TIDMVRS

RNS Number : 1857L

Versarien PLC

12 May 2022

12 May 2022

Versarien Plc

("Versarien", the "Company" or the "Group")

Interim Results for the twelve months ended 31 March 2022

Versarien Plc (AIM: VRS), the advanced engineering materials

group, is pleased to announce its unaudited interim results for the

twelve months ended 31 March 2022. As announced on 24 February

2022, the Company's accounting reference date has changed from 31

March to 30 September.

Financial Highlights

-- Group revenues from continuing operations up 34% to GBP7.63

million (2021: GBP5.69 million)*

-- Graphene revenues up 170% to GBP1.89 million (2021: GBP0.70

million)

-- Adjusted LBITDA** for continuing operations reduced by 45% to

GBP1.04 million (2021: GBP1.88 million)

-- Reported loss before tax from continuing operations of GBP5.14

million (2021: GBP8.08 million)

-- Reported loss for the period of GBP5.20 million (2021: GBP8.07

million)

-- Cash of GBP3.10 million at 31 March 2022 (31 March 2021: GBP2.36

million)

*Excludes discontinued revenues of GBP0.53 million (2021:

GBP0.88 million)

**Adjusted LBITDA (Loss Before Interest, Tax, Depreciation and

Amortisation) excludes Exceptional items, Share-based payment

charges and Other losses)

Operational/Manufacturing Highlights

-- Relocation to new dedicated graphene production facility in

Longhope, Gloucestershire to significantly expand capacity

-- 10,000 square foot floor slab laid for new Versarien innovation

centre using the Company's Cementene(TM) and Polygrene(TM) enhanced

concrete

-- Acquisition of Spanish graphene manufacturing assets transferred

to Longhope during the year and in process of commissioning

to provide up to an additional 100 tonne powder capacity per

annum

-- Equipment to scale up graphene ink production capacity by an

additional 12,000 litres per annum delivered and commissioned

Partnerships/Commercialisation Highlights

-- Commercial agreement signed with Superdry to produce graphene

enhanced garments and discussions ongoing with multiple other

garment suppliers

-- Grant agreement signed and project completed to support the

development of Pseudo-Capacitor technology aimed at zero emissions

for port-side infrastructure

-- Successful on-time delivery of Defence Science and Technology

Laboratory ("DSTL") contract within specification

-- Royalty agreement signed with Gerdau S.A. for the distribution

of graphene masks primarily in Latin America

-- Collaboration signed with US-based Flux Footwear LLC, an adaptive

footwear company, to supply graphene enhanced elastomers

-- Launch of 3D printed concrete "Lunar" lifestyle pods using Cementene(TM),

Versarien's graphene-enhanced cement

Funding Highlights

-- GBP1.93 million strategic investment in Versarien by GrapheneLab

Co. Ltd., South Korea, together with royalty and trademark agreements

Post Period Highlights

-- Sports brand Umbro has announced it will integrate Versarien's

Graphene-Wear(TM) technology into its " Elite Pro-Training Kit"

range for the spring/summer collection 2023

-- GoToGym in South America are launching active-wear incorporating

Versarien's Graphene-Wear(TM) technology

Neill Ricketts, CEO of Versarien, commented:

"The period has seen the financial benefits of the DSTL contract

focussed on understanding the benefits that graphene-loaded

materials may bring to defence applications with Group revenues

from continuing operations up 34% and reported losses significantly

reduced. Alongside the expansion of our production facilities in

Longhope we continue to progress the applications in which graphene

can be used with a view to launching new graphene enhanced products

over the coming months. This is a natural follow on from the

successful finalisation of the DSTL contract and the near

completion of the GSCALE development projects.

"In parallel, customer testing continues to prove successful and

we are seeing increased interest from global companies in signing

development agreements that may, in time, lead to significant

future revenues whilst at the same time we are looking to expand

our global footprint and enter into agreements with the right

strategic partners for the business, in part helped by having

passed the accreditation of the Graphene Council."

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, THIS INFORMATION IS CONSIDERED TO

BE IN THE PUBLIC DOMAIN

For further information please contact:

Versarien Plc

Neill Ricketts - Chief Executive Officer +44 (0) 1594 887204

Chris Leigh - Chief Financial Officer

Dr Stephen Hodge - Chief Technology Officer

SP Angel Corporate Finance (Nominated Adviser

and Joint Broker)

Matthew Johnson

Ewan Leggat

Adam Cowl +44 (0) 20 3470 0470

Berenberg (Joint Broker)

Mark Whitmore

Ciaran Walsh +44 (0) 20 3207 7800

IFC Advisory Limited (Financial PR & Investor

Relations)

Tim Metcalfe

Zach Cohen +44 (0) 20 3934 6630

Notes to Editors:

The strategy of Versarien Plc (AIM:VRS) is to be a globally

recognised graphene company with a wide portfolio of high-quality

verified materials allied to the largest relevant IP portfolio

supported by its own UK based research and development centre

driving recurring revenue growth through its innovative graphene

product applications.

