TIDMBRH

RNS Number : 0671P

Braveheart Investment Group plc

16 June 2022

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

16 June 2022

Braveheart Investment Group plc

("Braveheart", the "Company" or the "Group")

Final Results for the year ended 31 March 2022 & Notice of

AGM

Braveheart Investment Group plc (AIM: BRH) announces its audited

annual results for the financial year ended 31 March 2022,

highlights of which are set out below:

-- Earnings per share of 3.10 pence per share (2021: 36.30 pence per share)

-- Funds raised of GBP2.5 million before expenses during the year

-- Additional investment into Phase Focus Limited

-- Continued progress at Paraytec Limited

For further information:

Braveheart Investment Group plc Tel: 01738

587555

Trevor Brown, Chief Executive Officer

Allenby Capital Limited (Nominated Tel: 020

Adviser and Joint Broker) 3328 5656

David Worlidge / James Reeve / George

Payne

Peterhouse Capital Limited (Joint Tel: 020

Broker) 7469 0936

Heena Karani / Lucy Williams

Chief Executive Officer's Report

I am pleased to report to shareholders for the year ended 31

March 2022.

Overview

Group strategy continues to be application of the Board's

expertise and financial resources to those existing and newly

acquired businesses which the Board consider have the greatest

potential for outperformance. Details of these investments together

with operational updates about each of these companies follow

below.

Portfolio and Strategic Investments

As in previous years we have continued to divide our investments

into two categories, namely our Strategic Investments and Portfolio

Investments. Each of the Strategic Investments, of which there were

five at the end of the year under review, is summarised below in

this annual report. The Portfolio Investments are direct

investments into third party companies that were made by Braveheart

from 2002 until the summer of 2015 (the 'Portfolio Investments').

There are investments into a total of 13 different companies within

the Portfolio Investments as at 31 March 2022. Sentinel Medical

Limited is held in the accounts at GBP33, the original cost of

Braveheart's shareholding holding. This investment has been moved

out of Strategic Investments and into Portfolio Investments, until

the business reaches a point where it is determined to have

significant value. Therefore, at the end of the period under review

there were investments into a total of 18 companies. We will

continue to manage the Portfolio Investments with a view to seeking

exits wherever possible.

Strategic Investments Overview

Paraytec Limited ( Braveheart owns 100% per cent of the

company)

Paraytec Limited ("Paraytec") develops high performance

specialist detectors for the analytical and life sciences

instrumentation markets. In addition, the company has undertaken a

programme with the University of Sheffield to develop a rapid test

for identifying cancer and pathogens, including viruses.

As reported within our RNS on 15 November 2021, Paraytec has

continued to refine the platform technology that underpins its

proposed fast, sensitive COVID-19 test. The platform technology

(product reference "CX300") comprises a low-cost instrument that

utilises intense fluorescent light to detect small specific

pathogens or cells in a biological sample.

Although the market for COVID-19 tests has dramatically changed

in recent months, the Company believes there will continue to be a

significant long-term global market for point-of-care COVID-19

testing. In addition, it is clear that Paraytec's technology

platform has the potential for many other applications, and these

are primarily the focus of interest in ongoing discussions with

potential licensees and acquirers.

Paraytec has recently received ethical and HRA approval to

proceed with a clinical study at the Sheffield Teaching Hospitals

NHS Foundation Trust. This study will collect specimens from

COVID-19 positive participants for up to ten days and monitor the

ability of the Paraytec test to follow the course of infection by

comparison with the culture of SARS-CoV-2 virus from the specimens.

The test performance will also be compared with PCR (polymerase

chain reaction) and lateral flow tests. If successful, the

Directors believe these results will be a powerful demonstration of

the accuracy and uniqueness of the Paraytec test.

Professor Carl Smythe's team has established a CAT 3 laboratory

at the University of Sheffield to support the development of the

CX300 technology platform. This will allow the research team to

study a wide range of pathogens that cause infectious diseases,

including COVID-19. Potential acquirers have focused their interest

on a range of applications for the CX300, so the Paraytec team will

now concentrate on developing multiple tests, including those

previously commenced in bladder cancer and bacteraemia that causes

sepsis.

Phasefocus Holdings Limited (Braveheart owns 42.67 per cent of

the company)

Phasefocus Holdings Limited ("Phasefocus"), a spin-out from the

University of Sheffield, has developed a series of patented

computational imaging and analysis techniques that have a wide

range of applications including live cell imaging, engineering

metrology and electron microscopy. The company's novel method for

high fidelity quantitative imaging and microscopy is known in the

scientific literature as "ptychography".

Phasefocus's flagship product, Livecyte(TM) , allows researchers

and biotechnology companies to characterise the dynamic behaviour

of live cells in ways previously not possible. Livecyte integrates

Phasefocus's patented label-free Quantitative Phase Imaging

technology with state-of-the-art automatic cell tracking

algorithms. This enables users to automatically characterize

growth, morphology and motility of large populations of cells in a

96-well plate assay format.

