TIDMAFRN

RNS Number : 0259H

Aferian PLC

25 July 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN, IS

RESTRICTED AND IS NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN

WHOLE OR IN PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE

UNITED STATES, CANADA, JAPAN, AUSTRALIA, THE REPUBLIC OF SOUTH

AFRICA, NEW ZEALAND OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF THAT

JURISDICTION. THIS ANNOUNCEMENT SHOULD BE READ IN ITS ENTIRETY.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE UK VERSION OF REGULATION 2014/596/EU.

25 July 2023

Aferian plc

("Aferian", the "Company, the "Group")

Results of Placing & PDMR Dealings

Aferian plc (LSE AIM: AFRN), the B2B video streaming solutions

company, is pleased to announce the successful completion of the

Placing announced yesterday.

A total of 26,000,000 Placing Shares have been placed by

Investec Bank plc ("Investec"), the sole bookrunner, at the Placing

Price, raising gross proceeds of approximately US$4.0 million. The

Placing Price of 12 pence per share represents a premium of

approximately 20.0 per cent. to the closing middle market share

price of 10 pence per share on 24 July 2023.

In conjunction with the Placing, certain Directors and a member

of the senior management team have agreed to subscribe for an

aggregate of 2,020,833 Placing Shares at the Placing Price.

Application has been made to the London Stock Exchange for the

Placing Shares to be admitted to trading on AIM. It is expected

that Admission will take place at 8.00 a.m. on 26 July 2023 (or

such date as may be agreed between the Company and Investec). The

Placing Shares will, when issued, be credited as fully paid and

will rank pari passu in all respects with the existing issued

Ordinary Shares.

The Placing is conditional upon, amongst other things, Admission

becoming effective and the Placing Agreement not being terminated

in accordance with its terms.

Total voting rights

Following Admission, the Company will have 112,694,609 Ordinary

Shares in issue. There are 1,482,502 Ordinary Shares held in

treasury. Therefore, the Company hereby confirms that the total

number of voting rights in the Company will, following Admission,

be 111,212,107. This figure may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change to their

interest in, the Company under the FCA's Disclosure Guidance and

Transparency Rules.

Capitalised terms used in this announcement have the meanings

given to them in the Placing Announcement released earlier today,

unless the context provides otherwise.

Related Party Transactions

Kestrel Investment Partners ("Kestrel") currently holds

22,776,736 Ordinary Shares, representing approximately 26.7 per

cent. of the Company's Existing Ordinary Share capital and is

therefore a substantial shareholder (holding in excess of 10 per

cent. of the Company's issued share capital) and as such is a

related party for the purposes of the AIM Rules for Companies.

Kestrel has subscribed for approximately GBP0.7m in the Placing by

subscribing for 5,850,000 new Ordinary Shares, which will comprise

a related party transaction for the purposes of Rule 13 of the AIM

Rules for Companies.

Premier Miton Investors currently holds 14,421,812 Ordinary

Shares, representing approximately 16.9 per cent. of the Company's

Existing Ordinary Share capital and is therefore a substantial

shareholder (holding in excess of 10 per cent. of the Company's

issued share capital) and as such is a related party for the

purposes of the AIM Rules for Companies. Premier Miton Investors

has subscribed for approximately GBP0.5m in the Placing by

subscribing for 4,400,397 new Ordinary Shares, which will comprise

a related party transaction for the purpose of Rule 13 of the AIM

Rules for Companies.

The independent Directors (being Steve Oetegenn and Bruce

Powell), having consulted with Investec in its capacity as

nominated adviser to the Company for the purposes of the AIM Rules

considers that the participation by Kestrel Investment Partners and

Premier Miton Investors in the Placing is fair and reasonable

insofar as Shareholders are concerned.

Enquiries:

Aferian plc +44 (0)1954 234100

Mark Wells, Chairman

Donald McGarva, Chief Executive Officer

Mark Carlisle, Chief Financial Officer

Investec Bank plc (NOMAD and Sole Broker) +44 (0)20 7597 5970

David Anderson / Patrick Robb / Nick Prowting / Cameron MacRitchie

FTI Consulting (Financial communications) +44 (0)20 3727 1000

Emma Hall / Tom Blundell / Aisha Hamilton / Matt Dixon

Director/PDMR Shareholding

The Notification of Dealing Forms set out below are provided in

accordance with the requirements of the UK Market Abuse

Regulation.

