TIDMUKCM

Guernsey: 30 September 2022

UK Commercial Property REIT Limited

("UKCM" or the "Company")

LEI: 213800JN4FQ1A9G8EU25

INTERIM RESULTS FOR THE HALF YEARED 30 JUNE 2022

UK Commercial Property REIT Limited (FTSE 250, LSE: UKCM) which owns a £1.7

billion diversified portfolio of high-quality income-producing UK commercial

property and is managed and advised by abrdn, announces its interim results for

the half year ended 30 June 2022.

FINANCIAL REVIEW AS AT 30 JUNE 2022

* NAV TOTAL RETURN

Net Asset Value ("NAV") total return of 12.3% (H1 2021: 6.0%) primarily

driven by valuation increases and the portfolio weighting to the industrial

sector.

* SHARE PRICE TOTAL RETURN

Share price total return of 2.3% (H1 2021: 13.4%).

* EPRA EARNING PER SHARE

EPRA earnings per share increased 36% to 1.58 pence per share (H1 2021:

1.16p)

* DIVID

Quarterly dividend increased by a further 6.3% to 0.85 pence per share,

following the uplifts announced in both the fourth quarter of 2021 and the

first quarter of 2022. This brings the increase in the H1 2022 fully

covered dividend to 13.3%.

* GEARING

Low gearing of 13.7% (2021: 13.5%) as at 30 June 2022 remains one of the

lowest in the Company's peer group.

PORTFOLIO REVIEW AS AT 30 JUNE 2022

* PORTFOLIO PERFORMANCE

Portfolio total return of 11.2% resulted in continued outperformance of the

Company's MSCI benchmark, of 8.1%, driven by the positive relative

performance of the Company's industrial portfolio.

* PORTFOLIO VALUE

Portfolio is now valued at £1.71 billion. We believe that the Company's

well-let portfolio of scale, which is heavily weighted towards future-fit

sectors and offers good prospects for rental growth, is well placed to

deliver positive relative performance with good potential for future

earnings growth.

* OCCUPANCY

Occupancy rate of 98.5%.

* RENT

19% increase in portfolio annualised rent and ERV growth of 9%. Rent

collection for the three billing periods in 2022 of 99% as at 31 August

2022.

* ENVIRONMENTAL, SOCIAL AND GOVERNANCE (ESG)

2040 net zero carbon target for all emissions.

Commenting on the results, Ken McCullagh, Chair of UKCM, said: "UKCM has

delivered another strong set of results for the first six months of 2022, with

the team's ability to invest into a diversified range of sectors and

proactively manage the portfolio towards income growth and security ensuring

that the Company continues to outperform its benchmark. This performance has

been driven by a disciplined investment focus on future fit and operational

asset classes that look to capitalise on the imbalance between supply and

demand, are underpinned by societal changes that remain highly supportive of

the occupational markets and rental growth. The special dividend, paid in

August, is reflective of the Board's desire to return some of the strong

performance delivered over the last number of quarters to shareholders,

allowing them all to benefit from the recent growth in net asset value that is

not currently being reflected in the Company's share price.

Looking ahead, as a Board we are acutely aware of the broader economic

challenges that have been prevalent throughout the year and, more recently, the

impact of the government's latest fiscal announcement on the debt markets,

which have created further uncertainty. However, UKCM is extremely lowly

levered, has a strong and flexible balance sheet and a portfolio that has been

positioned over the past few years to deliver income growth through market

cycle. As a result, we have a number of options available to us to both manage

and, where appropriate, seek opportunities arising from the current

environment, and are confident in the future prospects for the Company."

Will Fulton, Fund Manager at UKCM at abrdn, added: "The UK real estate market's

performance remained very positive throughout the first half of this year,

despite the economic challenges. The Company's portfolio also successfully

outperformed the benchmark again, benefitting from our strategic overweight

position to the industrial sector, which again delivered the strongest returns

of all the major sectors, and from positive leasing and asset management.

Against a backdrop of economic and inflationary pressure, and rising interest

rates, we are alert to the challenges that lay ahead for our sector, but remain

positive on the ability of our Company's portfolio to deliver positive rental

and earnings growth going forward. Our strategy has been fashioned with this in

mind by targeting those areas of the market most likely to benefit from

positive structural changes and so experience positive demand versus supply

over the coming years with the ability for active asset management to enhance

income.

As we move into the second half of the year we expect ESG considerations to

become even more integral to investor decision making and asset underwriting.

This trend was expedited as a result of the Covid-19 pandemic, but with the

current energy crisis and pathway to net-zero, the case for integrating ESG

considerations across all UK real estate sectors has never been greater. An

even greater emphasis on ESG requirements for both acquisitions and

developments is already underway across our portfolio."

PERFORMANCE SUMMARY

CAPITAL VALUES AND GEARING 30 June 31 December %

2022 2021 Change

Total assets less current liabilities (excl bank 1,733,981 1,573,554 10.2

loan) £'000

IFRS Net asset value (£'000) 1,467,443 1,325,228 10.7

Net asset value per share (p) 112.9 102.0 10.7

Ordinary share price (p) 75.0 74.7 0.4

Discount to net asset value (%) (33.5) (26.8) n/a

Gearing (%)* 13.7 13.5 n/a

6 month 1 year 3 year 5 year

% return % return % return % return

TOTAL RETURN

NAV? 12.3 28.8 33.0 50.9

Share Price? 2.3 1.5 (5.0) (1.1)

UKCM Property portfolio 11.2 26.8 35.5 56.0

MSCI Benchmark 8.1 19.6 25.7 43.2

FTSE Real Estate Investment Trusts Index (18.8) (5.2) 4.9 9.2

FTSE All-Share Index (4.6) 1.6 7.4 17.8

30 June 30 June

EARNINGS AND DIVIDS 2022 2021

EPRA Earnings per share (p) 1.58 1.16

Dividends paid per ordinary share (p) # 1.55 1.635

Dividend Yield (%)? 3.8 3.3

MSCI Benchmark Yield (%) 3.9 4.5

FTSE Real Estate Investment Trusts Index Yield (%) 3.6 2.7

FTSE All-Share Index Yield (%) 3.5 2.8

* Calculated, under AIC guidance, as gross borrowings less cash

divided by portfolio value.

? Assumes re-investment of dividends excluding transaction

costs.

? Based on last four quarterly dividends, paid pre-30 June of

2.838p and the share price at 30 June 2022.

# Notes to the accounts, note 6 for further details.

Sources: abrdn, MSCI

CHAIR'S STATEMENT

Background

UKCM has delivered a strong set of results from our portfolio during the first

half of 2022, with capital allocation and further positive leasing momentum by

our asset management team driving rental growth and an increase in portfolio

valuation. The Company delivered a NAV total return of 12.3% for the period and

once again outperformed its benchmark. Over the past few years we have taken

advantage of our ability to invest in a diversified range of sectors to

proactively manage our portfolio towards income growth and security, with a

focus on future fit and operational

asset classes. Of particular note we have built a strong position in both urban

and big box logistics and the living asset classes, where we are invested in

student housing, and hotels. In all of these, the imbalance between supply and

demand and the societal changes continue to be highly supportive of the

occupational markets and rental growth.

We are acutely aware of the broader economic challenges ahead, including rising

inflation and interest rates, that

could be negative on valuations. However, we believe that we are well placed,

both in terms of the quality of our portfolio and the strength of our lowly

leveraged balance sheet, to continue to deliver shareholder value through a

growing level of income. The Investment Manager has delivered a 19% increase in

portfolio annual rent over the last 12 months and 9% ERV growth within the

standing portfolio. This confidence is reflected in the additional - and fully

covered - dividend increases the Company announced in the first half of 2022.

