TIDMMPL

RNS Number : 2252J

Mercantile Ports & Logistics Ltd

19 August 2021

THIS ANNOUNCEMENT WAS DEEMED BY THE COMPANY TO CONTAIN INSIDE

INFORMATION AS STIPULATED UNDER THE MARKET ABUSE REGULATION (EU)

NO. 596/2014 ("MAR") AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE

OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018. WITH THE PUBLICATION

OF THIS ANNOUNCEMENT, THIS INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN.

19 August 2021

Mercantile Ports & Logistics Limited

("MPL" or the "Company")

Proposed Placing and Subscription to raise minimum GBP9.5

million by way of accelerated bookbuild

PrimaryBid Offer

at a price of 0.45 pence per share

Share Consolidation

and

Notice of Extraordinary General Meeting

Mercantile Ports & Logistics Limited, which is operating and

developing out its port and logistics facility in Navi Mumbai,

Maharashtra, India, is pleased to announce a proposed Placing by

way of an accelerated bookbuild to raise a minimum of GBP9.5

million (before expenses) via the Subscription and a conditional

placing of new Ordinary Shares ("Placing Shares") at the issue

price of 0.45 pence per share ("Issue Price") to new and existing

institutional investors (the "Placing"). Proceeds from the Placing

and Subscription will help fund the servicing of new and existing

contracts, the construction of further storage facilities, debt

servicing and general working capital purposes. Under the

Subscription, Hunch Ventures has agreed to subscribe an aggregate

amount of 767,622,222 new Ordinary Shares at the Placing Price

("Subscription Shares"), equivalent to GBP3,454,300 (the

"Subscription"). Additionally, the Company has entered into an

unsecured loan facility with Hunch Ventures of up to GBP4.4

million, to provide additional headroom.

Furthermore, the Company is seeking to raise additional funds

via PrimaryBid (the "PrimaryBid Offer" and together with the

Placing, the "Fundraise") in order to provide other investors who

may not have taken part in the Placing, with an opportunity to

participate in the Fundraising.

Cenkos Securities plc is acting as lead manager in relation to

the Placing.

Transaction Highlights

-- The Company is conducting a conditional Placing and

Subscription to raise a minimum of GBP9.5 million via the placing

of the Placing Shares and Subscription Shares at the Issue

Price.

-- The Placing is to be conducted by way of an accelerated

bookbuild process which will commence immediately following this

Announcement and will be subject to the terms and conditions set

out in Appendix I to this Announcement.

-- Proposing to raise additional capital via the PrimaryBid

Offer, which shall remain open until 8:00pm on 19 August 2021.

-- The net proceeds of the Transaction will be used to fund the

servicing of new and existing contracts, the construction of

further storage facilities, debt servicing and general working

capital purposes.

-- Unsecured loan facility of GBP4.4 million entered into

between Hunch Ventures and the Company, to provide additional

headroom for the Company's operations.

-- Completion of the Fundraising is conditional, inter alia,

upon Shareholder approval at the General Meeting to be held on or

around 9 September 2021.

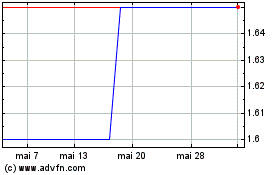

-- The Issue Price represents a discount of approximately 18.1

per cent. to the closing mid-market price of 0.55 pence on 18

August 2021, being the latest practicable date before this

Announcement.

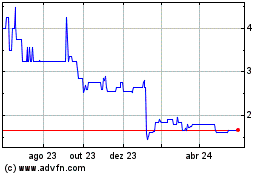

-- Proposed Share Consolidation of every 100 Existing Ordinary

Shares of nil par value each into 1 New Consolidated Ordinary Share

of nil par value each in the capital of the Company.

A circular, containing further details of the Fundraising, Share

Consolidation and notice of the General Meeting to be held at 11.00

a.m. on 9 September 2021 to, inter alia, approve the resolutions

required to implement the Fundraising and Share Consolidation, is

expected to be published and despatched to Shareholders on 20

August 2021 (the "Circular"). Set out below in Appendix I is an

adapted extract from the draft Circular that is proposed to be sent

to Shareholders after the closure of the Bookbuild. Following its

publication, the Shareholder Circular will be available on the

Group's website at

https://www.mercpl.com/article/investor-relations/shareholder-circulars/9

.

Jeremy Warner-Allen, Chairman of Mercantile, said:

"I have been delighted with the support shown from our

institutional shareholders in supporting the Company in this

fundraise. Particular thanks is given to Hunch Ventures for their

continuing support in our vision for the facility and their

presence as a strategic shareholder. In addition to Hunch's

significant investment in the Company, the provision of a GBP4.4

million unsecured loan underscores the confidence they have in our

team at MPL and the opportunities available to the Company as the

facility becomes operational.

I would also like to take this opportunity to thank the

employees and those involved with MPL, particularly in India, which

has suffered especially during the COVID-19 pandemic. The safety of

our staff and stakeholders is paramount and I believe MPL will come

through this a stronger entity."

For further information, please visit www.mercpl.com or contact:

Enquiries:

MPL Jay Mehta

C/O Newgate Communications

+44 (0)20 3757 6880

Cenkos Securities plc (Nominated Stephen Keys

Adviser and Joint Broker)

+44 (0)20 7397 8900

Zeus Capital Limited (Joint Broker) Daniel Harris/Andrew Jones/James

Hornigold

+44 (0)203 829 5000

Newgate Communications (Financial Adam Lloyd/Isabelle Smurfit

PR)

+44 (0)20 3757 6880

Expected Timetable of Principal Events

Announcement of the Placing, PrimaryBid Offer 4.35 p.m. 19 August

and Subscription, publication and posting 2021

of this document

Announcement of the Result of the Placing 20 August 2021

and PrimaryBid Offer

Publication and posting of the Circular 20 August 2021

Latest time and date for receipt of completed 11:00 a.m. on 7 September

Forms of Proxy to be valid at the General 2021

Meeting

General Meeting 11:00 a.m. on 9 September

2021

Announcement of result of General Meeting 9 September 2021

Admission and commencement of dealings in 8.00 a.m. on 10 September

the New Ordinary Shares on AIM 2021

New Ordinary Shares credited to CREST members' 10 September 2021

accounts

Record Date for the Consolidation 6.00 p.m. on 10 September

2021

Consolidation becomes effective 8.00 a.m. on 13 September

2021

Admission and commencement of dealings in 8.00 a.m. on 13 September

New Consolidated Ordinary Shares on AIM 2021

Despatch of definitive share certificates within 10 business

in certificated form, in respect of the placing, days of Admission

PrimaryBid Offer, Subscription and, if applicable,

the Share Consolidation

Notes:

References to times in this Announcement are to London time

unless otherwise stated.

The times and dates set out in the expected timetable of

principal events above and mentioned throughout this Announcement

may be adjusted by the Company in which event the Company will make

an appropriate announcement to a Regulatory Information Service

giving details of any revised dates and the details of the new

times and dates will be notified to the London Stock Exchange and,

where appropriate, Members. Members may not receive any further

written communication.

IMPORTANT NOTICE

This Announcement, and the information contained herein is not

for release, publication or distribution, directly or indirectly,

in whole or in part, in or into or from the United States, Canada,

Australia (save to professional investors and sophisticated

investors), Japan or the Republic of South Africa, or any other

jurisdiction where to do so might constitute a violation of the

relevant laws or regulations of such jurisdiction (the "Restricted

Jurisdictions").

This Announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. The Placing Shares referred to herein have not been

and will not be registered under the Securities Act and may not be

offered or sold in the United States, expect pursuant to an

applicable exemption from registration. No public offering of

Placing Shares is being made in the United States.

This Announcement does not constitute or form part of an offer

to sell or issue or a solicitation of an offer to buy, subscribe

for or otherwise acquire any securities in any jurisdiction

including, without limitation, the Restricted Jurisdictions or any

other jurisdiction in which such offer or solicitation would be

unlawful. This Announcement and the information contained in it is

not for publication or distribution, directly or indirectly, to

persons in a Restricted Jurisdiction, unless permitted pursuant to

an exemption under the relevant local law or regulation in any such

jurisdiction.

No action has been taken by the Company or the Bookrunners or

any of their respective directors, officers, partners, agents,

employees or affiliates that would permit an offer of the Placing

Shares or possession or distribution of this Announcement or any

other publicity material relating to such Placing Shares in any

jurisdiction where action for that purpose is required. Persons

receiving this Announcement are required to inform themselves about

and to observe any restrictions contained in this Announcement.

This Announcement is directed only at: (a) persons in member

states of the European Economic area who are "qualified investors",

as defined in article 2 (e) of the Regulation (EU) 2017/1129 (the

"Prospectus Regulation"), (b) if in the United Kingdom, persons who

(i) have professional experience in matters relating to investments

who fall within the definition of "investment professionals" in

Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended (the "FPO") or fall

within the definition of "high net worth companies, unincorporated

associations etc." in Article 49(2)(a) to (d) of the FPO and (ii)

are "qualified investors" as defined in section 86 of the Financial

Services and Markets Act 2000, as amended ("FSMA") or (c) persons

to whom it may otherwise lawfully be communicated (each, a

"Relevant Person"). No other person should act on or rely on this

Announcement and persons distributing this Announcement must

satisfy themselves that it is lawful to do so. By accepting the

terms of this announcement, investors represent and agree that they

are a Relevant Person.

This Announcement must not be acted on or relied on by persons

who are not Relevant Persons. Any investment or investment activity

to which this Announcement or the Placing relate is available only

to Relevant Persons and will be engaged in only with Relevant

Persons. As regards all persons other than Relevant Persons, the

details of the Placing set out in this Announcement are for

information purposes only.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement should seek appropriate advice before taking

any action.

This Announcement is not being distributed by, nor has it been

approved for the purposes of section 21 of FSMA by the Bookrunners

or any other person authorised under FSMA. This Announcement is

being distributed and communicated to persons in the United Kingdom

only in circumstances in which section 21(1) of FSMA does not

apply.

No prospectus or offering document will be made available in

connection with the matters contained in this Announcement and no

such prospectus is required (in accordance with the Prospectus

Regulation) to be published.

Certain statements in this Announcement are forward-looking

statements which are based on the Company's expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts. These forward-looking statements, which may use

words such as "aim", "anticipate", "believe", "could", "intend",

"estimate", "expect" and words of similar meaning, include all

matters that are not historical facts. These forward-looking

statements involve risks, assumptions and uncertainties that could

cause the actual results of operations, financial condition,

liquidity and dividend policy and the development of the industries

in which the Group's businesses operate to differ materially from

the impression created by the forward-looking statements. These

statements are not guarantees of future performance and are subject

to known and unknown risks, uncertainties and other factors that

could cause actual results to differ materially from those

expressed or implied by such forward-looking statements. Given

those risks and uncertainties, prospective investors are cautioned

not to place undue reliance on forward-looking statements.

Forward-looking statements speak only as of the date of such

statements and, except as required by the UK Financial Conduct

Authority ("FCA"), the London Stock Exchange or applicable law, the

Company undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Any indication in this Announcement of the price at which the

Company's shares have been bought or sold in the past cannot be

relied upon as a guide to future performance. Persons needing

advice should consult an independent financial adviser. No

statement in this Announcement is intended to be a profit forecast

and no statement in this Announcement should be interpreted to mean

that earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings per share of the Group.

Cenkos Securities plc and Zeus Capital Limited, each of which

are authorised and regulated in the United Kingdom by the FCA, are

acting for the Company and for no one else in connection with the

Placing and will not be responsible to anyone other than the

Company for providing the protections afforded to clients of Cenkos

or for providing advice in relation to the Placing, or any other

matters referred to in this Announcement.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by or on behalf of the Company, Cenkos, or

by their affiliates or their respective agents, directors, officers

and employees as to, or in relation to, the accuracy or

completeness of this Announcement or any other written or oral

information made available to or publicly available to any

interested party or its advisers, and any liability therefor is

expressly disclaimed.

The Placing Shares to be issued pursuant to the Placing will not

be admitted to trading on any stock exchange other than to trading

on AIM.

The Appendix to this Announcement sets out the terms and

conditions of the Placing. By participating in the Placing, each

person who is invited to and who chooses to participate in the

Placing by making or accepting an oral and legally binding offer to

acquire Placing Shares will be deemed to have read and understood

this Announcement in its entirety and to be making such offer on

the terms and subject to the conditions set out in this

Announcement and to be providing the representations, warranties,

undertakings and acknowledgements contained in the Appendix.

Members of the public are not eligible to take part in the

Placing and no public offering of Placing Shares is being or will

be made.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into, or forms part of, this Announcement.

Notice to distributors

Solely for the purposes of the product governance requirements

contained within: (a) EU Directive 2014/65/EU on markets in

financial instruments, as amended ("MiFID II"); (b) Articles 9 and

10 of Commission Delegated Directive (EU) 2017/593 supplementing

MiFID II; and (c) local implementing measures (together, the "MiFID

II Product Governance Requirements"), and disclaiming all and any

liability, whether arising in tort, contract or otherwise, which

any "manufacturer" (for the purposes of the MiFID II Product

Governance Requirements) may otherwise have with respect thereto,

the Placing Shares have been subject to a product approval process,

which has determined that such securities are: (i) compatible with

an end target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, each

as defined in MiFID II; and (ii) eligible for distribution through

all distribution channels as are permitted by MiFID II (the "Target

Market Assessment").

Notwithstanding the Target Market Assessment, distributors

should note that: the price of the Placing Shares may decline and

investors could lose all or part of their investment; the Placing

Shares offer no guaranteed income and no capital protection; and an

investment in the Placing Shares is compatible only with investors

who do not need a guaranteed income or capital protection, who

(either alone or in conjunction with an appropriate financial or

other adviser) are capable of evaluating the merits and risks of

such an investment and who have sufficient resources to be able to

bear any losses that may result therefrom.

The Target Market Assessment is without prejudice to the

requirements of any contractual, legal or regulatory selling

restrictions in relation to the Placing. Furthermore, it is noted

that, notwithstanding the Target Market, Assessment, Cenkos are

only procuring investors who meet the criteria of professional

clients and eligible counterparties.

For the avoidance of doubt, the Target Market Assessment does

not constitute: (a) an assessment of suitability of appropriateness

for the purposes of MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the Placing Shares.

Each distributor is responsible for undertaking its own target

market assessment in respect of the Placing Shares and determining

appropriate distribution channels.

APPIX I - EXTRACTS FROM THE CIRCULAR

1. Introduction

The Company has announced a conditional Placing, PrimaryBid

offer and Subscription to raise up a minimum of GBP9.5 million

before expenses by the issue of 2,111,111,112 New Ordinary Shares

at the Offer Price of 0.45 pence per New Ordinary Share.