Notification of Dealing Forms:

1 . Details of the person discharging managerial responsibilities / person closely associated

a ) Name 1. Mark Wells

2. Donald McGarva

3. Mark Carlisle

4. Hans Disch

------------------------------------------------------- -------------------------------------------------------

2 . Reason for the Notification

----------------------------------------------------------------------------------------------------------------

a) Position/status 1. Non-Executive Chairman

2. Chief Executive Officer

3. Chief Financial Officer & Chief Operations Officer

4. Co-Founder at 24i

------------------------------------------------------- -------------------------------------------------------

b) Initial notification / Amendment Initial notification

------------------------------------------------------- -------------------------------------------------------

3. Details of the issuer, emission allowance market participant, auction platform, auctioneer

or auction monitor

----------------------------------------------------------------------------------------------------------------

a) Name Aferian plc

------------------------------------------------------- -------------------------------------------------------

b) LEI 21380068JIMBNNZJL315

------------------------------------------------------- -------------------------------------------------------

4. Details of the transaction(s): section to be repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and (iv) each place where transactions have been

conducted

----------------------------------------------------------------------------------------------------------------

a) Description of the financial instrument, type of Ordinary shares of 1p each

instrument

------------------------------------------------------- -------------------------------------------------------

b) Identification code GB00B013SN63

------------------------------------------------------- -------------------------------------------------------

c) Nature of the transaction Purchase of Ordinary Shares

------------------------------------------------------- -------------------------------------------------------

d) Price(s) and volume(s) Price(s) Volume(s)

1. 12p 1. 208,333

2. 12p 2. 208,333

3. 12p 3. 145,833

4. 12p 4. 1,458,334

--------------

------------------------------------------------------- -------------------------------------------------------

e) Aggregated information N/A

* Price

* Aggregated volume

------------------------------------------------------- -------------------------------------------------------

f) Date of the transaction 24 July 2023

------------------------------------------------------- -------------------------------------------------------

g) Place of the transaction London Stock Exchange, AIM Market (XLON)

------------------------------------------------------- -------------------------------------------------------

IMPORTANT NOTICES

THIS ANNOUNCEMENT IS RESTRICTED AND IS NOT FOR PUBLICATION OR

DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR

INTO OR FROM THE UNITED STATES OF AMERICA, AUSTRALIA, CANADA, NEW

ZEALAND, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER

JURISDICTION IN WHICH SUCH PUBLICATION OR DISTRIBUTION WOULD BE

UNLAWFUL (" RESTRICTED JURISDICTIONS ").

MEMBERS OF THE PUBLIC ARE NOT ELIGIBLE TO TAKE PART IN THE

PLACING. THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND IS

DIRECTED ONLY AT PERSONS WHOSE ORDINARY ACTIVITIES INVOLVE THEM IN

ACQUIRING, HOLDING, MANAGING AND DISPOSING OF INVESTMENTS (AS

PRINCIPAL OR AGENT) FOR THE PURPOSES OF THEIR BUSINESS AND WHO HAVE

PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND ARE:

(1) IF IN A MEMBER STATE OF THE EUROPEAN ECONOMIC AREA ("EEA"),

QUALIFIED INVESTORS AS DEFINED IN ARTICLE 2(E) OF REGULATION (EU)

2017/1129 (THE "PROSPECTUS REGULATION"); (2) IF IN THE UNITED

KINGDOM, QUALIFIED INVESTORS AS DEFINED IN ARTICLE 2(E) OF THE

PROSPECTUS REGULATION AS IT FORMS PART OF DOMESTIC LAW BY VIRTUE OF

THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (THE "EUWA") WHO ALSO (A)

FALL WITHIN ARTICLE 19(5) (INVESTMENT PROFESSIONALS) OF THE

FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER

2005, AS AMED (THE "ORDER") OR (B) FALL WITHIN ARTICLE 49(2)(a) TO

(d) (HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.)

