Mercantile Ports & Logistics Ltd Accounts Filing Extension and Update (5542D)

30 Junho 2021 - 3:00AM

UK Regulatory

TIDMMPL

RNS Number : 5542D

Mercantile Ports & Logistics Ltd

30 June 2021

30 June 2021

Mercantile Ports & Logistics Limited

("MPL" or the "Company")

Accounts Filing Extension and Update

MPL announces that it has been granted an extension to the

timeline for the filing of its audited accounts for the period

ending 31 December 2020 until 30 September 2021. Whilst the audit

process is nearly complete, as has been widely reported, the

COVID-19 situation in India has continued to cause significant

disruption. The audit is expected to be concluded soon and the

Company will make further announcements as the timetable is

concluded.

Like many companies around the world, MPL's performance in 2020

was impacted by COVID-19. Despite this, the Company expects to

report turnover of approximately GBP0.75 million for 2020 and that

it had cash and cash equivalents of approximately GBP3.9 million at

the year end and approximately GBP1.7 million at the end of May*.

Whilst COVID-19 has also had an impact on the current year, the

Company has been able to make significant progress, signing new

contracts in February and also earlier this month, with revenues

expected to ramp up from now through to the end of the year and

beyond. Performance under the contract with the Tata Projects and

Daewoo Engineering Joint Venture continues to go well and, as

COVID-19 restrictions are lifted in India, the Company believes

that it is well placed to build on this momentum and win further

new business.

As announced earlier this month, the Company was delighted to

complete the restructuring of its debt facility after an extensive

due diligence process conducted by its banking consortium. The INR

475.57 Crores debt (approximately GBP46.2 million*) now has a

significantly reduced interest rate and the Board considers this to

be a clear endorsement of the Company's strategy and recognition of

the status of the Company's facility. MPL has a strong and

supportive, India based, shareholder in Hunch Ventures and, with

there having been discussions with other parties and an offer of

alternative debt facilities, the Company is confident that it would

have access to additional debt should that be required in the

future.

Chairman, Jeremy Warner Allen said "As India recovers from the

COVID pandemic, MPL is well placed to benefit from the expected

increased levels of economic activity. The board continues to be

pleased with the numbers of enquiries from potential new customers

and, as restrictions are lifted, expects to secure new contracts

and revenues through the rest of the year and beyond."

*Taking INR/GBP exchange rate of 103 as at 31 May 2021.

This announcement contains inside information.

Enquiries:

MPL Jay Mehta

C/O Newgate Communications

+44 (0)20 3757 6880

Cenkos Securities plc Stephen Keys

+44 (0)20 7397 8900

Newgate Communications (Financial Adam Lloyd/Isabelle Smurfit

PR)

+44 (0)20 3757 6880

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBRGDLIBDDGBC

(END) Dow Jones Newswires

June 30, 2021 02:00 ET (06:00 GMT)

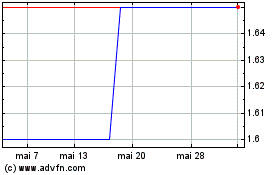

Mercantile Ports & Logis... (LSE:MPL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

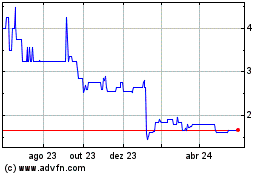

Mercantile Ports & Logis... (LSE:MPL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025