TIDMBRH

RNS Number : 6473E

Braveheart Investment Group plc

03 July 2023

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information as stipulated under the UK Market Abuse Regulation.

With the publication of this announcement, this information is now

considered to be in the public domain.

3 July 2023

Braveheart Investment Group plc

("Braveheart", the "Company" or the "Group")

Final Results for the year ended 31 March 2023

Braveheart Investment Group plc (AIM: BRH) announces its audited

annual results for the financial year ended 31 March 2023,

highlights of which are set out below:

-- Earnings per share of 2.68 pence per share (2022: 4.02 pence per share)

-- Strong technical and product development progress at Kirkstall, Paraytec and Phasefocus

-- These strategic investments are now well positioned for

growth in product, service and licence revenues

For further information:

Braveheart Investment Group plc Tel: 01738 587555

Trevor Brown, Chief Executive Officer

Viv Hallam, Executive Director

Allenby Capital Limited (Nominated Adviser Tel: 020 3328 5656

and Joint Broker)

James Reeve / George Payne

Peterhouse Capital Limited (Joint Broker) Tel: 020 7469 0936

Duncan Vasey / Lucy Williams

Chief Executive Officer's Report

I am pleased to report to shareholders for the year ended 31

March 2023.

I became CEO of Braveheart in August 2015. An investor buying

the shares at the then market price and selling them at the end of

the 2023 financial year would have enjoyed a total return (compound

annual growth rate "CAGR") of *28.59% pa. By comparison, over the

same period for the AIM All-Share index**, the CAGR was less than

2% pa (in the USA the CAGR of the S&P500 was 13% and Berkshire

Hathaway 14%). In the belief of the Directors, a total compound

return of 29% per annum places Braveheart amongst the best

performing UK listed investments during this period.

Our strategy is to invest shareholder funds in businesses that

we believe possess specific characteristics capable of generating

exceptional returns on disposal. The timing and price of such

disposals is impossible to forecast, and the Board acknowledges

that patience may be required of shareholders while waiting for

events to unfold. Although convention requires your directors to

offer guidance about the future, the reality is that your directors

have no more idea about timing of realisations than anyone else.

Where the directors do have control is in positioning the portfolio

to maximise exposure to potentially positive events.

Strategic Investments Overview

Paraytec Limited (Braveheart owns 100% per cent of the

company)

Paraytec develops high performance specialist detectors for the

analytical and life sciences instrumentation markets. In addition,

it has been undertaking a programme with the University of

Sheffield to develop rapid tests ("CX300") for identifying

pathogens, including viruses.

CX300 development programme and clinical study

As reported on 31 May 2023, the collection of patient specimens

for the COVID-19 clinical study at Sheffield Teaching Hospitals NHS

Foundation Trust was successfully completed. The data set has since

been 'locked' and passed to the independent clinical statisticians.

Paraytec is awaiting the findings of the statistical analysis and

initial reporting of results, which had been agreed for end June,

but due to delays at the clinical statistician service provider,

are now expected in July 2023.

Paraytec's programme to apply the CX300 technology to a test for

the rapid diagnosis of bacteraemia causing sepsis is underway. An

important element of this work has been to meet some of the UK's

leading clinicians who design and implement the NHS treatment

standards for the diagnosis and treatment of sepsis.

These meetings have concluded that the first target for Paraytec

will be an instrument for the rapid detection of bacteria in a

blood sample and if bacteria are present, to report whether these

bacteria are classed as Gram-positive or Gram-negative.

Differentiation between these two classes of bacteria is novel and

invaluable to clinicians for a number of reasons: firstly, it will

greatly help clinicians identify the likely source of the

infection; secondly, different antibiotics are used to treat

Gram-positive or Gram-negative bacteria, allowing clinicians to

immediately target the best antibiotic treatment; thirdly, this

will reduce the use of broad spectrum antibiotics to treat

patients, as this can cause the bacteria present to rapidly

increase their antibiotic resistance, making it even more difficult

to treat the patient.

Paraytec's novel CX300 technology can be a major tool in the

sepsis threat to global health and, as previously reported,

proof-of-concept is expected to be completed by the end of this

year. Antibiotic Stewardship is a challenge to global health. It

demands the responsible and strategic use of antibiotics to

optimise patient outcomes, minimize the development of antibiotic

resistance and preserve the effectiveness of these valuable drugs

for future generations.

Other applications

The CX300 instrument is now CE marked for laboratory use and

marketed for sale, details of which are on Paraytec's website,

www.paraytec.com/cx-300/ . Instruments are being produced and

initially sales will be direct to customer by Paraytec's team. As

volumes grow, the Company will seek volume manufacturing partners

and distributors. In parallel with the CX300 instrument sales,

there is potential for a substantial consumable market, which

Paraytec intends to develop and exploit.

Together with Professor Carl Smythe and his team at Sheffield

University, Paraytec has commenced a programme to test and develop

a series of user applications for the CX300. The first in this

series concerns the analysis of protein aggregation and a Technical

Note "Therapeutic Antibody Aggregation Analysis using CX-300 and

ParaySelect(TM) " is now available on the Paraytec website (

www.paraytec.com ). This shows users how the CX300 can quantify

aggregation in the monoclonal antibody Herceptin (TM) within 60

seconds, using a remarkably small sample of 30 microlitres.

Paraytec has instruments ready to demonstrate this procedure and is

setting up a contract service to analyse samples on behalf of

researchers.

Herceptin(TM) is an important biopharmaceutical used to treat

early and advanced Her2+ cancers, including breast, stomach and

oesophageal cancer, either alone or as an antibody-drug conjugate.

Aggregation is to be avoided because it results in loss of

function, decreased solubility, and, most importantly, enhances

unwanted immunogenicity. Aggregate information is highly valuable

to medical protein producers, who need to know if the material is

denatured or aggregated before they use it in drug production. The

CX300 can greatly increase aggregate detection over current

methods, which would assist the research, development and

production of better-quality drugs and diagnostics, whilst saving

time and cost.