The Board, as noted in recent prior statements, is conscious of the significant

discount on the share price to NAV which, in line with the broader real estate

sector, has continued to widen since the end of June. The Company paid a

special dividend of 1.92p per share in August to return some of the strong

gains that have been realised over the last number of quarters from capital

allocation and asset management initiatives, allowing all shareholders to

benefit from the recent growth in net asset value that is not currently being

reflected in the Company's share price. The Board believes this type of

distribution could be utilised in the future to reward shareholders, while

still also keeping the option of share buy-backs under consideration.

While the ongoing situation in Ukraine has created further economic uncertainty

just as Covid-19 restrictions were

receding, resulting in higher energy and developments costs, we remain

confident in the robustness and resilience of our portfolio. The Company is

also benefitting from the improved corporate efficiencies arising from the

reduction in investment management fees we announced at year end. These factors

combined with the strength of the current financial performance and future

investment pipeline were integral to our decision to recommend further

increases to shareholder dividends.

Portfolio Activity

In line with our strategy of increasing portfolio exposure to operational

assets and the alternatives sector, the Company committed to funding the

development of a high-quality hotel in central Leeds which will operate under

the renowned Hyatt brand. The development has a maximum commitment of £62.7

million and will complete in mid-2024 when it will be operated under a lease by

Interstate Hotels & Resorts. We expect it to be one of the best hotels in Leeds

on completion and to deliver a high income return as the lease structure means

the rents will be derived from the performance of the hotel.

The Company has made progress on its student housing developments in Gilmore

Place, Edinburgh. We were pleased to secure a strong 20-year lease with the

University of Edinburgh at an annual rent of £1.24 million per annum, which is

subject to annual CPIH increases. Whilst the Company had originally expected to

operate and lease the asset independently to generate a higher level of rent,

the opportunity to secure a lease of this nature to a leading UK university

whilst de-risking the asset was felt to be in the best interest of

shareholders. The Company will retain operational leasing exposure in the

student residential market at its asset in Exeter.

Portfolio occupancy increased to 98.5% within the period and this low level of

vacancy demonstrates the appeal of the assets to both current and prospective

tenants and provides good visibility on income streams. The Board and the

Investment Manager are focussed on driving earnings growth from the portfolio

and capturing the reversionary potential of the assets to deliver value for

shareholders.

Rent collection rates have normalised and returned to pre-Covid levels.

Cumulatively across the three relevant billing periods straddling the first

half of the year 99% of rents due have been received taking in to account

agreed deferrals and monthly payments.

Further details on all investment transactions and significant lettings are

given in the Investment Manager's Review.

Portfolio and Corporate Performance

The portfolio delivered a total return of 11.2% in the half year, ahead of the

MSCI benchmark total return of 8.1%. UKCM has continued to outperform against

its MSCI UK Balanced Portfolio Quarterly Index benchmark for 1,3,5 and 10

years.

Further details on the Company's portfolio performance are given in the

Investment Manager's Review.

The strong portfolio performance allowed the Company to report a 12.3% NAV

total return for the period. This strong performance, both absolute and

relative to its peers, is not reflected in the share price total return of 2.3%

for the same period. The discount at which the Company's shares traded versus

their net asset value increased from 26.8% at the end of December 2021, to

33.5% at 30 June 2022.

Financial Resources

UKCM continues to be on a solid financial footing with a NAV of £1.47 billion

as at 30 June 2022, and gearing of just 13.7%, meaning the Company remains one

of the lowest geared in its AIC peer group and the wider REIT sector. The

weighted average cost of this debt remains low at 2.79% per annum, and the

Company continues to be comfortably within the covenants on its three debt

facilities. In addition, with over £520 million of unencumbered assets, the

Company has significant headroom and further flexibility with respect to its

covenants and overall gearing strategy.

On the 19 August 2022 the Group increased its revolving credit facility with

Barclays Bank plc to £180 million (Dec 2021: £150 million). There were no

other amendments to the agreement. The facility expires in April 2024 and is

cancellable at any time.

Dividends

The Company paid two interim dividends totalling 1.55 pence per share during

the period. The second quarter dividend was increased by a further 6.3% to

0.85p per share. This follows a 6.7% increase for the prior quarter and

reflects the Board's continued recognition of the importance of income to

shareholders. Dividend cover for the first half of 2022 was 103% and the Board

believes the further increase to be appropriate and sustainable given the

current level of investment and development activity within the Company.

The Company paid a special dividend of 1.92p per share in August to return some

of the strong gains that have been realised over the last number of quarters

from capital allocation and asset management initiatives so that all

shareholders can benefit from the recent growth in net asset value that is not

currently reflected in the Company's share price.

Environmental, Social and Governance ("ESG")

ESG is embedded within the processes of UKCM and underpins every Board

discussion and decision.

ESG considerations are expected to become even more integral to investor

decision making and asset underwriting. This trend was expedited as a result of

the Covid-19 pandemic, but with the current energy and climate crisis, the case

for the pathway to net-zero and integrating ESG considerations across all UK

real estate sectors has never been greater.

Within the 2021 Annual Report & Accounts the Company made a commitment of

achieving Net Zero Carbon on Landlord emission by 2030 and Net Zero Carbon on

all emissions by 2040 and the Board is focussed on these ambitious targets.

Discount Policy / EGM

The Company's discount control policy provides that if the market price of the

ordinary shares of 25 pence each in the Company (the "shares") is more than 5

per cent below the published NAV for a continuous period of 90 dealing days or

more, following the second anniversary of the Company's most recent

continuation vote in relation to the discount control policy, the Directors

will convene an extraordinary general meeting to be held within three months to

consider an ordinary resolution for the continuation of the Company. The most

recent continuation vote in relation to the share discount policy was held on

18 March 2020.

The closing market price of the shares had been more than 5 per cent below the

published NAV for more than 90 continuous days up to 29 July 2022. In

accordance with the discount control policy, the Board is therefore convening

an extraordinary general meeting in October 2022 to consider a resolution to

approve the continuation of the Company.

The Investment Manager continues to improve earnings and identify attractive

opportunities for the Company's property portfolio and the Board believes it is

important for shareholders to approve the continuation vote in order that the

Investment Manager may continue to pursue the investment strategy effectively.

Accordingly, the Company will be publishing a circular convening an

extraordinary general meeting to consider that continuation resolution and the

Board will be recommending shareholders vote in favour of the Company's

continuation.

The Company has discussed the upcoming resolution with its largest shareholder,

Phoenix, which currently holds in aggregate approximately 43.4 per cent of the

Company's issued shares, and which has indicated it intends to vote in favour

of continuation.

Outlook

We have delivered a strong set of results from our portfolio during the first

half of 2022 with further positive leasing momentum by our asset management

team driving rental growth and an increase in portfolio valuation. Over the

past few years we have taken advantage of our ability to invest in a

diversified range of sectors to proactively manage our portfolio towards income

growth and security, with a focus on future fit and operational asset classes.

Of particular note we have built a strong position in both urban and big box

logistics, and the living asset classes, where we are invested mainly in

student housing, and hotels - in all of these the supply demand imbalance and

societal changes continue to be highly supportive of the occupational markets

and rental growth.

The underlying pace of the UK economy is clearly slowing whilst inflation is

running at multi-year highs. Despite the government's announcement that energy

prices will be frozen to help UK households and businesses, short-term

inflation is still set to rise above 10% in October. The government's huge

fiscal stimulus was always going to cause interest rates to rise further, but

the large market moves since the government's economic agenda was announced

suggest even higher rates will be necessary to restore confidence in UK assets.

