TIDMMILA

RNS Number : 5733E

Mila Resources PLC

31 October 2022

Mila Resources Plc / Index: LSE / Epic: MILA / Sector: Natural

Resources

31 October 2022

Mila Resources Plc

('Mila' or the 'Company')

Final Results

Mila Resources Plc (LSE:MILA), the post-discovery gold

exploration accelerator, is pleased to present its final results

for the year ended 30 June 2022.

Highlights

-- Acquisition of a 30% interest in the Kathleen Valley Project,

a proven gold asset located in a Tier One region in Western

Australia

-- Advancing a 13,500m drill campaign to deliver an enhanced resource.

-- Focussed on the Coffey Deposit, one of three known deposits,

with drilling delivering exceptional results including 6.6m @ 14.86

g/t Au and 21.79 g/t Ag from 209.40m

-- Results to-date give strong indication of an extensive

mineralised system with consistent commercial grades and widths

-- Strong investor support: November 2021 raised GBP3.5m via

capital raise (net of costs) and post-period end in October 2022

raised GBP696k via capital raise (net of costs).

-- The Company made a loss for the financial year ended 30 June

2022 of GBP1,011,445 (2021: GBP382,387). This loss includes a

non-cash accounting charge of GBP493,232 relating to the issuance

of Warrants and Options as part of the capital raise in November

2021 and as per the prospectus issued in October 2021.

Statement from the Board

Dear Shareholder

We have pleasure in presenting the financial statements for the

year ended 30 June 2022. Mila has been off to a flying start since

our readmission to trading in November 2021, following the

acquisition of an initial 30% interest in the Kathleen Valley Gold

Project in Western Australia. For further details on the

acquisition please see the sub-section titled "Acquisition of an

initial 30% interest in the Kathleen Valley Project" within the

Directors Report on page 15 of the annual report.

We wasted no time in getting on the ground and began a 13,500m

drill campaign within a fortnight of completing the transaction.

This commitment to rapidly turning initial discoveries into major

new resources is at the core of our investment philosophy, and we

are delighted with the exploration successes we have reported so

far during our development.

The first hurdle to success is of course identifying the right

asset. The Kathleen Valley Project came to our attention in 2020,

shortly after ASX-listed Bellevue Gold made a discovery at its

Government Well prospect, which is on the western boundary of the

Kathleen Valley licence area. Further evidencing the prospectivity

of the area, Kathleen Valley is located in a Tier One region with

proven production, including BHP's Mount Keith nickel mine (20km to

the north), and Kathleen Valley Gold (to the north), which in 2015

extracted 65,900 oz gold over an 18-month period. Kathleen Valley

certainly has the right geological postcode and the previous

operator had undertaken limited drilling at one of the three known

targets which resulted in a maiden JORC Inferred gold resource of

21,000oz @ 2.1g/t Au.

Given the calibre of the geological setting and the initial

success from a fairly modest drill campaign, the Mila team were

confident that Kathleen Valley had the potential to reveal a much

larger resource.

The first phase of drilling commenced in December 2021, with

first assays being returned later that month. Drilling has

continued intermittently since December, and indeed, the newest

phase of drilling commenced again in early September 2022. This

very comprehensive and targeted drilling has returned some

exceptional results and grades, but perhaps most importantly for

investors, has provided substantial evidence of consistent

commercial grades and widths at Kathleen Valley.

Drilling has also revealed quartz-sulphide veining, referred to

now as "Bellevue Style" mineralisation, which is significant. The

presence of the sulphides, particularly pyrrhotite, provides a

strong geophysical response and therefore responds very well to

Down Hole Electro-magnetic surveys ("DHEM"). DHEM has worked

extremely well at Bellevue, greatly assisting with their discovery

success rate. Mila will use the same DHEM geophysical methods to

test for extensions and accumulations of the sulphide

mineralisation. The drill holes have been polyvinyl chloride

("PVC") cased in preparation for the DHEM surveying, which will

highlight sulphide rich zones to further assist in targeting and

locating the mineralisation at depth.

Drilling to date has focussed on the Coffey Deposit, one of

three identified prospects in Kathleen Valley. Coffey is the most

advanced target so far and has returned some very significant

intersections to date including 6.6m @ 14.86 g/t Au and 21.79 g/t

Ag from 209.40m, 5m @ 4.26 g/t Au & 13.35 g/t Ag from 198m, 1m

@ 13.45 g/t Au & 37.70 g/t Ag from 202m, and 10m @ 8.38 g/t Au

& 13.96 g/t Ag, from 165m, 11.28 g/t Au & 33.48 g/t Ag from

173m.

Results from the Stage 1 drilling surpassed internal

expectations and importantly, demonstrated that the mineralisation

at Coffey has improved in grade and continuity down dip of the

original pre-Mila resource zone, confirming commercial grades over

mineable widths. Our drilling has substantially extended

mineralisation, which is now defined over a zone 200m long and 220m

down dip, with the higher grades and multiple lodes having the

potential to add significant grade, tonnage and higher-grade ounces

to the Coffey Deposit once we complete a new resource estimate at

the end of the Stage 2 & 3 drilling campaigns. Notably, the

potential silver credits provide Mila with additional optionality

over processing routes given the economic advantage of silver as a

co-product.

The next hole in the programme was stepped out 100m below the

previous hole, KVDD0035, and has the potential to extend the

mineralised zone to 300m in length down dip and to 300m below

surface, presenting a significant expansion in the footprint and

tonnage of the Coffey Deposit. This drilling is on-going, and we

will report more intersections to the market as they become

available.

As referred to above, Coffey is only one of three known

identified prospects at Kathleen Valley, and drilling at two new

major targets is expected when the Company is ready to take a break

from drilling at Coffey and once the Heritage Surveys over these

prospects are completed. The Sturrock Prospect is located 3.5km to

the NNW of Coffey, on a sheared contact between mafic and

ultramafic rocks which hosts the historical Main Road Au Pit, 2km

along strike to the NE. Auger soil sampling completed in 2019

highlighted a 700m x 250m zone of anomalous gold in soils and

shallow historical aircore drilling returned zones of highly

anomalous gold grades of between 0.1-1.1g/t Au. 12 Reverse

Circulation ("RC") holes totalling 2,400m with

downhole-electromagnetic surveying of the deeper holes are planned

to test the anomaly to depth in an optimal direction to the

shears.

