Merit Group PLC Trading Update (3416Y)

04 Maio 2023 - 3:00AM

UK Regulatory

TIDMMRIT

RNS Number : 3416Y

Merit Group PLC

04 May 2023

4 May 2023

Merit Group plc

("Merit", the "Company" or "the Group")

T rading update

Merit Group Plc (AIM:MRIT), the data and intelligence business,

is pleased to announce a positive post year end update on its

financial trading performance for the year ended 31 March 2023

("FY23").

The Group expects to report continuing operational revenues in

FY23 of approximately GBP18.6m and Adjusted EBITDA(1) from

continuing operations, ahead of market expectations(2) by around

20%, at no less than GBP2.6million. The Group had net debt of

GBP2.5m as at 31 March 2023.

The Group expects its FY23 financial results statement to

reflect the significant progress made in the year which

includes;

-- the disposal of assets / businesses and associates that were

not core to the Group's strategy of building a data and

intelligence business focused on subscription or recurring

revenue;

-- the settlement of all deferred liabilities, namely the

deferred consideration on the Meritgroup Limited acquisition and

deferred VAT and rent payments built up during the COVID

pandemic;

-- the disposal of the Group's excess office space in London,

which will deliver a significant reduction in the Group's

non-operating overheads for FY24 and beyond;

-- the strengthening of the Group's balance sheet through the

removal of significant property liabilities and the approximately

GBP5m of proceeds from the disposal of non-core assets.

The Board has now turned to the second stage of its plan, a

focus on generating significant value for shareholders.

David Beck, CEO of Merit Group plc, said;

"We now have two strong and profitable operating businesses with

attractive gross and net margins. Within the Dods Political

Intelligence business our revenue is almost entirely subscription

based and within Merit Data & Technology over 85% is recurring

from our long-standing customer base. The Group therefore now has

healthy visibility of earnings. Through our disposal programme we

have removed the seasonality that was previously a feature of our

trading performance. We continue to focus on reducing non-operating

overheads and central costs to ensure that the Group will convert

as much as possible of its operating earnings into cash.

"We are targeting further revenue growth in the new financial

year which, combined with the significant step down in costs

already achieved, will help us drive returns for shareholders."

(1) Adjusted EBITDA is calculated as earnings before tax,

depreciation, amortisation of intangible assets, share based

payments and non-recurring items in respect of continuing

operations

(2) Based on the GBP2.2m EBITDA forecast contained in the most

recent brokers research note, published on 27 March 2023

For further information, please contact:

Merit Group plc

David Beck - CEO

Phil Machray - CFO 020 7593 5500

www.meritgroupplc.com

Canaccord Genuity Limited (Nomad and Broker)

Bobbie Hilliam 020 7523 8150

Harry Pardoe

For the purposes of MAR and Article 2 of Commission Implementing

Regulation (EU) 2016/1055, this announcement is being made on

behalf of the Group by David Beck, Chief Executive Officer.

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310.Upon the publication of this announcement,

this inside information is now considered to be in the public

domain.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAPSDEDDDEFA

(END) Dow Jones Newswires

May 04, 2023 02:00 ET (06:00 GMT)

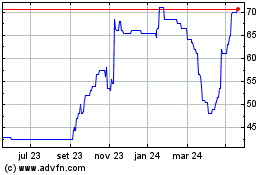

Merit (LSE:MRIT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

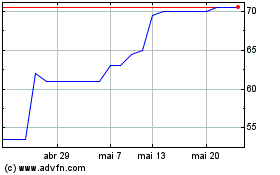

Merit (LSE:MRIT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024