TIDMCBG

RNS Number : 3314N

Close Brothers Group PLC

20 January 2023

This announcement contains inside information

Press Release

Scheduled Trading Update and Update on Novitas Loans

-------------------------------------------------------

20 January 2023

Embargoed for release until 7.00 am on 20 January 2023.

Close Brothers Group plc ("the group" or "Close Brothers") today

issues its scheduled pre-close trading update ahead of its 2023

half year end, as well as an update in respect of Novitas Loans

("Novitas"). Close Brothers will release its half year results for

the six months ending 31 January 2023 on 14 March 2023.

All statements in this release relate to the five months to 31

December 2022 ("the period") unless otherwise stated.

Adrian Sainsbury, Chief Executive Officer

"We have delivered a resilient performance so far this financial

year, despite the uncertain market backdrop. We saw good demand and

strong margins in Banking and delivered healthy net inflows in

CBAM, though trading activity remained subdued at Winterflood.

While our underlying credit performance remains strong, as we

accelerate our efforts to resolve the issues surrounding the

Novitas loan book, we will be increasing further provisions in the

H1 2023 financial statements to a level that will adequately cover

the remaining risk of credit losses for the current Novitas loan

book. The financial strength of the group leaves us well placed to

absorb the anticipated additional provisions and to continue to

deliver on our long-term track record of disciplined growth and

returns to shareholders".

Performance in the five months to 31 December 2022

We have maintained our strong capital, funding and liquidity

position, in line with our prudent and conservative approach. Our

Common Equity Tier 1 ("CET1") ratio was 14.4% at 31 December 2022

(31 July 2022: 14.6%), significantly above the applicable minimum

regulatory requirement of 8.5%(1) and also above the group's CET1

capital ratio target range of 12-13%.

In Banking , the loan book increased 1.5% in the period to

GBP9.23 billion (31 July 2022: GBP9.10 billion)(2) as we have seen

a pick-up in overall demand since the Q1 2023 trading update. This

was primarily driven by continued demand in the Commercial

businesses, as well as an increase in the Premium and Property

Finance books, partly offset by a moderation in business volumes in

Motor Finance compared to the prior financial year.

The annualised year-to-date net interest margin remained strong,

as we continued to focus on our pricing discipline in the higher

interest rate environment.

Our focus on rigorous management of costs remains unchanged,

whilst we continue to be mindful of inflationary pressures.

Excluding Novitas, the annualised year-to-date bad debt ratio

increased to 1.1% (FY 2022: 0.5%, Q1 2023: 1.0%), primarily

reflecting the recognition of further provisions to take into

account worsening macroeconomic variables and outlook(3) .

Including Novitas, the annualised year-to-date bad debt ratio

increased to 1.7% (FY 2022: 1.2%, Q1 2023: 1.2%), reflecting an

additional GBP24.8 million provision. The group anticipates the

recognition of further provisions against this loan book will be

required in the H1 2023 financial statements, as set out in the

separate update on Novitas below.

Close Brothers Asset Management ("CBAM") has continued to

attract client assets and delivered year-to-date annualised net

inflows of 6% (FY 2022: 5%), despite the impact of challenging

market conditions on investor sentiment. In the period, managed

assets decreased to GBP15.2 billion (31 July 2022: GBP15.3 billion)

and total client assets decreased to GBP16.3 billion (31 July 2022:

GBP16.6 billion), reflecting negative market movements.

As highlighted at the Q1 2023 trading update, Winterflood's

performance has been adversely impacted by the continued

market-wide slowdown in trading activity in higher margin sectors.

As a result, operating profit in the period was GBP1.7 million.

Notwithstanding the challenging trading conditions in the period,

the team's experience and focus on managing risk resulted in only

one loss day.

Update on Novitas Loans

We acquired Novitas Loans, a provider of finance for the legal

sector, in 2017. As previously announced, following a strategic

review, in July 2021 the group decided to cease permanently the

approval of lending to new customers across all of the products

offered by Novitas and withdraw from the legal services financing

market.

Since that time, the Novitas loan book has been in run-off, and

the business has continued to work with solicitors and insurers,

with a focus on supporting existing customers and managing the

existing book to ensure good customer outcomes, where it is within

Novitas' ability to do so. The group has been reviewing its

assumptions for the case failure and recovery rates in this

business to reflect experienced credit performance and ongoing

dialogue with customers' insurers.

The group has initiated formal legal action against one of the

After the Event ("ATE") insurers regarding the potential

recoverability of funds in relation to failed cases and is

considering its position in respect of other insurers. As a result,

an increased provision to reflect the expectation of a longer time

frame to recovery for related loans was included in the GBP24.8

million of provisions taken in the first five months of the 2023

financial year.

In addition, Novitas is reviewing its options with respect to

certain cases being funded which now have limited prospects of

successfully progressing through the courts. Subject to the outcome

of this review, the group anticipates that it will recognise an

additional provision in the H1 2023 financial statements against

the Novitas loan book of up to GBP90 million(4) . The higher end of

this range assumes a material increase in the Probability of

Default ("PD") and Loss Given Default ("LGD") assumptions and that

no further interest is receivable on the relevant loans. We expect

net income related to Novitas will reduce from c.GBP36 million in

FY 2022 to c.GBP8 million by FY 2024. This will be partially

mitigated by lower impairment charges in future years. These

assumptions will be reviewed as part of the group's half year

results process.

The impact of the anticipated increased provision would be

equivalent to a reduction of up to c.80bps in the CET1 capital

ratio on a pro-forma basis at 31 December 2022. The financial

strength of the group leaves us well placed to absorb this and to

continue to deliver on our long-term track record of disciplined

growth and returns to shareholders. Despite the additional

anticipated charge in relation to Novitas, we remain committed to

paying a progressive and sustainable dividend, in line with the

group's dividend policy.

