 31 December

Share Share Accumulated Other Translation

Capital Premium USD Losses Reserves Reserve USD Total

USD USD USD USD

=-------------------------------------------------------------------------------------

Balance at

31 December 1,129,110 27,499,843 (32,798,843) 13,312,190 (939,856) 8,202,444

2009

=-------------------------------------------------------------------------------------

Currency - - - - (143,478) (143,478)

translation

Other

comprehensive - - - - (143,478) (143,478)

income

Loss for the

year ended - - (11,436,103) - - (11,436,103)

31 December

2010

Total

comprehensive - - (11,436,103) - (143,478) (11,579,581)

income for

the year

Share options - - 61,186 (61,186) - -

lapsed

Share options - - - 588,586 - 588,586

expense

Issuance of

shares for 119,282 7,500,134 - - - 7,619,416

acquisition

Issuance of

shares for 221,947 14,386,364 - - - 14,608,311

cash

Share issue - (436,749) - - - (436,749)

costs

=-------------------------------------------------------------------------------------

Balance at

31 December 1,470,339 48,949,592 (44,173,760) 13,839,590 (1,083,334) 19,002,427

2010

=-------------------------------------------------------------------------------------

Currency - - - - 13,154 13,154

translation

Other

comprehensive - - - - 13,154 13,154

income

Loss for the

year ended - - (12,368,049) - - (12,368,049)

31 December

2011

Total

comprehensive - - (12,368,049) - 13,154 (12,354,895)

income for

the year

Share options - - 1,121,614 (1,121,614) - -

lapsed

Share options - - - 1,590,898 - 1,590,898

expense

Issuance of

shares for 1,034,439 83,036,336 - - - 84,070,775

cash

Share issue - (3,434,266) - - - (3,434,266)

costs

=-------------------------------------------------------------------------------------

Balance at

31 December 2,504,778 128,551,662 (55,420,195) 14,308,874 (1,070,180) 88,874,939

2011

=-------------------------------------------------------------------------------------

Consolidated Cash Flow Statement

For the Years Ended 31 December

2011 2010

USD USD

=------------------------------------------------------------------------------

Operating activities

=------------------------------------------------------------------------------

Loss for the year (12,368,049) (11,436,103)

Adjustments:

Amortisation expense - intangible assets 18,545 25,520

Depreciation expense - property, plant and equipment 576,871 490,024

(Profit)/loss on disposal of property, plant and (97,254) 5,094

equipment

Finance income (719,868) (14,363)

Share based payments 1,590,898 588,587

Losses/(gains) on foreign exchange 329,805 (42,590)

(Increase)/decrease in inventories (942,364) 8,553

Increase in accounts receivable (6,359,430) (1,080,142)

Increase in accounts payable 24,337 688,041

=------------------------------------------------------------------------------

Net cash flow used in operations (17,946,509) (10,767,379)

=------------------------------------------------------------------------------

Investing activities

=------------------------------------------------------------------------------

Purchase of computer software (34,086) (3,664)

Purchase of tangible assets (12,156,715) (98,445)

Acquisition of subsidiary (net of cash acquired) (143,847) 5,865

Proceeds from sale of equipment 293,263 -

Loans repaid - 4,407

Interest received 719,868 14,363

=------------------------------------------------------------------------------

Net cash used in investing activities (11,321,517) (77,474)

=------------------------------------------------------------------------------

Financing activities

=------------------------------------------------------------------------------

Proceeds from issue of share capital 84,070,775 14,608,310

Issue costs (3,434,266) (436,749)

=------------------------------------------------------------------------------

Net cash from financing activities 80,636,509 14,171,561

=------------------------------------------------------------------------------

Net change in cash and cash equivalents 51,368,483 3,326,708

Cash and cash equivalents at beginning of the year 10,124,977 6,812,046

Effect of changes in foreign exchange rates (308,545) (13,777)

=------------------------------------------------------------------------------

Cash and cash equivalents at end of the year 61,184,915 10,124,977

=------------------------------------------------------------------------------

Notes:

1. Preparation of accounts

The financial information set out in this announcement does not constitute the

Company's statutory accounts for

the years ended 31 December 2011 or 2010. The statutory accounts for the year

ended 31 December 2011 have

been finalised on the basis of the financial information presented by the

directors in this preliminary

announcement.

The consolidated balance sheet at 31 December 2011, the consolidated income

statement, consolidated statement of changes in equity, consolidated cash flow

statement and associated notes for the year then ended have been extracted from

the Group's 2011 annual financial statements upon which the auditors' opinion is

unqualified.