Since moving to a distribution sales model in 2019, partnerships

with a wide range of distributors have resulted in a marked

increase in awareness of the company's products in the marketplace.

The reach of distributors, such as Cytena (part of the BICO group,

formerly CELLINK Inc.) and SinsiTech in China, has helped

Phasefocus enter new territories and has led to a rapid growth in

revenues.

In the company's financial year ended 31 December 2021, revenue

increased by more than 125% over the prior year. The company's head

count also increased by more than 10% in 2021. To enable the

company to keep up with production demand, in March 2022 Phasefocus

opened an expanded production facility in Nottingham Science Park,

Nottingham, UK. The new facility has more than four times the floor

space of the previous production facility, with room to expand

further as demand grows in future years.

Kirkstall Limited (Braveheart owns 80% of the company)

Kirkstall Limited ("Kirkstall") operates in the market known as

'organ-on-a-chip', where it has developed Quasi Vivo(R), a system

of chambers for cell and tissue culture in laboratories. Its

patented technology is used by researchers in the growing

'organ-on-a-chip' market, where academia and drug development

companies need to maintain living cells in a nutrient flow.

With most of Europe's university research laboratories operating

fully again following relaxation of restrictions on non-COVID

related research, Kirkstall has seen a steady upturn in sales

enquiries and orders for its Quasi Vivo(R) products. The

versatility and uniqueness of these products has been able to

attract attention into wider application areas including inhalation

toxicity, parasitic infections, nanotechnology, biosystem

ecologies.

There has also been increased interest in its products from

non-European countries including USA, China, India and Singapore in

the field of non-animal micro-physiological in vitro models.

In the last year, the company identified three new peer reviewed

publications from research teams utilising Kirkstall's Quasi Vivo

(R) system. Kirkstall is a strong supporter of such research, as

publications like these are an excellent marketing tool.

The first study involved the evaluation of drug absorption via

gastrointestinal tract tissue and was conducted at Sheffield Hallam

University in collaboration with the Croda Group. The research is

the result of Kirkstall's partnership with Animal Free Research UK

that started two years ago to support human-relevant science and

the principle of the replacement of animals in research.

https://doi.org/10.3390/pharmaceutics14020364

The second study was conducted by the research group of Berthold

Huppertz at the Medical University of Graz, Austria. The study

involved ex vivo human placental tissue and concluded that

Kirkstall's Quasi Vivo (R) system is the most native-like in vitro

system that can be used to simulate blood flow from the mother to

placenta and back, and thus can enable novel and more physiological

study designs. https://doi.org/10.3390/ijms22147464

The third study was conducted by the group of Louise Carson,

School of Mechanical and Aerospace Engineering, Queens University

Belfast. The group utilised the Quasi Vivo (R) system to develop an

in vitro model to evaluate long term biocompatibility of bone

substitute biopolymer constructs. 10.1016/j.actbio.2021.07.049

Since September 2021, Kirkstall's Quasi Vivo(R) system has been

on public display at the Francis Crick Institute, London at their

'Outwitting Cancer' exhibition.

www.crick.ac.uk/whats-on/exhibitions/outwitting-cancer/outwitting-cancer-exhibition

A new Quasi Vivo(R)(TM) platform with advanced fluid flow is in

late stage development at Kirkstall. The system is a complete

redesign, incorporating new features which the directors of

Kirkstall believe are highly desired by both pharmaceutical and

academic users. Prototypes are currently undergoing user testing by

Kirkstall's partners in the CyGenTig European consortium, in which

new techniques are under development for the production of

engineered tissues by optogenetics, aiming to build replacement

human organs by controlling individual cell growth using coloured

laser light.

Autins Group plc (Braveheart owns 8.7% of the company)

During the period, Braveheart invested in Autins Group plc

("Autins") (AIM: AUTG) through market purchases of shares. Autins

specialises in solving acoustic and thermal problems in the

automotive industry and other specialist applications. In

particular, the company's leading product Neptune, a non-woven

microfibre web, is produced by a mixture of engineered polyester

fibre and melt-blown polypropylene. This material outperforms

traditional automotive insulation and is gaining traction in office

and flooring acoustics applications.

The Board considers that this investment fits well in its

portfolio of advanced technology businesses and seeks to identify

opportunities with Autins that will benefit both companies.

Velocity Composites plc (Braveheart owns 4.13% of the

company)

In September 2021, Braveheart acquired 4.13% of Velocity

Composites plc ("Velocity") (AIM: VEL) through the purchase of

shares. Velocity is a leading supplier of advanced composite

material kits to the Aerospace sector. Velocity Composites' clients

include multi-national manufacturers of composite parts and

assemblies, who in turn deliver to the world's leading civil and

military aircraft manufacturers. The Airbus A320, A330, A350, A380,

Eurofighter Typhoon, F35 Joint Strike Fighter, Boeing 737, Boeing

787 and V22 Osprey are all constructed using parts manufactured

from Velocity's kits.