While we will continue to review provisioning levels in light of

future developments, including the experienced credit performance

of the book and the outcome of the group's initiated legal action,

we believe the anticipated additional provisions to be recognised

in H1 2023 will adequately cover the remaining risk of credit

losses for the current Novitas loan book. The group remains focused

on maximising the recovery of remaining loan balances, either

through successful outcome of cases or recourse to the customers'

ATE insurers, whilst complying with its regulatory obligations and

always focusing on ensuring good customer outcomes.

The group will provide a detailed update at its half year

results on 14 March 2023.

Outlook

We are confident that our proven and resilient model leaves us

well positioned to navigate the economic uncertainty, as we

continue supporting our customers and clients and delivering on our

long track record of profitability and disciplined growth.

Footnotes

1 The group's capital ratios are presented on a transitional

basis after the application of IFRS 9 transitional arrangements

which allows banks to add back to their capital base a proportion

of the IFRS 9 impairment charges during the transitional period.

Without their application, the CET1 capital ratio would be 13.9%

(31 July 2022: 13.8%). The applicable minimum regulatory

requirement, excluding any applicable PRA buffer, was 8.5% at 31

December 2022.

2 The loan book is presented including operating lease

assets.

3 At 31 December 2022, there was a 32.5% weighting to the

baseline scenario, 30.0% to the upside and 37.5% to the downside

scenarios (unchanged from 31 July 2022). Moody's December

unemployment forecast for 2023 under the baseline scenario is 4.2%,

3.8% under the upside scenario and ranges between 4.6% and 6.0% in

the downside scenarios. Moody's December inflation forecast for

2023 under the baseline scenario is 7.3%, 6.9% for the upside

scenario and ranges between 5.8% and 2.9% in the downside

scenarios. Moody's December forecast for the Bank of England base

rate for 2023 is 4.4% in the baseline scenario, 4.3% under the

upside scenario and ranges from 4.8% to 5.4% in the downside

scenarios.

4 At 31 July 2022, Novitas had a net loan book of GBP159.4

million, net of an aggregate impairment provision of GBP113.3

million, representing coverage of 42% across the book as a whole.

Year-to-date, GBP24.8 million of impairment provision charges were

recognised in relation to the Novitas loan book. Assuming the

anticipated additional impairment provision of up to c.GBP90

million is recognised in the group's H1 2023 financial statements,

this would result in an aggregate impairment provision, net of

write offs, of up to GBP183 million. On a pro-forma basis at 31

December 2022, this would represent a coverage of up to c.75% with

a net loan book of c.GBP60 million.

Inside Information

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018. For the purposes of Article 2 of the UK

version of the Commission Implementing Regulation (EU) 2016/1055,

this announcement is made by Penny Thomas, Company Secretary for

Close Brothers Group plc.

Enquiries

Sophie Gillingham Close Brothers Group plc 020 3857 6574

Camila Sugimura Close Brothers Group plc 020 3857 6577

Kimberley Taylor Close Brothers Group plc 020 3857 6233

Irene Galvan Close Brothers Group plc 020 3857 6217

Sam Cartwright Maitland 07827 254561

About Close Brothers

Close Brothers is a leading UK merchant banking group providing

lending, deposit taking, wealth management services and securities

trading. We employ approximately 4,000 people, principally in the

United Kingdom and Ireland. Close Brothers Group plc is listed on

the London Stock Exchange and is a member of the FTSE 250.

Cautionary Statement

Certain statements included within this announcement may

constitute "forward-looking statements" in respect of the group's

operations, performance, prospects and/or financial condition.

Forward-looking statements are sometimes, but not always,

identified by their use of a date in the future or such words as

"anticipates", "aims", "due", "could", "may", "will", "should",

"expects", "believes", "intends", "plans", "potential", "targets",

"goal" or "estimates". By their nature, forward-looking statements

involve a number of risks, uncertainties and assumptions and actual

results or events may differ materially from those expressed or

implied by those statements. Accordingly, no assurance can be given

that any particular expectation will be met and reliance should not

be placed on any forward-looking statement. Additionally,

forward-looking statements regarding past trends or activities

should not be taken as a representation that such trends or

activities will continue in the future. Except as may be required

by law or regulation, no responsibility or obligation is accepted

to update or revise any forward-looking statement resulting from

new information, future events or otherwise. Nothing in this

announcement should be construed as a profit forecast. This

announcement does not constitute or form part of any offer or

invitation to sell, or any solicitation of any offer to subscribe

for or purchase any shares or other securities in the company or

any of its group members, nor does it constitute a recommendation

regarding the shares or other securities of the company or any of

its group members. Past performance cannot be relied upon as a

guide to future performance and persons needing advice should

consult an independent financial adviser or other professional.

Statements in this announcement reflect the knowledge and

information available at the time of its preparation. Liability

arising from anything in this announcement shall be governed by

English law. Nothing in this announcement shall exclude any

liability under applicable laws that cannot be excluded in

accordance with such laws.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPUBPGUPWPUB

(END) Dow Jones Newswires

January 20, 2023 02:00 ET (07:00 GMT)

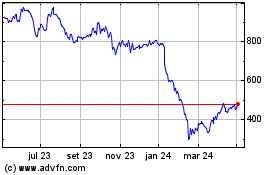

Close Brothers (LSE:CBG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

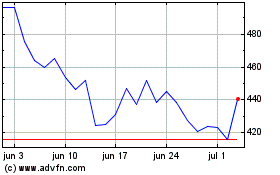

Close Brothers (LSE:CBG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024