TIDMEUA

RNS Number : 6535E

Eurasia Mining PLC

03 July 2023

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

REGULATION NO. 596/2014 (AS IT FORMS PART OF RETAINED EU LAW AS

DEFINED IN THE EUROPEAN UNION (WITHDRAWAL) ACT 2018) AND IS IN

ACCORDANCE WITH THE COMPANY'S OBLIGATIONS UNDER ARTICLE 7 OF THAT

REGULATION.

3 July 2023

Eurasia Mining Plc

Annual Results and Notice of AGM

Eurasia Mining Plc ("Eurasia", the "Company" or the "Group"),

the palladium, platinum, rhodium, iridium and gold producing

company, announces its audited financial results and operational

summary for the year ending 31 December 2022 (the "Annual Report")

as well as a notification of the Annual General Meeting (the

"AGM"), to be held virtual via an electronic meeting platform on 26

July 2023 at 9:00am. More details can be found in the complete

notice of AGM below, which together with the Form of Proxy, is

available on the Company's website from 7:00am today.

Audited Group Reporting for the year ending 31 December 2022

The Company's full Annual Report, including the audited

financial statements for the year ended 31 December 2022, is set

out below and will be posted, along with notice of AGM and form of

proxy to those Eurasia shareholders electing to receive paper

format notifications, today. The Company is grateful to the

remaining shareholders choosing to receive digital notifications

and the report is also available for download from the

Company's website at: https://www.eurasiamining.co.uk/investors/financial-reports .

The Company would like to remind shareholders that they may sign

up for digital notifications, and help to reduce the number of

paper reports printed and posted, by logging on to

www.signalshares.com to amend communications preferences. An

Investor Code is required for initial registration. Alternatively,

shareholders can call the Company's registrar, Link Group, on 0371

664 0300 (calls are charged at the standard geographical rate and

may vary by provider) or +44 371 664 0300 if calling from overseas.

Shareholders can also write to Link Group at 10th Floor, Central

Square, 29 Wellington Street, Leeds, LS1 4DL.

A copy of this announcement is also available on Eurasia's

website at:

https://www.eurasiamining.co.uk/investors/news-announcements

For further information, please contact:

Eurasia Mining Plc +44 (0) 20 7932 0418

Christian Schaffalitzky / Keith

Byrne

SP Angel (Nominated Advisor and

Joint Broker)

Jeff Keating / David Hignell /

Adam Cowl +44 (0) 20 3470 0470

Optiva Securities (Joint Broker)

Christian Dennis +44 (0) 20 3137 1902

Chairman's statement

The year 2022 stands out as a uniquely challenging year not only

for Eurasia, but also for the entire mining sector. Apart from the

Ukraine conflict which hit the world hard in February, the entire

industry has been disrupted by supply chain interruptions although

this has, however, resulted in positive price changes for EUA's

metals.

In the meantime, work has continued on optimising the asset base

prior to a possible sale.

West Kytlim

We took the decision to stockpile the ore from West Kytlim and

not to generate revenue from Russia in 2022 due to our strong cash

position and the expectation of improving prices in the future.

The West Kytlim mine saw significant investment over many years

culminating with a conversion of operations from diesel power to

electricity powered equipment and infrastructure. Hydro-derived

grid power and an electric dragline installed to site. This allows

stripping work to continue through the winter, with the

accommodation and office also on the grid. Significant reductions

in operating costs have been achieved.

As previously announced, we took the decision to stockpile the

mine product (a 'black sand' concentrate containing platinum,

palladium, iridium, rhodium and gold) from West Kytlim and not to

generate revenue from Russia during 2022.

Monchetundra

DFS

At Monchetundra, the DFS study for the several open pits at

Loipishnune and West Nittis was completed for the project's

development and submitted at the end of 2022 and the Company was

notified that all authorities were received at the end of June

2023.

NKT / Monchetundra Flanks

The NKT project comprises a brownfield Tier-1 scale deposit:

305Kt of Nickel, 143Kt of Copper, 57 tons of PGM and Gold (11.2Moz

of Platinum equivalent) as estimated by Wardell Armstrong

International as JORC-compliant resources for an underground mining

operation. We continue to look at the potential for additional

mineralisation on the property. For now the NKT Project sits as

considerable upside adjacent the Monchetundra asset.

Nyud Project and Rosgeo agreement

Eurasia retains a right to 75% of the Nyud exploration licence,

which was applied for and later received by Rosgeo's subsidiary OOO

Monchegorskoye with an intention of establishing a joint venture

with Eurasia's 100% owned subsidiary, Yuksporskaya Mining Company,

pursuant to the now expired two-year agreement between Rosgeo and

Eurasia as announced 26 March 2021. The project is now being

considered in the context of the Company's proposed asset sale.

Possible sale of Russian Assets

The Board remains of the view that any buyer is likely to be

found in BRICS countries. This process has now run on substantially

longer than the Company's management team had anticipated. We

acknowledge shareholder frustration regarding the duration of the

sale process, however, we also note recent precedent transactions

which have successfully completed despite the geopolitical

situation. Further updates will be made as appropriate although

there is currently low visibility as to when this might be. As

ever, there can be no guarantee that Eurasia will enter into

binding agreements regarding the sale process.

Company Cash Position

The Company's cash position, including US treasury notes, at 29

June 2023 stands at approximately GBP1.686 million*. In addition,

the Company's unsold PGM concentrate is valued at GBP4.1 million

(net of VAT). The Company's cash reserves are held in USD and GBP

accounts outside of Russia and therefore not exposed to Rouble

foreign exchange gains or losses against other major hard

currencies.

*Please note the cash figures provided by the Company in the

announcements dated 21 December 2022 and 11 April 2023 also

included US treasury notes held by Eurasia.

Sanctions

During 2022, the Board has maintained a regular dialogue with

the Company's legal advisers regarding the potential impact of any

sanctions. The Board remains satisfied the Company's activities are

not prohibited under the sanctions' rules. Furthermore, the Group

does not engage and has not engaged with any sanctioned persons,

entities or agencies.

Directorate Change

Management of the Company has also evolved in parallel with the

other changes. With the completion of the Monchetundra DFS, the

open pit mines are ready for construction. While we have a EPCF

agreement for the development of Monchetundra, the Board do not

believe it is appropriate to commence immediately due to the

ongoing sale process of the Russian assets. It is expected that

counterparties will have their own plans for future development,

and it is important to leave such options open. In that regard,

James Nieuwenhuys, an EPC expert, has retired from Eurasia. The

Company is grateful to James for his excellent work as CEO since

2020 and wish him well for the future.

Konstantin Firstov, our CEO at Kola has been appointed the

Country Manager and at West Kytlim, newly appointed CEO Vasily

Kudrin is in charge of pre-sale activities. Vasily has a strong

audit background with Ernst & Young and other firms in various

senior roles including a partner position.

Following James Nieuwenhuys' departure from the Eurasia board,

Christian Schaffalitzky will take on additional executive

responsibilities. As such, the Company anticipates announcing

further board changes to ensure the roles of the Chairman and CEO

are split.

Outlook

In terms of the future development of Eurasia Mining PLC, we

continue to look at expanding the business in various ways,

including the development of hydrogen projects outside of Russia

coupled with new mining opportunities in investment friendly

jurisdictions. The Company remains committed to the continued sale

of its assets in Russia.

