TIDMJET2

RNS Number : 1034F

Jet2 PLC

06 July 2023

Jet2 plc

PRELIMINARY UNAUDITED RESULTS FOR YEARED 31 MARCH 2023

Jet2 plc , the Leisure Travel group (the "Group" or the

"Company"), announces its preliminary results for the year ended 31

March 2023.

Group financial highlights 2023 2022 2020 Change

Unaudited 2023

vs 2020

Revenue GBP5,033.5m GBP1,231.7m GBP3,584.7m 40%

-------------------------------------------------- ------------ ------------ ------------ -----------

Operating profit / (loss) GBP394.0m (GBP323.9m) GBP293.0m 34%

-------------------------------------------------- ------------ ------------ ------------ -----------

Profit / (loss) before hedge ineffectiveness,

FX revaluation and taxation GBP390.8m (GBP376.2m) GBP264.2m 48%

-------------------------------------------------- ------------ ------------ ------------ -----------

Profit / (loss) before taxation GBP371.0m (GBP388.8m) GBP153.2m 142%

-------------------------------------------------- ------------ ------------ ------------ -----------

Profit / (loss) for the period

after taxation GBP290.8m (GBP315.4m) GBP116.0m 151%

-------------------------------------------------- ------------ ------------ ------------ -----------

Basic earnings per share 135.4p (147.0p) 77.9p 74%

-------------------------------------------------- ------------ ------------ ------------ -----------

Final dividend per share 8.0p - - 100%

-------------------------------------------------- ------------ ------------ ------------ -----------

* The rebound in consumer confidence to travel helped underpin

a significantly improved financial performance as Group profit

before FX revaluation and taxation increased to GBP390.8m (2022:

GBP376.2m loss ) which was 48% higher than the pre-Covid financial

year ended 31 March 2020 reporting period.

* Jet2.com flew a total of 16.22m (2022: 4.85m) single sector

passengers, an increase of 234%, with higher margin package

holiday customers representing 64.9% of overall flown passengers

(2022: 51.3%) which was also 13.2 ppts higher than 2020.

* Pleasingly, average load factor achieved was 90.5% (2022: 69.2%)

on a 156% increase in seat capacity to 17.93m (2022: 7.01m),

underlining the popularity of our leisure travel products.

* Despite having absorbed delay and associated compensation costs

in excess of GBP50.0m as a direct impact of the broader disruption

seen across the aviation sector and its supply chains in mid-summer

2022, Group operating profit increased by 222% to GBP394.0m

(2022: GBP323.9m loss).

* Total cash balances at the year-end of GBP2,624.7m (2022: GBP2,228.5m)

increased 18%. 'Own Cash' which excludes advance customer deposits,

increased by 4% to GBP1,127.1m (2022: GBP1,083.8m).

* In view of the positive financial performance and in keeping

with its previous principle of paying a moderate dividend,

the Board has resolved to pay a final dividend of 8.0p per

share (2022: nil).

* In March 2023, the Group was delighted to take delivery of

the first of its 98 firm ordered Airbus A321/A320neo aircraft,

which could eventually extend up to 146 aircraft.

* In April 2023, the Group announced an equity investment in

a new SAF production plant to be constructed in the North West

of England - one of the first such deals in UK aviation.

* We recently announced our intention to commence operations

from Liverpool John Lennon Airport from March 2024 - our eleventh

UK base.

* On sale seat capacity for Summer 2023 is currently 7.5% higher

than Summer 2022 at 15.29m seats. Although average load factors

are currently 0.8ppts behind Summer 2022 at the same point,

positively the mix of higher margin Package Holiday customers

represents over 73% of total departing passengers at present,

which is over 5ppts higher than Summer 2022.

* Despite the Group facing various input cost pressures, pricing

to date for both our package holidays and flight-only products

has been robust and consequently margins per booked passenger

satisfactory.

* We are cognisant of how quickly the macro-economic environment

is evolving and how this may affect consumers' future spending.

However, we continue to believe that the end-to-end package

holiday is a resilient and popular product, particularly during

difficult economic times.

* For the long term, our strategy remains consistent - To be

the UK's Leading and Best Leisure Travel Business - with 'People,

Service, Profits' serving as our guiding principles. Put simply,

our Customers want to be looked after throughout their eagerly

anticipated holiday experience by a happy, well paid and motivated

team of Jet2 Colleagues who continue to deliver outstanding

service, thereby generating sustainable long-term profitability

- in short, Nothing Beats a Jet2holiday!

Further information on the calculation of this measure can be

found in Note 6.

Analyst and Investor call

The management team will host an investor and analyst conference

call at 9.00am UK time, on Thursday, 6th July 2023. For dial-in

details for the conference call, please contact Buchanan

Communications in advance to register: Jet2@buchanan.uk.com.

OUR CHAIRMAN'S STATEMENT

The conclusion of the Covid-19 pandemic and the unprecedented

challenges faced by everyone during it, unleashed an enormous surge

of pent-up demand for those experiences that consumers had truly

missed in the preceding two years. One of the most important of

these experiences was the opportunity to enjoy a much deserved,

rejuvenating and relaxing overseas holiday.

And I am pleased to say, that despite a difficult return to

normal operations, primarily due to the lack of planning and

preparedness of many airports and associated suppliers, our UK

Leisure Travel Business - which encompasses Jet2holidays, our

acclaimed ATOL licensed package holidays provider, and Jet2.com,

our award-winning airline - responded determinedly to provide our

Customers with their eagerly anticipated Real Package Holidays from

Jet2holidays(R).

Results for the financial year

The resumption of international travel in early 2022 resulted in

the Group's financial performance for the year ended 31 March 2023

exceeding our pre-pandemic performance for the year ended 31 March

2020.

The positive progress reflects the decisions made in late 2021

to retain over 8,000 loyal Colleagues throughout the pandemic,

recruiting and training in good time for Summer 2022, making early

and substantial marketing investments and giving meaningful salary

increases to all Colleagues. It also demonstrates the robust and

sustainable nature of our business model.

For the reporting period, seat capacity increased 13% against

2020 and buoyant customer demand resulted in the business achieving

an average load factor of 90.5% (2020: 92.2%). Higher margin

Package Holiday customers grew by 40% to 5.29m (2020: 3.77m) and

were a materially higher mix of total departing passengers at 64.9%

(2020: 51.7%), with Flight-Only passengers reducing by 19% to 5.69m

(2020: 7.06m).

Despite being very well prepared for our summer operations, plus

the exceptional dedication of our Colleagues who consistently went

above and beyond to ensure our Customers could finally embark on

their long-awaited holidays, regrettably some Customers experienced

frustrating delays. These hold ups were a direct consequence of the

widespread disruption experienced throughout the aviation sector,

including but not limited to ground handling suppliers' poor

customer service, long queues for airport security checks and

bottlenecks in baggage handling areas, all of which led to extreme

levels of airport congestion. Consequently, delay and associated

compensation costs under Regulation EU261 UK, exceeded

GBP50.0m.

Despite these challenges, we were very proud that Jet2.com

earned the accolade of being the only UK airline not to cancel a

flight during July and August 2022, according to leading travel

intelligence company, OAG - we were determined that our Customers

should enjoy their well-deserved holidays!

Similarly, the financial performance of our in-flight retail

operation was weaker than expected during early Summer 2022. This

was largely attributable to inadequate onboard product availability

caused by resource limitations at our third-party in-flight retail

provider.

