TIDMSPDI

RNS Number : 4508E

Secure Property Dev & Inv PLC

30 June 2023

Secure Property Development & Invest PLC/ Index: AIM / Epic:

SPDI / Sector: Real Estate

30 June 2023

Secure Property Development & Investment PLC ('SPDI' or 'the

Company')

2022 Annual Results

Secure Property Development & Investment PLC, the AIM quoted

South Eastern European focused property company, is pleased to

announce its full year audited financial results for the year ended

31 December 2022.

Corporate Overview

The Company maintains its strategy to maximise value for

shareholders through the contribution of SDPI's property portfolio

to Arcona Property Fund (APF)

Significant asset backing behind the Company:

-- NAV per share stood at 9p a share as at 31 December 2022 -

37% higher than share price at year end and 38% higher than the

current share price

-- Having completed Stage 2 with APF, SPDI now has a total

holding of 1,072,910 shares in Arcona and 259,627 warrants over

shares in Arcona which based on the closing price of Arcona's

shares on 31 December 2022, values the SPDI's stake in Arcona at

c.EUR6.3 million (excluding the issue of the warrants), while based

on the current net asset value per Arcona share (as at 31 March

2022), values the stake at EUR12.75 million (excluding the issue of

the warrants)

Financial Overview

-- Rental and related income decreased during 2022 to

EUR1,649,537 (2021: EUR1,986,857) due to the disposal of assets

during the period

-- EBITDA from total operations of - EUR634,731 (2021: EUR819,431)

-- Operating losses after finance and tax for the year reached EUR1,181,414 (2021: EUR144,828)

Michael Beys, Chairman of the Board, said , "In 2022 we

concluded Stage 2 of the Arcona transaction, making SPDI one of the

largest APF shareholders, and installed our financial advisor in

APF's management team to ensure further value retention and

generation to our shareholders. We are therefore on the path of

transforming SPDI into a broader Central and Eastern Europe

property company, as per our shareholders' mandate."

Copies of the Annual report and Accounts are being posted to

Shareholders today and are available on the Company's website at

www.secure-property.eu .

* *S * *

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014

For further information please visit www.secure-property.eu or

contact:

Lambros Anagnostopoulos SPDI Tel: +357 22 030783

Rory Murphy Strand Hanson Limited Tel: +44 (0) 20 7409 3494

Ritchie Balmer

Jon Belliss Novum Securities Limited Tel: +44 (0) 207 399 9400

Catherine Leftley St Brides Partners Ltd Tel: +44 (0) 20 7236 1177

1. Letter to Shareholders

28 June 2023

2022 experienced contrasting property market forces. On one hand

the global energy crisis and the ensuing inflation which dragged

along the debt interest rates to levels not seen for a couple of

decades raised the property related costs and risk concerns. On the

other hand, the markets that SPDI is present in continued their

post pandemic recovery, with the exception of Ukraine for obvious

reasons. In this environment, and as we presented to our

shareholders last year, SPDI managed to conclude Stage 2 of its

indirect merger with the Amsterdam and Prague listed Arcona

Property Fund N.V. (APF - with assets in Poland, Czech Republic and

Slovakia) that involved the transfer of the remaining Romanian

portfolio to APF. APF is also committed to acquire the remaining

Ukrainian assets, with the transaction being delayed due to the

ongoing war, expected to take place in the future upon

normalization of current conditions .

In parallel, SPDI's Management increased their effort to

monetize any remaining assets that had not yet been sold to APF and

that were to be part of Stage 3, but as the discussions with APF

took much longer than expected and negotiations on their valuation

did not conclude, we opted to monetize them in the broader market.

As such we managed to sell the Kindergarten and the remaining Green

Lake land in Romania at values much higher than those APF was

offering. At the same time almost half of the loan SPDI had

extended to Olympians has by now been repaid (with a small amount

due to be repaid later this year) with the remaining half planned

to be transformed into a 50% equity stake in a Romanian logistics

platform that is to be monetized together with the Innovations

Terminal later this year.

At the moment SPDI owns 26% of APF, plus a number of warrants,

and has our Chairman as one of the three APF supervisory board

members, to facilitate the transition and ensure value retention

and generation for our shareholders. On the liability side, SDPI is

expecting the hearing of its court case in Cyprus against the

seller of its Praktiker Craiova asset so as to settle a liability

that we have provided for, but our legal advisers and our board are

confident will end up to our benefit anyway. During the year we

have reduced even further the Company's operating expenses to a

minimum with most of the executives being paid for part time

employment; a process that was further advanced earlier in 2023

with all executives moving out of the Company and offering their

(part time) services through a third-party services contract. As

SPDI did not reach the minimum size needed, these operating

expenses, despite being at the bottom end of the peer bracket,

weighted substantially on a limited size property company that SPDI

ended being, and became the management's priority to address,

always taking into consideration our fiduciary responsibility to

ensure smooth running and value retention for our Company.

We expect 2023 will be the last year of SPDI operations as we

know them with its net assets turned into APF shares and cash, and

opex being reduced to minimum. When such APF shares and cash are

distributed to our shareholders, subject to, inter alia, all

necessary shareholder/regulatory approvals being obtained and tax

advice, they will be able to either monetise their investment by

selling them or retain them and follow APF's growth into a dividend

issuing pan-East Europe property company, the preferred way of

safeguarding their investment value together with having the option

of further value generation. Management and directors of SPDI are

committed to see the conclusion of this transaction so that they

will ensure the transformation of our Company.

Best regards,

Lambros G. Anagnostopoulos, Chief Executive Officer

2. Management Report

SPDI's core property asset portfolio consists of South Eastern

European prime commercial and industrial real estate, the majority

of which is let to blue chip tenants on long leases. During 2022,

management, in line with the Company's strategy to maximise value

for shareholders, closed two transactions with Arcona Property Fund

N.V (Arcona) as part of the conditional implementation agreement

for the sale of Company's property portfolio, excluding its Greek

logistics property (which has now also separately been sold), in an

all-share transaction to Arcona, an Amsterdam and Prague listed

company that invests in commercial property in Central Europe.

Arcona originally held high yielding real estate investments in

Czech Republic, Poland and Slovakia, with the total agreement

valuing the SPDI NAV at EUR29m, significantly higher than the

current market value of the Company as a whole.

The combination of two complementary asset portfolios is

expected to create a significant European property company,

benefiting both the Company's and Arcona's respective

shareholders.

Following the completion of Stage 1 of the transaction in 2019,

which involved the sale of two land plots in Ukraine and

residential and land assets in Bulgaria and resulted in Company

receiving a total of 593.534 Arcona shares and 144.084 warrants

over Arcona shares, in June 2021, the two parties signed SPA

agreements for Stage 2 of the Arcona transaction. This stage

involves the transfer of the EOS and Delenco assets in Romania and

the Kiyanovskiy and Rozny land plots in Ukraine with a total net

asset value of EUR8,2 million, in exchange for approximately

560.000 new ordinary shares in Arcona and approximately 135.000

warrants over shares in Arcona, as well as EUR1m in cash, subject

to, inter alia, standard form adjustment and finalisation in

accordance with the relevant agreements.

During March and June 2022 the transactions for the sale of EOS

and Delenco were concluded, in exchange for the issue to the

Company of 479.376 new shares in Arcona and 115.543 warrants over

shares in Arcona.

The invasion of Ukraine by Russia during February 2022 suspended

the transfer process of the relevant Ukrainian assets included in

Stage 2 of the transaction. Any development of such process is

expected to take place in the future upon normalization of current

conditions.

