TIDMXPF

RNS Number : 8524Y

XP Factory PLC

09 September 2022

9 September 2022

XP Factory Plc

("XP Factory", the "Company" or the "Group")

Acquisition of Boom Battle Bar Cardiff Limited

and

Update on site openings and trading

XP Factory (AIM: XPF), a leading UK experiential leisure

business operating the Escape Hunt(TM) and Boom Battle Bar(TM)

brands, announces the acquisition of Boom Battle Bar Cardiff

Limited, which owns and operates the Boom Battle Bar site in

Cardiff, and provides an update on progress since its announcement

on 31 May 2022 of the results for the year to 31 December 2021

("FY21").

Acquisition of Boom Cardiff

XP Factory has acquired 100% of Boom Battle Bar Cardiff Limited

("Boom Cardiff") for an enterprise value of GBP2.15m. Boom Cardiff

was the third Boom Battle Bar site to open and has been operating

as a franchise site since September 2020 prior to the acquisition

last November of Boom Battle Bars by XP Factory. It is a strong

performer in the network and, in the twelve months ended 30 June

2022, delivered unaudited turnover of GBP3.82m, adjusted EBITDA of

GBP438k [1] and profit before tax of GBP201k. As at 30 June 2022,

Boom Cardiff had net debt of approximately GBP620k [2] including

GBP220k of loans due to XP Factory. The estimated net consideration

payable of GBP1.53m will be satisfied by a payment of GBP600k in

cash on completion, a further GBP600k six months after completion,

and the balance, which will be subject to a completion accounts

mechanism, on the first anniversary of the acquisition. The

unaudited net assets of Boom Cardiff as at 30 June 2022 were

GBP240k.

Boom Cardiff, which is located on Caroline Street in the Brewery

Quarter in central Cardiff is a popular destination for consumers.

The site offers a variety of competitive socialising games and

activities, including Bavarian Axe Throwing, Mini Golf,

Shuffle-Board, Electric Darts, American Pool, Ping Pong as well as

other games set in a cocktail bar environment and offering 'street

food' through an on-site kitchen.

Other site progress

Since the announcement on 31 May 2022 of the Company's full year

results for FY21, further progress has been made in our site

roll-out strategy.

Boom Battle Bars

-- In June 2022, a new owner operated Boom site opened in

Manchester, located at The Printworks, 27 Withy Grove;

-- In August 2022, the Company acquired the Boom franchise site

in Norwich ("Boom Norwich") for a consideration of GBP100k in cash.

In the 12 months to 30 June 2022, Boom Norwich delivered unaudited

turnover of GBP1.2m and operated at attractive margins in line with

our expected box economics. The acquisition will be funded from

cashflows from Boom Norwich over 12 months.

-- Two further franchise sites have opened in Ealing in June 2022, and Sheffield in July 2022.

As a result, the Boom Battle Bar network today comprises 18

sites, of which six are owner operated (including Cardiff) and 12

are franchised.

The pipeline remains strong, with a further 5 owner operated

sites currently in build in Edinburgh, London (Oxford Street),

Plymouth, Leeds and Birmingham. Three further franchise sites are

also in build in Bournemouth, Chelmsford and Southampton, with

contracts exchanged on a further site for which building is

expected to commence shortly. There are several other sites in the

final phases of legal documentation and the Board remains confident

that its target of 27 open Boom venues by the end of 2022 will be

met.

Escape Hunt

A new Escape Hunt site opened in a second venue in Norwich in

August 2022, and sites are in build in Bournemouth, London (Oxford

Street) and Edinburgh, the latter two co-located with Boom sites.

These additions will take the Escape Hunt network to 23 owner

operated sites.

Update on trading

The Company's unaudited results for the six months to 30 June

2022 are expected to show Group revenue in excess of GBP8m,

compared to GBP1.2m in the same period in 2021, which was prior to

the acquisition of Boom Battle Bars.

