TIDMGCG

RNS Number : 9334X

Golden Rock Global PLC

28 April 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, WITHIN, INTO OR IN THE UNITED STATES, AUSTRALIA,

CANADA, THE REPUBLIC OF SOUTH AFRICA, THE REPUBLIC OF IRELAND OR

JAPAN.

28 April 2023

Golden Rock Global plc

(Incorporated and registered in Jersey under the Companies

(Jersey) Law 1991 with registered number 121560)

Financial Statements

31 December 2022

CHAIRMAN'S STATEMENT

It is a pleasure to announce the audited results for the year

ended 31 December 2022.

Your Board realises that this has been a frustrating year for

shareholders and one that has been dominated by discussions with

Bolt Global Limited ("Bolt") regarding an acquisition by way of a

reverse takeover. Your Board committed a significant amount of time

and effort to these discussions over a prolonged period. However,

despite its best efforts, it became clear earlier this month that

the prospectus was unlikely to be completed and published within a

reasonable timeline. Not least Bolt would need to refresh its

financial information in the prospectus and undertake an audit for

the period ended 31 December 2022. Considering the timeframe this

process has taken to date, the cash position of the Company and

that the trading facility had been suspended for a prolonged period

of time, your Board decided it was in shareholders' best interests

to terminate discussions and allow the trading facility to be

restored with effect from 5 April 2023.

A second noteworthy event is that we entered an agreement to

raise GBP100,000 (gross) through the issue of a convertible loan

note to Wei Chen, a director, further details of which were

announced on 5 December 2022. This has been treated as a post

balance sheet event as the cash was drawn down after the year

end.

Turning to the results for the year. As a cash shell we had no

trading income, normal operating costs were modest mainly

comprising the regulatory costs of being a listed company. Cash at

the period end plus the receipt of the proceeds of the convertible

loan note was GBP134,335 post year end. It is important to note

that all professional costs in relation to the aborted acquisition

outstanding at the year-end (and those incurred since the year-end)

are the responsibility of Bolt.

You will note the audit opinion and the going concern statement

on pages 11 to 15 that the Company will need to raise cash during

the year. In this regard resolutions will be proposed at the Annual

General Meeting to provide the Company with the ability to raise

additional cash.

Your Board has now turned its attention to seek other

acquisition opportunities with a view to restoring shareholder

value and will provide updates at the appropriate time.

Finally, I know that shareholders will be, as the Board is,

hugely disappointed that the acquisition did not proceed. I take

this opportunity to thank you for your support.

Ross Andrews

Chairman

28 April 2023

CORPORATE GOVERNANCE REPORT

Introduction

There is no applicable regime of corporate governance to which

the directors of a Jersey company must adhere over and above the

general fiduciary duties and duties of care, skill and diligence

imposed on such directors under Jersey law. As a Jersey company and

a company with a Standard Listing, the Company is not required to

comply with the provisions of the UK Corporate Governance Code.

Nevertheless, the Directors are committed to maintaining high

standards of corporate governance and, so far as is practicable

given the Company's size and nature, have voluntarily adopted and

comply with the Quoted Companies Alliance Code ("QCA Code").

The Board has established two committees: An Audit committee and

a Remuneration and Nominations committee. John Croft chairs the

Audit committee whilst Ross Andrews chairs the Remuneration and

Nominations committee. Both committee members were elected in 2016.

In addition, the Company has a relationship agreement with

shareholders who in aggregate account for 38.38% of the issued

share capital, to ensure the independence and management of the

Company in relation to the day-to-day management, affairs and

governance of the Company.

Leadership

The terms and conditions of appointment of the non-executive

directors are available for inspection at the Company's registered

office.

Role of the Board

The Board sets the Company's strategy, ensuring that the

necessary resources are in place to achieve the agreed strategic

priorities, and reviews management and financial performance. It is

accountable to shareholders for the creation and delivery of

strong, sustainable financial performance and monitoring the

Company's affairs within a framework of controls which enable risk

to be assessed and managed effectively. The Board also has

responsibility for setting the Company's core values and standards

of business conduct and for ensuring that these, together with the

Company's obligations to its stakeholders, are widely understood

throughout the Company. The Board has a formal schedule of matters

reserved which is detailed later in this report.

Board Meetings

The core activities of the Board are carried out in scheduled

meetings of the Board and its Committees. These meetings are timed

to link to key events in the Company's corporate calendar. Outside

the scheduled meetings of the Board, the Directors maintain

frequent contact with each other to keep them fully briefed on the

Company's operations. In the period under review the Board met on 4

occasions.

Member's attendance record:

Meeting 1 Present: Ross Andrews, John Croft, Wei

Chen

Apologies:

Meeting 2 Present: Ross Andrews, John Croft, Wei

Chen

Apologies:

---------------------------------------

Meeting 3 Present: Ross Andrews, John Croft, Wei

Chen

Apologies:

---------------------------------------

Meeting 4 Present: Ross Andrews, John Croft

Apologies: Wei Chen

---------------------------------------

Matters reserved specifically for Board

The Board has a formal schedule of matters reserved that can

only be decided by the Board. The key matters reserved are the

consideration and approval of;

-- The Company's overall strategy;

-- Financial statements and dividend policy;

-- Management structure including succession planning,

appointments and remuneration (supported by the Remuneration

Committee);

-- Material acquisitions and disposals, material contracts,

major capital expenditure projects and budgets;

-- Capital structure, debt and equity financing and other matters;

-- Risk management and internal controls (supported by the Audit committee);

CORPORATE GOVERNANCE REPORT

(Continued)

-- The Company's corporate governance and compliance arrangements; and

-- Corporate policies.

Summary of the Board's work in the period

During the period under review, the Board, in addition to

monitoring the financial performance of the Company and ensuring

compliance with the listing rules, has spent considerable time

progressing the proposed acquisition of BOLT GLOBAL.

The Chairman sets the Board Agenda and ensures adequate time for

discussion.

The Non-executive Directors bring a broad range of business and

commercial experience to the Company and have a particular

responsibility to challenge independently and constructively the

performance of the Executive management (where appointed) and to

monitor the performance of the management team in the delivery of

the agreed objectives and targets. The Board considers Ross Andrews

and John Croft to be independent in character and judgement.

Non-executive Directors are initially appointed for a term of

two years, which may, subject to satisfactory performance and

re-election by shareholders, be extended by mutual agreement.

