TIDMCHH

RNS Number : 3787M

Churchill China PLC

14 September 2023

14 September 2023

CHURCHILL CHINA PLC

("Churchill" or the "Company" or the "Group")

INTER IM RESULTS

For the six months ended 30 June 2023

Solid revenue and significant margin progress in the first

half

Churchill China plc (AIM:CHH), the manufacturer of innovative

performance ceramic products serving hospitality markets worldwide,

is pleased to announce its Interim Results for the six months ended

30 June, 2023.

Highlights:

Financial

Six months to 30 June 2023 Six months to 30 June 2022 % change

Revenue GBP44.0m GBP41.4m 6.3%

--------------------------- --------------------------- ---------

Operating profit GBP4.9m GBP3.5m 39.0%

--------------------------- --------------------------- ---------

Profit before tax and exceptional items GBP5.0m GBP3.4m 47.1%

--------------------------- --------------------------- ---------

Adjusted* earnings per share 34.3p 24.7p 38.9%

--------------------------- --------------------------- ---------

Statutory earnings per share 31.9p 28.9p 10.4%

--------------------------- --------------------------- ---------

Interim dividend per share 11.0p 10.5p 4.8%

--------------------------- --------------------------- ---------

Net cash and deposits GBP9.9m GBP15.7m (36.9)%

--------------------------- --------------------------- ---------

-- Operating profit before exceptional items increased year on

year by 39% to GBP4.9m (2022 H1: GBP3.5m, FY2022: GBP9.1m)

-- Profit after exceptional items and before tax for the period

was GBP4.7m, an increase of 20% (2022 H1: GBP3.9m, FY2022:

GBP9.6m)

-- Adjusted* earnings per share were 34.3p (H1 2022: 24.7p, FY2022: 66.9p)

-- Interim dividend of 11.0 pence per share (H1 2022: 10.5 pence

per share, FY2022: 31.5 pence per share)

-- Net cash and deposits at 30 June 2023 of GBP9.9m (H1 2022:

GBP15.7m, FY2022: GBP14.7m) reflecting planned increases in stocks

and reduction of creditors

Business

-- Revenue in the period increased by 6% to GBP44.0m (H1 2022: GBP41.4m, FY2022: GBP82.5m)

-- Hospitality revenue increased by 9.2%

-- Stocks successfully built to meet orderbook demand

-- Strong demand from customers in the period

-- Operating margins improved by 3% as labour efficiency improves

-- Price per piece sustained in line with 2022

-- Investment strategy continues to focus on innovation,

automation and, energy efficiency to drive long term, sustainable,

profit growth

Robin Williams, Chairman of Churchill China, commented:

"We are pleased to report a healthy increase in revenue and

profit in the first half of the year and that despite some market

headwinds the Group is in a good position to meet the Board's

profit expectations for the full year."

Analyst meeting

An in-person meeting for analysts will be held at 10.00am today,

14 September 2023, at Buchanan, 107 Cheapside, London EC2V 6DN,

along with an online facility. Please contact Buchanan at

ChurchillChina@buchanan.uk.com for further details.

* Adjusted earnings per share is calculated after adjusting for

the post tax effect of exceptional items

For further information, please contact:

Churchill China plc Tel: 01782 577566

David O'Connor / Michael Cunningham

/ James Roper

Buchanan Tel: 020 7466 5000

Mark Court / Sophie Wills / Abigail

Gilchrist

ChurchillChina@buchanan.uk.com

Investec Tel: 020 7597 5970

David Flin / Alex Wright / William Brinkley

Chairman's Statement

We are pleased to report continued revenue, margin and profit

improvement for the Group during the first half of the year.

Sales revenues increased by 6.3% overall and by 9.2% in our

target hospitality market. Volumes were down year on year due to

the general macro-economic climate and in particular the soft

trading conditions within the UK. This is as a result of our

strategic focus on value added product, which has increased its

share of total revenue by 1% year on year and helped to improve the

margin performance of the business.

Increased production costs, driven by both material and labour,

have been mitigated by the price increases implemented last year

and improvements in labour efficiencies and efficient energy

purchasing has meant that margin expectations should be met for the

year.

The build of stock has continued in the first half of the year

with the aim of returning to pre-pandemic levels of customer

service. This task is almost complete and as a result the order

book has returned to normal levels, with much improved delivery

times as a result. Our performance product is continuing to gain

traction in our overseas markets, sales in which are up 12% on

prior year.