Phasefocus Holdings Limited (Braveheart owns 44.19% of the

company)

Phasefocus' patented imaging and analysis technology uses a

novel computational method for high fidelity Quantitative Phase

Imaging ("QPI") and advanced microscopy, known in the scientific

literature as "ptychography". The technology is useful for a wide

range of applications including live cell imaging, engineering

metrology and electron microscopy. The company's principal

offering, Livecyte(R), combines its QPI technology with integrated,

proprietary, analysis software for live cell analysis. What sets

this system apart from its counterparts is its unique ability to

continuously track thousands of individual cells and sustain cell

health and viability over prolonged durations. This fundamental

feature facilitates longitudinal studies involving live cells,

thereby permitting a more thorough exploration of dynamic cellular

processes. The system enables users to automatically characterize

growth, morphology, and motility of large populations of cells in a

96-well plate assay format.

We believe that the Livecyte (R) imaging and analysis system

https://www.phasefocus.com/livecyte is truly market leading . Its e

asy-to-use image processing and cell tracking algorithms allow cell

biologists to identify and track individual cells in real time .

Researchers can now monitor the effect of drugs on cell behaviour

over many days, identifying cell division events and subsequent

daughter cells.

Many drug treatments used in cancer therapy aim to: (1) disrupt

the cell cycle to stop the tumour growing; or (2) reduce the

probability of cells causing secondary cancers through metastasis.

Livecyte(R) has been demonstrated to provide novel measurements

crucial to assessing the performance of both therapy targets; cell

growth, proliferation and division events are useful for

understanding (1) and cell motion and migration characteristics are

valuable for (2).

Stem cells are extremely sensitive to DNA damage, which makes

them very challenging to image with most high-content cell analysis

systems which use high-power laser sources and fluorescent

labelling. Livecyte (R), with its QPI technology, produces high

contrast images without the need for fluorescent labels or a

high-powered illumination source, making it more suited to stem

cell research. Cells analysed with Livecyte(R) are also left viable

for subsequent downstream use, e.g. for further cell growth or

additional analysis.

Unlike comparative QPI systems, Livecyte (R) removes the need

for expensive consumables, reduces set up times, improves image

quality, expands the field of view and greatly reduces time to

results through real-time data analysis .

Two new Livecyte(R) applications have been developed by

Phasefocus in response to customer requests and are scheduled for

launch before the end of 2023. These will be marketed as

proprietary assays, to meet the needs of cell biologists testing

drug performance in immuno-oncology and neuroscience

applications.

Livecyte(R) systems are already being used in research

laboratories across the globe, with over 40 scientific research

papers featuring Livecyte(R) data published to date. There is

substantial further potential; the global live cell imaging market

is estimated to be $2.7 billion in 2023 and expected to grow at

CAGR of 10.2% over the period to 2028.

https://www.marketsandmarkets.com/Market-Reports/live-cell-imaging-market-163914483.html#::text=The%20global%20live%20cell%20imaging,

trend%20analysis%20of%20the%20market .

Kirkstall Limited (Braveheart owns 86.11% of the company)

Kirkstall operates in the market known as 'organ-on-a-chip',

where it has developed Quasi Vivo(R), a system of chambers for cell

and tissue culture in laboratories. Its patented technology is used

by researchers in the growing New Approach Methodologies ("NAMs"),

which enable human-relevant drug safety decisions to be made

without the need for animal testing.

Kirkstall is committed to delivering alternatives to animal

testing into the hands and mind-sets of researchers worldwide. With

Quasi Vivo and its associated test assays, the Directors believe

that Kirkstall has the potential to change the research landscape.

Quasi Vivo(R) systems enable precise control of flow and pressure,

to provide a significantly more human relevant research environment

than competitor systems, which enables the use of human

cells/tissue slices in 2D or 3D constructs (scaffolds, gels or

spheroids) in long term toxicology, mechanistic and metabolic

studies.

Kirkstall's new QV1200 product was launched in February 2023 and

has already attracted strong interest from academic and commercial

customers. The QV1200 combines all of the most useful features of

the previous Kirkstall products: it is easy to set up; allows

single and multi-organ experiments; has an air-liquid interface

(e.g. for use on lung experiments) and a liquid-liquid interface

(e.g. for use on blood brain barrier experiments); has a standard

microplate compatible with lab equipment and uses the standard

wells for cell experiments. In addition, the QV1200 has an

increased throughput, allows for cell imaging and uses improved

biocompatible materials. The QV1200 culture chambers are single

use, allowing Kirkstall to benefit from repeat sales from each

customer.

Together with the launch of QV1200, Kirkstall has taken the

exciting step of establishing its own contract research

organisation (CRO) service to customers from its laboratory in

Sheffield. Kirkstall will use the power of its NAMs technology to

provide early stage, clinically transferrable data across a range

of applications, providing customers with greater confidence in the

success of their projects, at a fraction of the time and cost

www.kirkstall.com/contact-us/ .

Kirkstall's research team is developing toxicity test assays for

liver, lung and gut cells and will offer these to others, both

through its CRO service and by providing assay kit products for

other laboratories to use. In parallel work, researchers at Oxford

University are developing blood-brain barrier assays for Kirkstall.

The aim is to provide data to prove that QV1200 system replicates

the human physiology more effectively than other flow systems.