The Powell Prospect is located 3.1km NNE of Coffey and 2km ESE

of Sturrock in the northeast portion of the tenement. The auger

soil sampling highlighted a 500m x 500m "X" shaped zone of

anomalous gold in soils where it appears that two shear zones

intersect. Field work located an historical shallow shaft and pit

which has been dug in the area and further investigative work is

required prior to drill testing.

Outlook

I am extremely optimistic about our ability to demonstrate

Kathleen Valley's commercial value to the market as we look to

materially expand our JORC Resource inventory over the coming

months. With the injection of GBP696,000 new capital (before

expenses) post period end, Mila is well positioned to move forward

with confidence in its objective to rapidly transition gold

discoveries into significant resources, with Kathleen Valley as our

first success story. Further funding will be needed to ensure that

the exploration and evaluation activities can continue, and the

project continues towards reaching its ultimate potential.

I would like to take this opportunity to thank our exploration

and technical team on the ground at Kathleen Valley, together with

the wider Mila team, and of course I would like to extend my

sincere thanks to our shareholders - both new and old - for their

continued support and vision.

Fund Raise - post year end

Post year end, on 6 October 2022, the Company announced that it

had raised GBP696,000 (before expenses) through a Placing of

23,199,984 New Ordinary Shares of GBP0.01 each ("Placing Shares")

at a price of 3 pence per Placing Share (the "Placing"). Investors

in the Placing will also receive one warrant per Placing Share to

subscribe for one new ordinary share at a cost of 4.8p per share

("Investor Warrants"). The Company has also issued 524,000 broker

warrants that are exercisable at 3p for a period of 3 years

("Broker Warrants").

The Investor Warrants and Broker Warrants are conditional on the

publication of a Prospectus by the Company, which it anticipates

filing as soon as practicable, and shareholder approval to increase

the Company's share authorities.

Mark Stephenson

Executive Director

28 October 2022

Statement of Comprehensive Income

For the year ended 30 June 2022

Year ended Year ended

30 June 30 June

Notes 2022 2021

GBP GBP

Administrative expenses 5 (518,213) (421,440)

Share warrant and options expense 16 (493,232) -

Operating loss (1,011,445) (421,440)

Other income 4 - 37,500

Interest receivable 8 - 1,553

------------ -----------

Loss on ordinary activities before

taxation 5 (1,011,445) (382,387)

Income tax expense 9 - -

------------ -----------

Loss and total comprehensive income

for the period attributable to the

owners of the company (1,011,445) (382,387)

============ ===========

Earnings per share (basic and diluted)

attributable to the equity holders

(pence) 10 (0.52) (1.65)

Statement of Financial Position

For the year ended 30 June 2022

Year ended Year ended

30 June 30 June

Notes 2022 2021

GBP GBP

NON-CURRENT ASSETS

Exploration and evaluation assets 11 4,698,625 -

------------ ------------

4,698,625 -

------------ ------------

CURRENT ASSETS

Trade and other receivables 12 22,568 24,185

Cash and cash equivalents 13 1,096,084 329,628

1,118,652 353,813

------------ ------------

TOTAL ASSETS 5,817,277 353,813

------------ ------------

CURRENT LIABILITIES

Trade and other payables 14 210,760 178,309

Convertible Loan Notes - 348,692

------------ ------------

TOTAL LIABILITIES 210,760 527,001

------------ ------------

NET ASSETS 5,606,517 (173,188)

============ ============

EQUITY

Share capital 15 3,065,511 232,000

Share premium 15 4,267,846 849,300

Share based payment reserve 16 543,813 4,720

Retained loss (2,270,653) (1,259,208)

TOTAL EQUITY 5,606,517 (173,188)

============ ============

Statement of Cashflows

For the year ended 30 June 2022

12 months 12 months

to 30 June to 30 June

2022 2021

GBP GBP

Cash flows from operating activities

Loss for the period (1,011,445) (382,387)

Adjustments for:

Warrants / Options expense (non-cash) 493,232 -

Operating cashflow before working capital

movements (518,213) (382,387)

Decrease / (Increase) in trade and other

receivables 1,616 (480)

Increase in trade and other payables 4,427 91,638

Shares issued for services 30,000 -

Interest income - (1,553)

Interest expense 3,801 8,692

Net cash flow from operating activities (478,369) (284,090)

------------ ------------

Cash flow from investing activities

Acquisition of Kathleen Valley - cash (300,000)

component -

Acquisition costs (336,732) -

Funds used for drilling and exploration (1,408,108) -

Repayment of loan from E-Tech - 85,849

Interest Income received - 1,553

Net cash (outflow) / inflow from investing

activities (2,044,840) 87,402

------------ ------------

Cash flow from financing activities

Proceeds from share issues 3,358,740 -

Issue costs paid in cash (69,075) -

Convertible Loan Notes - 340,000

Net cash inflow from financing activities 3,289,665 340,000

------------ ------------

Net Increase in cash and cash equivalents 766,456 143,312

Cash and cash equivalents at beginning

of the period 329,628 186,316

Cash and cash equivalents at end of the

period 1,096,084 329,628

------------ ------------

Statement of Changes in Equity

For the year ended 30 June 2022

Share Share Share Retained Total

Capital Premium Based Payment Loss

Reserve

GBP GBP GBP GBP GBP

Balance at 1 July

2020 232,000 849,300 4,720 (876,821) 209,199

---------- ---------- --------------- ------------ ------------

Total comprehensive

income for the year - - - (382,387) (382,387)

---------- ---------- --------------- ------------ ------------

Balance at 30 June

2021 232,000 849,300 4,720 (1,259,208) (173,188)

---------- ---------- --------------- ------------ ------------

Total comprehensive

income for the year - - - (1,011,445) (1,011,445)

Capital Raising -

Issue of shares 1,458,333 2,041,667 - - 3,500,000

Capital Raising -

Issue of shares in

lieu of fees 59,792 83,708 - - 143,500

Capital Raising -

Issue Costs - (221,135) - - (221,135)

Acquisition of Kathleen

Valley 835,432 1,169,605 - - 2,005,037

Conversion of convertible

loan notes 477,754 382,203 - - 859,957

Conversion of warrants 2,200 8,360 - - 10,560

Share warrants and

options expense - (45,861) 539,093 - 493,232

---------- ---------- --------------- ------------ ------------

Balance at 30 June

2022 3,065,511 4,267,846 543,813 (2,270,653) 5,606,517

---------- ---------- --------------- ------------ ------------

Notes to the Financial Statements

For the year ended 30 June 2022

1 GENERAL INFORMATION

Mila Resources Plc (the "Company") was listed on the London

Stock Exchange in 2016 with a view to acquiring projects in the

natural resources sector that have a significant innate value that

could be unlocked without excessive capital. In November 2021, the

Company acquired an interest in a gold exploration project in

Western Australia.

