TIDMSMD

RNS Number : 6916J

Spectral MD Holdings, Ltd.

17 August 2023

Spectral MD Holdings, Ltd

("Spectral MD" or the "Company")

Posting of Circular and Notice of General Meeting

Form S-4 approved by the U.S. Securities and Exchange Commission

and now effective

Spectral MD posting circular ahead of a general meeting to

approve business combination with Rosecliff

LONDON, U.K. AND DALLAS, TX, U.S. -Spectral MD Holdings, Ltd.

(AIM: SMD), an artificial intelligence (AI) company focused on

medical diagnostics for faster and more accurate treatment

decisions in wound care, announces that further to the announcement

made on 9 August 2023 in respect of the Company's proposed

cancellation to trading on AIM and business combination agreement

(the "Transaction") with Rosecliff Acquisition Corporation I

("Rosecliff"), a circular and notice of general meeting has today

been sent to shareholders and is available on the Company's website

here.

The general meeting will take place at the offices of the

Company located at 2515 McKinney Avenue, Suite 1000, Dallas TX

75201 at 3.00 p.m. (BST) 9.00 a.m. (CDT) on 31 August 2023.

Key information in relation to the Transaction contained in the

letter from the Chairman in the circular is reproduced below

(capitalised terms are as defined in the circular).

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ("MAR"). Upon the publication of this announcement via

Regulatory Information Service ("RIS"), this inside information is

now considered to be in the public domain.

Additional Information and Where to Find It

This press release is provided for informational purposes only

and contains information with respect to a proposed business

combination among Spectral MD, Rosecliff, Ghost Merger Sub I Inc.,

a wholly-owned subsidiary of Rosecliff and Ghost Merger Sub II LLC,

a wholly-owned subsidiary of Rosecliff (the "Transaction"). In

connection with the proposed Transaction, Rosecliff has filed a

registration statement on Form S-4 with the SEC, which includes the

definitive proxy statement/prospectus (as amended from time to

time, the "Registration Statement"). A full description of the

proposed Transaction has been included in the Registration

Statement filed by Rosecliff with the SEC. Rosecliff's

stockholders, investors and other interested persons are advised to

read the Registration Statement as well as other documents that

have been filed with the SEC, as these documents will contain

important information about Rosecliff, Spectral MD, and the

proposed Transaction. The Registration Statement has been declared

effective by the SEC as of 11 August 2023. The proxy

statement/prospectus and other relevant documents for the proposed

Transaction will be mailed to stockholders of Rosecliff as of a

record date to be established for voting on the proposed

Transaction. Rosecliff investors and stockholders will also be able

to obtain copies of the proxy statement/prospectus and other

documents filed with the SEC, without charge, at the SEC's website

at www.sec.gov.

Participants in the Solicitation

Rosecliff, Spectral MD and certain of their respective

directors, executive officers, other members of management and

employees may, under SEC rules, be deemed participants in the

solicitation of proxies from Rosecliff's stockholders with respect

to the proposed Transaction. Investors and security holders may

obtain more detailed information regarding the names and interests

in the proposed Transaction of Rosecliff's directors and officers

in Rosecliff's filings with the SEC, including Rosecliff's

definitive proxy statement, the Registration Statement and other

documents filed with the SEC. Such information with respect to

Spectral MD's directors and executive officers has also been

included in the Registration Statement.

No Offer or Solicitation

This press release and the information contained herein do not

constitute (i) (a) a solicitation of a proxy, consent or

authorization with respect to any securities or in respect of the

proposed Transaction or (b) an offer to sell or the solicitation of

an offer to buy any security, commodity or instrument or related

derivative, nor shall there be any sale of securities in any

jurisdiction in which the offer, solicitation or sale would be

unlawful prior to the registration or qualification under the

securities laws of any such jurisdiction or (ii) an offer or

commitment to lend, syndicate or arrange a financing, underwrite or

purchase or act as an agent or advisor or in any other capacity

with respect to any transaction, or commit capital, or to

participate in any trading strategies. No offer of securities in

the United States or for the account or benefit of U.S. persons (as

defined in Regulation S under the U.S. Securities Act of 1933 (the

"Securities Act") shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act, or an

exemption therefrom. Investors should consult with their counsel as

to the applicable requirements for a purchaser to avail itself of

any exemption under the Securities Act.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. This includes, without limitation, all statements regarding

