TIDMBKY

RNS Number : 9349G

Berkeley Energia Limited

24 July 2023

BERKELEY ENERGIA LIMITED

NEWS RELEASE | 24 July 2023

Quarterly Report June 2023

Highlights:

-- Project Update

Whilst the Company's focus is on resolving the current

permitting situation, and ultimately advancing the Salamanca

project towards production, the Company and BME will continue to

strongly defend its position and take all necessary actions to

preserve its rights.

During the quarter, Berkeley Energia Limited ("Berkeley" or

"Company") announced the Company's wholly owned Spanish subsidiary,

Berkeley Minera España ("BME") had submitted a

contentious-administrative appeal before the Spanish National

Court.

This follows notification from the Ministry for Ecological

Transition and the Demographic Challenge ("MITECO") in relation to

the rejection of the administrative appeal filed by BME against

MITECO's rejection of the Authorisation for Construction for the

uranium concentrate plant as a radioactive facility ("NSC II") at

the Salamanca project.

-- Spanish Politics

The 2023 Spanish general election was held on Sunday, 23 July to

elect the 15(th) Cortes Generales of the Kingdom of Spain (Spanish

Parliament). All 350 seats in the Congress of Deputies were up for

election, as well as 208 of 265 seats in the Senate.

With 99% of the votes counted, the results indicate the

right-wing parties Partido Popular (PP) and Vox are set to win 136

seats and 33 seats respectively, whilst the left-wing parties

Socialists (PSOE) and Sumar are set to win 122 seats and 31 seats

respectively.

In order to govern, a party or coalition must achieve a working

majority of 176 seats in the 350-seat parliament.

-- Global Nuclear Power and Uranium Market:

The outlook for nuclear power and the uranium market continued

to strengthen during the quarter, with a number of important recent

developments, including:

-- European Union

o Nuclear could provide up to 150 GWe of generating capacity by

2050 in the European Union, according to a statement issued by 16

European countries following a meeting in Paris with European

Commissioner for Energy. The so-called Nuclear Alliance called on

the European Commission to recognise nuclear energy in the EU's

energy strategy and relevant policies.

-- France

o French parliament approved a bill that would make the

administrative procedures related to moving new reactors into

construction more efficient, reducing the expected construction

time by up to two years.

-- Belgium

o French utility Engie and the Belgian federal government signed

an interim agreement defining the terms for the extended operation

of the Doel 4 and Tihange 3 nuclear power units by ten years.

-- Netherlands

o The Netherlands is planning to build two new nuclear power

plants by 2035, which will play an important role in the country's

energy transition as it aims to make its power production carbon

neutral by 2040.

-- Sweden

o Sweden's parliament has adopted a new energy target, clearing

the path for the government to push forward with plans to construct

new nuclear plants in the country.

o Changing the target to "100% fossil-free" electricity, from

"100% renewable" is key to the government's plan to meet an

expected doubling of electricity demand by 2040 and to reach

net-zero emissions by 2045.

-- Finland

o Finnish utility Fortum announced it has signed a memorandum of

understanding with Korea Hydro & Nuclear Power Co covering

cooperation and information exchange regarding future nuclear power

plants, new reactor designs as well as safe and efficient operation

of existing nuclear power plants.

-- Italy

o The lower house of the Italian parliament approved a motion

presented by the ruling majority requesting the government

reconsider the use of nuclear energy in the country. The approved

motion called on the government to "assess the opportuneness of

inserting nuclear, as an alternative, clean source of energy

production, into the national energy mix in order to accelerate

Italy's decarbonisation".

-- Poland

o Polish copper and silver producer KGHM Polska Mied SA's plan

to construct a power plant based on NuScale Power's small modular

reactor has been approved by the Ministry of Climate and

Environment.

-- Japan

o The Japanese parliament has passed a bill that allows nuclear

reactors in the country to be operated beyond the current limit of

60 years to help cut carbon emissions while ensuring an adequate

national energy supply.

-- South Korea

o South Korea's Ministry of Industry is to review the need for

new nuclear power plants to expand the country's power supply to

meet predicted increased demand for electricity.