However, despite having absorbed these substantial disruption

costs, I am pleased to report that Group profit before FX

revaluation and taxation increased to GBP390.8m (2022: GBP376.2m

loss ) which was also 48% higher than the financial year ended 31

March 2020, the last pre-Covid reporting period.

After accounting for net FX revaluation losses of GBP19.8m

(2022: GBP12.6m), total profit before taxation was GBP371.0m (2022:

GBP388.8m loss).

Further information on the calculation of this measure can be

found in Note 6.

Dividend

Prior to the pandemic, and subject to satisfactory financial

performance, the Board traditionally paid a modest dividend whilst

seeking to re-invest the majority of cash generated in growing the

business. For the year, basic earnings per share were 135.4p (2022:

(147.0p)) and in view of the positive financial performance and in

keeping with its previous principle, the Board has resolved to pay

a final dividend of 8.0p per share (2022: nil). This final dividend

is subject to shareholders' approval at the Company's Annual

General Meeting on 7 September 2023 and will be payable on 25

October 2023 to shareholders on the register at the close of

business on 22 September 2023, with the ex-dividend date being 21

September 2023.

Our Strategy

To be the UK's Leading and Best Leisure Travel business

In February 2003, Jet2.com proudly welcomed its first Customers

onboard, and over 100 million happy holidaymakers later, we were

thrilled to celebrate our 20th anniversary in February 2023, with

Jet2holidays now the UK's largest package holiday provider and

Jet2.com the UK's 3rd largest airline by number of passengers

flown.

While many aspects have evolved in the intervening years, our

unwavering commitment to our "Customer First" ethos has remained

steadfast and is what has driven Jet2's continuing success. At the

core of Jet2holidays and Jet2.com brand values lies the dedication

to delivering exceptional service. We recognise that whether our

Customers choose to embark on end-to-end Real Package Holidays from

Jet2holidays(R), or simply enjoy a holiday flight with Jet2.com,

providing an appealing and memorable holiday experience fosters

loyalty and encourages repeat bookings.

Our long-term ambition remains: To be the UK's Leading and Best

Leisure Travel business. Achieving this objective demands a clear

strategic vision and an unwavering customer focus, accompanied by

consistent and often material investment.

New Aircraft Order

In October 2022 we were pleased to announce that we were

entering into a further agreement with Airbus to purchase another

35 new firm ordered Airbus A321/A320neo aircraft with the ability

for this to extend up to 71 aircraft. Combined with existing

orders, this brings the total number of firm ordered Airbus

A321/A320neo aircraft for the Group to 98, which could eventually

extend up to 146 aircraft. Critically, this agreement ensures

certainty of supply well into the next decade.

The Group was delighted to take delivery of the first of these

aircraft in March 2023. With a spacious cabin capacity for 232

passengers and operational advantages through reduced fuel

consumption and resultant carbon emissions per seat, plus a much

lower noise footprint against previous generation single aisle

aircraft models, these aircraft will enable Jet2.com and

Jet2holidays to grow more sustainably. We are certain that the

introduction of the A321/A320neo aircraft will ensure that our

Customers continue to have a wonderfully comfortable and enjoyable

experience for many years to come.

Investment in Sustainable Aviation Fuel

As a socially and environmentally responsible airline and tour

operator, we take our environmental impact seriously. We firmly

believe that Sustainable Aviation Fuel ("SAF") is currently one of

the most effective solutions for reducing carbon emissions and is

key to achieving net-zero status by 2050. Consequently, in April

2023, the Group announced an equity investment in a new SAF

production plant to be constructed in the North West of England -

one of the first such deals in UK aviation. The Fulcrum NorthPoint

facility, being developed by Fulcrum BioEnergy Ltd, will operate as

a Waste-to-Fuels plant, and is anticipated to commence SAF

production by 2027. Once operational, Jet2.com will receive a

significant volume of SAF from the plant and expects to achieve net

emissions reductions totalling approximately 400,000 tonnes of

CO(2) over the 15-year period of the agreement.

New Training Facility

In February 2023, we were pleased to announce a new Airbus A321

flight simulator and training centre at Cheadle, near Manchester

Airport. The new centre builds on the success of the Company's

first training centre near Bradford, which opened in 2014. This

bespoke facility will provide a centre of excellence for existing

and new pilots, engineers, cabin crew and ground operations

Colleagues. The three-storey building will house full and

fixed-base flight simulators, cabin crew trainer units, engineering

training devices to enact real-life scenarios, high-tech computer

based training rooms, fully equipped classrooms and briefing rooms.

The centre enables Jet2.com to underpin its growth ambitions by

training thousands of Colleagues each and every year.

New UK Base

Finally in May 2023, we were delighted to announce the launch of

our highly acclaimed flights and holidays from Liverpool John

Lennon Airport. This development marks a significant milestone as

it becomes our eleventh UK base and is aligned with our long-term

strategy to sustainably grow our successful business.

Recognising the significant demand from both consumers and

independent travel agents across Liverpool, Merseyside and the

wider region, we are looking forward to commencing operations from

March 2024. Between now and then, our focus is on meticulous

preparation to ensure a seamless launch, so that from day one we

can provide Customers with the same award-winning service which has

delighted millions of others across the UK for so many years!

Nothing Beats a Jet2holiday!

Our Customers

We deeply appreciate the trust that our Customers place in us to

provide them with an exceptional holiday experience, and there is

no better validation of our performance than the recognition

received from the consumer champion Which? and its members.

We take immense pride in the fact that Jet2.com, Jet2holidays,

and Jet2CityBreaks continue to hold the distinguished status of

being Which? Recommended Providers, reflecting our unwavering

commitment to delivering exceptional service. Additionally in July

2023, Jet2Villas was named as a Which? Recommended Provider for the

first time - a great achievement. We are also delighted that

Jet2.com and Jet2holidays have recently been honoured as Travel

Brand of the Year 2023 by Which?, marking the second consecutive

year and the third time in six years that we have received this

prestigious accolade. This recognition acknowledges our dedication

to prioritising our Customers' satisfaction, both throughout the

challenging period of the pandemic and following the resumption of

international travel.

We understand that during times of uncertainty, consumers seek

operators they can trust and who offer them the best value for

their money. Therefore, our total focus leading up to Summer 2023

has been on delivering the same industry-leading levels of customer

service that our Customers have come to expect from us.

With this in mind, we have assumed direct control of all

ground-handling operations (check-in; baggage handling and aircraft

despatch) at a further two of our UK bases: Bristol and Newcastle -

this means we now independently 'self-handle' at seven of our

eleven UK bases and our Colleagues now control and manage passenger

check-in at all but one of our UK bases. This expansion ensures a

seamless and efficient experience for our valued Customers and

eliminates any reliance on third parties for these crucial aspects

of our operations.

As a result of our unwavering focus to do what is right for our

Customers, we are confident they will be even more determined to

indulge in the wonderful experience of a well-deserved Jet2holiday

and we are fully committed to doing our very best to ensure that

each of them "has a lovely holiday".

Our Colleagues

At the core of our company culture lies a deep-rooted "Customer

First" ethos, guided by our principles of People, Service, Profits

- great and attentive customer service is where we aim to

excel.

Whether in the UK or Overseas, the ability of our Colleagues to

continuously display our Company's 'Take Me There' values (Be

Present; Create Memories; Take Responsibility; and Work As One Team

), is of paramount importance in upholding our standards. This

"Customer First" approach has set us apart and enabled us to be

consistently recognised as an industry leader for our outstanding

customer service.