(i) the proposed Transaction with Rosecliff, including statements

regarding anticipated timing of the proposed Transaction, (ii)

redemptions of Rosecliff common stock, (iii) valuation of the

proposed Transaction, (iv) the closing of the proposed Transaction,

(v) the ability to regain compliance with Nasdaq Capital Market

listing requirements and to maintain listing, or for the Combined

Company to be listed, on the Nasdaq Capital Market, (vi) Rosecliff

and Spectral MD's managements' expectations and expected synergies

of the proposed Transaction and the Combined Company, (vii) the use

of proceeds from the proposed Transaction, (viii) potential

government contracts, and (ix) expected beneficial outcomes and

synergies of the proposed Transaction, (x) Spectral MD's U.S.

government contracts and future awards, (xi) FDA, CE and UKCA

regulatory submissions and approvals, (xii) target markets of burn

wounds and diabetic foot ulcers, (xiii) possible competitors, (xiv)

future clinical indications and use of BARDA, (xv) potential PIPE

transaction and amount raised, (xvi) future applications of

Spectral MD products, (xvii) potential indications and areas of

interest supported by BARDA, (xviii) future and pending U.S. patent

applications and foreign and international patent applications,

(xvix) the AIM delisting and its effects for U.K. Spectral MD

shareholders, (xxx) the development of DeepView(R) technology and

tools; (xxxi) the effectiveness of the DeepView(R) platform in

assessing burn wounds, (xxxii) the reliability of any studies

performed by Spectral MD, and (xxxiii) the completion of any

certifications. Generally, statements that are not historical

facts, including statements concerning our possible or assumed

future actions, business strategies, events or results of

operations, are forward-looking statements. These statements may be

preceded by, followed by or include the words "believes,"

"estimates," "expects," "projects," "forecasts," "may," "will,"

"should," "seeks," "plans," "scheduled," "anticipates" or "intends"

or similar expressions. Such forward-looking statements involve

risks and uncertainties that may cause actual events, results or

performance to differ materially from those indicated by such

statements. These forward-looking statements are expressed in good

faith, and Spectral MD and Rosecliff believe there is a reasonable

basis for them. However, there can be no assurance that the events,

results or trends identified in these forward-looking statements

will occur or be achieved. Forward-looking statements speak only as

of the date they are made, and neither Spectral MD nor Rosecliff is

under any obligation, and expressly disclaim any obligation, to

update, alter or otherwise revise any forward-looking statement,

whether as a result of new information, future events or otherwise,

except as required by law.

Forward-looking statements are inherently subject to risks,

uncertainties and assumptions. In addition to risk factors

previously disclosed in Rosecliff's reports filed with the SEC and

those identified elsewhere in this press release, the following

factors, among others, could cause actual results to differ

materially from forward-looking statements or historical

performance: (i) risks associated with product development and

regulatory review, including the time, expense and uncertainty of

obtaining clearance, approval or De Novo classification for

Spectral MD's DeepView technology, (ii) Spectral MD's ability to

obtain additional funding when needed and its dependence on

government funding, (iii) expectations regarding Spectral MD's

strategies and future financial performance, including its future

business plans or objectives, prospective performance and

opportunities and competitors, revenues, products and services,

pricing, operating expenses, market trends, liquidity, cash flows

and uses of cash, capital expenditures, and Spectral MD's ability

to invest in growth initiatives and pursue acquisition

opportunities; (iv) the risk that the proposed Transaction may not

be completed in a timely manner at all, which may adversely affect

the price of Rosecliff's securities; (v) the failure to satisfy the

conditions to the consummation of the proposed Transaction,

including the adoption of the business combination agreement by the

stockholders of Rosecliff and the stockholders of Spectral MD, and

the receipt of certain governmental and regulatory approvals; (vi)

