TIDMBRH

RNS Number : 4170E

Braveheart Investment Group plc

28 October 2022

The information contained within this announcement is deemed by

the Group to constitute inside information as stipulated under the

Regulation 11 of the Market Abuse (Amendment) (EU Exit) Regulations

2019/310 ("MAR"). With the publication of this announcement via a

Regulatory Information Service, this inside information is now

considered to be in the public domain.

28 October 2022

Braveheart Investment Group plc

("Braveheart" or the "Company" or the "Group")

Interim Results

Braveheart Investment Group plc (AIM: BRH), announces its

interim results for the six months ended 30 September 2022.

Highlights:

-- Income of GBP36,000 in the six months ended 30 September 2022 (H1 2021: GBP3,364,000);

-- Loss of GBP761,000 in the six months ended 30 September 2022 (H1 2021: GBP2,533,000);

-- Loss per share of 1.19p in the six months ended 30 September 2022 (H1 2021: 4.85p);

-- Investments into Aukett Swanke Group plc and PhaseFocus Holdings Limited

-- Funds raised in the period totalling GBP965,000 (before expenses)

Post Period End

-- Aukett Swanke Group plc shareholding increased to 19.37%

-- Autins Group plc shareholding increased to 12.91%

For further information:

Braveheart Investment Group plc Tel: 01738

587555

Trevor Brown, Chief Executive Officer

Viv Hallam, Executive Director

Allenby Capital Limited (Nominated Tel: 020

Adviser and Joint Broker) 3328 5656

David Worlidge / James Reeve / George

Payne

Peterhouse Capital Limited (Joint Tel: 020

Broker) 7469 0936

Duncan Vasey / Lucy Williams

Chief Executive Officer's Statement

We are pleased to report to shareholders the results for the six

months ended 30 September 2022. Progress has continued in all the

Group's activities and detailed operational summaries follow later

in this report.

Financial Review

The Directors have undertaken an unaudited interim review of the

valuations of the Group's investments and have concluded that, as

at 30 September 2022, the fair value of the Group's investments

were as follows:

-- Valuation of Portfolio Investments: GBP164,000 (31 March 2022: GBP164,000)*

-- Valuation of unconsolidated Strategic Investments:

GBP4,964,000 (31 March 2022: GBP4,552,000)**

* these are the historic investments made by Braveheart up to

2015

** these are the new investments made by Braveheart since

2015

Therefore, the total unaudited value of our unconsolidated

investment portfolio as at 30 September 2022 is GBP5,128,000 (31

March 2022: GBP4,716,000). This uplift is largely due to the

additional investments made into PhaseFocus Holdings Limited and

Aukett Swanke Group plc. As at 30 September 2021, the comparable

total valuation of our investments was GBP4,424,000.

The Group reports a loss after tax for the period under review

of GBP761,000 (2021: profit of GBP2,533,000). This equates to a

loss per share of 1.19 pence (September 2021: 4.85 pence).

The Directors believe that the Strategic Investments continue to

be the most likely drivers of growth in shareholder value over the

remainder of the current year and so have concentrated the

remainder of this CEO Statement on their operations and

prospects.

Strategic Investments Overview

Paraytec Limited (Braveheart owns 100% per cent of the

company)

Paraytec Limited ("Paraytec") develops high performance

specialist detectors for the analytical and life sciences

instrumentation markets. In addition, the Company has undertaken a

programme with the University of Sheffield to develop a rapid test

for identifying cancer and pathogens, including viruses.

The clinical study at the Sheffield Teaching Hospitals NHS

Foundation Trust, referred to in an announcement issued on 21 July

2022 commenced later than expected in September 2022 and

participant recruitment is ongoing. This study runs alongside the

Trust's existing NHS drive-through COVID-19 testing service for

staff. In the first phase, up to 100 participants, 50 of whom are

positive for COVID-19 and 50 who are negative, will provide swab

specimens for analysis by Paraytec's CX300 instrument. This data

will be compared to separate analyses by polymerase chain reaction

(PCR) and for some samples, culture for live SARS-CoV-2 virus in

the laboratory.

Although the market for COVID-19 tests has dramatically changed

in recent months, the Company believes that demonstration of

performance in a clinical setting will attract potential licensees

and acquirers to Paraytec's CX300 technology platform, not only for

point-of-care COVID-19 testing but for many other potential

applications.

As previously reported, the Paraytec team is progressing two

further applications for the CX300 instrument; a Proof of Concept

demonstration of a test for pathogens causing sepsis; and a method

to analyse the quality of Virus Like Particles which are used in

gene therapy medicine.