Experience of the Board

Wei Chen (executive director) has over 10 years of experience in

the financial services industry. He is an entrepreneur who has

invested in and operated businesses in the financial services and

fintech sectors, growing them organically and by acquisition. In

2013, Mr. Chen further expanded his business into the financial

segment focusing on Contracts for Difference through investments

into Australian Securities and Investments Commission regulated

companies. In 2016, Mr. Chen founded Golden Rock with his family

members. In 2021, Mr. Chen started a new software company in the

UK.

Ross Andrews (Independent Non-Executive Chairman) has over 30

years' experience as an investment banker and stockbroker to public

companies. He has wide sector and geographical experience and a

deep understanding of UK Corporate Governance regimes and complex

regulatory environments. He was a main board director of Zeus

Capital whilst the firm grow from a small corporate finance

advisory business in the North West of England to an established

investment banking operation based in London, Manchester and

Birmingham. Most recently he established Guild Financial Advisory,

a corporate finance advisory boutique. Ross is an experienced

chairman and non-executive director and is currently on the Board

of a number of businesses.

John Croft (Independent Non-Executive Director) is a

well-regarded Board Director with extensive experience of bringing

Corporate Governance disciplines to Boards of public and private

companies alike, having served also on numerous Board committees in

a recent career which has focussed particularly on international

companies in the Financial Services, Resources and TMT sectors.

John has extensive experience in Asia having served on Boards of

companies based in Malaysia, Hong Kong, China and Australia which

have been listed on the London Stock Exchange.

All the directors are actively involved in regulated entities

that provide up to date training.

Other governance matters

All the Directors are aware that independent professional advice

is available to each Director in order to properly discharge their

duties as a Director.

CORPORATE GOVERNANCE REPORT

(Continued)

Appointments

The Board is responsible for reviewing the structure, size and

composition of the Board and making recommendations to the Board

with regards to any required changes.

Commitments

All Directors have disclosed any significant commitments to the

Board and confirmed that they have sufficient time to discharge

their duties.

Induction

All new Directors receive an induction as soon as practical on

joining the Board.

Conflict of interest

A Director has a duty to avoid a situation in which he or she

has, or can have, a direct or indirect interest that conflicts, or

possibly may conflict, with the interests of the Company. The Board

had satisfied itself that there is no compromise to the

independence of those Directors who have appointments on the Boards

of, or relationships with, companies outside the Company. The Board

requires Directors to declare all appointments and other situations

which could result in a possible conflict of interest.

Board performance and evaluation

The Company has a policy of appraising Board performance

annually. The Company has concluded that for a company of its

current scale, an internal process administered by the Board is

most appropriate at this stage.

Accountability

The Board is committed to providing shareholders with a clear

assessment of the Company's position and prospects. This is

achieved through this report and as required other periodic

financial and trading statements.

Going concern - The Company was formed to seek acquisition

opportunities in the Fintech sector.

It has been agreed that BOLT GLOBAL shall settle the costs and

expenses of Golden Rock Global's professional advisers incurred in

respect of the proposed transaction up until 5 April 2023, the date

that the Company announced it was no longer in discussions with

BOLT GLOBAL

The financial statements have been prepared on the assumption

that the Company is a going concern. When assessing the foreseeable

future, the directors have looked at a period of 12 months from the

date of approval of this report. Despite cash being received post

year end from the convertible loan note, the Company will need to

raise additional funds in order to meet its day-to-day working

capital requirements. The Directors are confident in their ability

to raise sufficient capital from new shareholders or if necessary,

obtain alternative sources of funding. Whilst the Directors

recognise that there is significant material uncertainty around

going concern as a result of the current economic uncertainty and

2022 trading results, the accounts have still been prepared on a

going concern basis, which is supported by confidence over the

ability to raise sufficient funds through the issue of further

equity should the need arise. (Note 4c). The Board refers

shareholders to the Auditor's Report on page 9 and in particular to

the paragraph headed Material uncertainty related to going

concern.

Internal controls - The Board of Directors reviews the

effectiveness of the Company's system of internal controls in line

with the requirements of the QCA Code. The internal control system

is designed to manage the risk of failure to achieve

its business objectives. This covers internal financial and

operational controls, compliances and risk management. The Company

had necessary procedures in place for the period under review and

up to the date of approval of the Annual Report and Accounts. The

Directors acknowledge their responsibility for the Company's system

of internal controls and

for reviewing its effectiveness. The Board confirms the need for

an ongoing process for identification, evaluation and management of

significant risks faced by the Company. A risk assessment for each

project is carried out by the Directors before making any

commitments.

The Audit Committee comprises John Croft (Chairman) and Ross

Andrews (member) has responsibility for monitoring the Company's

financial reporting. Given the size of the Company and the relative

simplicity of the systems, the Board considers that there is no

current requirement for an internal audit function. The procedures

that have been established

CORPORATE GOVERNANCE REPORT

(Continued)

to provide internal financial controls are considered

appropriate for a company of its size and include controls over

expenditure, regular reconciliations and management accounts.

Provision of non-audit services is considered by the Audit

Committee. The Audit Committee has considered the use of external

accounting service providers for non-audit services, and all the

current providers have been retained and considered

appropriate.

During the year the auditors received fees set out in Note 9 to

the Financial Statements.

In addition, PKF Littlejohn LLP acted as reporting accountant on

the proposed transaction with BOLT GLOBAL until discussions

terminated on 5 April 2023.

The Remuneration and Nominations Committees comprise Ross

Andrews (chair) and John Croft (member) and has responsibility for

agreeing the remuneration policy for senior executives and for the

review of the composition and balance of the Board.

Report of the Audit Committee

The Audit Committee has written terms of reference and provides

a mechanism through which the Board can maintain the integrity of

the financial statements of the Company and any formal

announcements relating to its financial performance; to review the

Company's internal financial controls and its internal control and

risk management systems; and to make recommendations to the Board

in relation to the appointment of the external auditor, their

remuneration both for audit and non-audit work, the nature, scope

and results of the audit and the cost effectiveness, independence

and objectivity of the auditors. Provision is made by the Audit

Committee to meet the auditors at least twice a year. The Group is

still at an early stage of its development and is reliant on the

Audit Committee to perform various reporting requirements

particularly with regards the preparation of supporting accounting

papers for audit purposes.

The Audit Committee reviewed, considered and agreed the scope

and methodology of the audit work to be undertaken by the external

auditors and fees and agreed the terms of engagement for the audit

of the financial statements for the year ended 31 December 2022.

