Parkmead Group (The) PLC Strong Progress Across Netherlands Assets (7770X)

28 Abril 2023 - 3:00AM

UK Regulatory

TIDMPMG

RNS Number : 7770X

Parkmead Group (The) PLC

28 April 2023

28 April 2023

The Parkmead Group plc

("Parkmead", the "Group" or the "Company")

Strong Progress Across Netherlands Assets

Parkmead, the independent energy group, is pleased to provide

the following update on the performance of its Netherlands

operations.

Drenthe VI

As previously announced, the LDS-01 well successfully discovered

commercial reserves and delivered first gas in April 2023. Since

then, gas condensate flow rates have been significantly higher than

expected, at around 40m(3) /day, in addition to excellent dry gas

production rates. Following these better than expected flow rates,

the well has been temporarily shut-in, so that a process

optimization can take place at the Garijp terminal, to accommodate

the increased fluid production levels. Once an optimal operating

regime has been identified, the well will be brought back onstream,

this is currently expected to be in late May 2023. Post-drill

modelling work has indicated the well has discovered a much larger

net pay interval than initially thought at well completion.

The existing DIV-02 well at Diever continues to produce while

the LDS-01 well is temporarily shut-in.

Drenthe V

A large integrated subsurface study is currently ongoing to

target additional volumes at the producing Geesbrug gas field. This

work will be completed in the second half of 2023 and will confirm

the merits of a potential additional well. The existing Geesbrug

production well is also expected to undergo further work this year

to enhance production efficiency.

Andel Va

Subsurface work continues, confirming new opportunities on the

Andel Va licence. These include an infill well at the Brakel gas

field as well as a potential exploration well on the adjacent

Brakel South prospect. This work will be completed during 2023.

Alongside the Brakel area, the partners on this licence will also

be performing operational evaluations of the Wijk & Aalburg

fields which will include plans for refitting the production

facilities at those fields.

Drenthe IV

Parkmead's acquisition of the historic gas royalty in 2021 means

that a potential compression reactivation on the Grolloo gas field

will result in material net benefit to Parkmead.

Papekop

Excellent progress continues to be made on the Papekop

development. Commercial discussions are advancing with stakeholders

and GTS (the owner/operator of the national gas transmission

network in the Netherlands). Environmental Impact Assessments and

permitting will be completed over the next year, alongside detailed

engineering, before a Final Investment Decision is taken.

Tom Cross, Executive Chairman, commented:

"We are pleased to provide shareholders with an update on the

significant progress across our portfolio of Netherlands

assets.

Parkmead has worked closely with its joint-venture partners on

the fast-track development of the LDS-01 gas discovery. The initial

performance and recent reservoir modelling of the well are very

encouraging, and we are achieving higher than expected flow rates

of both dry gas and gas condensate.

The Netherlands onshore portfolio continues to generate a large

number of value-adding opportunities across all stages of the life

cycle including low-risk exploration, low-cost appraisal and

development.

These high-quality assets, combined with efficient cost control,

deliver strong cash flow from operations which allows for further

investment in growth opportunities throughout the Netherlands and

UK."

For enquiries please contact:

The Parkmead Group plc +44 (0) 1224 622200

Tom Cross (Executive Chairman)

Henry Steward (Group Commercial Manager)

finnCap Ltd (NOMAD and Broker to Parkmead) +44 (0) 20 7220 0500

Marc Milmo / Seamus Fricker - Corporate

Finance

Andrew Burdis / Barney Hayward - ECM

About Parkmead

The Parkmead Group is a UK and Netherlands focused independent

energy group listed on AIM of the London Stock Exchange (AIM: PMG).

The Group produces natural gas from a portfolio of four fields

across the Netherlands and holds significant additional oil and gas

interests across the UK and Dutch sectors. Parkmead also 100% owns

and operates the Kempstone Hill wind energy company, producing

electricity direct to the UK grid. This is in addition to a range

of complementary renewable energy opportunities throughout the

Group.

For further information please refer to Parkmead's website at

www.parkmeadgroup.com

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUBRBROWUSUAR

(END) Dow Jones Newswires

April 28, 2023 02:00 ET (06:00 GMT)

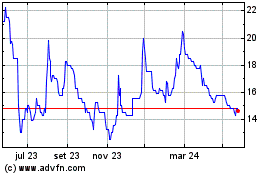

Parkmead (LSE:PMG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

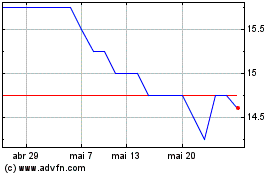

Parkmead (LSE:PMG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024