Phasefocus Holdings Limited (Braveheart owns 44.69%of the

company)

Phasefocus Holdings Limited ("Phasefocus"), a spin-out from the

University of Sheffield, has developed a series of patented

computational imaging and analysis techniques that have a wide

range of applications including live cell imaging, engineering

metrology and electron microscopy. The company's novel method for

high fidelity quantitative imaging and microscopy is known in the

scientific literature as "ptychography".

Phasefocus's flagship product, LivecyteTM, allows researchers

and biotechnology companies to characterise the dynamic behaviour

of live cells in ways previously not possible. Livecyte's

integration of the Phasefocus's patented label-free Quantitative

Phase Imaging technology with state-of-the-art automatic cell

tracking algorithms enables users to automatically characterize

growth, morphology and motility of large populations of cells in a

96-well plate assay format.

In September 2022, Phasefocus secured GBP370,000 of further

investment following a rights issue, in which Braveheart

participated. These funds will enable the Company to increase its

stock holding of critical components, to provide customers with

shorter lead times than are currently available due to global

supply-chain delays. In addition, the Company will increase its

marketing and direct sales activity in the EU and USA, where it

sees substantial potential to increase sales beyond those achieved

by its distributors.

Kirkstall Limited (Braveheart owns 80% of the company)

Kirkstall Limited ("Kirkstall") operates in the market known as

'organ-on-a-chip', where it has developed Quasi Vivo(TM), a system

of chambers for cell and tissue culture in laboratories. Its

patented technology is used by researchers in the growing New

Approach Methodologies ("NAMs"), which enable human-relevant drug

safety decisions to be made without the need for animal

testing.

On 10 and 11 November 2022, Kirkstall will organise its annual

conference, Advances in Cell and Tissue Culture ("ACTC 2022"), at

which 40 presenters from across the globe will present their latest

research in the development of non-animal micro-physiological in

vitro models https://theactc.com/ . This year the programme

includes several speakers from Singapore and Australia for the

first time.

Kirkstall's new Quasi Vivo(TM) product platform is in the final

stages of user testing prior to market launch in December 2022. Its

advanced fluid flow and compact design are considered highly

desired by both pharmaceutical and academic users.

Kirkstall's partnership in the EUR4m European project CyGenTig

is progressing well. The consortium is developing and testing new

techniques to produce engineered tissues by optogenetics, with the

aim to build replacement human organs by controlling individual

cell growth and differentiation.

Autins Group plc (Braveheart owns 12.91% of the company)

Post period, as announced on 20 October 2022, Braveheart

increased its holding in this company to 12.91%.

Autins Group specialises in solving acoustic and thermal

problems in the automotive industry and other specialist

applications. In particular, the company's leading product Neptune,

a non-woven microfibre web, is produced by a mixture of engineered

polyester fibre and melt-blown polypropylene. This material

outperforms traditional automotive insulation and is gaining

traction in office and flooring acoustics applications.

Aukett Swanke Group plc (Braveheart owns 19.37% of the

company)

Post period, as announced on 5 October 2022, Braveheart

increased its holding in this company to 19.37%.

Aukett Swanke is a professional services group that principally

provides architectural and interior design services in the primary

international market sectors of offices, residential, education,

industrial, hospitality and mixed use or 'hybrid' developments. It

has two principal UK subsidiaries, Aukett Swanke Limited and

Veretec Limited.

Velocity Composites plc (Braveheart owns 4.13% of the

company)

Velocity Composites is a leading supplier of advanced composite

material kits to the Aerospace sector. Velocity Composites' clients

include multi-national manufacturers of composite parts and

assemblies, who in turn deliver to the world's leading civil and

military aircraft manufacturers. The Airbus A320, A330, A350, A380,

Eurofighter Typhoon, F35 Joint Strike Fighter, Boeing 737, Boeing

787 and V22 Osprey are all constructed using parts manufactured

from Velocity's kits.

Fund raising

In April 2022, the Company raised GBP215,113, before expenses at

an issue price of 15p per share, and in September 2022, the Company

raised a further GBP750,000, before expenses, by way of a placing

and subscription at an issue price of 10.25p per share. These

fundraises were undertaken by the Company to enable it to be in

sufficient funds to be able to support its current investee

companies from a position of strength should the need arise for

further funds and to be able to make opportunistic new

investments.

At 30 September 2022, the Company had unaudited cash and cash

equivalents of GBP2.02 million (30 September 2021: GBP3.46

million).