PKF have completed the audit for the year ended 31 December 2022

and their appointment will be formally put before shareholders at

the next AGM. Significant matters considered by the Audit Committee

during the year included the independence of the auditor, scope and

methodology for the audit of the financial statements, in

particular determining the areas at greatest risk of material

misstatement (whether or not due to fraud or poor internal

controls). Following the Audit Committee's recommendation, the

Board considers the internal control system to be adequate for the

Company. The Audit Committee reviews the scope and scale of the

non-audit services undertaken by the auditors in order to ensure

that their independence and objectivity is safeguarded. The

Directors recognise the business will increase in complexity when

it undertakes a corporate transaction and they will review the

internal control system to ensure it responds to any change that

the appropriate time.

Report of the Remuneration Committee

The Remuneration Committee monitors the remuneration policies of

the Company to ensure that they are consistent with its business

objectives. Its terms of reference include the recommendation and

execution of policy on Director and executive management

remuneration and for reporting decisions made to the Board. The

Committee determines the individual remuneration package of the

Board.

The duties of the Committee are to:

-- determine and agree with the Board the framework or broad

policy for the remuneration of the each of the directors;

-- within the terms of the agreed policy, determine individual

remuneration packages;

-- determine the contractual terms on termination and individual

termination payments, ensuring that the duty of the individual to

mitigate loss is fully recognised;

-- in determining individual packages and arrangements, give due

regard to the comments and recommendations of the Listing

Rules;

CORPORATE GOVERNANCE REPORT

(Continued)

-- be told of and be given the chance to advise on any major

changes in employee benefit structures in the Company; and

The Company's Remuneration Policy is designed to provide

remuneration packages to motivate and retain high-calibre

individuals and new talent as required. The Committee takes into

account the principles of sound risk management when setting pay

and takes action to ensure that the remuneration structure and does

not encourage undue risk. The Remuneration Policy is unaudited.

Non-Executive Directors' fees

Purpose - core element of remuneration paid for fulfilling the

relevant role.

Operation - non-executive directors receive a basic fee, paid

monthly, in respect of their board duties. Non-executive directors

are not eligible for annual bonus or other benefits. Expenses

incurred directly in performance of non-executive duties for the

Company may be reimbursed or paid directly on their behalf.

Opportunity - current fee levels can be found in note 7 of the

financial statements. Fees are set at a level which is considered

appropriate to attract or retain non-executive directors of the

calibre required by the Company. Fee levels are normally set by

reference to amounts paid to non-executive directors serving on the

boards of similar sized UK-listed companies, taking into account

the size, responsibility and time commitment of the role.

The sole Executive Director waived his entitlement to fees

during the period.

Model Code

The Directors have voluntarily adopted the Model Code for

directors' dealings contained in the Listing Rules of the UK

Listing Authority. The Board will be responsible for taking all

proper and reasonable steps to ensure compliance with the Model

Code by the Directors.

Compliance with the Model Code is being undertaken on a

voluntary basis and the FCA will not have the authority to (and

will not) monitor the Company's voluntary compliance with the Model

Code, nor to impose sanctions in respect of any failure by the

Company to so comply.

Shareholder relations, communication and dialogue

Open and transparent communication with shareholders is given

high priority and the Directors are available to meet with

shareholders who have specific interests or concerns. The Company

issues its results to shareholders and publishes them on the

Company's website.

Annual General Meeting

At every AGM individual shareholders are given the opportunity

to put questions to the Chairman and to other members of the Board

that may be present. Notice of the AGM is sent to shareholders

before the meeting. Details of proxy votes for and against each

resolution, together with the votes withheld are announced to the

London Stock Exchange and are published on the Company's website as

soon as practical after the meeting.

Ross Andrews

Chairman

28 April 2023

COMPANY INFORMATION

Directors

Ross Andrews

Wei Chen

John Croft

Company secretary Bin Shi

Company number 121560

Registered office 11 Bath Street, St Helier, JE4 8UT, Jersey

Legal advisers to the Company as to English law:

Locke Lord

201 Bishopsgate, Spitalfields, London EC2M 3AB

United Kingdom

Legal advisers to the Company as to Jersey Islands law:

Ogier

44 Esplanade, St Helier JE4 9WG

Jersey

Auditors:

PKF Littlejohn LLP

15 Westferry Circus, Canary Wharf, London, E14 4HD

Registrar:

Link Market Services (Jersey) Limited

12 Castle Street, St Helier JE2 3RT

Jersey

Principal bankers:

Barclays Bank UK PLC

1 Churchill Place

London

E14 5HP

Company website:

https://www.grglondon.com

DIRECTORS' REPORT

The directors present their report together with the audited

financial statements for the year ended 31 December 2022. The

Company is incorporated in Jersey.

Results and dividends

The results for the period are set out in the financial

statements. The directors do not recommend the payment of a

dividend for the period (2021: Nil).

Principal activity and future developments

The principal activity of the Company is to seek acquisition

opportunities, initially focusing on the fintech sector. As

announced on 17 November 2021 the Company entered into non-legally

binding heads of terms to acquire the entire issued share capital

of Bolt Global Limited. On 5 April 2023 the Company announced that

it had ceased discussions with Bolt Global.

Directors' interests in shares and contracts

Directors' interests in the shares of the Company at the date of

this report are disclosed below. There are no requirements for

Directors to hold shares in the Company.

Director Ordinary Shares % held

held

-------------- ---------------- -------

Ross Andrews - -

Wei Chen 3,680,000* 19.19

John Croft - -

*held by Ms Hui Zhou, wife of Mr Wei Chen

Substantial interests

Feng Chen 3,680,000* 19.19

GSB Banking Group 4,480,000 23.36

* Feng Chen is a brother of Mr Wei Chen

Directors' Confirmation

Each of the directors who are a director at the time when the

report is approved confirms that:

(a) so far as each director is aware, there is no relevant audit

information of which the Company's auditors are unaware and;

(b) The director has taken all the steps that ought to have been

taken as a director, in order to be aware of any information needed

by the Company's auditors in connection with preparing their report

and to establish that the Company's auditors are aware of that

information.

Events after the reporting period

(a) In December 2022, the Company announced that it had entered

into an agreement for a 12% unsecured convertible loan note

instrument limited to an aggregate principal amount of GBP100,000.

This loan was fully drawn down on 10 January 2023.