We are sceptical on what is currently priced by markets, but a period of high

and sustained rates is likely increasing our conviction that the economy will

soon be in a recession. For UK real estate, the environment of rising rates

has resulted in a repricing of debt and other asset classes, which has been a

catalyst for a change in sentiment towards UK real estate more generally, with

prices having started to adjust. Weaker returns are expected for UK real estate

over the next 12-18 months, led by the lower yielding industrial and logistics

sector although almost all sectors are expected to follow suit. On a positive

note the occupational market for the industrial sector remains well balanced,

with healthy levels of take-up and a national vacancy at a low 3%. Despite

increased development for this sector, build cost inflation and development

delays are expected to act as a natural cap on future supply. Meanwhile, the

office market is becoming increasingly polarised between truly best in class

space and the rest. ESG is playing an increasingly critical role in this

regard, as are changing tenant requirements due to hybrid working arrangements,

necessitating greater flexibility of space. With the cost of living crisis

likely to weigh on consumer spending, the retail sector is more exposed, but

this will be felt most acutely for discretionary led retailers, with high

street shops and shopping centres more vulnerable.

While we are acutely aware of the broader economic challenges ahead, we believe

that we are well placed both in terms of the quality of our portfolio and the

strength of our lowly leveraged balance sheet, to continue to deliver

shareholder value through a growing level of income.

Ken McCullagh

Chair of UKCM

29 September 2022

MANAGER'S REVIEW

For the half year ended 30 June 2022

Commercial Property

UK real estate carried some of its positive performance momentum from 2021 into

the early part of 2022. However, this year will likely be one defined by the

proverbial 'game of two halves' as some of the strong performance in the first

half of the year is expected to be unwound moving forward. With sentiment

towards UK real estate weakening, investment volumes have slowed as the market

pauses for breath and takes stock.

Over the first half of the year, performance remained very positive and, at an

all property level, the UK real estate market delivered a total return of 8.1%

over the first six months of 2022 (MSCI Balanced Portfolios Quarterly Property

Index). As expected, the industrial and logistics sector continued to drive the

market and posted a total return of 13.3% in the first half of the year, whilst

over the same period the office sector once again provided the weakest

performance at 3.3%. The retail sector recorded performance and provided a

total return of 8.0%, but much of this positive performance was attributable to

the retail warehouse sector, which provided a robust total return of 14.1% in

the first half according the Company's MSCI benchmark.

Transaction volumes in the first half of 2022 remained very robust and UK real

estate recorded the strongest first half investment volumes since 2015

according to Real Capital Analytics with £31.2 billion transacted over this

period. However, approximately two thirds of the activity occurred in the

first quarter of 2022. Investment volumes were £10.2 billion in the second

quarter of 2022, which was lower than the Q2 10-year average of £13.5 billion.

The slowdown in investment activity towards the end of the second quarter of

2022 can largely be attributed to the emergence of a less accommodative

monetary policy environment as the Bank of England tries to bring inflation

back closer to its target rate of 2%. This has resulted in slowing economic

growth expectations, rising bond yields, and an increased cost of capital for

debt-backed real estate investors, which has caused weaker sentiment towards UK

real estate at this time.

The industrial sector experienced a record year in 2021 in terms of both

performance and transaction volumes and carried this momentum into 2022.

However, with the weakening economic environment, the sector has begun to slow

and investor sentiment has begun to cool somewhat. Whilst reflected in a

slowing level of transaction volumes, occupier markets have seen strong

performance, with leasing driven by the imbalance between supply and demand.

Amazon's announcement in April 2022 that it was to reduce its operational

estate surprised the market, but we believe this statement was primarily

focused on the US and, more importantly, that occupational demand is and has

proven to be more multi-faceted and deeply diverse than being wholly reliant on

one operator or business segment. The industrial sector continues to benefit

from longer term thematic tailwinds and rental value growth should remain

positive in response to tight supply levels, but return to a more normalised

growth rate.

Polarisation within the office sector has been gathering pace as both occupiers

and investors continue to narrow their focus on best in class office assets

with strong environmental credentials. There have been increased reports of

positive letting activity in the office sector over the second quarter of 2022.

But, according to CBRE Ltd ('CBRE'), the central London vacancy rate remains

elevated at 9%. Secondary accommodation accounts for approximately 70% of all

available accommodation. Overall office demand is expected to fall as a poorer

economic outlook weighs on job growth across the market, placing additional

pressure on occupational sentiment. However, Grade A 'future fit' office

assets, in prime locations, are anticipated to be more resilient in this

weakening environment, whilst the outlook for secondary assets is much more

challenging.

The UK retail sector was showing tentative signs of green shoots at the start

of 2022, but momentum, particularly in the occupational market, is expected to

experience a marked slowdown as the current cost-of-living crisis and slowing

economic growth puts pressure on consumer spending. This will be more acutely

felt in the consumer discretionary and fashion-led part of the market.

Essential, discount and convenience-led retail is expected to be much more

resilient in this environment, but not entirely immune to the cost-of-living

pressures facing UK households. Retail sales volumes fell by 0.5% in May 2022

and, in the three months to May 2022, by 1.3% when compared to the previous 3

months, continuing a downward trend that began in summer 2021. Foodstore sales

provided the largest contribution to the fall in sales over May, as sales fell

a further 1.6%. This supports the view that consumers are seeking to reduce

their outgoings in the face of rising costs.

Strong demographics and structural tailwinds are expected to continue to drive

interest in the alternative sectors, particularly in healthcare, build-to-rent

and student housing over the medium-to-long term. With the occupational

pressures facing the office and retail markets, investor allocation to

alternative sectors more generally is expected to grow. However, these sectors

are not immune to the weakening macro environment and a focus on quality will

be important to ensure performance remains resilient.

Portfolio Performance

The Company's portfolio delivered strong outperformance against its MSCI IPD

benchmark in the first half of the year. For the six months to 30 June 2022,

UKCM portfolio's total return was 11.2%, significantly ahead of the benchmark

return of 8.1%. The property portfolio continues to show outperformance over 1,

3, 5 and 10 years. Total return performance was particularly strong in Q1 2022

at 8.8% v 4.9% for the benchmark with performance still positive but slowing in

the second quarter, which was in line with our expectations, at 2.3% against

the benchmark return of 3.0%.

The table below breaks down this return by sector with all valuations

undertaken by the Company's external valuer, CBRE. The portfolio delivered an

income return marginally below benchmark of 1.8% (benchmark 1.9%) over the

first six months of the year, but this was offset by greater capital value

growth than the benchmark, 9.3% vs 6.1%. Portfolio-level outperformance has

been driven by the Company's strong overweight position to the industrial

sector which again delivered the strongest returns of all the major sectors.

The Company's exposure stands at 63.9% weighted by capital value at the end of

H1 2022. The office and retail assets within the portfolio also significantly

outperformed their benchmark over the first half of the year.

Exposure Total Return Income Return Capital Growth

UKCM % Benchmark % UKCM % Benchmark % UKCM % Benchmark

All 100.0% £1,711.0m 11.2 8.1 1.8 1.9 9.3 6.1

Industrials 63.9% £1,092.5m 12.5 13.3 1.4 1.6 11.0 11.6

Offices 13.3% £227.6m 6.1 3.3 2.3 1.8 3.8 1.5

Retail 12.4% £212.7m 16.7 8.0 2.5 2.6 14.0 5.3

Alternatives 10.4% £178.2m 1.8 5.1 3.5 2.4 (1.6) 2.6

Source: MSCI June 2022

Industrial

The Company has maintained for some time a strong, strategic overweight

position to the industrial sector which continues to be well placed to benefit

from the structural changes that have fuelled tenant demand for space such as

the growth e-commerce and renewed demand for storage of inventory due to the

disruption of global supply routes. Whilst demand is likely to taper down from

the heightened levels seen in 2020 and 2021 it is still expected to outstrip

levels of supply leading to rental growth, particularly in strategic locations

and those where supply of industrial land for development is restricted.