The Company is domiciled in the United Kingdom and incorporated

and registered in England and Wales, with registration number

09620350.

2 ACCOUNTING POLICIES

2.1 Basis of preparation

The financial statements have been prepared on a going concern

basis using the historical cost convention and in accordance with

the UK-Adopted International Accounting Standards, and in

accordance with the provisions of the Companies Act 2006.

The Company's financial statements for the year ended 30 June

2022 were authorised for issue by the Board of Directors on 28

October 2022 and were signed on the Board's behalf by Mr L

Daniels.

The Company's financial statements are presented in pounds

Sterling and presented to the nearest pound.

2.2 Business Combinations

Acquisitions of business are accounted for using the acquisition

method. At the acquisition date, the identifiable assets acquired,

and the liabilities assumed are recognised at their fair value.

Consideration is also measured at fair value at the acquisition

date. This is calculated as the sum of the fair values of assets

transferred less the fair value of the liabilities incurred by the

Company.

Goodwill is measured as the excess of the sum of the

consideration transferred, the amount of any non -- controlling

interests in the acquiree, and the fair value of the acquirers

previously held equity interest in the acquiree (if any) over the

net of the acquisition -- date amounts of the identifiable assets

acquired, and the liabilities assumed. If, after reassessment, the

net of the acquisition -- date amounts of the identifiable assets

acquired and liabilities assumed exceeds the sum of the

consideration transferred, the amount of any non -- controlling

interests in the acquiree and the fair value of the acquirers

previously held interest in the acquiree (if any), the excess is

recognised immediately in profit or loss as a bargain purchase

gain.

Acquisition -- related costs are recognised in profit or loss as

incurred.

2.3 Going concern

The Financial Statements have been prepared under the going

concern assumption, which presumes that the Company will be able to

meet its obligations as they fall due for at least the next 12

months from the date of the signing of the Financial

Statements.

The Company had a net cash inflow for the year of

GBP766,456(2021: GBP143,312) and at 30 June 2022 had cash and cash

equivalents balance of GBP1,096,084 (2021: GBP329,628).

An operating loss of GBP1,011,445 has been made and although the

Company was in a net current asset position of GBP907,892 at 30

June 2022 and has raised GBP696,000 (before expenses) post

year-end, the directors are aware the Company's ability to fund its

forecasted expenditure and thus remain a going concern for at least

12 months from the approval of these financial statements is

dependent on the raising of further equity and/or debt finance.

Whilst the directors acknowledge this is uncertain, they have a

reasonable expectation that necessary funds will be raised as

required over this period.

The Directors have made enquires and assessed the potential

impact of the COVID-19 virus on the Company. As such, whilst they

acknowledge that COVID-19 could continue to have long lasting and

significant impacts on the global economy, the Directors believe

that the Company has sufficient finance to meet their obligations

as they fall due for a period of at least 12 months from the date

of approval of the financial statements.

2.4 Standards, amendments and interpretations to existing

standards that are not yet effective and have not been early

adopted by the Company

New standards, amendments to standards and interpretations:

No new standards, amendments or interpretations, effective for

the first time for the financial year beginning on or after 1

January 2021 have had a material impact on the Company.

Standards issued but not yet effective:

At the date of authorisation of these financial statements, the

following standards and interpretations relevant to the Company and

which have not been applied in these financial statements, were in

issue but were not yet effective.

Standard Impact on initial application Effective date

--------------------- ----------------------------------- ----------------

IAS 1 Amendments - presentation TBC

and classification of liabilities

as current or non current

IFRS 3 (amendments) Business combinations 01 January 2022

IAS 37 (amendments) Onerous contracts 01 January 2022

IAS 16 (amendments) Proceeds before intended 01 January 2022

use

IAS 8 Amendments - Definition e 01 January 2023

of accounting policies

IAS 1 Amendments - Disclosure of 01 January 2023

accounting policies

IFRS 17 Insurance Contracts 01 January 2023

IFRS 17 (amendments) Insurance contracts 01 January 2023

The directors do not consider that these standards will impact

the financial statements of the Company.

2.5 Business Combinations

Acquisitions of business are accounted for using the acquisition

method.

At the acquisition date, the identifiable assets acquired, and

the liabilities assumed are recognised at their fair value.

Consideration is also measured at fair value at the acquisition

date. This is calculated as the sum of the fair values of assets

transferred less the fair value of the liabilities incurred by the

Company.

Goodwill is measured as the excess of the sum of the

consideration transferred, the amount of any non -- controlling

interests in the acquiree, and the fair value of the acquirers

previously held equity interest in the acquiree (if any) over the

net of the acquisition -- date amounts of the identifiable assets

acquired, and the liabilities assumed. If, after reassessment, the

net of the acquisition -- date amounts of the identifiable assets

acquired and liabilities assumed exceeds the sum of the

consideration transferred, the amount of any non -- controlling

interests in the acquiree and the fair value of the acquirers

previously held interest in the acquiree (if any), the excess is

recognised immediately in profit or loss as a bargain purchase

gain.

Acquisition -- related costs are recognised in profit or loss as

incurred.

2.6 Asset acquisition

Where an acquisition transaction constitutes the acquisition of

an asset and not a business, the consideration paid is allocated to

assets and liabilities acquired based on their relative fair

values, with transaction costs capitalised. No gain or loss is

recognised.

Consideration paid in the form of equity instruments is measured

by reference to the fair value of the asset acquired. The fair

value of the assets acquired would be measured at the point control

is obtained.

The Group recognises the fair value of contingent consideration

in respect to an asset acquisition, where it is probable that a

liability has been incurred, and the amount of that liability can

be reasonably estimated. Such contingent consideration is

recognized at the time control of the underlying asset is obtained,

and such an amount is included in the initial measurement of the

cost of the acquired assets.