(b) As announced on 17 November 2021 the Company entered into

non-legally binding heads of terms to acquire the entire issued

share capital of Bolt Global Limited. On 5 April 2023 the Company

announced that it had ceased discussions with Bolt Global.

By Order of the Board

Wei Chen

Director

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The directors are responsible for preparing the directors'

report and the financial statements in accordance with applicable

law and regulations.

Jersey Company law requires the directors to prepare financial

statements for each financial period. Under that law the directors

have elected to prepare the financial statements in accordance with

International Financial Reporting Standards as endorsed by European

Union (IFRS endorsed by EU). Under company law the directors must

not approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

Company and of the profit or loss of the Company for that

period.

In preparing these financial statements, the directors are

required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and estimates that are reasonable and prudent;

-- state whether the financial statements have been prepared in

accordance with IFRS endorsed by EU ; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the company will

continue in business.

The directors are responsible for keeping proper accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements comply with the Companies (Jersey) Law

1991. They are also responsible for safeguarding the assets of the

Company and hence for taking reasonable steps for the prevention

and detection of fraud and other irregularities.

The maintenance and integrity of the Group's website is the

responsibility of the Directors; the work carried out by the

auditors does not involve the consideration of these matters and,

accordingly, the auditors accept no responsibility for any changes

that may have occurred in the accounts since they were initially

presented on the website. Legislation in Jersey governing the

preparation and dissemination of the accounts and the other

information included in annual reports may di er from legislation

in other jurisdictions.

INDEPENT AUDITOR'S REPORT TO THE MEMBERS OF GOLDEN ROCK GLOBAL

PLC

Opinion

We have audited the financial statements of Golden Rock Global

Plc (the 'company') for the year ended 31 December 2022 which

comprise the Statement of Comprehensive Income, the Statement of

Financial Position, the Statement of Changes in Equity, the

Statement of Cash Flows and notes to the financial statements,

including significant accounting policies. The financial reporting

framework that has been applied in their preparation is applicable

law and EU-endorsed IFRS.

In our opinion, the financial statements:

-- give a true and fair view of the state of the company's

affairs as at 31 December 2022 and of its loss for the year then

ended;

-- have been properly prepared in accordance with International

Financial Reporting Standards as adopted by the EU ('IFRS');

and

-- have been prepared in accordance with the requirements of the Companies (Jersey) Law 1991.

Basis for opinion

We conducted our audit in accordance with International

Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our

responsibilities under those standards are further described in the

Auditor's responsibilities for the audit of the financial

statements section of our report. We are independent of the company

in accordance with the ethical requirements that are relevant to

our audit of the financial statements in the UK, including the

FRC's Ethical Standard as applied to listed public interest

entities, and we have fulfilled our other ethical responsibilities

in accordance with these requirements. We believe that the audit

evidence we have obtained is sufficient and appropriate to provide

a basis for our opinion.

Material uncertainty related to going concern

We draw attention to note 4c) to the financial statements which

states that the Company's ability to continue as a going concern is

dependent on the ability to raise further funding in the coming 12

months. As stated in note 4c), these events or conditions, along

with the other matters as set forth in note 4c), indicate that a

material uncertainty exists that may cast significant doubt on the

company's ability to continue as a going concern. Our opinion is

not modified in respect of this matter.

In auditing the financial statements, we have concluded that the

director's use of the going concern basis of accounting in the

preparation of the financial statements is appropriate. Our

evaluation of the directors' assessment of the company's ability to

continue to adopt the going concern basis of accounting included

the following;

-- Reviewed managements forecasts for the 12 month period from

the expected date of sign-off and challenged the inputs relating to

expenses forecast and injection of cashflow including expected

expenses to be incurred;

-- Verified the post year end receipt of funds from the issue of the convertible loan note; and

-- Enquired with management of any post year end events that

would cause significant doubt on the company's ability to continue

as a going concern.

Our responsibilities and the responsibilities of the directors

with respect to going concern are described in the relevant

sections of this report.

Our application of materiality

The scope of our audit was influenced by our application of

materiality. The quantitative and qualitative thresholds for

materiality determine the scope of our audit and the nature, timing

and extent of our audit procedures.

The materiality for the financial statements as a whole was set

at GBP8,500 (2021: GBP4,600), based on a benchmark of 5% of loss

before tax. Loss before tax was used as the basis for calculating

materiality as the company is loss making due to the fact that the

company is a shell and expenditure focus is key to investors.

Performance materiality was calculated at GBP6,800 (2021: GBP3,680)

or 80% of materiality for the financial statements as a whole. We

have set the performance materiality at 80% of the overall

financial statements materiality to reflect the risk associated

with the financial statements based on our experience of prior year

audits.

We have agreed with the audit committee that we would report any

individual audit difference in excess of GBP425 (2021: GBP230) as

well as differences below this threshold that, in our view,

warranted reporting on qualitative grounds.

Our approach to the audit

In designing our audit, we determined materiality, as above, and

assessed the risk of material misstatement in the financial

statements. In particular, we looked at areas involving significant

accounting estimates and judgements by the directors, such as going

concern assumption, and considered future events that are

inherently uncertain. We also addressed the risk of management

override of internal controls, including evaluating whether there

was evidence of bias by the directors that represented a risk of

material misstatements due to fraud. The company's key accounting

function is based in the United Kingdom and our audit was performed

remotely with regular contact with the company throughout.

Key Audit Matters

Key audit matters are those matters that, in our professional

judgment, were of most significance in our audit of the financial

statements of the current period and include the most significant

assessed risks of material misstatement (whether or not due to

fraud) we identified, including those which had the greatest effect

on: the overall audit strategy, the allocation of resources in the

audit; and directing the efforts of the engagement team. These

matters were addressed in the context of our audit of the financial

statements as a whole, and in forming our opinion thereon, and we

do not provide a separate opinion on these matters.

