Wynnstay Group PLC Trading Update (2161G)

14 Novembro 2022 - 4:00AM

UK Regulatory

TIDMWYN

RNS Number : 2161G

Wynnstay Group PLC

14 November 2022

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF THE MARKET ABUSE REGULATION (EU) 596/2014 WHICH FORMS PART OF UK

LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

IN ADDITION, MARKET SOUNDINGS (AS DEFINED IN MAR) WERE TAKEN IN

RESPECT OF CERTAIN OF THE MATTERS CONTAINED IN THIS ANNOUNCEMENT,

WITH THE RESULT THAT CERTAIN PERSONS BECAME AWARE OF SUCH INSIDE

INFORMATION, AS PERMITTED BY MAR. UPON THE PUBLICATION OF THIS

ANNOUNCEMENT, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN

THE PUBLIC DOMAIN AND SUCH PERSONS SHALL THEREFORE CEASE TO BE IN

POSSESSION OF INSIDE INFORMATION.

AIM: WYN

WYNNSTAY GROUP PLC

("Wynnstay" or "the Group")

TRADING UPDATE

The Board of Wynnstay, the agricultural supplies group, is

pleased to provide a further update on trading for the financial

year ended 31 October 2022.

Since the trading update provided on 6 September 2022, which

reported a strong trading backdrop across many core activities, it

is now clear that the Group's results for the financial year will

be ahead of market forecasts issued after that announcement.

This position reflects not only a favourable trading performance

in the final months of the financial year, but also a higher than

initially expected contribution from joint venture activities and

an additional, non-cash profit from grain trading operations within

the Group's Agriculture Division of approximately GBP0.5

million.

-- The beneficial trading conditions described in the September

statement continued through to the financial year-end,

further benefiting arable performance with additional

income across grain, seed and fertiliser categories.

-- Joint Venture businesses Bibby Agriculture Limited and

Wyro Developments Limited have both substantially exceeded

initial financial performance expectations, and the contribution

from these activities will be higher than budgeted.

-- Wynnstay's Agriculture Division's reported profit will

be increased by the accounting treatment in relation to

financial derivatives used to commercially hedge forward

physical transactions. The Group's accounting policies,

in accordance with International Financial Reporting Standard

9, require certain open derivative contracts to be valued

by reference to a recognised market price as at the financial

year-end. On Monday, 31 October 2022, (the date of the

Group's financial year-end) there was a spike in London

Wheat futures prices caused by the Russian Government's

announcement of its withdrawal from the Ukraine grain

export agreement on Saturday, 29 October 2022. These closing

reference prices have the effect of generating an additional

approximate GBP0.5m of non-cash reported profit in the

financial year to 31 October 2022. On Wednesday, 2 November

2022, the Russian Government announced the reversal of

its decision and London Wheat futures prices decreased

by approximately the same amount as they had initially

increased. This effectively extinguished the reported

additional non-cash profit, but the reversal will be accounted

for in the new financial year.

This accounting treatment has no effect on the grain trading

book of Wynnstay's Agricultural Division, where the derivative

contracts in place at the financial year-end are used

to commercially hedge physical contracts to be executed

in the next financial year. It simply accelerates the

recognition of the fair value from the relevant transactions.

As previously announced, the Board is very conscious of

inflationary pressures for the business, farmers and the

end-consumer and of the uncertain macroeconomic background. It

therefore believes it prudent to leave its expectations for the new

financial year and beyond unchanged.

Enquiries:

Wynnstay Group plc Gareth Davies, Chief T: 01691

Executive 827 142

Paul Roberts, Finance

Director

KTZ Communications Katie Tzouliadis / Dan T: 020 3178

Mahoney 6378

Shore Capital (Nomad Stephane Auton / John T: 020 7408

and Broker) More / Rachel Goldstein 4090

(corporate advisory)

Henry Willcocks (corporate

broking)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBKDBPFBDDKDD

(END) Dow Jones Newswires

November 14, 2022 02:00 ET (07:00 GMT)

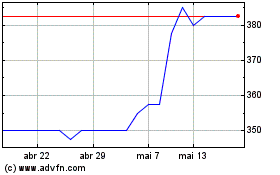

Wynnstay (LSE:WYN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Wynnstay (LSE:WYN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024