For further information please see: http://www.versarien.com

Chair's Statement

I am pleased to provide this, my first statement as

Non-executive Chair of Versarien, relating to the first twelve

months of the extended 18-month accounting period. In the interim

report for the first six months we stated that we would be

concentrating our graphene activities on the construction and

textile sectors, utilising our ability to help improve the

environment by using graphene to reduce CO(2) emissions, reduce

weight and improve recycling.

We continue to expand our production capability at Longhope,

Gloucestershire, and develop our international footprint and

product portfolio with the objective of being a global player in

the graphene market. At the same time monetisation of the

technology remains a priority and the progress made since my

appointment a few months ago is pleasing to see.

We are engaging with a number of international textile brands to

launch garments in the coming seasons and have launched our

Graphene-Wear(TM) website to showcase what can be achieved.

Cementene(TM) , our graphene admixture, has been used in a

number of concrete pours, providing validation for the technology.

The next stage will be to obtain the necessary accreditations to

allow full-scale commercialisation, a process which is

underway.

Whilst we focus on our objective of monetisation it is also

vital that we maintain a pipeline of development opportunities that

will provide future revenues. Global packaging companies are now

showing increased interest in how graphene can aid sustainability

and development agreements are in place. Participating in the UK's

Digital Roads for the Future programme also affords greater

opportunities in UK infrastructure projects.

In concluding, whilst we are pleased with the progress made we

cannot ignore the fact that the pandemic and recent macro-economic

events have provided a challenging environment, especially as we

have a global footprint to our operations. Whilst these factors

have delayed certain near-term projects, it has not affected our

objectives and we remain acutely aware of our shareholder's

expectations.

I would like to thank all our staff for their continued

endeavours and very much look forward to reporting further

progress.

Diane Savory OBE

Non-executive Chair

Chief Executive Officer's Review

I am pleased to report on the progress that the Group has made,

particularly in pursuit of solutions to the environmental

challenges we all face. Reducing CO(2) emissions, light-weighting,

electrification and recycling are all matters where Versarien's

advanced material technology can play a significant role.

The DSTL contract has been successfully delivered and we are

having ongoing dialogue with the UK defence sector. The development

work under the GSCALE project is nearing completion, and under the

terms of the Innovate UK loan the next two years will be focussed

on commercialising the developed technology. Monetisation of this

and Versarien's portfolio of other opportunities remains the focus

both in the UK and globally. The highlights of our recent progress

are set out below.

Construction:

The global construction industry is one of the biggest

contributors to CO(2) production, accounting for c.39% of energy

and process-related carbon dioxide emissions with concrete alone

contributing c.8% of the world's CO(2) emissions. A small amount of

graphene added to concrete can offer a way of significantly

reducing CO(2) emissions, as well as increasing the strength and

durability of the concrete, whilst reducing costs through less

labour and steel. With the UK and EU objectives of drastically

reducing carbon emissions by 2030 and for Europe to be a carbon

neutral continent by 2050, the development of Cementene(TM) and

Polygrene(TM) products provides a valuable societal and economic

benefit.

The global ready-mix concrete market is forecast to reach

US$1,375bn by 2028 and it is estimated that the global market for

graphene included in cement could be approximately GBP900 million

per annum by 2030. Obtaining a significant share of that market is

a primary focus for us. At our facilities at Longhope we conducted

a 10,000 square foot pouring of our graphene-enhanced concrete for

the Company's new innovation centre. The graphene-enhanced

polypropylene fibres eliminated the need for steel rebar, thereby

reducing costs and CO(2) emissions.

We have also demonstrated the efficiency of using 3D printed

graphene enhanced cement with the production of the Lunar Pod, a 3D

printed graphene enhanced concrete dwelling which has uses from

garden offices to humanitarian shelters. The Lunar Pod was designed

to showcase our technology and since its launch has proved to be a

valuable marketing tool.

Having demonstrated the technical viability of our graphene

enhanced cement, the next stage is to gain the required

accreditations under BS EN 8500. Further internal testing is

underway to meet BS EN 934-2.

Textiles/footwear and leisure-wear:

Further to previous announcements regarding the collaboration

with a prominent global sports and fashion wear manufacturer, the

customer, Umbro, has confirmed, post period end, that they will

launch a range of graphene-enhanced garments as part of their Elite

Pro-Training Kit range which will be available for sale in the

spring/summer collection in 2023. The garments will be available in

several countries around the world and will feature the Versarien

Graphene-Wear(TM) technology and trademark.

Following a period of collaboration, our strategic partner in

South America, GoToGym (a venture capital backed business), is

launching a new range of active wear garments featuring Versarien's

Graphene-Wear(TM) technology and trademark. GoToGym is working with

retail partners in North and South America with the garments to be

manufactured in Brazil.

Following delays caused by the Covid pandemic in Sri Lanka, we

are working with our partner MAS Holdings on a number of projects,

which involve the commercial team, MAS Active, and the development

team at Twinery, Innovations by MAS. The projects are a result of

further development work carried out at The Royal College of Arts

(Textile Division) which was able to further develop the printed

graphene ink technology in both ink designs and different fabric

compositions.

