Eurowag Director/PDMR Shareholding (2488Z)

12 Maio 2023 - 5:11AM

UK Regulatory

TIDMWPS

RNS Number : 2488Z

Eurowag

12 May 2023

W.A.G payment solutions plc

(the "Company" or "Eurowag")

Notification and public disclosure of transactions by PDMR

Acceptance of Options

W.A.G payment solutions plc (the "Company") a leading

pan-European integrated payments and mobility platform focused on

the Commercial Road Transportation ("CRT") industry, today

announces that on 12 May 2023 the following awards over ordinary

shares of 1 pence each in the Company were accepted by the

following person(s) discharging managerial responsibilities:

Participant Position Award Number of Shares

under Award

Chief Financial Performance Share

Oskar Zahn Officer Award 682,395

----------------- ------------------- -----------------

Chief Financial Buy-Out Related

Oskar Zahn Officer Awards 775,570

----------------- ------------------- -----------------

The Performance Share Award was granted on 20 April 2023 under

the Company's Performance Share Plan and will ordinarily vest on

the third anniversary of its grant, subject to Mr Zahn's continued

service and the extent to which the Performance Share Award's

performance conditions (described below) are satisfied.

The performance vesting of a distinct 60 per cent of the

Performance Share Award (the "EPS Part") will be dependent on the

Company's adjusted basic earnings per share for its financial year

ending 31 December 2025 ("EPS 2025"). One-quarter of the EPS Part

shall vest for EPS 2025 of 11.5 cents and full vesting of the EPS

Part shall apply for EPS 2025 of 14.24 cents or better. Pro-rata

vesting of the EPS Part shall apply between such targets.

The performance vesting of a distinct 40 per cent of the

Performance Share Award (the "TSR Part") will be dependent on the

Company's total shareholder return ("TSR") performance over the

performance period 1 January 2023 to 31 December 2025 relative to

the TSR performance (over the same period) of a comparator group of

companies (the constituents of the FTSE 250 Index (excluding

investment trusts) as at the start of the performance period).

The Performance Share Award is structured as an option with a

nominal option price of 1p per share and is subject to a two-year

post vesting holding period (net of sales for applicable

taxes).

The Buy-Out Related Awards were granted on 20 April 2023 under a

one-off arrangement delivered under the Company's Employee Share

Plan to recognise the value of incentive awards granted by his

previous employer that were forfeited on his departure from his

previous employment.

The Buy-Out Related Awards comprise five distinct Awards as

follows:

Award Notes Normal Vesting Number of Shares

Date under Award

Award Relates to a forfeited time

I based award 10 May 2026 37,689

--------------------------------- ---------------- -----------------

Award Relates to a forfeited time

II based award 8 March 2027 45,240

--------------------------------- ---------------- -----------------

Award Relates to a forfeited deferred

III bonus award 8 March 2024 79,233

--------------------------------- ---------------- -----------------

Award Relates to a forfeited LTIP

IV award 10 May 2024 251,391

--------------------------------- ---------------- -----------------

Award Related to a forfeited LTIP

V award 8 March 2025 362,017

--------------------------------- ---------------- -----------------

The Buy-Out Related Awards shall ordinarily vest on their Normal

Vesting Date subject to Mr Zahn's continued service through to the

relevant dates and in the case of Award IV and Award V to the

extent to which their performance conditions are met.

Award IV is subject to the same EBITDA per share related

performance conditions attached to the main senior awards granted

to others under the Company's Performance Share Plan at the time of

the Company's admission to the London Stock Exchange in 2021. Award

V is subject to the same EPS and relative TSR performance

conditions attached to senior awards granted to others under the

Company's Performance Share Plan in 2022. Full details of such

performance conditions have been previously reported in the

Company's Annual Reports.

The Buy-Out Related Awards are each structured as an option with

a nominal option price of 1p per share and Award IV and Award V are

subject to a two-year post vesting holding period (net of sales for

applicable taxes).

The information set out below is provided in accordance with the

requirements of Article 19(3) of the Market Abuse Regulation (EU)

No 596/2014.

Details of the person discharging managerial responsibilities

1 / person closely associated

a) Name Oskar Zahn

------------------------------- -------------------------------------------

Reason for Notification

2

----------------------------------------------------------------------------

a) Position/status Chief Financial Officer

------------------------------- -------------------------------------------

b) Initial notification/Amendment Initial Announcement

------------------------------- -------------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

----------------------------------------------------------------------------

a) Name W.A.G payment solutions plc

------------------------------- -------------------------------------------

b) LEI 213800HU63CWV5J8YK95

------------------------------- -------------------------------------------

Details of the transaction(s): section to be repeated

4 for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

----------------------------------------------------------------------------

a) Description of the Ordinary Shares of 1 pence each

financial instrument, ISIN GB00BLGXWY71

type of instrument

Identification code

------------------------------- -------------------------------------------

b) Nature of the transaction Acceptance of awards under (1) the

Company's Performance Share Plan and

(2) a one-off arrangement delivered

under the Company's Employee Share

Plan.

------------------------------- -------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

1. Nil 682,395

--------------------

2. Nil 775,570

--------------------

------------------------------- -------------------------------------------

d) Aggregated information

* Aggregated volume 1,457,965

Nil

* Price

------------------------------- -------------------------------------------

e) Date of the transaction 12 May 2023

------------------------------- -------------------------------------------

f) Place of the transaction Outside of a trading venue

------------------------------- -------------------------------------------

ENQUIRIES:

Eurowag

Carla Bloom

Head of Investor Relations and Communications

+44 (0) 789 109 4542

investors@eurowag.com

Instinctif Partners

Tim McCall, Galyna Kulachek, Bryn Woodward

IR and international media +44 (0)20 7457 2020

eurowag@instinctif.com

About Eurowag

Eurowag was founded in 1995 and is a leading pan-European

integrated payments and mobility platform focused on the Commercial

Road Transportation ("CRT") industry. Eurowag's innovative

solutions makes life simpler for small and medium businesses in the

CRT industry across Europe through its unique combination of

payments solutions, seamless technology, a data-driven digital

ecosystem and high-quality customer service.

https://investors.eurowag.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHSFWSAEEDSESI

(END) Dow Jones Newswires

May 12, 2023 04:11 ET (08:11 GMT)

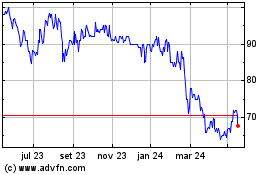

W.a.g Payment Solutions (LSE:WPS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

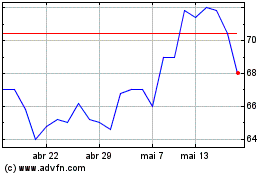

W.a.g Payment Solutions (LSE:WPS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025