The Placing will raise GBP6.05 million (before expenses) by the

issue by the Company of 1,343,488,890 New Ordinary Shares at the

Offer Price. In addition, in order to provide investors who have

not taken part in the Placing with an opportunity to participate in

the Transaction, the Company has appointed PrimaryBid to enable the

PrimaryBid Offer, giving investors the opportunity to subscribe at

the Offer Price.

Furthermore, Hunch Ventures, the Company's India-based strategic

investor, has agreed to subscribe for, and the Company has agreed

to issue, 767,622,222 New Ordinary Shares at the Offer Price on

Admission, representing gross subscription proceeds of GBP GBP3.45

million on such terms as are further described at paragraph 4 of

this document.

The Company is also carrying out the Consolidation to reduce the

number of Ordinary Shares in issue by a factor of 100. The Company

currently has 1,905,022,123 Existing Ordinary Shares in issue. This

is a significant number of shares for a Company with a market

capitalisation of approximately GBP10 million (as at 18 August

2021, being the latest practicable date prior to the publication of

this document). The Board considers that the effect of the

Consolidation will be to improve market liquidity by reducing the

volatility and spread of the Company's Ordinary Shares and make

trading in the Company's shares more attractive to a broader range

of institutional investors.

The receipt of the Transaction proceeds is conditional, inter

alia, upon Shareholders approving Resolutions 1 and 3 at the

General Meeting that will grant to the Directors the authority to

issue the New Ordinary Shares and the power to dis-apply

pre-emption rights set out in the articles of incorporation of the

Company in respect of the New Ordinary Shares and Admission. The

Resolutions are contained in the Notice of General Meeting at the

end of the Circular. Admission of the New Ordinary Shares to

trading on AIM is expected to occur no later than 8.00 a.m. on 10

September 2021 or such later time and/or date as Cenkos Securities,

Zeus Capital and the Company may agree (not being later than 8:30

a.m. on 30 September 2021). The Placing is not underwritten.

Based on the closing middle market price of 0.55 pence per

Existing Ordinary Share on 18 August 2021 (being the last

practicable date before publication of this document) the Offer

Price is at an implied discount of 18.1 per cent.

The purpose of this document is to explain the background to and

reasons for the Transaction, the use of proceeds, the details of

the Transaction and to recommend that you vote in favour of the

Resolutions.

2. Current status of the Project

The Company is pleased with the progress it has made and the

fact that its facility at Karanja Creek near Navi Mumbai, India has

been operational and generating revenue for some time. The

Facility's general cargo jetty is receiving vessels and the

separate bulk berth, which handles non-clean cargo is complete.

Over 100 acres of land have been reclaimed and being used for the

numerous customers with whom the Company has contracted.

With all customs and other approvals in place and, given the

unique location of the Facility, there has been significant

interest from potential customers in using the Facility. The

Company was delighted to secure the four year contract with the

Tata Projects and Daewoo Engineering Joint Venture, which is

constructing the Mumbai Trans Harbour Link and the Directors are

pleased with the performance under this contract. In addition,

numerous other contracts have been signed, meaning that the

Facility has contracted revenue of GBP8.2 million for next year,

with contracts worth several million pounds more being in the

pipeline. These contracts cover a range of cargos including iron

ore, fly ash, cement, coal and edible oils.

As well as the Trans Harbour Link, a number of significant

infrastructure projects are taking place in the region. Each of

these projects will require enormous quantities of steel, cement

and other materials, and the Directors expect the Facility to play

a part in the logistics for the construction of some of these

projects. The relationship with the Tata Projects Daewoo Joint

Venture was, the Directors believe, a landmark contract and they

remain confident that similar contracts will follow.

As referenced previously, Company continues to be delighted with

the support that it has received from the MMB. Whilst the

Directors' focus continues to be on completing the build out and

filling the Facility to 200 acres, the permission remains to extend

the Facility to 400 acres, with 2,000 metres of sea frontage, which

the Directors intend to pursue when aligned with capacity

requirements.

In June this year, as well as stating that the Company expected

volumes to increase during the rest of this year and beyond, which

remains the case, the Company announced that it had restructured

its debt facility after an extensive due diligence process

conducted by its banking consortium. The INR 475.57 Crores debt

(approximately GBP46.2 million) is now at a much reduced interest

rate and the Board considered this event to be a clear endorsement

of the Company's strategy and recognition of the status and

viability of the Facility. MPL has a strong and supportive, India

based shareholder in Hunch Ventures and, with there having been

discussion with other parties, the Company is confident that it

would have access to additional debt should that be required in the

future.

3. Background and Reasons for the Transaction

As previously reported, and like many companies around the

world, MPL's performance has been impacted by COVID-19. Whilst

progress was made in securing contracts, travel and other

restrictions in India meant that access to the site for potential

customers was limited and, at times, impossible. This was the

principal reason for the Company's performance being behind the

Board's plan, leading to the requirement for the Transaction. The

net proceed of the Transaction are required to fund servicing of

new and existing contracts, the construction of further storage

facilities, debt servicing and general working capital

purposes.

4. Subscription

Hunch Ventures has agreed to subscribe for the Subscription

Shares at the Placing Price per Subscription Share. The aggregate

subscription price payable by Hunch Ventures in respect of the

Subscription Shares amounts to GBP3,454,300 (the "Subscription

Price").

The payment of the Subscription Price by Hunch Ventures must be

made on or before 31 December 2021 as such payment requires the

consent of the Reserve Bank of India. Pending such payment Hunch

Ventures is required under the terms of the Subscription Agreement

to procure by no later than two Business Days prior to the

Admission of the Subscription Shares the Bank Guarantee for the

amount of the Subscription Price. The Bank Guarantee must be in a

form acceptable to the Company and Cenkos Securities and must be

capable of being called upon by the Company or its subsidiary in

India on or after the date of such Admission.

The Subscription is conditional on:

(a) the passing of Resolutions 1 and 3 at the General Meeting;

(b) Admission of the New Ordinary Shares becoming effective by

no later than 8.00a.m. on 10 September 2021 or such later date as

the Company, Cenkos and Hunch Ventures may agree in writing;

and

(c) the provision of the Bank Guarantee pursuant to the provisions of the Subscription Agreement.

If any of the conditions are not satisfied, the Subscription

Shares will not be issued to Hunch Ventures (or any member of Hunch

Ventures' group of companies as Hunch Ventures may direct).

The Subscription Shares are not subject to clawback. The

Subscription is not being underwritten.

The Subscription Shares will be issued free of all liens,

charges and encumbrances and will, when issued and fully paid, rank

pari passu in all respects with the Existing Ordinary Shares,

including the right to receive all dividends and other

distributions declared, made or paid after the date of their

issue.

Application will be made to the London Stock Exchange for the

admission of the Subscription Shares to trading on AIM. It is

expected that Admission will occur and that dealings will commence

at 8.00 a.m. on 10 September 2021, at which time it is also

expected that the Subscription Shares will be enabled for

settlement in CREST.

The Subscription Shares will comprise approximately 19.1 per

cent. of the Enlarged Share Capital.

Subscription Agreement

Pursuant to the terms of the Subscription Agreement, Hunch

Ventures has agreed to subscribe for the Subscription Shares at the

Placing Price per Subscription Share.

The Subscription Agreement contains, inter alia, warranties

given by both Hunch Ventures and the Company, namely relating to

their respective authority and capacity to enter into the

Subscription Agreement.