Kirkstall's products and services sit in the Cell Biology

Research and CRO markets, both of which are growing rapidly. The

global cell culture market size was USD 21.95 billion in 2021 and

is expected to surpass USD 52.65 billion by 2030 with a CAGR of

10.21% during the forecast period 2022 to 2030. The CRO market is

projected to reach USD 188.5 billion by 2030 from USD 73.4 billion

in 2022, at a CAGR of 12.5 %. Kirkstall's products support the

Early Phase

Development market which represents approximately 20% of this

market and is forecast to grow faster during this period due to the

increasing investment in the development of life-saving drugs.

https://www.fortunebusinessinsights.com/industry-reports/contract-research-organization-cro-services-market-100864

https://www.precedenceresearch.com/cell-culture-market

Listed Investments

At 31 March 2023, Braveheart held investments in the following

AIM listed companies:

-- Aukett Swanke Group plc (Braveheart owns 12.96% of the

company): a professional services group that principally provides

architectural and interior design services in the primary

international market sectors of offices, residential, education,

industrial, hospitality and mixed use or 'hybrid' developments.

-- Autins Group plc (Braveheart owns 15.98% of the company): an

industry-leading designer, manufacturer and supplier of acoustic

and thermal insulation solutions for the automotive industry and

other sectors.

-- Image Scan Group plc (Braveheart owns 7.05% of the company):

a specialist supplier of X-ray screening systems to the security

and industrial inspection markets.

-- Velocity Composites plc (Braveheart owns 1.26% of the

company): a UK based company and leading supplier of composite

material kits to aerospace and other high-performance

manufacturers.

Your Board believes these technology-driven companies each has a

significant opportunity to build sales and deliver profit. As

always, Braveheart is an active investor, regularly communicating

with their boards and seeking to introduce opportunities that help

deliver shareholder returns.

The Company also has a number of portfolio investments that are

smaller scale legacy investments. We will continue to manage these

investments and seek exits where appropriate.

Portfolio investments

The Company also has a number of portfolio investments that are

smaller scale legacy investments which we continue to manage and

seek exits where appropriate.

Prior-Year Restatement

Your Board has reviewed its accounting policy and concluded that

as Braveheart is an investment company and in accordance with IFRS

10, Kirkstall and Paraytec are not required to be consolidated and

thus these financial statements, including the prior year have been

restated to remove these previously consolidated entities.

Investment Strategy

When Braveheart became a company listed on AIM, the Admission

Document approved by shareholders on 27 March 2007 set out the

Investment Strategy which was appropriate to the business and the

market at that time. Over the years, Braveheart has moved away from

FCA regulated legacy fund management activities and has for some

years focused on making and managing direct investments made from

its own balance sheet resources. Your Board of directors now

considers that a New Investment Strategy is needed to reflect the

business opportunities and market conditions that the Company now

faces and recommends that this amendment to the Admission Document

be approved by shareholders at the forthcoming AGM.

Outlook

Shareholder funds are now deployed maximally to enhance the

attractiveness of our investments to potential acquirers. Intensive

work continues to further develop the attractiveness and value of

our 'cutting edge' science businesses. With the bait in the water,

masterful inactivity is probably the most appropriate stance for

your directors to take for now, as we wait for approaches.

Trevor Brown

Chief Executive Officer

30 June 2023

* Braveheart share price on 24/08/2015 was 7.5p and on 31/03/23

was 7.5p. Total dividend paid during the above period was 43.25p,

which equates to a CAGR of 28.59%.

**

https://www.londonstockexchange.com/indices/ftse-aim-all-share

FINANCIAL REVIEW

During the year, we continued the comprehensive review of our

cost base and continued to reduce the central costs.

Income Statement

Fee-based revenue was generated by Braveheart Investment Group

Plc. The principal revenue from the Group's operations comprises

investment management fees, with total revenue during the year

being GBP51,000 (2022: GBP64,000). Finance income was GBPNil (2022:

GBPNil), this being interest on outstanding loan notes within the

directly held portfolio.

As at 31 March 2023, the total number of directly held

investments in the portfolio of Strategic Investments and the

Portfolio Investments was 21 companies (2022: 18). The fair value

of the directly held portfolio was GBP9,458,000 (2022:

GBP4,937,000). During the year the group made investments of

GBP1,828,000 into six companies: Autins Group Plc, Aukett Swanke

Plc, Image Scan Holdings Plc, KDS Architecture Limited, Kirkstall

Limited and Phasefocus Holdings Limited.

Total income for the year ended 31 March 2023, including

realised gains and unrealised revaluation gains and losses, was

GBP2,958,000 (2022: GBP2,691,000).

The average number of employees remained at four during the

period under review. Employee benefits expense was GBP556,000

(2022: GBP534,000). Other operating and finance costs increased to

GBP283,000 (2022: GBP226,000).

The total profit after tax decreased to GBP1,585,000 (2022:

GBP1,883,000), equivalent to a basic profit per share of 2.68 pence

(2022: 4.02 pence).

Financial Position

The Group's net assets of GBP10,520,000 (2022:

GBP7,486,000).

At the year end, the Group had cash balances of GBP935,000

(2022: GBP1,853,000). There were no material borrowings.

A summary analysis of the Group's performance is as follows:

2023 2022

GBP'000 GBP'000

========================================== ======== ========

Investment management revenue and sales 51 64

Finance income 21 -

========================================== ======== ========

Income before portfolio movements 72 64

========================================== ======== ========

Profit on disposal of investments 171 60

Change in fair value of investments,

gain on disposal of investments and

movement in contingent liability 2,958 2,691

========================================== ======== ========

Total income of continuing activities 3,201 2,815

========================================== ======== ========

Employee benefits expense (including

share- based payments) (556) (534)

Other operating and finance costs (286) (228)

========================================== ======== ========

Total costs on continuing activities (842) (762)

Profit before tax - continuing 2,359 2,053

Tax (774) (170)

========================================== ======== ========

Total profit and total comprehensive

profit for the year 1,585 1,883

------------------------------------------ -------- --------

Opening cash balance 1,853 2,134

Investment in portfolio companies (1,529) (1,467)

Proceeds from sale of equity investments 428 246

Amount paid to BBB (6) (171)

Warrants and share options exercised - 7

Funds raised - net of share issue costs 930 2,416

Other activities (741) (1,312)

Closing cash balance 935 1,853

========================================== ======== ========

Net assets 10,520 7,487

========================================== ======== ========

Key Performance Indicators (KPIs)

The KPIs we use to monitor business performance have been

changed in order to better reflect the emphasis that the Board has

placed upon the development of the Strategic Investments as the

best way to increase shareholder value over the short and medium

term. Given the nature of our business, these KPI's remain as,

primarily, financial measures. They are:

2023 2022

------

Cash ('GBP000) 935 1,853

Share price (pence) 6.75 17.75

Income ('GBP000) 51 64

Value of investments 9,458 4,937

---------------------- ------ ------

Principal Risks and Uncertainties

Through its operations the Group is exposed to a number of

risks. The Group's risk management objectives and policies are

described in the Corporate Governance Statement. Braveheart is

ensuring that all necessary steps have been taken to maintain the

integrity of the Company's assets and the health and well-being of

our employees.