-- Africa

o The World Nuclear Association ("WNA") and the African Energy

Chamber have signed a Memorandum of Understanding to drive nuclear

energy adoption in Africa. This collaboration reflects the shared

commitment of both organizations to promoting clean, affordable and

reliable nuclear energy as a crucial component of Africa's energy

mix, to support economic growth, a just transition, and sustainable

energy development

-- During the quarter, UxC released its 2022 "U(3) O(8)

Production Review" which highlighted that uranium production

increased in 2022 to 129 million pounds a 4.9% increase. This was

driven due to the ramp up of Cigar Lake Uranium Mine and the

restart of the McArthur River Uranium Mine, both in Northern

Saskatchewan.

Spot uranium prices ended the quarter at US$56.00 per pound, an

increase of 10% from March 2023 and 14% increased year to date.

Longer-term uranium price indicators closed at the end of June 2023

at US$56.00 per pound (Long-Term); US$62.00 per pound (3-year

forward price); and US$67.00 per pound (5-year forward price).

-- Balance Sheet

The Company is in a strong financial position with A$79 million

in cash reserves and no debt at 30 June 2023.

Classification: 2.2 This announcement contains inside

information

For further information please contact:

Robert Behets Francisco Bellón

Acting Managing Director Executive Director

+61 8 9322 6322 +34 923 193 903

info@berkeleyenergia.com

Salamanca Project Summary

The Salamanca project is being developed in a historic uranium

mining area in Western Spain about three hours west of Madrid.

The Project hosts a Mineral Resource of 89.3Mlb uranium, with

more than two thirds in the Measured and Indicated categories. In

2016, Berkeley published the results of a robust Definitive

Feasibility Study ("DFS") for Salamanca confirming that the Project

may be one of the world's lowest cost producers, capable of

generating strong after-tax cash flows.

In 2021, the Company received formal notification from MITECO

that it had rejected the NSC II application at Salamanca. This

decision followed the unfavourable NSC II report issued by the NSC

in July 2021.

Berkeley strongly refutes the NSC's assessment and, in the

Company's opinion, the NSC has adopted an arbitrary decision with

the technical issues used as justification to issue the

unfavourable report lacking in both technical and legal

support.

Berkeley submitted documentation, including an 'Improvement

Report' to supplement the Company's initial NSC II application,

along with the corresponding arguments that address all the issues

raised by the NSC, and a request for its reassessment by the NSC,

to MITECO in July 2021.

Further documentation was submitted to MITECO in August 2021, in

which the Company, with strongly supported arguments, dismantled

all of the technical issues used by the NSC as justification to

issue the unfavourable report. The Company again restated that the

project is compliant with all requirements for NSC II to be awarded

and requested its NSC II Application be reassessed by the NSC.

In addition, the Company requested from MITECO access to the

files associated with the Authorisation for Construction and

Authorisation for Dismantling and Closure for the radioactive

facilities at La Haba (Badajoz) and Saelices El Chico (Salamanca),

which are owned by ENUSA Industrias Avandas S.A., in order to

verify and contrast the conditions approved by the competent

administrative and regulatory bodies for other similar uranium

projects in Spain.

Based on a detailed comparison of the different licensing files

undertaken by the Company following receipt of these files, it is

clear that Berkeley, in its NSC II submission, has been required to

provide information that does not correspond to: (i) the regulatory

framework, (ii) the scope of the current procedural stage (i.e., at

the NSC II stage), and/or (iii) the criteria applied in other

licensing processes for similar radioactive facilities.

Accordingly, the Company considers that the NSC has acted in a

discriminatory and arbitrary manner when assessing the NSC II

application for the Salamanca project.

In Berkeley's strong opinion, MITECO has rejected the Company's

NSC II Application without following the legally established

procedure, as the Improvement Report has not been taken into

account and sent to the NSC for its assessment, as requested on

multiple occasions by the Company.

In this regard, the Company believes that MITECO have infringed

regulations on administrative procedures in Spain but also under

protection afforded to Berkeley under the Energy Charter Treaty

("ECT"), which would imply that the decision on the rejection of

the Company's NSC II Application is not legal.