We are pushing forward with applying our Graphene-Wear (TM) ink

technology to Superdry's core fabrics that will be used to create

garments for a 2023 launch. Print trials are underway with their

supply chain partners and once completed, it will scale up into

production. We will be looking to establish a trademark licence

royalty agreement for the products sold which we expect to be a

framework for future projects with the company.

We are working closely with a niche fabric and garment

manufacturer with capabilities here in the UK and the Middle East.

We will be applying our Graphene-Wear(TM) ink technology to a range

of their fabrics for them to manufacture sportswear garments. They

will be selling these garments to their UK customers and also into

the Middle East where the company has established teamwear and

retail supply channels.

We have developed several Graphene-Wear (TM) rubber compounds

with our customers, one of which has been used to create the

outsole component of the Flux AdaptMid athletic shoe. Flux has

completed the prototyping stage and the shoes are ready for mass

production. Versarien is offering the first 500 pairs off the

production line in the autumn-winter 2022 season for the UK market

(available for pre-order now). Flux will be placing the shoe on

sale in the USA market immediately following this. We will be

receiving a trademark licence royalty on each pair sold.

We have supplied an initial 20kg of our Graphene-Wear(TM) rubber

compound to a major UK apparel manufacturer for them to mould into

prototype outsoles and outsole inserts, that they will be testing

for performance parameters.

We have launched our Graphene-Wear (TM) website

https://graphene-wear.com to showcase the technologies that we

offer. Alongside this, the Company's recently published white paper

shows the scientific validation behind our technology and offers

data points for our customers to view and assess.

We have been working with Inspecs Group to develop graphene

enhanced eyewear products that improve frame strength and

durability with initial technical tests proving successful. Rollout

is anticipated in 2023 and further information will be announced in

due course.

The graphene market for the textiles and footwear sector is

estimated to be approximately GBP400 million per annum by 2030 and

consequently this sector remains a high priority for Versarien.

Automotive

There are significant weight, structural and cost-saving

benefits to using graphene-enhanced carbon fibre reinforced

polymers (CFRP) in the automotive sector particularly with regard

to vehicle weight reduction which improves range for electric

vehicles and fuel consumption for internal combustion engined

vehicles.

As stated in the first interim report for the period, the Lotus

Evija bonnet was successfully developed as part of the Technology

Developer Accelerator Programme and further development will

continue as the parties look at optimisation of the process for use

in any body panel. This, together with the results of the DSTL

project are enabling further light-weighting development, including

a new bio-based resin with a reduced carbon footprint.

Graphene also has the potential to enhance the performance of

tyres. It can reduce the rolling resistance that, in turn,

increases the fuel efficiency of the vehicle or, in the case of an

EV, offer increased range.

We are now coming to the end of the initial lab scale tests for

Enso Tyres, with. the next step to repeat the most promising lab

scale tests with a second independent test house to ensure we have

robust test data to base any future prototype tyres upon.

The graphene market in the automotive sector is forecast to be

GBP300 million per annum by 2030, so continues to be a focus for

Versarien.

Aerospace

Graphene applications in the aerospace industry remain in the

early stages of research with light-weighting, fire retardancy, ice

protection systems, lightning strike protection and electrification

among the applications currently being explored.

We are at month 24 of 42 in the SpearHead 10 GICE project led by

Airbus, with a return to face-to-face meetings following Covid

restrictions. Versarien has been developing graphene heater mats to

be integrated into several aircraft demonstrators and has had the

technology validated to Technology Readiness Level 3 ("TRL")

(Airbus internal TRL scale 1-6). These heater mats are due to be

integrated into the various aero foil structures and have been

through preliminary icing wind tunnel testing prior to a

comprehensive icing wind tunnel campaign later this year.

Within the Graphene Flagship, Versarien is also working with

SpearHead 11 project SafeGraph, with the graphene heater mats a

case study for understanding the Lifecycle Analysis (LCA) and

exposure to nanomaterials during the various stages - e.g. graphene

production, heater mat manufacture and integration, during

operation and at end-of-life.

Steve Hodge, the Company's CTO, also maintains an active role as

part of the Graphene Flagship's ECHA-REACH working group.

The graphene aerospace market is estimated to be approximately

GBP70 million per annum by 2030 so continues to be a focus for the

Company.

DSTL Contract

The Company contracted with the UK's Defence Science and

Technology Laboratory (DSTL) in 2020 to undertake a package of work

to better understand the benefits that graphene-loaded materials

may bring to defence applications. This project completed

successfully on schedule by 31 March 2022 with the delivery of

demonstrators in two areas of application with some final reports

to be delivered post-period end. The manufacture of the

demonstrators has been proven to be a realistic practical

undertaking utilising the materials developed on the project.

One of the project work streams involved military bridging,

where a quarter scale bridge designed by Versarien was modelled

using finite element analysis (FEA) and manufactured from

graphene-enhanced carbon fibre polymer composite with minimal

metallic elements. The bridge underwent rigorous mechanical testing

to validate FEA models and will be housed at our Longhope

facility.