Moreover, the war in Ukraine has also affected our standard

local business. In particular, despite submitting the official

request to the City of Kiev to extend the lease of Tsymlyanskiy for

another 5 years in November 2021 (as we have first extension rights

over any other interested party) we have not managed to get an

official approval yet. The first step in the process whereby the

presiding committee of the municipality, before the final approval

by the City Council, did not take place as too many other cases had

accumulated which had time priority over our case. During the

period between 15 December 2021 and 20 January 2022, the committee

did not convene at all as is usual during holiday and vacation

times. Once the holiday season was over, the main focus of the

committee and the City Council unfortunately were on issues not

related to property lease extensions, but rather more pressing

matters for the interests and operational stability of the City of

Kiev. From there on, all decisions have been put on hold due to the

Russian invasion of Ukraine. However, management remains confident

that the Company will be

awarded the lease extension once the war status permits.

In August 2022 the Company signed with Myrian Nes Limited a

Shareholders Agreement for a joint venture for developing logistics

properties in Romania. As part of this agreement the Company will

convert EUR2,5 million of the loan it has extended in 2017 to

Myrian Nes Limited (Olympians Loan) into a 50% equity stake of the

joint venture company. The objective of this new company, which

Myrian Nes is contributing EUR2,5 million in equity funds to, is to

develop a portfolio of logistics properties in Romania with a view

of letting them to third party tenants in a market that has very

low vacancy and has shown substantial strength and resilience in

recent years. The remaining part of the Olympians Loan is being

repaid in regular intervals and is expected to be fully repaid to

the Company during the current period. As part of this joint

venture, the parties have proceeded to the establishment of the

required entities in Cyprus and Romania, while currently are

finalizing discussions with a counterparty for the purchase,

development and lease back of a particular asset.

Moreover, during the period the Company sold its total interest

in the 40.850 sqm land portfolio of the GreenLake project in

Bucharest, Romania, which is not zoned for development, as well as

its interest in the Kindergarten asset in GreenLake. These assets

was planned to be part of Stage 3 of the transaction with Arcona,

but negotiations on price did not concluded, and therefore

Management got higher prices in the market. The sale of the land

portfolio resulted in the full repayment of GreenLake's First Phase

bank loan, leading in turn to the successful monetization of the

remaining developed First Phase units of the associate Green Lake

Development Srl, as well as the settlement, after prolonged

negotiations, of an ongoing overlapping dispute over the GreenLake

land.

Regarding the economic environment in which the Company

operates, the Romanian economy which constitutes the main operating

market of the Company, grew by 4,7% in 2022, better than expected

given the persistent inflation during the year. Growth was driven

by strong consumer spending, which increased 5,5% year-on-year on

the back of the removal of pandemic restrictions and the higher

wages. Inflation rate reached 12% in 2022 while unemployment showed

a marginal increase to 5,6%, keeping the labor market relatively

tight and wage increases high. Real estate investment volume

reached in 2022 the historical milestone of 1,25 bln euros, 36%

higher than the volume registered the previous year, with office

assets representing 62% of the annual volume, while retail assets

attracted 24% and industrial 7%.

Total operating income decreased by 38% during 2022 as a result

of the disposal of assets during the period, leading to a decrease

in net income from operations by 69%.

Table 1

EUR 2022 2021

------------------------------------------------------------------------- ---------------------------------------------------------------------------

Continued Discontinued Total Continued Discontinued Total

Operations Operations Operations Operations

---------------- --------------------- ----------------------- ------------------------- ------------------------ ----------------------- ------------------------

Rental,

Utilities,

Management

& Sale of

electricity

Income 1,143,752 505,785 1,649,537 1,047,137 939,720 1,986,857

Net gain/(loss)

on disposal

of investment

property - (825,392) (825,392) - 653,567 653,567

Income from

Operations 1,143,752 (319,607) 824,145 1,047,137 1,593,287 2,640,424

Asset operating

expenses - (446,380) (446,380) - (763,024) (763,024)

Net Operating

Income 1,143,752 (765,987) 377,765 1,047,137 830,263 1,877,400

Share of

profit/(loss)

and gains from

associates (7,999) 335,533 327,534 - 344,746 344,746

Dividends

income - - - - 175,500 175,500

Net Operating

Income

from

investments 1,135,753 (430,454) 705,299 1,047,137 1,350,509 2,397,646

Administration

expenses (1,097,873) (242,157) (1,340,030) (1,367,129) (211,086) (1,578,215)

Operating

Result

(EBITDA) 37,880 (672,611) (634,731) (319,992) 1,139,423 819,431

Finance Cost,

net 162,704 (652,987) (490,283) 298,663 (854,114) (555,451)

Income tax

expense 17,940 (74,340) (56,400) (51,824) (67,328) (119,152)

Operating

Result after

Finance and

Tax Expenses 218,524 (1,399,938) (1,181,414) (73,153) 217,981 144,828

Other income /

(expenses),

net (3,390) (2,721,353) (2,724,743) 69,643 (12,510) 57,133

One off costs

associated

to Arcona

transaction (182,253) (182,253) (204,101) - (204,101)

Personnel (184,500) - - -

incentives

One off costs

associated

with previous

periods

and

re-financing

activities - - - (90,313) (78,000) (168,313)

One off costs

associated

with new

custodian due

to Brexit - - - (136,750) - (136,750)

Fair value

adjustments

from

Investment

Properties - (1,245,230) (1,245,230) - (754,979) (754,979)

Net gain/(loss)

on disposal

of

subsidiaries - (4,871,809) (4,871,809) 748 - 748

Fair Value

adjustment

on financial

investments (1,071,119) (1,071,119) 683,478 - 683,478

Foreign

exchange

differences,

net (17,647) (165,165) (182,812) (65,147) (253,666) (318,813)

Result for the

year (1,240,385) (10,403,495) (11,643,880) 184,405 (881,174) (696,769)

Exchange

difference on

translation

due to

presentation

currency - (692,906) (692,906) - 64,299 64,299

Total

Comprehensive

Income for the

year (1,240,385) (11,096,401) (12,336,786) 184,405 (816,875) (632,470)

---------------- --------------------- ----------------------- ------------------------- ------------------------ ----------------------- ------------------------

The administration costs, adjusted by the one-off costs,

decreased by 15%, and the recurring EBITDA finally decreased to

-EUR0,63m from EUR0,82m in 2021.

Overall, operating results after finance and tax for the year

decreased to -EUR1,18m as compared to EUR0,14m in 2021.

2.2 Property Holdings

The Company's portfolio at year-end consists of commercial

income producing and residential properties in Romania, as well as

land plots in Ukraine and Romania.

Commercial Property Location Key Features

Innovations Logistics Park

Bucharest, Romania Gross Leaseable Area: 16.570 sqm

-------------------- ----------------------- ---------------------

Anchor Tenant: Favorit Business Srl

-------------------- ----------------------- ---------------------

Occupancy Rate: 80%

------------------------------------------------------------------ ---------------------

Land & Residential Assets Location Key Features

Kiyanovskiy Residence Kiev, Ukraine Plot of land ( th. sqm): 6

Tsymlyanskiy Residence* Kiev, Ukraine Plot of land ( th. sqm): 4

Rozny Lane Kiev, Ukraine Plot of land ( th. sqm): 420

GreenLake (Associate) Romania Sold units during 2022: 4

GreenLake (Associate) Romania Available units (end 2022): 7

* As of November 2021, the Company had already submitted

official request to the City of Kiev to extend the lease of the

property for another 5 years, since it has first extension rights

over any other interested party. The first step in the process

whereby the presiding committee of the municipality, before the

final approval by the City Council, did not place as many other

cases had accumulated which had time priority over our case. During

the period between December 15(th) 2021 and January 20(th) of 2022,

the committee did not convene at all as is usual during holiday and

vacation times. Once the holiday season was over, the main focus of

the committee and the City Council unfortunately were on issues not

related to property lease extensions, but rather more pressing

matters for the interests and operational stability of the City of

Kiev. From there on, all decisions have been put on hold due to the

Russian insurgence of Ukraine. Management remains confident that

the Company will be awarded the lease extension once the war status

permits.

