TIDMTET

RNS Number : 7005C

Treatt PLC

13 October 2022

13 October 2022

TREATT PLC

("Treatt" or "the Group")

Trading update for the year ended 30 September 2022

Treatt, the manufacturer and supplier of a diverse and

sustainable portfolio of natural extracts and ingredients for the

beverage, flavour and fragrance industries, today publishes a

trading update for the year ended 30 September 2022 ("FY22").

Highlights

-- FY22 profit before tax and exceptional items still expected

to be in line with revised Board expectations of between GBP15.0m

and GBP15.3m, announced on 15 August 2022

-- Revenue growth of c.13% (9% in constant currency) in line with market expectations

-- Progressive dividend policy unchanged

-- Correction of over-hedged FX contracts and implementation of new FX management systems

-- Majority of production now transitioned to the new UK

facility and UK production capacity will at least double once

process is fully completed (anticipated in FY23)

-- Substantial investment over recent years in production and

people to support significant growth opportunities over medium

term, bolstered by favourable consumer trends in the beverage

market

FY22 performance

Revenue for the year is anticipated to be c.GBP140m (FY21:

GBP124.3m), an increase of c.13% (c. 9% in constant currency).

Revenue growth was broad-based, across all of our categories,

except for Tea as previously communicated. This performance was

driven in particular by our Citrus, Synthetic Aroma and Health

& Wellness categories. Coffee sales, which are anticipated be

to c.GBP1m, will be reported separately for the first time in our

full year results. Tea sales declined on the back of an exceptional

FY21 performance and lower than expected demand in hard tea in the

US, which also materially impacted margins for the year.

Our Citrus category, which contributed 48% of Group revenue

(FY21: 44%), grew by over 20%, while margins were broadly in line.

During the year we implemented selected price increases to offset

higher commodity prices.

Our Health & Wellness category (including sugar reduction)

had another strong year, growing by 15% (FY21: 29%) with strong

consumer demand for 'better for you' products driving sales in our

specialist solutions, such as the reduction of calorific content in

beverages.

Despite a very strong prior year, our Fruit & Vegetables

category continued to grow by 8% (FY21: 60%) with mango, pineapple,

strawberry and kiwi leading the way.

An increase in products used to flavour alternative proteins and

savoury snack foods helped grow our Synthetic Aroma category by 14%

(FY21: 9 %).

In line with revised guidance announced in August 2022, the

Board expects to report profit before tax and exceptional items of

between GBP15.0m and GBP15.3m.

Operational developments

The Company has reviewed how it can better limit FX exposure in

light of increasing volatility. This has resulted in the correction

of previously over-hedged FX contracts and the implementation of

new FX management systems which will provide greater controls for

the Group in this area moving forwards.

The majority of production has now transitioned to the new UK

headquarters and UK production capacity will at least double once

this process is fully completed. Distillation equipment is

anticipated to move to the new site in 2023.

Cash and dividends

The Group ended the year with net debt of c.GBP23m (FY2021:

GBP9.1m). During the year the Group spent GBP6m on its new UK

facility and invested in holding prudent levels of inventory to

mitigate supply chain risks for customers.

The business continues to generate good levels of cash and the

Board confirms its intention to continue its progressive dividend

policy.

Outlook

After a challenging year, the Group enters the new financial

year with confidence in Treatt's proposition and its ability to

deliver top line growth, supported by positive market dynamics.

After substantial investment in our people and production

facilities to support the Group's next phase of expansion, we do

not anticipate any significant increase in administrative expenses

in the short to medium term, above the normal rate of

inflation.

Daemmon Reeve, CEO of Treatt, commented:

"We delivered continued positive growth in sales for the year,

reflecting a good performance across the vast majority of our

categories, however, we were impacted by some specific factors in

the second half which ultimately led to a disappointing outcome for

the full year.

We have taken a number of immediate actions in recent weeks to

ensure the business has the right systems in place, whilst also

confirming that the substantial investment in our team and

facilities is adequate to meet our ambitious goals.

Whilst the macro environment remains uncertain, we are

encouraged by prevailing consumer trends, particularly in the

beverage market, which play into our specialist expertise in

flavour. As such, we are confident the business can revert to its

trajectory of growth."

Treatt's results for the year ended 30 September 2022 are

expected to be announced on 29 November 2022.

Treatt plc +44 (0)1284 702500

Daemmon Reeve Chief Executive Officer

Ryan Govender Chief Financial Officer

Financial PR

MHP Communications +44 (0) 20 3128 8789

Tim Rowntree

Simon Hockridge

Catherine Chapman

Joint Brokers

Investec Bank Plc +44 (0)20 7597 5970

Patrick Robb

David Anderson

Peel Hunt LLP +44 (0) 20 7418 8900

George Sellar

Andrew Clark

Lalit Bose

About the Group

Treatt is a global, independent manufacturer and supplier of a

diverse and sustainable portfolio of natural extracts and

ingredients for the flavour, fragrance and multinational consumer

product industries, particularly in the beverage sector. Renowned

for its technical expertise and knowledge of ingredients, their

origins and market conditions, Treatt is recognised as a leader in

its field.

The Group employs over 400 staff in Europe, North America and

Asia and has manufacturing facilities in the UK and US. Its

international footprint enables the Group to deliver powerful and

integrated solutions for the food, beverage and fragrance

industries across the globe.

For further information about the Group, visit www.treatt.com

.

CAUTIONARY STATEMENT ABOUT FORWARD-LOOKING STATEMENTS

This announcement contains forward-looking statements that are

subject to risk factors associated with, among other things, the

economic and business circumstances occurring from time to time in

the countries, sectors and markets in which the Group operates. It

is believed that the expectations reflected in these statements are

reasonable, but they may be affected by a wide range of variables

which could cause actual results to differ materially from those

currently anticipated. No assurances can be given that the

forward-looking statements in this announcement will be realised.

The forward-looking statements reflect the knowledge and

information available at the date of preparation of this

announcement and the Group undertakes no obligation to update these

forward-looking statements. Nothing in this announcement should be

construed as a profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFSEIALFLIF

(END) Dow Jones Newswires

October 13, 2022 02:00 ET (06:00 GMT)

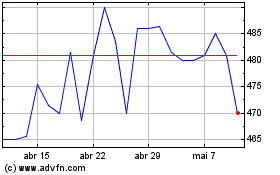

Treatt (LSE:TET)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Treatt (LSE:TET)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025