Exploitation plans have been developed and there is now ongoing

discussion with DSTL and industry OEMs to explore and capture

exploitation opportunities in the short, medium and long terms. The

project was a first for the Company and while it has delivered on

its technical requirements, the fruitful and constructive

relationship that has now been developed with DSTL has put the

Company on a firm footing for future engagements with the UK

defence sector.

United States of America

We continue to make good progress in the US market, adding new

customers, signing new NDAs, entering into new projects, and

selling samples. Our long-term relationships are moving towards

monetisation with Rust-Oleum, (a coatings company), having now

completed long term corrosion testing. We have performed companion

electrical corrosion testing in our UK labs, and the results are

good. The material is expected to be used in "professional grade"

corrosion inhibiting primer as soon as Versarien Graphene Inc.

attains the appropriate certification.

We have received our first order for sample material from NASA

where our graphene will be investigated for space-craft coating

applications. We are also working with a major fabric and yarn

manufacturer to include Versarien's graphene in ballistic

protection, stab resistant, flame retardant and abrasion resistant

garments as well as a high-end bicycle chain lubrication

manufacturer where Versarien's graphene materials have performed

exceptionally well in preliminary tests.

Interest is being shown by various US universities in

understanding more about Cementene(TM) with a view to including us

in their customer led concrete projects where significant US

Government funding for infrastructure is in place.

South Korea

Good progress has been made at Versarien Korea Limited ("VKL")

where strong partnerships have been forged with academic and

industrial partners. The core focus has been on chemical vapour

deposition ("CVD") growth optimisation with a portfolio of CVD

graphene products on different substrates to be launched pending

independent testing through the Graphene Flagship's

characterisation services. VKL is also looking at opportunities to

sell Versarien Graphene Limited's Cementene(TM) and

Graphene-Wear(TM) products in Korea .

South America

Graphene enhanced masks for COVID protection continue to be of

interest to the Brazilian market where the licence agreement with

Gerdau providing a royalty. Gerdau is currently going through the

process of getting the masks cleared by the Brazilian Health

Authorities after their initial order of 270,000 units.

Mature Businesses

Trading conditions for the mature businesses have improved over

the last 12 months, but nonetheless remain challenging. Revenues

were up 15% to GBP5.74 million (2021: GBP4.98 million), broadly the

same in each half, but pressure on margins has resulted in a small

loss for the 12 months.

Current trading and outlook

Trading in the current period has started satisfactorily with

order books at the mature businesses showing signs of improvement.

Our primary focus remains on the opportunities we see in the

construction and textile/leisure sectors where the potential

graphene markets are significant and within which we are moving

towards commercial product sales at the fastest rate. I look

forward to reporting further progress in due course.

Neill Ricketts

Chief Executive Officer

Chief Technology Officer's Review

The Innovate UK GSCALE programme has been running for over 18

months with the GBP5 million loan supporting Versarien in advancing

its graphene manufacturing capabilities, progressing research and

development of new graphene enhanced materials, with the primary

focus on commercial exploitation. This work is now largely complete

and now the focus will be on monetising the technology.

We have joined the Digital Roads of the Future (DRF) Partnership

which has two funding streams in place. The first being Digital

Roads, an GBP8.6 million project sponsored by the Engineering and

Physical Sciences Research Council, Costain, National Highways, the

University of Cambridge; and the second being Future Roads, a

GBP5.8 million project sponsored by 2020 Marie Sk odowska-Curie

Actions COFUND (a European funding initiative), Costain and

National Highways. Being a partner in this programme offers

Versarien the ability to become an active player in a GBP14.5

million programme over five years, developing direct links to

National Highways (formerly Highways England), developing stronger

links with a major international Tier 1 construction company,

Costain, gaining funded support for graphene material and

technology development, and delivering UK wide projects with

graphene materials and technologies on the road network.

We have excellent relationships with both the University of

Cambridge and Costain and by using our graphene admixture for

cementitious materials, Cementene(TM) , we can offer significant

advantages to new concrete material structures including

approximate 20% cost savings on ground bearing slab, reduction of

CO(2) emissions of up to 50%, use up to 30% less material

(reduction in thickness), removal/ significant reduction in steel

rebar requirements, no visible or microscopic cracking and highly

workable concrete.

We are in phase 2 of a development programme for graphene-based

packaging applications for a European based multi-national food

products company. Similar interest is being shown by the leading

global packaging and paper producer in Brazil with a development

contract also now in place. The objective is to improve

sustainability as well as cost effective performance.

In Spain, Gnanomat continues to upgrade its pilot plant and

manufacturing capabilities as part of the INNPRESSME project. It

has also signed a research contract with a global petrochemical

company to evaluate the use of metal oxide/activated carbon black

nanocomposites, inter alia, in active anode materials of lithium

ion batteries. It is making advances in its biocide materials

whilst developing prototypes for energy storage and developing new

ink formulations in conjunction with Cambridge Graphene. Gnanomat

materials have been utilised in the SUPPORTIVE project by 2-DTech

and two supercapacitor products have been developed with associated

datasheets. We are engaging with UK cell manufacturers to take

forward optimised devices.