In 2021, the Company's accredited valuers, namely CBRE Ukraine

for the Ukrainian Assets, and NAI RealAct for the Romanian Assets,

remained appointed. The valuations have been carried out by the

appraisers on the basis of Market Value in accordance with the

current Practice Statements contained within the Royal Institution

of Chartered Surveyors ("RICS") Valuation - Global Standards (2017)

(the "Red Book") and are also compliant with the International

Valuation Standards (IVS).

Following disposals of previous periods, SPDI's portfolio has

became more concentrated in terms of geography. At the end of the

reporting period, Romania remains the prime country of operations

(83%) in terms of Gross Asset Value, while in Ukraine (17%) the

Company still has interests in land plots intended to be sold as

part of the Arcona transaction.

In respect of the Company's income generation capacity, Romania

has become gradually the single operating income source.

** Net Operating Income includes NOI from Innovations Logistics

Park, Victini Logistics, EOS Business Park, Praktiker retail

center, Kindergarten, Residential units, GreenLake, as well as

Delenco office building (dividends).

The table below summarizes the main financial position of each

of the Company's assets (representing the Company's participation

in each asset) at the end of the reporting period.

Table 2

2022

------------------------------------------------- -----------------------------

Property Country GAV* EURm Debt * NAV

----------- ------ ------------- ------

Innovations Logistics Park Rom 9,7 6,2 3,5

----------- ------ ------------- ------

Land banking Ukr - Rom 1,9 4,0 -2,1

----------- ------ ------------- ------

Total Value 11,6 10,2 1,4

------ ------------- ------

Other balance sheet items, net ** +11,7

------ ------------- ------

Net Asset Value total 13,1

Market Cap in EUR as at 31/12/2022 (Share price at GBP0,0575) 8,3

Market Cap in EUR as at 23/06/2023 (Share price at GBP0,05625) 8 ,4

Discount of Market Cap in EUR at 23/06/2023 vs NAV at 31/12/2022 -36%

* Reflects the Company's participation at each asset

**Refer to balance sheet and related notes of the financial statements

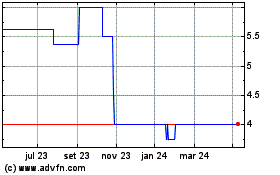

The Net Equity attributable to the shareholders as at 31

December 2022 stood at EUR13,1m vs EUR23,5m in 2021. The table

below depicts the discount of Market Share Price over NAV since

2012.

The NAV per share as at 31 December 2022 stood at GBP 0,09 and

the discount of the Market Value vis a vis the Company's NAV

denominated in GBP stands at 37% at year-end.

2.3 Financial and Risk Management

The Group's overall bank debt exposure at the end of the

reporting period was EUR10,2m (calculating relative to the

Company's percentage shareholding in each), comprising the

following:

a) EUR6,2m finance lease of Innovations Logistics Park with Piraeus Leasing Romania.

b) EUR4,0m being the Company's portion on land plot related debt financing.

Throughout 2022, the Company focused on managing and preserving

liquidity through cash flow optimization. In this context,

Management secured a) collection of scheduled re-payments of loans

provided to third parties, b) continuous sale of residential assets

and c) advancement of discussions related to transaction with

Arcona Property Fund N.V. which in most part materialized in

2022.

2.4 2022 and beyond

During 2023 the Company intends to sell all its assets, and

consequently its main operations are expected to be minimized,

provided that constraints brought by the the current war situation

in Ukraine will successfully be surpassed. Despite such

constraints, Management is working along the guidelines of the

board for the closing of the transaction with Arcona Property Fund

N.V., which will mark effectively the maximization of Company's

value and will give our shareholders the opportunity to gain direct

exposure to an entity of considerably larger size, with a strong

dividend distribution policy, and active in a more diversified and

faster growing region (Central and South Eastern Europe) of the

European property market.

Having already completed during 2022 the transfers of Delenco

and EOS assets in Romania, the Management is currently working

towards completion of the remaining parts of the transaction,

monitoring closely any developments in Ukraine, as well as with all

other open issues which if resolved will effectively turn the

Company having as assets only Arcona shares (including warrants

over shares) and cash.

To that end, as part of the cost reduction process, the Company

has agreed to externalize all HR and office costs in all operating

jurisdictions except Ukraine, resulting in that way in a 35% and

50% reduction vis a vis same costs in 2022 and 2021

respectively.

3. Regional Economic Developments (1)

The Romanian economy experienced in 2022 the second consecutive

year of strong growth following the global reset experienced in

2020 due to the pandemic. Growth reached 4,7% driven by strong

private consumption and robust investment. Private consumption

increased by 5,5% year on year backed by the release of the

restrictions as a result of the pandemic and the high wages.

Moreover, the local investment market reached the historical

milestone of EUR 1,25 bln, 36% higher than the investment volume

registered

the previous year.

Unemployment rate is estimated marginally higher but still in

low levels at 5,6%, keeping the labor market relatively tight and

wage increases high. Inflation peaked during the year at high

levels and closed at 12% at year end, on the back of the high

energy prices and the constantly increasing trend in foods and

services.

Macroeconomic data

Romania 2016 2017 2018 2019 2020 2021 2022f

---- ---- ---- ---- ---- ---- -----

GDP (EUR bn) 170 188 203 223 218 241 286

---- ---- ---- ---- ---- ---- -----

Population (mn) 19,8 19,6 19,5 19,5 19,3 19,3 19,6

---- ---- ---- ---- ---- ---- -----

Real GDP (y-o-y %) 4,8 7,0 4,1 4,1 -3,7 5,9 4,7

---- ---- ---- ---- ---- ---- -----

CPI (average, y-o-y

%) -1,5 1,3 4,6 3,3 2,3 4,1 12

---- ---- ---- ---- ---- ---- -----

Unemployment rate

(%) 5,9 4.3 3,6 3,1 6,1 5,4 5,6

---- ---- ---- ---- ---- ---- -----

Following the invasion of Russia in Ukraine in February 2022,

Ukraine's GDP fell by 29,1% in 2022 as a result of the damages the

war brought in the heavy industry, the power grid and the

agricultural sector, as well as the restricted access to Black Sea

ports that are vital for the export activities of the country.

With Ukraine's grain crop falling to 53 mil tonnes in 2022 from

86 mil tonnes in 2021, and steel production reduced by almost 71%,

export activity declined by 35% in 2022 compared to the previous

year.

The Ukrainian currency, Hryvnia, depreciated significantly

against major currencies. As at the end of 2022, Hryvnia had

depreciated 34% against US dollar and 26% against Euro, compared to

2021 year end. The invasion also affected the assessment of

country's solvency by international rating agencies. Currently

credit ratings have rebound partially with S&P's rating at CCC+

with stable outlook, Moody's one at Caa3 with stable outlook, and

Fitch's at CC.

[1] Sources: World Bank Group, Eurostat, EBRD, National

Institute of Statistics- Romania, National Institute of Statistics

- Ukraine, IMF, European Commission.

4. Real Estate Market Developments (2)

4.1 Romania

Total real estate investment volume in Romania reached in 2022

1,25 bln Euros, representing a 36% y-o-y increase. Bucharest proved

again to be the most liquid real estate market generating almost

three quarters from total annual investment volume driven mainly by

office transactions. Office segment represented 62% of the annual

volume, followed by retail sector (24%) and the industrial/

logistics one (7%).