In April 2023, the Company's wholly owned Spanish subsidiary,

Berkeley Minera España ("BME") submitted a

contentious-administrative appeal before the Spanish National Court

in an attempt to overturn the MITECO decision denying NSC II .

Whilst the Company's focus is on resolving the current

permitting situation, and ultimately advancing the Salamanca

project towards production, the Company and BME will continue to

strongly defend its position and take all necessary actions to

preserve its rights.

Initiation of the contentious-administrative appeal is necessary

to preserve BME's rights however, the Company reiterates that it is

prepared to collaborate with the relevant authorities and remains

hopeful that the permitting situation can be resolved amicably.

Salamanca Project Update

During the quarter, the Company continued with its commitment to

health, safety and the environment as a priority.

An assessment of the Environmental Aspects ("EA") according to

ISO 14001 Standards and Sustainable Mining Management Indicators

("SMMI") according to UNE 22470/80 Standards of the Company's

activities was carried out during the quarter, and work continued

on the achievement of the Sustainability Goals set in 2022.

Significant progress and improvements continue to be made and the

conclusions of the assessment will be reported in detail in the

Annual Sustainability Report planned to be published during the

September quarter.

A highlight of the Sustainability Goals achieved during the past

year is the award of the Calculation and Reduction Certificates for

the CO(2) emissions by MITECO. Given its importance, the Company

has set and successfully achieved the objective of calculating its

Carbon Footprint for the last four years, registering it in the

Carbon Footprint Register of MITECO, and obtaining the Calculation

and Reduction Certificates.

Solar Power System Study

As previously reported, Berkeley initiated a study evaluating

the design, permitting, construction and operation of a solar power

system at the Project.

The Project's location has a natural abundance of sunlight which

is conducive to solar power generation, which will become a

reliable source of low cost and carbon-free energy for the Project.

In addition to making a significant contribution to reduce carbon

emissions, the proposed solar power system will potentially

contribute to reducing the Project's power related operating

costs.

The proposed facility will have an installed power of 20.1 MW

and be able to supply up to 75% of the power requirements at the

Project. Detailed analysis evaluating storage capacity versus

capital and operational costs was included in the scope of work to

ensure the optimal outcome for the Project.

During the quarter, the engineering, design, and cost estimation

(capital and operating) workstreams were completed and the outputs

are currently being reviewed by the Company. The environmental

studies are also well advanced. These environmental studies, as

well as preparation and submission of all documentation required by

relevant authorities, is forecasted to be completed during the

September quarter.

The decision to pursue a solar power system is in line with

Berkeley's ongoing commitment to environmental sustainability and

to continue to have a positive impact on the people, environment

and society surrounding the mine.

Additional Information on the Global Nuclear Power and Uranium

Market

The outlook for nuclear power and the uranium market continued

to strengthen during the quarter, with several important recent

developments, including:

-- Nuclear could provide up to 150 GWe of generating capacity by

2050 in the European Union, according to a statement issued by 16

European countries following a meeting in Paris with European

Commissioner for Energy. The so-called Nuclear Alliance called on

the European Commission to recognise nuclear energy in the EU's

energy strategy and relevant policies.

-- French parliament approved a bill in a 399-100 vote that

would make the administrative procedures related to moving new

reactors into construction more efficient, reducing the expected

construction time by up to two years.

-- French utility Engie and the Belgian federal government have

signed an interim agreement defining the terms for the extended

operation of the Doel 4 and Tihange 3 nuclear power units by ten

years.

-- The Netherlands is talking to "three potential and interested

suppliers" to construct two new nuclear power plants, the energy

minister said in a letter to parliament. Discussion are reportedly

being held with the USA's Westinghouse, France's EDF and South

Korea's Korea Hydro & Nuclear Power. The Netherlands is

planning to build two new nuclear power plants by 2035, which will

play an important role in the country's energy transition as it

aims to make its power production carbon neutral by 2040.

-- Sweden's parliament has adopted a new energy target, clearing

the path for the government to push forward with plans to construct

new nuclear plants in the country. Changing the target to "100%

fossil-free" electricity, from "100% renewable" is key to the

government's plan to meet an expected doubling of electricity

demand to around 300 TWh by 2040 and to reach net-zero emissions by

2045. "This creates the conditions for nuclear power," the finance

minister said in parliament. "We need more electricity production,

we need clean electricity and we need a stable energy system."