Dr Stephen Hodge

Chief Technology Officer

Chief Financial Officer's review

As stated in previous reports, the aluminium business based at

Cheltenham has now ceased and consequently these results are split

between continuing and discontinued operations and the segmental

analysis between the technology and mature businesses. Details of

the discontinued operations are given in note 2 and include some

additional minor revenues and costs in the run-off period since the

last interim report.

The revenue from the continuing businesses increased by 34% to

GBP7.63 million up from GBP5.69 million. Revenue from graphene,

including that recognised under the DSTL contract, was up 170% to

GBP1.89 million from GBP0.70 million in the comparative period of

which DSTL accounted for GBP1.47 million (2021: GBP 0.25

million).

The loss from continuing operations was GBP4.74 million (2021:

GBP7.93 million). This was after charging GBP1.15 million in

respect of the valuation of the Lanstead Sharing Agreements (2021:

GBP3.28 million).

The adjusted LBITDA for continuing operations was GBP1.04million

compared to GBP1.88 million, an improvement of 45%, calculated as

follows:

12 months ended 12 months ended

31 March 2022 31 March 2021

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Continuing Discontinued TOTAL Continuing Discontinued TOTAL

operations operations operations operations

------------------------------ ----------- ------------ ------- ----------- ------------ -------

(Loss)/profit from

operations (4,738) (130) (4,868) (7,930) 22 (7,908)

Depreciation and Amortisation 1,396 41 1,437 1,135 98 1,233

Share based payments 1,156 - 1,156 1,193 - 1,193

Exceptional items - 64 64 441 - 441

Other losses 1,148 - 1,148 3,280 - 3,280

------------------------------ ----------- ------------ ------- ----------- ------------ -------

Adjusted LBITDA (1,038) (25) (1,063) (1,881) 120 (1,761)

------------------------------ ----------- ------------ ------- ----------- ------------ -------

The reported loss before tax for continuing operations was

GBP5.14 million (2021: GBP8.08 million). Group net assets at 31

March 2022 were GBP14.4 million (31 March 2021: GBP16.5 million)

with cash at the period end of GBP3.1 million (31 March 2021:

GBP2.4 million).

Net cash used in operating activities was GBP2.15 million (2021:

GBP0.89 million) with trade and other payables reducing by GBP1.2

million as the HMRC Covid payment plans unwound and trade creditor

payment terms returned to normal. Investment in development costs

and equipment was GBP3.57 million (2021: GBP1.68 million) and net

principal lease payments were GBP0.63 million (2021: GBP0.99

million) giving total cash outflows of GBP6.35 million (2021:

GBP3.56 million).

These activities were financed by net funds received from the

Lanstead sharing agreements of GBP3.17 million (2021: GBP2.34

million), net loans received of GBP2.10 million (2021: GBP2.45

million) and net funds received from the share issue to GrapheneLab

Co Ltd. of GBP1.90 million (2021: GBPNil) totalling GBP7.17 million

(2021: GBP4.79 million).

The surplus of GBP0.82 million (2021: GBP1.23 million) resulted

in reduced drawings on the invoice finance facilities of GBP0.08

million (2021: GBP0.53 million) thus increasing cash at the

period-end by GBP0.74 million (2021: GBP0.70 million). As we

progress our GSCALE project we continue to draw on the GBP5 million

Innovate UK loan facility, repayment of which is due to commence in

2024.

The mature business segment, whilst seeing increased revenues,

has incurred a loss of GBP0.1 million; however the current order

books are showing encouraging signs of improvement.

Chris Leigh

Chief Financial Officer

Consolidated Interim Financial Statements

Group statement of comprehensive income

For the 12 months ended 31 March 2022

31 March 31 March

2022 2021

Unaudited Audited

Restated***

GBP'000 GBP'000

Notes

Continuing operations

Revenue 3 7,633 5,685

Cost of sales (5,179) (4,498)

--------------------------------------------- ----- ---------- ------------

Gross profit 2,454 1,187

Other operating income 195 103

Other losses* (1,148) (3,280)

Operating expenses (including exceptional

items) (6,239) (5,940)

--------------------------------------------- ----- ---------- ------------

Loss from operations before exceptional

items (4,738) (7,489)

Exceptional items 4 - (441)

--------------------------------------------- ----- ---------- ------------

Loss from operations (4,738) (7,930)

Finance charge (398) (148)

--------------------------------------------- ----- ---------- ------------

Loss before income tax (5,136) (8,078)

Income Tax 5 81 -

--------------------------------------------- ----- ---------- ------------

Loss from continuing operations (5,055) (8,078)

(Loss)/profit from discontinued operations** 2 (141) 10

--------------------------------------------- ----- ---------- ------------

Loss for the period (5,196) (8,068)

--------------------------------------------- ----- ---------- ------------

Loss attributable to:

- Owners of the parent company (5,083) (7,779)

- Non-controlling interest (113) (289)

--------------------------------------------- ----- ---------- ------------

(5,196) (8,068)

--------------------------------------------- ----- ---------- ------------

Loss per share attributable to the equity

holders of the Company:

Basic and diluted loss per share 6 (2.62)p (4.45)p

--------------------------------------------- ----- ---------- ------------

There is no other comprehensive income for the year.