The Group recognises contingent consideration in the form of

cash, and contingent consideration in the form of equity

instruments. Contingent consideration in the form of cash is

recognised as a liability, and contingent consideration in the form

of equity instruments is recognised in the contingent share

reserve.

For contingent cash consideration milestones, the Group

estimates a probability for the likelihood of completion to

estimate the total liability for the expected variable payments.

The probability estimated for the likelihood of completion is

considered at each reporting period. Movements in the fair value of

contingent cash consideration payable is capitalised as part of the

asset.

For contingent share consideration milestones, the Group

estimates a probability for the likelihood of completion to

estimate the total contingent share consideration payable. The

probability estimated for the likelihood of completion is not

reassessed in subsequent reporting periods.

Deferred tax is not recognised upon an asset acquisition.

2.7 Foreign currency translation

The financial information is presented in Sterling which is the

Company's functional and presentational currency.

Transactions in currencies other than the functional currency

are recognised at the rates of exchange on the dates of the

transactions. At each balance sheet date, monetary assets and

liabilities are retranslated at the rates prevailing at the balance

sheet date with differences recognised in the Statement of

comprehensive income in the period in which they arise.

2.8 Financial instruments

Initial recognition

A financial asset or financial liability is recognised in the

statement of financial position of the Company when it arises or

when the Company becomes part of the contractual terms of the

financial instrument.

Classification

Financial assets at amortised cost

The Company measures financial assets at amortised cost if both

of the following conditions are met:

(1) the asset is held within a business model whose objective is

to collect contractual cash flows; and

(2) the contractual terms of the financial asset generating cash

flows at specified dates only pertain to capital and interest

payments on the balance of the initial capital.

Financial assets which are measured at amortised cost, are

measured using the Effective Interest Rate Method (EIR) and are

subject to impairment. Gains and losses are recognised in profit or

loss when the asset is de-recognised, modified or impaired.

Financial liabilities at amortised cost

Financial liabilities measured at amortised cost using the

effective interest rate method include current borrowings and trade

and other payables that are short term in nature. Financial

liabilities are derecognised if the Company's obligations specified

in the contract expire or are discharged or cancelled.

Amortised cost is calculated by taking into account any discount

or premium on acquisition and fees or costs that are an integral

part of the effective interest rate ("EIR"). The EIR amortisation

is included as finance costs in profit or loss. Trade payables

other payables are non-interest bearing and are stated at amortised

cost using the effective interest method.

Derecognition

A financial asset is de-recognised when:

(1) the rights to receive cash flows from the asset have expired, or

(2) the Company has transferred its rights to receive cash flows

from the asset or has undertaken the commitment to fully pay the

cash flows received without significant delay to a third party

under an arrangement and has either (a) transferred substantially

all the risks and the assets of the asset or (b has neither

transferred nor held substantially all the risks and estimates of

the asset but has transferred the control of the asset.

Impairment

The Company recognises a provision for impairment for expected

credit losses regarding all financial assets. Expected credit

losses are based on the balance between all the payable contractual

cash flows and all discounted cash flows that the Company expects

to receive. Regarding trade receivables, the Company applies the

IFRS 9 simplified approach in order to calculate expected credit

losses. Therefore, at every reporting date, provision for losses

regarding a financial instrument is measured at an amount equal to

the expected credit losses over its lifetime without monitoring

changes in credit risk. To measure expected credit losses, trade

receivables and contract assets have been grouped based on shared

risk characteristics.

Trade and other receivables

Trade and other receivables are initially recognised at fair

value when related amounts are invoiced then carried at this amount

less any allowances for doubtful debts or provision made for

impairment of these receivables.

Cash and cash equivalents

Cash and cash equivalents comprise cash at bank and in hand and

are subject to an insignificant risk of changes in value.

Trade payables

These financial liabilities are all non-interest bearing and are

initially recognised at the fair value of the consideration

payable.

2.9 Equity

Share capital is determined using the nominal value of shares

that have been issued.

The Share premium account includes any premiums received on the

initial issuing of the share capital. Any transaction costs

associated with the issuing of shares are deducted from the Share

premium account, net of any related income tax benefits.

Equity-settled share-based payments are credited to a

share-based payment reserve as a component of equity until related

options or warrants are exercised or lapse.

Retained losses includes all current and prior period results as

disclosed in the statement of comprehensive income.

2.10 Share-based payments

The Company records charges for share-based payments.

For warrant-based or option-based share-based payments, to

determine the value of the warrants or options, management estimate

certain factors used in the Black Scholes Pricing Model, including

volatility, vesting date exercise date of the warrants or option

and the number likely to vest. At each reporting date during the

vesting period management estimate the number of shares that will

vest after considering the vesting criteria. If these estimates

vary from actual occurrence, this will impact on the value of the

equity carried in reserves.

2.11 Taxation

Tax currently payable is based on taxable profit for the period.

Taxable profit differs from profit as reported in the income

statement because it excludes items of income and expense that are

taxable or deductible in other years and it further excludes items

that are never taxable or deductible. The Company's liability for

current tax is calculated using tax rates that have been enacted or

substantively enacted by the balance sheet date.

Deferred tax is recognised on differences between the carrying

amounts of assets and liabilities in the financial statements and

the corresponding tax bases used in the computation of taxable

profit and is accounted for using the balance sheet liability

method. Deferred tax liabilities are generally recognised for all

taxable temporary differences and deferred tax assets are

recognised to the extent that it is probable that taxable profits

will be available against which deductible temporary differences

can be utilised. Such assets and liabilities are not recognised if

the temporary difference arises from initial recognition of

goodwill or from the initial recognition (other than in a business

combination) of other assets and liabilities in a transaction that

affects neither the taxable profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary

differences arising on investments in subsidiaries and associates,

and interests in joint ventures, except where the Company is able

to control the reversal of the temporary difference and it is

probable that the temporary difference will not reverse in the

foreseeable future.

The carrying amount of deferred tax assets is reviewed at each

balance sheet date and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow

all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to

apply in the period when the liability is settled, or the asset

realised. Deferred tax is charged or credited to profit or loss,

except when it relates to items charged or credited directly to

equity, in which case the deferred tax is also dealt with in

equity.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off current tax assets against

current tax liabilities and when they relate to income taxes levied

by the same taxation authority and the Company intends to settle

its current tax assets and liabilities on a net basis.