Section 172 Statement

Section 172 (1) of the Companies Act obliges the Directors to

promote the success of the Company for the benefit of the Company's

members as a whole. This section specifies that the Directors must

act in good faith when promoting the success of the Company and in

doing so, have regard (amongst other things) to:

a. the likely consequences of any decision in the long term,

b. the interests of the Company's employees,

c. the need to foster the Company's business relationship with

suppliers, customers and others,

d. the impact of the Company's operations on the community and

environment,

e. the desirability of the Company maintaining a reputation for

high standards of business conduct, and

f. the need to act fairly between members of the Company.

The Board of Directors is collectively responsible for

formulating the Company's strategy, which is to provide advisory

services to SMEs and invest in businesses where prospects appear to

be exceptional and deliver growth to its shareholders.

The Board places equal importance on all shareholders and

strives for transparent and effective external communications,

within the regulatory confines of an AIM-listed company. The

primary communication tool for regulatory matters and matters of

material substance is through the Regulatory News Service, ("RNS").

The Company's

website is also updated regularly and provides further details

on the business as well as links to helpful content such as our

latest investor presentations.

Our employees are one of the primary assets of our business and

will be critical to the future success of the Company. First and

foremost, the Directors strive to ensure a safe working environment

for all its staff and contractors, and we are proud of our safety

achievements in 2022/23. We also seek to reward employees with

remuneration packages which align the interests of the Company and

its shareholders with those of employees. Employees are also

provided with challenging work and external training opportunities

to ensure their continual development.

The Directors believe they have acted in the way they consider

most likely to promote the success of the Company for the benefit

of its members as a whole, as required by Section 172 (1) of the

Companies Act 2006.

On behalf of the Board

Trevor E Brown

Chief Executive Officer

30 June 2023

Consolidated Statement of comprehensive INCOME for the year

ended 31 March 2023

Restated

2023 2022

Notes GBP GBP

Revenue from contracts with customers 3 50,902 64,257

Change in fair value of investments 5 2,957,665 2,690,598

Profit on disposal of investments 5 170,576 60,414

Total income 3,179,143 2,815,269

------------------------------------------- ------ ---------- ----------

Employee benefits expense (556,146) (534,240)

Other operating costs (283,356) (225,780)

------------------------------------------- ------ ---------- ----------

Total operating costs (839,502) (760,020)

------------------------------------------- ------ ---------- ----------

Finance costs (2,154) (1,721)

Finance income 21,003 88

------------------------------------------- ------ ---------- ----------

Total costs (820,653) (761,653)

------------------------------------------- ------ ---------- ----------

Profit before tax 2,358,490 2,053,616

=========================================== ====== ========== ==========

Tax (773,652) (170,398)

Profit from continuing operations 1,584,838 1,883,218

------------------------------------------- ------ ---------- ----------

Total profit and total comprehensive loss

for the year 1,584,838 1,883,218

------------------------------------------- ------ ---------- ----------

Profit attributable to :

Equity holders of the parent 1,584,838 1,883,218

1,584,838 1,883,218

------------------------------------------- ------ ---------- ----------

Earnings per share Pence Pence

- basic 4 2.68 4.02

- diluted 4 2.68 3.38

The accompanying accounting policies and notes form part of

these financial statements.

consolidated statement of financial position as at 31 March

2023

Restated Restated

2023 2022 2021

Notes GBP GBP GBP

ASSETS

Non-current assets

Property, plant and equipment 418 796 421

Investments at fair value

through profit or loss 5 9,458,324 4,937,155 834,922

Debtors due in over one year 1,155,200 813,200 317,200

10,613,942 5,751,151 1,152,543

------------------------------- ------ ------------ ---------- ----------

Current assets

Trade and other receivables 64,510 211,782 188,921

Cash and cash equivalents 7 934,861 1,852,742 2,133,746

------------------------------- ------ ------------ ---------- ----------

999,371 2,064,524 2,322,667

------------------------------- ------ ------------ ---------- ----------

Total assets 11,613,313 7,815,675 3,475,210

=============================== ====== ============ ========== ==========

LIABILITIES

Current liabilities

Trade and other payables (149,656) (158,761) (473,173)

(149,656) (158,761) (473,173)

------------------------------- ------ ------------ ---------- ----------

Non-current liabilities

Deferred taxation (944,050) (170,398) -

------------------------------- ------ ------------ ---------- ----------

Total liabilities (1,093,706) (329,159) (473,173)

=============================== ====== ============ ========== ==========

Net assets 10,519,607 7,486,516 3,002,037

------------------------------- ------ ------------ ---------- ----------

EQUITY

Called up share capital 4 1,274,469 1,044,807 766,148

Share premium reserve 4 5,370,711 4,371,343 2,226,671

Share based payment reserve 471,203 309,835 137,200

Retained earnings 3,403,224 1,760,531 (127,982)

------------------------------- ------ ------------ ---------- ----------

Equity attributable to owners

of the Parent 10,519,607 7,486,516 3,002,037

Total equity 10,519,607 7,486,516 3,002,037

------------------------------- ------ ------------ ---------- ----------

The accompanying accounting policies and notes form part of

these financial statements.