Our strategy continues to be the eventual sale of the Company's

assets in Russia, being the West Kytlim operating mine, the

Monchetundra Project mining license, the NKT brownfield project,

and the entitlement to the Nyud brownfield project.

In conclusion, and especially for this challenging year, I want

to thank my staff colleagues and fellow directors for their hard

work and dedication. I would also like to thank shareholders, who

have shown great patience with us in recognising that much of our

planning assumptions have been altered by the events of this year

past which were outside our control. We look forward to providing

our shareholders with further updates regarding our key objectives,

including the possible sale of our Russian assets.

C. Schaffalitzky

Executive Chairman

02 July 2023

Strategic Report

OPERATIONS UPDATE

Eurasia Mining Plc is a London listed, battery metals, PGM and

green hydrogen Company with a focus on environmental and

sustainability focused solutions, and with awareness of the future

outlook for the world energy supply landscape. Eurasia is an

international company incorporated in the UK with its headquarters

in London.

Following construction of a power line to site, an electric

dragline was assembled at the Company's West Kytlim PGM and gold

mine to provide a more environmentally sustainable and attractive

asset as well as a lower cost operation for the ongoing sale

discussions.

The Central Kola Peninsula Battery Metals (predominantly Nickel

and Copper) and PGM projects developed around the Company's fully

permitted Monchetundra Project adjacent the town of Monchegorsk,

home to Norilsk's Severonickel nickel and PGM processing facility.

A Definitive Feasibility Study was approved for the Monchetundra

Project, while the brown field NKT Mine is advanced, a former

producer.

The Company has demonstrated a consistent approach to creating

value by bringing quality projects from exploration through to

mining, as well as marketing for its proposed strategic sale

following the Board's decision to exit from Russia.

WEST KYTLIM

Open Pit PGM and Gold mine with a sustainability focus.

Predominantly powered by grid (hydro-derived) electric power.

Sustainable Mining

-- Shallow open pitting has reduced environmental impact

compared to conventional mining methods, and less long-term

environmental footprint - no blasting on site and no chemicals used

in the production process.

-- Recovery to previous land use within 5 to 10 years post

remediation and with no remnant pit or tailing dumps. Allows the

mine owner and management team to make provisions for remediation

on realistic time scale.

-- Hydro generated electricity powering ore body development

(dragline) and beneficiation (stationary plant).

-- Water a key element in beneficiation process - recycled in a

closed loop outside of river course.

-- Limiting the use of asphalt and concrete on site, many mine

buildings built from timber milled on site.

Historical CAPEX Highlights

-- Three enrichment plants.

-- Powerline and electric dragline projects delivered on

schedule including peripherals and high voltage substations and

hook ups.

-- A large fleet of equipment to support the electric dragline,

including: 2X Komatsu D275 Dozers, 1X Cat D8 Dozer, 1X Shantui

SD26AS, 6X Cat 330 excavators as well as one additional

washplant.

The Operation at West Kytlim has seen very significant upgrades

to machinery and mining equipment over the past years. Mining at

West Kytlim was initially sub-contracted with Eurasia retaining

control of the concentrate upgrade and refining components for two

seasons in 2017 and 2018. From 2019 to 2021 further machinery

including additional washplants were procured with stripping of

overburden and parts of the mining operation contracted as

required. A 14 kilometre power line was constructed from the nearby

town of Kytlim allowing the mine site and all stationary plant to

switch to hydro-derived grid electricity. A large electric shovel,

or dragline was also procured and assembled on site during 2022 and

was available to contribute to the following winter stripping

program. This machine with a 70m boom and 11m(3) bucket allows

stripping at greater efficiency and a fraction of the cost of

excavator/bulldozer pairings.

KOLA BATTERY METALS AND PGM

World class PGM and Nickel-Copper projects on Kola Peninsula -

cornerstone to a proposed new predominantly open-pittable PGM and

Battery Metals mining district.

To enable the sale of the assets and to exit from Russia, the

work during 2022 was dominated by the important Definitive

Feasibility Study (Russian TEO of permanent conditions) for the

open pits at Loipishnune and West Nittis within the Monchetundra

project (License MUR 16493) which was submitted on time in December

2022. The study involved a new metallurgical sample collected from

drill core and analysed following from the 2016 (pre-feasibility)

metallurgical work. Land surveying, geophysics and hydrogeological

and geotechnical studies were also completed. The ore at

Monchetundra contains commercial grades of Palladium, Nickel,

Copper, Platinum and Gold.

Monchetundra - 2022 Highlights

-- Submission of Definitive Feasibility Study for two open pits

at Loipishnune and West Nittis in December 2022.

-- Recognition of NKT as a potential Nickel dominant mine

relaunch opportunity, as a standalone project or integrated with

Monchetundra.

Monchetundra - 2023 Highlights in the year to date

-- Monchetundra DFS final approval received.

-- Mine now shovel ready with further developments to be led by

a new owner in the context of the Company's sale-of-assets

process.

-- No significant expenditure or work programme planned for the

Monchetundra Project during 2023.

NKT (Nittis-Kumuzhya-Travyanaya) Project - Base metals mine

relaunch adjacent the Monchetundra project

Tier-1 scale Nickel deposit with JORC MRE containing: 305Kt

Nickel, 143Kt Copper, and 57 tonnes PGM and Gold (11.2Moz of

Platinum equivalent) estimated by Wardell Armstrong International

(WAI) as JORC-compliant resources for a step room and pillar mining

operation, with nickel comprising half of the value in the metal

basket on a Net Smelter Royalty basis.

The NKT Project is being developed under license MUR 00950

BP.

A mine was successfully operated by Norilsk Nickel in the area,

put on hold because of low IRR at a Nickel price in the region of

US$2-5/lb versus above US$10/lb today(1) .

Following receipt of the Monchetundra Flanks exploration license

in August 2020, work commenced on collation of the very significant

body of historic and recent exploration and mining data available.

Originally developed as early as the 1930's, some further drilling

was completed in the early 1990's. Subsequently, further

exploration programs were completed by SeveroNickel,

PechengaNickel, Kolskaya Mining Metallurgical Company (Kolskaya

MMC), and more recently a drilling program undertaken by Rosgeo

from 2015 to 2017.

Eurasia commissioned Wardell Armstrong International to complete

a JORC analysis of the principal targets on the site during 2021

leading to publication of an NKT Competent Persons Report

describing the feasibility of a room and pillar mining operation

based on a 93,422kt (room-and-pillar mineable ore per 2021 WAI CPR)

with a total resource of Tier-1 scale: 305Kt of Nickel, 143Kt of

Copper, 57 tons of PGM and Gold (11.2Moz of Platinum equivalent) -

as estimated by WAI as JORC-compliant resources. The net present

value ("NPV") using an 8.33% discount rate for the underground part

of the NKT project is $1.2bn under the WAI price forecast and

$1.7bn under spot prices. The study had an IRR of 47% with a

payback period of 3 years.

The WAI report also included open pit optimisations for the

project area and a development program progressed to further detail

the overall geometry of all open pittable mineralisation throughout

the project area but principally at Kumuzhya, while also gathering

additional information on underground mining targets.

Mineralisation presents in two principal categories throughout the

area, both of which contribute to both open pit and underground

mineral resources;

A. Shallow epigenetic/post-magmatic low sulphide nickel-palladium disseminated and vein (chalcopyrite-pyrrhotite-pentlandite) mineralisation more concentrated in the axis of the massif.