2.9 Intangible assets - Exploration and evaluation expenditures (E&E) Development expenditure

The Company applies the successful efforts method of accounting,

having regard to the requirements of IFRS 6 'Exploration for and

Evaluation of Mineral Resources'. Costs incurred prior to obtaining

the legal rights to explore an area are expensed immediately to the

Statement of Comprehensive Income.

Expenditure incurred on the acquisition of a licence interest is

initially capitalised within intangible assets on a

licence-by-licence basis. Costs are held, unamortised, until such

time as the exploration phase of the field area is complete or

commercial reserves have been discovered. The cost of the licence

is subsequently transferred into property, plant and equipment and

depreciated over its estimated useful economic life.

Exploration expenditure incurred in the process of determining

exploration targets is capitalised initially within intangible

assets as drilling costs. Drilling costs are initially capitalised

on a licence-by-licence basis until the success or otherwise has

been established. Drilling costs are written off unless the results

indicate that reserves exist and there is a reasonable prospect

that these reserves are commercially viable. Drilling costs are

subsequently transferred into 'Drilling expenditure' within

property, plant and equipment and depreciated over their estimated

useful economic life.

2.10 Impairment of Exploration and Evaluation assets

The Company assesses at each reporting date whether there is an

indication that an asset may be impaired. This includes

consideration of the IFRS 6 impairment indicators for any

intangible exploration and evaluation expenditure capitalised as

intangible assets. Examples of indicators of impairment include

whether:

(a) the period for which the entity has the right to explore in

the specific area has expired during the period or will expire in

the near future and is not expected to be renewed.

(b) substantive expenditure on further exploration for and

evaluation of mineral resources in the specific area is neither

budgeted nor planned.

(c) exploration for and evaluation of mineral resources in the

specific area have not led to the discovery of commercially viable

quantities of mineral resources and the entity has decided to

discontinue such activities in the specific area.

(d) sufficient data exist to indicate that, although a

development in the specific area is likely to proceed, the carrying

amount of the exploration and evaluation asset is unlikely to be

recovered in full from successful development or by sale.

If any such indication exists, or when annual impairment testing

for an asset is required, the Group makes an estimate of the

asset's recoverable amount, which is the higher of its fair value

less costs to sell and its value in use. Any impairment identified

is recorded in the statement of comprehensive income.

2.11 Critical accounting judgements and key sources of uncertainty

In the process of applying the entity's accounting policies,

management makes estimates and assumptions that have an effect on

the amounts recognised in the financial information. Although these

estimates are based on management's best knowledge of current

events and actions, actual results may ultimately differ from those

estimates.

The areas involving a higher degree of judgement or complexity,

or areas where assumptions and estimates are significant to the

financial statements are as follows:

Impairment of intangible assets

The first stage of the impairment process is the identification

of an indication of impairment. Such indications can include

significant geological or geophysical information which may

negatively impact the existing assessment of a project's potential

for recoverability, significant reductions in estimates of

resources, significant falls in commodity prices, a significant

revision of the Company Strategy, operational issues which may

require significant capital expenditure, political or regulatory

impacts and others. This list is not exhaustive and management

judgement is required to decide if an indicator of impairment

exists. The Company regularly assesses the non-tangible assets for

indicators of impairment. When an impairment indicator exists an

impairment test is performed; the recoverable amount of the asset,

being the higher of the asset's fair value less costs to sell and

value in use, is compared to the asset's carrying value. Any excess

of the asset's carrying value over its recoverable amount is

expensed to the income statement.

Share-based payments

When issuing warrant, options or other share based payment

instruments that fall under the scope of IFRS 2, management are

required to determine the value of the warrants or options. To

calculate a fair value for such instrument, Management use the

black scholes valuation model and must therefore estimate certain

factors used in the option pricing model, including volatility,

expected life of the option and the risk free rate. At each

reporting date during the vesting period management estimate the

number of shares that will vest after considering the vesting

criteria. If these estimates vary from actual occurrence, this will

impact on the value of the equity carried in the reserves. For

further detail see note 16, in the notes to the financial

statements.

2.12 Earnings per share

Basic earnings per share is calculated as profit or loss

attributable to equity holders of the Company for the period,

adjusted to exclude any costs of servicing equity (other than

dividends), divided by the weighted average number of ordinary

shares, adjusted for any bonus element. The diluted profit per

share has been is the same as the basic profit per share for 2022

because, although certain warrants and options in issue were in the

money as at the year end, the Company reported a loss, hence

including the additional dilution would have resulted in a

reduction of the loss per share.

2.13 Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating

decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board as a whole.

All operations and information are reviewed together therefore

at present there is only one reportable operating segment.

3. SEGMENT REPORTING

The Companies strategy is to act as a post discovery

accelerator, where the Company identifies target(s) that have

already had an early-stage geological discovery. To date the

Company has identified and invested on one target, namely the

Kathleen Valley Project. Hence at the moment there is only one

reportable operating segment. In the prior year the sole operating

segment was that of searching for a potential acquisition

target.

4. OTHER INCOME

For the year ending 30 June 2022 this was GBPnil (2021:

GBP37,500).

5. OPERATING LOSS

This is stated after charging:

2022 2021

GBP GBP

Auditor's remuneration

Audit of the Company 30,000 16,500

Other services 2,000 -

Directors' remuneration 266,585 80,356

Stock exchange and regulatory

expenses 47,486 55,597

Share warrant and options expense 493,232 -

(1)

Other expenses 172,142 268,987

---------- --------

Operating expenses 1,011,445 421,440

---------- --------

(1) This is a non-cash accounting expense for the issue of share

warrants and options.

6. AUDITOR'S REUMERATION

2022 2021

GBP GBP

Fees payable to the Company's

current auditor:

* audit of the Company's financial statements

30,000 16,500

* other services 2,000 -

-------- -------

7. DIRECTORS AND STAFF COSTS

During the year the only staff of the Company were the Directors

and as such key management personnel. Management remuneration,

other benefits supplied and social security costs to the Directors

during the year was as follows below. For Directors costs see the

Directors remuneration report on page 27 of the annual report.