Consolidated Statement of CAsh flows for the year ended 31 March

2023

Restated

2023 2022

GBP GBP

Operating activities

Profit before tax 2,358,490 2,053,616

Adjustments to reconcile profit before tax

to net cash flows from operating activities

Share based payment 219,223 177,930

Increase in the fair value movements of investments (2,957,665) (2,690,598)

Profit on disposal of equity investments (170,576) (60,414)

Investment movement owed to BBB 6,801 41,265

Depreciation and amortisation 378 271

Interest income (21,003) (138)

Increase in trade and other receivables (194,728) (518,861)

Decrease in trade and other payables (9,106) (314,412)

------------------------------------------------------- ------------ ------------

Cash flow from operating activities (768,186) (1,311,341)

------------------------------------------------------- ------------ ------------

Investing activities

Proceeds from sale of investments 428,066 245,871

Amount paid to BBB - (170,887)

Purchase of investments (1,529,127) (1,467,469)

Purchase of tangibles - (646)

Interest received 21,003 138

------------------------------------------------------- ------------ ------------

Net cash flow from investing activities (1,080,058) (1,392,993)

------------------------------------------------------- ------------ ------------

Financing activities

Warrants and share options exercised - 7,480

Funds raised, net of share issue costs 930,363 2,415,850

Net cash flow from financing activities 930,363 2,423,330

------------------------------------------------------- ------------ ------------

Net decrease in cash and cash equivalents (917,881) (281,004)

Cash and cash equivalents at the beginning

of the year 1,852,742 2,133,746

------------------------------------------------------- ------------ ------------

Cash and cash equivalents at the end of the

year 934,861 1,852,742

------------------------------------------------------- ------------ ------------

During the year, there were two share for share exchanges

involving Aukett Swanke plc that resulted in additional non cash

investment of GBP298,668 and an equal uplift in share capital and

share premium.

The accompanying accounting policies and notes form part of

these financial statements.

Consolidated Statement of ChAnges in Equity for the year ended

31 March 2023

Share

Called Share based Retained Non-controlling

up Share Premium payment Earnings/ interest Total

Capital Reserve Reserve (Deficit) Total Equity

GROUP GBP GBP GBP GBP GBP GBP GBP

At 1 April 2021 766,148 2,226,671 137,200 (559,897) 2,570,122 (6,025) 2,564,097

----------------------- ---------- ----------- --------- ----------- ----------- ------------------ -----------

Prior year adjustment - - - 431,915 431,915 6,025 437,940

----------------------- ---------- ----------- --------- ----------- ----------- ------------------ -----------

At 1 April 2021

restated 766,148 2,226,671 137,200 (127,982) 3,002,037 - 3,002,037

----------------------- ---------- ----------- --------- ----------- ----------- ------------------ -----------

Profit and total

comprehensive profit

for the year - - - 1,883,218 1,883,218 1,883,218

Allotment of shares 278,659 2,228,822 - - 2,507,481 2,507,481

Cost of shares

issued - (84,150) - - (84,150) (84,150)

Share based payments - - 177,930 - 177,930 177,930

Transfer to retained

earnings - - (5,295) 5,295 - -

----------------------- ---------- ----------- --------- ----------- ----------- ------------------ -----------

Transactions with

owners, recognised

directly in equity 278,659 2,144,672 172,635 1,888,513 4,484,479 4,484,479

----------------------- ---------- ----------- --------- ----------- ----------- ------------------ -----------

At 1 April 2022

restated 1,044,807 4,371,343 309,835 1,760,531 7,486,516 7,486,516

======================= ========== =========== ========= =========== =========== ================== ===========

Profit and total

comprehensive profit

for the year - - - 1,584,838 1,584,838 1,584,838

Allotment of shares 229,662 1,034,118 - - 1,263,780 1,263,780

Cost of shares

issued - (34,750) - - (34,750) (34,750)

Share based payments - - 219,223 - 219,223 219,223

Transfer to retained

earnings - - (57,855) 57,855 - -

----------------------- ---------- ----------- --------- ----------- ----------- ------------------ -----------

Transactions with

owners, recognised

directly in equity 229,662 999,368 161,368 1,642,693 3,033,091 3,033,091

----------------------- ---------- ----------- --------- ----------- ----------- ------------------ -----------

At 31 March 2023 1,274,469 5,370,711 471,203 3,403,224 10,519,607 10,519,607

----------------------- ---------- ----------- --------- ----------- ----------- ------------------ -----------

Share capital is the number of shares issued in the company at

their nominal value. The share premium account represents the gross

proceeds from issue of shares, less their nominal value.

Notes to the financial statements for the year ended 31 March

2023

1 Corporate information

The Group and Company financial statements of Braveheart

Investment Group plc (the Company) for the year ended 31 March 2023

were authorised for issue by the Board of Directors on 30 June 2023

and the statements of financial position were signed on the Board's

behalf by Trevor Brown.

Braveheart Investment Group plc is a public company incorporated

in the United Kingdom under the Companies Act 2006 limited by

shares. The address of the registered office is detailed at the

back of this report. The nature of the Group's operations and its

principal activities are set out in the Strategic Report and

Directors' Report. The Company is registered in Scotland. The

Company's ordinary shares are traded on the AIM market of the

London Stock Exchange.

2 Accounting policies

(a) Basis of preparation

The Group and Company financial statements have been prepared in

accordance with UK-adopted international accounting standards in

accordance with the requirements of the Companies Act 2006 and in

accordance with the requirements of the AIM rules. The principal

accounting policies adopted by the Group and by the Company are set

out in the following notes.

The consolidated financial statements have been prepared on a

historical cost basis, except where otherwise indicated. The

financial statements are presented in sterling and all values are

rounded to the nearest pound (GBP), which is also the functional

currency of the company and its subsidiaries, except where

otherwise indicated.