the lack of third party valuation in determining whether or not to

pursue the proposed Transaction; (vii) the ability of

Rosecliff to regain compliance with Nasdaq Capital Market

listing requirements and to maintain listing, or for the Combined

Company to be listed, on the Nasdaq Capital Market; (viii) the

occurrence of any event, change or other circumstances that could

give rise to the termination of the business combination agreement;

(ix) the outcome of any legal proceedings that may be instituted

against Rosecliff or Spectral MD following announcement of the

proposed Transaction; (x) the risk that the proposed Transaction

may not be completed by Rosecliff's business combination deadline

and the potential failure to obtain an extension of the business

combination deadline; (xi) the effect of the announcement or

pendency of the proposed Transaction on Spectral MD's business

relationships, operating results, and business generally; (xii)

volatility in the price of Rosecliff's securities due to a variety

of factors, including changes in the competitive and regulated

industries in which Rosecliff plans to operate or Spectral MD

operates, variations in operating performance across competitors,

changes in laws and regulations affecting Rosecliff's or Spectral

MD's business, Spectral MD's inability to implement its business

plan or meet or exceed its financial projections and changes in the

combined capital structure; (xiii) Rosecliff's ability to raise

capital as needed; (ixv) the ability to implement business plans,

forecasts, and other expectations after the completion of the

proposed Transaction and identify and realize additional

opportunities; (xv) the risk that the announcement and consummation

of the proposed Transaction disrupts Spectral MD's current

operations and future plans; (xvi) the ability to recognize the

anticipated benefits of the proposed Transaction; (xvii) unexpected

costs related to the proposed Transaction; (xviii) the amount of

any redemptions by existing holders of the Rosecliff common stock

being greater than expected; (xix) limited liquidity and trading of

Rosecliff's securities; (xx) geopolitical risk and changes in

applicable laws or regulations; (xxi) the possibility that

Rosecliff and/or Spectral MD may be adversely affected by other

economic, business, and/or competitive factors; (xxii) operational

risk; and (xxiii) changes in general economic conditions, including

as a result of the COVID-19 pandemic. The foregoing list of factors

is not exhaustive. You should carefully consider the foregoing

factors and the other risks and uncertainties described in the

"Risk Factors" sections of the Rosecliff's Annual Report on Form

10-K, Quarterly Reports on Form 10-Q, the Registration Statement

and the other documents filed by Rosecliff from time to time with

the SEC. These filings identify and address other important risks

and uncertainties that could cause actual events and results to

differ materially from those contained in the forward-looking

statements.

Readers are cautioned not to put undue reliance on

forward-looking statements, and neither Spectral MD nor Rosecliff

assumes any obligation and do not intend to update or revise these

forward-looking statements, whether as a result of new information,

future events, or otherwise, except as required by securities and

other applicable laws. Neither Spectral MD nor Rosecliff gives any

assurance that it will achieve its expectations.

For further information please contact:

Spectral MD Holdings, Ltd. IR@Spectralmd.com

Wensheng Fan, Chief Executive Officer via Walbrook PR

Nils Windler, Chief Financial Officer

SP Angel Corporate Finance LLP (NOMAD and Joint Broker for Spectral MD) Tel: +44 (0)20 3470 0470

Stuart Gledhill / Harry Davies-Ball (Corporate Finance)

Vadim Alexandre / Rob Rees (Sales & Broking)