The Board considers that this investment fits well in its

portfolio of advanced technology businesses.

Outlook

We have entered our new financial year acutely aware of the

geo-political and macro-economic challenges the world is facing.

However, we are hopeful that this turbulence will also present

interesting new investment opportunities and we will be positioned

to respond as events unfold.

Financial Review

During the year we continued the comprehensive review of our

cost base and continued to reduce the central costs.

Income Statement

Fee-based revenue was generated by Braveheart Investment Group

Plc. The principal revenue from the Group's operations comprises

investment management fees, with total revenue during the year

being GBP43,000 (2021: GBP60,000). Revenue derived from strategic

subsidiary undertakings has decreased by GBP64,000 from GBP205,000

in 2021 to GBP141,000 in 2022. Finance income was GBPNil (2021:

GBPNil), this being interest on outstanding loan notes within the

directly held portfolio.

As at 31 March 2022, the total number of directly held

investments in the portfolio of Strategic Investments and the

Portfolio Investments was 18 companies (2021: 19), of which two

have been consolidated into Braveheart's accounts. The fair value

of the directly held portfolio, excluding the two companies now

consolidated into the Company's accounts, was GBP4,716,080 (2021:

GBP613,847). During the year the group made investments of

GBP1,467,000 into three portfolio companies, Autins Group Plc,

Velocity Composites Plc and Phase Focus Holdings Limited. This

excludes investments made into investments that are controlled by

the Group. Two investments (being Kirkstall and Paraytec) that are

considered as Strategic Investments by the Board are now deemed to

be 'controlled' by the Company and as a result of this, those

companies have been consolidated into Braveheart's accounts (but

remain categorised by management as Strategic Investments). At the

year end, the value of these two investments was GBP220,622 (2021:

GBP220,622), although the value in the consolidation in terms of

goodwill stands at GBP205,775 (2021: GBP205,775, two companies).

Therefore, the fair value of the directly held portfolio (Strategic

Investments and Portfolio Investments and including the two

investments that have now been consolidated into the Company's

accounts) was GBP4,921,855 (2021: GBP819,622).

Total income for the year ended 31 March 2022, including

realised gains and unrealised revaluation gains and losses, was

GBP2,937,000 (2021: GBP16,562,000).

The average number of employees remained at 7 during the period

under review. The number of employees working within the Group,

excluding employees of Kirkstall and Paraytec, was 4 during the

year under review (2021: 3). Employee benefits expense was

GBP636,000 (2021: GBP1,341,000). Other operating and finance costs

decreased to GBP753,000 (2021: GBP954,000).

The total profit after tax decreased to GBP1,442,000 (2021:

GBP13,907,000), equivalent to a basic profit per share of 3.10

pence (2021: 36.30 pence).

Financial Position

The Group's net assets of GBP6,607,000 (2021: GBP2,564,000),

include goodwill of GBP206,000 (2021: GBP206,000).

The carrying value of goodwill was reviewed during the year. The

income method was not deemed appropriate for the companies under

review due to the difficulty of projecting the future income of

these companies, so market value approach was considered more

appropriate.

At the year end the Group had cash balances of GBP1,894,000

(2021: GBP2,143,000 (including discontinued operations)). There

were no material borrowings.

A summary analysis of the Group's performance is as follows:

2022 2021

GBP'000 GBP'000

============================================= ========== ==============

Investment management revenue and sales 186 269

Finance income - -

============================================= ========== ==============

Income before portfolio movements 186 269

============================================= ========== ==============

Profit on disposal of investments 60 7,690

Profit on sale of subsidiary - 8,931

Change in fair value of investments, gain

on disposal of investments and movement in

contingent liability 2,691 (329)

============================================= ========== ==============

Total income of continuing activities 2,937 16,561

============================================= ========== ==============

Employee benefits expense (including share-

based payments) (636) (1,341)

Impairment of goodwill - (63)

Other operating and finance costs (755) (955)

============================================= ========== ==============

Total costs on continuing activities (1,391) (2,359)

Profit before tax - continuing 1,546 14,202

Loss on discontinued operations - (69)

Tax (104) (226)

============================================= ========== ==============

Total profit and total comprehensive profit

for the year 1,442 13,907

--------------------------------------------- ---------- --------------

Opening cash balance 2,143 685

Investment in portfolio companies (1,467) (250)

Proceeds from sale of equity investments 246 17,346

Amount paid to BBB (171) -

Dividends paid - (15,859)

Warrants and share options exercised 7 867

Funds raised - net of share issue costs 2,416 641

Other activities (1,280) (1,287)

