TIDMRGL

RNS Number : 7642Q

Regional REIT Limited

23 February 2023

23 February 2023

REGIONAL REIT Limited

("Regional REIT", the "Group" or the "Company")

Q4 2022 Dividend, Letting Update and Year-End Portfolio

Valuation

Dividend Yield of 11% and 99% Rent Collection for 2022

Regional REIT (LSE: RGL), the regional office specialist, is

today pleased to announce its Q4 2022 dividend, a positive rent

collection update and a portfolio valuation as at 31 December

2022.

Q4 2022 Dividend - Expected to be covered; yield of 11%

The Company confirms that it will pay a dividend of 1.65 pence

per share ("pps") for the period 1 October 2022 to 31 December 2022

(1 October 2021 to 31 December 2021: 1.70pps). This amounts to a

total dividend of 6.6pps for 2022 (2021: 6.5pps), and which is

expected to be covered by 2022 EPRA earnings. It equates to an

annualised dividend yield of c.11% at the closing price per share

on 22 February 2023. The entire dividend will be paid as a REIT

property income distribution ("PID").

Rent Collection 2022 Update

The Company is also pleased to report that as at 15 February

2023, Q1 2022 collections amounted to 99.2%, Q2 2022 to 98.9% and

Q3 2022 to 98.1%. Currently, Q4 2022 rent collection, adjusting for

monthly rent and agreed collection plans, stands at 97. 9 %, which

is above the equivalent period in 2021 when 96.6% had been

collected. The total rent collection for 2022 is currently at 98. 6

% compared with 98.6% this time last year.

% Q1 2022 Q2 2022 Q3 2022 Q4 2022 YTD

98.

Rent paid 99.2 98.9 98.1 97.2 4

Adjusted for monthly 0.

rents 0.0 0.0 0.0 0. 7 2

Agreed collections

plans 0.0 0.0 0.0 0.0 0.0

-------- -------- -------- -------- ----

98.

99.2 98.9 98.1 97. 9 6

The Company remains in supportive and ongoing discussions with

occupiers regarding the balance of the outstanding rent and expects

to collect the vast majority in due course.

Table may not sum due to rounding.

Quarterly rental collection refers to all invoices issued during

the calendar quarters:

Q1: 1 January 2022 to 31 March 2022

Q2: 1 April 2022 to 30 June 2022

Q3: 1 July 2022 to 30 September 2022

Q4: 1 October 2022 to 31 December 2022

Full Year 2022 Portfolio Valuation

Additionally, the Company provides the following portfolio

valuation update.

-- Portfolio valuation GBP789.5m (2021: GBP906.1m)

-- The like-for-like value of the portfolio decreased by 12.1%

in 2022 after adjusting for capital expenditure, acquisitions and

disposals during the period (11.0% excluding capital expenditure

adjustment)

-- Equivalent Yield 9.0% (2021: 8.7%)

-- Gross rent roll GBP71.8m (2021: GBP72.1m); ERV GBP92.0m (2021: GBP94.6m)

-- 154 properties (2021: 168); 1,076 occupiers (2021: 1,077)

-- Portfolio: offices (by value) at 91.8% of the portfolio

(2021: 89.8%), retail 3.6% (2021: 3.7%), industrials 3.1% (2021:

5.1%), and Other 1.4% (2021: 1.4%)

-- England represented 78.3% (2021: 75.7%) (by value), Scotland

16.7% (2021: 19.0%) and Wales 5.0% (2021: 5.3%)

-- EPRA Occupancy (by ERV) at 83.4% (2021: 81.8%)

-- Average lot size c. GBP5.1m (2021: c. GBP5.4m)

-- Net loan-to-value ratio was 49.5% (2021: 42.4%); ample

headroom remains on all loan covenants.