Outlook

The Board continues to work to enhance shareholder value within

our strategic investments, and also to invest in other businesses

where we consider there is good potential for medium term

growth.

Trevor Brown

Chief Executive Officer

27 October 2022

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the six months ended 30 September 2022

Six months ended Six months ended

Year ended

30 September 30 September 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

Continuing operations Note GBP GBP GBP

------------------------------------------------------ ----- ------------------- ------------------- -------------

Revenue 141,982 67,070 185,814

Change in fair value of investments 4 (105,781) 3,236,617 2,690,598

Profit on disposal of investments - 60,155 60,414

Total income 36,201 3,363,842 2,936,826

------------------------------------------------------ ----- ------------------- ------------------- -------------

Employee benefits expense (403,105) (195,899) (636,141)

Other operating costs (370,198) (360,516) (752,449)

Total operating costs (773,303) (556,415) (1,388,590)

------------------------------------------------------ ----- ------------------- ------------------- -------------

Finance income 4,170 3 138

Finance costs (1,178) (819) (2,349)

------------------------------------------------------ ----- ------------------- ------------------- -------------

Total costs (770,311) (557,231) (1,390,801)

(Loss)/ Profit before tax (734,110) 2,806,611 1,546,025

------------------------------------------------------ ----- ------------------- ------------------- -------------

Tax (27,376) (273,488) (104,048)

(Loss)/ Profit after tax for the period and total

comprehensive income for the period (761,486) 2,533,123 1,441,977

(Loss)/ Profit attributable to :

Equity holders of the parent 767,115 2,538,765 1,453,804

Non-controlling interest 5,629 (5,642) (11,827)

(761,486) 2,533,123 1,441,977

------------------------------------------------------ ----- ------------------- ------------------- -------------

Basic (loss)/earnings per share Pence Pence Pence

* Basic 2 (1.19) 4.85 3.10

* Diluted 2 (1.11) 4.75 2.82

The above condensed consolidated Statement of Comprehensive

Income should be read in conjunction with the accompanying

notes.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

as at 30 September 2022

30 September 30 September 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

------------------------------------------------ ----- ---------------------------------- ------------- ----------

ASSETS

Non-current assets

Property, plant and equipment 2,181 2,347 1,776

Intangible assets 27,963 30,649 26,103

Goodwill 3 205,775 205,775 205,775

Investments at fair value through profit or

loss 4 5,127,715 4,424,959 4,716,080

5,363,634 4,663,730 4,949,734

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Current assets

Inventory 80,934 93,720 90,113

Trade and other receivables 121,943 106,094 123,412

Cash and cash equivalents 2,018,440 3,460,760 1,893,931

------------------------------------------------ ----- ---------------------------------- ------------- ----------

2,221,317 3,660,574 2,107,456

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Total assets 7,584,951 8,324,304 7,057,190

------------------------------------------------ ----- ---------------------------------- ------------- ----------

LIABILITIES

Current liabilities

Trade and other payables (100,455) (409,197) (272,432)

Deferred income (18,026) (36,918) (7,025)

(118,481) (446,115) (279,457)

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Non-current liabilities

Deferred taxation (197,774) (273,488) (170,398)

(197,774) (273,488) (170,398)

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Total liabilities (316,255) (719,603) (449,855)

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Net assets 7,268,696 7,604,701 6,607,335

------------------------------------------------ ----- ---------------------------------- ------------- ----------

EQUITY

Called up share capital 5 1,274,469 1,044,807 1,044,807

Share premium 5,370,711 4,455,493 4,371,343

Share based payment reserve 503,652 131,905 309,835

Retained earnings 132,087 1,984,163 899,202

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Equity attributable to owners of the parent 7,280,919 7,616,368 6,625,187

Non-controlling interest (12,223) (11,667) (17,852)

------------------------------------------------ ----- ---------------------------------- ------------- ----------

Total equity 7,268,696 7,604,701 6,607,335

------------------------------------------------ ----- ---------------------------------- ------------- ----------

The above condensed consolidated statement of financial position

should be read in conjunction with the accompanying notes

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

for the six months ended 30 September 2022

Six months ended

30 September 30 September 31 March

2022 2021 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

---------------------------------------------------------------------- ----------------- ------------- ------------

Operating activities

(Loss)/ Profit before tax (734,110) 2,806,611 1,441,977

Adjustments to reconcile profit before tax to net cash flows from

operating activities

Decrease/ (Increase) in the fair value movements of investments 105,781 (3,236,617) (2,690,598)

