TIDMAURA

RNS Number : 5083J

Aura Energy Limited

27 April 2022

27 April 2022

Quarterly Report for the Period Ending 31 March 2022

KEY POINTS:

-- Successful capital raise of A$8.8 million (before costs) via

an over-subscribed placement with funds to be used for the

advancement of the fast-tracked 800 klb U(3) O(8) per annum Tiris

Uranium Project in Mauritania.

-- Appointment of Dr Will Goodall as Acting CEO to rapidly

progress development of the fast-tracked Tiris Project and

potential upgrade and expansion of the Tiris Resources.

-- Progress on initiation of Engineering, Procurement and

Construction Management (EPCM) for fast-track 800 klb U(3) O(8)

Tiris Uranium Project:

o Expressions of Interest distributed to qualified engineering

consultants and two stand-out companies short-listed to bid for

Front End Engineering Design (FEED) and EPCM development.

o Key appointment of Engineering Manager to drive delivery of

the fast-tracked Tiris Uranium project.

-- Baseline Greenhouse Gas Emissions for fast-track Tiris

Uranium Project modelled by Wood PLC to be 16,000 tCO2e per annum,

with a clear pathway for Net Zero Emissions defined.

-- Bulk test work programme initiated with ANSTO Minerals to

optimise uranium circuit and assess vanadium production

options.

-- JORC Resource of 18.4 million pounds V(2) O(5) defined within

Aura's low capex, low operating cost Tiris Uranium Project in

Mauritania ([1])

-- Work initiated on regulatory process in Mauritania for export

of Uranium Oxide Concentrate (UOC) product.

-- Work continues on integration of vanadium by-product circuit

in Fast track Tiris Uranium Project.

-- 10,000 m of drilling announced as part Resource Upgrade

Programme to convert additional material to Measured and Indicated

category announced to support future expansions.

-- Regional exploration programme to examine potential opportunity for expanded resource base.

-- Engagement of Diplomat Communications in Sweden to Liaise

with the Swedish Government and other stakeholders on the status of

Aura's 800mlb U(3) O(8) Häggån Resource.

Aura Energy Limited (ASX:AEE, AIM:AURA) ("Aura", the "Company")

is pleased to provide an overview of activities for the period

ending 31 March 2022 ("Quarter, "Reporting Period") to accompany

the Appendix 5B. To view the Appendix 5B, please click here:

http://www.rns-pdf.londonstockexchange.com/rns/5083J_1-2022-4-27.pdf

For the full PDF version of the announcement with Figures 1-15

included, please refer to:

http://www.rns-pdf.londonstockexchange.com/rns/5083J_2-2022-4-27.pdf

Introduction

The March 2022 Quarter represented a period of significant

development for Aura, with major milestones achieved to initiate

key programmes in the development of the 800 klb U(3) O(8) per

annum fast-tracked Tiris Uranium Project ("Tiris", "Fast-track

Project", or the "Project"), along with plans to upgrade and expand

the Tiris Resources. These steps have placed the Company in a

strong position to deliver the Fast-tracked Tiris Project as one of

the first greenfields uranium operations to achieve production in

the current cycle.

In addition, plans were implemented to undertake further

drilling at Tiris with the goal of upgrading and expanding the

Tiris Uranium Resource Estimate to potentially support expansion of

uranium production rate early in the project life.[2]

The Company received strong support from new and existing

shareholders, along with several institutional investors, raising

A$8.8 million (before costs) in March to advance the Tiris Uranium

Project. As a result, the Company is well funded for key programmes

throughout the remainder of the 2022 calendar year, allowing

progression of the Fast-track Project towards a final investment

decision to commence mining in Q1 CY 2023.

The geopolitical situation in Ukraine has led to significant

volatility in uranium markets through the Quarter, however

sustained upward pressure on uranium spot and contract prices has

maintained during the Reporting Period. The volatility has led to

renewed debate around energy security, particularly in Europe, and

a progressively positive sentiments towards nuclear energy as a

stable source of low-emission baseload energy.

Commenting on the activities through the March Quarter, acting

CEO Dr Will Goodall said:

"During the March 2022 quarter, Aura establish a strong baseline

for rapid development of the fast-tracked 800 klb U(3) O(8) per

annum Tiris Uranium Project. We are now well poised for the Project

to move into production of U(3) O(8) in 2024, aiming to be one of

the first greenfields uranium projects to be developed in the

current cycle."

"The Company received strong support from new and existing

shareholders in successfully raising A$8.8 million in March and is

now well-funded to move into Engineering for the Fast-track

Project. The funds will also allow Aura to complete a significant

in-fill drilling programme that will target upgrade of a much

higher proportion of the Tiris Resource to the Measured and

Indicated category, accelerating the potential for the production

rates of the Project to be expanded early in the project life."

"We are excited to have defined the baseline for our Net Zero

Emissions strategy through the Quarter and will proceed through the

development phase of the Fast-tracked Project, with sustainable

design as a key pillar of value engineering decision making. By

progressing work on inclusion of a vanadium pentoxide recovery

circuit in the Tiris flow sheet, we aim to extract additional value

from the processed material and will look to quantify these

benefits through the following quarters. We will also continue to

explore opportunities to reduce total GHG emissions by inclusion of

additional renewable energy generation for the Project."

"During the Quarter several geopolitical events occurred

highlighting the importance of energy security globally, and

specifically in Europe. Positive sentiments continue to grow for

nuclear energy as a key form of low-emission baseload electricity

and the inclusion of nuclear energy in the EU green taxonomy

represented a clear shift in this direction. We have now engaged

Diplomat Communications, a leading advisory group in Sweden, to

explore the impact of these shifting sentiments on Swedish policy

towards uranium mining. We continue to develop the Häggån Battery

Metals Project and will monitor opportunities to generate value

from the 800mlb U(3) O(8) Resource at Häggån in future."

"Overall, at the end of the

Quarter, Aura is well placed

to move into development of

the Fast-tracked Tiris Project,

prepare for potential expansion

of production rates early in

the project life and be positioned

to potentially provide security

of supply for critical battery

and energy minerals in Europe.

Our pipeline of projects provides

a strong basis for sustained

value generation for our stakeholders

and shareholders over many years."