Despite the current macro-economic backdrop, trading in the UK

since 30 June 2022 in both Boom and Escape Hunt sites has been

encouraging. The UK Escape Hunt owner-operated estate generated

unaudited turnover in the eight weeks to 28 August 2022 of

approximately GBP1.4m, an increase of 16% compared to the same

eight-week period in 2021. Adjusting for the VAT benefit received

in 2021, the underlying increase was 33%, reflecting an enlarged

network and 13% like-for-like growth from sites which were open in

the same period in 2021. Escape Hunt site level EBITDA margins

continue to exceed the Board's internal benchmark of 30%.

Performance in the Group's Boom Battle Bar estate has also been

developing positively. The owner operated sites [3] delivered

unaudited turnover in excess of GBP1m for the eight weeks to 28

August 2022 and each of the Group's sites has proved capable of

delivering margins in line with our expected box economics within

the first few months of operating, underpinning c onfidence in the

Group's business model. The Boom franchise estate provides the

Company with an increasingly consistent weekly royalty.

A fuller update on trading and prospects will be given with the

Company's unaudited interim results for the six months to 30 June

2022 which are expected to be published in the week beginning 26

September 2022.

Commenting on the Acquisition and site progress, Richard

Harpham, Chief Executive of XP Factory plc, said "We are delighted

to have been able to add the Boom Cardiff site into our owner

operated estate on attractive terms. It is consistently a strong

performing site. Likewise, the acquisition of the Boom Norwich site

is expected to provide an excellent cash on cash return. We

continue to see growing and attractive operating metrics at our

Boom sites whilst Escape Hunt has become a consistently high margin

business. Most importantly, we are seeing very high consumer

ratings for both our brands. We look forward to providing a more

detailed update with our interim results."

Enquiries:

XP Factory Plc

https://www.xpfactory.com/

Richard Harpham (Chief Executive

Officer)

Graham Bird (Chief Financial

Officer)

Kam Bansil (Investor Relations) +44 (0) 20 7846 3322

Shore Capital, NOMAD and Broker

https://www.shorecap.co.uk/

Tom Griffiths/David Coaten (Corporate

Advisory) +44 (0) 20 7408 4050

IFC Advisory - Financial PR

https://www.investor-focus.co.uk/

Graham Herring

Florence Chandler +44 (0) 20 3934 6630

Notes to Editors:

About XP Factory plc

The XP Factory Group is one of the UK's pre-eminent experiential

leisure businesses which currently operates two fast growing

leisure brands. Escape Hunt is a global leader in providing

escape-the-room experiences delivered through a network of

owner-operated sites in the UK, an international network of

franchised outlets in five continents, and through digitally

delivered games which can be played remotely.

Boom Battle Bar is a fast-growing network of owner-operated and

franchise sites in the UK that combine competitive socialising

activities with themed cocktails, drinks and street food in a high

energy, fun setting. Activities include a range of games such as

augmented reality darts, Bavarian axe throwing, 'crazier golf',

shuffleboard and others. The Group's products enjoy premium

customer ratings and cater for leisure or teambuilding, in small

groups or large, and are suitable for consumers, businesses and

other organisations. The Company has a strategy to expand the

network in the UK and internationally, creating high quality games

and experiences delivered through multiple formats and which can

incorporate branded IP content. ( https://xpfactory.com/ )

Facebook: EscapeHuntUK BoomBattleBar

Twitter: @EscapeHuntUK @boombattlebar

Instagram: @escapehuntuk @boombattlebar

[1] Adjusted EBITDA is calculated as earnings before directors'

remuneration and allocated franchisee head office costs, interest,

tax depreciation, amortisation, after franchise royalties.

[2] Net debt includes elements of working capital as defined for

the purposes of the completion accounts adjustment mechanism

[3] 4 sites for the full 8 week period, including Manchester

which opened to the public on 17 June, and Norwich for the final

two weeks

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQLPMBTMTBMTJT

(END) Dow Jones Newswires

September 09, 2022 02:01 ET (06:01 GMT)

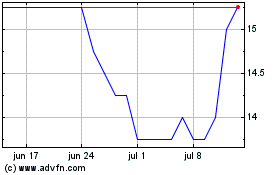

Xp Factory (LSE:XPF)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

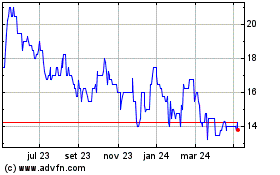

Xp Factory (LSE:XPF)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025