Closing cash balance 1,894 2,143

============================================ =========== ==============

Net assets 6,607 2,564

============================================ =========== ==============

Key Performance Indicators (KPIs)

The KPIs we use to monitor business performance have been

changed in order to better reflect the emphasis that the Board has

placed upon the development of the Strategic Investments as the

best way to increase shareholder value over the short and medium

term. Given the nature of our business these KPI's remain as,

primarily, financial measures. They are:

2022 2021

------

Cash ('GBP000) 1,894 2,143

Share price (pence) 17.75 70.50

Income ('GBP000) 186 269

Value of investments 4,716 614

---------------------- ------ ------

On behalf of the Board

Trevor E Brown

Chief Executive Officer

15 June 2022

Consolidated Statement of comprehensive INCOME for the year

ended 31 March 2022

2022 2021

Notes GBP GBP

Revenue from contracts with customers 2 185,814 268,725

Change in fair value of investments 2,690,598 (329,083)

Profit on disposal of investments 4 60,414 7,690,287

Profit on sale of subsidiary 4 - 8,931,434

Total income 2,936,826 16,561,363

------------------------------------------- ------ ------------ ------------

Employee benefits expense (636,141) (1,340,954)

Impairment of goodwill 7 - (62,543)

Other operating costs (752,449) (953,791)

------------------------------------------- ------ ------------ ------------

Total operating costs (1,388,590) (2,357,288)

------------------------------------------- ------ ------------ ------------

Finance costs (2,349) (1,745)

Finance income 138 150

------------------------------------------- ------ ------------ ------------

Total costs (1,390,801) (2,358,883)

------------------------------------------- ------ ------------ ------------

Profit before tax 1,546,025 14,202,480

=========================================== ====== ============ ============

Tax (104,048) (226,367)

Profit from continuing operations 1,441,977 13,976,113

------------------------------------------- ------ ------------ ------------

Loss from discontinued operations, net of

tax - (69,350)

Total profit and total comprehensive loss

for the year 1,441,977 13,906,763

------------------------------------------- ------ ------------ ------------

Profit attributable to :

Equity holders of the parent 1,453,804 13,936,436

Non-controlling interest (11,827) (29,673)

------------------------------------------- ------ ------------ ------------

1,441,977 13,906,763

------------------------------------------- ------ ------------ ------------

Earnings per share Pence Pence

- basic 5 3.10 36.30

- diluted 5 2.82 35.25

consolidated statement of financial position as at 31 March

2022

2022 2021

Notes GBP GBP

ASSETS

Non-current assets

Property, plant and equipment 1,776 2,166

Intangible assets 26,103 28,152

Goodwill 205,775 205,775

Investments at fair value through

profit or loss 4,716,080 613,847

4,949,734 849,940

----------------------------------- ------ ---------- ----------

Current assets

Inventory 90,113 98,441

Trade and other receivables 123,412 105,772

Cash and cash equivalents 8 1,893,931 2,142,866

------------------------------------ ------ ---------- ----------

2,107,456 2,347,079

----------------------------------- ------ ---------- ----------

Total assets 7,057,190 3,197,019

==================================== ====== ========== ==========

LIABILITIES

Current liabilities

Trade and other payables (272,432) (591,079)

Deferred income (7,025) (41,843)

------------------------------------ ------ ---------- ----------

(279,457) (632,922)

----------------------------------- ------ ---------- ----------

Non-current liabilities

Deferred taxation (170,398) -

------------------------------------ ------ ---------- ----------

Total liabilities (449,855) (632,922)

==================================== ====== ========== ==========

Net assets 6,607,335 2,564,097

------------------------------------ ------ ---------- ----------

EQUITY

Called up share capital 1,044,807 766,148

Share premium reserve 4,371,343 2,226,671

Share based payment reserve 309,835 137,200

Retained earnings 899,202 (559,897)

------------------------------------ ------ ---------- ----------

Equity attributable to owners

of the Parent 6,625,187 2,570,122

Non-controlling interest (17,852) (6,025)

------------------------------------ ------ ---------- ----------

Total equity 6,607,335 2,564,097

------------------------------------ ------ ---------- ----------

Consolidated Statement of CAsh flows for the year ended 31 March

2022

2022 2021

GBP GBP

Operating activities

Profit for the year 1,441,977 13,906,763

Adjustments to reconcile profit before tax

to net cash flows from operating activities

Share based payment 177,930 400,148

(Increase) / Decrease in the fair value movements

of investments (2,690,598) 329,083

Profit on disposal of subsidiary - (8,931,434)

Profit on disposal of equity investments (60,414) (7,690,287)

Fees taken from investment proceeds - 78,419

Bonus in lieu of cash - 300,000

Non-controlling interest on disposal - (92,673)

Investment movement owed to BBB 41,265 (15,528)

