TIDMTET

RNS Number : 9405V

Treatt PLC

15 August 2022

15 August 2022

TREATT PLC

("Treatt" or "the Group")

Trading Update

Treatt, the manufacturer and supplier of a diverse and

sustainable portfolio of natural extracts and ingredients for the

beverage, flavour and fragrance industries, today announces a

trading update for the year ending 30 September 2022.

In the Group's half year results announcement, we referenced the

anticipated return to Treatt's traditional H2 profit weighting

supported by a very strong order book. Although the Group is still

expecting to report strong revenue growth for the full year and

retains an excellent order book, it has been affected by a number

of separate factors which will impact profitability for the full

year. We now expect profit before tax and exceptional items to be

between GBP15.0m and GBP15.3m.

The revised guidance is given for the following reasons:

-- As stated in the half year results, we anticipated a much

stronger performance from our higher margin Tea category in H2

driven by iced and hard tea consumption in North America. As has

been well-documented, consumer confidence in the US has

deteriorated in recent months causing lower demand in this category

which has materially reduced our margins. Whilst Tea sales will be

lower year-on-year, after an exceptional FY21 performance, our

anticipated two year growth of over 60% in this category highlights

the significant opportunity in the future.

-- The Group's margins have been adversely affected by

increasing volatility in FX movements during H2. The UK business

makes a portion of its sales in US Dollars and uses foreign

currency exchange contracts to manage risk. The rapid devaluation

of Sterling against the US Dollar during the period has had a

significant impact on margins.

-- The Group is experiencing significant input cost inflation

and whilst, in a number of cases, the business has been able to

pass this onto its customers, some longer term contracts have not

yet allowed this to be achieved across the full portfolio.

-- Our China subsidiary has experienced well documented extended

Covid-19 related restrictions in large parts of the region

resulting in the loss of some higher margin revenue in the

year.

Notwithstanding these negative, predominantly short-term,

challenges to profitability, we are encouraged by other trends seen

through H2, including the ongoing strength of the order book which,

as announced in the half year results, continues to be up c.25%

year-on-year, giving us confidence as we head towards the new

financial year. Aside from the Tea category, we are seeing strong

growth in all other Treatt categories and the opportunity for

efficiencies in our new UK manufacturing site is increasingly

clear.

After substantial investment in our people over the past 12-18

months, we believe we now have the right people infrastructure in

place to seize the multiple growth opportunities available; we do

not anticipate any significant increase in administrative expenses

in the short to medium term, outside of the normal rate of

inflation. The Company is also reviewing how it can better limit FX

exposure in light of increasing volatility.

Daemmon Reeve, CEO of Treatt, commented:

"Whilst clearly disappointed by the short term impact on

profitability, we remain encouraged by the underlying trading

performance of the business and are confident in the long term

growth drivers for Treatt.

We have significant opportunities across our categories and

geographies and, notwithstanding the short-term impacts in Tea, we

see strong momentum in all of our categories given the alignment

with prevailing consumer trends. For example, there continues to be

sustained growth in demand for our natural and authentic extracts

and bespoke solutions for a wide range of beverages.

We also remain excited about the potential in Coffee over the

next few years and expect this category to be reported separately

at the full year given we are now seeing growth in orders and

multiple opportunities for the future."

Financial calendar

The Group expects to issue a trading update in October 2022,

after the completion of the financial year to 30 September

2022.

Treatt plc +44 (0)1284 702500

Daemmon Reeve Chief Executive Officer

Ryan Govender Chief Financial Officer

Joint Brokers

Investec Bank Plc +44 (0)20 7597 5970

Patrick Robb

David Anderson

Peel Hunt LLP +44 (0) 20 7418 8900

George Sellar

Andrew Clark

Lalit Bose

Financial PR

MHP Communications +44 (0) 20 3128 8789

Tim Rowntree

Simon Hockridge

Catherine Chapman

This announcement contains inside information within the meaning

of the Market Abuse Regulation. The person responsible for

arranging release of this announcement on behalf of Treatt is Ryan

Govender, Chief Financial Officer.

About the Group

Treatt is a global, independent manufacturer and supplier of a

diverse and sustainable portfolio of natural extracts and

ingredients for the flavour, fragrance and multinational consumer

product industries, particularly in the beverage sector. Renowned

for its technical expertise and knowledge of ingredients, their

origins and market conditions, Treatt is recognised as a leader in

its field.

The Group employs over 400 staff in Europe, North America and

Asia and has manufacturing facilities in the UK and US. Its

international footprint enables the Group to deliver powerful and

integrated solutions for the food, beverage and fragrance

industries across the globe.

For further information about the Group, visit www.treatt.com

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFFFVLTEISLIF

(END) Dow Jones Newswires

August 15, 2022 02:00 ET (06:00 GMT)

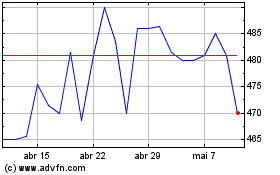

Treatt (LSE:TET)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Treatt (LSE:TET)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025