TIDMBRH

RNS Number : 8406Z

Braveheart Investment Group plc

20 September 2022

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

20 September 2022

Braveheart Investment Group Plc

("Braveheart", the "Company" or the "Group")

Placing and subscription to raise GBP750,000

Braveheart Investment Group (AIM: BRH), announces that the

Company has raised GBP750,000 (before expenses) by way of a placing

of and subscription for new ordinary shares of 2p each ("Ordinary

Shares") in the Company (together, the "Fundraise"), at an issue

price of 10.25p pence per share (the "Issue Price").

The Company has issued 1,951,220 new Ordinary Shares ("Placing

Shares") at the Issue Price pursuant to a placing, raising gross

proceeds of GBP200,000.05 before expenses (the "Placing"). The

Placing has been arranged by Peterhouse Capital Limited.

In addition, the Company has entered into a direct subscription

with Trevor Brown, Chief Executive Officer, for a total of

5,365,853 new Ordinary Shares (the "Subscription Shares"), raising

a total of GBP550,000 (the "Subscription"). Trevor Brown has

undertaken to the Company that he will not dispose of any of the

Subscription Shares for a period of one year from the date of

admission to trading on the AIM market of the Subscription Shares,

without the prior written consent of the Company and the Company's

Nomad.

A total of 7,317,073 new Ordinary Shares (together the

"Fundraise Shares") are to be issued at the Issue Price. The

Fundraise has been conducted utilising the Company's existing share

authorities granted at the Annual General Meeting of the Company

held on 13 July 2022. The Fundraise is conditional, inter alia, on

admission of the Fundraise Shares to trading on AIM ("Admission")

becoming effective.

The Fundraise has been undertaken by the Company to enable it to

be in sufficient funds to be able to support its current investee

companies from a position of strength should the need arise for

further funds and to be able to make opportunistic new

investments.

Director's holding

Trevor Brown's total beneficial interest following this

transaction will be 12,429,424 Ordinary Shares, representing

approximately 19.51% of the voting rights in the Company's enlarged

share capital following the issue of the Subscription Shares. The

FCA notification, made in accordance with the requirements of the

UK Market Abuse Regulation, is appended below.

Related Party Transaction

The subscriber for the Subscription Shares is Trevor Brown, who

is the CEO and a Director of Braveheart and, therefore, the

transaction is treated as a related party transaction under the AIM

rules. The independent directors, being Qu Li, Susan Hagan and

Vivian Hallam, consider, having consulted with Allenby Capital

Limited, the Company's Nominated Adviser, that the terms of the

Subscription and the issue of the Subscription Shares are fair and

reasonable insofar as the shareholders of Braveheart are

concerned.

Admission of the Fundraise Shares

Application has been made for the 7,317,073 Fundraise Shares to

be admitted to trading on AIM ("Admission"), which is expected to

take place on or around 26 September 2022. Once issued, the

Fundraise Shares will rank pari passu in all respects with the

existing Ordinary Shares of the Company.

Total Voting Rights

Following Admission, the Company's issued ordinary share capital

will consist of 63,723,489 Ordinary Shares, all of which carry one

voting right per share. The Company does not hold any Ordinary

Shares in treasury. Therefore, the total number of Ordinary Shares

and voting rights in the Company will be 63,723,489. With effect

from Admission, this figure may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

For further information:

Braveheart Investment Group plc Tel: 01738

587555

Trevor Brown, Chief Executive Officer

Viv Hallam, Executive Director

Allenby Capital Limited (Nominated Adviser Tel: 020 3328

and Joint Broker) 5656

David Worlidge / James Reeve / George

Payne

Peterhouse Capital Limited (Joint Broker) Tel: 020 7469

0936

Heena Karani / Lucy Williams

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

Details of the person discharging managerial responsibilities

1 / person closely associated

------------------------------------------------------------------------------

a) Name Trevor Brown

-------------------------------------- --------------------------------------

Reason for the notification

2

------------------------------------------------------------------------------

a) Position/status Chief Executive Officer

-------------------------------------- --------------------------------------

b) Initial notification Initial Notification

/Amendment

-------------------------------------- --------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

------------------------------------------------------------------------------

a) Name Braveheart Investment Group plc

-------------------------------------- --------------------------------------

b) LEI 2138006HQ3COMU626I61

-------------------------------------- --------------------------------------

Details of the transaction(s): section to be repeated

4 for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------------------

a) Description of the Ordinary shares of 2 pence each

financial instrument, in Braveheart Investment Group plc

type of instrument

Identification code GB00B13XV322

-------------------------------------- --------------------------------------

b) Nature of the transactions issue of new Ordinary Shares

-------------------------------------- --------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

10.25p 5,365,853

-------------------------------------- ---------------- --------------------

d) Aggregated information

- Aggregated volume 5,365,853

- Price 10.25p

- Principal amount GBP 549,999.93

-------------------------------------- --------------------------------------

e) Dates of the transaction 16 September 2022

f) Place of transaction Outside a trading venue

-------------------------------------- --------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOESFLFEAEESEFU

(END) Dow Jones Newswires

September 20, 2022 02:00 ET (06:00 GMT)

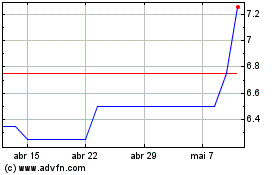

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024