2022 2021

GBP GBP

Salaries 266,585 80,356

Social security costs 29,016 2,901

Share based payments 59,658 -

-------- -------

355,259 83,257

-------- -------

8. INTEREST RECEIVABLE

2022 2021

GBP GBP

Interest due on Loans - 1,553

------- ------

9. TAXATION

2022 2021

GBP GBP

The charge / credit for the year

is made up as follows:

Current tax - -

Deferred tax - -

Taxation charge / credit for the - -

year

------------- ----------

A reconciliation of the tax charge / credit appearing in the

income statement to the tax that would result from applying the

standard rate of tax to the results for the year is:

Loss per accounts (1,011,445) (382,387)

------------- ----------

Tax credit at the standard rate

of corporation tax in the UK of

19% (2021: 19%) (192,175) (72,654)

Impact of costs disallowed for 17,919 -

tax purposes

Deferred tax in respect of temporary - -

differences

Impact of unrelieved tax losses

carried forward 174,256 72,654

- -

------------- ----------

Estimated tax losses of GBP2,116,641 (2021: GBP1,199,505) are

available for relief against future profits and a deferred tax

asset of GBP402,162 (2021: GBP227,906) has not been provided for in

the accounts due to the uncertainty of future profits.

Factors affecting the future tax charge

The standard rate of corporation tax in the UK is 19%.

Accordingly, the Company's effective tax rate for the period was

19% (2021: 19%). As announced post the unsuccessful Mini-budget in

September 2022, the rate of corporation tax will increase to 25%

from April 2023.

Deferred taxation

No deferred tax asset has been recognised by the Company due to

the uncertainty of generating sufficient future profits and tax

liability against which to offset the tax losses. Note 9 above sets

out the estimated tax losses carried forward.

10. EARNINGS PER SHARE

The calculation of the earnings per share is based on the loss

for the financial period after taxation of GBP1,011,445 (2021: loss

GBP382,387) and on the weighted average of 193,873,021 (2021:

23,200,000) ordinary shares in issue during the period.

The diluted profit per share is the same as the basic profit per

share because, although certain warrants and options in issue were

in the money as at 30 June 2022, the Company reported a loss, hence

including the additional dilution would have resulted in a

reduction of the loss per share.

Earnings Weighted average Per-share

GBP number of shares amount

unit pence

30 June 2022: Loss per

share attributed to ordinary

shareholders (1,011,445) 193,873,021 (0.52)

30 June 2021: Loss per

share attributed to ordinary

shareholders (382,387) 23,200,000 (1.65)

11. EXPLORATION AND EVALUATION ASSETS

At 30 At 30

June 2022 June 2021

GBP GBP

Opening balance - -

Cost of acquisition including

transaction costs 3,290,517 -

Exploration costs capitalised

in the year 1,408,108 -

----------- -----------

Net book value 4,698,625 -

=========== ===========

In November 2021, the Company acquired a 30% interest in the

Kathleen Valley (Gold) Project for GBP2,812,500. The consideration

was GBP300,000 in cash and the balance in new Mila shares.

Transaction costs of GBP478,017 have also been capitalised. The

principal assets are leases with rights to exploration of those

leases in Western Australia. At the period end the capitalised

exploration and evaluation assets totalled GBP4.7m (2021: GBPnil).

All Exploration costs capitalised in the year relate to the

Kathleen Valley Project.

Exploration and evaluation assets are regularly reviewed for

indicators of impairment. If an indicator of impairment is found an

impairment test is required, where the carrying value of the asset

is compared with its recoverable amount. The recoverable amount is

the higher of the assets fair value less costs to sell and value in

use. The Directors are satisfied that no impairments are required

for the current year.

12. TRADE AND OTHER RECEIVABLES

2022 2021

GBP GBP

Prepayments and other receivables 22,568 24,185

22,568 24,185

------- -------

The Directors consider that the carrying value amount of trade

and other receivables approximates to their fair value.

13. CASH AND CASH EQUIVALENTS

2022 2021

GBP GBP

Cash at bank 1,096,084 329,628

1,096,084 329,628

---------- --------

Cash at bank comprises balances held by the Company in current

bank accounts. The carrying value of these approximates to their

fair value.

14. TRADE AND OTHER PAYABLES

2022 2021

GBP GBP

Trade payables 36,722 43,038

Accruals and other payables 174,038 135,272

210,760 178,309

-------- --------

15. SHARE CAPITAL / SHARE PREMIUM

Number Share Share

of shares capital premium Total

on issue GBP GBP GBP

Balance as at 1 July 2020 23,200,000 232,000 849,300 1,081,300

Balance as at 30 June 2021 23,200,000 232,000 849,300 1,081,300

Capital Raising 151,812,495 1,518,125 1,904,240 3,422,365

Acquisition of Kathleen Valley 83,543,197 835,432 1,169,605 2,005,037

Conversion of convertible

loan notes 47,775,365 477,754 382,203 859,957

Conversion of warrants 220,000 2,200 8,360 10,560

Warrants issued in lieu of

share issue costs - - (45,861) (45,861)

------------ ---------- ---------- ----------

Balance as at 30 June 2022 306,551,057 3,065,511 4,267,846 7,333,357

------------ ---------- ---------- ----------

The Company issued a total of 283,351,057 new fully paid

ordinary shares during the year.

In November 2021, the Company completed a placing of 145,833,329

new fully paid ordinary shares with a nominal value of GBP0.01,

raising gross proceeds of GBP3.5m before expenses. 5,979,166

ordinary shares were issued directors and certain advisors as set

out in the Prospectus dated 29 October 2021.

In November 2021, the Company acquired an initial 30% interest

in the Kathleen Valley Gold Project in Western Australia. As part

of the purchase consideration the Company issued 83,543,197

ordinary shares.

In November 2021, the Company converted the outstanding

convertible loan notes by issuing 47,775,365 ordinary shares in

order to settle the outstanding loan notes.

In May 2022, the received a Warrant conversion request and

subsequently converted 220,000 outstanding warrants to 220,000 new

ordinary shares.