Depreciation and amortisation 12,919 11,755

Impairment of goodwill - 62,543

Interest income (138) (150)

Taxation 170,398 (4,136)

Decrease in inventory 8,328 39,253

Increase in trade and other receivables (17,640) (8,400)

(Decrease) / Increase in trade and other payables (353,465) 330,225

----------------------------------------------------- ------------ -------------

Cash flow from operating activities (1,269,438) (1,284,419)

----------------------------------------------------- ------------ -------------

Investing activities

Proceeds from sale of investments 245,871 17,346,338

Amount paid to BBB (170,887) -

Purchase of investments (1,467,469) (250,000)

Purchase of intangibles (9,834) (5,549)

Purchase of tangibles (646) (1,124)

Interest received 138 150

----------------------------------------------------- ------------ -------------

Net cash flow from investing activities (1,402,827) 17,093,951

----------------------------------------------------- ------------ -------------

Financing activities

Dividends paid - (15,859,160)

Warrants and share options exercised 7,480 866,980

Funds raised, net of share issue costs 2,415,850 640,623

Net cash flow from financing activities 2,423,330 (14,351,557)

----------------------------------------------------- ------------ -------------

Net (decrease) / increase in cash and cash

equivalents (248,935) 1,457,975

Cash and cash equivalents at the beginning

of the year 2,142,866 684,891

----------------------------------------------------- ------------ -------------

Cash and cash equivalents at the end of the

year 1,893,931 2,142,866

----------------------------------------------------- ------------ -------------

Consolidated Statement of ChAnges in Equity for the year ended

31 March 2022

Share

Called Share based Retained

up Share Premium payment Earnings/ Non-controlling Total

Capital Reserve Reserve (Deficit) Total interest Equity

GBP GBP GBP GBP GBP GBP GBP

At 1 April 2020 561,555 91,657 - 1,043,955 1,697,167 79,572 1,776,739

---------------------- ---------- ----------- ---------- ------------- ------------- ---------------- -------------

Profit and total

comprehensive profit

for the year - - - 13,936,436 13,936,436 (29,673) 13,906,763

Allotment of shares 204,593 2,135,014 - - 2,339,607 - 2,339,607

Dividend paid - - - (15,859,160) (15,859,160) - (15,859,160)

Non-controlling

interest on disposal - - - 55,924 55,924 (55,924) -

Share based payments - - 400,148 - 400,148 - 400,148

Transfer to retained

earnings - - (262,948) 262,948 - - -

---------------------- ---------- ----------- ---------- ------------- ------------- ---------------- -------------

Transactions with

owners, recognised

directly in equity 204,593 2,135,014 137,200 (1,603,852) 872,955 (85,597) 787,358

====================== ========== =========== ========== ============= ============= ================ =============

At 1 April 2021 766,148 2,226,671 137,200 (559,897) 2,570,122 (6,025) 2,564,097

====================== ========== =========== ========== ============= ============= ================ =============

Profit and total

comprehensive profit

for the year - - - 1,453,804 1,453,804 (11,827) 1,441,977

Allotment of shares 278,659 2,228,822 - - 2,507,481 - 2,507,481

Cost of shares

issued - (84,150) - - (84,150) - (84,150)

Share based payments - - 177,930 - 177,930 - 177,930

Transfer to retained

earnings - - (5,295) 5,295 - - -

---------------------- ---------- ----------- ---------- ------------- ------------- ---------------- -------------

Transactions with

owners, recognised

directly in equity 278,659 2,144,672 172,635 1,459,099 4,055,065 (11,827) 4,043,238

---------------------- ---------- ----------- ---------- ------------- ------------- ---------------- -------------

At 31 March 2022 1,044,807 4,371,343 309,835 899,202 6,625,187 (17,852) 6,607,335

---------------------- ---------- ----------- ---------- ------------- ------------- ---------------- -------------

Notes to the financial statements for the year ended 31 March

2022

1 Corporate information

The Group and Company financial statements of Braveheart

Investment Group plc (the Company) for the year ended 31 March 2022

were authorised for issue by the Board of Directors on 15 June 2022

and the statements of financial position were signed on the Board's

behalf by Trevor Brown.

Braveheart Investment Group plc is a public company incorporated

in the United Kingdom under the Companies Act 2006 limited by

shares. The address of the registered office is detailed at the

back of this report. The nature of the Group's operations and its

principal activities are set out in the Strategic Report and

Directors' Report. The Company is registered in Scotland. The

Company's ordinary shares are traded on the AIM market of the

London Stock Exchange.

While the financial information included in this announcement

has been prepared in accordance with International Financial

Reporting Standards (IFRSs), this announcement does not itself

contain sufficient information to comply with IFRSs. The Group has

also published full financial statements that comply with IFRSs

available on its website and to be circulated shortly.

