Trafalgar Property Group PLC Debt Consolidation (9262R)

11 Julho 2022 - 3:00AM

UK Regulatory

TIDMTRAF

RNS Number : 9262R

Trafalgar Property Group PLC

11 July 2022

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). With the

publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

TRAFALGAR PROPERTY GROUP PLC

("Trafalgar", the "Company" or "Group")

Consolidation and variation of terms of convertible loan notes

and debt

Trafalgar (AIM:TRAF), the AIM quoted residential and assisted

living property developer, announces that Christopher Johnson a

substantial shareholder in the Company and a director of one of its

subsidiaries, Trafalgar New Homes Limited) has agreed to a

consolidation and variation of the terms of his two unsecured

convertible loan notes and director loan held by him. The

conversion of the total amount owed to him by the Company

(GBP905,000) will result in the issue to Christopher Johnson of a

new unsecured convertible loan note (the "New CLN") for an

aggregate amount of GBP905,000. This replaces:

-- the GBP600,000 unsecured convertible loan note issued on 13

July 2020, which would have been redeemable on 31 July 2022, and

which was convertible at 0.2p per share (now 2p following the share

consolidation on 29 December 2020). It carried the right, upon a

conversion of the loan note, to the grant of warrants to subscribe

for ordinary shares on a one for one basis, exercisable at the

conversion price of 2p for a period of two years from the date of

grant;

-- the GBP200,000 unsecured convertible loan note comprising a

loan facility entered into on 22 November 2021, which is redeemable

on 30 November 2022, and which is convertible at 0.7p per share;

and

-- GBP105,000 owed to him by the Company on directors loan account.

The New CLN will be convertible in full into 226,250,000

Ordinary Shares at 0.4p per ordinary share (a 29 per cent. premium

to the mid-market closing price of 0.31p on 8 July 2022) and can be

converted at any time by Mr Johnson, subject inter alia to his

entire holding being less than 29.99 per cent of the voting rights

in issue in the Company.

The New CLN carries the right, upon a conversion, to the grant

of warrants to subscribe for ordinary shares on a one for one

basis, exercisable at the conversion price for a period of two

years from the date of grant.

The Company does not currently have sufficient authority to

allot securities to satisfy a conversion of the New CLN, and has

agreed to convene a general meeting to seek such authorities before

31 October 2022. Mr Johnson has agreed not to exercise conversion

rights under the New CLN until the Company has obtained sufficient

authorities.

The New CLN represents a material extension of the redemption

dates under the previous convertible loan notes, improving the

Company's cash flow position, which the Company has agreed with Mr

Johnson in consideration for the other variations in the terms of

the New CLN, namely the reduction in conversion price.

Following the issue of the New CLN, the Company will have no

indebtedness to Mr Johnson other than under the New CLN. Trafalgar

New Homes Limited ("TNH"), the principal operating subsidiary of

the Company, remains indebted to Mr Johnson under its loan

agreement with him ("TNH Loan") in the current approximate amount

of GBP2,204,650. TNH makes repayments or drawings under the TNH

Loan periodically, depending upon its working capital

requirements.

Related Party Transaction

As Christopher Johnson is a substantial shareholder in the

Company and a director of one of its subsidiaries (Trafalgar New

Homes Limited), the issue of the New CLN therefore constitutes a

related party transaction under Rule 13 of the AIM Rules for

Companies. The Directors of Trafalgar, all of whom are independent

in respect of the related party transaction, consider, having

consulted with SPARK, the Company's Nominated Adviser, that the

issuance and terms of the New CLN are fair and reasonable insofar

as the Company's Shareholders are concerned.

Enquiries:

Trafalgar Property Group plc

James Dubois +44 (0) 1732 700 000

SPARK Advisory Partners Limited

- AIM Nominated Adviser

Matt Davis +44 (0) 203 368 3550

Peterhouse Capital Limited -

Broker

Duncan Vasey/Lucy Williams +44 (0) 20 7409 0930

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAEXEFESAEFA

(END) Dow Jones Newswires

July 11, 2022 02:00 ET (06:00 GMT)

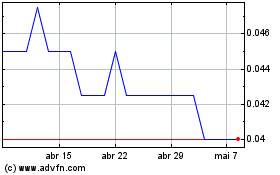

Trafalgar Property (LSE:TRAF)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Trafalgar Property (LSE:TRAF)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025