Compression and stability is the trend that describes yields in

Romania during 2022. Prime office yields remained at 6,75%, while

industrial ones compressed to 7,15% from 7,5%, and retail stood at

6,75% from 7%. Local investors represent 50% of total investment

volume, while foreign investment was driven by South Africans (15%)

and Austrians (10%).

With c.900.000 sq m delivered during 2022, the total modern

industrial/ logistics stock reached c.6,6 million sq m. Almost 50%

of the new deliveries were in Bucharest area, being by far the

largest consumer market in the country. At the end of 2022 the

vacancy rate in Romania's industrial modern stock stood at 4,5%,

while the vacancy rate for Bucharest was 5,8%. Headline rent in

logistic parks registered a 5% increase at 4,1 EUR/sqm/month as a

result of the robust demand and the increase in construction

costs.

4.2 Ukraine

During 2022 even though the land market was seriously affected

by the Russian military invasion, asking prices demonstrated

certain stability and have not decreased significantly. Despite the

extremely low demand observed on the market, the majority of owners

were not willing to sell at reduced prices and preferred even to

withdraw the asset from the market.

[1] Sources : Eurobank, CBRE Research , Colliers International ,

Cushman & Wakefield , Crosspoint Real Estate, Knight Frank,

Coldwell Banker Research, National Institute of Statistics- Romania

, State Statistics Service-Ukraine, NAI Real Act

5. Property Assets

5.1 EOS Business Park - Danone headquarters, Romania

The park consists of 5.000 sqm of land including a class "A"

office building of 3.386 sqm GLA and 90 parking places. It is

located next to the Danone factory, in the North-Eastern part of

Bucharest with access to the Colentina Road and the Fundeni Road.

The ark is very close to Bucharest's ring road and the DN 2

national road (E60 and E85) and is also served by public

transportation. The park is highly energy efficient.

The Company acquired the office building in November 2014. The

complex is fully let to Danone Romania, the French multinational

food company, until 2025. The asset was sold in June 2022 as part

of Stage 2 of the Arcona transaction.

5.2 Delenco office building, Romania

The property is a 10.280 sqm office building, which consists of

two underground levels, a ground floor and ten above-ground floors.

The building is strategically located in the very center of

Bucharest, close to three main squares of the city: Unirii, Alba

Iulia and Muncii, only 300m from the metro station.

The Company acquired 24,35% of the property in May 2015. As at

the end 2021, the building is 99% let, with ANCOM (the Romanian

Telecommunications Regulator) being the anchor tenant (81% of GLA).

The stake in the asset was sold in March and June 2022 as part of

Stage 2 of the Arcona transaction.

5.3 Innovations Logistics Park, Romania

The park incorporates approximately 8.470 sqm of multipurpose

warehousing space, 6.395 sqm of cold storage and 1.705 sqm of

office space. It is located in the area of Clinceni, south west of

Bucharest center, 200m from the city's ring road and 6km from

Bucharest-Pitesti (A1) highway. Its construction was completed in

2008 and was tenant specific. It comprises four separate

warehouses, two of which offer cold storage.

As at the year end the terminal was 80% leased. Anchor tenant

with 46% is Favorit Business Srl, a large Romanian logistics

operator, which accommodates in the terminal their new business

line which involves as end user Carrefour. Following recent

relevant agreement, Favorit's leases extended until 2026. Since

2019 the Company signs also short term lease agreements for ambient

storage space with Mondelez Srl, one of the fastest growing

regional food companies.

5.4 Kindergarten, Romania

Situated on the GreenLake compound on the banks of Grivita Lake,

a standalone building on ground and first floor, is used as a

nursery by one of the Bucharest's leading private schools. The

building is erected on 1.428.59 sqm plot with a total gross area of

1.198 sqm.

The property is 100% leased to International School for Primary

Education. The asset was sold in September 2022.

5.5 Residential Portfolio

-- GreenLake, Bucharest, Romania

A residential compound of 40.500 sqm GBA, which consists of

apartments and villas, situated on the banks of Grivita Lake, in

the northern part of the Romanian capital - the only residential

property in Bucharest with a 200 meters frontage to a lake. The

compound also includes facilities such as one of Bucharest's

leading private schools (International School for Primary

Education), outdoor sports courts and a mini-market.

During 2022, 4 apartments and villas were sold while at the end

of the year 7 units remained unsold but they are all precontracted

and sold during 2023.

5.6 Land Assets

-- -Kiyanovskiy Residence - Kiev, Ukraine

The property consists of 0,55 Ha of freehold and leasehold land

located at Kiyanovskiy Lane, near Kiev city center. It is destined

for the development of businesses and luxury residences with

beautiful protected views overlooking the scenic Dnipro River, St.

Michaels' Spires and historic Podil.

The asset is part of Stage 2 of the Arcona transaction and the

relevant SPA for its disposal has already been signed in June 2021

while closing has been postponed due to the invasion of Ukraine by

Russia.

-- -Tsymlyanskiy Residence - Kiev, Ukraine

The 0,36 Ha plot is located in the historic and rapidly

developing Podil District in Kiev. The Company owns 55% of the SPV

which leases the plot, with a local co-investor owning the

remaining 45%.

The extension of the lease, originally expected during 2021, was

delayed and currently is on hold due to the invasion of Ukraine by

Russia. The asset is planned to be part of Stage 3 of the Arcona

transaction.

-- -Rozny Lane - Kiev Oblast, Kiev, Ukraine

The 42 Ha land plot located in Kiev Oblast is destined to be

developed as a residential complex. Following a protracted legal

battle, it has been registered under the Company pursuant to a

legal decision in July 2015.

The asset is part of Stage 2 of the Arcona transaction and

relevant SPA for its disposal has already been signed in June 2021

while closing has been postponed due to the invasion of Ukraine by

Russia.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2022

Note 2022 2021

EUR EUR

Continued Operations

Income 10 1.143.752 1.047.137

Net Operating Income 1.143.752 1.047.137

Administration expenses 12 (1.464.626) (1. 798.293

)

Gain/(Loss) on disposal of subsidiary 20 - 748

Fair Value gain/(loss) on Financial

Assets at FV through P&L 26 (1.071.119) 683.478

Gain realized on acquisition on associate 1.041 -

Share of loss of associates 21 (9.040) -

Other operating income/ (expenses),

net 15 (3.390) 69 .643

Operating profit / (loss) (1.403.382) 2. 713

Finance income 16 361.035 489.072

Finance costs 16 (198.331) (190.409)

Profit / (Loss) before tax and foreign

exchange differences (1.240.678) 301.376

Foreign exchange loss, net 17a (17.647) (65.147)

Profit/(Loss) before tax (1.258.325) 236.229

Income tax expense 18 17.940 (51.824)

Profit/(Loss) for the year from continuing

operations (1.240.385) 184.405

Loss from discontinued operations 9b (10.403.495) (881.174)

Profit/ (Loss) for the year (11.643.880) (696.769)

Other comprehensive income

Exchange difference on translation

of foreign operations 29 (692.906) 64.299

Total comprehensive income for the

year (12.336.786) (632.470)

Profit/ (Loss) for the year from continued

operations attributable to:

Owners of the parent (1.240.385) 184.405

Non-controlling interests - -

(1.240.385) 184.405

Profit/ (Loss) for the year from discontinued

operations attributable to:

Owners of the parent (8.416.599) (659.215)

Non-controlling interests (1.986.896) (221.959)

(10.403.495) (881.174)

Profit/ (Loss) for the year attributable

to:

Owners of the parent (9.656.984) (474.810)

Non-controlling interests (1.986.896) (221.959)

( 11.643.880) (696.769)

Total comprehensive income attributable

to:

Owners of the parent (10.142.264) (459.449)

Non-controlling interests (2.194.522) (173.021)

(12.336.786) (632.470)

Earnings/(Losses) per share (Euro

per share):

Basic earnings/(losses) for the year

attributable to ordinary equity owners

of the parent 37b (0,01) (0,00)

Diluted earnings/(losses) for the

year attributable to ordinary equity

owners of the parent 37b (0,01) (0,00)

Basic earnings/(losses) for the year

from discontinued operations attributable

to ordinary equity owners of the parent 37c (0,06) (0,00)

Diluted earnings/(losses) for the

year from discontinued operations

attributable to ordinary equity owners

of the parent 37c (0,06) (0,00)

The notes form an integral part of these consolidated financial

statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

For the year ended 31 December 2022

Note 2022 2021

EUR EUR

ASSETS

Non--current assets

Tangible and intangible assets 23 816 1.628

Long-term receivables and prepayments 24 824 824

Investment in associate 21 1 -

Financial Assets at FV through 26 12.078.808 7.470.722

P&L

12.080.449 7.473.174

Current assets

Prepayments and other current 25 4.153.162 4. 510.381

assets

Cash and cash equivalents 27 66.570 2.160.576

------------- -------------

4.219.732 6.670.

957

Assets classified as held for 9d 13.835.091 39.011.516

sale

Total assets 30.135.272 53.155.

647

EQUITY AND LIABILITIES

Issued share capital 28 1.291.281 1.291.281

Share premium 72.107.265 72.107.265

Foreign currency translation reserve 29 8.484.507 8.969.787

Exchange difference on I/C loans

to foreign holdings 39.3 (211.199) (211.199)

Accumulated losses (68.560.594) ( 58.903.610

)

Equity attributable to equity 13.111.260 23.253.524

holders of the parent

Non-controlling interests 30 369.399 5.748.132

Total equity 13.480.659 29.001.656

Non--current liabilities

Borrowings 31 597.357 126.066

Bonds issued 32 723.690 1.033.842

Tax payable and provisions 35 579.519 627.130

------------- -------------

1.900.566 1.787.038

Current liabilities

Borrowings 31 - 1.577.500

Bonds issued 32 99.046 293.214

Trade and other payables 33 3.731.769 4.396.123

Tax payable and provisions 35 37.574 256.437

3.868.389 6 . 523.274

Liabilities directly associated

with assets classified as held

for sale 9d 10.885.658 15.843.679

14.754.047 22.366.953

Total liabilities 16.654.613 24.153.991

Total equity and liabilities 30.135.272 53.155.

647

Net Asset Value (NAV) EUR per

share: 37d

Basic NAV attributable to equity

holders of the parent 0,10 0,18

Diluted NAV attributable to equity

holders of the parent 0,10 0,18

On 28 June 2022 the Board of Directors of SECURE PROPERTY

DEVELOPMENT & INVESTMENT PLC authorised these financial

statements for issue.

Lambros Anagnostopoulos Michael Beys Theofanis Antoniou

Director & Chief Executive Director & Chairman CFO

Officer of the Board

The notes form an integral part of these consolidated financial

statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the year ended 31 December 2022

Attributable to owners of the Company

----------------------------------------------------------------------------------------------- ------- ---------------

Share Share Accumulated Exchange Foreign Total Non- controlling Total

capital premium, losses, difference currency interest

Net(1) net of on I/C translation

non-controlling loans reserve

interest(2) to foreign (4)

holdings

(3)

EUR EUR EUR EUR EUR EUR EUR EUR

Balance - 31 December

2020 1.291.281 72.107.265 (58.428.800) (211.199) 8.954.426 23.712.973 5.921.153 29.634.126

( 474.810 ( 474.810 ( 696.769

Loss for the year - - ) - - ) (221.959) )

Foreign currency

translation

reserve - - - - 15.361 15.361 48.938 64.299

Balance - 31 December

2021 1.291.281 72.107.265 (58.903.610) (211.199) 8.969.787 23.253.524 5.748.132 29.001.656

( 9.656.984 ( 9.656.984 ( 11.643.880

Loss for the year - - ) - - ) (1.986.896) )

Foreign currency

translation

reserve - - - - (485.280) (485.280) (207.626) (692.906)

Disposals of - (3.184.211)

subisdiaries - - - - - (3.184.211)

Balance - 31 December

2022 1.291.281 72.107.265 (68.560.594) (211.199) 8.484.507 13.111.260 369.399 13.480.659

(1) Share premium is not available for distribution.

(2) Companies which do not distribute 70% of their profits after

tax, as defined by the relevant tax law, within two years after the

end of the relevant tax year, will be deemed to have distributed as

dividends 70% of these profits. Special contribution for defence at

17% and GHS contribution at 1,7%-2,65% for deemed distributions

after 1 March 2019 will be payable on such deemed dividends to the

extent that the ultimate shareholders are both Cyprus tax resident

and Cyprus domiciled. The amount of deemed distribution is reduced

by any actual dividends paid out of the profits of the relevant

year at any time. This special contribution for defence is payable

by the Company for the account of the shareholders.

(3) Exchange differences on intercompany loans to foreign

holdings arose as a result of devaluation of the Ukrainian Hryvnia

during previous years. The Group treats the mentioned loans as a

part of the net investment in foreign operations (Note 39.3).

(4) Exchange differences related to the translation from the

functional currency of the Group's subsidiaries are accounted for

directly to the foreign currency translation reserve. The foreign

currency translation reserve represents unrealized profits or

losses related to the appreciation or depreciation of the local

currencies against the euro in the countries where the Group's

subsidiaries own property assets.

The notes form an integral part of these consolidated financial

statements.

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 31 December 2022

Note 2022 2021

EUR EUR

CASH FLOWS FROM OPERATING ACTIVITIES

Profit/(Loss) before tax and non-controlling

interests-continued operations (1.258.325) 236.229

Profit/(Loss) before tax and non-controlling

interests-discontinued operations 9b (10.329.155) (813.846)

------------ -----------

Profit/(Loss) before tax and non-controlling

interests (11.587.480) (577.617)

Adjustments for:

(Gain)/Loss on revaluation of investment

property 13 1.245.230 754.979

Net loss on disposal of investment property 14.1 825.392 (653.567)

Fair Value (gain)/ loss on Financial Assets

at FV through P&L 26 1.071.119 (683.478)

(Reversal) /Impairment of prepayments and

other current assets 15 2.721.151 5.932

Accounts payable written off 15 (4.401) (62.978)

Depreciation/ Amortization charge 12 7.292 2.101

Interest income 16 (369.017) (498.438)

Interest expense 16 850.400 1.044.296

Share of profit from associates 21 (326.493) (344.746)

Gain on disposal of subsidiaries 20 4.870.768 (748)

Effect of foreign exchange differences 17a 182.812 318.813

Cash flows from/(used in) operations before

working capital changes (513.227) (695.451)

Change in prepayments and other current

assets 25 (531409) (61.750)

Change in trade and other payables 33 (1.230.439) (441.639)

Change in VAT and other taxes receivable 25 141.751 (17. 181)

Change in provisions 35 - 28.954

Change in other taxes payables 35 (173.788) 18.580

Change in deposits from tenants 34 (41.229) -

( 2.348.341 (1. 168.487

Cash generated from operations ) )

( 117.762

Income tax paid ) (515.938)

( 2.466.103 (1. 684.425

Net cash flows provided in operating activities ) )

CASH FLOWS FROM INVESTING ACTIVITIES

Sales proceeds from disposal of investment

property 14.1 1.164.133 3.245.322

Cash inflow from sale of subsidiaries 20 382.750 -

Dividend received from associates 21 219.190 183.583

Payment on acquisition of associate (8.000) -

Increase/(Decrease) in long term receivables 24 (18.263) (18.251)

Repayment of principal and interest of

loan receivable 25 821.891 2.289.683

Net cash flows from / (used in) investing

activities 2.561.701 5.700.337

CASH FLOWS FROM FINANCING ACTIVITIES

Proceeds from bank and non-bank loans 31 - 3.500.000

Repayment of bank and non-bank loans 31 (1.618.403) (2.538.099)

( 391.126 (117 .