Furthermore, given that, following the issue of the Subscription

Shares, Hunch Ventures will hold approximately 29.9 per cent. of

the Enlarged Share Capital, the Subscription Agreement also governs

the relationship between the Company and Hunch Ventures by, inter

alia, providing that:

(a) Hunch Ventures shall have the right to appoint two Directors

for so long as it holds more than 15 per cent. of the voting rights

of the Company's issued share capital from time to time and the

right to appoint one Director for so long as it holds more than 10

per cent. but less than 15 per cent. of the voting rights of the

Company's issued share capital from time to time;

(b) for a two year period from Admission, Hunch Ventures and its

group of companies undertake not to be engaged in any competing

business of the Company in India;

(c) all transactions between Hunch Ventures and the Group shall

be undertaken on an arms' length basis;

(d) Hunch Ventures agrees not to dispose of any Subscription

Shares without the prior consent of the Company and Cenkos

Securities during the 12 month period following Admission, except

in certain customary exceptions; and

(e) Hunch Ventures agrees to dispose of any Subscription Shares

via Cenkos Securities during the 36 month period following

Admission so as to ensure an orderly market in the Enlarged Share

Capital.

The Subscription Agreement and the obligations thereunder will

cease to have effect on the earlier of: (i) the New Ordinary Shares

ceasing to be traded on AIM; or (ii) Hunch Ventures ceasing to hold

at least 5 per cent. of the voting rights of Company's issued share

capital from time to time.

The Subscription Agreement provides that the Subscription Shares

may be issued to Hunch Ventures or any member of Hunch Ventures'

group of companies. The obligations thereunder will also apply to

the member of Hunch Ventures' group of companies to whom the

Subscription Shares are issued.

5. Unsecured Loan Facility

In addition to the Subscription, Hunch Ventures on 19 August

2021 entered into an unsecured loan of up to GBP 4.4 million

(equivalent to 45,00,00,000 (Indian Rupees Forty Five Crores Only))

with the Company's India subsidiary, KTLPL, for the purposes of

KTLPL's business operations (the "Loan"). The Loan can be drawn

down in one or more tranches between 1 September 2021 and 31

December 2022 and is repayable by 1 September 2023. Interest is

payable on the Loan at a rate of 8 per cent. per annum.

6. Market and Macroeconomic Dynamics

Indian Macroeconomic Environment

The World Bank reduced its India's GDP forecast to 8.3% for

FY22, as against its earlier estimate of 10.1%. It has further

projected India's growth to be 7.5% in 2022. Recovery being

hampered by an unprecedented second wave of the Covid-19, the

largest outbreak in the world since the beginning of the deadly

pandemic.

The World Bank, in its latest issue of Global Economic Prospects

released here, noted that in India, an enormous second Covid-19

wave could undermine the sharper-than-expected rebound in activity

seen during FY21, especially in services. In 2020, India's economy

is estimated to have contracted by 7.3%.

Indian Shipping and Port Industry

India's economic strength is placing substantial stress on its

port and logistics infrastructure, an aspect in which India lags

behind its counterparts (ranked 44th globally in World Bank

'International Logistics Ranking' 2018).

During FY20, cargo traffic at major ports in the country was

reported at 704 million tonnes. India's vast coast line (c7,500km)

and inland water ways (c14,500km) offer substantial opportunities

for domestic cargo transportation. Karanja is well positioned both

in location and berth size to accommodate ships used for domestic

cargo transportation.

The cost per tonne per kilometer of moving cargo by sea or

inland waterway routes can be 60 to 80% lower than by road or rail.

However, India's maritime logistics sector is under-utilised when

compared to its road and railway logistics sectors.

Despite the under-utilisation of ports as a transportation

method, India's Major Ports continue to be heavily congested. This

results in inefficiencies, an average turnaround time, being the

time in which a vessel can be loaded or discharged of cargo, of 4.5

days compared to only 1 day and 1.2 days in China and the United

States respectively, which the Indian government fears could hamper

India's potential for wider economic growth.

According to the Ministry of Shipping, around 95% of India's

trading by volume and 70% by value is done through maritime

transport. In November 2020, the Prime Minister, Mr. Narendra Modi

renamed the Ministry of Shipping as the Ministry of Ports, Shipping

and Waterways.

India has 12 major and 205 notified minor and intermediate

ports. Under the National Perspective Plan for Sagarmala, six new

mega ports will be developed in the country. The Indian ports and

shipping industry play a vital role in sustaining growth in the

country's trade and commerce. India is the sixteenth-largest

maritime country in the world with a coastline of about 7,517 kms.

The Indian Government plays an important role in supporting the

ports sector. It has allowed Foreign Direct Investment (FDI) of up

to 100% under the automatic route for port and harbour construction

and maintenance projects. It has also facilitated a 10-year tax

holiday to enterprises that develop, maintain and operate ports,

inland waterways and inland ports.

The Directors believe that this further validates the Group's

investment in the Facility to date and represents opportunities now

that the Facility is fully operational.

JNPT is located twelve nautical miles via sea and 8 km via road

from Karanja. The proximity of the Facility to JNPT is a key factor

that the Directors believe will contribute to the Company's

success. JNPT is India's largest container handler by volume and is

the primary gateway for container shipments in India. JNPT accounts

for approximately 50%. of India's container traffic. Congestion

issues have been a recent problem at JNPT, with poor evacuation

infrastructure leading to high levels of congestions and resulting

in an inability to grow volumes through the port. The Directors

believe that the Facility can play an important role in relieving

congestion at JNPT.

The JNPT port facility is expected to have further expansion,

and the Directors' expect that the continued expansion of JNPT will

represent significant opportunities for the Company. In particular,

the Directors believe that the Company will benefit from the

Karanja facility being able to:

-- offer coastal movement of cargos, servicing end users along

the industrialised west coast of India

-- ease congestion issues in the road network around Mumbai and JNPT.

The Directors continue to believe that the Facility will have

limited direct competition from surrounding Minor Ports due to the

Facility's proximity JNPT and that the Facility will also benefit

from the proposed closure of Mumbai Port, which is planned to be

developed as prime real estate.

Increasing investment and cargo traffic point towards a healthy

outlook for the Indian ports sector. Providers of services such as

operation and maintenance (O&M), pilotage and harbouring and

marine assets such as barges and dredgers are benefiting from these

investments. The capacity addition at ports is expected to grow at

a CAGR of 5-6% till 2022, thereby adding 275-325 MT of

capacity.

Domestic waterways have found to be a cost-effective and

environmentally sustainable mode of freight transportation. The

government aims to operationalise 23 waterways by 2030. As part of

the Sagarmala project, more than 574 projects worth 6 lakh crore

(US$ 82 bn) have been planned for implementation between 2015 and

2035.

In Maritime India Summit 2021, the Ministry of Ports, Shipping

and Waterways identified a total of 400 projects worth 2.25 lakh

crore (US$ 31 bn) investment potential.

India's cargo traffic handled by ports is expected to reach

1,695 million metric tonnes by 2021-22 according to a report by the

National Transport Development Policy Committee

7. The Placing and Primary Bid Offer

Details of the Placing

The Company is proposing to raise additional capital via the

PrimaryBid Offer, which shall remain open until 8:00pm on 19 August

2021.

The Placing is conditional, inter alia, upon:

(a) the passing of Resolutions 1 and 3 at the General Meeting ;

(b) each of the Placing Agreement and the Subscription Agreement

becoming or being declared unconditional in all respects and not

having been terminated in accordance with its terms prior to

Admission;

(c) Admission of the New Ordinary Shares becoming effective by

no later than 8.00 a.m. on 10 September 2021 or such later time

and/or date (being no later than 8.30 a.m. on 30 September 2021) as

Cenkos Securities and the Company may agree.