-- Group cost of debt (incl. hedging) 3.5% pa (2021: 3.3% pa) -

100% fixed and hedged, ensuring the maximum cost of debt will not

exceed 3.5%

-- Weighted average debt duration 4.5years (2021: 5.5 years)

Stephen Inglis, CEO of London and Scottish Property Investment

Management, the Asset Manager, commented:

"2022 was operationally strong, with the Company delivering on

its targeted distribution of 6.6 pence per share, equating to a

yield of 11 % on the share price as at 22 February 2022. The full

year 2022 dividend is expected to be covered by earnings, which

will be confirmed when the 2022 annual results are announced.

"Although, as elsewhere in the commercial real estate sector,

property valuations were impacted negatively during the period by

the macroeconomic environment, operationally the Company has

performed well. We have continued to focus on providing vibrant

spaces to help our customers to thrive and in-turn to collect the

rents. This has allowed the dividend to be increased to 6.6 pence

per share for 2022 from 6.5 pence per share for 2021. Additionally,

while the Company's LTV has increased, we are encouraged by the

ample headroom available across the debt facilities and the fixed

nature of the Company's debt at 3.5%.

"There is an air of optimism as we progress into the new year,

with our 30 November 2022 internal data showing that 99% of our

tenants had returned to the office in some form, with only 12 of

our 1,076 tenants yet to do so."

Further Background Information

Dividend

The Company has introduced the option for shareholders to invest

their dividend in a Dividend Reinvestment Plan ("DRIP"). More

details can be found on the Company's website

https://www.regionalreit.com/investors/investors-dividend/dividend-reinvestment-plan

.

The key dates relating to this dividend are given below:

Ex-dividend date 02 March 2023

Record date 03 March 2023

--------------

Last day for DRIP election 16 March 2023

--------------

Payment date 06 April 2023

--------------

Lettings Update - Summary of Activity since 30 September

2022:

Since 30 September 2022, notable new lettings in aggregate

amounted to c.GBP1.7m of new rent and aggregate lease renewals

amounted to c. GBP1.0m, reflecting in aggregate an increase of a

7.3% above 30 June 2022 ERV.

-- Norfolk House, Birmingham - 44,245 sq. ft. of previously

vacant Grade A office space has been let to Global Banking School.

The annual rent amounts to GBP840,991 pa (GBP19.01/ sq. ft.), with

a 15-year lease including an option to break after 10 years.

-- Capitol Park, Leeds - Hermes Parcelnet Ltd (Evri) renewed its

lease for a further five years to December 2028, at a rental income

of GBP473,045 pa (GBP18.34/ sq. ft.) on 25,790 sq. ft. of space.

Moreover, the tenancy also includes provision of additional car

parking spaces at a rent of GBP25,632 pa.

-- Hampshire Corporate Park, Eastleigh - Complete Fertility Ltd

has leased 9,928 sq. ft. of space for 15 years with a break option

in 2032 at a rent of GBP287,921 pa (GBP29.00/ sq. ft.).

-- Integration House, Fleet - Boeing United Kingdom Ltd renewed

its lease for a further five years, to December 2027, at a rental

income of GBP194,943 pa (GBP16.67/ sq. ft.) on 11,679 sq. ft. of

space.

-- The Foundation, Chester Business Park, Chester - 8,676 sq.

ft. of space has been let to SpaMedica Ltd at a rent of GBP173,520

pa (GBP20.00/ sq. ft.) for a period of 10 years with the option to

break in 2027.

-- Milburn House, Newcastle - Lycett, Brown-Swinburne &

Douglass Ltd renewed its lease for a further 12 months, at a rental

income of GBP170,012 pa (GBP14.82/ sq. ft.) for 11,469 sq. ft. of

space.

-- Ashby Park, Ashby De La Zouch - A new tenancy agreement has

been signed with Ashfield Healthcare Ltd for 6,462 sq. ft.. The

lease is for two years with the option to break in 2023, providing

a rental income of GBP119,547 pa (GBP18.50/ sq. ft.).

-- 1-4 Llansamlet Retail Park, Nantyffin Rd, Swansea - 2,810 sq.

ft. of space has been let to TH UK & Ireland Ltd (Tim Hortons)

at a rent of GBP98,000 pa (GBP34.88/ sq. ft.) for a period of 15

years with the option to break in 2032.