-- Sweden's environment minister believes the country should

lift its 2018 ban on uranium exploration and mining. The

environment minister believes the country needs to change the law

as it considers building new nuclear capacity, and in light of its

mining industry's good safety and environmental credentials. "It is

important to mine all the minerals we need for climate change with

respect for environmental laws and how those who live nearby are

affected. Sweden has good conditions to do so," the minister

said.

-- Finnish utility Fortum announced it has signed a memorandum

of understanding with Korea Hydro & Nuclear Power Co covering

cooperation and information exchange regarding future nuclear power

plants, new reactor designs as well as safe and efficient operation

of existing nuclear power plants.

-- Norsk Kjernekraft has signed a letter of intent with TVO

Nuclear Services to jointly investigate the deployment of small

modular reactors in Norway.

-- The Chamber of Deputies - the lower house of the Italian

parliament - approved a motion presented by the ruling majority

requesting the government reconsider the use of nuclear energy in

the country. Italy operated four nuclear power plants starting in

the early 1960s but decided to phase out nuclear power in a

referendum that followed the 1986 Chernobyl accident. The approved

motion called on the government to "assess the opportuneness of

inserting nuclear, as an alternative, clean source of energy

production, into the national energy mix in order to accelerate

Italy's decarbonisation".

-- Polish copper and silver producer KGHM Polska Mied SA's plan

to construct a power plant based on NuScale Power's small modular

reactor has been approved by the Ministry of Climate and

Environment.

-- The World Nuclear Association ("WNA") and nuclear trade

associations from Canada, Japan, Europe, the UK, and the USA have

issued a declaration calling on G7 governments to support the

long-term operation of existing nuclear power plants and to

accelerate the deployment of new nuclear power plants.

-- US public support for nuclear energy has remained at a record

high level for the third consecutive year, according to the latest

survey by Bisconti Research Inc. The results show three quarters of

the public favour nuclear energy, and about seven in ten support

the construction of more nuclear power plants.

-- The US Senate Environment and Public Works Committee advanced

a bill to aid the development of advanced nuclear reactors.

-- The Japanese parliament has passed a bill that allows nuclear

reactors in the country to be operated beyond the current limit of

60 years to help cut carbon emissions while ensuring an adequate

national energy supply.

-- South Korea's Ministry of Industry is to review the need for

new nuclear power plants to expand the country's power supply to

meet predicted increased demand for electricity.

-- The WNA and the African Energy Chamber have signed a

Memorandum of Understanding to drive nuclear energy adoption in

Africa. This collaboration reflects the shared commitment of both

organizations to promoting clean, affordable and reliable nuclear

energy as a crucial component of Africa's energy mix, to support

economic growth, a just transition, and sustainable energy

development.

-- Spain's Almaraz nuclear power plant on 19 May reached a

cumulative production of 600 TWh of electricity since the beginning

of its commercial operation in 1983, operator Centrales Nucleares

Almaraz-Trillo ("CNAT") announced. "This is a historical milestone

that places the plant as the one with the greatest contribution to

the national electrical system," CNAT said. "With an average annual

production of more than 16 million MWh in the last decade, Almaraz

generates 7% of the annual electricity demand of all of Spain,

equivalent to the annual consumption of more than 4 million homes."

The Almaraz plant comprises two pressurised water reactors with net

capacities of just over 1000 MWe each.

Exploration

During the quarter, the Company continued with its initial

exploration program focusing on battery and critical metals in

Spain.

The exploration initiative is targeting lithium, cobalt, tin,

tungsten, rare earths, and other battery and critical metals,

within the Company's existing tenements in western Spain that do

not form part of Berkeley's main undertaking being the development

of the Salamanca uranium project. Further analysis of the mineral

and metal endowment across the entire mineral rich province and

other prospective regions in Spain is also being undertaken, with a

view to identifying additional targets and regional consolidation

opportunities.

Investigation Permit Conchas

The Investigation Permit ("IP") Conchas is located in the very

western part of the Salamanca province, close to the Portuguese

border.