B. Bottom lode syngenetic mineralisation (wider interval and

lower grade) occurring on the margins of the massif - Open pit and

underground mining potential.

(1 Nickel price history :)

(https://www.mining.com/markets/commodity/nickel/all/) (early 200's

price). Despite significant volatility from January 2022 Nickel has

traded above the US$10/lb line for much of the past two years.

Key performance indicators

Results for the year - the Group has made a loss before tax of

GBP7,230,088 for the year ended 31 December 2022 (2021: loss before

tax of GBP3,138,521). The single largest item causing this

variation is the absence of revenue in 2022.

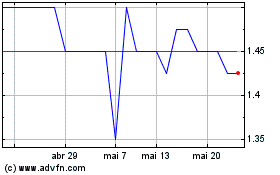

Shareholder return and share price performance . The Company's

shares are quoted on the AIM market of the London Stock Exchange

and the shares have traded at between 4.1p and 28.5p*(2021:

15p-36.5p) during the year under review. A range of factors both

internal and external to the Company can impact share price

performance, including significant geopolitical developments and

uncertainty therein, commercial and new business developments,

operational performance and metal price and metal price forecasting

fluctuations. The emergence of conflict in Ukraine in February and

March 2022 had an immediate effect on the Company's share price as

investor perception was affected across all business sectors.

Exploration and development.

The Group maintained sufficient funding to develop and expand

operations during the year reported.

The West Kytlim asset, following considerable investment over

the past number of years is considered by management to be fully

capitalised and capable of sustained production at current levels

for a life of mine of up to 15 years, excluding further resources

and reserves to be defined in both the West Kytlim Flanks and Typil

license areas adjacent the mining license.

A Definitive Feasibility Study ('DFS') for the Monchetundra

project was completed during 2022. No further significant expenses

are forecast for the Monchetundra project.

The NKT Project is being assessed either as a standalone mine

relaunch adjacent to the Monchetundra Project or with its reserves

and resources integrated with those at the Monchetundra Project for

concurrent development.

No funds were raised in equity or debt capital markets and no

warrants or options were exercised in the period reported.

(*Based on yahoo finance closing prices for 01 January 2022 to

31 December 2022)

Non-financial KPIs

Environmental management : the Group has environmental policies

in place and receives annual approvals for development work at West

Kytlim, where adherence to the relevant environmental subsoil

licensing laws is clearly stipulated. All relevant codes in

managing exploration programmes (specifically drilling) are also

strictly adhered to. Performance against environmental policies is

continuously monitored and annually audited including a provision

for environmental rehabilitation (note 28).

Health and Safety : the Group has occupational health and safety

policies and procedures in place ensuring that all efforts are made

to minimise adverse personal and corporate outcomes, through best

practice training, implementation and monitoring. These were

appropriately reviewed including appointment of a permanent health

and safety office following supply of high-voltage electric power

and oversized machinery to West Kytlim. The Group's LTIFR (Lost

time injury frequency ratio) remains at zero for the year

reported.

Operational : The Group has achieved further milestones at each

of the Monchetundra, NKT and West Kytlim Projects during the year

in review, as discussed in the Operations section herewith. Key

deliverables at each project are the Definitive Feasibility Study

at Monchetundra, the provision of electric power to West Kytlim and

the ongoing development program for the NKT project.

Governance : The Company followed the appointment of two board

members during 2021 with the appointment of Artem Matyushok in May

2022. Artem brings significant international mergers and

acquisitions experience to the Board which now comprises four

Directors and an Executive Chairman and Managing Director. New

appointments were made to roles within key subsidiary Kosvinsky

Kamen and the creation of a new Country Manager role in May

2023.

The risks inherent in all mineral exploration and development

businesses are kept under constant review by the Board and the

executive team. The risks affecting the Group and the Company are

described in detail in the Directors' report and Notes 2 (Going

concern) and 32 (Risk management objectives and policies) to the

financial statements. The principal operating risks affecting the

Group are highlighted below:

Exploration and project development risks

Mineral exploration presents an inherent risk in that

information on in-ground resources is both limited (quantitatively

and qualitatively) and in most instances expensive to obtain. This

presents a challenge which if not properly managed can lead to

misallocation of exploration funds, not identifying reserves and

resources or, following discovery, not demonstrating the economics

of an ore reserve to accepted industry standards. The necessary

consents and approvals to conduct exploration and development work

must also be obtained and managed.

Mitigation: The Group maintains appropriate in-house expertise

and long-standing relationships with external consultancies in

mining and metallurgy to keep abreast of their changing

requirements, and to make sure all regulatory obligations are met

and duly reported. Together these increase the prospect of a

successful outcome which is measured in terms of a project meeting

its licensing and reporting requirements and the overall financial

and other metrics of the project. The Board impress on senior

management the need to identify and address the major sources of

execution risk in any development project, and to continuously

monitor diversion from schedules or targets.

Operating mine risks

Machinery breakdowns, departures from expected grade and other

operational risks may have a significant impact on revenue, which

is a component of the group's financial capacity.

Mitigation: Multiple areas are developed concurrently to

mitigate risks of a lower than calculated grade at any location.

In-fill drilling and in pit sampling are carried out as required,

and in addition to resource definition requirements. The majority

of the machinery mine fleet is relatively new, having been acquired

from 2021 onwards. Skilled operators and mechanics were appointed

as required to operate and service this significant new item of

machinery at the mine site, as well as new health and safety

protocols.

Political risk and sanctions compliance

In view of sanctions imposed on individuals and entities in

Russia, from 2014 until the present time, further legal and

economic risks may arise. Further sanctions were imposed on Russia

from late February 2022 and were subject to further updates during

2022. The group has generated no revenue from Russia since the

beginning of February 2022.

Mitigation : Strict adherence to the Group's sanctions policy.

The Group does not engage with politically exposed or sanctioned

persons or entities. The Company employs expert legal advisors and

continues to monitor updates to international sanctions legislation

focussed on Russia and resulting from the conflict in Ukraine to

determine their effect on the businesses operations and medium and

long-term strategies. Two in-depth reviews of operations against

changes in the UK and EU sanctions landscape were carried out in

May and December 2022.

Environmental

The Group's operations are subject to statutory environmental

regulation, including environmental impact assessments and

permitting including forestry permitting. The environmental

legislation comprises numerous federal and regional codes discussed

further in the environmental report herewith. The Group makes an

assessment of the environmental impact when applying for permits

and licences. Review and approval of the rehabilitation plan is a

pre-requisite of the mine plan approval for each season of

mining.

Mitigation: The Group mitigates risk to the operation arising

from environmental issues by strictly adhering to relevant

environmental laws and codes and by ensuring an appropriate plan

for managing the environmental impact of any operation is in place

prior to commencement of on-site activity. The West Kytlim mine, by

nature of the relatively simple beneficiation methods employed does

not require management of hazardous mine and process plant tailings

within a tailings dam, as is necessary in large scale underground

and open pit mining operations.

The regulatory environment

The Company and the group's activities are subject to laws and

regulations governing various matters, including licensing,

production, taxes, mine safety, labour standards, occupational

health and safety and environmental protections.