If any of the conditions are not satisfied, the Placing Shares

will not be issued and all monies received from the Placees will be

returned to the Placees (at the Placees' risk and without interest)

as soon as possible thereafter.

The Placing Shares are not subject to clawback. The Placing is

not being underwritten.

The Placing Shares will be issued free of all liens, charges and

encumbrances and will, when issued and fully paid, rank pari passu

in all respects with the Existing Ordinary Shares, including the

right to receive all dividends and other distributions declared,

made or paid after the date of their issue.

Application will be made to the London Stock Exchange for the

admission of the Placing Shares to trading on AIM. It is expected

that Admission will occur and that dealings will commence at 8.00

a.m. on 10 September 2021 at which time it is also expected that

the Placing Shares will be enabled for settlement in CREST.

Use of net proceeds

The net proceeds of the Placing are expected to be approximately

GBP8.9 million and it is proposed that such proceeds shall be used

as follows:

-- business development and servicing of new and existing contracts;

-- debt servicing; and

-- for general working capital purposes.

Further funds are raised via the Subscription and the PrimaryBid

Offer will be used for the same purposes as above.

Details of the PrimaryBid Offer

The PrimaryBid Offer allowed investors to participate in the

Fundraising by subscribing for New Ordinary Shares at the Issue

Price via PrimaryBid.com

The New Ordinary Shares issued pursuant to the PrimaryBid Offer

will be free of all liens, charges and encumbrances and will, when

issued and fully paid, rank pari passu, in all respects with the

Existing Ordinary Shares including the right to receive dividends

and other distributions declared following Admission.

A further announcement was made by the Company on 19 August 2021

regarding further details of the PrimaryBid Offer and how investors

may participate in the Fundraise.

The Company is relying on an available exemption against the

need to publish a prospectus approved by the UK Listing

Authority.

The PrimaryBid Offer was not underwritten and will close at 8.00

p.m. on 19 August 2021.

8. The Consolidation

As at 18 August 2021 (being the latest practicable date prior to

the publication of the Circular), the Company had 1,905,022,123

Existing Ordinary Shares in issue, having a mid-market price per

Existing Ordinary Share as at the close of business on such date of

0.55 pence. The Board believes that the Consolidation is necessary

in order to increase the marketability of the Company's Ordinary

Shares through the creation of a higher trading price per Ordinary

Share.

The Consolidation will consist of the following steps:

-- a consolidation of every 100 Existing Ordinary Shares in to one New Ordinary Share; and

-- the redemption of all fractional entitlements arising on the Consolidation.

Your board considers that the distribution of any amount of less

than GBP1 per Shareholder would be nullified by the administrative

costs of making such a distribution. Accordingly, the Board

proposes pursuant to the Resolutions that any amount of less than

GBP1 that would otherwise be paid to a Shareholder pursuant to the

redemption of fractional entitlements will instead be donated to

charity. For the avoidance of doubt the Company is only responsible

for dealing with fractions arising on registered shareholdings. For

Shareholders whose shares are held in the nominee accounts of

stockbrokers, intermediaries or other nominees, the effect of the

Consolidation on their individual shareholdings will be

administered by the stockbroker, intermediary or nominee in whose

account the relevant shares are held and it will be that person's

responsibility to deal with fractions arising within their customer

accounts, and not the Company's responsibility.

9. Related Party Transactions

M&G Investment Management ("M&G") is a substantial

Shareholder in the Company and consequently is considered to be a

related party of the Company pursuant to Rule 13 of the AIM Rules

for Companies . M&G is subscribing for 316,444,444 Placing

Shares under the Placing. This subscription by M&G constitutes

a related party transaction for the purposes of the AIM Rules for

Companies . In the absence of any independent directors for the

purposes of opining on the fairness of the terms of the

transaction, Cenkos Securities considers that that the

participation in the Placing by M&G is fair and reasonable

insofar as the Shareholders are concerned.

The Directors have agreed to subscribe for a combined total of

36,666,666 Placing Shares, equivalent to GBP165,000. The commitment

from the directors constitute a related party transaction for the

purposes of the AIM Rules for Companies. In the absence of any

independent directors for the purposes of opining on the fairness

of the terms of the transaction, Cenkos Securities considers that

that the participation in the Transaction by the directors is fair

and reasonable insofar as the Shareholders are concerned.

Director Number of shares to Total price/GBP

be subscribed in the

Placing

Jeremy Warner Allen 11,111,111 50,000

---------------------- ----------------

Howard Flight 8,888,889 40,000

---------------------- ----------------

Jay Mehta 11,111,111 50,000

---------------------- ----------------

John Fitzgerald 5,555,555 25,000

---------------------- ----------------

TOTAL 36,666,666 165,000

---------------------- ----------------

The Subscription Agreement between Hunch Ventures and the

Company described in section 4 and the Hunch Loan described in

section 5, are related party transactions for the purposes of the

AIM Rules for Companies. In the absence of any independent

directors for the purposes of opining on the fairness of the terms

of the Loan, Cenkos Securities considers that that the terms of the

Loan are fair and reasonable insofar as the Shareholders are

concerned.

10. General Meeting

The Directors do not currently have authority to issue all of

the New Ordinary Shares and, accordingly, the Board is seeking the

approval of Shareholders to issue the New Ordinary Shares at the

General Meeting. The Board is also seeking the approval of

Shareholders for the Consolidation.

A notice convening the General Meeting, which is to be held at

registered office of the Company at 1st Floor, Tudor House, Le

Bordage, St Peter Port, Guernsey GY1 at 11.00 am on 9 September

2021, is set out at the end of this document. At the General

Meeting, the Resolutions will be proposed t o approve the

Consolidation, authorise the Directors to issue relevant securities

pursuant to the Placing, PrimaryBid Offer and Subscription, and to

issue such relevant securities on a non-pre-emptive basis.

The authorities to be granted pursuant to Resolutions 1 and 3

shall expire on whichever is the earlier of the conclusion of the

General Meeting of the Company to be held in 2021 or the date

falling six months from the date of the passing of the Resolutions

(unless renewed, varied or revoked by the Company prior to or on

that date) and shall be in addition to any existing Directors'

authorities to issue relevant securities and dis-apply statutory

pre-emption rights

The Resolutions proposed will facilitate the completion of the

Transaction. The Company will receive 0.45p per New Ordinary Share,

which the Directors consider to be a fair and reasonable amount per

share on the basis that the closing market price on 18 August 2021

was 0.55p per Existing Ordinary Share.

11. Risks

In additional to the principal risks facing the Group that were

set out in the Group's most recent Annual Report and Accounts, now

that the Facility is operational, the Company is exposed to the

normal risks associated with being an operational company,

including around achieving new customer and revenue targets,

margins and customer retention.

12. Action to be taken in respect of the General Meeting

Shareholders will not receive a form of proxy for the General

Meeting. Instead you will find instructions in the section entitled

"Notes" in the Notice of Meeting to enable you to vote

electronically and how to register to do so. To register, you will

need your Investor Code, which can be found on your share

certificate.

Shareholders may request a paper form of proxy from our

Registrar, Link Market Services, if they do not have access to the

internet. Proxy votes should be submitted as early as possible and

in any event by no later than 11.00 a.m. on 7 September 2021 (or,

in the case of an adjournment, no later than 48 hours (excluding

non-working days) before the time fixed for holding of the

adjourned meeting).

The completion and return of a form of proxy will not preclude

you from attending and voting in person at the General Meeting, or

any adjournment thereof, should you wish to do so.