* The other losses in the period relates to the fair value

assessment of the Lanstead sharing agreements at the balance sheet

date.

** Details of the components of the discontinued operations are

given in note 2.

*** The audited results have been restated in accordance with

the required disclosure of discontinued operations.

Group statement of financial position

As at 31 March 2022

31 March 31 March

2022 2021

Unaudited Audited

Note GBP'000 GBP'000

Assets

Non-current assets

Intangible Assets 7 11,555 9,706

Property, plant and equipment 4,673 4,119

Deferred taxation 25 25

Trade and other receivables 38 772

---------------------------------------------------- ---- ---------- --------

16,291 14,622

---------------------------------------------------- ---- ---------- --------

Current assets

Inventory 1,901 1,814

Trade and other receivables 2,558 6,449

Cash and cash equivalents 3,095 2,359

---------------------------------------------------- ---- ---------- --------

7,554 10,622

---------------------------------------------------- ---- ---------- --------

Total assets 23,845 25,244

---------------------------------------------------- ---- ---------- --------

Equity

Called up share capital 1,941 1,899

Share premium 34,948 33,003

Merger reserve 1,256 1,256

Share-based payment reserve 4,405 3,249

Accumulated losses (26,708) (21,625)

---------------------------------------------------- ---- ---------- --------

Equity attributable to owners of the parent company 15,842 17,782

Non-controlling interest (1,401) (1,288)

---------------------------------------------------- ---- ---------- --------

Total equity 14,441 16,494

---------------------------------------------------- ---- ---------- --------

Liabilities

Non-current liabilities

Trade and other payables 1,187 1,222

Deferred taxation 67 67

Innovate Loan 4,371 2,260

Long-term borrowings 396 356

---------------------------------------------------- ---- ---------- --------

6,021 3,905

---------------------------------------------------- ---- ---------- --------

Current liabilities

Trade and other payables 2,532 3,748

Provisions 53 119

Invoice discounting advances 549 631

Current portion of long-term borrowings 249 347

---------------------------------------------------- ---- ---------- --------

3,383 4,845

---------------------------------------------------- ---- ---------- --------

Total liabilities 9,404 8,750

---------------------------------------------------- ---- ---------- --------

Total equity and liabilities 23,845 25,244

---------------------------------------------------- ---- ---------- --------

Group statement of changes in equity

For 12 months ended 31 March 2022

Share Share-based Non-

Share premium Merger payment Accumulated controlling Total

capital account reserve reserve losses interest equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- -------- -------- -------- ----------- ----------- ------------ --------

At 1 April 2020 (audited) 1,697 25,497 1,256 2,056 (13,846) (999) 15,661

Issue of shares 202 7,506 - - - - 7,708

Loss for the year - - - - (7,779) (289) (8,068)

Share-based payments - - - 1,193 - - 1,193

----------------------------- -------- -------- -------- ----------- ----------- ------------ --------

At 31 March 2021 (audited) 1,899 33,003 1,256 3,249 (21,625) (1,288) 16,494

Issue of shares 42 1,945 - - - - 1,987

Loss for the period - - - - (5,083) (113) (5,196)

Share-based payments - - - 1,156 - - 1,156

----------------------------- -------- -------- -------- ----------- ----------- ------------ --------

At 31 March 2022 (unaudited) 1,941 34,948 1,256 4,405 (26,708) (1,401) 14,441

----------------------------- -------- -------- -------- ----------- ----------- ------------ --------

Included within the merger reserve is GBP53,000 in respect of

the merger with Versarien Technologies Limited (now Versarien

Graphene Limited) and GBP964,000 in respect of the acquisition of

Total Carbide Limited and GBP239,000 in respect of the acquisition

of AAC Cyroma Limited.

Statement of Group cash flows

For the 12 months ended 31 March 2022

12 months

ended Year ended

31 March 31 March

2022 2021

Unaudited Audited

GBP'000 GBP'000

--------------------------------------------- ---------- ------------

Cash flows from operating activities

Cash used in operations (1,911) (734)

Interest paid (242) (160)

--------------------------------------------- ---------- ------------

Net cash used in operating activities (2,153) (894)

--------------------------------------------- ---------- ------------

Cash flows from investing activities

Purchase/capitalisation of intangible assets (2,190) (1,638)

Purchase of property, plant and equipment (1,377) (42)

--------------------------------------------- ---------- ------------

Net cash used in investing activities (3,567) (1,680)

--------------------------------------------- ---------- ------------

Cash flows from financing activities

Share issue 1,926 -

Share issue costs (23) (134)

Funds received from Innovate UK 2,111 2,260

Funds received from sharing agreements 3,171 2,479

Net funds (paid)/received from CBILS (13) 186

Principal payment of leases under IFRS 16 (634) (990)

Net invoice discounting advances (82) (525)