The financial information set out in the announcement does not

constitute the company's statutory accounts for the years ended 31

March 2022 or 2021. The financial information for the year ended 31

March 2021 is derived from the statutory accounts for that year,

which were prepared under IFRSs, on which the auditors gave a

qualified report, and which have been delivered to the Registrar of

Companies.

The financial information for the year ended 31 March 2022 is

derived from the statutory accounts for that year, which were

prepared under IFRSs, on which the auditors have given an

unqualified report that did not contain a statement under section

498(2) or 498(3) of the Companies Act 2006, and which will be

delivered to the Registrar of Companies.

2 Accounting policies

Basis of preparation

The Group and Company financial statements have been prepared in

accordance with UK-adopted international accounting standards in

accordance with the requirements of the Companies Act 2006 and in

accordance with the requirements of the AIM rules. The principal

accounting policies adopted by the Group and by the Company are set

out in the following notes.

The consolidated financial statements have been prepared on a

historical cost basis, except where otherwise indicated. The

financial statements are presented in sterling and all values are

rounded to the nearest pound (GBP) except where otherwise

indicated.

3 Revenue from contracts with customers

Revenue is attributable to the principal activities of the

Group. In 2022 and 2021, all revenue arose within the United

Kingdom.

2022 2021

GBP GBP

Investment management 1,500 3,600

Consultancy 43,090 59,634

Sale of goods 33,537 54,333

Grant income 74,984 111,181

Royalties 32,703 39,977

------------------------ -------- --------

185,814 268,725

----------------------- -------- --------

Of the revenue stated above, GBP43,090 (2021: GBP59,634) related

to The Lachesis Seed Fund Limited Partnership.

The group derives revenue from the transfer of goods and

services over time and at a point in time in the following major

product lines:

Investment Grant

management Consultancy Sale of goods income Royalties Total

2022

Timing of

revenue recognition

At a point

in time 1,500 - 33,537 74,984 - 110,021

Over time - 43,090 - - 32,703 75,793

============ ============ ================== ======== ========== ==========

1,500 43,090 33,537 74,984 32,703 185,814

============ ============ ================== ======== ========== ==========

2021

Timing of

revenue recognition

At a point

in time 3,600 - 54,333 111,181 - 169,114

Over time - 59,634 - - 39,977 99,611

============ ============ ================== ======== ========== ==========

3,600 59,634 54,333 111,181 39,977 268,725

============ ============ ================== ======== ========== ==========

4 Profit on sale of investment and subsidiary

During the previous year, the company disposed of its

shareholding in Pharm 2 Farm Limited in exchange for 310,354,815

shares in Remote Monitored Systems Plc. The sale was completed on 5

November 2020, and the group made a profit of GBP8,931,434 on the

initial investment of GBP225,000.

The group also sold 519,992,405 shares in Remote Monitored

Systems Plc for GBP17,424,757. The shares were acquired during the

previous year through a share for share exchange, cash investment

and the sale of Pharm 2 Farm Limited. The consideration of these

various transactions was GBP9,734,470, resulting in a profit on

disposal of GBP7,690,287.

5 Earnings per share

Basic earnings per share has been calculated by dividing the

profit attributable to equity holders of the parent by the weighted

average number of ordinary shares in issue during the year.

The calculations of profit per share are based on the following

profit and numbers of shares in issue:

2022 2021

GBP GBP

Profit for the year 1,441,977 13,906,763

----------------------------------------------- ----------- -----------

Weighted average number of ordinary shares in No. No.

issue:

For basic profit per ordinary share 46,870,999 38,307,451

Potentially dilutive ordinary shares 4,596,000 1,140,000

----------------------------------------------- ----------- -----------

For diluted earnings per ordinary share 51,466,999 39,447,451

----------------------------------------------- ----------- -----------

Dilutive earnings per share adjusts for share options granted

where the exercise price is less than the average price of the

ordinary shares during the period. At the current year end there

were 4,596,000 (2021: 1,140,000) potentially dilutive ordinary

shares.

The diluted loss per Ordinary Share is calculated by adjusting

the weighted average number of Ordinary shares outstanding to

consider the impact of options, warrants and other dilutive

securities.

6 Investments at fair value through profit or loss

Level 1 Level 2 Level 3

Equity Equity Equity

investments investments Debt investments investments Debt investments

in quoted in unquoted in unquoted in unquoted in unquoted

companies companies companies companies companies Total

GBP GBP GBP GBP GBP GBP

At 1 April 2020 - - - 724,402 - 724,402

Additions at Cost 9,734,470 - - 203,000 - 9,937,470

Disposals (9,734,470) - - - - (9,734,470)

Amount owed to

creditors - - - 15,528 - 15,528

Change in Fair Value - - - (329,083) - (329,083)

--------------------- ------------- ------------- ----------------- ------------- ----------------- ------------

At 1 April 2021 - - - 613,847 - 613,847

Additions at Cost 1,420,534 - - 46,935 - 1,467,469

Disposals - - - (48,274) - (48,274)

Amount owed to

creditors - - - (7,560) - (7,560)

Change in Fair Value (286,680) - - 2,977,278 - 2,690,598

--------------------- ------------- ------------- ----------------- ------------- ----------------- ------------

At 31 March 2022 1,133,854 - - 3,582,226 - 4,716,080

--------------------- ------------- ------------- ----------------- ------------- ----------------- ------------

Included in the balance above are investments that would be owed

to the British Business Bank through the Revenue Share Agreement.