Overall, the continued solid performance, despite difficult

trading conditions, continues to highlight the resilience of the

Company's long term strategy and the strength of the Churchill

brand.

Financial Review

Total revenues increased 6.3% in the period from GBP41.4m to

GBP44.0m (FY2022: GBP82.5m). Revenue increases were due in large

part to the price increases implemented in 2022 which have helped

with a softer volume requirement in the period.

Hospitality showed a 9.2% increase over H1 2022 and material

sales performed strongly in the period.

Good progress has been made on gross margin improvement in the

period. A 3% improvement was shown in H1 and this is expected to

continue as agency staffing levels are reduced and energy prices,

already forward purchased, feed through in H2. The Company expects

gross margin to continue improving in the short to medium term.

Operating profit before exceptional expenses increased from

GBP3.4m in H1 2022 to GBP5.0m in the current period, an increase of

47%. Operating profit was 12.5% ahead at GBP4.5m against GBP4.0m in

H1 2022.

Adjusted earnings per share before exceptional expenses were

34.3p (H1 2022: 24.7p, FY2022: 66.9p).

Basic earnings per share were 31.9p (H1 2022: 28.9, FY2022:

71.7p).

Profit before taxation after exceptional items was GBP4.7m (H1

2022: GBP3.9m, FY2022: GBP9.6m).

During the period the Company completed its planned increase in

stock levels to facilitate improved customer service. The required

level of inventory has now been achieved, with the result that cash

has reduced in the period from GBP14.7m at year end to GBP9.9m at

the end of June.

Capital expenditure has continued at the same level as previous

year, with GBP2.7m spent in the period (H1 2022: GBP2.7m, FY2022:

GBP4.9m).

Dividends

During the period the Company paid GBP2.3m in dividend payments

and is pleased to announce that the Directors recommend an interim

dividend of 11.0 pence per share (H1 2022: 10.5 pence per share,

FY2022: 31.5 pence per share) an increase of approximately 5% on

the previous year despite the increase in corporation tax in the

current year to 25% (2022: 19%). This improvement in dividend is in

keeping with the Company's aim of increasing returns to

shareholders and our confidence in the ongoing performance of the

business. This dividend will be payable on 13 October 2023 to

shareholders on the register at 22 September 2023.

Business

The first half of the year has been very positive for the

business, with the Company performing well against its objectives.

A slight reduction in volume, driven by the wider global

macro-economic environment highlights the importance of the

Company's focus on defined market segments, quality product,

customer service and the transitioning of customers into value

added offerings.

The Company continues to focus on export to countries where our

market share is low and where opportunities abound for continued

growth.

Ceramics

Hospitality revenue for the period was up 9.2% with Europe

faring particularly well at 15% above 2022 levels. Volume for the

period was however, down on H1 2022 by 7.8% with over 75% of this

reduction coming from the UK, mirroring the slowdown in the UK

market.

Our end user hospitality venues appear to have maintained

revenues, whilst margins are being squeezed. This has had the

effect of delaying purchasing decisions within the marketplace.

There is a good level of enquiries which the Company expects will

begin to convert to orders later in the year.

New product launch performance has been strong, with sales more

than double those of 2022 and returning to levels seen

pre-pandemic. The schedule for launches has returned to normal and

the sales from last year's new products are well ahead of

target.

The prospective pipeline on new installations remains healthy,

particularly in overseas markets. Despite an increase in the lead

time from enquiry to order, it is expected that a number of these

orders will materialise as the general climate improves and as we

enter the key end of year period.

Volume of added value products remained at similar percentage

levels to 2022 however the revenue value of this increased by

9.7%.

Materials

Furlong Mills external sales were up 24% year on year with

intercompany sales to Churchill up by a broadly similar 26% during

the period. Furlong is in a similar position to Churchill with

efficiencies delivering an improvement to margin and maintaining

the Company's expectations on bottom line profitability. The

Company has forward purchased some of its volatile priced stock in

order to protect against rising commodity pricing and therefore

cost input rises will be kept to a minimum for the foreseeable

future.

Operations

As we communicated last year, the Company was constrained by

labour availability and lower levels of workforce experience. The

normalisation of our stock position and the current volumes have

allowed manufacturing to focus on yield improvements along with a

reduction in agency staff. This, combined with the natural

improvement in colleague experience, is starting to bear fruit

through better efficiencies in manufacturing, along with lower

levels of waste, and it is through these important value-added

activities that the Company expects to improve margins in the

immediate future.

