Braveheart Investment Group plc Posting of annual report and notice of AGM (9488E)

05 Julho 2023 - 3:00AM

UK Regulatory

TIDMBRH

RNS Number : 9488E

Braveheart Investment Group plc

05 July 2023

5 July 2023

Braveheart Investment Group plc

("Braveheart", the "Company" or the "Group")

Posting of annual report and accounts, notice of AGM and

proposed amendment to investment strategy

Braveheart Investment Group (AIM: BRH), announces that the

Company's annual report and accounts for the year ended 31 March

2023, which incorporates notice of the Company's 2023 Annual

General Meeting ("AGM") will be posted to shareholders today and

will be available to download from the Company's website at

www.braveheartgroup.co.uk.

The AGM will be held on 28 July 2023 at 10.30 am at the office

of China Ventures Ltd, Unit 2, Common Farm, Common Lane,

Mappleborough Green, Warwickshire, B80 7DP.

Proposed amendments to the Group's investment strategy

The AGM notice contains a resolution (the "Investment Strategy

Resolution") to permit the Directors to replace the Company's

investment strategy (the "Investment Strategy") as set out in part

1 of the Company's admission document dated 27 March 2007, which

determines the permitted business and strategy of the Company.

The proposed new Investment Strategy is set out below:

The Group's strategy is to invest in early and later-stage

businesses, primarily in the technology sector, but it will also

consider opportunities in other sectors that are knowledge

intensive, such as healthcare and professional services.

The Group will target investments in both unlisted and listed

companies, where there is potential for significant growth.

Investments are expected to be mainly in the form of equity and

equity-related instruments, including convertible debt instruments

in certain circumstances.

The Group may acquire investments directly or by way of holdings

in intermediate holding or subsidiary entities. The Group might

also invest in limited liability partnerships and other forms of

legal entity. Where possible, the Group will seek investor

protection rights, as determined by the Board.

The Group may offer its Ordinary Shares in exchange for shares

in investee businesses in addition to a cash investment in such

businesses.

For unlisted company investments, the Group targets companies at

different stages of development, ranging from those which are just

starting to trade to those which are expecting to achieve an IPO in

the short term, thus providing portfolio diversification. These

investments will typically involve active investment

management.

The Group, where appropriate and deemed by the Board to be in

the Group's best interests, may seek a position on the boards of

unlisted investee companies. The Group where appropriate, will

assist the board and management of investee companies, including

helping to scale management teams, informing strategy and assisting

with future financing.

For listed company investments, the Group targets investments

where the Board considers the shares are undervalued but there are

opportunities for significant growth. These investments will

typically involve passive investment management, although the Board

may take a more active approach if it considers there is a need to

effect change.

Braveheart may occasionally invest in companies that are in

rescue or distress situations where a value-creating opportunity

has been identified. The Group does not have any maximum exposure

limits but will generally take a minority stake in a business and

look for investments where there is a good prospect of an exit in a

two-to-five-year time period.

As risk reduces, the Group may increase its investment in

subsequent rounds of funding and, as those businesses grow, may

find itself holding a controlling interest in some trading

companies. However, in such instances the Board will ensure that

there is sufficient separation between the Group and the investee

company so that the investee company does not become a trading

company of the Group.

Full details of the proposed amendments to the Investment

Strategy are set out in the explanatory notes to the notice of AGM.

Should the Investment Strategy Resolution not be passed at the AGM,

the Company will not be able to make the proposed amendments to the

Investment Strategy. A further announcement will be made on

conclusion of the AGM.

For further information:

Braveheart Investment Group plc Tel: 01738

587555

Trevor Brown, Chief Executive Officer

Viv Hallam, Executive Director

Allenby Capital Limited (Nominated Tel: 020

Adviser and Joint Broker) 3328 5656

James Reeve / George Payne

Peterhouse Capital Limited (Joint Tel: 020

Broker) 7469 0936

Duncan Vasey / Lucy Williams

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOANKQBBNBKDCOK

(END) Dow Jones Newswires

July 05, 2023 02:00 ET (06:00 GMT)

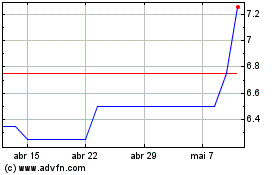

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024