OF THE ORDER; AND (3) ANY OTHER PERSON TO WHOM IT MAY OTHERWISE

LAWFULLY BE COMMUNICATED; AND, IN EACH CASE, WHO HAVE BEEN INVITED

TO PARTICIPATE IN THE PLACING BY INVESTEC (ALL SUCH PERSONS

TOGETHER BEING REFERRED TO AS "RELEVANT PERSONS").

THIS ANNOUNCEMENT AND THE INFORMATION IN IT MUST NOT BE ACTED ON

OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. PERSONS

DISTRIBUTING THIS ANNOUNCEMENT MUST SATISFY THEMSELVES THAT IT IS

LAWFUL TO DO SO. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH

THIS ANNOUNCEMENT RELATES IS AVAILABLE ONLY TO RELEVANT PERSONS AND

WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS.

THIS ANNOUNCEMENT OR ANY PART OF IT DOES NOT CONSTITUTE AN OFFER

TO SELL OR ISSUE OR A SOLICITATION OF AN OFFER TO BUY OR SUBSCRIBE

FOR ANY SECURITIES IN ANY RESTRICTED JURISDICTION AND, IN

PARTICULAR IS NOT TO BE FORWARDED, DISTRIBUTED, MAILED OR OTHERWISE

TRANSMITTED IN OR INTO A RESTRICTED JURISDICTION OR TO ANY NATIONAL

RESIDENT OR CITIZEN OF A RESTRICTED JURISDICTION OR TO ANY

CORPORATION, PARTNERSHIP OR OTHER ENTITY CREATED OR ORGANISED UNDER

THE LAWS THEREOF, OR TO ANY PERSONS IN ANY OTHER COUNTRY OUTSIDE

THE UK, WHERE SUCH DISTRIBUTION, FORWARDING OR TRANSMISSION MAY

LEAD TO A BREACH OF ANY LEGAL OR REGULATORY REQUIREMENT.

THE PLACING SHARES HAVE NOT BEEN AND WILL NOT BE REGISTERED

UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMED (THE

"SECURITIES ACT"), OR UNDER THE SECURITIES LAWS OF ANY STATE OR

OTHER JURISDICTION OF THE UNITED STATES. ACCORDINGLY, THE PLACING

SHARES MAY NOT BE OFFERED OR SOLD DIRECTLY OR INDIRECTLY IN, INTO

OR WITHIN THE UNITED STATES EXCEPT PURSUANT TO AN EXEMPTION FROM,

OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS

OF THE SECURITIES ACT AND IN ACCORDANCE WITH APPLICABLE STATE

SECURITIES LAWS. THERE WILL BE NO PUBLIC OFFERING OF THE PLACING

SHARES IN THE UNITED STATES. THE PLACING SHARES ARE BEING OFFERED

AND SOLD OUTSIDE THE UNITED STATES IN ACCORDANCE WITH REGULATION S

UNDER THE SECURITIES ACT.

The distribution of this Announcement and/or issue or sale of

the Placing Shares in certain jurisdictions may be restricted by

law. No action has been taken by the Company, Investec or any of

their respective affiliates, agents, directors, officers or

employees that would permit an offer of the Placing Shares or

possession or distribution of this Announcement or any other

offering or publicity material relating to such Placing Shares in

any jurisdiction where action for that purpose is required. Persons

into whose possession this Announcement comes are required by the

Company and Investec to inform themselves about and to observe any

such restrictions.

All offers of the Placing Shares in the United Kingdom or the

EEA will be made pursuant to an exemption under the Prospectus

Regulation (including, with regards to the United Kingdom, as it

forms part of domestic law in the United Kingdom by virtue of the

European Union (Withdrawal) Act 2018) from the requirement to

produce a prospectus. In the United Kingdom, this Announcement is

being directed solely at persons in circumstances in which section

21(1) of the Financial Services and Markets Act 2000 (as amended)

does not require the approval of the relevant communication by an

authorised person.

Persons (including, without limitation, nominees and trustees)

who have contractual or other legal obligations to forward a copy

of this Announcement should seek appropriate advice before taking

any such action.