--------------------------------------------- ---------- ------------

Net cash generated from financing activities 6,456 3,276

--------------------------------------------- ---------- ------------

Increase in cash and cash equivalents 736 702

Cash and cash equivalents at start of period 2,359 1,657

--------------------------------------------- ---------- ------------

Cash and cash equivalents at end of period 3,095 2,359

--------------------------------------------- ---------- ------------

Note to the statement of Group cash flows

For the 12 months ended 31 March 2022

12 months

ended Year ended

31 March 31 March

2022 2021

Unaudited Audited

GBP'000 GBP'000

--------------------------------------------------- ---------- ------------

Loss before income tax (5,277) (8,068)

Adjustments for:

Share-based payments 1,156 1,193

Depreciation 1,096 1,081

Amortisation 341 152

Disposal of tangible assets 86 -

Finance cost 409 160

R&D Tax credit received 81 -

Loss on FV movement of share agreement 1,148 3,280

Increase/(Decrease) in trade and other receivables

and investments 306 (211)

(Increase)/Decrease in inventories (87) 438

(Decrease)/Increase in trade and other payables (1,170) 1,241

--------------------------------------------------- ---------- ------------

Cash used in operations (1,911) (734)

--------------------------------------------------- ---------- ------------

Discontinued operations 12months Year ended

ended 31 March

31 March 2021

2022 Unaudited

Unaudited GBP'000

GBP'000

-------------------------------------------------------- ----------------- ----------

Net cash generated/(used) in operating activities 122 34

Net cash used in investing activities (3) -

Net cash generated/(used) from financing activities (118) (37)

-------------------------------------------------------- ----------------- ----------

Increase in cash and cash equivalents from discontinued

operations 1 (3)

-------------------------------------------------------- ----------------- ----------

Notes to the unaudited interim statements

For the 12 months ended 31 March 2022

1. Basis of preparation

Versarien Plc is an AIM quoted company incorporated and

domiciled in the United Kingdom under the Companies Act 2006. The

Company's registered office is Units 1A-D, Longhope Business Park,

Monmouth Road, Longhope, Gloucestershire, GL17 0QZ.

The interim financial statements were prepared by the Directors

and approved for issue on 12 May 2022. These interim financial

statements do not comprise statutory accounts within the meaning of

section 434 of the Companies Act 2006. Statutory accounts for the

year ended 31 March 2021 were approved by the Board of Directors on

16 August 2021 and delivered to the Registrar of Companies. The

report of the auditors on those accounts was unqualified and did

not contain statements under sections 498 (2) or (3) of the

Companies Act 2006.

As permitted, these interim financial statements have been

prepared in accordance with UK AIM Rules and UK-adopted IAS 34,

"Interim Financial Reporting". They should be read in conjunction

with the annual financial statements for the year ended 31 March

2021, which have been prepared in accordance with UK-adopted

international accounting standards, consistent with the IFRS

framework adopted in UK law. The accounting policies applied are

consistent with those of the annual financial statements for the

year ended 31 March 2021, as described in those annual financial

statements. Where new standards or amendments to existing standards

have become effective during the year, there has been no material

impact on the net assets or results of the Group.

These interim financial statements have been prepared on a going

concern basis making the following assumptions:

-- The Group meets its day-to-day working capital requirements

through careful cash management and the use of its invoice discounting

facilities which are expected to continue;

-- As at 31 March 2022, the Group had cash balances totalling GBP3.10

million with GBP0.44 million of headroom on its invoice discounting

facilities;

-- The Group was awarded a GBP5 million loan by Innovate UK to

fund certain of its activities, of which GBP0.6 million remains

to be drawn;

-- The Group receives monthly settlements from its sharing agreements

with Lanstead, the quantum of which is dependent upon share

price; but which will cease in July;

-- The Group has unused authority to issue 29 million shares without

pre-emption rights until the next AGM due by 30 September 2022

and expects the placing authority to be renewed; and

-- That there are a number of mitigating actions the Group could

implement, such as reducing the funds spent on development of

its technologies and overheads to concentrate solely on GSCALE

commercial opportunities.

The Directors have prepared detailed projections of expected

future cash flows for a period of twelve months from the date of

issue of this interim statement. These indicate that the Group will

need to raise additional funding in the following financial year. T

he Board remains confident that the Group will be able to secure

the required funding through strategic investment, equity issue or

other financial instruments. However, the timing and availability

of funding sources is currently outside of the control of the Board

and none of this funding is committed at the date of these interim

statements. Whilst noting this, the Directors continue to adopt the

going concern basis in preparing the consolidated financial

statements.

Certain statements within this report are forward looking. The

expectations reflected in these statements are considered

reasonable. However, no assurance can be given that they are

correct. As these statements involve risks and uncertainties the

actual results may differ materially from those expressed or

implied by these statements. The interim financial statements have

not been audited.

2. Discontinued operations

On 5 August, within the preliminary results statement, the Group

announced its decision to exit the non-core aluminium business of

Versarien Technologies Limited based in Cheltenham. The company has

been re-named Versarien Graphene Limited and will be used as the

revenue generating entity for UK graphene sales whilst 2-DTech

Limited and Cambridge Graphene Limited will continue as the UK

research and development arms of the graphene business. Financial

information relating to the discontinued operation is set out

below.