The Directors held the following warrants at the beginning and

end of the year:

Director At 30 Granted during At 30 Exercise Earliest Last date

June 2021 the year (1) June 2022 price date of of exercise

exercise

22 Nov 31 Dec

M. Stephenson - 7,500,000 7,500,000 GBP0.024 2021 2026

22 Nov 31 Dec

L. Daniels - 7,500,000 7,500,000 GBP0.024 2021 2026

22 Nov 31 Dec

N. Hutchison - 5,000,000 5,000,000 GBP0.024 2021 2026

22 Nov 31 Dec

L. Mair - 2,000,000 2,000,000 GBP0.024 2021 2026

--------------- -----------

22,000,000 22,000,000

(1) as outlined in the prospectus dated 29 October

2021("Prospectus").

The Directors held the following EMI Options at the beginning

and end of the year:

Director At 30 Granted during At 30 Exercise Earliest Last date

June 2021 the year June 2022 price date of of exercise

exercise

10 Dec 10 Dec

M. Stephenson - 3,500,000 3,500,000 GBP0.024 2021 2026

10 Dec 10 Dec

L. Daniels - 2,500,000 2,500,000 GBP0.024 2021 2026

--------------- -----------

6,000,000 6,000,000

16. SHARE BASED PAYMENT RESERVE AND SHARE BASED PAYMENTS

SHARE BASED PAYMENT RESERVE

2022 2021

GBP GBP

At 1 July 4,720 4,720

Issue of Warrants per prospectus 479,435 -

Issue of EMI Options per prospectus 59,658 -

-------- ------

At 30 June 543,813 4,720

-------- ------

Warrants and Options Number of Number Weighted

in Issue Options in of Warrants average exercise

Issue in Issue price Expiry date

At 1 July 2020 (1) - 15,825,000 GBP0.048

------------ ------------- ------------------

Expired during the

year - 4,400,000

------------ ------------- ------------------

Balance at 30 June - 11,425,000 GBP0.048 31 Dec 2022

2021 (2)

Warrants issued during

the year - per the

prospectus - 242,264,111 GBP0.0432 31 Dec 2026

EMI options scheme

issued during the year

- per the prospectus 6,000,000 - GBP0.024 10 Dec 2026

Warrants exercised

during the year - (220,000)

------------ ------------- ------------------

At 30 June 2022 6,000,000 253,469,111 GBP0.0429

------------ ------------- ------------------

1. On 4 December 2020 the expiration date of the Series 2

warrants (350,000 warrants) and the IPO Investor warrants

(11,075,000 warrants) was extended to the 31(st) of December 2022.

The 4,400,000 founder warrants expired on 31 December 2020

2. The strike price for all of the remaining warrants at 30 June

2021, namely the Series 2 warrants and the IPO Investor warrants,

was reduced from 10 pence to 4.8 pence.

The market price of the shares at year end was GBP0.032 per

share.

During the year, the minimum and maximum prices were GBP0.026

and GBP0.062 per share respectively.

SHARE BASED PAYMENTS - WARRANTS AND OPTIONS

The Warrants below were issued or amended during the period

Issued Exercisable Expiry Number Exercise Share

from Date outstanding price Based Payment

Charge

Warrants -

12 September From date of 31 December

2016(1) issue 2022 350,000 4.8 pence GBP 60

Warrants -

26 September 31 December

2016(2) 7 October 2016 2022 10,855,000 4.8 pence -

Warrants -

22 November 22 November 31 December

2021 2021 2026 193,608,694 4.8 pence -

Warrants -

22 November 22 November 31 December

2021(3) 2021 2026 48,655,417 2.4 pence GBP 433,514

253,469,111 GBP 433,574

------------- ---------------

1. The warrants were issued conditionally upon the Ordinary

Shares being admitted to trading on the London Stock Exchange's

main market for listed securities which occurred on 7 October 2016.

On 23 November 2021 the strike price for these warrants was reduced

from 10 pence to 4.8 pence. The warrants are fully vested and

expire on the 31(st) of December 2022. The Share Warrant expense

charge to the Statement of Comprehensive income for the year ending

30 June 2022 was GBP60; this was calculated using the Black Scholes

model utilising the inputs listed below:

i. Number of warrants amended 0.35m

ii. Date of Amendment - 23 Nov 2021

iii. Expected Date of Exercise - 31 Dec 2022

iv. Exercise price 4.8 pence

v. Expiry - 31 December 2022

vi. Risk free rate .930%

vii. Volatility 66.24% (Historical Annualised Volatility). As

the entity has been suspended periodically throughout its life we

have selected exploration companies in the similar space to obtain

our annual sample volatility.

viii. Share price at measurement date 2.4 pence. This is the

fair value of shares based on initial re-listing price

ix. Dividend Yield 0%

x. Expected life 1.10 years

2. On 23 November 2021 the strike price for these warrants was

reduced from 10 pence to 4.8 pence.

3. On 23 November 2021, the Company granted 48,655,417 warrants,

on the terms and set out in the Prospectus dated 29 October 2021 to

brokers, certain advisors, and directors. The warrants are fully

vested and expire on the 31(st) of December 2026. The Share Warrant

expense charge to the Statement of Comprehensive income for the

year ending 30 June 2022 was GBP433,514; this was calculated using

the Black Scholes model utilising the inputs listed below:

i. Number of warrants issued 48.6m

ii. Date of Grant - 23 Nov 2021

iii. Expected Date of Exercise - 12 June 2024

iv. Exercise price 2.4 pence

v. Expiry - 31 December 2026

vi. Risk free rate .930%

vii. Volatility 66.24% (Historical Annualised Volatility). As

the entity has been suspended periodically throughout its life we

have selected exploration companies in the similar space to obtain

our annual sample volatility.

viii. Share price at measurement date 2.4 pence. This is the

fair value of shares based on initial re-listing price

ix. Dividend Yield 0%

x. Expected life 2.55 years

The Options below were issued during the period

Issued Exercisable Expiry Date Number Exercise Share Based

from outstanding price Payment

Charge

Options -

10 December 10 December 10 December

2021(4) 2021 2026 6,000,000 2.4 pence GBP 59,658

6,000,000 GBP 59,658

------------- ------------

4. Issued under the Company's EMI Scheme established on the 10th

of December 2021, as set out in the Prospectus dated 29 October

2021. The options are fully vested and expire on the 10(th) of

December 2026. The options expense charge to the Statement of

Comprehensive income for the year ending 30 June 2022 was

GBP59,658; this was calculated using the Black Scholes model

utilising the inputs listed below:

i. Number of options issued 6m

ii. Date of Grant - 9 Dec 2021

iii. Expected Date of Exercise - 9 June 2024

iv. Exercise price 2.4 pence

v. Expiry - 10 December 2026

vi. Risk free rate .810%

vii. Volatility 65.12% (Historical Annualised Volatility). As

the entity has been suspended periodically throughout its life we

have selected exploration companies in the similar space to obtain

our annual sample volatility.

viii. Share price at measurement date 2.45 pence.

ix. Dividend Yield 0%

x. Expected life 2.50 years

17. CAPITAL COMMITMENTS

There were no capital commitments at 30 June 2021 and 30 June

2022.

