TIDMAAU

RNS Number : 8820G

Ariana Resources PLC

24 July 2023

24 July 2023

AIM: AAU

KIZILCUKUR DRILLING AND NEW GEOPHYSICAL TARGETS

Ariana Resources plc ("Ariana" or "the Company"), the AIM-listed

mineral exploration and development company with gold mining

interests in Europe, is pleased to announce positive results from

an airborne magnetic survey and the commencement of drilling at the

Kizilcukur Project ("Kizilcukur" or "the Project") of the Kiziltepe

Sector. Kizilcukur is part of Zenit Madencilik San. ve Tic. A.S.

("Zenit"), in partnership with Proccea Construction Co. and Ozaltin

Holding A.S. and is 23.5% owned by Ariana.

Highlights:

-- Resource infill and extension drilling programme has

commenced, following the receipt of new forestry permits.

-- An automated multi-sensor core scanner (BoxScan) was used to

obtain digital logging data on the historical Kizilcukur drill core

to assist in the building of a revised 3D model.

-- An airborne magnetic survey has better defined the

controlling structures of the Kizilcukur vein system.

-- New potential gold mineralisation zones have been identified

along strike of the known veins.

To read a pdf version of the release, please click here:

http://www.rns-pdf.londonstockexchange.com/rns/8820G_1-2023-7-23.pdf

Dr. Kerim Sener, Managing Director, commented:

"Following the completion of the data processing and analysis of

our recent airborne magnetic survey, the receipt of forestry

permits over several target areas, and the detailed multi-sensor

scanning of about 2,500m of historical drill core, we are

commencing a new resource drilling campaign at the Kizilcukur

Project. Up to 3,000m of drilling has been planned and the

programme will be managed jointly by the Ariana and Zenit teams.

The programme will progress in an iterative manner, with each drill

hole informing the final planning of each subsequent hole. This is

to ensure optimal targeting and capital efficiency.

Ultimately, we expect to define a high-grade Reserve at this

satellite project capable of being mined by open-pit methods and

then trucked to the Kiziltepe processing plant. The current global

Mineral Resource Estimate across Measured, Indicated and Inferred

categories is c. 21,100 oz gold (Au) and 0.62 Moz silver (Ag)

contained metal across three main veins at an overall average grade

of about 2.6 g/t Au and 75 g/t Ag. The new drilling programme has

been designed to provide further confidence to the Resource prior

to conversion to a Reserve, in addition to testing certain vein

extensions. "

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

Drilling Programme

The last phase of drilling completed at Kizilcukur (see

announcement of 6 June 2019), led to a substantial upgrade in

resource classification of the Zeki Main Vein, with additional

improvements to the Mineral Resource. However, additional drilling

is required to provide the confidence required to complete a

conversion of the Resource to Reserve, in addition to further

testing along known mineralised structures, both at depth and along

strike.

Since the completion of the 2019 drilling and an Unmanned Aerial

Vehicle ("UAV") geophysics programme, the team have prepared a

definitive drilling programme to convert the Resource largely into

the Measured category. This pending programme consists of up to

3,000m of drilling across 48 locations (Figure 1).

The Ariana and Zenit exploration teams have recently initiated

the drilling programme (Figure 2). Further exploration drilling,

primarily expanding on the results of the UAV geophysics, and

anomalous surface sampling of vein outcrop extensions to the

south-east of the Zeki, Ziya and Zafer proposed pits may be

investigated through future exploration-focused drilling

campaigns.

Figure 1: The 2023 planned diamond drilling programme. Planned

collars are highlighted in yellow. The current extents of the 2020

MRE mineralisation domain is shaded in red.

Figure 2: The drill rig on site for the 2023 Kizilcukur drilling

programme, now commencing.

Drill-core Scanning

An automated multi-sensor core scanner (BoxScan) was used to

obtain data on geochemistry, mineralogy, magnetic susceptibility,

core topography and high-resolution RGB colour imagery of the

Kizilcukur drill core across 30 holes from the 2007, 2018 and 2019

drill programmes, totalling over 2,530m (712 core trays).

Single-element and multi-element analysis methods were applied to

the new data to aid machine learning by training the system on the

known lithologies. The alteration and mineralisation zones were

also defined for use in improving the 3D geological model.

Geophysical Programme

This geophysical programme update comprises the last in a series

of updates following an extensive data review of several new

geophysical surveys across the Kiziltepe Sector. The recent

geophysical programmes were undertaken over four prospects located

within the Sindirgi Gold Corridor, a north-east trending

mineralised zone extending from the Kiziltepe Mine in the southwest

to the Kizilcukur Project in the northeast. This work included

Induced Polarisation ("IP") / Resistivity surveys over the

Kiziltepe mine area, Kepez Main, Kepez North and an Unmanned Aerial

Vehicle ("UAV") magnetic survey over Kizilcukur (Figure 3).