Throughout the year, our Colleagues have worked tirelessly,

particularly during the challenging period of early Summer 2022.

The Board is hugely appreciative for their tremendous support and

efforts, which enabled Jet2.com and Jet2holidays to fulfil the

dreams of so many Customers, taking them on their well-deserved and

eagerly anticipated holidays.

To recognise the invaluable contribution our Colleagues made, we

were very pleased to award pay increases totalling 8% during the

year ended 31 March 2023 together with an end of summer season

'Thank You Bonus' of GBP1,000 each. We firmly believe that happy

and well paid Colleagues are fundamental to the future success of

our business and with this and the pressures of elevated inflation

levels in mind, we awarded a pay increase of 9% to them all for the

year ending 31 March 2024.

In addition, we launched our award-winning ShareSave Scheme in

September 2022, offering Colleagues the opportunity to become

shareholders in Jet2 plc, by granting options to acquire shares in

the Company at a discount to the prevailing August 2022 share

price, subject to the completion of three years' employment. The

take-up rate was in excess of 60% - a very pleasing outcome.

Finally, we are delighted that the successful financial

performance of the Group for the year ended 31 March 2023 has

allowed us to reinstate both our Discretionary Colleague Profit

Share Scheme for non-management Colleagues and our Discretionary

Bonus Scheme for management Colleagues. These payments, which will

be the first in four years due to the pandemic, will be made in the

July 2023 payroll.

The Board is dedicated to upholding our People, Service, Profits

ethos and is satisfied that the investment made in our Colleagues

has resulted in engaged and dedicated teams who are committed to

carry on delivering the outstanding "Customer First" service that

means so much to our Customers, and which has contributed

immeasurably to our long-term success.

Our Stakeholders

Suppliers

We recognise the importance of cultivating strong relationships

with our many suppliers to realise our growth objectives. We were

delighted to be able to resume our annual supplier conference where

we focused on how we and our supplier partners can work together

effectively to forge mutually beneficial long-term relationships.

These strong partnerships are proving crucial as we head towards

our peak flying operation in Summer 2023.

We also acknowledge the importance of timely and full payment to

our suppliers, including of course our hotel partners, to underpin

their financial well-being. In accordance with the 'Duty to report

on payment practices and performance' legislation, the average

invoice payment period during the year reduced to 20.2 days (2022:

23.9 days) for Jet2.com Limited and to 22.7 days (2022: 27.5 days)

for Jet2holidays Limited.

Shareholders

We maintain open lines of communication with our shareholders

and institutional investors, engaging with them appropriately

through regular interactions such as at Preliminary and Interim

results meetings, individual investor meetings,

broker/institutional conferences and at our Annual General

Meeting.

UK Government and the Civil Aviation Authority

The Executive Directors and certain senior managers within the

organisation regularly engage with senior representatives of the UK

government and regulatory bodies. In the past year, discussions

focused on addressing the operational disruption faced by the

aviation industry in the early stages of the Summer 2022 season, as

well as numerous meetings with the government and industry

associations on the future of sustainable air travel. Furthermore,

our Chief Executive Officer actively engages with government,

business and tourism bodies in the UK and in our destination

countries, fostering relationships at both national and regional

levels.

In addition, our Group Chief Financial Officer has regular

dialogue with the UK Civil Aviation Authority on the financial

performance of the Group and our Accountable Manager, the Managing

Director of Jet2.com, meets regularly with his respective

counterparts.

Our Commitment to Sustainability

As a major provider of leisure travel in the UK, taking millions

of people away on holiday, Jet2 plc aspires to be "the leading

brand in sustainable air travel and package holidays".

Consequently, we endeavour to operate in the most efficient and

sustainable manner possible, focusing on minimising both emissions

and carbon intensity (emissions per passenger kilometre) and we

continue to make steady progress against the targets published in

our Sustainability Strategy in September 2021.

In addition to the significant investment made in new Airbus

aircraft which extends well into the next decade, and our

commitment to long-term SAF production, our efficient operations

also contribute to minimising our environmental impact in terms of

noise and air quality pollutants. These efforts are integral to our

journey towards achieving our Jet2 Net Zero 2050 commitment.

Following the return to more normalised levels of flight

activity and pre-pandemic load factors, the Group successfully

reduced its CO(2) emissions per passenger kilometre from 67.0g in

2019 to 65.9g, representing positive progress towards our 2025

target of 65.0g.

Jet2 plc fully complies with both national and international

efforts aimed at combatting climate change, which include the UK

and EU Emission Trading Schemes (ETS) and the Carbon Offsetting and

Reduction Scheme for International Aviation (CORSIA). In addition,

during the year the Group offset all emissions not covered by UK

and EU ETS existing carbon pricing mechanisms. This equated to

voluntary offsets of over 1.5m tonnes of carbon emissions. We were

delighted to work with our offsetting partner, Vertis, in selecting

projects including the Darajat Geothermal Project in Indonesia and

the Aksu Wind Power Project in Türkiye, ensuring that the

real-world impact of our carbon offsetting program is

maximised.

Following consistent investment, 47% of our Ground Support

Equipment now operates on zero-carbon technology, and we have

achieved an 80% reduction in single-use plastics on our aircraft as

compared to 2019 - equivalent to removing 11 million items per

annum!

Finally, Jet2holidays is acting on the environmental impacts in

its supply chain by continuing discussions with its hotel partners

and the Global Sustainable Tourism Council to implement a hotel

sustainability labelling scheme, thereby enabling Customers to make

more sustainable accommodation choices. More detailed information

on the Group's Sustainability Strategy can be found at

www.jet2plc.com/sustainability .

Our Board

The Board acknowledges its responsibility for ensuring the

enduring prosperity of the Group. This includes overseeing its

effective management and being accountable to shareholders by

making decisions that generate both long-term value and ensure that

the foundations of the business remain strong and sustainable in an

ever-changing marketplace.

Consequently in April 2023, the Board was very pleased to

announce the appointments of Simon Breakwell and Angela Luger as

independent Non-Executive Directors of the Company with effect from

27 April and 3 July 2023 respectively. Their extensive expertise

aligns perfectly with the current phase of our growth, and we have

full confidence in their ability to make substantial contributions

to the success of our business as we continue our focus on People,

Service, Profits.

Outlook

On sale seat capacity for Summer 2023 is currently 7.5% higher

than Summer 2022 at 15.29m seats. Although average load factors are

currently 0.8ppts behind Summer 2022 at the same point, positively

the mix of higher margin Package Holiday customers represents over

73% of total departing passengers at present, which is over 5ppts

higher than Summer 2022.

Despite the Group facing various input cost pressures such as

fuel, carbon taxes, a strengthened US dollar and wage increases, as

well as investment to support the well-being and work-life balance

of our Colleagues, pricing to date for both our package holidays

and flight-only products has been robust and consequently margins

per booked passenger satisfactory.

Looking forward, although we continue to believe that the

end-to-end package holiday is a resilient and popular product,

particularly during difficult economic times and o ur ability to

offer truly variable duration holidays enables our Customers to

tailor their holiday plans to suit their individual budgets, we are

cognisant of how quickly the macro-economic environment is evolving

and how this may affect consumers' future spending.

On that basis, and with the peak summer months of July, August

and September not yet complete plus the majority of Winter

2023/2024 seat capacity still to sell, it remains premature as is

always the case at this time of year, to provide definitive

guidance as to Group profitability for the financial year ending 31

March 2024.