Mitigation: The Group closely monitors all regulatory

requirements and changes to the laws, rules and regulation taking

steps whenever necessary to comply with regulation. The board

considers the regulatory environment for mining companies to be

transparent, not more difficult than other jurisdictions,

sufficiently prescriptive and in general navigable for a company

employing sufficient expertise and resources to manage that aspect

of its business. Sanctions legislation has presented a new

challenge to the Company which has been met by the appointment of

suitably qualified and UK based firm.

Commodity risk

A potential fall in commodity prices could result in it becoming

uneconomic for the Group to mine its assets.

Mitigation: The Group closely monitors the markets for platinum

group metals and battery metals, changes in their demand and

supply, and the effect these have on metal prices, with a view to

taking necessary measures in response to such changes, including

stockpiling concentrate as has occurred during 2022. The group

continues to consider potential opportunities in other mineral and

energy industries which can diversify risk.

Demand for platinum group metals from their principal use -

autocatalysts, which reduce harmful engine emissions is perceived

by market commentators to remain strong as electric vehicle uptake

is offset by tighter emissions control for traditional internal

combustion engine vehicles, and as PGM continue to find application

in emerging transport technologies such as Fuel Cell Electric

Vehicles. For further details see the PGM market summary section at

the front of this report.

Loss of key personnel risk

The loss of key personnel consists of the departure (voluntary

or otherwise) of an important employee, which will, in all

likelihood, result in a financial loss or increased expense to the

small or medium business. The expenses may be of a temporary or a

permanent nature. These increased expenses relate to the search for

and hiring of a new employee, training costs for the new hire,

possible "signing" bonus and higher remuneration packages.

Mitigation: The Group takes measures to motivate and retain

existing employees and has retained a significant number of its

senior management for more than ten years. There is not currently a

shortage of Mining industry personnel and expertise and the Group

is confident a suitable replacement could be found should it be

necessary to replace any key member of staff.

Financing risk

Historically, the Company has relied on international equity and

to a lesser extent debt capital markets to maintain adequate levels

of working capital.

Mitigation: The Group maintains tight financial and budgetary

controls as well as cost controls which with forward planning help

ensure the Company is adequately funded to reach its objectives.

The Russian assets' sale process is in progress.

The Board considers risk assessment to be important in achieving

its strategic objectives. Further details of the Group's financial

risk management policies can be found in note 32.

Research and future development

The Group's activities during the year continued to be

concentrated on advancing mineral exploration projects through

feasibility to mine development. While developing its core projects

as discussed in the Operations Update the Company will continue to

consider new directions for the business in other minerals and

energy markets globally.

ENVIRONMENTAL, SOCIAL and GOVERNANCE

Introduction

Environmental, Social and Governance priorities are a clear

focus of the mining industry generally and increasingly mining

industry investors. The Board welcome changes to the international

mining landscape particularly with respect to environmental

responsibility, and the example being set by industry majors in

setting net zero emissions targets, as well as developments in

international reporting standards to ensure adequate reporting

mechanisms. The Company's West Kytlim operation has undergone

significant changes in energy usage which will determine its future

environmental impact. With the Monchetundra Project on Kola in

pre-mine development, the Board feel it is premature for the Group

to set a net-zero emissions target but has taken steps to commence

appropriate environmental reporting going forward.

This section of the report describes how Directors consider and

adopt principles of corporate governance, as well as environmental

and social governance and apply them through the group of Companies

while achieving corporate objectives and ensuring the overall

direction, supervision and accountability of the organisation.

Other key aspects of Corporate Governance within this report

are;

-- The Section 172 Statement (Strategic Report above) describes

how Directors promote the Company for the benefit of members as a

whole;

-- Financial and non-financial Key Performance Indicators which

are outlined to measure performance of the board year on year;

and

-- Principal Risks and Uncertainties demonstrate an awareness of

potential obstacles to achieving corporate goals.

The Board has adopted the QCA Corporate Governance Code (2018)

("QCA Code") and strives to follow its 10 principles to the fullest

extent possible. Directors consider the West Kytlim operation, one

of the largest mines of its type in the world, to be an opportunity

to demonstrate a potential new style of lower emissions PGM

production, competing with other global sources of PGM in terms of

CO2/oz metal produced as well as long term environmental

disturbance. The Group ensures the land disturbed by mining

activities is returned, post mining, to a safe and stable landform.

Rehabilitation plans set out land and forestry is managed with an

equal amount of forest planted as is removed for mining. Open pits

are infilled with the overburden removed prior to mining, top-soil

is replaced and the land regenerates over a period of five to ten

growing seasons.

Environmental report

West Kytlim

The area developed at West Kytlim will itself be replanted with

appropriate local species and will recover to its pre-mine

condition within 5 to 10 years following mining.

Surface mining requires significant disturbance of the upper

layers of top-soil and river sediment terraces which are removed to

allow access to mineral bearing gravels. These areas are then

scheduled for remediation following mining.

Water is a key resource in any stable natural environment.

Process water at the mine site is derived from river water and is

fully recirculated meaning the water used to disintegrate and

beneficiate pay gravels is continuously recycled in a closed loop

maintained separate to any free-flowing water course. This hydro

infrastructure of damns, roads and ponds is constructed as required

at washplant sites in the mining area. There have not as yet been

cases of contamination of rivers or streams in the areas under

development in the year under review or in previous years. Tails

from the mining operation do not contain hazardous chemicals but do

include large volumes of sediment and clay, which could damage the

ecosystem in a natural river course if not correctly managed.

Several relatively small specially protected water environments are

defined within the mine license and particular care is taken to not

disturb these areas.

Waste management

The tailings of alluvial mining do not contain any hazardous

substances as no chemicals are used in the beneficiation process

which is driven by gravity and hydro-mechanical operations.

Measures are taken at site to ensure mine site water is maintained

in a closed loop separate from river courses.

Air emissions

The switch to electric powered draglines as the key machine

component for overburden stripping will remove a significant amount

of the vehicle emissions associated with overburden stripping.

Tracked and heavy machinery on site complies with the latest

accepted emissions standards having mostly been purchased new and

is specified to the latest environmental compliance standards.

Social

Relationship with the local community

Consultation

Giving notice of pre-approved and permitted work such as the

West Kytlim Power line project, and receiving feedback from the

local community who may be affected is a key element of good

community relations. No impact on local communities or their

activities has been identified at the West Kytlim Mine which is

situated in an area of unpopulated wilderness without nearby

farming operations. The Monchetundra operation adjacent the town of

Monchegorsk is located in a mining friendly jurisdiction with

mining and metallurgical processing being the largest employer in

the town and district.

Health and Safety report

During 2022 and in the year to date there have been no injuries

or accidents on operational sites. Health and safety protocols have

been upgraded at the West Kytlim mine site following the arrival of

electric draglines and high voltage electricity. Appropriate HSE is

available to all employees and its use closely monitored. Signage

is a key element of safety awareness which is maintained by the

mine site Health and Safety Officer. The highest risk situations

are during construction and assembly of various components of the

washplants and their peripherals as no on foot presence is required

in pit during excavation, and no drilling and blasting required

prior to digging.

Maintaining best-in-class Environmental, Social and Governance

position remains a key focus

OUR MINE SITES ARE ENGAGED WITH LOCAL COMMUNITIES

-- Consultation - A key aspect of community involvement for high impact projects.

-- All mine workers and equipment operators are local (within

70km area), Project companies registered locally and taxes are paid

locally.