The tenement covers an area of 31km(2) in the western part of

the Ciudad Rodrigo Basin and is largely covered by Cenozoic aged

sediments. Only the north-western part of the tenement is uncovered

and dominated by the Guarda Batholith intrusion. The tenement hosts

a number of sites where small-scale historical tin and tungsten

mining was undertaken. In addition, several mineral occurrences

(tin, tungsten, titanium, lithium) have been identified during

historical mapping and stream sediment sampling programs.

Billiton PLC undertook exploration on the IP Conchas between

1981 and 1983, with a focus on tin and tantalum (lithium was not

taken into account). Billiton's work programs comprised regional

and detailed geological mapping, geochemistry, trenching and

limited drilling.

Soil sampling programs completed by Berkeley in the northern and

central portions of the tenement during 2021 (200m by 200m) and

2022 (100m by 100m) defined a tin-lithium anomaly covering

approximately 1.1km by 0.7km which correlated with a mapped

aplo-pegmatitic leucogranite.

Based on the results of the Company's soil sampling programs and

information gleaned from a review of the available historical data,

a small initial drilling program was designed and implemented to

test the tin-lithium anomaly. The drill program comprised five

broad spaced reverse circulation ("RC") holes for a total of 282m.

Anomalous results for lithium ("Li"), tin ("Sn"), rubidium ("Rb"),

cesium ("Cs"), niobium ("Nb") and tantalum ("Ta") obtained from

multi-element analysis of drill samples were reported in the prior

quarter.

The occurrence of these six elements is observed to be largely

associated with a sub-horizontal muscovitic leucogranite unit that

locally outcrops at surface. The muscovitic leucogranite has a

mapped extent of approximately 2km (in a NE-SW orientation) by

0.4km (in a NW-SE orientation) and varies in thickness from 7m to

over 70m in the drill holes.

Mineralogical studies are currently being undertaken on 25

samples from the drilling at ALS Laboratories (Perth, Australia)

and the University of Oviedo (Oviedo, Spain), to determine the

mineral species present and understand their characteristics and

properties.

Subject to the results of the mineralogical studies currently

underway, further work at the IP Conchas may include follow-up

drilling focused on improving confidence in the geology,

continuity, and grade distribution of the zone of multi-element

mineralisation.

Oliva and La Majada Projects

No work was undertaken on the Oliva or La Majada Projects during

the quarter.

These projects comprise three new tenements within two project

areas in Spain which are considered prospective for tungsten,

cobalt, antimony, and other metals.

Forward Looking Statements

Statements regarding plans with respect to Berkeley's mineral

properties are forward-looking statements. There can be no

assurance that Berkeley's plans for development of its mineral

properties will proceed as currently expected. There can also be no

assurance that Berkeley will be able to confirm the presence of

additional mineral deposits, that any mineralisation will prove to

be economic or that a mine will successfully be developed on any of

Berkeley mineral properties. These forward-looking statements are

based on Berkeley's expectations and beliefs concerning future

events. Forward looking statements are necessarily subject to

risks, uncertainties and other factors, many of which are outside

the control of Berkeley, which could cause actual results to differ

materially from such statements. Berkeley makes no undertaking to

subsequently update or revise the forward-looking statements made

in this announcement, to reflect the circumstances or events after

the date of that announcement.

Competent Persons Statement

The information in this report that relates to Exploration

Results is extracted from the March 2023 Quarterly Report which is

available to view on Berkeley's website at www.berkeleyenergia.com.

Berkeley confirms that: a) it is not aware of any new information

or data that materially affects the information included in the

original announcement; b) all material assumptions and technical

parameters underpinning the Exploration Results in the original

announcement continue to apply and have not materially changed; and

c) the form and context in which the relevant Competent Persons'

findings are presented in this announcement have not been

materially modified from the original announcement.

The information in this report that relates to the Mineral

Resource Estimate is extracted from the announcement entitled

'Annual Report 2022' dated 31 August 2022, which is available to

view on Berkeley's website at www.berkeleyenergia.com. Berkeley

confirms that: a) it is not aware of any new information or data

that materially affects the information included in the original

announcement; b) all material assumptions and technical parameters

underpinning the Mineral Resource Estimate in the original

announcement continue to apply and have not materially changed; and

c) the form and context in which the relevant Competent Persons'

findings are presented in this announcement have not been

materially modified from the original announcement.