Share based payment 193,817 - 177,930

Profit on disposal of equity investments - (60,155) (60,414)

Fees taken from investment proceeds - 84,150 -

Movement in liabilities due to Viking fund 104 33,565 41,265

Taxation - - 170,398

Depreciation and amortisation 6,557 6,111 12,919

Interest income (4,170) (3) (138)

Decrease in inventory 9,179 4,721 8,328

Decrease / (Increase) in trade and other receivables 1,469 (322) (17,640)

(Decrease) / Increase in trade and other payables (160,976) (186,807) (353,465)

---------------------------------------------------------------------- ----------------- ------------- ------------

Net cash flow used in operating activities (582,349) (548,746) (1,269,438)

---------------------------------------------------------------------- ----------------- ------------- ------------

Investing activities

Proceeds from sale of investments - 74,865 245,871

Amount paid to BBB - - (170,887)

Acquisition of investments (218,853) (622,769) (1,467,469)

Acquisition of intangible assets (7,845) (7,987) (9,834)

Acquisition of tangible assets (977) (802) (646)

Interest received 4,170 3 138

---------------------------------------------------------------------- ----------------- ------------- ------------

Net cash flow used in investing activities (223,505) (556,690) (1,402,827)

---------------------------------------------------------------------- ----------------- ------------- ------------

Financing activities

Warrants and share options exercised - 7,480 7,480

Funds raised, net of share issue costs 930,363 2,415,850 2,415,850

Net cash flow from financing activities 930,363 2,423,330 2,423,330

Net increase / (decrease) in cash and cash equivalents 124,509 1,317,894 (248,935)

Cash and cash equivalents at the start of the period 1,893,931 2,142,866 2,142,866

---------------------------------------------------------------------- ----------------- ------------- ------------

Cash and cash equivalents at the end of the period 2,018,440 3,460,760 1,893,931

---------------------------------------------------------------------- ----------------- ------------- ------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the six months ended 30 September 2022

Attributable to owners of the Parent

-------------------------------------------------------------

Share

based

Share Share payment Retained Non-controlling Total

Capital Premium Reserve Earnings Total Interest Equity

GBP GBP GBP GBP GBP GBP GBP

----------------------- ---------- ---------- --------- ------------ ------------ ---------------- ------------

At 31 March 2021

(audited) 766,148 2,226,671 137,200 (559,897) 2,570,122 (6,025) 2,564,097

----------------------- ---------- ---------- --------- ------------ ------------ ---------------- ------------

Total comprehensive

income for the

period - - - 2,538,765 2,538,765 (5,642) 2,533,123

Transactions

with owners recorded

directly in equity:

Allotment of shares 278,659 2,228,822 - - 2,507,481 - 2,507,481

Transfer to retained

earnings - - (5,295) 5,295 - - -

At 30 September

2021 (unaudited) 1,044,807 4,455,493 131,905 1,984,163 7,616,368 (11,667) 7,604,701

----------------------- ---------- ---------- --------- ------------ ------------ ---------------- ------------

Total comprehensive

income for the

period - - - (1,084,961) (1,084,961) (6,185) (1,091,146)

----------------------- ---------- ---------- --------- ------------ ------------ ---------------- ------------

Transactions

with owners recorded

directly in equity:

----------------------- ---------- ---------- --------- ------------ ------------ ---------------- ------------

Cost of shares

issued - (84,150) - - (84,150) - (84,150)

Share based payments - - 177,930 - 177,930 - 177,930

At 31 March 2022

(audited) 1,044,807 4,371,343 309,835 899,202 6,625,187 (17,852) 6,607,335

----------------------- ---------- ---------- --------- ------------ ------------ ---------------- ------------

Total comprehensive

income for the

period - - - (767,115) (767,115) 5,629 (761,486)

Transactions

with owners recorded

directly in equity:

Allotment of shares 229,662 1,034,118 - - 1,263,780 - 1,263,780

Cost of shares

issued - (34,750) - - (34,750) - (34,750)

Share based payments - - 193,817 - 193,817 - 193,817

At 30 September

2022 (unaudited) 1,274,469 5,370,711 503,652 132,087 7,280,919 (12,223) 7,268,696

----------------------- ---------- ---------- --------- ------------ ------------ ---------------- ------------

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1 Basis of preparation

The financial information presented in this half-yearly report

constitutes the condensed consolidated financial statements (the

interim financial statements) of Braveheart Investment Group plc

("Braveheart" or "the Company"), a company incorporated in the

United Kingdom and registered in Scotland, and its subsidiaries

(together, "the Group") for the six months ended 30 September 2022.