In the first half of 2022 the Company's industrial holdings delivered a strong

total return of 12.5%, albeit this was behind the benchmark return of 13.3%.

The six-month industrial income return of 1.4% which is below the benchmark

level of 1.6%.

As the strongest performing segment of the benchmark, our strategic overweight

allocation to the sector enhanced overall portfolio returns. The Company's

industrial holdings are split respectively between multi-let industrial estates

at 45% by capital value and 55% by capital value in single-let big-box

distribution units in strategic locations throughout the South-East and the

Midlands. In general, the multi-let estates offer more immediate prospects for

asset management, and therefore opportunities to grow income, whilst the

distribution units tend to be longer let and offer secure income streams with

the opportunity to capture growth at rent reviews and lease renewals. We expect

that returns from the sector will be driven by rental growth and would expect

some yield weakening throughout the rest of 2022 as a result of interest rate

rises. This will be most pronounced initially on very low yielding London /

South East assets but is likely to have a knock-on effect to the rest of the

sector.

Office

The Company has a low exposure to the office sector of 13.3% against the

benchmark weighting of 25%. The office portfolio significantly outperformed the

benchmark with a return of 6.1% vs 3.3%. It delivered an above benchmark income

return of 2.3% vs 1.8% for the 6-month period reflecting that the Company is

deliberately underweight to lower yielding London offices, with the vast

majority of its office exposure being elsewhere in the South East or in

regional cities where yields are generally higher.

Over H1 2022 a strong capital return of 3.8% was also delivered by the office

portfolio significantly ahead of the benchmark level of 1.5%. Capital growth

was driven by positive asset management at assets such as 2 Rivergate, Bristol

where a lease extension was agreed with the Secretary of State and at Craven

House in London where a strong rent review settlement was also agreed. There

was also the positive impact of acquisitions completed in Q4 2021 particularly

Kantar House at Hanger Lane where the value is underpinned by the redevelopment

value of the site which has significantly increased.

The polarisation of the sector is expected to continue with occupiers strongly

favouring best in class 'future-fit' properties with access to amenities and

excellent ESG credentials. The Company is focused on ensuring all its office

assets meet, or can meet, these standards and as a result of this analysis the

decision was made to sell 9 Colmore Row, Birmingham in July for £26.48 million.

Full details are provided below.

Retail

At the end of the half year, the Company's weighting to retail was 12.4%

compared to 22% in the benchmark. The portfolio comprises supermarkets and

retail parks dominated by either bulky goods retailers or convenience and

discount operators. These tenants have generally emerged strongly from the

Covid-19 pandemic and should prove to be robust in the forthcoming challenging

economic environment where spending is likely to be focussed away from

non-discretionary items. The Company has no exposure to shopping centres and

its only remaining high street shops are part of the office investment at 81

George Street, Edinburgh which are well let. At the end of Q2 2022 there were

no vacancies in the retail portfolio which reflects the strength of these

locations and their appeal to tenants.

The quality of the Company's retail holdings is further demonstrated by its

total return in the period of 16.7% against 8.0% recorded in the benchmark.

This was principally driven by much stronger capital growth in the period of

14.0% against 5.3% for the benchmark with the majority of this performance

derived from the retail park element of the portfolio. These assets closely

match those sought by investors in 2021 and H1 2022 in that they are

well-located and let to tenants suited to the surrounding demographic at

sustainable rental levels, and they have therefore benefitted from the strong

yield compression seen in this sub-sector of the market.

Alternatives

Within the alternatives sector we saw positive total returns of 1.8% delivered

over the first half of 2022 which was below the benchmark level of 5.1%. The

Company's alternatives portfolio at the end of the period was split evenly in

terms of capital value between three cinema-led leisure schemes in Kingston

upon Thames, Glasgow and Swindon and four hotel / student housing assets, of

which three are developments and therefore will not fully contribute to

portfolio performance until completion. The Maldron Hotel in Newcastle which is

let on a long-lease to Dalata and trades strongly is the fourth non-leisure

asset within the alternatives sector.

Rent collection levels at the leisure assets have normalised which contributed

to an above benchmark income return of 3.5% v 2.4%, but this was offset by a

capital decline of 1.6% in the portfolio whilst the benchmark recorded capital

growth of 2.6%.

The Company's student housing development in Edinburgh completed in time for

the 2022/2023 academic year. Within the period the Company agreed an attractive

20 year lease, which includes annual index-linked rental uplifts, with the

University of Edinburgh over its asset at Gilmore Place, Edinburgh

substantially derisking the operation of this asset. UKCM also committed to the

funding of a 305 bed Hyatt Hotel in Leeds which is scheduled to complete in

mid-2024 and detailed below.

Investment Activity

Following the significant levels of investment activity seen in 2021 there have

been fewer transactions completed in the first half of this year. In May, the

Company committed to the development of a high-quality hotel in central Leeds

which will complete mid-2024 with a 25-year franchise agreement in place with

Hyatt Hotels, one of the leading global hotel brands. UKCM is funding the

development for a total commitment of £62.7 million. The hotel will be operated

under a lease by Interstate Hotels & Resorts, a 50+ year old global leader in

hotel operation, with UKCM's rental income based on the income generated from

the operation of the hotel.

The 140,000 sq ft hotel's 305 rooms will be split between the short stay Hyatt

Place and the long stay Hyatt House brands. The upscale hotel will provide

meeting rooms, a gym and several food and beverage options, including a rooftop

bar with its own dedicated entrance and on completion should be one of the best

quality hotels in Leeds. The acquisition is in line with part of UKCM's

strategy to increase its exposure to alternatives and to invest in operational

real estate sectors that are expected to deliver resilient rental incomes. On

completion the asset is expected to have strong ESG credentials with a target

EPC rating of A and an expected BREEAM rating of Excellent.

After the reporting period in July, the Company disposed of its 68,400 sq ft

central Birmingham office, 9 Colmore Row, to Birmingham City Council at a price

of £26.48 million, ahead of the asset's book cost and at a premium to the

latest valuation. In addition to securing a strong sale price, the disposal is

in line with the Company strategy of exiting risk assets and those in need of

capital expenditure which will not enhance value.

The building's current EPC rating is D and this will require to be improved to

meet forthcoming Minimum Energy Efficiency Standards legislation, with an

expectation these costs will primarily fall upon the landlord.

The Company has financial resources totalling £24 million available as at 30

June 2022 to utilise for further acquisitions including the post-period receipt

from the sale of Colmore Row, and allowing for future commitments and the

dividends paid in August 2022. We are exploring sectors offering higher initial

income returns but with some future capital growth potential with a focus on

best in class regional offices which meet future occupier demands in terms of

access to amenity and ESG credentials and well as further assets in the

alternatives sector which offer strong fundamentals and robust incomes.

Asset Management and Rent Collection

Rent collection rates have normalised throughout the first half of 2022 and

have largely returned to pre-pandemic levels of collection. There continue to

be some tenants within the portfolio that pay rents by agreement on a monthly

basis as opposed to quarterly however once these are adjusted for rent

collection for the three billing periods covering the start of this year, 99%

of rents due have been collected.

The Company benefits from low tenant income concentration due to its diverse

tenant mix of 227 tenancies across 41 assets, with its top tenant, Ocado,

accounting for 6% of contracted rental income. In total the portfolio's top ten

tenants account for 36.9% of total rents at the end of June 2022.