For the long term our strategy remains consistent - To be the

UK's Leading and Best Leisure Travel Business - with 'People,

Service, Profits' serving as our guiding principles. Put simply,

our Customers want to be looked after throughout their eagerly

anticipated holiday experience by a happy, well paid and motivated

team of Jet2 Colleagues who continue to deliver outstanding

service, thereby generating sustainable long-term profitability -

in short, Nothing Beats a Jet2holiday!

Philip Meeson

Executive Chairman

6 July 2023

BUSINESS & FINANCIAL REVIEW

The Group's financial performance for the year ended 31 March

2023 is reported in accordance with UK-adopted international

accounting standards and applicable law.

Summary Income Statement 2023 2022 2020 Change

GBPm GBPm GBPm 2023

Unaudited vs 2020

Revenue 5,033.5 1,231.7 3,584.7 40%

Net operating expenses (4,639.5) (1,555.6) (3,291.7) (41%)

------------------------------------------------- ------------------- -------------------- ---------- ---------

Operating profit / (loss) 394.0 (323.9) 293.0 34%

Net financing expense (excluding Net FX

revaluation losses) (5.8) (53.4) (29.5) 80%

Profit on disposal of property, plant and

equipment 2.6 1.1 0.7 271%

------------------------------------------------- ------------------- -------------------- ---------- ---------

Profit / (loss) before hedge ineffectiveness,

FX revaluation and taxation 390.8 (376.2) 264.2 48%

Hedge ineffectiveness - - (108.4) 100%

Net FX revaluation losses (19.8) (12.6) (8.1) (144%)

------------------------------------------------- ------------------- -------------------- ---------- ---------

Profit / (loss) before taxation from continuing

operations 371.0 (388.8) 147.7 151%

Profit before taxation from discontinued

operations - - 5.5 (100%)

Profit / (loss) before taxation 371.0 (388.8) 153.2 142%

Net financing expense (including Net FX

revaluation losses) 25.6 66.0 37.6 32%

Depreciation 185.2 158.3 204.5 9%

Hedge ineffectiveness - - 108.4 100%

EBITDA from continuing operations* 581.8 (164.5) 498.2 17%

================================================= =================== ==================== ========== =========

* EBITDA is included as an alternative performance measure in

order to aid users in understanding the underlying operating

performance of the Group. Further information can be found in Note

6.

Customer Demand & Revenue

The rebound in consumer confidence to travel following the

resumption of international flying in early 2022 reaffirmed our

decision to invest well ahead of the Summer 2022 season to ensure

we had an ample and capable workforce available to deliver our

popular holiday offering.

As a result, on sale seat capacity for the Summer 2022 season

remained 14% higher than Summer 2019. This planning stability

allowed us to capitalise on the sustained customer demand,

particularly for our package holidays and, combined with a

resilient pricing environment and effective cost management, not

only resulted in a significantly improved financial performance

compared to the prior pandemic-impacted year, but also materially

surpassed the result achieved in the pre-pandemic year ended 31

March 2020.

D uring the financial year Jet2.com flew a total of 16.22m

(2022: 4.85m) single sector passengers, an increase of 234% with

customers choosing our end-to-end package holiday products

increasing by 310% to 5.29m (2022: 1.29m) assisted by certain high

volume, popular routes operating package-only flights.

Consequently, higher margin package holiday customers represented

64.9% of overall flown passengers (2022: 51.3%) which was 13.2 ppts

higher than 2020.

Pleasingly, average load factor achieved was 90.5% (2022: 69.2%)

on a 156% increase in seat capacity to 17.93m (2022: 7.01m),

underlining the popularity of our leisure travel products and the

resurgence in consumer confidence to travel, with load factors in

the latter months of the financial year broadly in line with those

of 2019/20.

Average flight-only ticket yield per passenger sector at

GBP100.28 (2022: GBP67.90) was 48% higher than the prior year, due

to changes in the mix of destinations flown, notably an increase to

those in the Eastern Mediterranean, combined with strong consumer

demand meaning fewer promotional offers were required.

The average price of a Jet2holidays package holiday increased by

10% to GBP761 (2022: GBP689) reflecting changes in destination mix

and favourable pricing driven by the consistently robust consumer

demand.

Non-Ticket Retail Revenue per passenger sector declined by 14%

to GBP25.99 (2022: GBP30.28). This decrease can be largely

attributed to the weaker than anticipated performance of our

in-flight retail operations, primarily due to resource limitations

at Jet2.com's third party in-flight retail supplier which affected

onboard product availability. Pleasingly, towards the end of summer

this disruption had largely abated and availability levels returned

to the high standards our Customers have come to expect and

enjoy.

As a result, overall Group Revenue increased by 309% to

GBP5,033.5m (2022: GBP1,231.7m).

Net Operating Expenses

Higher levels of flying activity led to a corresponding 250%

increase in direct operating expenses (including direct staff

costs) to GBP3,843.0m (2022: GBP1,099.3m), significantly lower than

the revenue growth.

It is important to note that this result was achieved despite

the severe operational challenges experienced during mid-Summer

2022 due to the lack of planning and investment by many airports

and their associated suppliers. Despite the tremendous efforts of

our Colleagues, this disruption led to a significant increase in

flight delays in excess of three hours deemed eligible under EU261

UK. As a result, delay and associated compensation costs exceeded

GBP50.0m, over 200% higher than those incurred in the financial

year ended 31 March 2020.

As a gesture of the Board's huge appreciation of their

tremendous efforts and support, all Colleagues received an end of

summer 'Thank You Bonus' of GBP1,000 in recognition of the strong

operational and financial performance achieved, despite the very

challenging circumstances.

Underlying wage costs increased as a result of an 8% pay award

made during the year, which recognised the fact that many had taken

up to a 20% pay cut for the majority of the pandemic period to

support the Company and also reflected the challenging inflationary

environment.

Additionally, the Group continued to invest significant monies

into colleague recruitment and training, not only to ensure it was

well-placed to capitalise on consumer demand, but also to support a

balanced lifestyle, particularly in operational areas.

The purchase of carbon allowances to satisfy our obligations

under the UK and EU ETS resulted in a total charge of GBP76.7m and

were acquired at an average price (excluding voluntary offsetting)

of GBP63.17, up by 14% on 2022 (GBP55.35) and 350% on 2020

(GBP14.03).

B rand and direct marketing investment was over GBP90.0m higher

than the previous year at approximately GBP220m as the business

ramped up activity post-pandemic to optimise load factors for

Summer 2022, and also drive customer bookings for Winter 2022/2023

and Summer 2023.

Pleasingly, the successful performance of the Group has meant

the reinstatement of both our Discretionary Colleague Profit Share

Scheme for non-management Colleagues at 6% of pre-tax profit and

Discretionary Bonus Scheme for management Colleagues. These

payments totalling approximately GBP45m, will be the first since

2019 due to the pandemic and will be made in the July 2023

payroll.

As a result, net operating expenses increased by 198% to

GBP4,639.5m (2022: GBP1,555.6m).

Operating profit

Overall Group operating profit for the year was GBP394.0m (2022:

GBP323.9m loss), a 34% increase on 2020 (GBP293.0m).

Net Financing Expense

Net financing expense of GBP25.6m (2022: GBP66.0m) is stated

after finance income of GBP58.7m (2022: GBP5.1m), which improved

materially due to higher levels of cash deposits coupled with

increases to central bank interest rates made over the course of

the financial year. Finance expenses of GBP64.5m (2022: GBP58.5m)

increased primarily due to annualisation of the interest expense on

the Group's convertible bond, which resulted in a cost of GBP17.3m

(2022: GBP13.6m) and additional interest incurred on lease

liabilities as a result of aircraft acquired to support further

fleet expansion.