The interim financial statements should be read in conjunction with

the Annual Report and Accounts for the year ended 31 March 2022 and

have been prepared in accordance with UK-adopted international

accounting standards in accordance with the requirements of the

Companies Act 2006. The financial information in this half-yearly

report, which was approved by the Board and authorised for issue on

26 October 2022 is unaudited.

The interim financial statements do not constitute statutory

accounts for the purpose of sections 434 and 435 of the Companies

Act 2006. The comparative financial information presented herein

for the year ended 31 March 2022 has been extracted from the

Group's Annual Report and Accounts for the year ended 31 March 2022

which have been delivered to the Registrar of Companies. The

Group's independent auditor's report on those accounts was

unqualified, did not include references to any matters to which the

auditors drew attention by way of emphasis without qualifying their

report and did not contain a statement under section 498(2) or

498(3) of the Companies Act 2006.

The preparation of the half-yearly report requires management to

make judgements, estimates and assumptions that affect the policies

and the reported amounts of assets and liabilities, income and

expenses. The estimates and associated assumptions are based on

historical experience and other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making judgements about carrying values of assets and

liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates. In preparing this

half-yearly report, the significant judgements made by management

in applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those applied to the

audited consolidated financial statements for the year ended 31

March 2022.

The interim financial statements have been prepared using the

same accounting policies as those applied by the Group in its

audited consolidated financial statements for the year ended 31

March 2022 and which will form the basis of the 2023 Annual Report

and Accounts. The interim financial statements have been prepared

on the same basis as the financial statements for year ended 31

March 2022 which is on the assumption that the Company is a going

concern.

Going Concern

The Directors have reviewed the Group's and the Company's

budgets and plans, taking account of reasonably possible changes in

trading performance and have a reasonable expectation that the

Group and the Company have adequate resources to continue in

operational existence for the foreseeable future and that it is

therefore appropriate to continue to adopt the going concern basis

in preparing the financial statements.

a) New and amended standards adopted by the Group

A number of new or amended standards became applicable for the

current reporting period. These new/amended standards do not have a

material impact on the Group, and the Group did not have to change

its accounting policies or make retrospective adjustments as a

result of adopting these standards.

b) New accounting policies adopted by the Group

There were no new accounting policies adopted by the Group

during the period, nor any amendments to existing accounting

policies.

2 (Loss)/Earnings per share

The basic (loss)/earnings per share has been calculated by

dividing the (loss)/ profit for the period attributable to equity

holders of the parent by the weighted average number of ordinary

shares in issue during the period.

The calculation of (loss)/ earnings per share is based on the

following profit and number of shares in issue:

Six months ended Six months ended Year ended

30 Sept 2022 30 Sept 2021 31 Mar 2022

(unaudited) (unaudited) (audited)

GBP GBP GBP

-------------------------------------------------------------- ----------------- ----------------- ------------

(Loss)/ Profit for the period attributable to equity holders

of the parent (761,486) 2,533,123 1,441,977

-------------------------------------------------------------- ----------------- ----------------- ------------

Weighted average number of ordinary shares in issue:

* For basic earnings per ordinary share 54,450,921 52,240,340 46,870,999

* Potentially dilutive ordinary shares 4,596,000 1,096,000 4,596,000

-------------------------------------------------------------- ----------------- ----------------- ------------

* For diluted earnings per ordinary share 59,046,921 53,336,340 51,466,999

-------------------------------------------------------------- ----------------- ----------------- ------------

Dilutive earnings per share adjusts for share options granted

where the exercise price is less than the average price of the

ordinary shares during the period. At the end of the current period

there were 4,596,000 potentially dilutive ordinary shares.

3 Goodwill

Paraytec Kirkstall Total

GBP GBP GBP

---------------------------------- --------- ---------- --------

At 1 April 2021 (audited) 205,775 - 205,775

At 30 September 2021 (unaudited) 205,775 - 205,775

At 31 March 2022 (audited) 205,775 - 205,775

At 30 September 2022 (unaudited) 205,775 - 205,775

---------------------------------- --------- ---------- --------

The income approach was not deemed a reliable method for valuing

the goodwill of Paraytec and Kirkstall. Therefore, the market value

method was used in order to ascertain the value of goodwill at the

period end.