Interest and financial charges paid ) 032)

Decrease in financial lease liabilities 36 (289.917) (3.176.182)

Net cash flows from / (used in) financing ( 2.299.446

activities ) (2.331.313)

Net increase/(decrease) in cash at banks (2.203.848) 1.684.599

Cash:

At beginning of the year 27 2.555.246 870.647

At end of the year 27 351.398 2.555.246

------------ -----------

The notes form an integral part of these consolidated financial

statements.

Notes to the Consolidated Financial Statements

For the year ended 31 December 2022

1. General Information

Country of incorporation

SECURE PROPERTY DEVELOPMENT & INVESTMENT PLC (the "Company")

was incorporated in Cyprus on 23 June 2005 and is a public limited

liability company, listed on the London Stock Exchange (AIM): ISIN

CY0102102213. Its registered office is at Kyriakou Matsi 16, Eagle

House, 10th floor, Agioi Omologites, 1082 Nicosia, Cyprus while its

principal place of business is in Cyprus at 6 Nikiforou Foka

Street, 1060 Nicosia, Cyprus.

Principal activities

The principal activities of the Group are to invest directly or

indirectly in and/or manage real estate properties, as well as real

estate development projects in South East Europe (the "Region").

These include the acquisition, development, commercializing,

operating and selling of property assets in the Region.

The Group maintains offices in Nicosia, Cyprus, Bucharest,

Romania and Kiev, Ukraine.

As at 31 December 2022, the companies of the Group employed

and/or used the services of 10 full time equivalent people, (2021 à

15 full time equivalent people).

2. Basis of preparation

The consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union (EU) and the requirements of the

Cyprus Companies Law, Cap.113. The consolidated financial

statements have been prepared under the historical cost as modified

by the revaluation of investment property and investment property

under construction, of financial assets at fair value through other

comprehensive income and of financial assets at fair value through

profit and loss.

The preparation of financial statements in conformity with IFRSs

requires the use of certain critical accounting estimates and

requires Management to exercise its judgment in the process of

applying the Company's accounting policies. It also requires the

use of assumptions that affect the reported amounts of assets and

liabilities and disclosure of contingent assets and liabilities at

the date of the financial statements and the reported amounts of

revenues and expenses during the reporting period. Although these

estimates are based on Management's best knowledge of current

events and actions, actual results may ultimately differ from those

estimates.

Following certain conditional agreement signed in December 2018

with Arcona Property Fund N.V for the sale of Company's non-Greek

portfolio of assets, the Company classifies its assets since 2018

as discontinued operations (Note 4.3) .

Going concern basis

The financial statements have been prepared on a going concern

basis which assumes the Company will be able to realize its assets

and discharge its liabilities in the normal course of business for

the foreseeable future.

In particular, the Company is in a process of disposing of its

portfolio of assets in an all share transaction with Arcona

Property Fund N.V., meaning that as soon as this transaction

consummates the Company will be left with its corporate receivables

and liabilities.

These conditions raise some doubt about the Company's ability to

continue as a going concern within the next twelve months from the

date these financial statements are available to be issued. The

ability to continue as a going concern is dependent upon positive

future cash flows.

Management believes that the Company will be able to finance its

needs given the fact that the additional corporate receivables, as

well as the consideration received in the form of Arcona shares is

estimated that it can effectively discharge all corporate

liabilities. At the same time, the transaction with Arcona Property

Fund N.V., which is a cash flow generating entity, will result in

the Company being a significant shareholder, entitled to dividends

according to the dividend policy of Arcona Property Fund N.V.

3. Adoption of new and revised Standards and Interpretations

During the current year the Company adopted all the new and

revised International Financial Reporting Standards (IFRS) that are

relevant to its operations and are effective for accounting periods

beginning on 1 January 2022. This adoption did not have a material

effect on the accounting policies of the Company.

4. Significant accounting policies

The principal accounting policies adopted in the preparation of

these consolidated financial statements are set out below. These

policies have been consistently applied to all years presented in

these consolidated financial statements unless otherwise

stated.

Local statutory accounting principles and procedures differ from

those generally accepted under IFRS. Accordingly, the consolidated

financial information, which has been prepared from the local

statutory accounting records for the entities of the Group

domiciled in Cyprus, Romania, and Ukraine reflects adjustments

necessary for such consolidated financial information to be

presented in accordance with IFRS.

4.1 Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities (including special purpose

entities) controlled by the Company (its subsidiaries).

Subsidiaries are all entities (including structured entities)

over which the Group has control. The Group controls an entity when

the Group is exposed to, or has rights to, variable returns from

its involvement with the entity and has the ability to affect those

returns through its power over the entity.

The Group applies the acquisition method to account for business

combinations. The consideration transferred for the acquisition of

a subsidiary is the fair values of the assets transferred, the

liabilities incurred to the former owners of the acquiree and the

equity interests issued by the Group. The consideration transferred

includes the fair value of any asset or liability resulting from a

contingent consideration arrangement. Identifiable assets acquired,

liabilities and contingent liabilities assumed in a business

combination are measured initially at their fair values at the

acquisition date. The Group recognizes any non-controlling interest

in the acquiree on an acquisition-by-acquisition basis, either at

fair value or at the non-controlling interest's proportionate share

of the recognized amounts of acquiree's identifiable net

assets.

If the business combination is achieved in stages, the

acquisition date carrying value of the acquirer's previously held

equity interest in the acquiree is re-measured to fair value at the

acquisition date; any gains or losses arising from such

re-measurement are recognized in profit or loss.

Any contingent consideration to be transferred by the Group is

recognized at fair value at the acquisition date. Subsequent

changes to the fair value of the contingent consideration that is

deemed to be an asset or liability is recognized in accordance with

IAS 39, either in profit or loss or as a change to other

comprehensive income. Contingent consideration that is classified

as equity is not re-measured and its subsequent settlement is

accounted for within equity.

If the initial accounting for a business combination is

incomplete by the end of the reporting period in which the

combination occurs, the Group reports provisional amounts for the

items for which the accounting is incomplete. Those provisional

amounts are adjusted during the measurement period (see above), or

additional assets or liabilities are recognized, to reflect new

information obtained about facts and circumstances that existed at

the acquisition date that, if known, would have affected the

amounts recognized at that date.

Business combinations that took place prior to 1 January 2010

were accounted for in accordance with the previous version of IFRS

3.

Inter-company transactions, balances and unrealized gains on

transactions between group companies are eliminated. Unrealized

losses are also eliminated. When necessary, amounts reported by

subsidiaries have been adjusted to conform with the Group's

accounting policies.

Changes in ownership interests in subsidiaries without change of

control and Disposal of Subsidiaries

Transactions with non-controlling interests that do not result

in loss of control are accounted for as equity transactions - that

is, as transactions with the owners in their capacity as owners.

The difference between fair value of any consideration paid and the

relevant share acquired of the carrying value of net assets of the

subsidiary is recorded in equity. Gains or losses on disposals of

non-controlling interests are also recorded in equity.