In addition, a net FX revaluation loss of GBP19.8m (2022:

GBP12.6m) resulted from the year end revaluation of foreign

currency denominated monetary balances.

Statutory Profit for the Year

As a result, the Group made a statutory profit before taxation

of GBP371.0m (2022: GBP388.8m loss) which was over 150% higher than

the pre-pandemic performance in the year ended 31 March 2020.

Taxation

The Group recorded a tax charge of GBP80.2m (2022: GBP73.4m

credit), at an effective tax rate of 22% (2022: 19%). The Finance

Bill enacted on 10 June 2021 detailed a proposed increase in the

rate of corporation tax from 19% to 25% from 1 April 2023 and

consequently, the Group has provided for all deferred tax at 25%

(2022: 25%).

Statutory Net Profit for the year and Earnings Per Share

Consequently, the Group made a statutory profit after taxation

of GBP290.8m (2022: GBP315.4m loss) and basic earnings per share

were 135.4p (2022: (147.0p)).

Other Comprehensive Income and Expense

The Group had an Other comprehensive expense of GBP179.0m (2022:

GBP193.1m income); the change compared to the prior year primarily

due to the transfer to the consolidated income statement over the

course of the current year of hedged gains from in-the-money fuel

derivatives from the previous year.

Cash Flows and Financial Position

The Group continues to maintain a strong balance sheet with

significant liquidity which gives flexibility to pursue its growth

aspirations and to refresh certain of its aircraft fleet.

The following table sets out condensed cash flow data and the

Group's cash and cash equivalents and money market deposits:

Summary of Cash Flows 2023 2022 2020 Change

GBPm GBPm GBPm 2023

vs 2020

Unaudited

EBITDA from continuing operations 581.8 (164.5) 498.2 17%

EBITDA from discontinued operations - - 20.9 (100%)

Other Income Statement adjustments 7.8 3.0 (0.4) 2,050%

------------------------------------------- -------------------- ------------------- -------- ---------

Operating cash flows before movements

in working capital 589.6 (161.5) 518.7 14%

Movements in working capital 362.6 966.0 (21.5) 1,787%

Payment on settlement of derivatives - (15.5) - -

Interest and taxes (0.1) (38.0) (54.1) 100%

------------------------------------------- -------------------- ------------------- -------- ---------

Net cash generated from operating

activities 952.1 751.0 443.1 115%

Purchase of intangibles - - (26.8) 100%

Purchase of property, plant and equipment

and right-of-use assets (196.6) (108.4) (211.3) 7%

Movement on borrowings (287.7) 268.5 27.0 (1,166%)

Movement on lease liabilities (76.2) (67.5) (99.7) 24%

Dividends paid in the year (6.4) - (15.5) 59%

Other items 11.0 5.9 9.1 21%

------------------------------------------- -------------------- ------------------- -------- ---------

Net increase in cash and money market

deposits (a) 396.2 849.5 125.9 215%

=========================================== ==================== =================== ======== =========

(a) Cash flows are reported including the movement on money

market deposits (cash deposits with maturity of more than three

months from point of placement) to give readers an understanding of

total cash generation. The Consolidated Statement of Cash Flows

reports net cash flow excluding these movements. Further

information on these balances as at the year-end can be found in

Note 6.

Net Cash Generated From Operating Activities

The Group generated operating cash inflows before working

capital movements of GBP589.6m (2022: GBP161.5m outflow) primarily

driven by the Leisure Travel business trading performance which

resulted in EBITDA improving to GBP581.8m (2022: EBITDA of

GBP164.5m loss).

In addition, movements in working capital resulted in cash

inflows of GBP362.6m (2022: GBP966.0m), principally due to holding

higher levels of customer cash deposits than the prior year from

much improved forward bookings and an increase in trade and other

payables due to increased operational activity in the final quarter

of the year as compared to the previous year. After net interest

received of GBP15.1m (2022: GBP38.4m paid) and corporation tax

payments of GBP15.2m (2022: GBP0.4m refunded), the Group generated

GBP952.1m of cash from its operating activities (2022:

GBP751.0m).

Net Cash Used In Investing Activities

Total capital expenditure amounted to GBP196.6m (2022:

GBP108.4m) primarily representing pre-delivery payments made for

the Group's Airbus A321/A320neo order and including the balance

payment for the first Airbus A321neo delivery received in March

2023. Additionally, we continued to invest in the ongoing

maintenance of our existing aircraft fleet, ensuring its long-term

reliability and performance. Furthermore, we were delighted to

acquire a second flight simulator and training centre near our

Manchester Airport base. This bespoke facility will serve as an

additional dedicated training hub for our pilots, cabin crew,

engineers and other operational functions as we continue to grow

over the coming years. Finally, as part of our commitment to

achieve the targets set out within our Sustainability Strategy, we

continued to invest in improving the carbon efficiency of our

ground service equipment at our UK bases, transitioning from

combustion engine to electric (either fully electric or hybrid)

powered alternatives.

Net Cash Used In Financing Activities

Net cash used in financing activities amounted to GBP370.3m

(2022: GBP201.0m cash generated from financing activities)

following repayments of borrowings and lease liabilities of

GBP363.9m (2022: GBP327.0m), which included repayment of the

existing GBP65.0m Revolving Credit Facility ("RCF") and early

repayment of a GBP150.0m short term loan taken out during the

pandemic, and an interim dividend payment of GBP6.4m (2022: nil).

There were no new loans advanced during the year (2022:

GBP528.0m).

Other items totalling an inflow of GBP11.0m (2022: GBP5.9m) are

largely driven by the effect of foreign exchange rate changes on

the Group's cash and money market deposit balances totalling

GBP8.3m (2022: GBP4.8m) and GBP2.7m proceeds from engine sales

(2022: GBP1.1m).

Overall, this resulted in a net cash inflow of GBP396.2m (2022:

GBP849.5m) and a year-end gross cash position (including money

market deposits) of GBP2,624.7m (2022: GBP2,228.5m). Net cash,

stated after borrowings and lease liabilities increased by 90% to

GBP1,249.7m (2022: GBP658.3m).

At the reporting date, the Group had received payments in

advance of travel from its Leisure Travel customers amounting to

GBP1,497.6m (2022: GBP1,144.7m) and had increased its 'Own Cash'

balance to GBP1,127.1m (2022: GBP1,083.8m).

Further information on the calculation of this measure can be

found in Note 6.

Liquidity

The Group maintains a robust financial position, characterised

by a strong balance sheet and ample liquidity. This financial

strength gives the flexibility to pursue our growth ambitions,

comfortably repay our borrowings and to renew certain aircraft

within our fleet.

In October 2022, the Group successfully renegotiated its RCF,

with the addition of one new financing partner, National

Westminster Bank plc, alongside our three existing supportive

relationship banks: Barclays Bank plc; HSBC UK Bank plc; and Lloyds

Bank plc. The new RCF, which remains undrawn, provides the Group

with unsecured available facilities of up to GBP300m and represents

an increase of GBP200m from the previous arrangement.

An important feature of the new facility is its sustainability

focus. Commencing 1 April 2023, it will be linked via a margin

ratchet adjustment to sustainability criteria, specifically the

Group's key climate metric - gCO2 per passenger kilometre aircraft

fuel burn. This integration of sustainability targets into our

financing structure underscores our commitment to addressing the

climate impact and aligning our financial operations with our

environmental objectives.