-- The mine has a sustainability focus - for example most mine

building structures and interiors are constructed from timber

milled on site and move to electric power.

ENVIRONMENTAL PROTECTION IS FRONT OF MIND

-- Minimise impact - Surface mining with limited remnant waste and tails heaps

-- Limit use of concrete, steel and asphalt at the mine site

-- Rehabilitate - Eurasia is committed to ensuring the land

disturbed by mining is returned to a safe and stable landform with

no long term damage to the environment or eco system

-- Rehabilitation plans envisage works impacting local climate,

geochemistry of soils, fertility, degree of disturbance, specific

landscape and topography features

-- GHG emissions reduction - Installation of electric draglines

powered by mains hydro-derived electricity

OVER 20 YEARS' EXPERIENCE

-- Building robust partnerships and developing industry contacts

-- Leveraging an in-depth knowledge of the licensing system in

partnership with support from expert international technical

consultants

-- Group companies maintain strong contacts base amongst

machinery suppliers, contractors, industry consultants, and

sub-soil licensing professionals

Christian Schaffalitzky

Managing Director and Chairman

Directors' report

Directors

The Directors who served during the period were:

Christian Schaffalitzky - Executive Chairman

Anthony James Nieuwenhuys - Chief Executive Officer (retired

July 2023)

Tamerlan Abdikeev - Non-Executive Director

David Iain Rawlinson - Non-Executive Director

Kotaro Kosaka - Non-Executive Director

Artem Matyushok - Non-Executive Director (appointed May

2022)

Director's interests

Share interests

The Directors of the Company active at 31 December 2022 held the

following beneficial interests (including interests held by spouses

and minor children) in the ordinary shares of the Company:

31 Dec 2022 31 Dec 2021

No. of shares No. of shares

C. Schaffalitzky 89,569,517 89,569,517

Total 89,569,517 89,569,517

------------------ -------------- --------------

Share options and warrants

31 Dec 2022 31 Dec 2021

Options No. of shares No. of shares

C. Schaffalitzky 20,000,000 20,000,000

Total 20,000,000 20,000,000

-------------- --------------

All options granted to the Directors vested by 31 December

2021.

No share options were exercised by the Directors during 2022

(2021 - nil).

Dividends and profit retention

No dividend is proposed in respect of the year (2021: nil) and

the retained loss for the year attributable to the e quity holders

of the parent of GBP5,840,245 (2021: loss of GBP2,910,479) has been

taken to reserves.

Share capital

The issued capital of the Company as at 31 December 2022

was:

Number of Nominal Share premium

shares value account

Fully paid ordinary of

shares at 0.1 pence each 2,853,559,995 2,853,560 51,343,246

Deferred shares of 4 .9

pence each 143,377,203 7,025,483 -

--------------- ----------- --------------

2,996,937,198 9,879,043 51,343,246

Risk Management

The Directors consider that assessing and monitoring the

inherent risks in the exploration and mine development business, as

well as other financial risks, is crucial for the success of the

Group. The Board regularly reviews the performance of the Company's

projects against plans and forecasts. Further detail on management

of financial risks, which includes foreign currency, interest rate,

credit, liquidity and capital risks are set out in Note 32.

Going Concern

As at 31 December 2022 the Group's net current assets amounted

to GBP5,883,581 (GBP23,036,966 in 2021) and includes unsold

inventory of GBP4,182,382. As at the same date, the Group's cash

balance was GBP1,009,908 (GBP22,009,507 in 2021) and investment in

US treasuries of GBP3,807,925 (2021: nil). The majority of the

reduction in year on year cash position (2021 to 2022) is

attributable to capital investments and operating costs for the

West Kytlim Mine.

The Group's debt consists of lease liabilities set up to acquire

mining machinery for a total amount of GBP348,269 (at 31 December

2021 - GBP429,543).

The Group's current (as at 29 June 2023) cash position is around

GBP40,000 and US treasury Bonds valued at GBP1,646,255 with the

reduction since December 2022 being accounted for by GBP150,000 in

capital expenditure, GBP950,000 on development expenditure on its

assets portfolio, and GBP2,031,578 in costs.

These financial statements have been prepared on a going concern

basis, which assumes that the Group will continue in operation for

the foreseeable future. The directors have prepared detailed

bottom-up financial forecasts to address a range of scenarios for

the Group's operations. The Group's forecasts and assumptions

reflect key assumptions based on information available at the time

of review and include:

1. Sale of inventory of raw platinum concentrate:

The Company currently has an inventory of raw platinum

concentrate, the product of the 2022 mining season at the Kluchiki

and Bolshaya Sosnovka areas, which has been retained in safe

storage for later refining. The concentrate has a total net weight

of 199.3 kg and a realisable value of not less than GBP4.1 million.

The Company is in advanced negotiations with a number of parties to

realise this value in the near future. These funds will be used to

support the current mining season (see 2 below) and to continuing

operating costs of the Group.

2. Continuing mining operations of the Group

The Group's current mining operations in West Kytlim mine has

been running at reduced capacity at start-up of the season, as we

were engaged in stripping activity only with a commensurate and

very significant reduction in diesel and labour costs. The Board

have agreed a new and extensive mining plan for the remainder of

the season, based on electricity powered machinery and equipment.

The mining operations in West Kytlim will contribute significant

additional funds to the Group when the value of the extracted

concentrate is realised.

3. Expenditure on Monchetundra asset

The Group has spent GBP900,000 on a development programme for

the Monchetundra asset during 2022 leading to approval of the DFS

in 2023. No further significant outgoings have been budgeted for

this asset.

4. Management of future cash outflows

In addition to the above, the Group have the ability to manage

and where required, reduce expenditure as needed.

As such, the Directors have prepared the financial statements on

a going concern basis and consider it to be reasonable.

2022 Events and sanctions compliance

The Company has satisfied itself that its current activities at

the West Kytlim Mine and on the Kola Peninsula are not prohibited

under UK or EU sanctions rules. For the avoidance of doubt this

includes sale of West Kytlim mine product. Furthermore, the Group

does not engage and has not engaged with any sanctioned persons/

entities or agencies. Two in-depth reviews of the Company and

Group's activities were tested with appropriate legal advice

against EU and UK sanctions legislation in May and December

2022.

The Company has continued to fund Group companies through

international disbursements as required and in compliance with

applicable regulation.

Debt and equity capital markets are expected to remain as

options for the Company going forward.

Directors have concluded that the combination of the above

factors, with account of the current applicable sanctions regimes,

support the Board's opinion that it has a reasonable expectation

that the Group has adequate resources to continue in operational

existence for the foreseeable future, which management has

determined to be at least 12 months from the signing of this Annual

Report.

The Board therefore believes it is appropriate to adopt a going

concern basis in preparing the Annual Report and Accounts.

Directors Responsibilities statement

The Directors are responsible for preparing the Strategic report

and the Directors' report.