This announcement has been authorised for release by Mr Robert

Behets, Director.

To view this announcement in full, including all illustrations

and figures, please refer to

https://app.sharelinktechnologies.com/announcement/asx/c22266f52a068b523b3ace9a49f3db31

.

Appendix 1: Mineral Resource at Salamanca

Deposit Resource Tonnes U(3) O(8) U(3) O(8)

Category

Name (Mt) (ppm) (Mlbs)

-------------------------- ------------ -------- ----------- -----------

Retortillo Measured 4.1 498 4.5

Indicated 11.3 395 9.8

Inferred 0.2 368 0.2

--------------------------------------- -------- ----------- -----------

Total 15.6 422 14.5

--------------------------------------- -------- ----------- -----------

Zona 7 Measured 5.2 674 7.8

Indicated 10.5 761 17.6

Inferred 6.0 364 4.8

--------------------------------------- -------- ----------- -----------

Total 21.7 631 30.2

--------------------------------------- -------- ----------- -----------

Alameda Indicated 20.0 455 20.1

Inferred 0.7 657 1.0

--------------------------------------- -------- ----------- -----------

Total 20.7 462 21.1

--------------------------------------- -------- ----------- -----------

Las Carbas Inferred 0.6 443 0.6

Cristina Inferred 0.8 460 0.8

Caridad Inferred 0.4 382 0.4

Villares Inferred 0.7 672 1.1

Villares North Inferred 0.3 388 0.2

-------------------------- ------------ -------- ----------- -----------

Total Retortillo

Satellites Total 2.8 492 3.0

-------------------------- ------------ -------- ----------- -----------

Villar Inferred 5.0 446 4.9

Alameda Nth Zone 2 Inferred 1.2 472 1.3

Alameda Nth Zone 19 Inferred 1.1 492 1.2

Alameda Nth Zone 21 Inferred 1.8 531 2.1

-------------------------- ------------ -------- ----------- -----------

Total Alameda Satellites Total 9.1 472 9.5

-------------------------- ------------ -------- ----------- -----------

Gambuta Inferred 12.7 394 11.1

-------------------------- ------------ -------- ----------- -----------

Salamanca Project

Total Measured 9.3 597 12.3

Indicated 41.8 516 47.5

Inferred 31.5 395 29.6

--------------------------------------- -------- ----------- -----------

Total (*) 82.6 514 89.3

======================================= ======== =========== ===========

Appendix 2: Summary of Mining Tenements

As at 30 June 2023, the Company had an interest in the following

tenements:

Location Tenement Name Percentage Status

Interest

--------------- ----------------------------- ----------- ----------

Spain

Salamanca D.S.R Salamanca 28 (Alameda) 100% Granted

D.S.R Salamanca 29 (Villar) 100% Granted

E.C. Retortillo-Santidad 100% Granted

E.C. Lucero 100% Pending

I.P. Abedules 100% Granted

I.P. Abetos 100% Granted

I.P. Alcornoques 100% Granted

I.P. Alisos 100% Granted

I.P. Bardal 100% Granted

I.P. Barquilla 100% Granted

I.P. Berzosa 100% Granted

I.P. Campillo 100% Granted

I.P. Casta ñ os 100% Granted

2

I.P. Ciervo 100% Granted

I.P. Conchas 100% Granted

I.P. Dehesa 100% Granted

I.P. El Á guila 100% Granted

I.P. El Vaqueril 100% Granted

I.P. Espinera 100% Granted

I.P. Horcajada 100% Granted

I.P. Lis 100% Granted

I.P. Mailleras 100% Granted

I.P. Mimbre 100% Granted

I.P. Pedreras 100% Granted

E.P. Herradura* 100% Granted

C á ceres I.P. Almendro 100% Granted

I.P. Ibor 100% Granted

I.P. Olmos 100% Granted

--------------- ----------------------------- ----------- ----------

Badajoz I.P. Los Bélicos 100% Granted**

I.P.A. Ampliación 100% Pending**

Los Bélicos

Ciudad Real I.P.A. La Majada 100% Pending**

--------------- ----------------------------- ----------- ----------

*An application for a 1-year extension at E.P. Herradura was

previously rejected however this decision has been appealed and the

Company awaits the decision regarding its appeal.