Project Development Pipeline

Aura has developed a strong pipeline of projects to support the

transition from uranium explorer to uranium producer with continued

growth. A timeline of key projects and how they relate to the Aura

development strategy has been summarized in Figure 1 .

Figure 1 - Development pipeline and key milestones for Aura

Energy projects

Tiris Uranium Project

Aura's flagship Tiris Uranium Project remains the main focus of

the Company's development strategy. The Project, located in

Mauritania is proposed to be developed over two phases:

Phase 1

Fast-tracked 800,000 lb U(3) O(8) Project is targeted at

achieving uranium production in the near term, with low capital

expenditure.

Phase 2

The second phase of the Project is planned to expand the

production rate within 2-3 years of Phase 1 commissioning,

providing better utilisation of the Tiris Uranium Resources.

Project Highlights

The Tiris Uranium Project in Mauritania was discovered by Aura,

with development progressing to a Definitive Feasibility Study

(DFS) in 2019. The fast tracked 800 klbs U(3) O(8) per annum

project now represents a compelling opportunity for Aura to move

into uranium production by 2024, positioning the Project as

potential to be one of the first greenfields uranium projects to

move into production in the current cycle.

The uranium mineralisation at Tiris is shallow, extending from

surface to a depth of 4m, and is distributed over several deposits

as shown in Figure 2. . Uranium and vanadium are hosted with the

mineral, carnotite (K (UO ) (VO ) --3H O) as fine liberated grains

on the surface of friable weathered granite gangue. The material is

free digging and liberation of the carnotite can be readily

achieved using a simple rotary scrubbing and screening operation.

These characteristics allow for 80% of the mass to be rejected

early in the process, with the balance containing 90% of the

uranium and vanadium for recovery in the leaching circuit.

Figure 2 - Location of Aura's Tiris uranium and vanadium

resources

Aura completed a Definitive Feasibility Study for the Tiris

fast-tracked 800 klb U(3) O(8) per annum project in August 2019,

with an update to the Capital Estimate in 2021[3]. The fast-track

project is fully permitted for mining and the Company is pursuing a

strategy of rapid development to maximise value for shareholders

early in the current uranium price cycle.

The Tiris Resource Estimate contains 56.9 Mlbs U(3) O(8) and

18.4 Mlbs V(2) O(5) at cut off grade of 100 ppm U(3) O(8) [4]. The

total Mineral Resource Estimate for the Tiris Project is summarised

Table 1. and Table 2 .

Table 1 - Tiris Uranium Project Global Resource Estimate at

100ppm U(3) O(8) cut off grade

Cut-off U3O8 Class Tonnes U(3) O(8) U(3) O(8) V(2) O(5) V(2) O(5)

ppm (Mt) (ppm) (Mlb) (ppm) (Mlb)

100 All 102.1 253 56.9 82 18.4

------ ------- ---------- ---------- ---------- ----------

Table 2 - TIRIS RESOURCE CLASSIFICATION at 100ppm U(3) O(8) cut

off grade - TOTAL, Feb 2022

Cut-off U(3) Class Tonnes U(3) O(8) U(3) O(8) V(2) V(2) O(5)

O(8) ppm (Mt) (ppm) (Mlb) O(5) (Mlb)

(ppm)

100 Measured 10.2 235.7 5.3 76.4 1.7

---------- ------- ---------- ---------- ------- ----------

Indicated 29.0 222.1 14.2 72.0 4.6

---------- ------- ---------- ---------- ------- ----------

Total

M&I 39.2 226 19.5 73 6.3

---------- ------- ---------- ---------- ------- ----------

Inferred 62.9 270 37.4 87 12.1

---------- ------- ---------- ---------- ------- ----------

A Maiden Reserve of 18.1 Mlbs U(3) O(8) at 175ppm cut-off grade

was defined with the DFS[5]. This represents only 27% of the total

uranium Resource at comparative cut-off grade.

Table 3 - Tiris Maiden uranium Reserve Estimate at 175ppm U(3)

O(8) cut-off grade

Description Mt U(3) O(8) U(3) O(8)

(ppm) (Mlb)

Lazare North

Proved 0.7 354 0.6

----- ---------- ----------

Probable 4.4 332 3.2

----- ---------- ----------

Lazare South

Proved 1.5 342 1.1

----- ---------- ----------

Probable 0.7 340 0.5

----- ---------- ----------

Hippolyte

Proved 1.9 331 1.4

----- ---------- ----------

Probable 1.7 334 1.3

----- ---------- ----------

Total

Proved 4.1 339 3.1

----- ---------- ----------

Probable 6.8 333 5

----- ---------- ----------

Total 10.9 336 8.1

----- ---------- ----------

The Tiris DFS defined a very simple mining operation, with the

ore being free digging and mineralisation easily identified as

shown in Figure 3 . Utilising a small contract mining fleet a

mining rate of 1.25Mtpa could be achieved with mining costs of

US$2.25/t material moved.

Figure 3 - Mining strategy for Tiris U ranium P roject

The Tiris process flow sheet is simple, utilising the natural

characteristics of the mineralisation to reject barren material

early and minimise the size of the leaching, ion exchange and

precipitation circuits. Figure 4 shows the beneficiation circuit

located at the mining pits, with concentrated slurry pumped to a

central processing facility and barren waste returned to pits.

Figure 4 - Tiris Uranium Project process flow sheet

Aura completed an Environmental and Social Impact Assessment in

2017 and the Tiris exploitation permit was granted by the

Mauritanian Government in 2018. The Project is fully permitted to

mine, with minor regulatory approvals to be completed once

construction is underway. Although Mauritania does not currently

have an active uranium export market, Aura continues to work

closely with the Mauritanian government and regulatory authorities

to ensure that safeguards are in place for transport of UOC

product.

The Tiris DFS was completed in 2019[6] for the fast-tracked

800klb U(3) O(8) per annum project and the Capital Estimate was

updated in 2021[7] with current pricing to reflect the potential

impact of COVID-19 related supply chain pressure. The outcomes of

the DFS, using a conservative uranium price estimate of US$60/lb

U(3) O(8) have been summarized in Table 4 and Table 5 .