At the year end, an amount of GBP31,043 would be due to the British

Business Bank on disposal. This liability is shown in the accounts

within other creditors.

As at 31 March 2022, the group total value of investments in

companies was GBP4,716,080 (2021: GBP613,847). The group total

change in fair value during the year was a profit of GBP2,690,598

(2021: loss GBP329,083).

Investments, which is made up of equity investments, are

designated on initial recognition as financial assets at fair value

through profit or loss. This measurement basis is consistent with

the fact that the Group's performance in respect of its portfolio

investments is evaluated on a fair value basis in accordance with

an established investment strategy. When investments are recognised

initially, they are measured at fair value.

After initial recognition the fair value of listed investments

is determined by reference to bid prices at the close of business

on the reporting date. Unlisted equity investments are measured at

fair value by the directors in compliance with the principles of

the International Private Equity and Venture Capital Guidelines,

updated and effective December 2015, as recommended by the European

Venture Capital Association. The fair value of unlisted equity

investments is determined using the most appropriate of the

valuation methodologies set out in the guidelines. These include

using recent arm's length market transactions; reference to the

current market value of another instrument, which is substantially

the same; earnings or profit multiples; indicative offers;

discounted cash flow analysis and pricing models.

The Group classifies its investments using a fair value

hierarchy. Classification within the hierarchy has been determined

on the basis of the lowest level input that is significant to the

fair value measurement of the relevant investment as follows:

-- Level 1 - valued using quoted prices in active markets for identical assets;

-- Level 2 - valued by reference to valuation techniques using

observable inputs other than quoted prices included within Level 1;

and

-- Level 3 - valued by reference to valuation techniques using

inputs that are not based on observable market data.

The fair values of quoted investments are based on bid prices in

an active market at the reporting date. All unquoted investments

have been classified as Level 3 within the fair value hierarchy,

their respective valuations having been calculated using a number

of valuation techniques and assumptions, notwithstanding that the

basis of the valuation methodology preferred by the Group is 'price

of most recent investment'. To reflect the potential impact of

alternative assumptions and a lack of liquidity in these holdings,

a discount of 15% has been applied to all Level 3 valuations. When

using the DCF valuation method, reasonably possible alternative

assumptions could have a material effect on the fair valuation of

investments.

The methodologies used in the year are broken down as

follows:

% of portfolio

valued

on this

Methodology Description Inputs Adjustments basis

-------------- ----------------------- ----------------------- -------------------------------- ------------------

A liquidity discount

is applied, typically

Used for unquoted 15%. Where last

investments where funding round is

there has been greater than twelve

a funding round, months then further

generally within The price of the discounts ranging

the last twelve most recent between 0% and 100%

Fund Raising months investment are applied. 26%

-------------- ----------------------- ----------------------- -------------------------------- ------------------

Used for investments Earnings multiples

which we can are applied to

determine the earnings of

a set of listed the company to

companies with determine the A liquidity discount

similar enterprise is applied, typically

Earnings characteristics value 15% 0%

-------------- ----------------------- ----------------------- -------------------------------- ------------------

The fair value

of debt investment

is deemed to be

cost less any

Debt/Loan impairment Impairment provision

notes Loan investments provision if deemed necessary 0%

-------------- ----------------------- ----------------------- -------------------------------- ------------------

Used where an

investment

is in a sales

process, A discount between

a price has been 5% - 10% is applied

agreed but the Contracted proceeds to reflect any uncertain

Indicative transaction has or best estimate adjustments to expected

offers not yet settled of expected proceeds proceeds 74%

-------------- ----------------------- ----------------------- -------------------------------- ------------------

Long term cash

flows are discounted

at a rate considered

appropriate for

Used for companies the business, A liquidity discount

Discounted with long-term typically is applied, typically

cash flow cash flows 9% - 12.5% 15% 0%

-------------- ----------------------- ----------------------- -------------------------------- ------------------

Group Group

Change in fair value in the year: 2022 2021

GBP GBP

Fair value gains 2,982,077 11,895

Fair value losses (291,479) (340,978)

------------------------------------------------------------------------------ -------------- ----------------

2,690,598 (329,083)

------------------------------------------------------------------------------ -------------- ----------------

The gain in the year came from the uplift of the valuation in

Phase Focus.