Figure 3: The Sindirgi Gold Corridor with defined prospects and

areas currently covered by geophysical datasets.

Previous announcements have discussed the geophysics completed

at the Kiziltepe mine site (see announcement of 22 February 2023),

and at the Kepez Main and Kepez North areas (see announcement of 13

March 2023). The geophysical results reported in this update are

the results from an UAV magnetic survey conducted over Kizilcukur

(Figure 3) covering a total area of 4.5 km(2).

Data was collected from 24 north-south oriented profiles

parallel to historic IP/Resistivity survey lines at Kizilcukur. The

lines were spaced 100m apart with 3 east-west control lines for a

total length of 50km. A UAV with attached Geometrics MagArrow was

used for the survey. This was paired with a Geometrics G-852RBS

magnetometer as a base station. The average flight altitude was 40m

above the topographic profile. The quality of the data was assured

in line with the pre-set daily quality control procedures. All data

generated by the subcontractor was reprocessed in-house to

eliminate noise and to better define geological structures within

the survey area (Figure 4).

Figure 4: Overview map showing the UAV magnetic survey data

results and the extent of the known gold-bearing quartz veins. The

map shows the first vertical derivative of the reduced-to-pole

magnetic data. The relationship between the mapped and drill-tested

quartz veins and distinct NW- to NNW-trending magnetic anomaly

boundaries is clear. In addition, lithological boundaries and major

regional faults are also identified.

The Kizilcukur mineralisation and its geology is well understood

by the Company following previous testing by various phases of

drilling. The latest resource estimate (see announcement of 11 May

2020) was completed following the completion of a diamond drilling

programme during the winter of 2018-19, for a total of 745.8

meters. This magnetic survey aimed to identify potential extensions

of mineralisation and to better define the geological and

structural controls of mineralisation.

The results obtained from the UAV geophysical survey have

confirmed several historic geological studies; primarily the

confirmation of known lithological boundaries, regional faults and

the trend of gold-bearing quartz veins. To the southeast of the

Kizilcukur prospect, a portion of a major regional

northeast-southwest fault, characterising the eastern limit of the

Sindirgi Gold Corridor, is also well defined from the newly

acquired geophysics. This is likely to represent a major

controlling fault for the Kizilcukur vein system.

Furthermore, the trend of magnetic anomalies within the

Kizilcukur area not only confirms the extent of known

mineralisation but also shows the potential for strike extensions

in a NW to NNW orientation in the immediate vicinity of the areas

previously drilled.

Project Summary

The Kizilcukur Project consists of one operational licence

located in Balikesir Province in Western Turkey. The property lies

22km to the northeast (straight line) and 70km by road from the

Kiziltepe Mine. The Kizilcukur Project is one of the 3 satellite

projects which have been sold to Zenit (see announcement of 2

December 2020).

The Project covers an area containing a series of sub-parallel

quartz veins hosted by ophiolitic (dominantly basaltic) units that

trend northwest and extend for about two kilometres. The veins

exhibit classic low-sulfidation epithermal textures and attain a

maximum true width of 8m. The Zeki Vein extends over a strike

length of 820m. Composite rock-chip sampling of 80m strike along

this quartz vein returned encouraging assay results of 6m at 3.3g/t

gold, 2m at 9.6g/t gold and 1m at 7.2g/t gold prior to drill

testing. The peak rock-chip assay result in this area was 152g/t

gold and 1,320g/t silver, suggesting the potential for substantial

near-surface enrichment.

The global Mineral Resource Estimate is c. 21,100 oz gold (Au)

and 0.62 Moz silver (Ag) contained metal on three main veins (see

announcement of 11 May 2020). 85% of the tonnage is in Measured and

Indicated (M+I) categories: 218,317 t @ 2.72 g/t Au and 77.04 g/t

Ag. 46% of the M+I tonnage is located within the higher-grade Zeki

Main Vein, with a grade of 3.62 g/t Au and 82.54 g/t Ag, upon which

trial mining operations have previously been undertaken.

Trial mining was completed within the central part of the Zeki

Pit in 2017. This pit is the largest and highest grade of the three

pits defined following Whittle optimisation of the Kizilcukur

resource in 2016. The General Directorate of Mining Affairs

approved blasting operations on the licence as part of the Mining

Permit (see announcement of 18 November 2015).

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited (Nominated Tel: +44 (0) 20 7628 3396

Adviser)

Roland Cornish / Felicity Geidt

Panmure Gordon (UK) Limited (Joint Tel: +44 (0) 20 7886 2500

Broker)

John Prior / Hugh Rich / Atholl

Tweedie

WHIreland Limited (Joint Broker) Tel: +44 (0) 207 2201666

Harry Ansell / Katy Mitchell / George

Krokos Tel: +44 (0) 7983 521 488

Yellow Jersey PR Limited (Financial

PR)

Dom Barretto / Shivantha Thambirajah arianaresources@yellowjerseypr.com

/

Bessie Elliot

Editors' Note:

The information in this announcement that relates to exploration

results is based on information compiled by Dr. Kerim Sener BSc

(Hons), MSc, PhD, Managing Director of Ariana Resources plc. Dr.