13. Recommendation

The Directors believe that the Transaction and the passing of

the Resolutions are in the best interests of the Company and

Shareholders, taken as a whole. Accordingly, the Directors

unanimously recommend that Shareholders vote in favour of the

Resolutions, as they intend to do in respect of their own holdings

of Ordinary Shares, totalling 586,158,030 Existing Ordinary Shares,

being approximately 30.8 per cent. of the Existing Ordinary

Shares.

The Placing, Subscription and PrimaryBid Offer are conditional,

inter alia, upon the passing of Resolutions 1 and 3 at the General

Meeting. Shareholders should be aware that if the Resolutions are

not approved at the General Meeting, the Placing, Subscription and

PrimaryBid Offer will not proceed.

Definitions

The following definitions apply throughout this document, unless

the context requires otherwise:

"Admission" the admission of the New Ordinary Shares

and/or the admission of the New Consolidated

Ordinary Shares (as the context requires)

to trading on AIM in accordance with

the AIM Rules for Companies

"AIM" the AIM market operated by London Stock

Exchange

"AIM Rules for Companies" the AIM Rules for Companies and guidance

notes as published by London Stock Exchange

from time to time

"Bank Guarantee " the bank guarantee for the Subscription

Price which is to be procured by Hunch

pursuant to the provisions of the Subscription

Agreement

"Board" or "Directors" the directors of the Company as at the

date of this document

"CAGR" compounded annual growth rate

"Cenkos Securities" Cenkos Securities plc

"Company" Mercantile Ports & Logistics Limited

"Consolidation" the proposed consolidation of the Company's

ordinary share capital pursuant to which

every 100 Existing Ordinary Shares and

New Ordinary Shares will be consolidated

into 1 New Consolidated Ordinary Share

pursuant to Resolution 2 as set out in

the Notice of General Meeting

"CREST" the relevant system (as defined in the

CREST Regulations) in respect of which

Euroclear is the operator (as defined

in the CREST Regulations)

"CREST member" a person who has been admitted to CREST

as a system-member (as defined in the

CREST Manual)

"CREST Regulations" the Uncertificated Securities Regulations

2001 (SI 2001/3755) (as amended)

"CREST sponsor" a CREST participant admitted to CREST

as a CREST sponsor

"CREST sponsored member" a CREST member admitted to CREST as a

sponsored member

"Enlarged Share Capital" the entire issued share capital of the

Company following completion of the Placing,

PrimaryBid Offer and Subscription on

Admission, assuming the Placing and PrimaryBid

Offer are each fully subscribed, that

all of the Subscription Shares are issued

and including [--] New Ordinary Shares

to be subscribed for by Cenkos Securities

out of part of the commission payable

to them by the Company under the Placing

Agreement

"Euroclear" Euroclear UK & Ireland Limited

"Existing Ordinary Shares" the 1,905,022,123 Ordinary Shares in

issue on the date of this document

"Fractional Entitlement" a fractional entitlement to a New Ordinary

Share arising on the Consolidation

"Facility" the completed Logistics Park and Multi-purpose

Terminal

"FCA" the Financial Conduct Authority of the

UK

"Form of Proxy" the form of proxy for use in relation

to the General Meeting enclosed with

this document

"FSMA" Financial Services and Markets Act 2000

(as amended)

"GDP" gross domestic product

"General Meeting" the Extraordinary General Meeting of

the Company, convened for 11.00 a.m.

on [9] September 2021 or at any adjournment

thereof, notice of which is set out at

the end of this document

"Group" the Company and its subsidiaries

"Hunch Ventures" Hunch Ventures and Investment Private

Limited, a company incorporated in India,

with company registration number 289161

and whose registered office is at 5 Ground

Floor, Plot No. 09 Copia Corporate Suites,

Jasola New Delhi, South Delhi DL 110044,

India

"India" the Republic of India

"JNPT" Jawaharlal Nehru Port Trust

"Karanja" the Project Land

"KTLPL" Karanja Terminal and Logistics Private

Limited, a company incorporated under

the provisions of the Companies Act ,1956

of India, having its registered office

at Hermes Atrium, Office No. 411, 04(th)

Floor, A-Wing, Plot No. 57, Sector No.

11, CBD, Belapur, Navi Mumbai, Thane

- 400614, and being a subsidiary of the

Company

"Logistics Park" the logistics park being developed by

the Group on the Project Land

"London Stock Exchange" the London Stock Exchange plc

"Major Port" each of the 12 ports located in India

designated as 'Major Ports' by India's

Ministry of Shipping

"Minor Port" any port located in India which is not

a Major Port

"MMB" Maharashtra Maritime Board

"Mumbai Trans-Harbour the proposed 22 kilometre freeway grade

Link" road bridge connecting Mumbai with Navi

Mumbai, its satellite city

"New Consolidated Ordinary the [--] new consolidated ordinary shares

Shares" of no par value each in the capital of

the Company following the Consolidation

"New Ordinary Shares" the [--] new ordinary shares of no par

value each in the capital of the Company

to be issued pursuant to the Placing,

Subscription and PrimaryBid Offer

"Notice of General Meeting" the notice convening the General Meeting

as set out at the end of this document

"Offer Price" 0.45 pence per New Ordinary Share

"Ordinary Shares" ordinary shares of no par value each

in the capital of the Company

"Overseas Shareholders" a Shareholder with a registered address

outside the United Kingdom or who is

a citizen of, or incorporated, registered

or otherwise resident in, a country outside

the United Kingdom

"Placees" subscribers for Placing Shares

"Placing" the placing by the Company of the Placing

Shares with certain institutional and

other investors pursuant to the Placing

Agreement

"Placing Agreement" the agreement entered into between the

Company, Cenkos Securities and Zeus Capital

in respect of the Placing dated [19]

August 2021, as described in this document

"Placing Shares" the [--] New Ordinary Shares the subject

of the Placing

"Project Land" the c.1.62 Mn SQM (approximately 400

acres) of land with a sea frontage of

approximately 2,000 metres at Karanja

Creek, Chanje Village, Taluka Uran, District

Raigad, Maharashtra, India as described

in the Deed of Lease

"PrimaryBid Offer" the offer of New Ordinary Shares to be

issued pursuant to the PrimaryBid Offer

at the Offer Price

"PrimaryBid Shares" the [--] New Ordinary Shares to be issued

pursuant to the PrimaryBid Offer at the

Offer Price

"Registrars" Link Market Services (Guernsey) Limited

"Regulatory Information has the meaning given in the AIM Rules

Service" for Companies

"Resolutions" the ordinary and special resolutions

to be proposed at the General Meeting,

as set out in the Notice of the General

Meeting

"Rupees" or "Rs" Indian Rupees, the legal currency of

India

"Securities Act" US Securities Act of 1933 (as amended)