When the Group ceases to have control, any retained interest in

the entity is re-measured to its fair value at the date when

control is lost, with the change in carrying amount recognized in

profit or loss. The fair value is the initial carrying amount for

the purposes of subsequently accounting for the retained interest

as an associate, joint venture or financial asset. In addition, any

amounts previously recognized in other comprehensive income in

respect of that entity are accounted for as if the Group had

directly disposed of the related assets or liabilities. This may

mean that amounts previously recognized in other comprehensive

income are reclassified to profit or loss.

4. Significant accounting policies (continued)

4.2 Functional and presentation currency

Items included in the Group's financial statements are measured

applying the currency of the primary economic environment in which

the entities operate ("the functional currency"). The national

currency of Ukraine, the Ukrainian Hryvnia, is the functional

currency for all the Group's entities located in Ukraine, the

Romanian leu is the functional currency for all Group's entities

located in Romania, and the Euro is the functional currency for all

Cypriot subsidiaries.

The consolidated financial statements are presented in Euro,

which is the Group's presentation currency.

As Management records the consolidated financial information of

the entities domiciled in Cyprus, Romania, Ukraine in their

functional currencies, in translating financial information of the

entities domiciled in these countries into Euro for inclusion in

the consolidated financial statements, the Group follows a

translation policy in accordance with IAS 21, "The Effects of

Changes in Foreign Exchange Rates", and the following procedures

are performed:

-- All assets and liabilities are translated at closing rate;

-- Equity of the Group has been translated using the historical rates;

-- Income and expense items are translated using exchange rates

at the dates of the transactions, or where this is not practicable

the average rate has been used;

-- All resulting exchange differences are recognized as a separate component of equity;

-- When a foreign operation is disposed of through sale,

liquidation, repayment of share capital or abandonment of all, or

part of that entity, the exchange differences deferred in equity

are reclassified to the consolidated statement of comprehensive

income as part of the gain or loss on sale;

-- Monetary items receivable from foreign operations for which

settlement is neither planned nor likely to occur in the

foreseeable future and in substance are part of the Group's net

investment in those foreign operations are recongised initially in

other comprehensive income and reclassified from equity to profit

or loss on disposal of the foreign operation.

The relevant exchange rates of the European and local central

banks used in translating the financial information of the entities

from the functional currencies into Euro are as follows:

Average 31 December

Currency 2022 2021 2022 2021 2020

-------- -------- -------- -------- --------

USD 1,0530 1,1827 1,0666 1,1326 1,2270

-------- -------- -------- -------- --------

UAH 33,9820 32,3009 38,9510 30,9226 34,7396

-------- -------- -------- -------- --------

RON 4,9315 4,9204 4,9474 4,9481 4,8694

-------- -------- -------- -------- --------

4.3 Discontinued operations

A discontinued operation is a component of the Group's business,

the operations and cash flows of which can be clearly distinguished

from the rest of the Group and which:

-- represents a separate major line of business or geographic area of operations;

-- is part of a single coordinated plan to dispose of a separate

major line of business or geographic area of operations; or

-- is a subsidiary acquired exclusively with a view to resale.

Classification as a discontinued operation occurs at the earlier

of disposal or when the operation meets the criteria to be

classified as held-for-sale.

When an operation is classified as a discontinued operation, the

comparative statement of profit or loss and OCI is re-presented as

if the operation had been discontinued from the start of the

comparative year.

4.4 Investment Property at fair value

Investment property, comprising freehold and leasehold land,

investment properties held for future development, warehouse and

office properties, as well as the residential property units , is

held for long term rental yields and/or for capital appreciation

and is not occupied by the Group. Investment property and

investment property under construction are carried at fair value,

representing open market value determined annually by external

valuers. Changes in fair values are recorded in the statement of

comprehensive income and are included in other operating

income.

A number of the land leases (all in Ukraine) are held for

relatively short terms and place an obligation upon the lessee to

complete development by a predetermined date. It is important to

note that the rights to complete a development may be lost or at

least delayed if the lessee fails to complete a permitted

development within the timescale set out by the ground lease.

4. Significant accounting policies (continued)

4.4 Investment Property at fair value (continued)

In addition, in the event that a development has not commenced

upon the expiry of a lease then the City Authorities are entitled

to decline the granting of a new lease on the basis that the land

is not used in accordance with the designation. Furthermore, where

all necessary permissions and consents for the development are not

in place, this may provide the City Authorities with grounds for

rescinding or non-renewal of the ground lease. However Management

believes that the possibility of such action is remote and was made

only under limited circumstances in the past.

Management has noticed that rescinding or non-renewal of the

ground lease is remote if a project is on the final stage of

development or on the operating cycle. In undertaking the

valuations reported herein, the valuer of Ukrainian properties,

CBRE, has made the assumption that no such circumstances will arise

to permit the City Authorities to rescind the land lease or not to

grant a renewal.

Land held under operating lease is classified and accounted for

as investment property when the rest of the definition is met.

Investment property under development or construction initially

is measured at cost, including related transaction costs.

The property is classified in accordance with the intention of

the management for its future use. Intention to use is determined

by the Board of Directors after reviewing market conditions,

profitability of the projects, ability to finance the project and

obtaining required construction permits.

The time point, when the intention of the management is

finalized is the date of start of construction. At the moment of

start of construction, freehold land, leasehold land and investment

properties held for a future redevelopment are reclassified into

investment property under development or inventory in accordance to

the final decision of management.

Initial measurement and recognition

Investment property is measured initially at cost, including

related transaction costs. Investment properties are derecognized

when either they have been disposed of or when the investment

property is permanently withdrawn from use and no future economic

benefit is expected from its disposal. Any gains or losses on the

retirement or disposal of an investment property are recognized in

the consolidated statement of comprehensive income in the period of

retirement or disposal.

Transfers are made to investment property when, and only when,

there is a change in use, evidenced by the end of owner occupation,

or the commencement of an operating lease to third party. Transfers

are made from investment property when, and only when, there is a

change in use, evidenced by commencement of owner occupation or

commencement of development with a view to sale.

If an investment property becomes owner occupied, it is

reclassified as property, plant and equipment, and its fair value

at the date of reclassification becomes its cost for accounting

purposes. Property that is being constructed or developed for

future use as investment property is classified as investment

property under construction until construction or development is

complete. At that time, it is reclassified and subsequently

accounted for as investment property.

Subsequent measurement

Subsequent to initial recognition, investment property is stated

at fair value. Gains or losses arising from changes in the fair

value of investment property are included in the statement of

comprehensive income in the period in which they arise.

If a valuation obtained for an investment property held under a

lease is net of all payments expected to be made, any related

liabilities/assets recognized separately in the statement of

financial position are added back/reduced to arrive at the carrying

value of the investment property for accounting purposes.

Subsequent expenditure is charged to the asset's carrying amount

only when it is probable that future economic benefits associated

with the item will flow to the Group and the cost of the item can

be measured reliably. All other repairs and maintenance costs are

charged to the statement of comprehensive income during the

financial period in which they are incurred.

Basis of valuation

The fair values reflect market conditions at the financial

position date. These valuations are prepared annually by chartered

surveyors (hereafter "appraisers"). The Group appointed valuers in

2014, which remain the same in 2022:

-- CBRE Ukraine, for all its Ukrainian properties,

-- NAI Real Act for all its Romanian properties.

The valuations have been carried out by the appraisers on the

basis of Market Value in accordance with the appropriate sections

of the current Practice Statements contained within the Royal

Institution of Chartered Surveyors ("RICS") Valuation - Global

Standards (2018) (the "Red Book") and is also compliant with the

International Valuation Standards (IVS).

"Market Value" is defined as: "The estimated amount for which a

property should be exchanged on the date of valuation between a

willing buyer and a willing seller in an arm's-length transaction

after proper marketing actions, wherein the parties had each acted

knowledgeably, prudently and without compulsion".