The Group's business activities (together with the factors

likely to affect its future development, performance and position)

and its financial position is set out in the Chief Executive

Officer's Report. The Group's risk management objectives and

policies are described in the Corporate Governance Statement .

Further information regarding the Group's financial risk management

objectives and policies, including those in relation to credit

risk, liquidity risk and market risk, is provided in n ote 21 to

the financial statements. The Group's capital management objectives

are stated on page 47, note (n).

3 Revenue from contracts with customers

Revenue is attributable to the principal activities of the

Group. In 2023 and 2022, all revenue arose within the United

Kingdom.

Restated

Group Group

2023 2022

GBP GBP

Investment management 15,000 21,167

Monitoring fees 3,600 -

Consultancy 32,302 43,090

50,902 64,257

----------------------- ------- ---------

Of the revenue stated above, GBP32,302 (2022: GBP43,090) related

to The Lachesis Seed Fund Limited Partnership.

The group derives revenue from the transfer of goods and

services over time and at a point in time in the following major

product lines:

Investment Monitoring

management fee Consultancy Total

2023

Timing of

revenue recognition

At a point

in time 15,000 3,600 - 18,600

Over time - - 32,302 32,302

============ =========== ============ =======

15,000 3,600 32,302 50,902

============ =========== ============ =======

2022 Restated

Timing of

revenue recognition

At a point

in time 21,167 - - 21,167

Over time - - 43,090 43,090

============ =========== ============ =======

21,167 - 43,090 64,257

============ =========== ============ =======

4 Earnings per share

Basic earnings per share has been calculated by dividing the

profit attributable to equity holders of the parent by the weighted

average number of ordinary shares in issue during the year.

The calculations of profit per share are based on the following

profit and numbers of shares in issue:

Restated

2023 2022

GBP GBP

Profit for the year 1,584,838 1,883,218

----------------------------------------------- ----------- -----------

Weighted average number of ordinary shares in No. No.

issue:

For basic profit per ordinary share 59,104,950 46,870,999

Potentially dilutive ordinary shares - 1,633,195

----------------------------------------------- ----------- -----------

For diluted earnings per ordinary share 59,104,950 48,504,194

----------------------------------------------- ----------- -----------

Dilutive earnings per share adjusts for share options granted

where the exercise price is less than the average price of the

ordinary shares during the period. At the current year end there

were Nil (2022: 1,633,195) potentially dilutive ordinary

shares.

The diluted loss per Ordinary Share is calculated by adjusting

the weighted average number of Ordinary shares outstanding to

consider the impact of options, warrants and other dilutive

securities.

5 Investments at fair value through profit or loss

Level 1 Level 2 Level 3

Equity Equity Equity

investments investments Debt investments investments Debt investments

in quoted in unquoted in unquoted in unquoted in unquoted

companies companies companies companies companies Total

GROUP GBP GBP GBP GBP GBP GBP

At 1 April 2021

Restated - - - 834,922 - 834,922

Additions at Cost 1,420,534 - - 46,935 - 1,467,469

Disposals - - - (48,274) - (48,274)

Amount owed to

creditors - - - (7,560) - (7,560)

Change in Fair Value (286,680) - - 2,977,278 - 2,690,598

----------------------- ------------- ------------- ----------------- ------------- ----------------- ----------

At 1 April 2022

Restated 1,133,854 - - 3,803,301 - 4,937,155

Additions at Cost 1,177,139 - - 650,656 - 1,827,795

Disposals (257,490) - - - - (257,490)

Amount owed to

creditors - - - (6,801) - (6,801)

Change in Fair Value (41,626) - - 2,999,291 - 2,957,665

----------------------- ------------- ------------- ----------------- ------------- ----------------- ----------

At 31 March 2023 2,011,877 - - 7,446,447 - 9,458,324

----------------------- ------------- ------------- ----------------- ------------- ----------------- ----------

Included in the balance above are investments that would be owed

to the British Business Bank through the Revenue Share Agreement.

At the year end, an amount of GBP24,242 would be due to the British

Business Bank on disposal. This liability is shown in the accounts

within other creditors.

5 Investments at fair value through profit or loss

(continued)

Level 1 Level 2 Level 3

Equity Equity Equity

investments investments Debt investments investments Debt investments

in quoted in unquoted in unquoted in unquoted in unquoted

companies companies companies companies companies Total

COMPANY GBP GBP GBP GBP GBP GBP

At 1 April 2021

Restated - - - 731,366 - 731,366

Additions at Cost 1,420,534 - - 46,935 - 1,467,469

Disposal - - - (126) - (126)

Change in Fair Value (286,680) - - 2,980,518 - 2,693,838

---------------------- ------------- ------------- ----------------- ------------- ----------------- ----------

At 1 April 2022

Restated 1,133,854 - - 3,758,693 - 4,892,547

Additions at Cost 1,177,139 - - 650,717 - 1,827,856

Disposal (257,490) - - - - (257,490)

Change in Fair Value (41,626) - - 3,002,195 - 2,960,569

---------------------- ------------- ------------- ----------------- ------------- ----------------- ----------

At 31 March 2023 2,011,877 - - 7,411,605 - 9,423,482

---------------------- ------------- ------------- ----------------- ------------- ----------------- ----------

As at 31 March 2023, the group total value of investments in

companies was GBP9,458,324 (2022: GBP4,937,155). The group total

change in fair value during the year was a profit of GBP2,957,665

(2022: profit GBP2,690,598).

Investments, which is made up of equity investments, are

designated on initial recognition as financial assets at fair value

through profit or loss. This measurement basis is consistent with

the fact that the Group's performance in respect of its portfolio

investments is evaluated on a fair value basis in accordance with

an established investment strategy. When investments are recognised

initially, they are measured at fair value.