Key Audit Matter How our scope addressed this matter

Other income and professional

fee expenses recognition

===========================================

Under ISA (UK) 240, there is a Our work in this area included:

rebuttable presumption that revenue Updating our understanding of the

recognition is a significant fraud information system and related

risk. However, during the year controls relevant to recognition

there was no revenue recognised of other income and expenses..

in the financial statements but Substantive transactional testing

we identified a risk in respect of other income and professional

of the recognition of other income fees recognised in the financial

and recognition of corresponding statements,

expenses against the income. Reviewing the contract terms and

conditions and ensuring that conditions

In the prior year there was an set out have been met for the other

agreement was made between Golden income to be recognised; Confirmed

Rock Global (GRG) management and the treatment of the other income

a third party, whereby the third and professional fees is in accordance

party will reimburse the professional with the terms of the accounting

fees relating to the acquisition standards; and

by the Company of the third party. Reviewed of post year-end invoices

The fees required to be reimbursed and payments to ensure completeness

by are recorded as professional of professional fees recorded in

expenses in the Company's books the accounting period.

and also as other income. Other income has been appropriately

recorded within the financial statements.

There is a risk relating to the

complete recognition of such other

income and expenses in GRG financial

statements. We have considered

it as a key audit matter due to

its quantum and also being new

in the period.

===========================================

Other information

The other information comprises the information included in the

annual report, other than the financial statements and our

auditor's report thereon. The directors are responsible for the

other information contained within the annual report(8) . Our

opinion on the financial statements does not cover the other

information and, except to the extent otherwise explicitly stated

in our report, we do not express any form of assurance conclusion

thereon. Our responsibility is to read the other information and,

in doing so, consider whether the other information is materially

inconsistent with the financial statements or our knowledge

obtained in the course of the audit, or otherwise appears to be

materially misstated. If we identify such material inconsistencies

or apparent material misstatements, we are required to determine

whether this gives rise to a material misstatement in the financial

statements themselves. If, based on the work we have performed, we

conclude that there is a material misstatement of this other

information, we are required to report that fact.

We have nothing to report in this regard.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the company

and its environment obtained in the course of the audit, we have

not identified material misstatements in the strategic report or

the directors' report.

We have nothing to report in respect of the following matters in

relation to which the Companies (Jersey) Law 1991 requires us to

report to you if, in our opinion:

-- adequate accounting records have not been kept, or returns

adequate for our audit have not been received from branches not

visited by us; or

-- the financial statements are not in agreement with the accounting records and returns; or

-- we have not received all the information and explanations we require for our audit.

Responsibilities of directors

As explained more fully in the Statement of Directors'

Responsibilities, the directors are responsible for the preparation

of the financial statements and for being satisfied that they give

a true and fair view, and for such internal control as the

directors determine is necessary to enable the preparation of

financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, the directors are

responsible for assessing the company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the company or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material

misstatement, whether due to fraud or error, and to issue an

auditor's report that includes our opinion. Reasonable assurance is

a high level of assurance but is not a guarantee that an audit

conducted in accordance with ISAs (UK) will always detect a

material misstatement when it exists. Misstatements can arise from

fraud or error and are considered material if, individually or in

the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial

statements.

Irregularities, including fraud, are instances of non-compliance

with laws and regulations. We design procedures in line with our

responsibilities, outlined above, to detect material misstatements

in respect of irregularities, including fraud. The extent to which

our procedures are capable of detecting irregularities, including

fraud is detailed below:

-- We obtained an understanding of the company and the sector in

which they operate to identify laws and regulations that could

reasonably be expected to have a direct effect on the financial

statements. We obtained our understanding in this regard through

discussion with management and audit committee industry research

and our cumulative knowledge and experience of the sector, and

including obtaining and reviewing supporting documentation,

concerning the company's policies and procedures relating to:

o identifying, evaluating and complying with laws and

regulations and whether they were aware of any instance of

non-compliance;

o detecting and responding to the risks of fraud and whether

they have knowledge of any actual, suspected or alleged fraud;

and

o the internal controls established to mitigate risks related to

fraud or non-compliance with laws and regulations.

-- We determined the principal laws and regulations relevant to

the company in this regard to be those arising from the Companies

(Jersey) Law 1991, Listing Rules, and relevant tax legislation,

rules applicable to issuers on LSE standard List Main Market,

including the FCA Listing Rules and the Disclosure Guidance and

Transparency Rules.

-- We designed our audit procedures to ensure the audit team

considered whether there were any indications of non-compliance by

the company with those laws and regulations. These procedures

included, but were not limited to:

o Discussion with management and audit committee regarding

compliance with laws and regulations by the company.

o Review board minutes; and

o Review of regulatory news announcements made throughout and

post year end.

o Obtain an understanding of the legal and regulatory frameworks

that the company operates in, focusing on those laws and

regulations that had a direct effect on the financial statements.

The key laws and regulation we considered in this context included

the Companies (Jersey) Law 1991, Listing Rules, and relevant tax

legislation.

-- We also identified the risks of material misstatement of the

financial statements due to fraud. We considered, that apart from

the non-rebuttable presumption of a risk of fraud arising from

management override of controls, that there is no other fraud risk

to consider.

-- As in all of our audits, we addressed the risk of fraud

arising from management override of controls by performing audit

procedures which included, but were not limited to: the testing of

journals; reviewing accounting estimates for evidence of bias; and

evaluating the business rationale of any significant transactions

that are unusual or outside the normal course of business.

Because of the inherent limitations of an audit, there is a risk

that we will not detect all irregularities, including those leading

to a material misstatement in the financial statements or

non-compliance with regulation. This risk increases the more that

compliance with a law or regulation is removed from the events and

transactions reflected in the financial statements, as we will be

less likely to become aware of instances of non-compliance. The

risk is also greater regarding irregularities occurring due to

fraud rather than error, as fraud involves intentional concealment,

forgery, collusion, omission or misrepresentation.

A further description of our responsibilities for the audit of

the financial statements is located on the Financial Reporting

Council's website at: www.frc.org.uk/auditorsresponsibilities .

This description forms part of our auditor's report.

Use of our report

This report is made solely to the company's members, as a body,

in accordance with our engagement letter dated 8 April 2022 audit.

Our audit work has been undertaken so that we might state to the

company's members those matters we are required to state to them in

an auditor's report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone, other than the company and the company's members as a body,

for our audit work, for this report, or for the opinions we have

formed.

Joseph Archer (Engagement Partner) 15 Westferry Circus

For and on behalf of PKF Littlejohn LLP Canary Wharf

Statutory Auditor London E14 4HD

28 April 2023

STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2022

Year Ended Year Ended

31/12/2022 31/12/2021

GBP GBP

Note

Administrative expenses

(257,892) (149,304)

* Professional fees 7 (55,000) 80,958

(25,429) (24,910)

* Directorship fees

* Other expenses

--------------------- ------------

Total Administrative expenses (338,321) (93,256)

Other Income 172,415 -

Finance income - -

--------------------- ------------

Loss before income tax (165,906) (93,256)

Taxation 9 - -

--------------------- ------------

Loss and Total comprehensive

income for the year (165,906) (93,256)

--------------------- ------------

Earnings per share

Loss from continuing operations

- basic and diluted (pence per

share) 10 (0.87) (0.49)

The notes on pages 20 to 27 form an integral part of these

financial statements.

STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2022

Note 31/12/2022 31/12/2021

GBP GBP

Assets

Current assets

Other Receivables 11 107,085 5,336

Cash and cash equivalents 12 34,335 182,974

----------------- ------------

Total current assets 141,420 188,310

----------------- ------------

Total assets 141,420 188,310

----------------- ------------

Equity and liabilities

Capital and reserves

Ordinary shares 14 191,750 191,750

Share premium 1,605,788 1,605,788

Accumulated losses (1,800,747) (1,634,841)

----------------- ------------

Total equity (3,209) 162,697

----------------- ------------

Liabilities

Current liabilities

Trade creditors 13 101,102 2,613

Accruals 13 43,527 23,000

Total current liabilities 144,629 25,613

----------------- ------------

Total equity and liabilities 141,420 188,310

----------------- ------------

These financial statements were approval by the Board of

Directors for issue on ...28/04/2023...... and signed on

behalf by:

WEI CHEN

Executive Director

The notes on pages 20 to 27 form an integral part of these

financial statements.

STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2022

Note Share Share premium Accumulated Total

capital losses equity

GBP GBP GBP GBP

Balance at 01 January

2021 160,000 1,439,100 (1,541,585) 57,515

Loss and Total comprehensive

income for the year 31,750 166,688 (93,256) 105,182

Balance at 31 December

2021 14 191,750 1,605,788 (1,634,841) 162,697

Loss and Total comprehensive

income for the year - - (165,906) (165,906)

Balance at 31 December

2022 14 191,750 1,605,788 (1,800,747) (3,209)

--------- -------------- ------------ ----------

The notes on pages 20 to 27 form an integral part of these

financial statements.

STATEMENT OF CASH FLOWS

FOR THE YEARED 31 DECEMBER 2022

31/12/2022 31/12/2021

GBP GBP

Cash flows from operating

activities

Loss before tax (165,906) (93,256)

(Increase) / Decrease in receivables (101,749) 171,464

Decrease / (Increase) in payables 119,016 (122,137)

--------------- -------------

Net cash used in operating

activities (148,639) (43,929)

--------------- -------------

Cash flows from financing

activities

Net proceeds from issue of

ordinary shares - 198.438

--------------- -------------

Cash flows from financing

activities - 198.438

--------------- -------------

Net (decrease) / increase

in cash and cash equivalents (148,639) 154,509

Cash and cash equivalents at

beginning of the year 182,974 28,465

Cash and cash equivalents

at end of the year 34,335 182,974

--------------- -------------

The notes on pages 20 to 27 form an integral part of these

financial statements.

No net debt reconciliation as the Company has no debt.

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 31 DECEMBER 2022

1. GENERAL INFORMATION

The Company was incorporated and registered in Jersey as a

public company limited by shares on 17 June 2016 under the

Companies (Jersey) Law 1991, as amended, with the name Golden Rock

Global plc, and registered number 121560.

The Company's registered office is located at 11 Bath Street, St

Helier, JE4 8UT, Jersey.

2. PRINCIPAL ACTIVITIES

The principal activity of the Company is to seek acquisition

opportunities, focusing on the Financial and Technology sector.

3. RECENT ACCOUNTING PRONOUNCEMENT

There are a number of standards and interpretations which have

been issued by the International Accounting Standards Board that

are effective for the year ended 31 December 2022:

Applied in 2022:

IFRS Particular Effective

Date

Amendments to IFRS Reference to the Conceptual Framework 1st January

3 2022

-------------------------------------- ------------

Amendments to IAS Cost of Fulfilling a Contract 1st January

37 Framework 2022

-------------------------------------- ------------

Amendments to IAS Property, Plant and Equipment: 1st January

16 Proceeds before Intended Use 2022

-------------------------------------- ------------

Not yet effective:

IFRS Particular Effective

Date

Amendments to IAS Classification of Liabilities 1st January

1 as Current or Non-current 2023

--------------------------------------- ----------------------

Amendments to IAS Definition of Accounting Estimates 1st January

8 2023

--------------------------------------- ----------------------

Amendments to IAS Deferred Tax Related to Assets

12 and Liabilities arising from 1st January

a Single Transaction 2023

--------------------------------------- ----------------------

Amendments to IFRS Sale or Contribution of Assets Deferred indefinitely

10 and IAS 28 between an Investor and its Associate by amendments

or Joint Venture made in December

2015

--------------------------------------- ----------------------

Amendments to IFRS Insurance Contracts 1st January

17 2023

--------------------------------------- ----------------------

The Directors do not believe these standards and interpretations

will have a material impact on the financial statements. Those

applied during the year did not have a material impact on the

financial statements.

4. ACCOUNTING POLICIES

a) Basis of preparation

The financial information has been prepared in accordance with

International Financial Reporting Standards ("IFRS") as adopted by

the European Union and prepared on a going concern basis, under the

historic cost convention.

The financial information is presented in Pounds Sterling (GBP)

to the nearest pound, which is the Company's functional and

presentation currency.

b) Foreign currency translation

The financial statements of the Company are presented in the

currency of the primary environment in which the Company operates

(its functional currency). Foreign currency transactions are

translated into the functional currency using the exchange rates

prevailing at the dates of the transactions. Foreign exchange gains

or losses resulting from the settlement of such transactions and

from the translation at year end exchange rates of monetary assets

and liabilities denominated in foreign currencies are recognised in

profit or loss.

NOTES TO THE FINANCIAL STATEMENTS (CONT'D)

4. ACCOUNTING POLICIES (CONT'D)

c) Going Concern

The financial statements have been prepared on the assumption

that the Company is a going concern. When assessing the foreseeable

future, the directors have looked at a period of 12 months from the

date of approval of this report. Despite cash being received post

year end from the convertible loan note, the Company will need to

raise additional funds in order to meet its day-to-day working

capital requirements. The Directors are confident in their ability

to raise sufficient capital from new shareholders or if necessary,

obtain alternative sources of funding. Whilst the Directors

recognise that there is significant material uncertainty around

going concern as a result of the current economic uncertainty and

2022 trading results, the accounts have still been prepared on a

going concern basis, which is supported by confidence over the

ability to raise sufficient funds through the issue of further

equity should the need arise. The Board refers shareholders to the

Auditor's Report on page 11 and in particular to the paragraph

headed Material uncertainty related to going concern.

d) Financial instruments

Initial recognition

A financial asset or financial liability is recognised in the

statement of financial position of the Company when it arises or

when the Company becomes part of the contractual terms of the

financial instrument.