Details of investments where the nominal value of the holding in

the undertaking is 20% or more of any class of share are as

follows:

Caledonia Portfolio Realisations Limited ('CPR') holds a 20%

aggregate shareholding in Verbalis Limited ('Verbalis'), a design

and production of automated language translation systems company .

Neither CPR nor the Company is represented on the Board or within

management of Verbalis and in the opinion of the directors, this

shareholding does not entitle the Company to exert a significant or

dominant influence over Verbalis. The carrying value of Verbalis is

GBPnil (2021: GBPnil).

The Company holds a 6.43% aggregate holding on Gyrometric

Systems Limited, this company has developed a patent protected

system of hardware and software to accurately monitor the

vibrations in rotating shafts. During the year Braveheart announced

that it and Remote Monitored Systems plc ("RMS") had entered into a

share purchase agreement with the founders of Gyrometric Systems

Limited to return of control of Gyrometric to the founders of the

company, David Orton, Dr Paul Orton and Dr Janet Poliakoff. Under

the terms of the reorganisation, Braveheart's 19.5% interest in

Gyrometric was reduced to 6.43% and Braveheart wrote off a loan of

GBP39,200. The carrying value of Gyrometric is GBP1 (2021:

GBP1).

The Company holds a 42% aggregate holding on Phase Focus

Holdings Limited, has developed a series of patented computational

imaging techniques that have a wide range of applications including

live cell imaging, engineering metrology and electron microscopy.

The Company is represented on the Board and in the opinion of the

directors, this shareholding nor the representative entitles the

Company to exert a significant or dominant influence over Phase

Focus. The carrying value of Phase Focus is GBP3,418,573 (2021:

GBP389,913).

The Company holds a 38% aggregate holding on Sentinel Medical

Limited, this company is developing a point of care diagnostic

device for bladder cancer detection and monitoring . The Company is

represented on the Board and in the opinion of the directors, this

shareholding nor the representative entitles the Company to exert a

significant or dominant influence over Sentinel. The carrying value

of Sentinel is GBP33 (2021: GBP33).

The registered addresses for these entities are as follows:

Verbalis Limited Frostineb Cottage, Fala, Pathhead, Midlothian, EH37 5TB

Gyrometric Systems Limited Dockholme Lock Cottage, 380 Bennett

Street, Long Eaton, Nottingham, NG10 4JF

Phase Focus Holdings Limited 125 Wood Street, London, United Kingdom, EC2V 7AW

Sentinel Medical Limited York House, Outgang Lane, Osbaldwick, York, England, YO19 5UP

7 Goodwill

Paraytec Kirkstall Pharm 2 Total

Farm

GBP GBP GBP GBP

Cost - At 31 March

2020 571,137 944,409 131,359 1,646,905

Disposals - - (131,359) (131,359)

Cost - At 31 March

2021 571,137 944,409 - 1,515,546

Disposals - -

======================= ========== ========== ========== ============

Cost - At 31 March

2022 571,137 944,409 - 1,515,546

======================= ========== ========== ========== ============

Impairment - At 31

March 2020 (365,362) (881,866) - (1,247,228)

Impairment (62,543)- - (62,543)

Impairment - 31 March

2021 (365,362) (944,409) - (1,309,771)

Impairment - - - -

Impairment - 31 March

2022 (365,362) (944,409) - (1,309,771)

======================= ========== ========== ========== ============

Net Book Value - At

1 April 2022 205,775 - - 205,775

======================= ========== ========== ========== ============

Net Book Value - At

1 April 2021 205,775 - - 205,775

======================= ========== ========== ========== ============

The income approach was not deemed a reliable method for valuing

the goodwill of Paraytec and Kirkstall. Therefore, the market value

method was used in order to ascertain the value of goodwill at the

year end.

8 Cash and cash equivalents

2022 2021

GBP GBP

Cash at bank and on hand 1,893,931 2,142,866

========================== ========== ==========

Cash balances are held with HSBC Bank plc and Bank of Scotland

plc and earn interest at floating rates based on daily bank deposit

rates.

9 Posting of audited results for the year ended 31 March 2022

and Notice of AGM

The Company is pleased to announce that it expects to post its

audited report and accounts for the year ended 31 March 2022 to

shareholders shortly. It is also posting notice of its annual

general meeting ("Notice of AGM"), to be held on 13 July 2022 at

10.30 am. Copies of the final report and accounts and the Notice of

AGM will also be available to view on the Company's website

shortly, at http://www.braveheartgroup.co.uk/.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SFSEDIEESESM

(END) Dow Jones Newswires

June 16, 2022 02:00 ET (06:00 GMT)

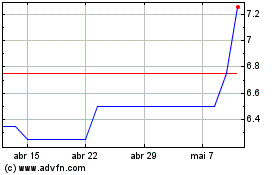

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024