4 Investments at fair value through profit or loss

Level 1 Level 2 Level 3

----------------- --------------- -------------------------------- -------------------------------- ----------

Equity Equity Debt Equity Debt

investments in investments in investments in investments in investments in

quoted unquoted unquoted unquoted unquoted

companies companies companies companies companies Total

GBP GBP GBP GBP GBP GBP

----------------- --------------- --------------- --------------- --------------- --------------- ----------

At 31 March 2021

(audited) - - - 613,847 - 613,847

Additions at

cost 575,834 - - 46,935 - 622,769

Disposals - - - (48,274) - (48,274)

Change in Fair

Value 43,385 - - 3,193,232 - 3,236,617

At 30 September

2021

(unaudited) 619,219 - - 3,805,740 - 4,424,959

----------------- --------------- --------------- --------------- --------------- --------------- ----------

Additions at

cost 844,700 - - - - 844,700

Disposals - - - - - -

Amount owed to

creditors - - - (7,560) - (7,560)

Change in Fair

Value (330,065) - - (215,954) - (546,019)

----------------- --------------- --------------- --------------- --------------- --------------- ----------

At 31 March 2022

(audited) 1,133,854 - - 3,582,226 - 4,716,080

Additions at

cost 333,553 - - 183,968 - 517,521

Disposals - - - - - -

Change in Fair

Value (105,737) - - (149) - (105,886)

At 30 September

2022

(unaudited) 1,361,670 - - 3,766,045 - 5,127,715

----------------- --------------- --------------- --------------- --------------- --------------- ----------

4 Investments at fair value through profit or loss (continued)

The Group classifies its investments using a fair value

hierarchy. Classification within the hierarchy has been determined

on the basis of the lowest level input that is significant to the

fair value measurement of the relevant investment as follows:

-- Level 1 - valued using quoted prices in active markets for identical assets;

-- Level 2 - valued by reference to valuation techniques using

observable inputs other than quoted prices included within Level 1;

and

-- Level 3 - valued by reference to valuation techniques using

inputs that are not based on observable market data.

The fair values of quoted investments are based on bid prices in

an active market at the reporting date. All unquoted investments

have been classified as Level 3 within the fair value hierarchy,

their respective valuations having been calculated using a number

of valuation techniques and assumptions, notwithstanding that the

basis of the valuation methodology used most commonly by the Group

is 'price of most recent investment'. The use of reasonably

possible alternative assumptions has a material effect on the fair

valuation of PhaseFocus Holdings Limited in the period, as

PhaseFocus Holdings Limited has been valued based a recent offer

price which was made to the company for shares. This was in excess

of the last round share price and so this offer price has been used

as the basis for valuation. The impact on the fair value of

investments if the discount rate and provision shift by 1% is

GBP51,277 (2021: GBP44,250).

5 Share capital

30 Sept 30 Sept 31 Mar 2022

2022 2021

(unaudited) (unaudited) (audited)

Authorised GBP GBP GBP

68,674,431 ordinary shares of 2 pence

each

(30 September 2021: 53,630,431,

31 March 2022: 72,240,340) 1,373,489 1,072,609 1,444,807

--------------------------------------- ------------ ------------ ------------

Allotted, called up and fully paid

63,723,489 ordinary shares of 2 pence

each

(30 September 2021: 52,240,340,

31 March 2022: 52,240,340) 1,274,469 1,044,807 1,044,807

--------------------------------------- ------------ ------------ ------------

On 12 April 2022, the Company raised GBP215,113 (before expenses

of GBP14,735) through a placing of 1,434,091 new ordinary shares of

2 pence each in the Company at a price of 15 pence per share. On 27

September 2022, the Company raised an additional GBP750,000 (before

expenses of GBP20,015) through a placing of 7,317,073 new ordinary

shares of 2 pence each in the Company at a price of 10.25 pence per

share.

The Company has one class of ordinary shares. All shares carry

equal voting rights, equal rights to income and distribution of

assets on liquidation or otherwise, and no right to fixed

income.

6 Availability of Interim Results

Shareholder communications

A copy of this report is available on request from the Company's

registered office: 1 George Square, Glasgow, G2 1AL. A copy has

also been posted on the Company's website:

www.braveheartinvestmentgroup.co.uk.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR DBBDGDGDDGDR

(END) Dow Jones Newswires

October 28, 2022 02:00 ET (06:00 GMT)

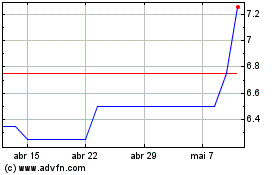

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024