Table 4 - DFS outcomes summary[8]

Key Metric DFS

Resource Life of Mine (LOM) 15 Years

------------------------------------ ----------------

Beneficiation Plant ore throughput 1.25 Mtpa

(Design)

------------------------------------ ----------------

Process Plant ore throughput 0.16 Mtpa

------------------------------------ ----------------

ROM uranium grade (LOM) 364 ppm U(3)

O(8)

------------------------------------ ----------------

Production Uranium Metallurgical Recovery 86.1%

------------------------------------ ----------------

Average Annual uranium production 823,000 lb U(3)

O(8)

------------------------------------------------- ----------------

LOM uranium production 12.35 Mlb U(3)

O(8)

------------------------------------------------- ----------------

Table 5 - DFS financial outcomes summary4

Key Metric US$ A$

Process plant, infrastructure,

Capital indirects 70.1 M 100.1 M

-------------------------------- ---------- ----------

Contingency 4.7 M 6.8 M

---------------------------------------------- ---------- ----------

Total Capital 74.8 M 106.9 M

---------------------------------------------- ---------- ----------

Operations Exchange rate (USD:AUD) 0.70

-------------------------------- ----------------------

C1 Cash operating cost ($/lb

U(3) O(8) ) 25.43 36.33

---------------------------------------------- ---------- ----------

AISC operating cost ($/lb

U(3) O(8) ) 29.81 42.56

---------------------------------------------- ---------- ----------

Project Assumed price (baseline)

Financials ($/lb U(3) O(8) ) 60 86

-------------------------------- ---------- ----------

Project NPV(8) (incl Royalties

and tax) 79.9 M 114 M

---------------------------------------------- ---------- ----------

Project IRR (incl Royalties

and tax) 22%

---------------------------------------------- ----------------------

Cashflow - Total (after-tax) 214 M 305 M

---------------------------------------------- ---------- ----------

Cashflow - Annual (after-tax) 17.1 M pa 24.4 M pa

-------------------------------- ---------- ----------

Project NPV8 (incl Royalties,

pre-tax) 106 M 151 M

---------------------------------------------- ---------- ----------

Project Cashflow - Total

(pre-tax) 275 M 393 M

---------------------------------------------- ---------- ----------

Project Cashflow - Annual 24.5 M pa 33 M pa

(pre-tax)

---------------------------------------------- ---------- ----------

Project payback from start-up 4 years

---------------------------------------------- ----------------------

The DFS demonstrated that at current uranium price levels, the

fast-track 800klb U(3) O(8) per annum project is projected to

generate strong returns, providing an excellent baseline for future

development of the Tiris Resources.

Tiris development strategy

Aura's strategy for development of the Tiris Project is to focus

on rapidly achieving uranium production at a capital investment and

production rate appropriate for the stage of the uranium price

cycle. This means focusing on fast tracking the low CAPEX 800 klb

U(3) O(8) pa project, while providing the baseline for growing the

project as the market matures to be a long life, low cost uranium

producer. The targeted development programme for the Tiris

fast-track and planned expansion projects has been summarized in

Figure 5

Figure 5 - Tiris development schedule

The Tiris fast-track 800klb/a project development will target

production by 2024 to generate early cash flow, which will be

achieved by targeting a lean, low CAPEX operation for the first

phase. Smaller production volumes allow for product contracting

earlier in the uranium cycle while maintaining price upside through

project expansion. In addition, by targeting lower production

rates, Aura can leverage reductions in technical, country and

marketing risk for lower initial capital outlay.

In conjunction with the fast-track project development, the

Company will plan for project expansion early in the mine life.

Design decisions through the Fast-track Project have always

considered the option to expand the production rate once the

operation is underway. The first step in preparation for production

rate expansion is to work on upgrade of the resource and Reserves

to support higher U(3) O(8) production rates. When the target of

increased Reserves is achieved, studies will commence to evaluate

production scenarios and economies of scale.

Finally, regional exploration will be undertaken to support long

life production at expanded production rates. Aura's exploration

tenements cover a highly prospective and under-explored region of

Northern Mauritania and the Companies target is to continue to

expand the global Resource base to support long-life uranium

production in the area.

Project update - Fast-track 800 klb U(3) O(8) per annum

project

During the Reporting Period, Aura continued to accelerate the

development of the fast-tracked 800klb U(3) O(8) per annum Tiris

Project. Work undertaken throughout the Quarter provided a solid

groundwork for progression of the Project, with a target to

complete FEED engineering by Q1 2023 and first production of U(3)

O(8) in 2024.

Tiris project development and Engineering

As outlined in the Chairman's Letter[9] the Company has made the

strategic decision to move the Fast-tracked Project forward to the

Engineering and construction phase, with a target to achieve first

production of U(3) O(8) in 2024. The development timeline, with key

milestones has been summarized in Figure 6 .

Figure 6 - Tiris Fast-track Project proposed engineering

development timeline

A critical stage in development of the Tiris project is to

engage an engineering partner with the ability to add value to the

Project and deliver on-time and on-budget. During the Quarter, the

Company engaged an Engineering Manager for the Owners Team and has

been seeking and evaluating Expressions of Interest from

Engineering Consultants to rapidly move the Tiris 800 klb U(3) O(8)

pa project forward.

FEED and EPCM Expression of Interest were distributed to target

Engineering Consultants with relevant expertise.

The Scope of work included:

-- Value Engineering Study

-- Front End Engineering and Design (FEED) Study

-- Engineering, Procurement, Construction and Management (EPCM) programme.

Engineering consultants with both expertise in uranium flow

sheets and demonstrated experience building operations in West

Africa were shortlisted. Two highly qualified engineering

consultants were shortlisted and are currently preparing bids for

review by the Company.

Next steps include:

-- Receipt of bids from shortlisted engineering consultants in Early May 2022.

-- Award of FEED study contract and kick-off in early June 2022.

-- Target to complete FEED study, supporting final investment decision by Q1 2023

During the Quarter, discussions were initiated with key vendors

on opportunities to fast-track decision to proceed on long lead

items.

Bulk test work programme

In 2019, a successful pilot scale test of the rotary scrubbing

and screening circuit was undertaken at Mintek Laboratories,

Johannesburg South Africa. The products of this pilot programme

were stored for use in final confirmatory bulk leaching, ion

exchange and precipitation optimisation programme to support value

engineering initiatives. The programme aims to target optimisation

of leaching conditions, final definition of solid/liquid separation

design factors and inclusion of vanadium by-product recovery in ion

exchange.