After initial recognition the fair value of listed investments

is determined by reference to bid prices at the close of business

on the reporting date. Unlisted equity investments are measured at

fair value by the directors in compliance with the principles of

the International Private Equity and Venture Capital Guidelines,

updated and effective December 2015, as recommended by the European

Venture Capital Association. The fair value of unlisted equity

investments is determined using the most appropriate of the

valuation methodologies set out in the guidelines. These include

using recent arm's length market transactions; reference to the

current market value of another instrument, which is substantially

the same; earnings or profit multiples; indicative offers;

discounted cash flow analysis and pricing models.

The Group classifies its investments using a fair value

hierarchy. Classification within the hierarchy has been determined

on the basis of the lowest level input that is significant to the

fair value measurement of the relevant investment as follows:

-- Level 1 - valued using quoted prices in active markets for identical assets;

-- Level 2 - valued by reference to valuation techniques using

observable inputs other than quoted prices included within Level 1;

and

-- Level 3 - valued by reference to valuation techniques using

inputs that are not based on observable market data.

The fair values of quoted investments are based on bid prices in

an active market at the reporting date. All unquoted investments

have been classified as Level 3 within the fair value hierarchy,

their respective valuations having been calculated using a number

of valuation techniques and assumptions, notwithstanding that the

basis of the valuation methodology preferred by the Group is 'price

of most recent investment'. To reflect the potential impact of

alternative assumptions and a lack of liquidity in these holdings,

a discount has been applied to all Level 3 valuations. When using

the DCF valuation method, reasonably possible alternative

assumptions could have a material effect on the fair valuation of

investments.

The methodologies used in the year for level 3 investments are

broken down as follows:

% of

portfolio

valued

on this

Methodology Description Inputs Adjustments basis

-------------- --------------------- ----------------------- ---------------------- ------------

A liquidity

discount is

applied, typically

15%. Where

last funding

Used for unquoted round is greater

investments where than twelve

there has been months then

a funding round, further discounts

generally within The price of ranging between

the last twelve the most recent 0% and 100%

Fund Raising months investment are applied. 2.4%

-------------- --------------------- ----------------------- ---------------------- ------------

The fair value

of debt investment

is deemed to

be cost less Impairment

Debt/Loan any impairment provision if

notes Loan investments provision deemed necessary 0.7%

-------------- --------------------- ----------------------- ---------------------- ------------

Long term cash

flows are discounted

at a rate considered

appropriate

Used for companies for the business,

with long-term typically 25%.

cash flows and Revenue multiples

Discounted having comparable are typically A liquidity

cash flow transactions/ 5 to 10 times discount is

and revenue companies in of forward looking applied, typically

multiples the listed segment revenue. 20% 96.9%

-------------- --------------------- ----------------------- ---------------------- ------------

Group Group

Change in fair value in the year: 2023 2022

GBP GBP

Fair value gains 4,722,538 2,982,077

Fair value losses (1,764,873) (291,479)

--------------------------------------------------------------- -------------------- --------------

2,957,665 2,690,598

--------------------------------------------------------------- -------------------- --------------

The gain in the year came from the uplift of the valuations in

Phasefocus Holdings, Paraytec and Kirkstall

Details of investments where the nominal value of the holding in

the undertaking is 20% or more of any class of share are as

follows:

Caledonia Portfolio Realisations Limited ('CPR') holds a 20%

aggregate shareholding in Verbalis Limited ('Verbalis'), a design

and production of automated language translation systems company .

Neither CPR nor the Company is represented on the Board or within

management of Verbalis and in the opinion of the directors, this

shareholding does not entitle the Company to exert a significant or

dominant influence over Verbalis. The carrying value of Verbalis is

GBPnil (2022: GBPnil).

The Company holds a 100% aggregate holding in Paraytec Limited,

which develops high performance specialist detectors for the

analytical and life sciences instrumentation market. The valuation

of Paraytec has been reviewed following new patent filing of

intellectual property, launch of its new product and associated

business plans. The Company is represented on the board. The

carrying value of Paraytec GBP3,038,625 (2022: GBP220,622).

The Company holds a 86% aggregate holding in Kirkstall Limited,

a biotechnology company which developed a system of interconnected

chambers for cell and tissue culture in laboratories. The valuation

of Kirkstall has been reviewed following development of new

intellectual property, patent application and launch of its new

product and associated business plans. The Company is represented

on the Board. The carrying value of Kirkstall is GBP1,678,844

(2022: GBPNil).

The Company holds a 42% aggregate holding on PhaseFocus Holdings

Limited, has developed a series of patented computational imaging

techniques that have a wide range of applications including live

cell imaging, engineering metrology and electron microscopy. The

Company is represented on the Board and in the opinion of the

directors, neither this shareholding nor the representative

entitles the Company to exert a significant or dominant influence

over PhaseFocus. The valuation method has changed following

consultation with Phasefocus representatives and their advisers.

The carrying value of Phase Focus is GBP2,502,512 (2022:

GBP3,418,573).

The Company holds a 38% aggregate holding on Sentinel Medical

Limited, this company is developing a point of care diagnostic

device for bladder cancer detection and monitoring . The Company is

represented on the Board and in the opinion of the directors, this

shareholding nor the representative entitles the Company to exert a

significant or dominant influence over Sentinel. The carrying value

of Sentinel is GBP33 (2022: GBP33).

The Company holds a 38.65% aggregate holding in KDS Architecture

Limited, a company which provides architectural services. The

Company is not represented on the Board or within management of KDS

Architecture and in the opinion of the directors, this shareholding

does not entitle the Company to exert a significant or dominant

influence over KDS Architecture. The carrying value of KDS

Architecture is GBP76,074 (2022: GBPnil).