12 months Year ended

ended 31 March

31 March 2022 2021

Unaudited Unaudited

Notes GBP'000 GBP'000

Revenue 3 534 882

Cost of sales (427) (614)

------------------------------------------ ----- -------------- ------------

Gross profit 107 268

Other operating income 1 4

Operating expenses (including exceptional

items) (238) (250)

------------------------------------------ ----- -------------- ------------

Profit from operations before exceptional

items (66) 22

Exceptional items 4 (64) -

------------------------------------------ ----- -------------- ------------

(Loss)/Profit from operations (130) 22

Finance charge (11) (12)

------------------------------------------ ----- -------------- ------------

Profit before income tax (141) 10

Income Tax 5 - -

------------------------------------------ ----- -------------- ------------

Profit from discontinued operations (141) 10

------------------------------------------ ----- -------------- ------------

3. Segmental information

The segment analysis for the twelve months to 31 March 2022 is

as follows:

Central Technology Mature Discontinued Intra-group TOTAL

Businesses Businesses Operations Adjustments

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue - 1,891 5,742 534 - 8,167

Gross Margin - 933 1,521 107 - 2,561

Other gains/(losses) (1,148) - - - - (1,148)

Other operating

income - 191 4 1 - 196

Operating expenses (2,041) (2,672) (1,552) (238) 26 (6,477)

(Loss)/ profit

from operations (3,189) (1,548) (27) (130) 26 (4,868)

Finance income/(charge) (283) (41) (74) (11) - (409)

(Loss)/profit

before tax (3,472) (1,589) (101) (141) 26 (5,277)

The segment analysis for the twelve months to 31 March 2021 is

as follows:

Central Technology Mature Discontinued Intra-group TOTAL

Businesses Businesses Operations Adjustments

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue - 703 4,982 882 - 6,567

Gross Margin - 91 1,096 268 - 1,455

Other gains/(losses) (3,280) - - - - (3,280)

Other operating

income - 103 - 4 - 107

Operating expenses (2,686) (1,638) (1,584) (250) (32) (6,190)

(Loss)/ profit

from operations (5,966) (1,444) (488) 22 (32) (7,908)

Finance income/(charge) (44) (33) (71) (12) - (160)

(Loss)/profit

before tax (6,010) (1,477) (559) 10 (32) (8,068)

4. Exceptional items

12 months 12 months

ended ended

31 March 31 March

2021 2021

Unaudited Audited

GBP'000 GBP'000

------------------------------------ ---------- ---------

Continuing operations :

------------------------------------ ---------- ---------

Relocation and restructuring costs - 53

Costs relating to expansion in Asia - 137

Acquisition costs - 186

Other - 65

------------------------------------ ---------- ---------

- 441

------------------------------------ ---------- ---------

Discontinued operations:

------------------------------------ ---------- ---------

Relocation and restructuring costs 64 -

------------------------------------ ---------- ---------

64 -

------------------------------------ ---------- ---------

5. Taxation

The tax charge on the results for the period has been estimated

at GBPnil (2021: GBPnil). At the last year end the Group had GBP

19.4 million of trading losses carried forward to set-off against

future trading profits. Taxation received in the year relates to

R&D tax credit.

6. Loss per share

The loss per share has been calculated by dividing the loss

after taxation of GBP5,083,000 (2021: GBP7,779,000) by the weighted

average number of shares in issue of 193,997,352 (2021:

174,660,000) during the period.

The calculation of the diluted earnings per share is based on

the basic earnings per share adjusted to allow for the issue of

shares on the assumed conversion of all dilutive options. However,

in accordance with IAS33 "Earnings per Share", potential Ordinary

shares are only considered dilutive when their conversion would

decrease the profit per share or increase the loss per share. As at

31 March 2022 there were 14,677,130 (2021: 14,677,130) potential

Ordinary shares that have been disregarded in the calculation of

diluted earnings per share as they were considered non-dilutive at

that date.

7. Intangible assets

31 March 31 March

2022 2021

Unaudited Audited

GBP'000 GBP'000

----------------------------- ---------- --------

Goodwill 3,555 3,555

Customer relationships/order

books - 27

Development costs 4,535 2,453

Licence 48 58

Intellectual property 3,417 3,613

----------------------------- ---------- --------

Total 11,555 9,706

----------------------------- ---------- --------

8. Dividends

As stated in the 2013 AIM Admission document, the Board's

objective is to continue to grow the Group's business and it is

expected that any surplus cash resources will, in the short to

medium term, be re-invested into the research and development of

the Group's products. Consequently, the Directors will not be

recommending a dividend for the foreseeable future. However, the

Board intends that the Company will recommend or declare dividends

at some future date once they consider it commercially prudent for

the Company to do so, bearing in mind its financial position and

the capital resources required for its development.

9. Interim Report

This interim announcement is available on the Group's website at

www.versarien.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPUAPAUPPGRG

(END) Dow Jones Newswires

May 12, 2022 02:01 ET (06:01 GMT)

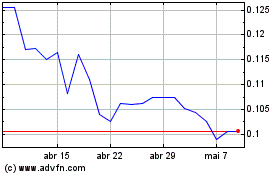

Versarien (LSE:VRS)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Versarien (LSE:VRS)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024