The test work programme was initiated in January 2022 at ANSTO

Minerals, Lucas Heights, NSW ( www.ansto.gov.au ). ANSTO Minerals

are global leaders in uranium and vanadium processing and have been

responsible for process test work throughout the Tiris

development.

The aims of the programme include:

-- Uranium recovery

o To further optimise alkaline leaching conditions

o To confirm Phase 1 ion exchange and uranium precipitation

conditions on liquors generated from bulk leaching using optimised

alkaline leaching conditions.

o To produce samples of UO(4) that meet relevant industry

specifications with regards to impurity content.

o To undertake vendor filtration and settling test work.

-- Vanadium recovery

o Test work to examine options for vanadium recovery from bulk

leach liquors.

o Assessment of preferred flow sheet for vanadium by-product

production and expected reagent consumptions.

Overall, the ANSTO test work programme will provide the final

inputs for the FEED engineering study and value engineering

initiatives.

The test work programme was initiated in January 2022 and during

the Quarter leach optimisation test work was completed. The bulk of

the programme will be completed in Q2 CY 2022, including bulk

leaching, vendor filtration and thickening, ion exchange

optimisation and vanadium circuit option analysis. Final UO(4)

precipitation for product marketing is expected early in Q3

2022.

Uranium Export from Mauritania

Mauritania has a well-established radiation regulatory

authority, ARSN, and is a signatory for the International Atomic

Energy Agency ("IAEA"). Aura has initiated process with ARSN to

gain regulatory approval for export of Uranium Oxide Concentrate

(UOC). ARSN has defined that to approve export of UOC Aura must

provide a plan for radiation management, security and safe

transport of uranium, with Aura having engaged expert independent

consultants to extend work completed during the DFS on these

matters. Once submitted ARSN will review plans with guidance from

IAEA and if satisfactory within guidelines will approve export of

UOC from Mauritania.

The final plan expected to be ready for submission to

Mauritanian ARSN by Q3 CY 2022.

During the Reporting Period, the Company continued to work with

Mauritanian government for finalisation of shareholders agreement,

which will defines terms of the Mauritanian government's 15%

ownership of the Tiris Project. Completion of the terms is expected

to be achieved in Q2 2022.

Sustainable design

During the Quarter the baseline report for Greenhouse Gas

Emission (GHG) projects based on the DFS was completed by Wood PLC

("Wood") as the first step in defining the Net Zero Emission

Pathway for the Tiris fast-track project[10].

Total baseline Greenhouse Gas (GHG) emissions calculated at

16,600 tCO(2) e per annum, representing approximately 0.15% of the

total GHG emissions of Mauritania per annum.

This reinforces Tiris as a source of uranium products with low

GHG emissions, enhancing the positive emission reduction potential

and sustainability of nuclear energy.

The Study by Wood clearly defines a Net Zero Emission Pathway

for the Tiris Fast-tracked Project, which is outlined in the

summary below:

-- Extended provision of renewable generation to meet the

majority of power needs and reduce emissions associated with

stationary combustion (Diesel generators).

-- Further reductions via lower global warming potential (GWP)

alternative refrigerants in buildings and vehicles.

-- Residual emissions following these interventions are assessed

as around potentially 30% of the initial baseline.

-- Discussions with the Government of Mauritania, SOMELEC and UN

partners to focus on potential direct investment in national

projects to offset residual emissions (in preference to accessing

the voluntary carbon market).

Figure 7 - Emissions by source as a percentage of annual

emissions

Aura is strongly committed to ESG practices and aims to create

real and lasting benefits through uranium production at Tiris.

Aligning with global targets for carbon neutrality, the Company

aims to achieve net zero carbon emissions at the Project and will

continue to review and implement the Net Zero Emission Pathway over

the coming period.

A key component of the Net Zero Emissions Pathway will be to

integrate GHG emissions reduction as a driver in Engineering

decision making and value engineering. In doing this Aura will

establish sustainable design practice as a core driver in project

cost optimisation.

Value Engineering

The DFS defined the Tiris fast-track project as a low operating

cost process with potential for further optimisation. An

opportunity review conducted by METS Engineering in 2021[11].

The major opportunities identified included:

-- Inclusion of a circuit to recover vanadium pentoxide as a by-product of U(3) O(8) .

-- Reduction of operating costs and total greenhouse gas

emissions (GHG) through optimization of power generation

options.

Inclusion of V(2) O(5) by-product production circuit

The opportunity review for Tiris Fast-track project completed in

Q3 2021 identified production of V(2) O(5) by-product to have

potential to materially reduce operating costs. Similar

opportunities identified at Langer Heinrich restart and are planned

for inclusion.

Potential alterations to Tiris flowsheet were explored with two

technically viable options recommended by METS Engineering. To

realise this opportunity Aura has been working throughout the

Quarter to:

-- Define vanadium pentoxide resource estimate to support

uranium resource estimate at Tiris (completed).

-- Complete test work on recommended process flow sheet

configurations to define optimum strategy to maximise vanadium

pentoxide recovery without negatively impacting uranium oxide

production (underway).

-- Integrate proven vanadium pentoxide circuit configuration with uranium circuit in FEED study.

The first step in addition of a V(2) O(5) by-product circuit was

to define a vanadium pentoxide Resource Estimate to support the

Uranium Oxide Resource Estimate. As announced on 16 February 2022,

Aura announced the inclusion of V(2) O(5) in the Tiris Resource

Estimate, demonstrating that vanadium consistently occurs at a

ratio of 34% uranium through the Resource. The result was inclusion

of 18.4Mlbs V(2) O(5) at an average recoverable grade of 82.5ppm

V(2) O(5) .