Classification

Financial assets at amortised cost

The Company measures financial assets at amortised cost if both

of the following conditions are met:

1) the asset is held within a business model whose objective is

to collect contractual cash flows; and

2) the contractual terms of the financial asset generating cash

flows at specified dates only pertain to capital and interest

payments on the balance of the initial capital.

Financial assets which are measured at amortised cost, are

measured using the Effective Interest Rate Method (EIR) and are

subject to impairment. Gains and losses are recognised in profit or

loss when the asset is derecognised, modified or impaired.

Financial liabilities at amortised cost

Financial liabilities measured at amortised cost using the

effective interest rate method include current borrowings and trade

and other payables that are short term in nature. Financial

liabilities are derecognised if the Company's obligations specified

in the contract expire or are discharged or cancelled.

Amortised cost is calculated by taking into account any discount

or premium on acquisition and fees or costs that are an integral

part of the effective interest rate ("EIR"). The EIR amortisation

is included as finance costs in profit or loss. Trade payables

other payables are non-interest bearing and are stated at amortised

cost using the effective interest method.

Derecognition

A financial asset is derecognised when:

1) the rights to receive cash flows from the asset have expired, or

2) the Company has transferred its rights to receive cash flows

from the asset or has undertaken the commitment to fully pay the

cash flows received without significant delay to a third party

under an arrangement and has either (a) transferred substantially

all the risks and the assets of the asset or (b) has neither

transferred nor held substantially all the risks and estimates of

the asset but has transferred the control of the asset.

NOTES TO THE FINANCIAL STATEMENTS (CONT'D)

4. ACCOUNTING POLICIES (CONT'D)

d) Financial instruments

Impairment

The Company recognises a provision for impairment for expected

credit losses regarding all financial assets. Expected credit

losses are based on the balance between all the payable contractual

cash flows and all discounted cash flows that the Company expects

to receive. Regarding trade receivables, the Company applies the

IFRS 9 simplified approach in order to calculate expected lifetime

credit losses. Therefore, at every reporting date, provision for

losses regarding a financial instrument is measured at an amount

equal to the expected credit losses over its lifetime without

monitoring changes in credit risk. To measure expected credit

losses, trade receivables and contract assets have been grouped

based on shared risk characteristics.

e) Cash and cash equivalents

Cash and cash equivalents includes cash in hand, deposits held

on call with banks and other short term (having maturity within 3

months) highly liquid investments that are readily convertible into

known amounts of cash and which are subject to an insignificant

risk of changes in value.

f) Share capital

Financial instruments issued by the Company are classified as

equity only to the extent that they do not meet the definition of a

financial liability or financial asset.

The Company's ordinary shares are classified as equity

instruments.

g) Earnings per share

Basic earnings per share is computed using the weighted average

number of shares outstanding during the year.

h) Other income

Other income includes professional fees payable by a third party

in respect of the aborted reverse take-over transaction and are

recognised based on an agreement with the third party to pay

invoiced professional fees associated with the aborted

transaction..

5. ACCOUNTING ESTIMATES AND JUDGEMENTS

Preparation of financial information in conformity with IFRS

requires management to make judgements, estimates and assumptions

that affect the application of accounting policies and the reported

amounts of assets, liabilities, income and expenses. The estimates

and associated assumptions are based on historical experience and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making

judgements about carrying values of assets and liabilities that are

not readily apparent from other sources.

It is the Directors' view that, other than the material

uncertainty related to going concern, there are no significant

areas of estimation, uncertainty and critical judgements in

applying accounting policies that have significant effect on the

amount recognised in the financial information for the period.

6. FINANCIAL RISK MANAGEMENT

a) Categories of financial instruments

The carrying amounts of the Company 's f inancial assets and

liabilities as at the end of the reporting year are as follows:

2022 2021

GBP GBP

Financial assets at amortised cost

Cash and cash equivalent 34,335 182,974

Other receivables 107,085 5,336

Total: 141,420 188,310

Financial liabilities at amortised cost

Trade creditors 101,102 2,613

Accruals 43,527 23,000

-------- ----------

Total: 144,629 25,613

-------- ----------

Cash at bank earns interest at floating rates based

on daily bank deposit rates.

b) Financial risk management objectives and policies.

The Company is exposed to a variety of financial risks: market

risk (including currency risk), credit risk and liquidity risk. The

risk management policies employed by the Company to manage these

risks are discussed below. The primary objectives of the financial

risk management function are to establish risk limits, and then

ensure that exposure to risk stays within these limits. The

operational and legal risk management functions are intended to

ensure proper functioning of internal policies and procedures to

minimise operational and legal risks.

i) Market risk

Market risk is not material.

ii) Credit risk

Credit risk refers to the risk that counterp ar ty will default

on its contractual obligations resulting in financial loss to the

Company. Credit allowances are made for estimated losses that have

been incurred by the reporting date. The maximum exposure is

GBP141,420 as on 31 December 2022.

iii) Liquidity risk

Liquidity risk is the risk that the Company will encounter

difficulty in meeting the obligations associated with its financial

liabilities. The Company's approach to managing liquidity is to

ensure, as far as possible, that it will always have sufficient

liquidity to meet its liabilities when due, under both normal and

stressed conditions, without incurring unacceptable losses or

risking damage to the Company's reputation. All financial

liabilities currently have a short payment times between 0 and 30

days, therefore no further analysis has been provided.

6. SEGMENT REPORTING

IFRS 8 defines operating segments as those activities of an

entity about which separate financial information is available and

which are evaluated by the Board of Directors to assess perfo rm

ance and determine the allocation of resources. The Board of

Directors are of the opinion that under IFRS 8 the Company has only

being one operating segment that is the entire company, being a

cash shell seeking investment opportunities. The Board of Directors

assess the perfo rm ance of the operating segment using financial

information which is measured and presented in a m ann er

consistent with that in the Financial Statements. Segmental

reporting will be considered in light of the development of the

Company's business over the next reporting period.