** During the March 2023 quarter, ERM, a wholly owned subsidiary

of the Company, entered into a Tenement Sale and Purchase Agreement

and Royalty Deed with COPROMI, to acquire IP Los B é licos, IPA

Ampliación Los B é licos, and IPA La Majada.

Appendix 3: Related Party Payments

During the quarter ended 30 June 2023, the Company made payments

of $257,000 to related parties and their associates. These payments

relate to existing remuneration arrangements (director and

consulting fees plus statutory superannuation).

Appendix 4: Exploration and Mining Expenditure

During the quarter ended 30 June 2023, the Company made the

following payments in relation to exploration and development

activities:

Activity $000

------------------------------------------------- -----

Radiological protection and monitoring 1

Permitting related expenditure (including legal

dispute expenses) 189

Consultants and other expenditure 162

Payment/(return) of VAT in Spain (49)

Total as reported in the Appendix 5B 303

------------------------------------------------- -----

There were no mining or production activities and expenses

incurred during the quarter ended 30 June 2023.

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

Name of entity

-----------------------------------------------------

Berkeley Energia Limited

ABN Quarter ended ("current quarter")

--------------- ----------------------------------

40 052 468 569 30 June 2023

----------------------------------

Consolidated statement of cash Current quarter Year to date

flows

$A'000 (12 months)

$A'000

1. Cash flows from operating

activities

1.1 Receipts from customers - -

1.2 Payments for

(a) exploration & evaluation (303) (2,320)

(b) development - -

(c) production - -

(d) staff costs (332) (1,048)

(e) administration and corporate

costs (388) (1,092)

1.3 Dividends received (see note - -

3)

1.4 Interest received 756 1,033

1.5 Interest and other costs of - -

finance paid

1.6 Income taxes paid - -

1.7 Government grants and tax - -

incentives

Other (provide details if

1.8 material)

(a) Business Development (42) (205)

(b) Preparation of Prospectus (12) (488)

---------------- --------------

Net cash from / (used in)

1.9 operating activities (321) (4,120)

----------------- ----------------------------------- ---------------- --------------

2. Cash flows from investing

activities

2.1 Payments to acquire or for:

(a) entities - -

(b) tenements - -

(c) property, plant and equipment - -

(d) exploration & evaluation - -

(e) investments - -

(f) other non-current assets - -

2.2 Proceeds from the disposal

of:

(a) entities - -

(b) tenements - -

(c) property, plant and equipment - -

(d) investments - -

(e) other non-current assets - -

2.3 Cash flows from loans to other - -

entities

2.4 Dividends received (see note - -

3)

2.5 Other (provide details if - -

material)

---------------- --------------

2.6 Net cash from / (used in)

investing activities - -

----------------- ----------------------------------- ---------------- --------------

3. Cash flows from financing

activities

3.1 Proceeds from issues of equity

securities (excluding convertible

debt securities) - -

3.2 Proceeds from issue of convertible

debt securities - -

3.3 Proceeds from exercise of - -

options

3.4 Transaction costs related

to issues of equity securities

or convertible debt securities - -

3.5 Proceeds from borrowings - -

3.6 Repayment of borrowings - -

3.7 Transaction costs related

to loans and borrowings - -

3.8 Dividends paid - -

3.9 Other (provide details if - -

material)

---------------- --------------

3.10 Net cash from / (used in)

financing activities - -

----------------- ----------------------------------- ---------------- --------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 78,157 79,942

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (321) (4,120)

4.3 Net cash from / (used in)

investing activities (item

2.6 above) - -

4.4 Net cash from / (used in)

financing activities (item

3.10 above) - -

Effect of movement in exchange

4.5 rates on cash held 940 2,954

---------------- --------------

Cash and cash equivalents

4.6 at end of period 78,776 78,776

----------------- ----------------------------------- ---------------- --------------

5. Reconciliation of cash and Current quarter Previous quarter

cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 78,726 78,107

5.2 Call deposits 50 50

5.3 Bank overdrafts - -

5.4 Other (provide details) - -

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 78,776 78,157

----------------- ----------------------------------- ---------------- -----------------

6. Payments to related parties of the entity Current quarter

and their associates $A'000

Aggregate amount of payments to related

parties and their associates included in

6.1 item 1 (257)

----------------

6.2 Aggregate amount of payments to related

parties and their associates included in

item 2 -

----------------

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly

activity report must include a description of, and an explanation

for, such payments.