This Announcement may contain and the Company may make verbal

statements containing "forward-looking statements" with respect to

certain of the Company's plans and its current goals and

expectations relating to its future financial condition,

performance, strategic initiatives, objectives and results.

Forward-looking statements sometimes use words such as "aim",

"anticipate", "target", "expect", "estimate", "intend", "plan",

"goal", "believe", "seek", "may", "could", "outlook" or other words

of similar meaning. By their nature, all forward-looking statements

involve risk and uncertainty because they relate to future events

and circumstances which are beyond the control of the Company,

including amongst other things, United Kingdom domestic and global

economic business conditions, market-related risks such as

fluctuations in interest rates and exchange rates, the policies and

actions of governmental and regulatory authorities, the effect of

competition, inflation, deflation, the timing effect and other

uncertainties of future acquisitions or combinations within

relevant industries, the effect of tax and other legislation and

other regulations in the jurisdictions in which the Company and its

affiliates operate, the effect of volatility in the equity, capital

and credit markets on the Company's profitability and ability to

access capital and credit, a decline in the Company's credit

ratings; the effect of operational risks; and the loss of key

personnel. As a result, the actual future financial condition,

performance and results of the Company may differ materially from

the plans, goals and expectations set forth in any forward-looking

statements. Any forward-looking statements made in this

Announcement by or on behalf of the Company speak only as of the

date they are made. Except as required by applicable law or

regulation, the Company expressly disclaims any obligation or

undertaking to publish any updates or revisions to any

forward-looking statements contained in this Announcement to

reflect any changes in the Company's expectations with regard

thereto or any changes in events, conditions or circumstances on

which any such statement is based.

Investec Bank plc is authorised by the Prudential Regulation

Authority (the " PRA ") and regulated in the United Kingdom by the

PRA and the Financial Conduct Authority (the " FCA "). Investec

Europe Limited (trading as Investec Europe), acting as agent on

behalf of Investec Bank plc in certain jurisdictions in the EEA ("

Investec Europe " and Investec Bank plc together, " Investec ") is

regulated in Ireland by the Central Bank of Ireland. Investec is

acting exclusively for the Company and no one else in connection

with the Bookbuild and the Placing, and will not be responsible to

anyone (including any Placees) other than the Company for providing

the protections afforded to its clients or for providing advice in

relation to the Bookbuild or the Placing or any other matters

referred to in this Announcement.

The Announcement has been issued by and is the sole

responsibility of the Company. No representation or warranty,

express or implied, is or will be made as to, or in relation to,

and no responsibility or liability is or will be accepted by

Investec or by any of its affiliates or agents as to or in relation

to, the accuracy or completeness of any information provided in

this Announcement or any other written or oral information made

available to or publicly available to any interested party or its

advisers, and any liability therefore is expressly disclaimed.

Any indication in this Announcement of the price at which

Ordinary Shares have been bought or sold in the past cannot be

relied upon as a guide to future performance. No statement in this

Announcement is intended to be a profit forecast or estimate, and

no statement in this Announcement should be interpreted to mean

that earnings per share of the Company for the current or future

financial years would necessarily match or exceed the historical

published earnings per share of the Company.

This Announcement does not constitute a recommendation

concerning any investor's investment decision with respect to the

Placing. The price of shares and the income from them (if any) may

go down as well as up and investors may not get back the full

amount invested on disposal of the Placing Shares. Past performance

is no guide to future performance, and persons needing advice

should consult an independent financial adviser. The contents of

this Announcement are not to be construed as legal, business,

financial or tax advice.

The Placing Shares to be issued pursuant to the Placing will not

be admitted to trading on any stock exchange other than AIM, a

market operated by the London Stock Exchange.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKZLFLXDLFBBQ

(END) Dow Jones Newswires

July 25, 2023 02:00 ET (06:00 GMT)

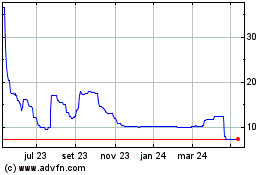

Aferian (LSE:AFRN)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

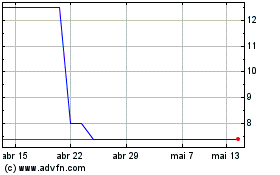

Aferian (LSE:AFRN)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024