Summary Statement of Financial 2023 2022 2020 Change

Position

GBPm GBPm GBPm 2023 vs

2020

Unaudited

---------------------------------- -------------------- ---------- -------- --------

Non-current assets (a) 1,519.8 1,363.9 1,492.7 2%

Net liabilities (b) (115.0) (87.6) (138.7) 17%

Cash and money market deposits 2,624.7 2,228.5 1,387.5 89%

Deferred revenue (1,563.6) (1,189.1) (745.2) (110%)

Borrowings (729.2) (991.7) (485.7) (50%)

Lease liabilities (645.8) (578.5) (672.7) 4%

Deferred taxation (36.7) (12.6) (78.7) 53%

Derivative financial instruments (41.8) 163.7 (191.5) 78%

Assets held for sale - - 66.4 (100%)

Total shareholders' equity 1,012.4 896.6 634.1 60%

================================== ==================== ========== ======== ========

(a) Stated excluding derivative financial instruments.

(b) Stated excluding cash and cash equivalents, money market

deposits, deferred revenue, borrowings, lease liabilities and

derivative financial instruments.

Total shareholders' equity increased by GBP115.8m (2022:

GBP67.6m decrease) which included the profit after taxation of

GBP290.8m (2022: GBP315.4m loss). This was partially offset by a

net movement within the cash flow hedging and cost of hedging

reserves of GBP182.9m, notably the crystallisation of prior year

in-the-money fuel derivatives during the year.

Our Leisure Travel business emerged from the pandemic at the

beginning of 2022 firmly on the front foot, made possible by its

strong Own Cash position, a well-capitalised Balance Sheet and a

highly committed, skilled workforce. These invaluable resources

have helped steer the Group through a phased recovery to more

normalised levels of operational activity. Moreover, they form the

bedrock of our growth ambitions for the coming years.

In addition, the strength of our balance sheet means the Group

is well positioned to capitalise on the growth opportunities that

we believe exist for our exciting and dynamic business, but also

provides us with the necessary financial resilience to adapt to and

navigate potential challenges should they arise.

Gary Brown

Group Chief Financial Officer

6 July 2023

Leisure Travel Key Performance Change

Indicators 2023 vs

2023 2022 2020 2020

---------------------------------------- ------------ ------------ ------------ -----------

Leisure Travel sector seats available

(capacity) 17.93m 7.01m 15.85m 13%

Leisure Travel passenger sectors

flown 16.22m 4.85m 14.62m 11%

Leisure Travel load factor 90.5% 69.2% 92.2% (1.7 ppts)

Flight-only passenger sectors

flown 5.69m 2.36m 7.06m (19%)

Package holiday customers 5.29m 1.29m 3.77m 40%

Package holiday customers % of

total passenger sectors flown 64.9% 51.3% 51.7% 13.2 ppts

Flight-only ticket yield per passenger

sector (excl. taxes) GBP100.28 GBP67.90 GBP85.59 17%

Average package holiday price GBP761 GBP689 GBP687 11%

Non-ticket revenue per passenger

sector GBP25.99 GBP30.28 GBP24.91 4%

Fuel requirement hedged - next

12 months 81.8% 87.6% N/A N/A

Advance sales made as at 31 March GBP3,028.2m GBP2,396.0m GBP1,679.2m 80%

---------------------------------------- ------------ ------------ ------------ -----------

For further information please contact:

Jet2 plc

Philip Meeson, Executive

Chairman

Gary Brown, Group Chief 0113 239

Financial Officer 7692

Cenkos Securities plc

Nominated Adviser 020 7397

Katy Birkin / Camilla Hume 8900

Canaccord Genuity

Joint Broker 020 7523

Adam James 8000

Jefferies International

Limited

Joint Broker 020 7029

Ed Matthews / Becky Lane 8000

Buchanan

Financial PR

Richard Oldworth / Toto 020 7466

Berger 5000

COnsolidated income statement (unaudited)

for the year ended 31 March 2023

Results for Results for

the the

year ended year ended

31 March 2023 31 March 2022

GBPm GBPm

Revenue 5,033.5 1,231.7

Net operating expenses 3 (4,639.5) (1,555.6)

------------------------------------------ --------------- ---------------

Operating profit / (loss) 394.0 (323.9)

Finance income 58.7 5.1

Finance expense (64.5) (58.5)

Net FX revaluation losses (19.8) (12.6)

------------------------------------------ --------------- ---------------

Net financing expense 4 (25.6) (66.0)

Profit on disposal of property, plant

and equipment 2.6 1.1

Profit / (loss) before taxation 371.0 (388.8)

Taxation (80.2) 73.4

------------------------------------------ --------------- ---------------

Profit / (loss) for the year 290.8 (315.4)

(all attributable to equity shareholders

of the Parent)

========================================== =============== ===============

Earnings per share

- basic 5 135.4 p (147.0p)

- diluted 5 126.6 p (147.0p)

-------------------- -------- ---------

Consolidated statement of comprehensive income (UNAUDITED)

for the year ended 31 March 2023

Year ended Year ended

31 March 31 March

2023 2022

GBPm GBPm

------------------------------------------- ----------- -----------

Profit / (loss) for the year 290.8 (315.4)

Other comprehensive (expense) / income

Items that are or may be reclassified

subsequently to profit or loss:

Cash flow hedges:

Fair value (losses) / gains (49.4) 225.2

Net amount transferred to Consolidated

Income Statement (164.1) 22.4

Cost of hedging reserve - changes

in fair value (17.0) (8.0)

Related taxation credit / (charge) 47.6 (46.5)

Revaluation of foreign operations 3.9 -

------------------------------------------- ----------- -----------

(179.0) 193.1

Total comprehensive income / (expense)

for the year 111.8 (122.3)

(all attributable to equity shareholders

of the Parent)

=========================================== =========== ===========

Consolidated Statement of Financial Position (UNAUDITED)

at 31 March 2023

2023 2022

GBPm GBPm

Non-current assets

Intangible assets 26.8 26.8

Property, plant and equipment 927.7 845.2

Right-of-use assets 565.3 491.9

Derivative financial instruments 14.3 20.5

----------------------------------- --------

1,534.1 1,384.4

---------------------------------- -------- --------

Current assets

Inventories 40.2 8.5

Trade and other receivables 281.3 185.8

Derivative financial instruments 45.8 186.3

Money market deposits 1,669.5 1,181.0

Cash and cash equivalents 955.2 1,047.5

2,992.0 2,609.1

---------------------------------- -------- --------

Total assets 4,526.1 3,993.5

----------------------------------- -------- --------

Current liabilities

Trade and other payables 339.1 217.8

Deferred revenue 1,547.2 1,173.4

Borrowings 125.9 134.5

Lease liabilities 101.8 74.8

Provisions 57.4 41.8

Derivative financial instruments 85.1 39.6

2,256.5 1,681.9

---------------------------------- -------- --------

Non-current liabilities

Deferred revenue 16.4 15.7

Borrowings 603.3 857.2

Lease liabilities 544.0 503.7

Provisions 40.0 22.3

Derivative financial instruments 16.8 3.5

Deferred taxation 36.7 12.6

----------------------------------- --------

1,257.2 1,415.0

---------------------------------- -------- --------

Total liabilities 3,513.7 3,096.9

----------------------------------- -------- --------

Net assets 1,012.4 896.6

=================================== ======== ========

Shareholders' equity

Share capital 2.7 2.7

Share premium 19.8 19.8

Cash flow hedging reserve (15.3) 155.2

Cost of hedging reserve (17.9) (5.5)