7. Financing facilities Total facility

Note: the term "facility' amount at quarter Amount drawn

includes all forms of financing end at quarter end

arrangements available to $A'000 $A'000

the entity. Add notes as necessary

for an understanding of the

sources of finance available

to the entity.

7.1 Loan facilities - -

------------------- ----------------

7.2 Credit standby arrangements - -

------------------- ----------------

7.3 Other (please specify) - -

------------------- ----------------

7.4 Total financing facilities - -

------------------- ----------------

7.5 Unused financing facilities available at -

quarter end

----------------

7.6 Include in the box below a description of each facility

above, including the lender, interest rate, maturity date

and whether it is secured or unsecured. If any additional

financing facilities have been entered into or are proposed

to be entered into after quarter end, include a note providing

details of those facilities as well.

----------------- ---------------------------------------------------------------------------

Not applicable

-----------------

8. Estimated cash available for future operating $A'000

activities

Net cash from / (used in) operating activities

8.1 (item 1.9) (321)

8.2 (Payments for exploration & evaluation classified

as investing activities) (item 2.1(d)) -

8.3 Total relevant outgoings (item 8.1 + item (321)

8.2)

8.4 Cash and cash equivalents at quarter end 78,776

(item 4.6)

8.5 Unused finance facilities available at quarter -

end (item 7.5)

-------

8.6 Total available funding (item 8.4 + item 78,776

8.5)

-------

8.7 Estimated quarters of funding available

(item 8.6 divided by item 8.3) >10

-------

Note: if the entity has reported positive relevant outgoings

(ie a net cash inflow) in item 8.3, answer item 8.7 as

"N/A". Otherwise, a figure for the estimated quarters

of funding available must be included in item 8.7.

8.8 If item 8.7 is less than 2 quarters, please provide answers

to the following questions:

8.8.1 Does the entity expect that it will continue to

have the current level of net operating cash flows for

the time being and, if not, why not?

---------------------------------------------------------------------------------------

Answer: Not applicable

---------------------------------------------------------------------------------------

8.8.2 Has the entity taken any steps, or does it propose

to take any steps, to raise further cash to fund its operations

and, if so, what are those steps and how likely does it

believe that they will be successful?

---------------------------------------------------------------------------------------

Answer: Not applicable

---------------------------------------------------------------------------------------

8.8.3 Does the entity expect to be able to continue its

operations and to meet its business objectives and, if

so, on what basis?

---------------------------------------------------------------------------------------

Answer: Not applicable

---------------------------------------------------------------------------------------

Note: where item 8.7 is less than 2 quarters, all of

questions 8.8.1, 8.8.2 and 8.8.3 above must be answered.

---------------------------------------------------------------------------------------

Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 24 July 2023

Authorised by: Company Secretary

(Name of body or officer authorising release - see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity's

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 6: Exploration for and Evaluation of

Mineral Resources and AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market

by your board of directors, you can insert here: "By the board". If

it has been authorised for release to the market by a committee of

your board of directors, you can insert here: "By the [name of

board committee - eg Audit and Risk Committee]". If it has been

authorised for release to the market by a disclosure committee, you

can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market

by your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council's Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSEMSELEDSELW

(END) Dow Jones Newswires

July 24, 2023 02:00 ET (06:00 GMT)

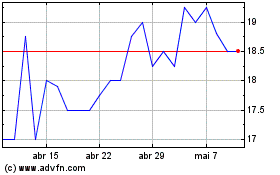

Berkeley Energia (LSE:BKY)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Berkeley Energia (LSE:BKY)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025