Occupancy levels in the portfolio increased to 98.5% at the end of H1 2022

which reflects a void rate approximately one fifth of the MSCI Benchmark rate

of 7.7% at the same period. The portfolio occupancy rate is also an improvement

on the position at the end of 2021 when the occupancy rate stood at 97.9%. This

minimal level of vacancy reflects the work undertaken by the asset management

team in securing income for the Company as well as the quality and appeal to

occupiers of the assets themselves.

Asset management highlights within the period included:

* As previously mentioned, at Gilmore Place in Edinburgh, the Company's

student housing development, a 20 year lease has been agreed with

University of Edinburgh at an annual rent of £1.238m per annum. The rent is

increased annually by CPIH with a cap and collar of 1-4%. The development

is due to complete in time for the commencement of the 2022/23 academic

year.

* At Temple Quay in Bristol, the Secretary of State has extended its

occupation of the Company's 70,000 sq ft HQ-style office building for a

further three years which includes an increase in rent to £1.72 million per

annum. The asset is located in a prime location within Bristol's office

core directly opposite Temple Meads railway station which is due to benefit

from an investment of £95 millon into to the station and surrounds. The

lease is now outside the Landlord & Tenant Act and the deal therefore

secures the opportunity for a future redevelopment in this excellent

location.

* A new tenant was secured for Unit 12, Newton's Court, Dartford following a

comprehensive refurbishment and environmental upgrade of the property. Paak

Logistics UK Limited has taken a new 15 year lease without break over the

67,300 sq ft unit at a rent of £942,816 per annum, representing a 27%

premium to the ERV at the start of the year and demonstrating the continued

demand for high quality, well located logistics space. This also sets a new

headline rental tone for the estate of £14 psf per annum and the lease

incorporates 5 yearly upward only open market rent reviews. The achieved

rent is significantly ahead of the original underwritten rental level when

the refurbishment commenced demonstrating the potential within the

portfolio to capture strong rental growth. In line with the Company's ESG

priorities the building's EPC was improved from a rating of D to A through

the refurbishment works which included using energy efficient materials and

installing photo voltaic panels.

* Also at Newton's Court, Dartford, Unit 6 was let to Rodenstock UK Ltd on a

new 10 year lease with a tenant only break option in year 5 over the 6,650

sq ft unit which had recently fallen vacant. The agreed annual rent is £

89,775 per annum equating to £13.50 psf per annum, which is 6% ahead of the

unit's previous ERV at the start of the year. Overall Newton's Court,

Dartford has experienced 9% growth in market rents in the first six months

of the year.

* The rent review from June 2021 over the accommodation at Craven House,

Foubert's Place, London the Company's 20,100 sq ft West End office, was

settled 5% ahead of ERV at an increased rent equating to £54 psf per annum.

The prominent building is situated adjacent to Carnaby Street and is let to

film and television production company Molinaire until June 2026.

* St George's Retail Park in Leicester became fully occupied within the

period as Autoglass completed a new 10 year lease with a tenant break on

the fifth anniversary at a rent of £52,500 per annum in line with ERV. The

park has been substantially repositioned following extensive letting

activity on 2021 and boasts an attractive line-up of strong tenants

including Next, Home Bargains, DSG and Iceland.

Environmental, Social and Governance (ESG)

The Company received a three star rating and was second in its GRESB peer group

for ESG performance and made its 2022 submission in Q2. The Company also

obtained a Gold Star from EPRA for ESG reporting in 2021. UKCM is working

towards the long-term commitments announced within its 2021 Annual Report of

Net Zero Carbon for landlord emissions by 2030 and Net Zero Carbon for all

portfolio emissions by 2040.

A number of asset-specific initiatives have been completed within the period

such as the ESG-focussed refurbishment of Unit 12, Newton's Court, Dartford

detailed above. The Manager continues to assess all assets within the portfolio

for potential opportunities to improve ESG performance and also to ensure that

the buildings can comply with forthcoming Minimum Energy Efficiency Standards

legislation in a commercially sensible manner.

Investment Outlook

Looking forward we expect some of the strong first half 2022 performance to be

unwound over the second half and, given the current market environment, our

overall outlook for the next 12-18 months has been revised downwards.

By early September 2022, the spread between UK real estate and UK 10 year gilts

reached the lowest level since 2008 as the UK 10 year yield peaked at 3.1% in

response to increasing inflation and interest rate expectations. We expect the

yield on the UK 10 year gilt to remain at or above this level in the near-term

adding pressure on UK real estate yields to move out to maintain an appropriate

yield buffer. On top of this, with rising debt costs driven by tightening

monetary policy, a number of leveraged players have begun to step back from the

market as the cost of debt outstrips yields in several sectors making its use

in these sectors prohibitive. As a result, we are now beginning to see some

repricing across the UK real estate market, driven predominantly by interest

rates 're-rating' and an increased cost of capital impacting yields.

Investors are anticipated to take a more risk off approach towards UK real

estate in the second half of this year and we expect polarisation of investor

focus to widen, as investors target best in class assets which should provide

more resilient returns in a weakening environment, with greater scrutiny on the

sustainability of income streams.

ESG considerations are expected to become even more integral to investor

decision making and asset underwriting. This trend was expedited as a result of

the Covid-19 pandemic, but with the current energy crisis and pathway to

net-zero, the case for integrating ESG considerations across all UK real estate

sectors has never been greater. An even greater emphasis on ESG requirements

for both acquisitions and developments is already underway.

The government's huge fiscal stimulus was always going to cause interest rates

to rise further, but the large market moves since the government's economic

agenda was announced suggest even higher rates will be necessary to restore

confidence in UK assets. We are sceptical on what is currently priced by

markets, but a period of high and sustained rates is likely increasing our

conviction that the economy will soon be in a recession. Whilst we expect a

slowdown in the market in the near term, we also expect inflation to fall

through 2023 into 2024 as a result of interest rate tightening from the Bank of

England before a cutting cycle starts. When the overall cost of debt does in

time move lower, and become more widely available as the economic environment

and investor sentiment towards UK real estate improves, UK government bond

yields will also move lower. We therefore expect a relatively short period of

increasingly tight spreads over the next 12-18 months, before UK real estate

begins to look more attractive. Opportunities within the market should emerge

once repricing has occurred and a rebound in real estate performance is

anticipated.

Portfolio Strategy

Against a backdrop of economic and inflationary pressure, and rising interest

rates, we remain positive on the ability of your Company's portfolio to deliver

positive rental, and so earnings, growth. Our strategy has been fashioned with

this in mind by targeting those areas of the market most likely to benefit from

positive structural changes and so experience positive demand versus supply

over the coming years with the ability for active asset management to enhance

income. Embedded across your Company's strategic thinking is an awareness of

the current and future implications of environmental, social and governance

factors, collectively ESG, with the Company's February announcement of its net

carbon zero targets of 2030 (landlord-controlled emissions) and 2040 (all

emissions) a focus for asset management and investment decision-making.

Whilst, as highlighted earlier, we do expect some negative repricing of real

estate over the short term we also believe winners and losers will emerge. We

look to maintain a diversified portfolio to reduce specific risk which we

achieve by maintaining a wide spread of tenants, geography and a diversified

property sector allocation - but importantly diversified across those sectors

and assets we believe will deliver better rental growth and value prospects

rather than simply spreading across a benchmark. The bulk of the portfolio

comprises a solid bedrock of assets with strong fundamentals, durable income

streams and a low risk profile. Layered on this is a select group of assets

allowing the team to add value and rent through more active management and, in

some cases, controlled development exposure aiming to drive superior income and

returns. And across all an aim to maintain relatively low levels of gearing

from our low cost and flexible debt facilities.