During the period the Company has continued the installation of

1MW of solar panel arrays which will deliver up to 33% of the

factory electricity requirement in the peak summer months. In

addition to this our energy hedging strategy continues to be to

forward purchase contracts when those prices are favourable and to

de-risk future costs.

The Company continues to invest in its automated pressure cast

operation with the addition of an additional 25% of capacity in

this area and further capital spend approved to increase the

flexibility and efficiency. Staff training has also been focused on

this area to improve productivity and yields from the operation and

additional work has been completed at Furlong Mills to improve the

material flow to pressure cast production.

Environmental, Social and Governance ('ESG')

As an energy intensive industry, the Company is focussed on

reducing the energy consumption within our operations. As already

mentioned, the Company has invested heavily in solar arrays, but in

addition the Company looks on energy as a strategic area for

development, as our customers, shareholders, and employees expect

an environmentally aware approach to our production techniques. As

a result, the Company is investing in research to identify new

processes and materials to reduce the energy required to produce

our product. In addition to this the Company has commenced the

journey to identify the impact of our supply chain emissions and to

address the impact of our market offering through packaging

recycling.

We have continued our journey to improve our engagement with our

workforce, particularly within the context of the wider

macro-economic environment. We supply support to assist employees

in managing their day-to-day finances through helplines and, for

those who request it we assist with language lessons to integrate

employees into the workplace and to facilitate their interaction

with their colleagues. In addition, the Company continues to engage

with local schools to promote the benefits of a career in

manufacturing.

As a larger employer the Company also focuses on delivering high

quality employment with the opportunity for advancement at all

levels of the organisation. Colleagues are encouraged to

cross-skill and all sections and levels of the business have

succession planning as a core requirement.

The Company has always strived to adhere to good governance

principles. In line with this the Company is currently continuing

with its succession activities with the recruitment of a new Audit

Committee Chair and expects to be fully compliant with current

guidance on Board Composition before the 2024 AGM.

People

The Company continues to appreciate the high level of commitment

and engagement of our colleagues and was pleased to be able award

an above inflation pay rise in April, at a time when many are

struggling in their home lives with rapidly rising costs. Churchill

remains committed to offering the local community a long-term

destination for employment.

Outlook

We believe that the Company is well placed to improve

profitability and move towards the levels of efficiency and

productivity that were evident prior to the pandemic and indeed the

first half performance in 2023 illustrates further progress on this

journey. This performance improvement is expected to continue into

the second half of 2023, albeit against the backdrop of a

potentially worsening macroeconomic situation. The Company remains

ungeared and in the current rising interest rate environment this

is a welcome position. Rising interest rates will naturally have an

impact on consumer discretionary spend and therefore impact our

markets. The Company will continue to closely monitor the situation

and will respond proportionately. Overall, the Group is in a good

position to meet the Board's profit expectations for the full

year.

The Board remains positive that the Company is resilient and

operating in the optimal market segments to deliver long term

growth such that, regardless of the short-term impacts of the

economic environment, the Company will continue to deliver growth

over the longer term.

Robin GW Williams

Chairman

13 September 2023

Churchill China plc

Consolidated Income Statement

for the six months ended 30 June 2023

Unaudited Unaudited Audited

Six months to Six months to Twelve months to

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

Note

Revenue 1 44,042 41,375 82,528

=========== =========== ===========

Operating profit before exceptional

item 1 4,872 3,508 9,142

Exceptional items 2 (359) 471 547

---------------------------------------- ----- ------------------- ------------------- -------------------

Operating Profit 1 4,513 3,979 9,689

Finance income 3 207 15 60

Finance costs 3 (34) (93) (148)

------------------ ------------------ ------------------

-------------------------------------- ----- ------------------- ------------------- -------------------

Profit before exceptional item and

income tax 5,045 3,430 9,054

Exceptional items 2 (359) 471 547

--------------------------------------- ----- ------------------- ------------------- -------------------

Profit before income tax 4,686 3,901 9,601

Income tax expense 4 (1,183) (713) (1,706)