The registered addresses for these entities are as follows:

Verbalis Limited Frostineb Cottage, Fala, Pathhead, Midlothian,

Scotland, EH37 5TB

Paraytec Limited York House, Outgang Lane, Osbaldwick, York,

England, YO19 5UP

Kirkstall Limited York House, Outgang Lane, Osbaldwick, York,

England, YO19 5UP

Gyrometric Systems Limited Dockholme Lock Cottage, 380 Bennett

Street, Long Eaton, Nottingham, England, NG10 4JF

Phasefocus Holdings Limited 125 Wood Street, London, England, EC2V 7AW

Sentinel Medical Limited York House, Outgang Lane, Osbaldwick, York, England, YO19 5UP

KDS Architecture Limited 42 Lytton Road, Barnet, England, EN5 5BY

6 Investment in subsidiaries

The Company has the following interests in subsidiary

undertakings:

Country % Interest

Name of Incorporation Nature of Business

------------------------------------------ ------------------- ------------------------- -----------

Caledonia Portfolio Realisations

Limited (i) Scotland Investment management 100%

Braveheart Academic Seed Funding

GP Limited (i) England Investment management 100%

Ridings Holdings Limited (i) England Investment management 100%

The Ridings Early Growth Investment

Company Limited (ii) England Investment management 100%

Development of high

performance specialist

Paraytec Limited (iii) England detectors 100%

Kirkstall Limited (iii) England Biotechnology 86%

Combrook Holdings England Investment management 60%

(i) Direct subsidiary of Braveheart

Investment Group plc

(ii) Indirect subsidiary of Braveheart

Investment Group plc

(iii) Not consolidated

Group entities act as General Partner to, and have an interest

in, the following limited partnerships:

Place of % Interest

Name Business

-------------------- ----------- -----------

Lachesis Seed Fund England 0%

The registered addresses for the subsidiary undertakings are as

follows:

Caledonia Portfolio Realisations Limited 1 George Square,

Glasgow, Scotland, G2 1AL

Braveheart Academic Seed Funding GP Limited One Fleet Place,

London, EC4M 7WS

Ridings Holdings Limited One Fleet Place, London, EC4M 7WS

The Ridings Early Growth Investment Company Limited One Fleet

Place, London, EC4M 7WS

Paraytec Limited York House, Outgang Lane, Osbaldwick, York,

North Yorkshire, YO19 5UP

Kirkstall Limited York House, Outgang Lane, Osbaldwick, York,

North Yorkshire, YO19 5UP

Combrook Holdings Limited Old Linen Court, 83-85 Shambles

Street, Barnsley,South Yorkshire, England, S70 2SB

7 Cash and cash equivalents

Restated Restated

Group Group Company Company

2023 2022 2023 2022

GBP GBP GBP GBP

Cash at bank and on hand 934,861 1,852,742 684,532 1,602,140

========================== ======== ========== ======== ==========

Cash balances are held with HSBC Bank plc and earn interest at

floating rates based on daily bank deposit rates.

8 Prior year adjustment

The accounts have been restated in order to take Kirkstall

Limited and Paraytec Limited out of the group accounts. IFRS 10

provides mandates that an investment entity shall not consolidate

its subsidiaries or apply IFRS 3 when it obtains control of another

entity, excluding any subsidiary that is itself an investment

entity and whose main purpose and activities are providing services

that relate to the investment entity's investment activities. As

such, the consolidation of Kirkstall Ltd and Paraytec Ltd in the

prior year's financial statements is deemed to be not in accordance

with IFRS 10 and as such requires correction and the prior-year

figures should be restated to reflect this change. The effects are

stated below.

Changes to the Consolidated Statement of Financial Position

As previously Adjustment Adjustment Restated

at at

reported 1 April 31 March 31 March

2021 2022 2022

GBP GBP GBP GBP

Non current assets

Property, plant and equipment 1,776 (1,745) 765 796

Intangible assets 26,103 (28,152) 2,049 -

Goodwill 205,775 (205,775) - -

Investments at fair value through

profit or loss 4,716,080 221,075 - 4,937,155

Debtors due in over one year - 371,200 442,000 813,200

8 Prior year adjustment (Continued)

As previously Adjustment Adjustment Restated

at at

Reported 1 April 31 March 31 March

31 March 2021 2022 2022

2022

GBP GBP GBP GBP

Current assets

Inventory 90,113 (98,441) 8,328 -

Trade and other receivables 123,412 (69,292) 157,662 211,782

Cash and cash equivalents 1,893,931 (9,120) (32,069) 1,852,742

Current liabilities

Trade and other payables (272,432) 117,906 (4,235) (158,761)

Deferred income (7,025) 41,843 (34,818) -

-------------- -------------- ----------- ----------

Equity

Retained earnings 899,202 431,915 429,414 1,760,531

Total equity 6,607,335 437,940 441,241 7,486,516

-------------- -------------- ----------- ----------

Changes to the consolidated

income statement

As previously Restated

Reported Adjustment 31 March

31 March 2022

2022

GBP GBP GBP

Total income 185,814 (121,557) 64,257

Total costs (1,390,801) 629,148 (761,653)

Tax (104,048) (66,350) (170,398)

Profit for the year 1,441,977 441,241 1,883,218

-------------- ----------- ----------

Changes to the consolidated cash flow

As previously Restated

Reported Adjustment 31 March

31 March 2022

2022

GBP GBP GBP

Cash flow from operating activities (1,269,438) (41,903) (1,311,341)

Net cash flow from investing

activities (1,402,827) 9,834 (1,392,993)

Net cash flow from financing

activities 2,423,330 - 2,423,330

-------------- ----------- ------------

Net decrease in cash and cash

equivalents (248,935) (32,069) (281,004)

Cash and cash equivalents at

the beginning of the year 2,142,866 (9,120) 2,133,746

Cash and cash equivalents at

the end of the year 1,893,931 (41,189) 1,852,742

-------------- ----------- ------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR GSGDRXUGDGXD

(END) Dow Jones Newswires

July 03, 2023 02:00 ET (06:00 GMT)

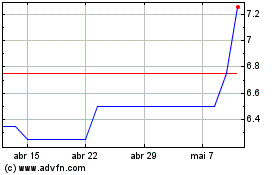

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024