Although we may consider selective disposals in the logistics/distribution and

industrial sector to recycle to higher yielding stock, we wish to maintain a

strong allocation to this important part of the market in high demand locations

and fit-for-purpose property. We believe this sector remains well placed to

deliver rental growth as we continue to see growing demand from the twin

engines of continuing e-commerce penetration plus the growth expected in the

demand for UK on-shoring of goods as the country adapts to disrupted global

supply chains. Both, we believe, will lead to a growing demand for distribution

space in a market still short of the right supply.

We remain keen on parts of the alternative property 'beds' sector, particularly

selective student accommodation and hotel opportunities, which can also offer

the opportunity for enhanced returns versus traditional leasing models. Our

latest commitment is to a Hyatt Hotel due to open in Leeds city centre during

summer 2024 which will supplement our hotel investment in Newcastle and two

student developments at Exeter and Edinburgh.

The office sector potentially offers the greatest scope for divergence of

returns and opportunity, as ever with care. Not only is it exposed to the force

of an evolving model for how business and employees use an office, but it is

also approaching regulatory hurdles to be met on energy efficiency in buildings

by 2027 and 2030. Many offices will require significant investment to meet

these.

It is very easy to imagine business embracing the potential of agile or

flexible home working to reduce office occupancy costs, but also allocating

that smaller overall budget to higher quality offices to attract and retain

staff to encourage regular office participation for the business community

benefits that can bring. And so we believe extreme bifurcation is the watchword

for the office sector. Those assets in strong locations displaying flexibility,

with good built-in or locally available amenities, strong e-connectivity,

multi-modal transport links and sustainability are likely to emerge best placed

to capture this focused demand. The reverse is likely to be true for those that

do not with the potential they become 'stranded' economic assets requiring

investment to meet regulations that is not rewarded by demand and rental

growth. We are interested in opportunities in this thin slice of the overall

office market, those asset-specific opportunities representing offices of the

future. Conversely, we may disinvest from those assets we do not believe pass

muster on this test and indeed our sale of Colmore Row, Birmingham, fits that

category.

We believe that the Company's well-let portfolio of scale, heavily weighted

towards future-fit sectors, and with good prospects for rental growth, is well

placed to deliver positive relative performance with good potential for future

earnings growth.

Will Fulton

Fund Manager

29 September 2022

PRINCIPAL RISKS AND UNCERTAINTIES

The Group's assets consist of direct investments in UK commercial property. Its

principal risks are therefore related to the UK commercial property market in

general, but also the particular circumstances of the properties in which it is

invested and their tenants. Other risks faced by the Group include those

relating to strategy, investment & asset management, macroeconomics & finance,

operations, regulation and shareholder engagement. These risks, and the way in

which they are mitigated and managed, are described in more detail under the

headings Principal Risks and Emerging Risks within the Report of the Directors

in the Company's Annual Report for the year ended 31 December 2021, published

in April 2022, on pages 34 to 41. The Group's principal risks have not changed

since the date of that report.

GOING CONCERN

After making enquiries, and bearing in mind the nature of the Company's

business and assets, the Directors consider that the Company has adequate

resources to continue in operational existence for the next twelve months. In

assessing the going concern basis of accounting the Directors have had regard

to the guidance issued by the Financial Reporting Council. They have considered

the current cash position of the Group, forecast rental income and other

forecast cash flows. The Group has agreements relating to its borrowing

facilities with which it has complied during the period. Based on the

information the Directors believe that the Group has the ability to meet its

financial obligations as they fall due for the foreseeable future, which is

considered to be for a period of at least twelve months from the date of

approval of the financial statements. For this reason, they continue to adopt

the going concern basis in preparing the accounts.

STATEMENT OF DIRECTORS' RESPONSIBILITIES IN

RESPECT OF THE HALF YEARLY FINANCIAL REPORT TO 30 JUNE 2022

We confirm that to the best of our knowledge:

* The condensed set of half yearly financial statements have been prepared in

accordance with IAS 34 "Interim Financial Reporting", and give a true and

fair view of the assets, liabilities, financial position and return of the

Company.

* The half yearly Management Report includes a fair value review of the

information required by:

(a) DTR 4.2.7R of the Disclosure Guidance and Transparency Rules, being an

indication of important events that have occurred during the first six months

of the financial year and their impact on the condensed set of financial

statements and a description of the principal risks and uncertainties for the

remaining six months of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and Transparency Rules, being related

party transactions that have taken place in the first six months of the current

financial year and that have materially affected the financial position or

performance of the company during that period; and any changes in the related

party transactions described in the last Annual Report that could do so.

On behalf of the Board

Ken McCullagh

Chair

29 September 2022

HALF YEARLY CONDENSED Consolidated Statement of Comprehensive Income

For the HALF year ended 30 JUNE 2022

Half year ended Half year Year ended 31

30 June 2022 ended 30 June December 2021

(unaudited) 2021 (audited)

Notes £'000 (unaudited) £'000

£'000

REVENUE

Rental income 32,326 28,769 58,307

Impairment reversal/(loss) on trade 641 (1,152) 412

receivables

Service charge income 3,024 2,963 6,063

Gains on investment properties 2 141,768 51,761 201,753

Interest income 66 61 116

Total Income 177,825 82,402 266,651

EXPITURE

Investment management fee (4,798) (4,080) (8,500)

Direct property expenses (1,756) (4,004) (5,343)

Service charge expenses (3,024) (2,963) (6,063)

Other expenses (1,754) (1,125) (3,229)

Total expenditure (11,332) (12,172) (23,135)

Net operating profit before finance 166,493 70,230 243,516

costs

FINANCE COSTS

Finance costs (4,137) (3,422) (7,283)

Operating profit after finance costs 162,356 66,808 236,233

Net profit from ordinary activities 162,356 66,808 236,233

before taxation

Taxation on profit on ordinary 8 - - -

activities

Net profit for the period 162,356 66,808 236,233

Total comprehensive income for the 162,356 66,808 236,233

period

Basic and diluted earnings per share 3 12.49p 5.14p 18.18p

EPRA earnings per share 3 1.58p 1.16p 2.65p

All of the profit and total comprehensive income for the period is attributable

to the owners of the Company. All items in the above statement derive from

continuing operations.

The accompanying notes are an integral part of this statement.

HALF YEARLY CONDENSED Consolidated Balance Sheet

As at 30 JUNE 2022

Year ended

30 June 2022 31 December 30 June

(unaudited) 2021 2021

Notes £'000 (audited) (unaudited)

£'000 £'000

NON-CURRENT ASSETS

Investment properties 2 1,655,915 1,508,368 1,172,556

1,655,915 1,508,368 1,172,556

CURRENT ASSETS

Investment properties held for sale 2 22,675 - 6,250

Trade and other receivables 56,198 50,763 41,073

Cash and cash equivalents 34,288 42,121 176,742

113,161 92,884 224,065

Total assets 1,769,076 1,601,252 1,396,621

CURRENT LIABILITIES

Trade and other payables (35,095) (27,698) (26,017)

(35,095) (27,698) (26,017)

NON-CURRENT LIABILITIES

Bank loan (266,538) (248,326) (198,065)

Total liabilities (301,633) (276,024) (224,082)

Net assets 1,467,443 1,325,228 1,172,539

5

REPRESENTED BY

Share capital 539,872 539,872 539,872

Special distributable reserve 568,891 568,891 566,194

Capital reserve 358,233 216,465 66,473

Revenue reserve 447 - -

Equity shareholders' funds 5 1,467,443 1,325,228 1,172,539

Net asset value per share 5 112.9p 102.0p 90.2p

EPRA Net tangible asset value per 5 112.9p 102.0p 90.2p

share

The accompanying notes are an integral part of this statement.