------------------ ------------------ ------------------

Profit for the period 3,503 3,188 7,895

=========== =========== ===========

Pence

per Pence per Pence per

share share share

Adjusted earnings per

ordinary share 5 34.3 24.7 66.9

Basic earnings per ordinary

share 5 31.9 28.9 71.7

Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2023

Unaudited Unaudited Audited

Twelve months

Six months to Six months to to

31 December

30 June 2023 30 June 2022 2022

GBP'000 GBP'000 GBP'000

Other comprehensive income

Items that will not be reclassified to profit

and loss:

Actuarial gain on retirement benefit

obligations (net) - - 9,332

Items that may be reclassified subsequently

to profit

and loss

Exchange differences - - 58

--------------- -------------- ---------------

Other comprehensive income - - 9,390

Profit for the period 3,503 3,188 7,895

--------------- --------------- ----------------

Total comprehensive income for the period 3,503 3,188 17,285

========== ========= ==========

All above figures relate to continuing operations

Churchill China

plc

Consolidated Balance

Sheets

as at 30 June

2023

Unaudited Unaudited Audited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Property, plant

and equipment 24,056 22,318 23,039

Intangible assets 760 908 849

Deferred income

tax assets 130 1,591 132

Retirement benefit

assets 7,889 - 6,924

------------------ ------------------- ----------------------

32,835 24,817 30,944

------------------ ------------------- ----------------------

Current assets

Inventories 19,154 11,097 15,889

Trade and other

receivables 12,928 14,651 14,380

Other financial

assets 3,604 5,016 5,057

Cash and cash equivalents 6,332 10,650 9,604

------------------ ------------------- ----------------------

42,018 41,414 44,930

------------------ ------------------- ----------------------

Total assets 74,853 66,231 75,874

========== ========== =============

Liabilities

Current liabilities

Trade and other

payables (11,566) (13,666) (14,291)

----------------- ---------------- ---------------------

Total current liabilities (11,566) (13,666) (14,291)

----------------- ---------------- ---------------------

Non-current liabilities

Lease liabilities

payables (554) (515) (477)

Deferred income

tax liabilities (4,794) (2,048) (4,458)

Retirement benefit

obligations - (6,353) -

----------------- ---------------- ---------------------

Total non-current

liabilities (5,348) (8,916) (4,935)

----------------- ---------------- ---------------------

Total liabilities (16,914) (22,582) (19,226)

========== ========== =============

Net assets 57,939 43,649 56,648

========== ========== =============

Equity

Issued share capital 1,103 1,103 1,103

Share premium account 2,348 2,348 2,348

Treasury shares (431) (431) (431)

Other reserves 1,431 1,230 1,344

Retained earnings 53,488 39,399 52,284

----------------- ---------------- ---------------------

Total equity 57,939 43,649 56,648

=========== ========== =============

Churchill China plc

Consolidated Statement of Changes in Equity

as at 30 June Issued

2023

Retained share Share Treasury Other Total

earnings capital premium shares reserves Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

January 2022 38,117 1,103 2,348 (80) 1,195 42,683

Comprehensive

income

Profit for the period 3,188 - - - - 3,188

Other comprehensive

income

Depreciation transfer

- gross 6 - - - (6) -

Depreciation transfer

- tax (2) - - - 2 -

Deferred tax - - - - - - -

change in rate

Currency translation - - - - - -

------------------------------------- --------- -------- -------- --------- --------- --------

Total comprehensive

income 3,192 - - - (4) 3,188

------------------------------------- --------- -------- -------- --------- --------- --------

Transactions with

owners

Share based payment - - - - 39 39

Dividends (1,907) - - - - (1,907)

Treasury Shares - - - (351) - (351)

Deferred tax -

share based payment (3) - - - - (3)

Total transactions

with owners (1,910) - - (351) 39 (2,222)

------------------------------------- --------- -------- -------- --------- --------- --------

Balance at 30

June 2022 39,399 1,103 2,348 (431) 1,230 43,649

------------------------------------- --------- -------- -------- --------- --------- --------

Comprehensive

income

Profit for the period 4,707 - - - - 4,707

Other comprehensive

income

Depreciation transfer

- gross 6 - - - (6) -

Depreciation transfer

- tax (1) - - - 1 -

Re-measurement of retirement

benefit obligations - net of tax 9,332 - - - - 9,332

Currency translation - - - - 58 58

------------------------------------- --------- -------- -------- --------- --------- --------