18. CONTINGENT LIABILITIES

There were no contingent liabilities at 30 June 2021 and 30 June

2022.

19. COMMITMENTS UNDER LEASES

There were no commitments under operating leases at 30 June 2021

and 30 June 2022.

20. FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

The Company's financial instruments comprise primarily cash and

various items such as trade debtors and trade payables which arise

directly from operations. The main purpose of these financial

instruments is to provide working capital for the Company's

operations. The Company does not utilise complex financial

instruments or hedging mechanisms.

Financial assets by category

2022 2021

GBP GBP

Current Assets:

Cash and cash equivalents 1,096,084 329,628

Trade and other receivables 11,520 9,297

---------- --------

Categorised as financial assets at

amortised cost 1,107,604 338,925

---------- --------

Financial liabilities by category

2022 2021

GBP GBP

Current Liabilities:

Trade and other payables 210,760 166,355

Convertible Loan Notes - 348,692

Categorised as financial liabilities

measured at amortised cost 210,760 391,789

-------- --------

All amounts are short term and payable in 0 to 6 months.

Credit risk

The maximum exposure to credit risk at the reporting date by

class of financial asset was:

2022 2021

GBP GBP

Trade and other receivables 11,520 9,297

------- ------

- -

------- ------

Capital management

The Company considers its capital to be equal to the sum of its

total equity. The Company monitors its capital using a number of

key performance indicators including cash flow projections, working

capital ratios, the cost to achieve development milestones and

potential revenue from partnerships and ongoing licensing

activities.

The Company's objective when managing its capital is to ensure

it obtains sufficient funding for continuing as a going concern.

The Company funds its capital requirements through the issue of new

shares to investors.

Interest rate risk

The maximum exposure to interest rate risk at the reporting date

by class of financial asset was:

2022 2021

GBP GBP

Bank balances 1,096,084 329,628

---------- --------

The Company is not financially dependent on the income earned on

these resources and therefore the risk of interest rate

fluctuations is not significant to the business and the Directors

have not performed a detailed sensitivity analysis.

All deposits are placed with main clearing banks, with 'A'

ratings, to restrict both credit risk and liquidity risk. The

deposits are placed for the short term, between one and three

months, to provide flexibility and access to the funds.

Credit and liquidity risk

Credit risk is managed on a Company basis. Funds are deposited

with financial institutions with a credit rating equivalent to, or

above, the main UK clearing banks. The Company's liquid resources

are invested having regard to the timing of payment to be made in

the ordinary course of the Company's activities. All financial

liabilities are payable in the short term (between 0 to 3 months)

and the Company maintains adequate bank balances to meet those

liabilities.

Currency risk

The Company operates in a global market with income and costs

possibly arising in a number of currencies. The Company's strategic

aim of acquiring asset(s) or business(es) acting as a post

discovery accelerator, is not limited to any specific geo-political

area or jurisdiction. Currently the majority of the Company's

overhead costs are incurred in GBPGBP. The Kathleen Valley Project

is located in Western Australia, and hence the majority of the

exploration and evaluation costs relating to this project are

incurred in $AUD. The Company has not hedged against any currency

depreciation but continues to keep the matter under review. The

Company did not have foreign currency exposure at year end.

21. RELATED PARTY TRANSACTIONS

Key management personnel compensation

The Directors are considered to be key management personnel.

Detailed remuneration disclosures are provided in the remuneration

report on pages 23 - 25 of the annual report.

Amounts due from/to related parties

There were no amounts due to directors as at 30 June 2022 (2021:

GBP11,954). No amounts were due from directors as at 30 June 2022

(2021: GBPNil).

In the prior year, Mark Stephenson, subscribed to GBP50,000 of

the convertible loan notes disclosed in note 15. As at 30 June 2022

the balance due, to Mark Stephenson, in relation to this

convertible loan note, including the accrued interest, was GBPNil

(2021: GBP51,192)

There were no other related party transactions.

22. EVENTS SUBESQUENT TO YEAR

Fund Raise - post year end

Post year end, the Company announced on the 6(th) of October

2022 that it raised GBP696,000 (before expenses) through a Placing

of 23,199,984 New Ordinary Shares of GBP0.01 each ("Placing

Shares") at a price of 3 pence per Placing Share (the "Placing").

Investors in the Placing will also receive one three year warrant

per Placing Share to subscribe for one new ordinary share at a cost

of 4.8p per share ("Investor Warrants"). The Company has also

issued 524,000 broker warrants that are exercisable at 3p for a

period of 3 years ("Broker Warrants").

The Investor Warrants and Broker Warrants are conditional on the

publication of a Prospectus by the Company, which it anticipates

filing as soon as practicable, and shareholder approval to increase

the Company's share authorities.

23. CONTROL

In the opinion of the Directors there is no single ultimate

controlling party.

**S**

For more information visit www.milaresources.com or contact:

Mark Stephenson info@milaresources.com

Mila Resources Plc

Jonathan Evans

Tavira Financial +44 (0) 20 7100 5100

Nick Emerson

SI Capital +44 (0) 20 3143 0600

Susie Geliher / Max Bennett

St Brides Partners Limited +44 (0) 20 7236 1177

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UROWRUSUROAA

(END) Dow Jones Newswires

October 31, 2022 03:00 ET (07:00 GMT)

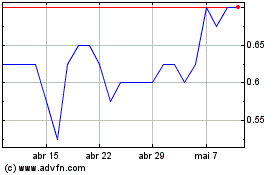

Mila Resources (LSE:MILA)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Mila Resources (LSE:MILA)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025