HALF YEARLY Consolidated Statement of Changes in Equity

FOR THE HALF YEARED 30 JUNE 2022

Equity

HALF YEARED Share Special Capital Revenue Shareholders'

30 JUNE 2022 Capital Distributable Reserve Reserve funds

(UNAUDITED) Notes £'000 Reserve £'000 £'000 £'000 £'000

At 1 January 2022 539,872 568,891 216,465 - 1,325,228

Total Comprehensive - - - 162,356 162,356

income

Dividends paid 6 - - - (20,141) (20,141)

Transfer in respect of 2 - - 141,768 (141,768) -

gains on investment

property

As at 30 June 2022 539,872 568,891 358,233 447 1,467,443

Special Equity

FOR THE YEARED Share Distributable Capital Revenue Shareholders'

31 DECEMBER 2021 Capital Reserve Reserve Reserve Funds

(AUDITED) Notes £'000 £'000 £'000 £'000 £'000

At 1 January 2021 539,872 572,392 14,712 - 1,126,976

Total comprehensive - - - 236,233 236,233

income

Dividends paid - - - (37,981) (37,981)

Transfer in respect of - - 201,753 (201,753) -

gains on investment

property

Transfer from special - (3,501) - 3,501 -

distributable reserve

539,872 568,891 216,465 - 1,325,228

As at 31 December 2021

Special Equity

HALF YEARED Share Distributable Capital Revenue Shareholders'

30 JUNE 2021 Capital Reserve Reserve Reserve Funds

(UNAUDITED) Notes £'000 £'000 £'000 £'000 £'000

At 1 January 2021 539,872 572,392 14,712 - 1,126,976

Total comprehensive - - - 66,808 66,808

income

Dividends paid 6 - - - (21,245) (21,245)

Transfer in respect of - - 51,761 (51,761) -

gains on investment

property

Transfer from special - (6,198) - 6,198 -

distributable reserve

539,872 566,194 66,473 - 1,172,539

As at 30 June 2021

The accompanying notes are an integral part of this statement.

HALF YEARLY CONDENSED CONSOLIDATED CASH FLOW STATEMENT

FOR THE HALF YEARED 30 JUNE 2022

30 June 2022 30 June 2021 Year ended

Notes (unaudited) (unaudited) 31 December

£'000 2021

£'000 (audited)

£'000

CASH FLOWS FROM OPERATING ACTIVITIES

Net profit for the period before taxation 162,356 66,808 236,233

Adjustments for:

Gain on investment properties 2 (141,768) (51,761) (201,753)

Movement in lease incentive 2 (2,277) (2,827) (5,877)

Movement in provision for bad debts 641 (1,152) 412

(Increase)/decrease in operating trade and (3,312) 10,338 2,134

other receivables

Increase/(decrease) in operating trade and 7,397 (2,578) (464)

other payables

Finance costs 4,137 3,422 7,283

Net cash inflow from operating activities 27,174 22,250 37,968

CASH FLOWS FROM OPERATING ACTIVITIES

Purchase of investment properties 2 (6,552) (7,124) (179,861)

Sale of investment properties - 67,926 74,181

Capital expenditure 2 (21,902) (4,424) (18,077)

Net cash (outflow)/inflow from investing (28,454) 56,378 (123,757)

activities

CASH FLOWS FROM FINANCING ACTIVITIES

Facility fee charges from bank financing (657) (560) (1,020)

Dividends paid 6 (20,141) (21,245) (37,981)

Bank loan interest paid (3,755) (2,823) (5,831)

Bank loan drawdown 28,000 - 50,000

Bank loan repaid (10,000) - -

Net cash (outflow)/inflow from financing (6,553) (24,628) 5,168

activities

Net (decrease)/increase in cash and cash (7,833) 54,000 (80,621)

equivalents

Opening cash and cash equivalents 42,121 122,742 122,742

Closing cash and cash equivalents 34,288 176,742 42,121

REPRESENTED BY

Cash at bank 17,800 53,247 22,879

Money market funds 16,488 123,495 19,242

34,288 176,742 42,121

The accompanying notes are an integral part of this statement.

NOTES TO THE ACCOUNTS

1. ACCOUNTING POLICIES

The condensed consolidated financial statements have been prepared in

accordance with International Financial Reporting Standard ('IFRS') IAS 34

'Interim Financial Reporting' and, except as described below, the accounting

policies set out in the statutory accounts of the Group for the year ended 31

December 2021.

The condensed consolidated financial statements do not include all of the

information required for a complete set of IFRS financial statements and should

be read in conjunction with the consolidated financial statements of the Group

for the year ended 31 December 2021, which were prepared under full IFRS

requirements.

These condensed interim financial statements were approved for issue on 29

September 2022.

2. INVESTMENT PROPERTIES

FREEHOLD AND LEASEHOLD PROPERTIES Period ended

30 June 2022

£'000

Opening valuation 1,508,368

Purchases at cost 6,552

Capital expenditure 21,902

Gain on revaluation to fair value 144,045

Adjustment for lease incentives (2,277)

Total fair value at 30 June 2022 1,678,590

Less: Current Assets - reclassified as held for sale (22,675)

Non-current Assets - Fair value as at 30 June 2022 1,655,915

GAINS ON INVESTMENT PROPERTIES AT FAIR VALUE COMPRISE

Valuation gains 144,045

Movement in provision for lease incentives (2,277)

141,768

ASSET HELD FOR SALE

At the balance sheet date one asset was classified as held for sale, Colmore

Row, Birmingham. The asset has been shown at market value in the Balance Sheet

as a held for sale asset and included within the investment property table

shown in this note.

3. BASIC AND DILUTED EARNINGS PER SHARE

Period ended Period ended

30 June 2022 30 June 2021

Weighted average number of shares 1,299,412,465 1,299,412,465

Net Profit (£'000) 162,356 66,808

Basic and diluted Earnings per share (pence) 12.49 5.14

EPRA earnings per share (pence) 1.58 1.16

4. EARNINGS

Earnings for the period to 30 June 2022 should not be taken as a guide to the

results for the year to 31 December 2022.

5. NET ASSET VALUE

Period ended Period ended

30 June 2022 30 June 2021

Number of ordinary shares in issue at the 1,299,412,465 1,299,412,465

period end

Net assets attributable at the period end (£ 1,467,443 1,172,539

'000)

Net asset value per ordinary share (pence) 112.9 90.2

EPRA net tangible asset per share (pence) 112.9 90.2

6. DIVIDS

Period ended Period ended

30 June 2022 30 June 2021

£'000 £'000

2021 Fourth interim: PID of 0.466p per share, 9,746 5,977

Non PID of 0.284p per share paid 25 February

2022 (2020 Fourth interim: PID of 0.46p per

share)

2021 Fifth interim: nil - 6,900

(2020 Fifth interim: PID of 0.531p per share)

2022 First interim: PID of 0.80p per share paid 10,395 8,368

25 May 2022 (2021 First interim: PID of 0.644p

per share)

20,141 21,245

7. RELATED PARTY TRANSACTIONS

No Director has an interest in any transactions which are or were unusual in

their nature or significant to the nature of the Group.

abrdn Fund Managers Limited (previously Aberdeen Standard Fund Managers

Limited) received fees for their services as investment managers. The total

management fee charged to the Statement of Comprehensive Income during the

period was £4,798,238 (30 June 2021: £4,079,597) of which £4,798,238 (30 June

2021: £2,061,904) remained payable at the period end.

The Directors of the Company are deemed as key management personnel and

received fees for their services. Total fees for the period were £134,377 (30

June 2021: £159,759) of which £Nil (30 June 2021: £Nil) was payable at the

period end.

The Group invests in the abrdn Liquidity Fund which is managed by abrdn. As at

30 June 2022 the Group had invested £16.5 million in the Fund (30 June 2021: £

123.5 million). No additional fees are payable to the Investment Manager as a

result of this investment.