Other reserves 55.2 51.3

Retained earnings 967.9 673.1

Total shareholders' equity 1,012.4 896.6

=================================== ======== ========

consolidated statement of cash flows (UNAUDITED)

for the year ended 31 March 2023

2023 2022

GBPm GBPm

Profit / (loss) before taxation 371.0 (388.8)

Net financing expense (including

Net FX revaluation losses) 25.6 66.0

Hedge ineffectiveness - 0.8

Depreciation 185.2 158.3

Profit on disposal of property, plant

and equipment (2.6) (1.1)

Equity settled share-based payments 10.4 3.3

Operating cash flows before movements

in working capital 589.6 (161.5)

-------------------------------------------- -------- ----------

Increase in inventories (31.7) (7.5)

Increase in trade and other receivables (117.5) (35.5)

Increase in trade and other payables 118.7 151.8

Increase in deferred revenue 374.5 866.7

Increase / (decrease) in provisions 18.6 (9.5)

Payment on settlement of derivatives - (15.5)

-------------------------------------------- -------- ----------

Cash generated from operations 952.2 789.0

-------------------------------------------- -------- ----------

Interest received 58.7 5.1

Interest paid (43.6) (43.5)

Income taxes (paid) / refunded (15.2) 0.4

Net cash generated from operating

activities 952.1 751.0

-------------------------------------------- -------- ----------

Cash used in investing activities

Purchase of property, plant and equipment (193.9) (107.9)

Purchase of right-of-use assets (2.7) (0.5)

Proceeds from sale of property, plant

and equipment 2.7 1.1

Net increase in money market deposits (481.9) (1,181.0)

Net cash used in investing activities (675.8) (1,288.3)

-------------------------------------------- -------- ----------

Cash (used in) / generated from financing

activities

Repayment of borrowings (287.7) (259.5)

New loans advanced - 147.9

Payment of lease liabilities (76.2) (67.5)

Proceeds on issue of convertible

bonds - 380.1

Dividends paid in the year (6.4) -

Net cash (used in) / generated from

financing activities (370.3) 201.0

-------------------------------------------- -------- ----------

Net decrease in cash in the year (94.0) (336.3)

Cash and cash equivalents at beginning

of year 1,047.5 1,379.0

Effect of foreign exchange rate changes 1.7 4.8

Cash and cash equivalents at end

of year 955.2 1,047.5

-------------------------------------------- -------- ----------

Consolidated statement of changes in equity (UNAUDITED)

for the year ended 31 March 2023

Share Share Cash flow Cost of Other Retained Total shareholders'

capital premium hedging hedging reserves earnings equity

reserve reserve

GBPm GBPm GBPm GBPm GBPm GBPm GBPm

---------------------- --------- --------- ---------- --------- ---------- ---------- --------------------

Balance at 31

March 2021 2.7 19.8 (44.2) 0.8 (0.1) 985.2 964.2

Total comprehensive

expense - - 199.4 (6.3) - (315.4) (122.3)

Share-based payments - - - - - 3.3 3.3

Issue of convertible

bonds (1) - - - - 51.4 - 51.4

Balance at 31

March 2022 2.7 19.8 155.2 (5.5) 51.3 673.1 896.6

Total comprehensive

income - - (170.5) (12.4) 3.9 290.8 111.8

Share-based payments - - - - - 10.4 10.4

Dividends paid

in the year - - - - - (6.4) (6.4)

Balance at 31

March 2023 2.7 19.8 (15.3) (17.9) 55.2 967.9 1,012.4

====================== ========= ========= ========== ========= ========== ========== ====================

(1) In June 2021, senior unsecured convertible bonds were issued

generating gross proceeds of GBP387.4m. The equity component of

these bonds was valued at GBP51.4m and recognised in other

reserves. The remaining balance held in other reserves relates to

foreign exchange translation differences arising on revaluation of

non-sterling functional currency subsidiaries of the Group, which

totalled GBP3.8m at 31 March 2023.

Notes to the UNAUDITED PRELIMINARY ANNOUNCEMENT

for the year ended 31 March 2023

1. Accounting policies and general information

Basis of preparation

The financial information in this preliminary announcement has

been prepared and approved by the Board of Directors in accordance

with UK-adopted international accounting standards and applicable

law ("UK-adopted IAS").

Whilst the information included in this preliminary announcement

has been prepared in accordance with UK-adopted IAS, the financial

information contained within this preliminary announcement for the

years ended 31 March 2023 and 31 March 2022 does not itself contain

sufficient information to comply with UK-adopted IAS, nor does it

comprise statutory financial statements within the meaning of

section 434 of the Companies Act 2006.

The financial information for 2022 is derived from the financial

statements for the year ended 31 March 2022, which have been

delivered to the Registrar of Companies. The Auditor has reported

on the year ended 31 March 2022 financial statements; their

report:

i. was unqualified.

ii. did not include a reference to any matters to which the

Auditor drew attention by way of emphasis without qualifying their

report; and

iii. did not contain a statement under section 498 (2) or (3) of the Companies Act 2006.

The financial statements for the year ended 31 March 2023 will

be finalised on the basis of the financial information presented by

the Board of Directors in this preliminary announcement and will be

delivered to the Registrar of Companies in due course.

The 2023 Annual Report & Accounts (including the Auditor's

Report) will be made available to shareholders during the week

commencing 7 August 2023. The Jet2 plc Annual General Meeting will

be held on 7 September 2023.

The financial information has been prepared under the historical

cost convention except for all derivative financial instruments,

which have been measured at fair value.

The Group's financial information is presented in pounds

sterling and all values are rounded to the nearest GBP100,000

except where indicated otherwise.

Going concern

The Directors have prepared financial forecasts for the Group,

comprising profit before and after taxation, balance sheets and

cash flows through to 31 March 2026.

For the purpose of assessing the appropriateness of the

preparation of the Group's financial statements on a going concern

basis, two financial forecast scenarios have been prepared for the

12-month period following approval of these financial statements

:

-- A base case which assumes a full unhindered flying programme

utilising an aircraft fleet of 120 at load factors above 90%

against an 8% increase in seat capacity; and

-- A downside scenario with load factors reduced to 80% from

August 2023 to reflect a possible reduction in demand but with no

restrictions on flying to any of the Group's destinations.

The forecasts consider the current cash position and an

assessment of the principal areas of risk and uncertainty as

described in more detail in the Group's Annual Report &

Accounts, paying particular attention to the impact of the current

UK macro-economic environment and how this may affect consumers'

future spending.

In addition to forecasting the cost base of the Group, both

scenarios incorporated the funding of future aircraft deliveries

with our well-established aircraft financing partners and no

mitigating actions taken to defer uncommitted capital expenditure

during the forecast period.

The Directors concluded that, given the combination of a closing

cash balance (including money market deposits) of GBP2,624.7m at 31

March 2023 together with the forecast monthly cash utilisation,

under both scenarios the Group would have sufficient liquidity

throughout a period of 12 months from the date of approval of the

financial statements at the end of July 2023. In addition, the

Group is forecast to meet its RCF covenants at 30 September 2023

and 31 March 2024 under both scenarios with significant

headroom.