The Equity Group Inc. (US Investor Relations) dsullivan@equityny.com

Devin Sullivan Tel: 212-836-9608

Walbrook PR Ltd (UK Media & Investor Relations) spectralMD@walbrookpr.com

Paul McManus / Louis Ashe-Jepson / Alice Woodings Tel: +44 (0)20 7933 8780

About Spectral MD

Spectral MD is a predictive AI company focused on medical

diagnostics for faster and more accurate treatment decisions in

wound care for burn, DFU, and future clinical applications. At

Spectral MD, we are a dedicated team of forward-thinkers striving

to revolutionize the management of wound care by "Seeing the

Unknown"(R) with our DeepView(R) Wound Diagnostics System. The

Company's DeepView(R) platform is the only predictive diagnostic

device that offers clinicians an objective and immediate assessment

of a wound's healing potential prior to treatment or other medical

intervention. With algorithm-driven results that substantially

exceed the current standard of care, Spectral MD's diagnostic

platform is expected to provide faster and more accurate treatment

insight, significantly improving patient care and clinical

outcomes. For more information, visit the Company at:

www.spectralmd.com.

About Rosecliff Acquisition Corp I

Rosecliff is a blank check company formed for the purpose of

effecting a merger, capital stock exchange, asset acquisition,

stock purchase, reorganization or similar business combination with

one or more businesses. Its principals possess public and private

market investing experience and operational knowledge to bring

value added benefits to Spectral MD. The Rosecliff team has

substantial experience investing in rapidly growing and disruptive

technologies across the financial, consumer, healthcare and

software industries, as well as a long-term track record in

creatively structuring transactions to unlock and maximize

value.

1. INTRODUCTION

I am pleased to be writing to you to inform you of certain

material transactions that the Board of Directors of the Company is

recommending for your approval at a General Meeting to be held on

31 August 2023. The Company is seeking your approval of the

following resolutions (the "Resolutions"): (i) the approval of an

amendment to the Company's Certificate of Incorporation to change

the consent requirement to approve the delisting of the Company's

Common Stock from AIM to consent by Shareholders holding not less

than 75 per cent of votes cast by Shareholders present in a general

meeting; and (ii) subject to the approval of the Resolution set out

above, the approval of the Company to seek the Cancellation. The

Notice of General Meeting is set out on page 12 of the Circular.

The Board of Directors of the Company have unanimously approved

each of the Resolutions listed above. Additionally, the Circular

constitutes notice, pursuant to Section 228(e) of the General

Corporation Law of the State of Delaware (the "DGCL"), that

Shareholders constituting the required Company Stockholder

Transaction Approval (as defined in the Business Combination

Agreement) adopted the Business Combination Agreement and approved

the Business Combination and the other transactions contemplated by

the Business Combination Agreement, by executing the Written

Consent in Lieu of Special Meeting of Shareholders on 16 August

2023. A copy of this Written Consent is enclosed as Appendix I in

the Circular.

The purpose of the Circular is to: (i) provide notice of the

General Meeting; (ii) seek Shareholders' approval of the

Resolutions; (iii) provide information on the background to and

reasons for the proposed Merger and Cancellation; and (iv) explain

the consequences of the Merger and Cancellation and provide reasons

why the Directors unanimously consider both the Merger and

Cancellation to be in the best interests of the Company and its

Shareholders as a whole.

2. THE MERGER AND CANCELLATION

(A) Merger with Rosecliff Merger Sub I

On 11 April 2023, the Company entered into the Business

Combination Agreement with Rosecliff and two of Rosecliff's

wholly-owned subsidiaries, including Rosecliff Merger Sub I.

Following completion of the Business Combination, the Company will

become a subsidiary of Rosecliff and will maintain all the ongoing

business operations of the Company. In connection with the

completion of the Business Combination, Rosecliff will be renamed

Spectral AI, Inc. (the "Combined Company") and will change its

ticker symbol on The Nasdaq Capital Market to "MDAI".

