TIDMMRIT

RNS Number : 2556E

Merit Group PLC

27 October 2022

27 October 2022

Merit Group plc

("Merit", the "Company" or the "Group")

Disposal of Media, Events and Training Operations

Merit Group plc (AIM: MRIT), the data and intelligence business,

announces that it has agreed to sell the Media, Events and Training

operations of its Dods Political Engagement business (together, the

"MET Operations") to Political Holdings Limited, a private company

owned by Lord Ashcroft KCMG PC, for a cash consideration of GBP4.5

million (the "Disposal").

In the year ending 31 March 2022, the MET Operations generated

revenue of GBP9.3 million and an adjusted EBITDA of approximately

GBP0.5 million, with net assets of GBP0.5 million as at 31 March

2022.

Merit expects the Disposal to complete in the current calendar

year. The Disposal remains subject to the satisfaction of certain

conditions, including satisfaction of financing by Political

Holdings Limited. Following completion the Group will use the net

proceeds(1) to pay down its net debt(2) , which as at 30 September

2022 was GBP3.2m, and to fund the growth plans of its ongoing

business intelligence operations.

(1) Net proceeds comprise GBP4.5m consideration, to be adjusted

for normalised working capital, less transaction costs

(2) Net debt/net cash comprises the aggregate of gross debt,

excluding IFRS16 lease liabilities and cash and cash

equivalents

Background to and reasons for the Disposal

Following the Group's change of name and new strategic focus

announced in March 2021, and having conducted an internal review of

its operations, the Board of Merit concluded earlier this year that

the Group was overly diverse and complex given its market size and

that it needed to focus its future strategy on its core data and

intelligence offerings. These core operations comprise; the market

leading Dods Political Intelligence service with over 800

subscribers in the UK and Europe, which generated GBP6.9 million of

subscription revenue in the last financial year; and the data and

intelligence business of Merit Data & Technology which

generated GBP10.7 million, the significant majority of which is

recurring revenue.

The Board of Merit believes focussing on business intelligence

will allow it to grow its core business operations and improve

returns to shareholders.

Political Holdings Limited owns three companies in the media

sector, focused on politics and government: Biteback Publishing

(Britain's leading political publisher), Campaigns & Elections

(the non-partisan go-to resource for political campaign

professionals in the USA and Mexico), and ConservativeHome (the

UK's premier independent conservative news and analysis site).

Merit believes that its MET Operations will benefit from the focus

that will come from being part of a company specialising in media

and events.

David Beck, CEO of Merit Group plc, said:

"This is an important step for Merit. The Disposal will allow us

to focus on the parts of the Group with recurring or subscription

revenue, attractive margins and strong cash generation. Following

the Disposal we will become fully focussed on the business

intelligence sector.

"This transaction, together with the disposal of our minority

stake in Social 360 announced in July, will mean we have raised

GBP5m from the disposal of non core assets. When set against our

market capitalisation of approximately GBP8.5m these are obviously

significant strategic developments."

Related Party Transaction

Political Holdings Limited is owned by Lord Ashcroft KCMG PC, a

substantial shareholder in the Company as defined by the AIM Rules.

Further, Angela Entwistle, a non-executive director of the Company,

is a director of Political Holdings Limited.

The Disposal therefore constitutes a related party transaction

under Rule 13 of the AIM Rules. The Independent Directors of the

Company (being all Directors save for Angela Entwistle) consider,

having consulted with Canaccord Genuity Limited in its capacity as

the Company's nominated adviser for the purposes of the AIM Rules,

the terms of the Disposal to be fair and reasonable insofar as the

Company's shareholders are concerned.

About Merit's Media, Events and Training Operations

Included in the MET Operations in the Disposal are the leading

political news website Politics Home and magazines such as The

House, Holyrood and The Parliament as well as the online

publication Civil Service World. Under the Dods brand the Company

runs events such as its Diversity & Inclusion Series that

includes Women into Leadership events; in Scotland the annual

Holyrood Garden Party and Political Awards and in Brussels the MEP

Awards. The Company also runs events for others, notably Government

Departments including Civil Service Live and the CS Awards. Dods

Training runs training courses for civil servants as well as NGOs

and commercial organisations.

For further information contact:

Merit Group plc

David Beck - CEO 020 7593 5500

www.meritgroupplc.com

Canaccord Genuity Limited (Nomad and Broker)

Bobbie Hilliam 020 7523 8150

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFFFFIIALRFIF

(END) Dow Jones Newswires

October 27, 2022 02:00 ET (06:00 GMT)

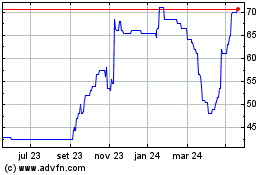

Merit (LSE:MRIT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

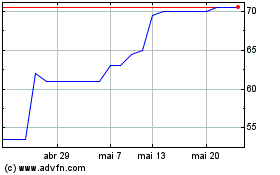

Merit (LSE:MRIT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024