Table 6 - Tiris Uranium Project Global Resource Estimate[12]

Cut-off U(3) Class Tonnes U(3) O(8) U(3) O(8) V(2) O(5) V(2) O(5)

O(8) ppm (Mt) (ppm) (Mlb) (ppm) (Mlb)

100 All 102.1 253 56.9 82 18.4

------ ------- ---------- ---------- ---------- ----------

200 All 55.0 336 40.8 109 13.2

------ ------- ---------- ---------- ---------- ----------

300 All 24.8 452 24.7 146 8.0

------ ------- ---------- ---------- ---------- ----------

Table 7 - TIRIS RESOURCE CLASSIFICATION - TOTAL, Feb

2022[13]

Cut-off U(3) Class Tonnes U(3) O(8) U(3) O(8) V(2) O(5) V(2) O(5)

O(8) ppm (Mt) (ppm) (Mlb) (ppm) (Mlb)

100 Measured 10.2 235.7 5.3 76.4 1.7

---------- ------- ---------- ---------- ---------- ----------

Indicated 29.0 222.1 14.2 72.0 4.6

---------- ------- ---------- ---------- ---------- ----------

Total

M&I 39.2 226 19.5 73 6.3

---------- ------- ---------- ---------- ---------- ----------

Inferred 62.9 270 37.4 87 12.1

---------- ------- ---------- ---------- ---------- ----------

200 Measured 4.6 355.0 3.6 115.0 1.2

---------- ------- ---------- ---------- ---------- ----------

Indicated 12.8 315.4 8.9 102.2 2.9

---------- ------- ---------- ---------- ---------- ----------

Total

M&I 17.4 326 12.5 106 4.1

---------- ------- ---------- ---------- ---------- ----------

Inferred 37.6 678.4 28.3 219.8 9.2

---------- ------- ---------- ---------- ---------- ----------

300 Measured 2.1 496.8 2.3 161.0 0.7

---------- ------- ---------- ---------- ---------- ----------

Indicated 4.7 453.6 4.7 147.0 1.5

---------- ------- ---------- ---------- ---------- ----------

Total

M&I 6.8 467 7.0 151 2.3

---------- ------- ---------- ---------- ---------- ----------

Testing of vanadium recovery process options defined in the

Opportunity Review is currently underway at ANSTO Minerals. It is

anticipated that confirmation of the preferred option for vanadium

pentoxide by-product recovery will be available late in Q2 2022,

with potential operating cost savings modelled early in Q3 2022 as

shown in Figure 8 .

Figure 8 - Tiris fast-track project operating cost update

timeline

Sustainable design for cost reduction

Net Zero Emissions guidelines established through the baseline

GHG emissions study completed by Wood will form the basis for

optimisation of the Tiris operation through the value engineering

and FEED phase.

Aura has defined direct relationship between GHG reduction and

operating cost savings at Tiris based on the findings of the Wood

Net Zero Emission study. Value engineering initiatives, such as

reduction of diesel usage for power generation, have potential to

bring equal positive impact to reduction of GHG emissions and

overall operating cost of the operation.

Water Programme

On the 13 December 2021 Aura announced the completion and

successful results from the Company's 2021 water drilling

programme, with strong flows encountered at the Tiris Uranium

Project. This reconfirmed results from the 2019 water drilling

programme undertaken by Aura (ASX & AIM Release - 25 September

2019).

Aura completed 8 boreholes for the 2021 water drilling

programme, 7 of which are at Target C22, with all producing strong

water flows, including several with high yields. With sufficient

water located in the Oued el Foule Depression at the Project,

production can be expedited with capital expenditure and operating

costs likely to remain low in comparison to peer uranium

projects.

The Project has an initial water requirement of approximately

0.5 giga-litres. Based on the spacing of water bearing drillholes

to date, the C22 water occurrence is estimated to contain several

giga-litres of water, and possibly significantly more, without

allowing for recharge.

Figure 9 - Water Drilling at the Tiris Uranium Project

During the Reporting Period preliminary modelling of the

groundwater supply options was undertaken. It was estimated based

on measured flow rates that the C22 water occurrence showed

potential for continuous water supply at a rate of 0.25GL per year.

In addition, recommendations were made for exploration of

additional targets where the aquifer remains open to the south (

Figure 10 ). These targets will be drilled as part of the upcoming

drilling programme.

Figure 10 - C22 water occurrence aquifer modelled zone

Project Expansion - Tiris Uranium Resource Upgrade Programme

On 16 February 2022, Aura announced the inclusion of vanadium

pentoxide in the Tiris Resource Estimate. The addition of vanadium

to the Tiris Resource Estimate was undertaken after confirmation of

a constant ratio of vanadium to uranium at Tiris in carnotite, a

uranium vanadium potassium oxide mineral (K (UO ) (VO ) --3H O),

which is the primary host of uranium.

The inclusion of vanadium pentoxide supports inclusion of a V(2)

O(5) by-product in the 800klb U(3) O(8) per annum fast track Tiris

project, potentially reducing operating costs.

On 9 February 2022, Aura announced plans to upgrade additional

areas with the Tiris East deposits from the Inferred category to

Measured or Indicated categories. Any upgrade of the Resource

categories will aim to support future expansion of the Tiris

project U(3) O(8) production rate.

Figure 11 - Tiris East Resource zones. The resource upgrade

programme will focus on areas of Inferred Resource at Sadi, Lazare

South and Hippolyte.

The Tiris uranium resource upgrade programme will represent a

key milestone, laying the groundwork for potential future expansion

of the Tiris Reserves and production rate. The Company anticipates

that drilling will commence in mid-May 2022, with resource upgrade

results available in Q3 2022.

The drilling programme will be the largest single programme

undertaken on the Tiris deposits, aiming to increase the proportion

of the Resources in the Measured and Indicated categories from 34%

to >50%. If achieved, this will provide the baseline for

increasing Reserves and supporting increased U(3) O(8) production

rates from the Tiris Expansion Project.

Tiris Regional Exploration

During the Quarter, Aura announced plans to continue exploration

for uranium in Mauritania. As part of the Resource Upgrade

programme Aura will undertake additional radiometric surveys and

drilling to assess expansion of the Global Tiris Resource base.

The results of additional exploration activities are expected to

be available in late Q3 2022.

Häggån Project

Aura holds the 100% owned Häggån Project in Sweden, with a

significant inferred resource[14] of 800m pounds of U(3) O(8) [15],

and a high grade zone of 800m pounds of V(2) O(5,) along with other

important Battery Metals including Ni, Zn and Mo[16].

The Häggån Project provides a unique opportunity to support

supply security in Sweden for both battery metals and uranium,

through independent operations.

