TIDMMTL

RNS Number : 0115T

Metals Exploration PLC

20 July 2022

METALS EXPLORATION PLC

QUARTERLY UPDATE TO 30 JUNE 2022

Metals Exploration plc (AIM: MTL) ("Metals Exploration", the

"Company" or the "Group"), a gold producer in the Philippines, is

pleased to announce its quarterly results for Q2 2022.

Finance and corporate

-- Gold sold during Q2 2022 of 14,992 ounces at an average

realised gold price of US$1,858 per ounce (Q1 2022: 15,685 ounces

at an average realised gold price of US$1,898 per ounce).

-- Gold sales of US$27.8 million in Q2 2022 (Q1 2022: US$29.8 million).

-- Positive free cash flow of US$5.4 million in Q2 2022 (Q1 2022: US$8.2 million).

-- Senior debt repaid during Q2 2022 of US$5.0 million (Q1 2022: US$12.0 million).

-- Senior debt outstanding as at 30 June 2022 was US$8.1 million

(31 March 2022: US$12.9 million).

-- Net debt as at 30 June 2022 was US$92.9 million (31 March 2022: US$94.2 million).

Mining Operations

-- No lost time injuries occurred during the period, with over

17 million hours worked without a reportable injury .

-- Ore mined decreased for the quarter to 510kt (Q1 2022: 779kt)

with waste mined at 2.47Mt (Q1 2022: 3.15Mt).

Processing Operations

-- Gold recovered during Q2 2022 of 16,529 ounces (Q1 2022:

14,819 ounces) from a higher head grade of 1.18g/t (Q1 2022:

1.02g/t).

-- Gold recovery for Q2 2022 was 86.6% (Q1 2022: 89.0%).

COVID-19 Impacts

-- Operations continuing to be largely unaffected by COVID-19 impacts.

-- COVID-19 vaccine programme well advanced, with over 95% of

all employees having had at least two vaccination doses.

Darren Bowden, CEO of Metals Exploration, commented :

"Runruno has maintained a positive trend in recovery and we are

delighted that the operation is now able to sustain an >85%

average recovery. The project is well positioned for a strong

second half of 2022 as the grade in the mine improves once the

higher grade ore in Stage 3 is accessed. The Company remains on

track to meet our 2022 production guidance and to repay the senior

debt during Q4 2022 as forecast, which will further strengthen our

balance sheet.

"I would also like to take this opportunity to thank the

operations team for an outstanding safety performance as the

Company passes 17 Million man-hours without a lost time

injury."

Production and Finance Summary

Runruno Project

Report Quarter Quarter FY 2022 FY 2021

FY 2022 Actual Actual Actual Actual

------------------------- ------------- ------------------- -------------------

PHYSICALS Units Q2 2022 Q2 2021 6 Months 6 Months

------------- ---------- ----------

Mining

------------- ---------- ----------

Ore Mined Tonnes 509,825 287,866 1,289,123 713,742

-------------- ---------- ----------

Waste Mined Tonnes 2,467,685 2,371,708 5,619,472 4,537,749

-------------- ---------- ----------

Total Mined Tonnes 3,002,244 2,659,574 6,965,979 5,251,491

-------------- ---------- ----------

Au Grade Mined g/tonne 1.18 1.10 1.10 1.27

-------------- ---------- ----------

Strip Ratio 4.77 7.42 4.28 5.92

---------- ----------

Processing

------------- ---------- ----------

Ore Milled Tonnes 510,214 511,536 1,017,258 1,048,290

-------------- ---------- ----------

Au Grade g/tonne 1.16 1.26 1.09 1.29

-------------- ---------- ----------

S(2) Grade % 1.10 1.17 0.98 1.11

-------------- ---------- ----------

Au Milled (contained) Ounces 19,087 20,745 35,742 43,620

-------------- ---------- ----------

Recovery % 86.6 80.0 87.7 81.0

-------------- ---------- ----------

Au Recovered/Poured Ounces 16,529 16,591 31,348 35,316

-------------- ---------- ----------

Sales

------------- ---------- ----------

Au Sold Ounces 14,992 16,429 30,676 34,745

-------------- ---------- ----------

Au Price US$/oz 1,858 1,807 1,878 1,797

-------------- ---------- ----------

FINANCIALS (Unaudited)