"Share Consolidation" the proposed consolidation of the Company's

ordinary share capital pursuant to which

every 100 Existing Ordinary Shares and

New Ordinary Shares will be consolidated

into 1 New Consolidated Ordinary Share

pursuant to Resolution 2 as set out in

the Notice of General Meeting

"Shareholders" the holders of Existing Ordinary Shares

"Subscription" the subscription for Subscription Shares

pursuant to the terms of the Subscription

Agreement

"Subscription Agreement" the subscription and relationship agreement

entered into on or around [19] August

2021 between Hunch Ventures, the Company

and Cenkos Securities in respect of both

the Subscription and the relationship

between the Company and Hunch Ventures

following Admission

"Subscription Price" GBP3,454,300, being the aggregate subscription

price payable in respect of the Subscription

Shares at the Offer Price

"Subscription Shares" the aggregate of 767,622,222 New Ordinary

Shares to be issued by the Company under

the terms of the Subscription Agreement

"Transaction" the Placing, the PrimaryBid Offer, the

Subscription and the Consolidation

"United Kingdom" or "UK" the United Kingdom of Great Britain and

Northern Ireland

"United States", "United the United States of America, its territories

States of America" or and possessions, any State of the United

"US" States, and the District of Columbia

"Zeus Capital" Zeus Capital Limited

APPIX II - TERMS AND CONDITIONS OF THE PLACING

The terms and conditions contained in this Announcement,

including this Appendix (together the "Announcement") (the "Terms

and Conditions") and the information comprising this Announcement

are restricted and are not for publication, release or

distribution, in whole or in part, directly or indirectly, in or

into the United States, Canada, Australia, New Zealand, the

Republic of South Africa, or Japan, or any other state or

jurisdiction in which such release, publication or distribution

would be unlawful. The Terms and Conditions and the information

contained herein is not intended to and does not contain or

constitute an offer of, or the solicitation of an offer to buy or

subscribe for, securities to any person in the United States,

Canada, Australia, New Zealand, the Republic of South Africa or

Japan, or any other state or jurisdiction in which such an offer

would be unlawful.

Important information for invited Placees only regarding the

Placing

Members of the public are not eligible to take part in the

Placing. This Announcement and the Terms and Conditions set out in

this Announcement are for information purposes only and are

directed only at persons in Member States who are "qualified

investors" in such Member State within the meaning of Article 2(e)

of the EU Prospectus Regulation or the United Kingdom within the

meaning of the UK Prospectus Regulation ("Qualified Investors"). In

addition, in the United Kingdom, this Announcement and the Terms

and Conditions are directed only at (i) Qualified Investors who

have professional experience in matters relating to investments

falling within the meaning of Article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005, as

amended (the "FPO"), and/or (ii) Qualified Investors who are high

net worth companies, unincorporated associations or other bodies

within the meaning of Article 49(2)(a) to (d) of the FPO; and/or

(iii) persons to whom it may otherwise be lawfully communicated

(each a "Relevant Person"). No other person should act or rely on

this Announcement and persons distributing this Announcement must

satisfy themselves that it is lawful to do so. By accepting the

Terms and Conditions each Placee represents and agrees that it is a

Relevant Person. This Announcement and the Terms and Conditions set

out herein must not be acted on or relied on by persons who are not

Relevant Persons. Any investment or investment activity to which

this Announcement and the Terms and Conditions set out herein

relate is available only to Relevant Persons and will be engaged in

only with Relevant Persons. This Announcement does not itself

constitute an offer for sale or subscription of any securities in

the Company.

The Placing Shares have not been and will not be registered

under the US Securities Act or under the applicable securities laws

of any state or other jurisdiction of the United States, and may

not be offered, sold, taken up, resold, transferred or delivered,

directly or indirectly within, into or in the United States, except

pursuant to an applicable exemption from the registration

requirements of the US Securities Act and in compliance with the

securities laws of any relevant state or other jurisdiction of the

United States. There will be no public offer of the Placing Shares

in the United States. The Placing Shares are being offered and sold

only outside the United States in "offshore transactions" as

defined in, and in accordance with Regulation S of the US

Securities Act ("Regulation S").

The Placing Shares have not been approved or disapproved by the

US Securities and Exchange Commission, any state securities

commission or other regulatory authority in the United States, nor

have any of the foregoing authorities passed upon or endorsed the

merits of the Placing or the accuracy or the adequacy of this

Announcement. Any representation to the contrary is a criminal

offence in the United States.

This Announcement does not constitute an offer to sell or issue,

or the solicitation of an offer to buy or subscribe for, securities

in any jurisdiction in which such offer or solicitation is unlawful

and, in particular, is not for publication or distribution in or

into the United States, Canada, Australia, New Zealand, the

Republic of South Africa or Japan, nor in any country or territory

where to do so may contravene local securities laws or regulations.

The distribution of this Announcement (or any part of it or any

information contained within it) in other jurisdictions may be

restricted by law and therefore persons into whose possession this

Announcement (or any part of it or any information contained within

it) comes should inform themselves about and observe any such

restriction. Any failure to comply with these restrictions may

constitute a violation of the securities law of any such

jurisdictions. The Ordinary Shares have not been and will not be

registered under the US Securities Act nor under the applicable

securities laws of any state of the United States or any province

or territory of Canada, Australia, New Zealand, the Republic of

South Africa or Japan. Accordingly, the Shares may not be offered

or sold directly or indirectly in or into or from the United

States, Canada, Australia, New Zealand, the Republic of South

Africa or Japan or to any resident of the United States, Canada,

Australia, New Zealand, the Republic of South Africa or Japan. No

public offering of securities is being made in the United States.

The Shares have not been approved or disapproved by the US

Securities and Exchange Commission, any state securities commission

or any other regulatory authority in the United States, nor have

any of the foregoing authorities passed upon or endorsed the

accuracy or adequacy of this Announcement. Any representation to

the contrary is a criminal offence in the United States.

Each Placee should consult with its own advisers as to legal,

tax, business, financial and related aspects of a purchase of

and/or subscription for the Placing Shares.

Each Placee will be deemed to have read and understood this

Announcement in its entirety and to be making such offer on these

terms and conditions, and to be providing the representations,

warranties, acknowledgements and undertakings, contained in these

terms and conditions. In particular each such Placee represents,

warrants and acknowledges to each of the Company and the Brokers

that:

(a) it is a Relevant Person (as defined above) and undertakes

that it will purchase and/or subscribe for, hold, manage or dispose

of any Placing Shares that are allocated to it for the purposes of

its business;

(b) it is acquiring the Placing Shares for its own account or

acquiring the Placing Shares for an account with respect to which

it has sole investment discretion and has the authority to make,

and does make the representations, warranties, indemnities,

acknowledgments, undertakings and agreements contained in this

Announcement;

(c) in the case of any Placing Shares subscribed for by it as a

financial intermediary as that term is used in Article 5 of the EU

Prospectus Regulation or the UK Prospectus Regulation (as

applicable), any Placing Shares purchased and/or subscribed for by

it in the Placing will not be subscribed for and/or purchased on a

non-discretionary basis on behalf of, nor will they be subscribed

for and/or purchased with a view to their offer or resale to,

persons in a Member State or the United Kingdom (as applicable)

other than Qualified Investors, or in circumstances which may give

rise to an offer of securities to the public other than an offer or

resale in the United Kingdom or in a Member State to Qualified

Investors, or in circumstances in which the prior consent of the

Brokers has been given to each such proposed offer or resale;

and

(d) it understands (or if acting for the account of another

person, such person has confirmed that such person understands) the

resale and transfer restrictions set out in this Announcement;

and

(e) it is not a US Person (as defined in, and in accordance with

Regulation S) and it, and any accounts it represents, (i) is, or at

the time the Placing Shares are acquired will be, outside the

United States and is not acquiring the Placing Shares for the

account or benefit of any US Person (as defined in, and in

accordance with Regulation S) or any other person located in the

United States, (ii) is acquiring the Placing Shares in an "offshore

transaction" (as defined in, and in accordance with Regulation S)

and (iii) will not offer or sell, directly or indirectly, any of

the Placing Shares except in an "offshore transaction" as defined

in, and in accordance with Regulation S or in the United States

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements under the US Securities Act.

Persons (including, without limitation, nominees and trustees)

who have a contractual or other legal obligation to forward a copy

of this Announcement, of which these terms and conditions form

part, should seek appropriate advice before taking any action.

