TIDMSPDI

RNS Number : 7132B

Secure Property Dev & Inv PLC

14 June 2021

Secure Property Development & Invest PLC/ Index: AIM / Epic:

SPDI / Sector: Real Estate

14 June 2021

Secure Property Development & Investment PLC ('SPDI' or 'the

Company')

Update on Arcona Property Fund N.V. Agreement

Highlights

-- Agreements signed for Stage Two of the Arcona transaction

which involves transfer of certain SPDI assets in Romania and

Ukraine in exchange for Arcona shares and warrants and EUR1m cash

(the 'Arcona Transaction')

-- Estimated EUR8.2 million value of Stage Two alone is almost

at par with SPDI's overall current market capitalisation,

highlighting significant divergence between real asset value within

the Company and market value of the Company

-- Arcona Transaction, which has an estimated intrinsic value of

EUR30 million, is in line with strategy to create a larger Central

and South Eastern European focused investment vehicle

Secure Property Development and Investment PLC (AIM: SPDI), the

AIM-quoted South Eastern European focused property company, is

pleased to announce the signing of three agreements ('the

Agreements') relating to the proposed transfer of certain assets

owned by SPDI in Romania and Ukraine (together 'the Stage Two

Assets') to Arcona Property Fund N.V. ('Arcona'). Under the terms

of the Agreements, SPDI will receive approximately 605,000 new

ordinary shares in Arcona (the 'Stage Two Shares') and

approximately 145,000 warrants over ordinary shares in Arcona (the

'Stage Two Warrants') (the 'Stage Two Transaction') as well as

EUR1m in cash, subject to, inter alia, standard form adjustment and

finalisation in accordance with the Agreements.

Creating a larger Central and South Eastern European focused

investment vehicle

The transfer of the Stage Two Assets represents the second stage

of an intended three-stage process for the Arcona Transaction to

complete the previously announced transfer to Arcona of SPDI's

property portfolio, excluding its Greek logistics properties, to

create a leading Central and South Eastern European focused

property investment vehicle. In exchange for the transfer of the

Company's assets, and subject to the same standard form adjustment

and finalisation mentioned above, SPDI is to be issued new ordinary

shares in Arcona and warrants over Arcona ordinary shares. Arcona

invests in Central European commercial property and is listed on

Euronext Amsterdam and the Prague Stock Exchange. As at close of

markets on 10 June 2021, Arcona's share price was EUR6.08.

EUR8.2 million value of the Stage Two Transaction

The total EUR8.2 million value of the Stage Two Transaction

(based on a net asset value of EUR11.87 per Arcona share as at 31

December 2020) is almost at par with SPDI's current overall market

capitalisation which, in addition to the Stage Two Assets, reflects

Arcona shares held already by SPDI following the completion of

Stage One of the Arcona Transaction, as well as the Assets to be

included in Stage Three of the Arcona Transaction (the 'Stage Three

Transaction').

Stage Two Transaction

The Stage Two Assets which, as per the Company's unaudited 31

December 2020 financials, recorded an aggregate Gross Asset Value

of EUR15.1 million, comprise the following:

-- EOS, a purpose built one-tenant office building in Bucharest Romania leased to Danone Romania

-- 24,345% of the Delenco office building also in Bucharest,

fully let to a number of tenants with the anchor tenant being

ANCOM, the telecoms regulator in Romania

-- Two plots of land for development in Kiev

Closing of the Stage Two Transaction is expected to take place

in H2 2021, at which point SPDI will be issued the Stage Two Shares

and the Stage Two Warrants. As previously disclosed, SPDI intends,

in time, to distribute the Arcona shares and warrants to its

Shareholders.

In August 2019, SPDI and Arcona signed a conditional Framework

Agreement which sets out the process by which both parties will

proceed to execute the Stage Two Transaction and Stage Three

Transaction. It should be noted that completion of the Stage Two

Transaction is not conditional on reaching agreement on the Stage

Three Transaction, discussions on which are still ongoing. It is

likely that closing of the Stage Two Transaction will be

conditional on SPDI Shareholder approval pursuant to AIM Rule 15,

and further updates will be provided in this regard as and when

appropriate.

Michael Beys, Chairman, said ; "With an estimated intrinsic

value of EUR30million, the Arcona transaction has been worth

pursuing, as per our shareholders' guidance, despite the challenges

posed, both at corporate and personal levels, by the global

pandemic and associated lockdowns. It is therefore a testament to

the perseverance of the board and the management team that the

transaction has been advanced to the point of signing the

agreements for Stage Two. With an estimated value of EUR8.2

million, Stage Two on its own highlights the substantial divergence

that has opened up between how the market and the industry value

SPDI's portfolio of South Eastern European real estate. The

expected completion of Stage Two later this year therefore ought to

act as a value trigger event for shareholders, not just because it

crystallises the value of the assets concerned, but also because

SPDI will be issued with shares in a much larger and more

diversified Central and South Eastern European focused property

company."

Shareholder call

The Company intends to hold a shareholders' call within the next

few weeks, during which management will provide a review of the

Arcona Transaction and answer any questions raised by its

shareholders. Further details regarding the shareholder call will

be provided in due course.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014.

* * ENDS * *

Lambros Anagnostopoulos SPDI Tel: +357 22 030783

Rory Murphy Strand Hanson Limited Tel: +44 (0) 20 7409 3494

Ritchie Balmer

Rob Patrick

Jon Belliss Novum Securities Limited Tel: +44 (0) 207 399 9400

Frank Buhagiar St Brides Partners Ltd Tel: +44 (0) 20 7236 1177

Cosima Akerman

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDLLLFFFQLBBBL

(END) Dow Jones Newswires

June 14, 2021 02:00 ET (06:00 GMT)

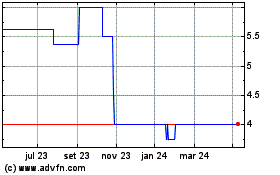

Secure Property Developm... (LSE:SPDI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Secure Property Developm... (LSE:SPDI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025