Total comprehensive income 14,044 - - - 53 14,097

------------------------------------- --------- -------- -------- --------- --------- --------

Transactions with owners

Dividends relating to 2022 (1,155) - - - - (1,155)

Share based payment - - - - 61 61

Deferred tax - share based payment (4) - - - - (4)

Total transactions with owners (1,159) - - - 61 (1,098)

------------------------------------- --------- -------- -------- --------- --------- --------

Balance at 31 December 2022 52,284 1,103 2,348 (431) 1,344 56,648

------------------------------------- --------- -------- -------- --------- --------- --------

Churchill China plc

Consolidated Statement of Changes in Equity

as at 30 June 2023 Issued

Retained share Share Treasury Other Total

earnings capital premium shares reserves Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 January 2023 52,284 1,103 2,348 (431) 1,344 56,648

Comprehensive income

Profit for the period 3,503 - - - - 3,503

Other comprehensive income:

Depreciation transfer - gross 7 - - - (7) -

Depreciation transfer - tax (2) - - - 2 -

Total comprehensive income 3,508 - - - (5) 3,503

------------------------------------- --------- -------- -------- --------- --------- --------

Transactions with owners

Share based payment - - - - 92 92

Dividends (2,310) - - - - (2,310)

Treasury Shares - - - - - -

Deferred tax - share based payment 6 - - - - 6

Total transactions with owners (2,304) - - - 92 (2,212)

------------------------------------- --------- -------- -------- --------- --------- --------

Balance at 30 June 2023 53,488 1,103 2,348 (431) 1,431 57,939

------------------------------------- --------- -------- -------- --------- --------- --------

Churchill China plc

Consolidated Cash Flow Statement

for the six months ended 30 June 2023

Unaudited Unaudited Audited

Six months to Six months to Twelve months to

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Cash generated from operations (note 6) 436 2,008 4,939

Interest received 117 15 60

Interest paid (34) (21) (35)

Income tax paid (90) (333) (991)

----------------- ----------------- ------------------

Net cash generated from operating activities 429 1,669 3,973

----------------- ----------------- -----------------

Investing activities

Purchases of property, plant and equipment (2,680) (2,644) (4,618)

Proceeds on disposal of property, plant and

equipment 34 5 15

Purchases of intangible assets (33) (25) (86)

Net Sale/(Purchase) of other financial

assets 1,453 (1,011) (1,052)

----------------- ----------------- -----------------

Net cash used in investing activities (1,226) (3,675) (5,741)

----------------- ----------------- -----------------

Financing activities

Dividends paid (2,310) (1,907) (3,062)

Treasury shares - (352) (351)

Principal element of finance lease payments (165) (131) (263)

----------------- ----------------- -----------------

Net cash generated by / (used in) financing

activities (2,475) (2,390) (3,676)

----------------- ----------------- -----------------

Net (decrease)/ increase in cash and cash

equivalents (3,272) (4,396) (5,444)

Cash and cash equivalents at the beginning of

the period 9,604 15,046 15,046

Exchange gain/(loss) on cash and cash

equivalents - - 2

----------------- ----------------- -----------------

Cash and cash equivalents at the end of the

period 6,332 10,650 9,604

----------------- ----------------- -----------------

1. Segmental analysis

for the six months ended 30 June 2023

Unaudited Unaudited Audited

Six months Six months Twelve months

to to to

30 June

2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

Revenue

by class

of business

Ceramics 40,101 37,737 75,335

Materials 8,002 6,408 13,500

-------------------------- ------------------------- -----------------------------------

48,103 44,145 88,835

Inter segment (4,061) (2,770) (6,307)

-------------------------- ------------------------- -----------------------------------

44,042 41,375 82,528

--------------------------- -------------------------- ------------------------------------

Revenue

by

destination

United Kingdom 15,668 16,040 33,244

Rest of

Europe 19,970 17,431 31,888

USA 4,801 3,926 8,715

Rest of

the World 3,603 3,978 8,681

-------------------------- -------------------------- -----------------------------------

44,042 41,375 82,528

--------------------------- -------------------------- ------------------------------------

1. Segmental analysis (continued)

for the six months ended 30 June 2023

Unaudited Unaudited Audited

Six months Six months Twelve months

to to to

30 June

2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

Operating

profit

before

exceptional

items

Ceramics 4,208 2,985 7,932

Materials 664 523 1,210

-------------------------- ------------------------- -----------------------------------