2. Loss per share

Loss per share is calculated by reference to the loss for the year of USD

12,368,049 (2010: USD 11, 436,103) and the weighted number of shares in issue

during the year of 232,963,591 (2010: 125,387,960)

There is no dilutive effect of share options.

3. Selected accounting policies

BASIS OF PREPARATION

The financial information has been prepared in accordance with IFRS as adopted

by the European Union. As detailed under the Basis of consolidation note, the

acquisition of the Company in 2007 was treated as a reverse acquisition by its

then operating subsidiary, without the presence of goodwill. The principal

accounting policies adopted in the preparation of the annual financial

statements are set out below. The policies have been consistently applied.

There are no new and revised Standards and Interpretations issued by the

International Accounting Standards Board ("IASB") that are relevant to its

operations and effective for accounting periods beginning 1 January 2011.

The Group has not adopted any standards or interpretations in advance of the

required implementation dates. It is not expected that adoption of standards or

interpretations which have been issued by the International Accounting Standards

Board but have not been adopted will have a material impact on the financial

statements.

GOING CONCERN AND FUNDING REQUIREMENTS

In common with many exploration and development groups, the Group raises finance

for its exploration, appraisal and development activities in discrete tranches.

A fund raising was completed in March 2011 which raised GBP 51.6 million before

expenses (approximately USD 81.5 million). The funds were raised to fast track

the Tulkubash Project to production including developing the required

infrastructure. The Company is satisfied that the original budget, as presented

when the funds were raised in March 2011, remains adequate to complete

construction of all elements to commence production.

As announced on 16 April 2012, pending negotiations with the Kyrgyz government

regarding the fiscal terms of the project, further capital investment activities

(other than the infrastructure projects relating to power and roads and certain

other key procurements which have already commenced and will be completed) will

be suspended until agreement is reached. Chaarat has entered into direct

negotiation with the government of the Kyrgyz Republic, the aim of which is to

secure long term stability for the Chaarat Project by the development of a

mutually agreed Investment Agreement, containing a "stabilisation clause",

protecting the Group from changes to taxation, ownership structure and

royalties.

Based on a review of the Group's budgets and cash flow plans and the flexibility

to alter these to suit prevailing circumstances, the Board considers this is

sufficient to maintain the Group as a going concern for a period of over twelve

months from the date of signing the annual report and accounts. The Board is

satisfied that it has sufficient funds for going concern purposes whether or not

agreement is reached with the government on a timely basis. However, additional

funds of approximately $20m will be required for working capital purposes to

reach production. The Board believes, based on early indications from suitable

sources, that the funding will be available but no such facility is currently in

place. If a working capital facility is not put in place the Group may not be

able to fully develop the Tulkubash project and the carrying value of the

project may become impaired.

At 31 December 2011, the Group had cash and cash equivalents of USD 61.1million

and no borrowings.

4. Timetable and distribution of accounts

The Annual General Meeting will be held at 10:00 on 12th July 2012 at the

offices of the Company's Nominated Adviser, Numis Securities Limited, The London

Stock Exchange Building,

10 Paternoster Square, London EC4M 7LT.

Additional copies of the Annual Report and Accounts, Notice of AGM and Proxy

form will be available, free of charge, from Central Asia Services Limited, 6

Conduit Street, London, W1S 2XE, for a period of 14 days from the date of

posting and will be made available on the Company's website - www.chaarat.com.

Note to Editors:

About Chaarat Gold

Chaarat Gold is an exploration and development company operating in the Kyrgyz

Republic. The Company's main activity is the development of the Chaarat Gold

Project situated within the Middle Tien Shan Mountains of Kyrgyzstan, which form

part of the Tien Shan gold belt. The Company has delineated a JORC compliant

mineral resource of 5.59Moz at a grade of 4.08g/t gold. Chaarat's key objective

is to become a low cost gold producer; with initial production from the

Tulkubash project, targeting increased combined annual production of over

200,000 ounces as the full project comes on stream.

Further information is available at www.chaarat.com

This announcement is distributed by Thomson Reuters on behalf of

Thomson Reuters clients. The owner of this announcement warrants that:

(i) the releases contained herein are protected by copyright and

other applicable laws; and

(ii) they are solely responsible for the content, accuracy and

originality of the information contained therein.

Source: Chaarat Gold Holdings Ltd via Thomson Reuters ONE

[HUG#1616800]

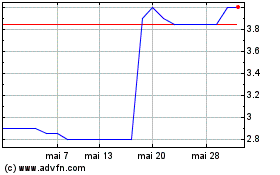

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Chaarat Gold (LSE:CGH)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024