-- Central Park, New Lane, Leeds - Akari Care Ltd has leased

4,400 sq. ft. for a period of five years with the option to break

in 2025 at a rent of GBP83,600 pa (GBP19.00/ sq. ft.).

-- Quadtech, Hemel Hempstead - 5,001 sq. ft. of space has been

let to the Glenelly Infrastructure Solutions Ltd at a rent of

GBP75,000 pa (GBP15.00/ sq. ft.) for a period of ten years with the

option to break in 2027.

-- Delta 1200, Delta Business Park, Swindon - TM Group (UK) Ltd

has leased 4,857 sq. ft. for a period of eight years at a rent of

GBP69,198 pa (GBP14.25/ sq. ft.).

-- Oakland, Manchester - Secretary of State for Levelling Up,

Housing and Communities renewed its lease for a further 12 months,

at a rental income of GBP54,500 pa (GBP10.00/ sq. ft.) on 5,450 sq.

ft. of space.

-- The Royals, Altrincham Road, Manchester - Texas Instruments

Ltd renewed its lease for a further five years, to August 2027, at

a rental income of GBP51,557 pa (GBP14.50/ sq. ft.) on 3,557 sq.

ft. of space.

Forthcoming Events

28 March 2023 Full year 2022 Preliminary Results Announcement

24 May 2023 May 2023 Trading Update and Outlook Announcement

Q1 2023 Dividend Declaration Announcement

25 May 2023 Annual General Meeting

Note: All dates are provisional and subject to change.

-S -

Enquiries:

Regional REIT Limited

Press enquiries through Buchanan

Toscafund Asset Management Tel: +44 (0) 20 7845 6100

Investment Manager to the Group

Adam Dickinson, Investor Relations, Regional REIT Limited

London & Scottish Property Investment Management Tel: +44 (0) 141 248 4155

Asset Manager to the Group

Stephen Inglis

Buchanan Communications Tel: +44 (0) 20 7466 5000

Financial PR

Charles Ryland, Henry Wilson, George Beale

About Regional REIT

Regional REIT Limited ("Regional REIT" or the "Company") and its

subsidiaries (the "Group") is a United Kingdom ("UK") based real

estate investment trust that launched in November 2015. It is

managed by London & Scottish Property Investment Management

Limited, the Asset Manager, and Toscafund Asset Management LLP, the

Investment Manager.

Regional REIT's commercial property portfolio is comprised

wholly of income producing UK assets and comprises, predominantly

of offices located in the regional centres outside of the M25

motorway. The portfolio is geographically diversified, with 154

properties, 1,076 occupiers as at 31 December 2022, with a

valuation of c.GBP789.5m.

Regional REIT pursues its investment objective by investing in,

actively managing and disposing of regional core and core plus

property assets. It aims to deliver an attractive total return to

its Shareholders, targeting greater than 10% per annum, with a

strong focus on income supported by additional capital growth

prospects.

For more information, please visit the Group's website at www.regionalreit.com .

Cautionary Statement

This document has been prepared solely to provide additional

information to Shareholders to assess the Group's performance in

relation to its operations and growth potential. The document

should not be relied upon by any other party or for any other

reason. Any forward looking statements made in this document are

done so by the Directors in good faith based on the information

available to them up to the time of their approval of this

document. However, such statements should be treated with caution

due to the inherent uncertainties, including both economic and

business risk factors, underlying any such forward-looking

information.

ESMA Legal Entity Identifier ("LEI"): 549300D8G4NKLRIKBX73

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVTTMRTMTATBBJ

(END) Dow Jones Newswires

February 23, 2023 02:00 ET (07:00 GMT)

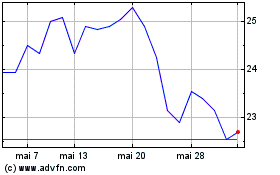

Regional Reit (LSE:RGL)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Regional Reit (LSE:RGL)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025