------------------------- ------------- ---------- ----------

Revenue

------------- ---------- ----------

Gold Sales (US$000's) 27,849 29,682 57,622 62,439

-------------- ---------- ----------

Operating Costs

- Summary

------------- ---------- ----------

Mining (US$000's) 6,972 6,415 13,307 11,950

-------------- ---------- ----------

Processing (US$000's) 6,926 7,876 14,296 15,363

-------------- ---------- ----------

G&A (US$000's) 2,616 2,638 5,316 5,548

-------------- ----------

Total Operating

Costs (US$000's) 16,515 16,929 32,919 32,860

-------------- ----------

Excise Duty (US$000's) 1,099 1,190 2,317 2,541

-------------- ---------- ----------

UK/Philippine G&A (US$000's) 3,102 1,897 4,783 3,496

-------------- ---------- ----------

Total Direct Production

Costs (US$000's) 20,716 20,016 40,019 38,897

-------------- ---------- ----------

Net Cash Income (US$000's) 7,133 9,666 17,603 23,543

-------------- ---------- ----------

Total Capital Costs (US$000's) 1,775 4,209 4,039 6,553

-------------- ---------- ----------

Total non-cash

costs (US$000's) 3,009 3,583 7,682 7,907

-------------- ---------- ----------

Free Cashflow ( US$000's) 5,358 5,457 13,564 16,989

-------------- ---------- ----------

Cash Cost / oz

Sold - C1 US$/oz 938 1,014 960 946

-------------- ---------- ----------

Cash Cost / oz

Sold - AISC US$/oz 1,336 1,458 1,323 1,309

-------------- ---------- ----------

Note: AISC includes all UK Corporate costs.

Review of Operations

Gold sales for Q2 2022 were US$27.8 million (Q1 2022: US$29.8

million), at an average realised gold price of US$1,858 per ounce

(Q1 2022: average gold price of US$1,898 per ounce); producing a

positive free cash flow of US$5.4 million (Q1 2022: US$8.2

million).

During Q2 2022, debt repayments of US$5.0 million (Q1 2022:

US$12.0 million) were made. The net Group debt position as at 30

June 2022 was US$92.9 million (Q1 2022: US$94.2 million). Cash

holdings at 30 June 2022 were $0.3million (31 March 2022: $0.7

million).

Mining Operations

Mining production of ore and waste for Q2 2022 was above

forecast at 3.00Mt (Q1 2022: 3.96Mt), with a total of 510Kt of ore

mined in Q2 2022 (Q1 2022: 779kt).

Back-fill of waste into Stage 1 has continued with mining in

Stage 2 expected to be completed during Q3 2022.

Although the removal and resettlement of illegal miners from

Stages 3 and 4 of the Project site is largely complete, full access

to Stage 3 has not yet been achieved. Despite several court orders

in the Company's favour, access to a key area of Stage 3 has not

yet been achieved. This delay has resulted in changes to the

Company mine plan such that higher grade material in Stage 3 is now

scheduled for mining during H2 2022. These access issues have also

temporarily halted the exploration drill programme planned for

Stages 4 and 5.

Process Plant

Throughput for Q2 2022 was 510kt (Q1 2022: 507kt). Gold

production for Q2 2022 was 16,529 ounces at a recovery rate of

86.6% (Q1 2022: 14,819 ounces at a recovery rate of 89.0%). The

higher quarter production was achieved notwithstanding continuing

issues with the BIOX bacteria culture reflecting a higher head

grade of 1.18g/t (Q1 2022: 1.02g/t).

Further power failures were experienced during Q2 2022 that

contributed to a lack of stability of the BIOX bacteria culture;

giving rise to resultant recovery losses. In addition, studies

continue in an effort to identify an as yet unknown contaminant

that developed in the return water sources that were being used to

feed the BIOX circuit. The combined impact of these issues resulted

in the BIOX circuit performance to under-perform during the

quarter.

A major upgrade to the process plant return water and cooling

systems is continuing.

Residual Storage Impoundment ("RSI")

Work continued on the final RSI dam-wall raise. D am water

freeboard remains well above design minimum levels. Detailed

planning of the RSI final in-rock spillway is advancing.

Occupational Health & Safety

Runruno continues to record an exceptional safety record with

over 17 million hours worked without a reportable injury as at the

date of this announcement.