Sweden ranks 22(nd) of nations supplying battery metals[17],

however has made significant investment in battery manufacture with

support for the Northvolt Gigafactory[18] positioning

electrification as a central topic of debate.

On 1 January 2022, Brussels proposed a green taxonomy for

nuclear power[19], which will allow all European Union states to

provide a green label for ESG nuclear investment in Europe to

assist in meeting the Net Zero 2050 carbon emission target, with

the aim of accelerating the low-carbon transition and phase out

from coal.

The battle to recognise nuclear power as green has intensified

in recent months as EU countries have faced record electricity

prices this winter[20] Figure 1 below shows up to 500% + increases

in electricity wholesale prices for some European countries between

January 2020 and January 2022.

Figure 12 - Average monthly electricity wholesale prices in

selected countries in the European Union (EU) from January 2020 to

January 2022

Sweden currently has 6 nuclear power plants in operation

providing 40% of total power to the citizens that is carbon

emission free[21]. In August 2018, under a power sharing deal with

the Green party, the Swedish Government banned uranium mining[22]

with that government coalition dissolved late 2021.

In February 2022, Swedish energy giant, Vattenfall AB, suspended

orders of uranium and nuclear fuel from Russia in light of the

current geopolitical situation ([23]) (,) with the Company

expecting further countries expected to cease buying uranium from

Russia. This highlights the relevance that security of supply will

continue to show in the current political landscape.

Engagement of Diplomat Communication

During the Quarter, Aura appointed leading consultancy group,

Diplomat Communications, to liaise with the Swedish Government and

other relevant stakeholders in relation to advancing the Häggån

Projects. Based in Sweden, Diplomat Communications is a leading

strategic communications consulting firm, that works across

business, politics, the financial markets and media, to build

trusting relationships, and drive internal and external change.

Aura looks forward to working with the current government with

the aim of changing the current situation to help provide locally

sourced uranium for Sweden's nuclear power plants, export market

and associated jobs with the potential for the Häggån Projects.

The Company also aims to work alongside Diplomat Communications

and the Swedish Government to further advance the project as the

global demand for battery metals and carbon free energy continues

to increase, supporting Sweden's energy transition.

Archaean Greenstone Gold

Tasiast South Gold and Battery Metals

Bedrock Drilling Programme

Aura also holds 100% of the Tasiast South Project in Mauritania,

with assay results received from the auger drilling programme

completed in late 2021. The objective of the programme was to

sample top of bedrock within Nomads Farmin permit where outcrop is

almost non-existent. The area lies along strike and in the same

Archean greenstone belt as the giant Tasiast goldmine operated

Kinross and has never before been subject to any subsurface

testing.

Figure 13 - Historic drill intercepts from Tasiast South

region

In 2021, Aura conducted a detailed ground gravity survey over

its entire tenement holdings at Tasiast South to better define

geology and structures of relevance to gold and base metals

mineralisation. On the Nomads Farmin the only prior existing data

was regional air-magnetics, which is of limited use in defining

geology, hence the gravity surveying a was value in defining the

limits of the greenstone belt and structures. Structural geology

specialist PGN Geoscience was commissioned to process the interpret

the data. Their geological interpretation is presented in Figure 14

. This highlighted similar geology to that present at the Tasiast

mine 35 km to the north, with predominantly mafic rocks, banded

iron formation and late stage intrusives within the greenstone

belt.

Figure 14 - Interpreted geology Nomads JV.

A programme of reconnaissance auger drilling was conducted with

holes 100 m apart on lines spaced 800m to 1600m. Approximately 30%

of holes failed to penetrate to fresh rock due to the occurrence of

lateritic duricrust.

Results are summarised in Figure 15 . Given the very broadly

spaced nature of the drilling and the number of holes with limited

penetration even low levels of gold can be significant in locating

mineralisation. A number of zones of anomalous gold are evident, in

places coinciding with anomalous arsenic which can be an indicator

of mineralisation.

Closer spaced aircore drilling is being planned to follow up on

these anomalous zones prior to deeper RC drilling.

Figure 15 - Nomads Farmin auger geochemistry - best in hole gold

& arsenic

Corporate

Acting CEO

On 13 January 2022, Aura appointed Dr Will Goodall as acting CEO

to rapidly build momentum towards expansion of the Tiris Resource

and preparation for uranium production (ASX Release 13 January

2022).

Dr Goodall has worked with Aura for over 10 years, has held the

role of Aura's Principal Metallurgist since 2018, and was

responsible for delivering the Tiris Uranium Scoping and Definitive

Feasibility Studies, and the Häggån Uranium Scoping Study.

Dr Goodall contributes over 20 years of experience in

geometallurgy, mineral processing and hydrometallurgy across a wide

range of commodities, contributing a strong mix of technical

expertise and corporate experience.

Further to the Strategic Board Restructure announcement on 22

November 2021, the recruitment process to appoint a Managing

Director & CEO with significant production experience was

ongoing through Q1 2022.

Financing

Funds Raised from the Rights Issue completed in November 2021

have been utilised as follows.

Table 8 .1 -Use of funds from November 2021 Rights Issue

Use of Funds under Prospectus Funds allocated Funds expended Variance

under Prospectus between Rights

Nov 2021 Issue and 31

Mar 2022

Tiris Uranium Project $1,200,000 $439,531 $760,469 63%

----------------- --------------- --------- ---

Corporate costs (including

capital raising cost) $217,000 $234,458 $(17,458) -8%

----------------- --------------- --------- ---

Working capital $613,399 $454,955 $158,444 26%

----------------- --------------- --------- ---

Total $2,030,399 $1,128,944 $901,455 44%

----------------- --------------- --------- ---

On 14 March 2022 the Company announced the successful placement

of 35.2 million new shares in the Company to raise A$8.8 million

before costs ("The Placement") to advance the Tiris Uranium Project

as defined in Table 9 .2.

Table 9 .2 -Use of funds from A$8.8 million placement

Use of Funds under Funds allocated Funds expended Variance

Prospectus under Prospectus between Placement

17 Mar 2022 and 31 Mar

2022

Tiris Uranium Project $7,600,000 - $7,600,000 100%

----------------- ------------------ ---------- ----

Corporate costs (including

capital raising cost) $557,000 $540,810 $16,190 3%

----------------- ------------------ ---------- ----

Working capital $643,000 - $643,000 100%

----------------- ------------------ ---------- ----

Total $8,800,000 $540,810 $8,259,190 94%

----------------- ------------------ ---------- ----

The Placement provides sufficient funds for the Company to

complete the proposed Resource Upgrade Programme at Tiris and

complete the fast-track Tiris Uranium Project FEED study by Q1

2023.