Neither Cenkos Securities plc ("Cenkos Securities") or Zeus

Capital Limited ("Zeus Capital", and Cenkos Securities and Zeus

Capital being referred to together as the "Brokers") nor any of

their affiliates, agents, directors, officers or employees, make

any representation to any Placees regarding an investment in the

Placing Shares.

Introduction

Each of Cenkos Securities and Zeus Capital, as applicable, may

require a Placee to agree to such further terms and/or conditions

and/or give such additional warranties and/or representations

and/or undertakings as it (in its absolute discretion) sees fit

and/or may require any such Placee to execute a separate placing

letter (for the purposes of this Announcement, a "Placing Letter").

The terms of this Announcement will, where applicable, be deemed to

be incorporated into that Placing Letter.

Details of the Placing

The Brokers have entered into the Placing Agreement with the

Company, under which the Brokers have agreed, on the terms and

subject to the conditions set out therein, and undertaken to use

their reasonable endeavours to procure, as the Company's agents for

the purpose of the Placing, subscribers for the Placing Shares at

the Placing Price.

The Placing is conditional upon, amongst other things, Admission

becoming effective and the Placing Agreement not being terminated

in accordance with its terms, as detailed further below.

The Placing Shares are and will be credited as fully paid and

will rank pari passu in all respects with the existing issued

Ordinary Shares, including the right to receive all dividends and

other distributions (if any) declared, made or paid on or in

respect of the Ordinary Shares after the date of issue of the

Placing Shares to the relevant Placees.

Application for admission to trading

The Application has been or will be made to the London Stock

Exchange for Admission of the Placing Shares .

The Placing is conditional and is subject to, inter alia,

Shareholder approval at the General Meeting. Should the conditions

not be satisfied, Admission will not occur.

The Placing Shares will not be admitted to trading on any stock

exchange other than AIM.

No Prospectus

No offering document or prospectus has been or will be submitted

to be approved by the FCA or submitted to the London Stock Exchange

in relation to the Proposals and no such prospectus is required (in

accordance with the UK Prospectus Regulation and/or the EU

Prospectus Regulation) to be published and Placees' commitments

will be made solely on the basis of the information contained in

this Announcement released by the Company today and subject to the

further terms set forth in the trade confirmation or contract note

to be provided to individual prospective Placees.

Each Placee, by accepting a participation in the Placing, agrees

that the content of this Announcement and all other publicly

available information previously or simultaneously published by the

Company by notification to a Regulatory Information Service or

otherwise filed by the Company is exclusively the responsibility of

the Company and confirms that it has neither received nor relied on

any other information, representation, warranty, or statement made

by or on behalf of the Company, Cenkos Securities or Zeus Capital,

or any other person and none of the Company, Cenkos Securities or

Zeus Capital, or any of their respective affiliates will be liable

for any Placee's decision to participate in the Placing based on

any other information, representation, warranty or statement which

the Placees may have obtained or received. Each Placee acknowledges

and agrees that it has relied on its own investigation of the

business, financial or other position of the Company in accepting a

participation in the Placing. Nothing in this paragraph should

exclude or limit the liability of any person for fraudulent

misrepresentation by that person.

Bookbuild

The Brokers will today commence the bookbuilding process in

respect of the Placing (the "Bookbuild") to determine both demand

by Placees for participation in the Placing. No commissions will be

paid to Placees or by Placees in respect of any Placing Shares.

The Brokers and the Company shall be entitled to effect the

Placing by such alternative method to the Bookbuild as they may, in

their absolute discretion, determine.

Participation in, and principal terms of, the Placing

1. Each of Cenkos Securities or Zeus Capital, (whether through

itself or any of its affiliates) is arranging the Placing as

placing agent and broker of the Company for the purpose of each

using its reasonable endeavours to procure Placees at the Placing

Price for the Placing Shares.

2. Participation in the Placing will only be available to

persons who may lawfully be, and are, invited to participate by

either Cenkos Securities and Zeus Capital. Cenkos Securities and

Zeus Capital, and/or their respective affiliates may participate in

the Placing as principals (and are each entitled to enter bids as

principal in the Bookbuild).

3. The Bookbuild will establish the number of Placing Shares to

be issued and will be agreed between the Brokers and the Company

following completion of the Bookbuild in respect of the Placing

Shares and will be recorded in a term sheet entered into between

them (the "Term Sheet"). The number of Placing Shares and to be

issued and the Placing Price will be announced on a Regulatory News

Service following completion of the Bookbuild.

4. To bid in the Bookbuild, Placees should communicate their bid

by telephone or in writing to their usual sales contact at either

of the Brokers. Each bid should state the number of Placing Shares

for which the prospective Placee wishes to subscribe. Bids may be

scaled down by the Brokers on the basis referred to in paragraph 13

below.

5. A bid in the Bookbuild will be made on the terms and subject

to the conditions in this Announcement and will be legally binding

on the Placee on behalf of which it is made and except with the

Brokers' consent will not be capable of variation or revocation

after the time at which it is submitted. Each Placee will also have

an immediate, separate, irrevocable and binding obligation, owed to

the Company and the Brokers, to pay to them (or as the Brokers may

direct) in cleared funds an amount equal to the product of the

Placing Price and the number of Placing Shares that such Placee has

agreed to subscribe for and the Company has agreed to allot and

issue to that Placee. Each prospective Placee's obligations will be

owed to the Company and the Brokers.

6. The Bookbuild in respect of the Placing is expected to close

no later than 7.00 a.m. on 20 August 2021, but the Bookbuild may be

closed earlier or later at the discretion of the Brokers and the

Company. The Brokers may, in agreement with the Company, accept

bids, either in whole or in part, that are received after the

Bookbuild has closed.

7. This Announcement gives details of the terms and conditions of, and the mechanics of participation in, the Placing. No commissions will be paid to Placees or by Placees in respect of any Placing Shares.

8. Each Placee's commitment will be made solely on the basis of

the information set out in Announcement . By participating in the

Placing, Placees will be deemed to have read and understood these

Terms and Conditions and the rest of this Announcement in its

entirety and to be participating and making an offer for the

Placing Shares on these terms and conditions. Each Placee will be

deemed to have read and understood these Terms and Conditions in

their entirety and to be making such offer on the Terms and

Conditions and to be providing the representations, warranties and

acknowledgements and undertakings contained in these Terms and

Conditions.

9. The Placing Price will be a fixed price of 0.45 pence per Placing Share.

10. An offer for Placing Shares, which has been communicated by

a prospective Placee to Cenkos Securities or Zeus Capital , shall

not be capable of withdrawal or revocation without the consent of

Cenkos Securities or Zeus Capital (as applicable).

11. Each Placee's allocation will be confirmed to Placees orally

or in writing by Cenkos Securities or Zeus Capital as soon as

practicable following the close of the Bookbuild. The terms of this

Announcement will be deemed incorporated by reference therein. The

oral or written confirmation to such Placee will constitute an

irrevocable legally binding commitment upon such person (who will

at that point become a Placee) in favour of Cenkos Securities or

Zeus Capital (as applicable), and the Company, under which it

agrees to subscribe for and/or acquire the number of Placing Shares

allocated to it at the Placing Price on the terms and conditions

set out in this Announcement and in accordance with the Company's

articles of association. Except as required by law or regulation,

no press release or other announcement will be made Cenkos

Securities, Zeus Capital, or the Company using the name of any

Placee (or its agent), in its capacity as Placee (or agent), other

than with such Placee's prior written consent.

12. Each Placee will have an immediate, separate, irrevocable