NOTES TO THE FINANCIAL STATEMENTS (CONT'D)

7. STAFF COSTS AND KEY MANAGEMENT EMOLUMENTS

Year ended Year ended

31/12/2022 31/12/2021

GBP GBP

Key management emoluments

Remuneration (55,000) 80,958

--------------- -------------------

The annual remuneration of the key management was as follows,

with no other cash or non-cash benefits. All amounts are short-term

in nature.

GBP GBP

Executive Directors

Wei Chen - -

Non-executive Directors

Directors fees charged for the

year

Ross Andrews (30,000) (25,625)

John Croft (25,000) (20,917)

Directors fees waived during the

year

Wei Chen - 37,500

Feng Chen (Resigned) - 45,000

Bin Shi (Resigned) - 45,000

--------------- ---------------

(55,000) 80,958

--------------- ---------------

In 2021, the other directors have waived their accumulated

accrued remunerations with a total amount of GBP127,500 which was

deducted from the Administrative Expenses.

8. AUDITORS' REMUNERATION

The following remuneration was received by the Company's auditors: Year ended Year ended

31/12/2022 31/12/2021

GBP GBP

Remuneration receivable for auditing

the financial statements for 22,500 17,500

the auditors

Non-audit service fees 46,400 -

9. TAXATION

The Company is incorporated in Jersey, and its activities are

subject to taxation at a rate of 0%.

10. EARNINGS PER SHARE

The Company presents basic and diluted earnings per share

information for its ordinary shares. Basic earnings per share are

calculated by dividing the profit attributable to ordinary

shareholders of the Company by the weighted average number of

ordinary shares in issue during the reporting period. Diluted

earnings per share are determined by adjusting the profit

attributable to ordinary shareholders and the weighted average

number of ordinary shares outstanding for the effects of all

dilutive potential ordinary shares.

NOTES TO THE FINANCIAL STATEMENTS (CONT'D)

Year ended Year ended31 December

31 December 2021

2022

Loss attributable

to ordinary shareholders GBP165,906 GBP93,256

Weighted average

number of shares 19,175,000 19,175,000

Earnings per

share (expressed

as pence per

share) (0.87) (0.49)

11. TRADE AND OTHER RECEIVABLES

2022 2021

GBP GBP

Other receivables 107,085 5,336

--------- ----------

Other receivables include the professional fees payable by a

third party in respect of the aborted reverse take-over

transaction.

12. CASH AND CASH EQUIVALENTS

2022 2021

GBP GBP

Cash at bank equivalents 34,335 182,974

-------- ----------

Cash at bank earns interest at floating rates based on daily

bank deposit rates.

13. TRADE AND OTHER PAYABLES

2022 2021

GBP GBP

Trade creditors 101,102 2,613

Accruals 43,527 23,000

--------- ----------

Accruals and other payables 144,629 25,613

--------- ----------

Trade creditors and Accruals include professional fees and

payable by a third party in respect of the aborted reverse

take-over transaction.

NOTES TO THE FINANCIAL STATEMENTS (CONT'D)

14. SHARE CAPITAL

Number Nominal

of shares value

GBP

Authorised

Ordinary shares of GBP 0.01 each 48,000,000 480,000

Issued and fully paid

On incorporation 100 100

Subdivided share capital 9,900 -

----------- --------

10,000 100

Issue of shares upon placing 19,165,000 191,650

----------- --------

At 31 December 2021 19,175,000 191,750

At 31 December 2022 19,175,000 191,750

=========== ========

The issued shares have nominal value of each share of GBP0.01

and are fully paid. There are no restrictions on the distribution

of dividends and the repayment of capital .

In 23 February 2021, the company issued warrant certificates to

certain parties. Constitute 4,055,000 warrants to subscribe for up

to 4,055,000 new ordinary shares in the capital of the company.

1,587,500 warrants are granted to each of the two new investors and

880,000 warrants are granted to the Chairman and Mr Croft, all at

the exercise price of GBP0.0625 per ordinary share. These warrants

are subject to the satisfaction of various conditions detailed in

the warrant instrument and they are exercisable within 2-year

period commencing on the date of the warrant instrument. The number

of warrants exercisable as on 31 December 2022 is 4,055,000.

15. CAPITAL MANAGEMENT

The Company manages its capital to ensure that it will be able

to continue as a going concern while maximising the ret ur n to

shareholders through the optimisation of the balance between debt

and equity.

The Company reviews the capital structure on an on-going basis.

As part of this review, the directors consider the cost of capital

and the risks associated with each class of capital. The Company

will balance its overall capital s tr ucture through the payment of

dividends, new share issues and the issue of new debt or the

repayment of existing debt.

The Company entered into an agreement to issue a GBP100,000

convertible loan note instrument on 2 December 2022 and the loan

was fully drawn down on 10 January 2023.

16. RELATED PARTY TRANSACTIONS

There is no ultimate controlling party.

The remuneration of the Directors, the key management personnel

of the Company, is set out in note 7.

On 5 December 2022, the Company entered into a c onvertible loan

note agreement with Wei Chen, a director, for aggregate gross

proceeds of GBP100,000, and the loan was fully drawn down on 10

January 2023.

17. SUBSEQUENT EVENTS

(a) In December 2022, the Company announced that it had entered

into an agreement for a 12% unsecured convertible loan note

instrument limited to an aggregate principal amount of GBP100,000.

This loan was fully drawn down on 10 January 2023.

(b) As announced on 17 November 2021 the Company entered into

non-legally binding heads of terms to acquire the entire issued

share capital of Bolt Global Limited. On 5 April 2023 the Company

announced that it had ceased discussions with Bolt Global.

Enquiries

Golden Rock Global plc

Ross Andrews, Chairman

+44 (0) 1534 733 401

www.grglondon.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR NKFBDQBKDCQB

(END) Dow Jones Newswires

April 28, 2023 10:29 ET (14:29 GMT)

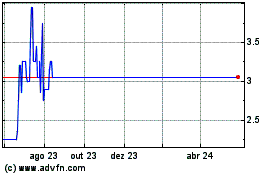

Golden Rock Global (LSE:GCG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

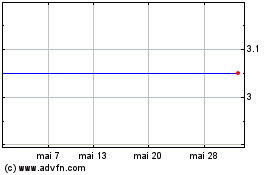

Golden Rock Global (LSE:GCG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024