Sener is a Fellow of The Geological Society of London and a Member

of The Institute of Materials, Minerals and Mining and has

sufficient experience relevant to the styles of mineralisation and

type of deposit under consideration and to the activity that has

been undertaken to qualify as a Competent Person as defined by the

2012 edition of the Australasian Code for the Reporting of

Exploration Results, Mineral Resources and Ore Reserves (JORC Code)

and under the AIM Rules - Note for Mining and Oil & Gas

Companies. Dr. Sener consents to the inclusion in the report of the

matters based on his information in the form and context in which

it appears.

About Ariana Resources:

Ariana is an AIM-listed mineral exploration and development

company with an exceptional track-record of creating value for its

shareholders through its interests in active mining projects and

investments in exploration companies. Its current interests include

gold production in Turkey and copper-gold exploration and

development projects in Cyprus and Kosovo.

The Company holds 23.5% interest in Zenit Madencilik San. ve

Tic. A.S. a partnership with Ozaltin Holding A.S. and Proccea

Construction Co. in Turkey which contains a depleted total of c.

2.1 million ounces of gold and other metals (as at February 2022).

The partnership comprises the Kiziltepe Mine and the Tavsan and

Salinbas projects.

The Kiziltepe Gold-Silver Mine is located in western Turkey and

contains a depleted JORC Measured, Indicated and Inferred Resource

of 222,000 ounces gold and 3.8 million ounces silver (as at

February 2022). The mine has been in pro table production since

2017 and is expected to produce at a rate of c.20,000 ounces of

gold per annum to at least the mid-2020s. A Net Smelter Return

("NSR") royalty of 2.5% on production is being paid to

Franco-Nevada Corporation.

The Tavsan Gold Mine is located in western Turkey and contains a

JORC Measured, Indicated and Inferred Resource of 307,000 ounces

gold and 1.1 million ounces silver (as at November 2022). Following

the approval of its Environmental Impact Assessment and associated

permitting, Tavsan is being developed as the second gold mining

operation in Turkey and is currently in construction. A NSR royalty

of up to 2% on future production is payable to Sandstorm Gold.

The Salinbas Gold Project is located in north-eastern Turkey and

contains a JORC Measured, Indicated and Inferred Resource of 1.5

million ounces of gold (as at July 2020). It is located within the

multi-million ounce Artvin Gold eld, which contains the "Hot Gold

Corridor" comprising several signi cant gold- copper projects

including the 4 million ounce Hot Maden project, which lies 16km to

the south of Salinbas. A NSR royalty of up to 2% on future

production is payable to Eldorado Gold Corporation.

Ariana owns 100% of Australia-registered Asgard Metals Fund

("Asgard"), as part of the Company's proprietary Project Catalyst

Strategy. The Fund is focused on investments in high-value

potential, discovery-stage mineral exploration companies located

across the Eastern Hemisphere and within easy reach of Ariana's

operational hubs in Australia, Turkey and the UK.

Ariana owns 75% of UK-registered Western Tethyan Resources Ltd

("WTR"), which operates across south-eastern Europe and is based in

Pristina, Republic of Kosovo. The company is targeting its

exploration on major copper-gold deposits across the

porphyry-epithermal transition. WTR is being funded through a

ve-year Alliance Agreement with Newmont Corporation

(www.newmont.com) and is separately earning-in to 85% of the

Slivova Gold Project which contains Measured, Indicated and

Inferred Resource of 176,000 oz gold and 646,000 oz silver (as at

July 2023).

Ariana owns 58% of UK-registered Venus Minerals Ltd ("Venus")

which is focused on the exploration and development of copper-gold

assets in Cyprus which contain a combined JORC Indicated and

Inferred Resource of 17Mt @ 0.45% to 1.10% copper (excluding

additional gold, silver and zinc.

Panmure Gordon (UK) Limited and WH Ireland Limited are brokers

to the Company and Beaumont Cornish Limited is the Company's

Nominated Adviser.

For further information on Ariana, you are invited to visit the

Company's website at www.arianaresources.com .

Glossary of Technical Terms:

"Au" gold;

"Ag" silver;

"g/t" grams per tonne;

"IP" Induced Polarisation;

"km" Kilometres;

"m" Metres;

"UAV" Unmanned Aerial Vehicle;

Ends.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLPPUBWMUPWPGW

(END) Dow Jones Newswires

July 24, 2023 02:00 ET (06:00 GMT)

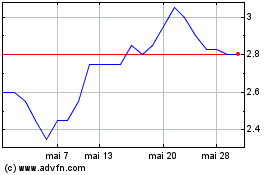

Ariana (AQSE:AAU.GB)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Ariana (AQSE:AAU.GB)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025