4. Significant accounting policies (continued)

4.4 Investment Property at fair value (continued)

Basis of valuation (continued)

In expressing opinions on Market Value, in certain cases the

appraisers have estimated net annual rentals/income from sale.

These are assessed on the assumption that they are the best

rent/sale prices at which a new letting/sale of an interest in

property would have been completed at the date of valuation

assuming: a willing landlord/buyer; that prior to the date of

valuation there had been a reasonable period (having regard to the

nature of the property and the state of the market) for the proper

marketing of the interest, for the agreement of the price and terms

and for the completion of the letting/sale; that the state of the

market, levels of value and other circumstances were, on any

earlier assumed date of entering into an agreement for lease/sale,

the same as on the valuation date; that no account is taken of any

additional bid by a prospective tenant/buyer with a special

interest; that the principal deal conditions assumed to apply are

the same as in the market at the time of valuation; that both

parties to the transaction had acted knowledgeably, prudently and

without compulsion.

A number of properties are held by way of ground leasehold

interests granted by the City Authorities. The ground rental

payments of such interests may be reviewed on an annual basis, in

either an upwards or downwards direction, by reference to an

established formula. Within the terms of the lease, there is a

right to extend the term of the lease upon expiry in line with the

existing terms and conditions thereof. In arriving at opinions of

Market Value, the appraisers assumed that the respective ground

leases are capable of extension in accordance with the terms of

each lease. In addition, given that such interests are not

assignable, it was assumed that each leasehold interest is held by

way of a special purpose vehicle ("SPV"), and that the shares in

the respective SPVs are transferable.

With regard to each of the properties considered, in those

instances where project documentation has been agreed with the

respective local authorities, opinions of the appraisers of value

have been based on such agreements.

In those instances where the properties are held in part

ownership, the valuations assume that these interests are saleable

in the open market without any restriction from the co-owner and

that there are no encumbrances within the share agreements which

would impact the sale ability of the properties concerned.

The valuation is exclusive of VAT and no allowances have been

made for any expenses of realization or for taxation which might

arise in the event of a disposal of any property.

In some instances the appraisers constructed a Discounted Cash

Flow (DCF) model. DCF analysis is a financial modeling technique

based on explicit assumptions regarding the prospective income and

expenses of a property or business. The analysis is a forecast of

receipts and disbursements during the period concerned. The

forecast is based on the assessment of market prices for comparable

premises, build rates, cost levels etc. from the point of view of a

probable developer.

To these projected cash flows, an appropriate, market-derived

discount rate is applied to establish an indication of the present

value of the income stream associated with the property. In this

case, it is a development property and thus estimates of capital

outlays, development costs, and anticipated sales income are used

to produce net cash flows that are then discounted over the

projected development and marketing periods. The Net Present Value

(NPV) of such cash flows could represent what someone might be

willing to pay for the site and is therefore an indicator of market

value. All the payments are projected in nominal US Dollar/Euro

amounts and thus incorporate relevant inflation measures.

Valuation Approach

In addition to the above general valuation methodology, the

appraisers have taken into account in arriving at Market Value the

following:

Pre Development

In those instances where the nature of the 'Project' has been

defined, it was assumed that the subject property will be developed

in accordance with this blueprint. The final outcome of the

development of the property is determined by the Board of Directors

decision, which is based on existing market conditions,

profitability of the project, ability to finance the project and

obtaining required construction permits.

Development

In terms of construction costs, the budgeted costs have been

taken into account in considering opinions of value. However, the

appraisers have also had regard to current construction rates

prevailing in the market which a prospective purchaser may deem

appropriate to adopt in constructing each individual scheme.

Although in some instances the appraisers have adopted the budgeted

costs provided, in some cases the appraisers' own opinions of costs

were used.

Post Development

Rental values have been assessed as at the date of valuation but

having regard to the existing occupational markets taking into

account the likely supply and demand dynamics during the

anticipated development period. The standard letting fees were

assumed within the valuations. In arriving at their estimates of

gross development value ("GDV"), the appraisers have capitalized

their opinion of net operating income, having deducted any

anticipated non-recoverable expenses, such as land payments, and

permanent void allowance, which has then been capitalized into

perpetuity.

4. Significant accounting policies (continued)

4.4 Investment Property at fair value (continued)

Valuation Approach (continued)

The capitalization rates adopted in arriving at the opinions of

GDV reflect the appraisers' opinions of the rates at which the

properties could be sold as at the date of valuation.

In terms of residential developments, the sales prices per sq.

m. again reflect current market conditions and represent those

levels the appraisers consider to be achievable at present. It was

assumed that there are no irrecoverable operating expenses and that

all costs will be recovered from the occupiers/owners by way of a

service charge.

The valuations take into account the requirement to pay ground

rental payments and these are assumed not to be recoverable from

the occupiers. In terms of ground rent payments, the appraisers

have assessed these on the basis of information available, and if

not available they have calculated these payments based on current

legislation defining the basis of these assessments.

4.5 Goodwill

Goodwill arising on an acquisition of a business is carried at

cost as established at the date of acquisition of the business less

accumulated impairment losses, if any.

For the purposes of impairment testing, goodwill is allocated to

each of the Group's cash-generating units (or Groups of

cash-generating units) that is expected to benefit from the

synergies of the combination.

A cash-generating unit to which goodwill has been allocated is

tested for impairment annually, or more frequently when there is

indication that the unit may be impaired. If the recoverable amount

of the cash-generating unit is less than its carrying amount, the

impairment loss is allocated first to reduce the carrying amount of

any goodwill allocated to the unit and then to the other assets of

the unit pro rata based on the carrying amount of each asset in the

unit. Any impairment loss for goodwill is recognized directly in

profit or loss in the consolidated statement of comprehensive

income. An impairment loss recognized for goodwill is not reversed

in subsequent periods.

On disposal of the relevant cash-generating unit, the

attributable amount of goodwill is included in the determination of

the profit or loss on disposal.

4.6 Property, Plant and equipment and intangible assets

Property, plant and equipment and intangible non-current assets

are stated at historical cost less accumulated depreciation and

amortization and any accumulated impairment losses.

Properties in the course of construction for production, rental

or administrative purposes, or for purposes not yet determined and

intangibles not inputted into exploitation, are carried at cost,

less any recognized impairment loss. Cost includes professional

fees and, for qualifying assets, borrowing costs capitalized in

accordance with the Group's accounting policy. Depreciation of

these assets, on the same basis as other property assets, commences

when the assets are ready for their intended use.

Depreciation and amortization are calculated on the

straight--line basis so as to write off the cost of each asset to

its residual value over its estimated useful life. The annual

depreciation rates are as follows:

Type %

Leasehold 20

IT hardware 33

Motor vehicles 25

Furniture, fixtures and office equipment 20

Machinery and equipment 15

Software and Licenses 33

No depreciation is charged on land.

Assets held under leases are depreciated over their expected

useful lives on the same basis as owned assets or, where shorter,

the term of the relevant lease.

The assets residual values and useful lives are reviewed, and

adjusted, if appropriate, at each reporting date.

Where the carrying amount of an asset is greater than its

estimated recoverable amount, the asset is written down immediately

to its recoverable amount.

4. Significant accounting policies (continued)

4.6 Property, Plant and equipment and intangible assets

(continued)

Expenditure for repairs and maintenance of tangible and

intangible assets is charged to the statement of comprehensive

income of the year in which it is incurred. The cost of major

renovations and other subsequent expenditure are included in the

carrying amount of the asset when it is probable that future

economic benefits in excess of the originally assessed standard of

performance of the existing asset will flow to the Group. Major

renovations are depreciated over the remaining useful life of the

related asset.

An item of tangible and intangible assets is derecognized upon