Environment and Compliance

Compliance matters continue to be successfully monitored, and

the mine remains compliant, with no outstanding material

issues.

Community & Government Relations

In conjunction with relevant government agencies, the Company

continues in its efforts to complete the removal of the few

remaining illegal miners, including their infrastructure and

dwellings, from those areas scheduled to be mined as part of mine

plan Stages 3 and 4, and those areas the Company wishes to conduct

exploration drilling in Stages 4 and 5.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014, which forms part of United

Kingdom domestic law by virtue of the European Union (Withdrawal)

Act 2018 (as amended). Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

- END -

For further information please visit or contact:

Metals Exploration PLC

Via Tavistock Communications

Limited +44 (0) 207 920 3150

-------------------------

Nominated & Financial Adviser: STRAND HANSON LIMITED

-------------------------

James Spinney, James Dance,

Rob Patrick +44 (0) 207 409 3494

-------------------------

Financial Adviser & Broker: HANNAM & PARTNERS

-------------------------

Matt Hasson, Franck Nganou +44 (0) 207 907 8500

-------------------------

Public Relations: TAVISTOCK COMMUNICATIONS

LIMITED

-------------------------

Jos Simson, Nick Elwes +44 (0) 207 920 3150

-------------------------

Web: www.metalsexploration.com

Twitter: @MTLexploration

LinkedIn: Metals Exploration

Competent Person's Statement

Mr Darren Bowden, a director of the Company, a Member of the

Australasian Institute of Mining and Metallurgy and who has been

involved in the mining industry for more than 25 years, has

compiled, read and approved the technical disclosure in this

regulatory announcement in accordance with the AIM Rules - Note for

Mining and Oil & Gas Companies.

Forward Looking Statements

Certain statements relating to the estimated or expected future

production, operating results, cash flows and costs and financial

condition of Metals Explorations, planned work at the Company's

projects and the expected results of such work contained herein are

forward-looking statements which are based on current expectations,

estimates and projections about the potential returns of the Group,

industry and markets in which the Group operates in, the Directors'

beliefs and assumptions made by the Directors . Forward-looking

statements are statements that are not historical facts and are

generally, but not always, identified by words such as the

following: "expects", "plans", "anticipates", "forecasts",

"believes", "intends", "estimates", "projects", "assumes",

"potential" or variations of such words and similar expressions.

Forward-looking statements also include reference to events or

conditions that will, would, may, could or should occur.

Information concerning exploration results and mineral reserve and

resource estimates may also be deemed to be forward-looking

statements, as it constitutes a prediction of what might be found

to be present when and if a project is actually developed.

These statements are not guarantees of future performance or the

ability to identify and consummate investments and involve certain

risks, uncertainties and assumptions that are difficult to predict,

qualify or quantify. Among the factors that could cause actual

results or projections to differ materially include, without

limitation: uncertainties related to raising sufficient financing

to fund the planned work in a timely manner and on acceptable

terms; changes in planned work resulting from logistical, technical

or other factors; the possibility that results of work will not

fulfil projections/expectations and realize the perceived potential

of the Company's projects; uncertainties involved in the

interpretation of drilling results and other tests and the

estimation of gold reserves and resources; risk of accidents,

equipment breakdowns and labour disputes or other unanticipated

difficulties or interruptions; the possibility of environmental

issues at the Company's projects; the possibility of cost overruns

or unanticipated expenses in work programs; the need to obtain

permits and comply with environmental laws and regulations and

other government requirements; fluctuations in the price of gold

and other risks and uncertainties.

The Company expressly disclaims any obligation or undertaking to

disseminate any updates or revisions to any forward looking

statements contained herein to reflect any change in the Group's

expectations with regard thereto or any change in events,

conditions or circumstances on which any such statements are based

unless required to do so by applicable law or the AIM Rules.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDRLMTTMTBBBAT

(END) Dow Jones Newswires

July 20, 2022 02:00 ET (06:00 GMT)

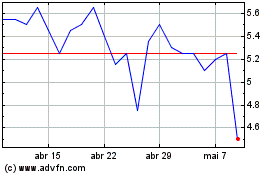

Metals Exploration (LSE:MTL)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Metals Exploration (LSE:MTL)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025