TIDMMPL

RNS Number : 0152C

Mercantile Ports & Logistics Ltd

16 June 2021

16 June 2021

Mercantile Ports & Logistics Limited

("MPL", the "Group" or the "Company")

Re-structured Debt Facility

and

Board Appointment

Mercantile Ports & Logistics Limited, which is operating and

developing out its port and logistics facility in Navi Mumbai,

Maharashtra, India is pleased to announce that it has successfully

negotiated and executed a re-structured debt facility with its

consortium of banks that both takes into account the significant

progress made with business at its Karanja port and logistics

facility while also recognising the acute disruption in India

caused by the Covid-19 pandemic.

The terms of the re-structured debt facility are favourable to

the Company, in summary:

-- Debt Interest Rate lowered from 13.45% to 9.5% per annum.

-- There will be a moratorium on interest rate payments until

February 2022 in recognition of the severity of the Covid-19

pandemic which is currently impacting India.

-- The commencement of the amortisation of the principal loan

amount has also been extended by 24 months from October 2020 to

October 2022.

While the interest moratorium and extended amortisation period

are a feature of the Reserve Bank of India's Covid-19 relief

policy, MPL is pleased to note that the almost 400 bps reduction in

the interest rate is based on the consortium banks own independent

viability report on MPL's business on the ground. The terms of the

re-structured debt facility underscore that the facility is now

revenue generating and has a healthy pipeline of future

customers.

MPL is also pleased to announce the appointment of Peter Mills

as a Non-Executive Director and Chair of the audit committee with

immediate effect.

Peter is an experienced Chairman and Board member, both

non-executive and executive, with a strong corporate governance and

regulatory understanding. He has a widespread industry knowledge

with approximately 30 years in onshore and offshore financial

services markets and broad involvement with government and

regulators. Having qualified as a Chartered Accountant in 1996, his

directorships have included banking groups, fund management

companies, fiduciary services companies, listed and unlisted

investment funds, captive insurance company and leasing companies.

His fund management and investment fund roles have predominately

been in the infrastructure, private equity and property asset

classes.

Jeremy Warner Allen, Chairman of MPL said , "The restructured

debt facility is testament to the growing strength of MPL's

business. The opportunities now available to MPL are significant

and it is very pleasing to note that our consortium of banks

endorse our business.

"Our Karanja based port and logistics facility has moved from

being a development project to becoming a revenue generating asset.

While the Covid-19 pandemic has, as for many companies in India and

around the world, had an impact on our business, I am pleased about

the progress that has been made by our business development team.

While navigating the Covid-19 restrictions, they have continued to

sign new customers and develop a healthy pipeline of new business

that could use the facility.

"I am also delighted to welcome Peter Mills to the MPL Board.

His extensive experience will bring invaluable skills and expertise

to the Group especially in his role as Chair of the Audit

Committee."

Jay Mehta, CEO of MPL stated , "The restructuring of our debt

facility is an important milestone. Our consortium of bankers,

after conducting their own diligence and viability studies in

conjunction with independent rating agencies, have deemed our

business worthy of a significant reduction in interest rate on our

term loan.

"I am also particularly pleased that the moratorium in principal

payments and interest payments gives significant flexibility to our

business as we navigate around the global pandemic. We continue to

make progress with potential end customers and will further update

the market in due course".

This announcement contains inside information.

Further information pursuant to Schedule Two, paragraph (g) of

the AIM Rules:

Peter David Mills, aged 51, is currently or has previously been

a director of the following companies within the past five

years:

Current Directorships

Guernsey Union D'Escrime LBG

Aspida Services Limited

Beauvoir Group Limited

Mercantile Ports & Logistics Limited

Basalt Infrastructure Partners III GP Limited

M&G (Guernsey) Limited

The M&G Offshore UK Inflation Linked Corporate Bond

Fund Limited

The M&G Offshore Corporate Bond Fund Limited

The M&G Offshore Global Dividend Fund Limited

The M&G Offshore Global High Yield Bond Fund Limited

The M&G Offshore Global Macro Bond Fund Limited

The M&G Offshore Recovery Fund Limited

Aspida Advisory Services Limited

Shelley Capital (Guernsey) Limited

Aspida Group Limited

EFG Private Bank (Channel Islands) Limited

Magellan Limited

Basalt Infrastructure Partners II GP Limited

BWE GP II Limited

Butterfield Trust (Guernsey) Limited

Basalt Infrastructure Partners GP Member Limited

KYC ME (Guernsey) Limited

Icondia Limited

The Finance Sector Non-Executive Director Forum LBG

BWE GP Limited

Basalt Infrastructure Partners GP Limited

Two Acres Limited

Mid Europa Fund Management Limited

Past Directorships

InfraRed NF China Real Estate Company Limited

InfraRed NF China Investors GP Limited

Beauvoir Tax and Accounting Services Limited

Shield Blockchain Infrastructure PCC Limited

Inside Africa Capital Advisors & Wealth Management

Limited

DEBL Capital Partners Limited

Enhance Group Limited

There is no further information required to be disclosed

pursuant to Schedule Two, paragraph (g) of the AIM Rules for

Companies

Peter holds no interest in the Company's shares

Enquiries:

Mercantile Ports & Logistics Jay Mehta

Ltd

C/O SEC Newgate

+44 (0)203 757 6880

Cenkos Securities plc Stephen Keys

(Nomad and Joint Broker) +44 (0)207 397 8900

Zeus Capital Limited John Goold (Corporate Broking)

(Joint Broker) +44 (0)203 829 5000

SEC Newgate Adam Lloyd/Isabelle Smurfit

(Financial PR) +44 (0)203 757 6880

mpl@secnewgate.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEANKSFAXFEFA

(END) Dow Jones Newswires

June 16, 2021 02:00 ET (06:00 GMT)

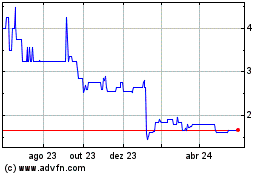

Mercantile Ports & Logis... (LSE:MPL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

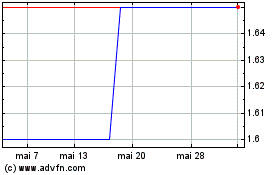

Mercantile Ports & Logis... (LSE:MPL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025