Payments to related parties of the entity and their associates

are set out in the attached Appendix 5B. The payments relate to

director fees to non-executive directors in the normal course of

business at commercial rates, excluding reimbursements of

out-of-pocket expenses.

Tenement Summary

Details of mining tenements, farm-in and farm-out agreements

held at the end of the quarter, and any changes to such tenements

and agreements during the quarter.

Table 10 - Summary of tenements

Country

/ Grant /

Tenement Application

number Name date Expiry date km(2) Holder Equity

Mauritania

-------------- ------------ --------------- ----- ---------------------- ------

Exploitation

2491C4 Ain Sder 8/02/2019 Licence 207 Tiris Resources SA 85%

-------------- ------------ --------------- ----- ---------------------- ------

Exploitation

2492C4 Oued El Foule 8/02/2019 Licence 190 Tiris Resources SA 85%

-------------- ------------ --------------- ----- ---------------------- ------

Subject

to exclusivity

561 Oum Ferkik 16/04/2008 negotiation 60 Aura Energy Limited 100%

-------------- ------------ --------------- ----- ---------------------- ------

Tiris International

2457B2 Hadeibet Belaa 2/04/2019 2/04/2022 41 Mining Co. 100%

-------------- ------------ --------------- ----- ---------------------- ------

Tiris International

2458B2 Touerig Taet 2/04/2019 2/04/2022 134 Mining Co. 100%

-------------- ------------ --------------- ----- ---------------------- ------

Sweden

-------------- ------------ --------------- ----- ---------------------- ------

Haggan nr Vanadis Battery Metals

2007-243 1 28/08/2007 28/08/2022 18 AB 100%

-------------- ------------ --------------- ----- ---------------------- ------

Mockelasen Vanadis Battery Metals

2018-9 nr 1 21/01/2019 21/01/2022 18 AB 100%

-------------- ------------ --------------- ----- ---------------------- ------

Skallbole Vanadis Battery Metals

2018-7 nr 1 20/01/2019 20/01/2022 8 AB 100%

-------------- ------------ --------------- ----- ---------------------- ------

Farm-in agreement with Nomads Mining Company sarl, Mauritania,

to earn up to 70% interest in Nomads 100% owned exploration permit

in Mauritania (details in ASX announcement 11 June 2019).

Summary of ASX releases

-- Acting CEO appointment

-- Chairman's Letter

-- Global X ETF inclusion

-- Resource Enhancement programme

-- Vanadium resource estimate

-- Investor presentation

-- Placement results

-- Media Release: Diplomat communications

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ('MAR') which has

been incorporated into UK law by the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service ('RIS'), this inside information is now

considered to be in the public domain.

For Further Information, please contact:

Will Goodall Jane Morgan

Acting CEO JMM

Aura Energy Limited Investor & Media Relations

info@auraenergy.com.au info@janemorganmanagement.com.au

+61 405 555 618

SP Angel Corporate Finance LLP WH Ireland Limited

(Nominated Advisor and Joint (Joint Broker)

Broker) Jessica Cave

David Hignell Andrew de Andrade

Kasia Brzozowska +44 (0) 207 220 1666

+44 (0) 203 470 0470

----------------------------------

About Aura Energy (ASX:AEE, AIM:AURA)

Aura Energy is an Australian based minerals company that has

major uranium and polymetallic projects with large resources in

Africa and Europe.

The Company is now focused on uranium production the Tiris

Project, a major greenfields uranium discovery in Mauritania, with

Aura announcing a Resource Upgrade in August 2021 of 10% or 5.0

million lb U3O8 bringing the total JORC Resource to 56 Mlbs (at a

100 ppm U3O8 lower cut-off grade).

Aura also completed a capital estimate update for the Tiris

Definitive Feasibility Study, to reflect current global pricing,

with these 2021 figures reconfirming Tiris as one of the lowest

capex, lowest operating cost uranium projects.

In October 2021, the Company entered a US$10m Offtake Financing

Agreement with Curzon, which includes an additional up to US$10m

facility, bringing the maximum available under the agreement to

US$20m.

In 2022, Aura will continue to transition from a uranium

explorer to uranium producer, to capitalise on the rapidly growing

demand for nuclear power as the world continues to shift towards a

decarbonised energy system.

Disclaimer Regarding Forward Looking Statements

This ASX announcement (Announcement) contains various

forward-looking statements. All statements other than statements of

historical fact are forward-looking statements. Forward-looking

statements are inherently subject to uncertainties in that they may

be affected by a variety of known and unknown risks, variables and

factors which could cause actual values or results, performance or

achievements to differ materially from the expectations described

in such forward-looking statements. The Company does not give any

assurance that the anticipated results, performance or achievements

expressed or implied in those forward-looking statements will be

achieved.

Mineral Resource and Ore Reserve Estimates

The information in this announcement that relates to Mineral

Resources or Ore Reserves is extracted from the reports titled '

Tiris Uranium Project - Resource Upgrade of 10% ' released to the

Australian Securities Exchange (ASX) on 27 August 2021 and 'Tiris

Uranium Project DFS Update' released to the ASX on 18 August 2021

and for which Competent Persons' consents were obtained. Each

Competent Person's consent remains in place for subsequent releases

by the Company of the same information in the same form and

context, until the consent is withdrawn or replaced by a subsequent

report and accompanying consent. The Company confirms that it is

not aware of any new information or data that materially affects

the information included in the original ASX announcements and, in

the case of estimates of Mineral Resources or Ore Reserves, that

all material assumptions and technical parameters underpinning the

estimates in the original ASX announcements continue to apply and

have not materially changed.

The Company confirms that the form and context in which the

Competent Person's findings are presented have not been materially

modified from the original ASX announcements.

In respect to Resource statements there is a low level of

geological confidence associated with inferred mineral resource and

there is no certainty that further exploration work will result in

the determination of indicated measured resource or that the

production target will be realised.