Company law requires the Directors to prepare financial

statements for each financial year. Under that law the Directors

must prepare the financial statements in accordance with the UK

adopted International Accounting Standards and in accordance with

the Companies Act 2006. Under company law the Directors must not

approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs and profit

or loss of the Company and Group for that period. In preparing

these financial statements, the Directors are required to;

-- select suitable accounting policies and apply them

consistently;

-- make judgements and accounting estimates that are reasonable

and prudent;

-- state whether applicable accounting standards have been

followed, subject to any material departures being disclosed and

explained in the financial statements;

-- with contributions from advisors, set the Company and Group's

corporate strategy including research and development activities

(detailed in the strategic report above);

-- prepare the financial statements on a going concern basis

unless it is inappropriate to presume that the Company will

continue in business. The Directors are responsible for keeping

adequate accounting records that are sufficient to show and explain

the Company's transactions and disclose with reasonable accuracy at

any time, the financial position of the Company and Group and

enable them to ensure that the financial statements comply with the

Companies Act 2006. They are also responsible for safeguarding the

assets of the Company and Group and hence for taking reasonable

steps for the prevention and detection of fraud and other

irregularities.

The Directors confirm that: so far as each Director is aware

there is no relevant audit information of which the Company's

auditor is unaware; and the Directors have taken all the steps that

they ought to have taken as Directors in order to make themselves

aware of any relevant audit information and to establish that the

Company's auditor is aware of that information. The Directors are

responsible for the maintenance and integrity of the corporate and

financial information included on the company's website.

Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

Revenue

No sale of mine product from the West Kytlim mine occurred in

the year under review. Historically, revenues generated by the

Group have been from refining of PGM concentrates. Refinery

receipts record the total of metal sales with payments received for

platinum and gold, at the market rate, on average every month

throughout the mining season. For reasons related to the nature of

metals refining the revenue for other PGM (Rhodium, Iridium and

Palladium) are received when all shipments for that year have been

received.

Directors Indemnity

The group maintains Directors and Officers liability insurance

as an indemnity provision renewed annually.

Corporate Governance

Eurasia Mining applies the QCA Code as a Corporate Governance

framework to ensure adequate corporate governance standards for the

current business and mindful of how the business will evolve

in-line with its corporate strategy and business goals. The QCA

Code's ten principles describe how the code should be applied to

any company.

Eurasia has established a strategy designed to promote long-term

value and a return on investment for its shareholders, a strategy

which also aims to build the Company to an increasingly profitable

enterprise while maintaining good corporate governance and social

and environmental responsibility standards.

Delivering Growth

Eurasia has established a strategy designed to promote long term

value and a return on investment for its shareholders, a strategy

which also aims to build the Company to an increasingly profitable

enterprise while maintaining good corporate governance and social

and environmental responsibility standards.

Principle 1: Strategy

The Company's strategy is to self-fund exploration and

development of marketable resource and energy projects in various

commodities, and to realise a return on investment, either by

carrying the project through feasibility to commissioning or by

straightforward sale at any stage of development. The Company

recognises that all project development expenditure adds value to a

project by increasing its resource and reserve base. Risk to

further investment in development expenditure, or in mine

development, is also reduced as resources are moved to lower risk

categories. The Company has adopted a dual strategy of both project

development towards mining, while also investing significant

resources in active high-level mergers and acquisitions activity.

The Company adapts this strategy in response to external stimulus

such as geopolitical events.

The Company is focused on selling its assets in Russia while

maintaining corporate governance principles in line with the QCA

Code. The key commitments and challenges in adhering to the QCA's

10 principles are set out below.

Principle 2:

Understanding shareholders

Eurasia seeks to maintain open, direct and two-way communication

with its shareholders through various media including press

releases, the Company website, interviews and industry events. The

Company employs public relations professionals and maintains

third-party contracts as required to better disseminate Company

news-flow. Through shareholder feedback the Company ensures that it

remains in touch with the information requirements of shareholders,

their expectations regarding their investment, and the motivation

behind their voting decisions. Director's consider shareholder's

expectations to be correlated with that of the Company and the

Company's strategy. The Company aims to update on key operation and

commercial events as appropriate and the Board recognises that

shareholders require complete and timely information as a necessary

input to their investment decisions. Working with its Nominated

Advisor the Company maintains strict adherence to the AIM rules for

Companies.

Principle 3:

Stakeholders and social responsibility

Experienced and knowledgeable long-standing employees and

service providers are a recognised key asset within the Company and

our Corporate Governance principles seek to cultivate a productive

and fulfilling working environment within the Company and the Group

of companies. Our mining and other operations are a further key

asset and attention is paid to how these operations engage with

society and the various stakeholders important to the project's

continuous success. Any issue arising from any stakeholder will

immediately be dealt with or communicated to the required level to

allow for action to be taken. No material events have occurred in

the history of the mining operation and where an issue may arise it

is reported in full to senior management and Directors. Managing

relationships within the Company's workforce, and its outward

interactions with local communities, service providers, and the

environment, all have the potential to impact on the Company's

ability to achieve its medium to long term goals - managing these

relationships is considered a fundamental facet of good Corporate

Governance operating at project level.

Principle 4:

Risk management

The leading risks at operational level relate to the reliability

of our resource and reserve estimations and our ability to manage

the mining operation to achieve its goals. These risks are

mitigated by ensuring qualified and knowledgeable personnel are

employed and that they are adequately resourced and supported by

effective management. Resource exploration involves inherent risks

stemming from the fact that information relating to the

mineralisation is not immediately available and is expensive to

obtain. Recognising this risk and then managing it effectively is a

critical aspect of a successful resource exploration and

development business. The Company's annual audit provides an

opportunity to reassess the key risks facing the business at both a

corporate and operational level (see principal risks and

uncertainties herewith). These are agreed by directors and

delineated and audited on an annual basis, thus ensuring adequate

recognition and articulation of each risk category.

Principle 5:

Maintaining a dynamic management framework

The Board consists of a Chairman and Managing Director supported

by four Non-Executive Directors. The Board aims to maintain two

independent Non-Executive Director positions at all times. At the

date of this revision Iain Rawlinson, Artem Matyushok and Kotaro

Kosaka are considered independent Non-Executive Directors. In

addition, the board maintains appointments made as strategic

advisors with the Mergers and Acquisitions Officer role recognised

as pivotal in the current overall strategy.

The board meets when an executive decision requires board

approval, and in any event no less than once per six-week period.

Board members are regularly consulted on executive decisions which

would benefit from specific input relevant to a board members area

of expertise. All board members are aware of and comfortable with

the time and resource requirements associated with their position.

Relevant information relating to a board discussion is prepared and

circulated in advance of board meetings. An attendance record for

each director is maintained and annualised for distribution within

the board. Separately, the Company secretary, is considered a key

position necessary in preserving a functional and ergonomic

management framework within the Company and good communication

across the Group of companies.

Principle 6:

Experience and skills

The board has an effective combination of commercial and

technical experience, being led by a chair with a strong background

in geology, who is supported by non-executive directors with

commercial, legal and mergers and acquisitions experience in a

range of markets and jurisdictions. Board members retire on a fixed

rota and declare themselves eligible for reappointment by

shareholders at the Company's AGM.

The board considers the skill sets within the current board to

be sufficient for the successful running of the business, and the

delivery of the stated corporate strategy and goals through the

medium to long term, however further appointments may be made in

due course. In addition, where more specialised skills are

required, the board has access to a network of individuals and

organisations with whom it can consult for further information.

This can include input to operational decisions relating to the

Company's operating mine, or advice of a commercial nature. Each

board member's long-standing career in the industry is invaluable

in this regard. Continuing Professional Development ('CPD') and

membership of institutions which promote best practice in industry

is encouraged in all board members, though not compulsory to board

membership. As an example, the professional accreditations PGeo

('Professional Geologist', Institute of Geologists of Ireland) and

EurGeol ('European Geologist', European Federation of Geologists),

attained by the Executive Chairman, are maintained by adherence to

a programme of CPD activities.