As part of the Business Combination, the Company's Shareholders

will receive aggregate consideration in the form of 17,000,000

shares of common stock of the Combined Company, equal to

approximately 92.7 per cent. of the issued and outstanding shares

of the Combined Company's common stock immediately following

completion of the Business Combination (the "Aggregate Transaction

Consideration").(1) Assuming a value of $10.00 per share of the

Combined Company's common stock (which is the price at which

Rosecliff completed its initial public offering on 17 February

2021), the Aggregate Transaction Consideration implies an aggregate

equity value for the Company of approximately $170 million. All the

Company's operations will continue unchanged following completion

of the Business Combination.

Pursuant to the Cancellation, all Common Stock will be cancelled

and converted into the right to receive a pro rata portion of the

Aggregate Transaction Consideration in shares of the Combined

Company's common stock which will be traded on Nasdaq under the new

Combined Company's ticker symbol (NASD:MDAI). Subject to the

passing of the Resolutions and completion of the Business

Combination, trading in shares of the Combined Company is expected

to commence on or about 8 September 2023.

Completion of the Business Combination is conditional on the

following:

-- the requisite approval by Rosecliff shareholders of the

Business Combination and related matters being obtained;

-- the requisite approval by the Company's Shareholders of the

Merger being obtained (which, as stated in Section 1 hereof, has

already been obtained);

-- the registration statement on Form S-4 including a proxy

statement/prospectus filed by Rosecliff with the SEC becoming

effective under the Securities Act, a "no stop order" suspending

the effectiveness of such registration statement having been

issued, and there being no proceedings initiated or threatened by

the SEC (and not withdrawn) for that purpose; and

-- confirmation of there being no governmental order, statute,

rule or regulation in force to restrain, enjoin, or otherwise

prohibit the completion of the Business Combination.

For further information on the Business Combination, please see

the latest Form S-4 available on the SEC's website at:

https://www.sec.gov/Archives/edgar/data/1833498/000121390023066382/f424b30823_rosecliff.htm

(B) Amendment to the Company's Certificate of Incorporation

The Company was admitted to trading on AIM on 22 June 2021. The

Company amended its original Certificate of Incorporation to

include certain elements considered appropriate or otherwise

required for companies listed on AIM. The Company now wishes to

amend Article 4(C)(3) of its Certificate of Incorporation prior to

the Cancellation to conform with Rule 41 of the AIM Rules. The

current Certificate of Incorporation provides that the approval of

Shareholders holding 75 per cent of all of the outstanding shares

of Common Stock is required to delist the Company's Common Stock

from trading on AIM, and the proposed amendment would change this

to be a requirement for the approval of shareholders holding not

less than 75 per cent of votes cast by Shareholders at a general

meeting.

(C) Voluntary Cancellation of the Company's Admission to AIM

Following completion of the Business Combination, the Combined

Company's common stock will be traded on Nasdaq. Following

completion of the Business Combination, the Company will not be

eligible to remain on AIM without the Combined Company being

admitted to AIM. The Directors believe that such efforts would

incur substantial additional costs and expenses associated with

maintaining a dual-listing on both AIM and Nasdaq. The Company

seeks to eliminate the additional regulatory costs and expenses

associated with the Company's maintenance of an admission to AIM.

The Company is headquartered in the United States and is formed and

governed by the laws of the State of Delaware located in the United

States.

1 This level of ownership interest assumes: (a) no Rosecliff

shareholder exercises its redemption rights with respect to

his/her/its shares for a pro rata portion of the funds in

Rosecliff's trust account; (b) no shares are issued pursuant to the

new Rosecliff equity incentive plan; (c) forfeiture of all of the

Rosecliff management team's private placement warrants and no

exercise of the public warrants; (d) no shares are issued pursuant

to the potential private placement; (e) Rosecliff and other

founding initial stockholders retain 880,000 founder shares; (f)

all new options for shares of the Combined Company common stock are

vested and exercised; (g) all new warrants for shares of the

Combined Company stock are exercised; and (h) all new restricted

stock units for shares of the Combined Company stock are vested and

issued in respect thereof.