As a result, the Directors have a reasonable expectation that

the Group as a whole has adequate resources to continue in

operational existence for a period of 12 months from the date of

approval of the financial statements. For this reason, they

continue to adopt the going concern basis in preparing the

financial statements for the year ended 31 March 2023.

Accounting policies

The accounting policies adopted are consistent with those

described in the Annual Report & Accounts for the year ended 31

March 2022.

2. Segmental reporting

IFRS 8 - Operating segments requires operating segments to be

determined based on the Group's internal reporting to the Chief

Operating Decision Maker ("CODM").

The CODM is responsible for the overall resource allocation and

performance assessment of the Group. The Board of Directors

approves major capital expenditure, assesses the performance of the

Group and also determines key financing decisions. Consequently,

the Board of Directors is considered to be the CODM.

The information presented to the CODM for the purpose of

resource allocation and assessment of the Group's performance

relates to its Leisure Travel segment as shown in the Consolidated

Income Statement.

The Leisure Travel business specialises in offering package

holidays by its ATOL licensed provider, Jet2holidays, to leisure

destinations in the Mediterranean, the Canary Islands and to

European Leisure Cities, and scheduled holiday flights by its

airline, Jet2.com. Resource allocation decisions are based on the

entire route network and the deployment of its entire aircraft

fleet. All Jet2holidays customers fly on Jet2.com flights, and

therefore these segments are inextricably linked and represent the

only segment within the Group.

Revenue is principally generated from within the UK, the Group's

country of domicile. No customer represents more than 10% of the

Group's revenue. Segment revenue reported below represents revenue

generated from external customers.

Revenues for the Group can be further disaggregated by their

nature for the purposes of IFRS 15 as follows:

2023 2022

GBPm GBPm

Unaudited

---------------------------- ---------- --------

Package holidays 4,028.9 887.9

Flight-only ticket revenue 570.3 160.3

Non-ticket revenue 421.5 147.0

Other Leisure Travel 12.8 36.5

Total revenue 5,033.5 1,231.7

============================ ========== ========

3. Net operating expenses

2023 2022

GBPm GBPm

Unaudited

------------------------------------------------- ---------- --------

Direct operating costs:

Accommodation 1,973.6 473.5

Fuel 521.4 132.8

Landing, navigation and third-party handling 403.4 139.5

Agent commission 142.0 29.5

Maintenance 105.2 38.7

In-flight cost of sales 76.7 28.9

Carbon 76.7 11.0

Aircraft rentals (less than twelve months) 61.1 0.6

Other direct operating costs 190.1 53.6

Staff costs including agency staff 590.4 313.2

Depreciation of property, plant and equipment 118.9 105.2

Depreciation of right-of-use assets 66.3 53.1

Other operating charges 313.7 176.0

Total net operating expenses 4,639.5 1,555.6

================================================= ========== ========

4. Net financing expense

2023 2022

GBPm GBPm

Unaudited

----------------------------------------- ---------- -------

Finance income 58.7 5.1

Interest expense on aircraft loans (16.4) (16.0)

Interest expense on other loans (7.1) (7.7)

Interest expense on convertible bond (17.3) (13.6)

Interest expense on lease liabilities (23.7) (21.2)

----------------------------------------- ---------- -------

Finance expense (64.5) (58.5)

Net foreign exchange revaluation losses (19.8) (12.6)

----------------------------------------- ---------- -------

Total net financing expense (25.6) (66.0)

========================================= ========== =======

5. Earnings per share

Basic earnings per share is calculated by dividing the profit /

(loss) attributable to the equity owners of the Parent Company by

the weighted average number of ordinary shares in issue during the

year.

Diluted earnings per share is calculated by dividing the profit

/ (loss) attributable to the equity owners of the Parent Company by

the weighted average number of ordinary shares in issue during the

year, adjusted for the effects of potentially dilutive share

options and deferred awards, along with the potential conversion of

the convertible bonds to ordinary shares at maturity in June 2026.

In accordance with IAS 33, these were not included in the

calculation of diluted earnings per share for the year ended 31

March 2022, as they were anti-dilutive for that loss-making

period.

2023

Unaudited 2022

Earnings Weighted EPS Earnings Weighted EPS

GBPm average pence GBPm average pence

number number

of shares of shares

millions millions

------------------------------ --------- ----------- ------- --------- ----------- --------

Basic EPS

Profit / (loss) attributable

to ordinary shareholders 290.8 214.7 135.4 (315.4) 214.6 (147.0)

------------------------------ --------- ----------- ------- --------- ----------- --------

Effect of dilutive instruments

Share options and

deferred awards - 4.6 (2.8) - - -

Convertible bond 14.0 21.5 (6.0) - - -

Diluted EPS 304.8 240.8 126.6 (315.4) 214.6 (147.0)

------------------------------ --------- ----------- ------- --------- ----------- --------

6. Alternative performance measures

The Group's alternative performance measures are not defined by

IFRS and therefore may not be directly comparable with other

companies' alternative performance measures. These measures are not

intended to be a substitute for, or superior to, IFRS

measurements.

Profit / (loss) before FX revaluation and taxation

Profit / (loss) before FX revaluation and taxation is included

as an alternative performance measure in order to aid users in

understanding the underlying operating performance of the Group

excluding the impact of foreign exchange volatility.

EBITDA

Earnings before interest, tax, depreciation and amortisation

(EBITDA) is included as an alternative performance measure in order

to aid users in understanding the underlying operating performance

of the Group.

These can be reconciled to the IFRS measure of profit / (loss)

before taxation as below:

2023 2022

GBPm GBPm

Unaudited

----------- --------

Profit / (loss) before taxation 371.0 (388.8)

Net FX revaluation losses 19.8 12.6

----------- --------

Profit / (loss) before FX revaluation

and taxation 390.8 (376.2)

Net financing expense (excluding Net FX

revaluation losses) 5.8 53.4

Depreciation of property, plant and equipment 118.9 105.2

Depreciation of right-of-use assets 66.3 53.1

----------- --------

EBITDA 581.8 (164.5)

=========== ========

'Own Cash'

'Own Cash' comprises cash and cash equivalents and money market

deposits and excludes advance customer deposits. It is included as

an alternative measure in order to aid users in understanding the

liquidity of the Group.

2023 2022

GBPm GBPm

---------- ----------

Cash and cash equivalents 955.2 1,047.5

Money market deposits 1,669.5 1,181.0

---------- ----------

Cash and money market deposits 2,624.7 2,228.5

Deferred revenue (1,563.6) (1,189.1)

Trade and other receivables 66.0 44.4

---------- ----------

'Own Cash' 1,127.1 1,083.8

========== ==========

Trade and other receivables relates to invoicing of amounts due

from travel agents in respect of package holiday deposits and

balance payments.

7. Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information as stipulated under the UK version

of the EU Market Abuse Regulation (2014/596) which is part of UK

law by virtue of the European Union (Withdrawal) Act 2018, as

amended and supplemented from time to time, until the release of

this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UVRNROKUBRAR

(END) Dow Jones Newswires

July 06, 2023 02:00 ET (06:00 GMT)

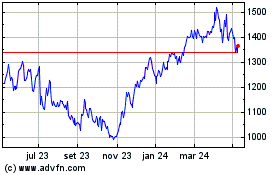

Jet2 (LSE:JET2)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

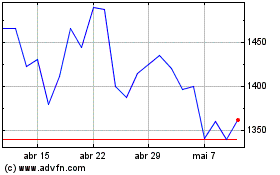

Jet2 (LSE:JET2)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024