8. TAXATION

Period ended

30 June 2022

£'000

Net profit from ordinary activities before tax 162,356

UK corporation tax at a rate of 19 per cent 30,848

Effects of:

Capital gain on investment properties not taxable (26,936)

UK REIT exemption on rental profits and gains (3,912)

Total tax charge -

9. FINANCIAL INSTRUMENTS AND INVESTMENT PROPERTIES

The Group's investment objective is to provide ordinary shareholders with an

attractive level of income, together with the potential for income and capital

growth from investing in a diversified UK commercial property portfolio.

Consistent with that objective, the Group holds UK commercial property

investments. The Group's financial instruments consist of cash, receivables and

payables that arise directly from its operations and loan facilities.

The main risks arising from the Group's financial instruments are credit risk,

liquidity risk, market risk and interest rate risk. The Board reviews and

agrees policies for managing its risk exposure. These policies are set out in

the statutory accounts of the Group for the year ended 31 December 2021. The

Board, through its Risk Committee, has undertaken a thorough review of these

risks and believe they have not changed materially from those set out in the

2021 statutory accounts.

Fair value hierarchy

The following table shows an analysis of the fair values of investment

properties recognised in the balance sheet by level of the fair value

hierarchy:

Explanation of the fair value hierarchy:

Level 1 Quoted prices (unadjusted) in active markets for identical

assets or liabilities that the entity can access at the measurement date.

Level 2 Use of a model with inputs (other than quoted prices included in

level 1) that are directly or indirectly observable market data.

Level 3 Use of a model with inputs that are not based on observable

market data.

Total fair

Level 1 Level 2 Level 3 £ value

30 June 2022 £'000 £'000 '000 £'000

Investment properties - - 1,678,590 1,678,590

The lowest level of input is the underlying yields on each property, which is

an input not based on observable market data.

The fair value of investment properties is calculated using unobservable inputs

as set out in the statutory accounts of the Group for the year ended 31

December 2021.

The following table shows an analysis of the fair value of bank loans

recognised in the balance sheet by level of the fair value hierarchy:

Total fair

Level 1 Level 2 Level 3 value

30 June 2022 £'000 £'000 £'000 £'000

Loan Facilities - 266,538 - 266,538

The lowest level of input is the interest rate applicable to each borrowing as

at the balance sheet date which is a directly observable input.

The fair value of the bank loans is estimated by discounting expected future

cash flows using the current interest rates applicable to each loan.

The following table shows an analysis of the fair values of financial

instruments and trade receivables and payables recognised at amortised cost in

the balance sheet by level of the fair value hierarchy:

Total fair

Level 1 Level 2 Level 3 value

30 June 2022 £'000 £'000 £'000 £'000

Trade and other receivables - 56,198 - 56,198

Trade and other payables - 35,095 - 35,095

The carrying amount of trade and other receivables and payables is equal to

their fair value, due to the short-term maturities of these instruments.

Expected maturities are estimated to be the same as contractual maturities.

There have been no transfers between levels of the fair value hierarchy during

the period.

10. FINANCING

The Company has fully utilised the £100 million facility, which is due to

mature in April 2027, with Barings Real Estate Advisers (previously Cornerstone

Real Estate Advisers LLP).

The Company has fully utilised the £100 million facility, which is due to

mature in February 2031, with Barings Real Estate Advisers.

The Company has in place a £150 million revolving credit facility with Barclays

Bank Plc of which £68m was drawn down at the period end (30 June 2021: £nil).

11. SUBSIDIARY UNDERTAKINGS

The Company owns 100 per cent of the issued share capital of UK Commercial

Property Estates Holdings Limited (UKCPEHL), a company incorporated in Guernsey

whose principal business is to hold and manage investment properties for rental

income. UKCPEHL Limited owns 100 per cent of the issued share capital of UK

Commercial Property Estates Limited, a company incorporated in Guernsey whose

principal business is to hold and manage investment properties for rental

income. UKCPEHL also owns 100% of Brixton Radlett Property Limited and UK

Commercial Property Estates (Reading) Limited, both are UK companies, whose

principal business is that of an investment and property company. In addition,

UKCPEHL owns 100% of the issued share capital of Duke Distribution Centres Sarl

and Duke Offices & Developments Sarl; both companies are incorporated in

Luxembourg with the principal business being to hold and manage investment

properties for rental income.

The Company owns 100 per cent of the issued ordinary share capital of UK

Commercial Property Finance Holdings Limited (UKCPFHL), a company incorporated

in Guernsey whose principal business is to hold and manage investment

properties for rental income.

UKCPFHL owns 100 per cent of the issued share capital of UK Commercial Property

Nominee Limited, a company incorporated in Guernsey whose principal business is

that of a nominee company. UKCPFHL owns 100 per cent of the issued ordinary

share capital of UK Commercial Property Holdings Limited (UKCPHL), a company

incorporated in Guernsey whose principal business is to hold and manage

investment properties for rental income. UKCPT Limited Partnership, (LP), is a

Guernsey limited partnership, whose principal business is to hold and manage

investment properties for rental income. UKCPHL and GP, have a partnership

interest of 99 and 1 per cent respectively in the LP. The GP is the general

partner and UKCPHL is a limited partner of the LP.

In addition, the Group controls three JPUTS namely Junction 27 Retail Unit

Trust, St George's Leicester Unit Trust and Rotunda Kingston Property Unit

Trust. The principal business of the Unit Trusts is that of investment in

property.

As at 31 March 2021, Brixton Radlett Property Limited, UK Commercial Property

Estates (Reading) Limited, the GP, Nominee and the Limited Partnership were all

placed in the hands of liquidators as part of a solvent liquidation process and

the conclusion of this process is due to conclude in the second half of 2022.

During the period the Group successfully completed the voluntary liquidation of

Kew Retail Park, a JPUT whose principal business prior to liquidation was that

of investment in property.

12. POST BALANCE SHEET EVENTS

The Group completed the sale of Colmore Row, Birmingham on 7 July for a

headline sales price of £26.48m.

On the 10 August 2022 the Company declared a Property Income Distribution of

0.85p per ordinary share payable in respect of the quarter-ended 30 June 2022

and a Special Dividend of 1.92p per ordinary share. Both were paid to

Shareholders on the 31 August 2022.

On the 19 August 2022 the Group increased its revolving credit facility with

Barclays Bank plc to £180m (Dec 2021: £150m). There were no other amendments to

the agreement, the facility expires in April 2024 and is cancellable at any

time.

- For further information please contact:

Will Fulton / Jamie Horton, abrdn

Via FTI consulting

William Simmonds / Harry Randall, J.P. Morgan Cazenove

Tel: 020 7742 4000

Richard Sunderland / Claire Turvey / Emily Smart / Andrew Davis, FTI Consulting

Tel: 020 3727 1000

UKCM@fticonsulting.com

------------

The Interim Report will be posted to shareholders in October 2022 and

additional copies will be available from the Manager or by download from the

Company's webpage (www.ukcpreit.co.uk).

Please note that past performance is not necessarily a guide to the future and

that the value of investments and the income from them may fall as well as

rise. Investors may not get back the amount they originally invested.

All enquiries to:

The Company Secretary

Northern Trust International Fund Administration Services (Guernsey) Limited

Trafalgar Court

Les Banques

St Peter Port

Guernsey

GY1 3QL

Tel: 01481 745001

END OF ANNOUNCEMENT

END

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

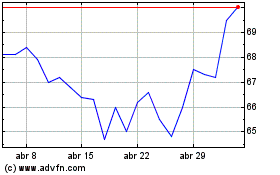

Uk Commercial Property R... (LSE:UKCM)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Uk Commercial Property R... (LSE:UKCM)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024