Please note that the Company's proxyholder currently holds an

aggregate of 90,646,476 shares of Common Stock, representing

approximately 66.6 per cent. of the outstanding Common Stock of the

Company, voting in FAVOUR of all the Resolutions.

3. THE PROCESS FOR EXCHANGING SHARES ON AIM FOR SHARES OF COMMON STOCK ON NASDAQ

Following the completion of the Business Combination and the

receipt of the Aggregate Transaction Consideration, all shares of

the Company's Common Stock will be cancelled and converted into the

right to receive a pro rata portion of shares of the Combined

Company's common stock, without any action to be completed on

behalf of the Company's Shareholders.

The Business Combination Agreement provides that, at the

effective time of the first merger between the Company and

Rosecliff Merger Sub I (the "First Effective Time"), Rosecliff will

deposit with the Exchange Agent certificates, or at the Company's

option, evidence of book-entry shares representing the shares of

Combined Company's common stock issuable to the Company's

Shareholders. The Company's current intention is that the Combined

Company common stock issuable to the Company's Shareholders in the

Business Combination will be issued in book-entry form.

The Business Combination Agreement provides that concurrently

with Rosecliff's mailing of a proxy statement to its stockholders

for purposes of approving the Business Combination and related

matters, the Exchange Agent will mail to each Shareholder of record

(i) a certificate or certificates which, immediately prior to the

First Effective Time, represented outstanding shares of the

Company's Common Stock,; (ii) a letter of transmittal; and (iii)

instructions for surrendering and exchanging Company stock

certificates and book entry shares held by such record holder in

exchange for certificates or book-entry shares of the Combined

Company's common stock. Upon surrender of a Company stock

certificate or book entry shares to the Exchange Agent, together

with a duly signed letter of transmittal and such other documents

as the Exchange Agent or Company may reasonably require, the

Company stock certificate or book entry shares so surrendered will

be cancelled and the Shareholder will be entitled to receive a

certificate or certificates or book-entry shares, as applicable,

representing the number of shares of the Combined Company's common

stock that such holder has the right to receive pursuant to the

provisions of the Business Combination Agreement. No interest shall

be paid or shall accrue for the benefit of holders of Company stock

certificates or book entry shares on the Aggregate Transaction

Consideration payable in respect of such certificates or book entry

shares.

From and after the First Effective Time, until it is

surrendered, each share of Company Common Stock will be deemed to

represent only the right to receive a pro rata portion of shares of

the Combined Company's common stock.

4. THE PROCESS FOR THE CANCELLATION

The Directors are aware that certain Shareholders may be unable

or unwilling to hold common stock in the Combined Company which is

intended to be traded on Nasdaq in the event the Cancellation is

approved and becomes effective. Such Shareholders should consider

selling their interests in the Company's Common Stock prior to the

Cancellation becoming effective.

Under the AIM Rules, it is a requirement that the Cancellation

must be approved by not less than 75 per cent. of votes cast by

Shareholders at the General Meeting, and the amended Certificate of

Incorporation

of the Company will reflect this position. Accordingly, the

Notice of General Meeting set out at the end of the Circular

contains a resolution of the Shareholders to approve the

Cancellation.

If the Cancellation Resolution is passed, the last day of

dealings in Common Stock on AIM will be 7 September 2023 and the

Cancellation will take effect at 7.00 a.m. (BST) on 8 September

2023. If the Cancellation becomes effective, SP Angel Corporate

Finance LLP will cease to be the Nominated Adviser of the Company

and the Company will no longer be required to comply with the AIM

Rules.

If the Business Combination is completed, the Company will be a

wholly-owned subsidiary of Spectral AI, Inc. and accordingly there

will be no mechanism for trading shares in the Company.

Shareholders should note that, as a wholly-owned subsidiary, should

the Cancellation not be approved, the Company's Common Stock is

unlikely to remain suitable for continued Admission to trading on

AIM.