Notes to Project Description

The Company confirms that the material assumptions underpinning

the Tiris Uranium Production Target and the associated financial

information derived from the Tiris production target as outlined in

the Aura Energy release dated 18 August 2021 for the Tiris Uranium

Project Definitive Feasibility Study continue to apply and have not

materially changed.

The Tiris Uranium Project Resource was released on 27 August

2021 "Resource Upgrade of 10% - Tiris Uranium Project". The Company

confirms that it is not aware of any new information or data that

materially affects the information included in the relevant market

announcement and that all material assumptions and technical

parameters underpinning the estimates in the relevant market

announcements continue to apply and have not materially

changed.

In respect to Resource statements there is a low level of

geological confidence associated with inferred mineral resource and

there is no certainty that further exploration work will result in

the determination of indicated measured resource or that the

production target will be realised.

Competent Persons

The Competent Person for the portion of the 2022 Tiris Vanadium

Mineral Resource Estimate and classification relating to the

Hippolyte, Hippolyte South, Lazare North, and Lazare South deposits

is Mr Arnold van der Heyden of H&S Consulting Pty Ltd. The

information in the report to which this statement is attached that

relates to the 2018 Mineral Resource Estimate is based on

information compiled by Mr van der Heyden. Mr van der Heyden has

sufficient experience that is relevant to the resource estimation

to qualify Mr van der Heyden as a Competent Person as defined in

the 2012 edition of the 'Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves'. Mr van

der Heyden is an employee of H&S Consultants Pty Ltd, a Sydney

based geological consulting firm. Mr van der Heyden is a Member and

Chartered Professional of The Australasian Institute of Mining and

Metallurgy (AusIMM) and consents to the inclusion in the report of

the matters based on his information in the form and context in

which it appears.

The Competent Person for the portion of the 2022 Tiris Vanadium

Resource Estimate and classification relating to all other deposits

within the resource (Sadi South, Sadi North, Marie, Hippolyte West,

Oum Ferkik East, Oum Ferkik West deposits) is Mr Oliver Mapeto, an

independent resources consultant.

The information in the report to which this statement is

attached that relates to the 2018 Resource Estimate is based on

information compiled by Mr Mapeto. Mr Mapeto has sufficient

experience that is relevant to the resource estimation to qualify

Mr Mapeto as a Competent Person as defined in the 2012 edition of

the 'Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves'. Mr Mapeto is a Member of The

Australasian Institute of Mining and Metallurgy (AusIMM) and

consents to the inclusion in the report of the matters based on his

information in the form and context in which it appears.

The Competent Person for drill hole data and for integrating the

different resource estimates is Mr Neil Clifford. The information

in the report to which this statement is attached that relates to

compiling resource estimates and to drill hole data is based on

information compiled by Mr Neil Clifford. Mr Clifford has

sufficient experience that is relevant to the style of

mineralisation and type of deposit under consideration and to the

activity which he is undertaking to qualify Mr Clifford as a

Competent Person as defined in the 2012 edition of the

'Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves'. Mr Clifford is a consultant to Aura

Energy. Mr Clifford is a Member of the Australasian Institute of

Geoscientists. Mr Clifford consents to the inclusion in the report

of the matters based on his information in the form and context in

which it appears.

[1] At a lower cut-off grade of 100 ppm U(3) O(8)

[2] ASX & AIM release 19 April 2022 'Uranium Resource

Upgrade Programme Underway'

[3] ASX & AIM Release 18 August 2021 "Capital Estimate

Update-Zero Emission Tiris Uranium Project"

[4] ASX & AIM Release 16 February 2022 "Aura Defines

Vanadium JORC Resource at Tiris Uranium Project "

[5] ASX & AIM Release 29 July 2019 "TIRIS URANIUM DFS

COMPLETED DEMONSTRATING A ROBUST DEVELOPMENT PROJECT "

[6] ASX & AIM Release: Tiris Uranium Definitive Feasibility

Study completed, 29 July 2019

[7] ASX & AIM Release: Capital Estimate Update, 18 August

2021

[8] ASX & AIM Release: Tiris Uranium Definitive Feasibility

Study completed, 29 July 2019

[9] ASX & AIM Release: Chairmans Letter Uranium Production

and Expanding Resource, 20 January 2022

[10] ASX & AIM Release - Aura advances towards Net Zero

Emission Production at Tiris - 27 Jan 2022

[11] ASX & AIM Release: Tiris uranium project DFS update, 18

August 2021

[12] ASX & AIM Release: Aura defines vanadium JORC resource

at Tiris uranium Project, 16 February 2022

[13] ASX & AIM Release: Aura defines vanadium JORC resource

at Tiris uranium Project, 16 February 2022

[14] The information relating to the Häggån Uranium Resource

Estimate was prepared and first disclosed under the JORC Code 2004.

It has not been updated since to comply with the JORC Code 2012 on

the basis that the information has not materially changed since it

was last reported.

[15] ASX Release: "Outstanding Häggån Uranium Resource Expands

to 800 million pounds" 22 August 2012

[16] ASX & AIM Release: "New Resource Estimate - Häggån

Battery Metals Project, 23 May 2018

[17] Ranked: Top 25 nations producing battery metals for the EV

supply chain, www.mining.com 15 April 2021

[18] Northvolt Ett assembles first lithium-ion battery cell

[19]

https://ec.europa.eu/commission/presscorner/detail/en/ip_22_711

[20]

https://www.statista.com/statistics/1267500/eu-monthly-wholesale-electricity-price-country/

[21]

https://world-nuclear.org/information-library/country-profiles/countries-o-s/sweden.aspx

[22] ASX Release: "New Resource Estimate - Häggån Battery Metals

Project, 23 May 2018

[23]

https://thedeepdive.ca/nuclear-energy-producer-vattenfall-cuts-uranium-purchases-from-russia

/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAKLXADAAEEA

(END) Dow Jones Newswires

April 27, 2022 02:42 ET (06:42 GMT)

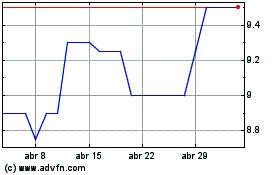

Aura Energy (LSE:AURA)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Aura Energy (LSE:AURA)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024