All board members regularly attend industry events and

conferences to keep abreast of developments in their area of

expertise. No one board member, or group of board members,

dominates decision making within the Board.

Principle 7:

Board performance

The Remuneration Committee, whose membership is considered

annually is responsible for evaluating the performance of the

executive directors. As mentioned above board members retire on a

fixed rota, and efforts are made with regard to succession planning

and appointment of new board members.

The appointment process involves; assessment of suitability

based on qualifications and work history, due diligence by the

Company and its Nominated Adviser, a series of meetings with board

members and key personnel, and finally contract negotiation and

appointment. Board evaluations are internal to the Company and on

an ad-hoc basis, as befits the small scale of the Company

currently, but not less than once per year at the time of the

Company AGM. Adhering to the Company's strategy, achieving the

Company's goals, and maintaining good corporate governance

standards are the three most prominent identifiers by which board

effectiveness is evaluated. Board evaluations are not currently

made public, and it is the Company's intention to reconsider this

position and ensure continued compliance with the Code as the

Company develops.

Principle 8:

Values

The Company is founded on a culture of following and promoting

the highest ethical standards with regard to its commercial

transactions, business practices, strategy, internal employee

relations and outward-facing stakeholder and community

relationships. The Company is incorporated and domiciled in the UK

and governed by the laws of England and Wales and its corporate

culture and values extend from PLC level throughout the

organisation irrespective of jurisdiction. An ability to recognise

and promote good ethical values is seen throughout the organisation

as an asset to an employee, potential employee or board member. The

current board members have been chosen with awareness of the

Company's corporate culture and the Company's ethical standards in

mind - new board appointments are also considered in this light.

Corporate culture, and high ethical standards with regard to

business practices are considered a critical element in attaining

the Company's strategy and goals and these standards are reinforced

through the nominations and staff appraisal process. High standards

of ethics create a competitive advantage for the Company and are a

core element of the Company's business model, as they ensure the

Company's long-term sustainability. Eurasia is an equal

opportunities employer, and the Board has recognised a lack of

board diversity which it intends to address.

Principle 9:

Governance

Maintaining governance structures that are fit for use as the

Company evolves in size and complexity is an essential element of

good corporate governance. Maintenance of the corporate governance

code is the sole remit of the Chairman, who instigates changes in

policy, and ensures the code is applied throughout the

organisation. Non-executive directors are appointed and participate

in all board level decisions and also provide scrutiny and

oversight of the executive director's roles. The board's

non-executive directors are each skilled in different aspects of

commerce, law, finance and the UK regulatory environment, with a

combined breath of experience across various markets, commodities

and jurisdictions. They communicate regularly with the Chairman and

executive directors and provide reliable advice in their areas of

expertise. The terms and functions of the audit and risk,

remuneration and nomination committees are set out below. The

Company Secretary is available to non-executive directors to

support their information requirements and decision making and

reports directly to the Chairman.

Audit and Risk Committee

The Audit and Risk Committee may examine any matter relating to

the financial affairs of the Group and the Group's audits, this

includes reviews of the annual financial statements and

announcements, internal control procedures, accounting procedures,

accounting policies, the appointment, independence, objectivity,

terms of reference and fees of external auditors and such other

related functions as the Board may require. The external Auditors

have direct access to the members of the committee, without

presence of the executive Directors, for independent discussions.

Several Audit and Risk Committee meetings are held during the year,

prior to and during the annual audit; and to approve Interim and

Annual Financial Statements. The Audit and Risk Committee opines on

whether accounts are in compliance with International Financial

Reporting Standards.

The Chairman of the Audit and Risk Committee is Iain Rawlinson

and the committee comprises Iain Rawlinson and Tamerlan Abdikeev.

The Audit and Risk Committee is guided by company policy and

procedure including the Audit and Risk Committee terms of

reference.

Remuneration Committee

The Remuneration Committee determines the terms and conditions

of employment and annual remuneration of the executive Directors

and senior staff. It consults with the Executive Chairman, takes

into consideration external data and comparative third-party

remuneration and has access to professional advice outside the

Company.

The Chairman of the Remuneration Committee is Iain Rawlinson and

the committee comprises Iain Rawlinson and Tamerlan Abdikeev.

The key policy objectives of the Remuneration Committee in

respect of the Company's executive Directors and other senior

executives are to ensure that individuals are fairly rewarded for

their personal contribution to the Company's overall performance,

and to act as an independent committee ensuring that due regard is

given to the interests of the Company's Shareholders and to the

financial and commercial health of the Company. Remuneration of

executive Directors comprises basic salary, discretionary bonuses,

participation in the Company's Share Option Scheme and other

benefits. The Company's remuneration policy with regard to options

is to maintain an amount of not more than 10% of the issued share

capital in options for the Company's management and employees which

may include the issue of new options in line with any new share

issues. The Remuneration Committee is guided by company policy and

procedure including the Remuneration Committee terms of

reference.

Nominations Committee

The Chairman of the Nominations Committee is Christian

Schaffalitzky and the committee comprises Christian Schaffalitzky

and Iain Rawlinson. The committee convenes at a minimum twice

annually to consider board composition, and, if considered

necessary, seek further appointments. The committee is conscious of

a need for board diversity when considering future appointments.

The Nominations Committee is guided by company policy and procedure

including the Nominations Committee terms of reference.

Principle 10:

Build trust

The Board seeks to maintain both direct and two-way

communication with its shareholders through its public and investor

relations programmes. All shareholders may at their discretion

chose to attend the Company AGM either virtually or in person. The

Company employs Public Relations and Investor Relations

professionals and maintains several third-party contracts to better

disseminate Company news-flow. Through shareholder feedback the

Company ensures that the Board's communication of the Company's

progress is thorough and well understood. A clear statement on the

outcomes of board resolutions is communicated immediately after the

Company's AGM by RNS and posted to the Company's website. This

includes a summary of votes for and against the resolutions put

before the shareholders, and where a significant number of votes is

cast against a resolution this is clearly stated, with an

explanation as to possible remediation regarding that voting. A

catalogue of historical annual reports and AGM notices is

maintained at an appropriate location on the Company's website.

Matters which are reserved strictly for the consideration of the

board include, but are not limited to, discussions and decision on

Company strategy, major investment decisions in new business

development, commercial arrangements including funding

requirements, high-level decisions on distribution of funds, and

recruitment or dismissal of senior personnel and board members. The

above outline of the Company's corporate governance framework

befits the current scale of the Company but will be subject to

appropriate modifications as the Company grows in line with its

stated strategy.

An annual review of the corporate governance framework outlined

above is undertaken at the board meeting preceding or directly

following the Company's AGM. Changes considered to the current

corporate governance framework, to be assessed in due course,

include further appointments to the board, and establishing

independent bodies to review and assess board performance.

UK Code on Takeovers and Mergers: Eurasia Mining is subject to

the UK City code on takeovers and mergers, which was revised and

extended to apply to all companies listed on the AIM market in

October 2013.

Auditors Grant Thornton are willing to continue in office and a

resolution proposing their re-appointment as auditors of the

Company and a resolution authoring the Directors to agree their

remuneration will be put to shareholders at the Annual General

Meeting.