5. THE PRINCIPAL EXPECTED EFFECTS OF THE CANCELLATION

The principal expected effects of the Cancellation include the

following:

-- the Company will no longer have an independent Nominated

Adviser after the Cancellation with the Combined Company

maintaining a listing on Nasdaq;

-- the regulatory and financial reporting regime applicable to

companies whose shares are admitted to trading on AIM will no

longer apply to the Company;

-- Shareholders will lose certain protections for minority

shareholders under the AIM Rules, such as the independence of the

Board and scrutiny of transactions with related parties,

potentially allowing larger shareholders to exercise more influence

and control (although the Combined Company will be subject to

Nasdaq rules on independence and the SEC's disclosure rules with

respect to transactions with related parties);

-- the Company may no longer be required to seek Shareholder

approval, where applicable, for reverse takeovers and fundamental

changes in the Company's business (although the Combined Company

will be subject to Nasdaq's shareholder approval rules);

-- the Company will no longer be subject to UK MAR regulating

inside information and other matters;

-- the Company will no longer be required to publicly disclose

any change in major shareholdings in the Company under the

Disclosure Guidance and Transparency Rules (although greater than 5

per cent. beneficial owners in the Combined Company will be

required to file certain reports with the SEC disclosing their

beneficial ownership and changes in their beneficial ownership);

and

-- the Company will become subject to the rules and regulations

of the SEC for publicly traded securities and the Nasdaq rules and

regulations (including those noted above) in relation to operating

as a U.S. public company and maintaining a listing on Nasdaq.

The above considerations are not exhaustive, and all

Shareholders should seek their own independent advice when

assessing the likely impact of the Cancellation and of any possible

tax effects on them.

Certain Shareholders may be unable or unwilling to hold Common

Stock following the Cancellation and they should consider selling

their Common Stock on AIM prior to the Cancellation becoming

effective. The Board is, however, making no recommendation as to

whether or not Shareholders should buy or sell Common Stock.

6. GENERAL MEETING

A Notice of General Meeting is included with the Circular

convening the General Meeting to be held at the offices of the

Company located at 2515 McKinney Avenue, Suite 1000, Dallas TX

75201 at 3.00 p.m. (BST)/9.00 a.m. (CDT) on 31 August 2023 at which

the Resolutions will be proposed.

7. RECOMMENDATION AND IRREVOCABLE VOTING UNDERTAKINGS

The Directors consider the Merger (and the larger Business

Combination) and the Cancellation to be in the best interests of

the Company and its Shareholders as a whole and accordingly

unanimously recommend that Shareholders vote in favour of the

Resolutions to be proposed at the General Meeting.

The Company has received irrevocable undertakings to vote in

favour of the Resolutions from all of the Directors who hold Common

Stock in respect of their entire beneficial holdings of Common

Stock amounting to, in aggregate, 1,869,267 shares of Common Stock,

representing approximately 1.4 per cent. of the Common Stock.

In addition to the Directors, certain other Shareholders have

irrevocably undertaken to vote in favour of the Resolutions in

respect of the Common Stock in which they are interested, amounting

in aggregate to 88,777,209 shares of Common Stock, representing

approximately 65.2 per cent. of the Common Stock.

Finally, as stated in Section 1, certain Shareholders

constituting the required Company Stockholder Transaction Approval

(as defined in the Business Combination Agreement) adopted the

Business Combination Agreement and approved the Business

Combination and the other transactions contemplated by the Business

Combination Agreement, by executing the Written Consent in Lieu of

Special Meeting of Shareholders on 16 August 2023. A copy of this

Written Consent is enclosed hereto as Appendix I in the

Circular.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEASPXFLPDEFA

(END) Dow Jones Newswires

August 17, 2023 12:01 ET (16:01 GMT)

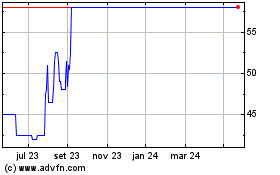

Spectral Md (LSE:SMD)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Spectral Md (LSE:SMD)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025