By order of the Board

K. Byrne

Company Secretary

02 July 2023

Consolidated statement of profit or loss and other comprehensive

income

For the year ended 31 December 2022

Note Year to Year to

31 December 31 December

2022 2021

GBP GBP

Sales 8 119,525 2,331,225

Cost of sales 9 (30,173) (2,584,680)

------------- -------------

Gross profit/(loss) 89,352 (253,455)

Administrative costs 9 (4,618,351) (2,717,765)

Investment income 61,325 1,394

Finance cost 10 (107,697) (103,445)

Other gains 11 187,592 -

Other losses 11 (2,842,309) (65,250)

------------- -------------

Loss before tax (7,230,088) (3,138,521)

Income tax expense 12 - -

------------- -------------

Loss for the year (7,230,088) (3,138,521)

Other comprehensive income:

Items that will not be reclassified

subsequently to profit and

loss:

NCI share of foreign exchange

differences on translation

of foreign operations 16 (61,656) 36,855

Items that will be reclassified

subsequently to profit and

loss:

Parent's share of foreign exchange

differences on translation

of foreign operations (341,762) (58,679)

------------- -------------

Other comprehensive expense

for the year, net of tax (403,418) (21,824)

------------- -------------

Total comprehensive loss for

the year (7,633,506) (3,160,345)

============= =============

Loss for the year attributable

to:

Equity holders of the parent (5,840,245) (2,910,479)

Non-controlling interest 16 (1,389,843) (228,042)

------------- -------------

(7,230,088) (3,138,521)

============= =============

Total comprehensive loss for

the year attributable to:

Equity holders of the parent (6,182,007) (2,969,158)

Non-controlling interest 16 (1,451,499) (191,187)

------------- -------------

(7,633,506) (3,160,345)

============= =============

Loss per share attributable

to equity holders of the parent:

Basic and diluted loss (pence

per share) 30 (0.22) (0.10)

The accompanying notes are an integral part of these financial

statements.

Consolidated statement of financial position

As at 31 December 2022

Note 31 December 31 December

2022 2021

GBP GBP

ASSETS

Non-current assets

Property, plant and equipment 13 9,600,231 5,061,743

Assets in the course of construction 13 696,026 640,423

Intangible assets 14 2,859,368 1,389,029

Investment in financial assets 17 3,807,925 -

Investment to potential share

in joint venture 15 - 367,464

------------- -------------

Total non-current assets 16,963,550 7,458,659

------------- -------------

Current assets

Inventories 19 4,182,382 38,673

Trade and other receivables 20 3,171,669 1,681,864

Current tax asset 6,050 5,334

Cash and cash equivalents 21 1,009,908 22,009,507

------------- -------------

Total current assets 8,370,009 23,735,378

------------- -------------

Total assets 25,333,559 31,194,037

============= =============

EQUITY

Issued capital 22 61,187,111 61,187,111

Other reserves 24 3,580,929 3,922,691

Accumulated losses (38,954,777) (33,114,532)

------------- -------------

Equity attributable to equity

holders

of the parent 25,813,263 31,995,270

Non-controlling interest 16 (3,401,548) (1,950,049)

------------- -------------

Total equity 22,411,715 30,045,221

------------- -------------

LIABILITIES

Non-current liabilities

Lease liabilities 26 181,198 307,136

Provisions 28 254,218 143,268

------------- -------------

Total non-current liabilities 435,416 450,404

------------- -------------

Current liabilities

Borrowings 25 - 31,953

Lease liabilities 26 167,071 122,407

Trade and other payables 27 2,230,879 486,558

Provisions 28 88,478 57,494

Total current liabilities 2,486,428 698,412

------------- -------------

Total liabilities 2,921,844 1,148,816

------------- -------------

Total equity and liabilities 25,333,559 31,194,037

============= =============

These financial statements were approved by the board on 02 July

2023 and were signed on its behalf by:

C. Schaffalitzky

Executive Chairman

The accompanying notes are an integral part of these financial

statements.

Company statement of financial position

As at 31 December 2022

Note 31 December 31 December

2022 2021

GBP GBP

ASSETS

Non-current assets

Property, plant and equipment 13 419 804

Investments in financial assets 17 3,807,925 -

Investments in subsidiaries 16 1,132,246 1,132,246

Total non-current assets 4,940,590 1,133,050

------------- -------------

Current assets

Trade and other receivables 20 434,040 308,485

Other financial assets 18 28,157,840 12,681,450

Cash and cash equivalents 21 136,733 21,892,793

------------- -------------

Total current assets 28,728,613 34,882,728

------------- -------------

Total assets 33,669,203 36,015,778

============= =============

EQUITY

Issued capital 22 61,187,111 61,187,111

Other reserves 24 3,924,026 3,924,026

Accumulated losses (31,878,477) (29,371,048)

------------- -------------

Total equity 33,232,660 35,740,089

LIABILITIES

Current liabilities

Trade and other payables 27 436,543 275,689

Total current liabilities 436,543 275,689

------------- -------------

Total liabilities 436,543 275,689

------------- -------------

Total equity and liabilities 33,669,203 36,015,778

============= =============

In accordance with section 408(3) of the Companies Act 2006,

Eurasia Mining plc is exempt from the requirement to present its

own statement of profit or loss. The amount of loss for the

financial year recorded within the financial statements of Eurasia

Mining plc is GBP2,507,429 (2021: loss of GBP2,004,556).

These financial statements were approved by the board on 02 July

2023 and were signed on its behalf by:

C. Schaffalitzky

Executive Chairman

The accompanying notes are an integral part of these financial

statements.

Consolidated statement of changes in equity

For the year ended 31 December 2022Consolidated statement of

changes in equity

Attributable

to equity

holders

Share Share Deferred Other Translation Accumulated of the Non-controlling

Note capital premium shares reserves reserve losses parent interest Total

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1 January

2021 2,758,702 28,028,671 7,025,483 3,924,026 57,344 (30,204,053) 11,590,173 (1,758,862) 9,831,311

Issue of ordinary

share

capital for cash 94,858 24,834,836 - - - - 24,929,694 24,929,694

Share issue cost - (1,555,439) - - - - (1,555,439) (1,555,439)

Transaction with

owners 94,858 23,279,397 - - - - 23,374,255 - 23,374,255

---------- ------------ ---------- ---------- ------------ ------------- ------------- ---------------- ------------

Loss for the year - - - - - (2,910,479) (2,910,479) (228,042) (3,138,521)

-

Other

comprehensive

income

Exchange differences

on

translation

of foreign operations - - - - (58,679) - (58,679) 36,855 (21,824)

Total comprehensive

loss

for the year ended 31

December

2021 - - - - (58,679) (2,910,479) (2,969,158) (191,187) (3,160,345)

---------- ------------ ---------- ---------- ------------ ------------- ------------- ---------------- ------------

Balance at 31 December

2021 2,853,560 51,308,068 7,025,483 3,924,026 (1,335) (33,114,532) 31,995,270 (1,950,049) 30,045,221

========== ============ ========== ========== ============ ============= ============= ================ ============

Attributable

to equity

holders

Share Share Deferred Other Translation Accumulated of the Non-controlling

Note capital premium shares reserves reserve losses parent interest Total

GBP GBP GBP GBP GBP GBP GBP GBP GBP

Balance at 1 January