4,872 3,508 9,142

--------------------------- -------------------------- ------------------------------------

Exceptional

items

Ceramics (359) 471 484

Materials - - 63

-------------------------- ------------------------- -----------------------------------

(359) 471 547

--------------------------- -------------------------- ------------------------------------

Operating

profit

after

exceptional

items

Ceramics 3,849 3,456 8,416

Materials 664 523 1,273

-------------------------- ------------------------- -----------------------------------

4,513 3,979 9,689

Unallocated

items

Finance income 207 15 60

Finance costs (34) (93) (148)

--------------------------- -------------------------- ------------------------------------

Profit before

income tax 4,686 3,901 9,601

--------------------------- -------------------------- ------------------------------------

2. Exceptional items

During the six months to 30 June 2022, Churchill China plc

received a further GBP34,000 in relation to the voluntary wind up

of the British Pottery Manufacturers' Federation, of which the

Company was a 23.53% shareholder (in addition to the GBP471,000

received during 2022). Due to the nature of this income, the amount

received has been treated as exceptional. A total exceptional cost

was also recognised of GBP393,000 in relation to employee

restructuring costs.

3. Finance income and costs

Unaudited Unaudited Audited

Six months to Six months to Twelve months to

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

Finance income

Other interest receivable 117 15 60

Interest on pension scheme 90 - -

Finance income 207 15 60

-------------- -------------- -----------------

Finance costs

Interest paid (34) (21) (35)

Interest on pension scheme - (72) (113)

Finance costs (34) (93) (148)

-------------- -------------- -----------------

The interest income arising from pension schemes is a non-cash

item.

4. Income tax expense

Unaudited Unaudited Audited

Six months to Six months to Twelve months to

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

Current taxation 839 392 631

Deferred taxation 344 321 1,075

Income tax expense 1,183 713 1,706

-------------- -------------- -----------------

5. Earnings per ordinary share

Basic earnings per ordinary share is based on the profit after

taxation attributable to owners of the Company of GBP3,503,000

(June 2022: GBP3,188,000; December 2022: GBP7,895,000) and on

10,997,835 (June 2022: 11,020,612; December 2022: 11,009,068)

ordinary shares, being the weighted average number of ordinary

shares in issue during the period. Adjusted earnings per ordinary

share is calculated after adjusting for the post tax effect of

exceptional items (see note 2).

Unaudited Unaudited Audited

Six months to Six months to Twelve months to

30 June 2023 30 June 2022 31 December 2022

Pence per share Pence per share Pence per share

Basic earnings per share 31.9 28.9 71.7

Less exceptional items 2.4 (4.2) (4.8)

---------------- ---------------- -----------------

Adjusted earnings per share 34.3 24.7 66.9

---------------- ---------------- -----------------

6. Reconciliation of operating profit to net cash inflow from

continuing activities

Unaudited Unaudited Audited

Six months to Six months to Twelve months to

30 June 2023 30 June 2022 31 December 2022

GBP'000 GBP'000 GBP'000

Cash flow from operations

Operating profit 4,872 3,508 9,142

Exceptional Income (360) 471 547

Adjustments for

Depreciation and amortisation 1,753 1,481 2,983

Profit on disposal of property, plant and equipment (1) - (4)

Charge for share based payment 91 39 100

Decrease in retirement benefit obligations (875) (875) (1,750)

Changes in working capital

Inventory (3,265) (611) (5,403)

Trade and other receivables 861 (3,833) (3,067)

Trade and other payables (2,640) 1,828 2,391

Cash inflow from operations 436 2,008 4,939

-------------- -------------- -----------------

7. Basis of preparation and accounting policies

The financial information included in the interim results

announcement for the six months to 30 June 2023 was approved by the

Board on 13 September 2023.

The interim financial information for the six months to 30 June

2023 has not been audited or reviewed and does not constitute

statutory accounts within the meaning of Section 434 of the

Companies Act 2006. The Company's statutory accounts for the year

ended 31 December 2022, prepared in accordance with international

accounting standards in conformity with the requirements of the

Companies Act 2006.

The interim financial statements have been prepared under the

historical cost convention as modified by the revaluation of land

and buildings and financial assets and liabilities (including

derivative instruments) at fair value through the profit and loss

account. The same accounting policies, presentation and methods of

computation are followed in the interim financial statements as

were applied in the Group's last audited financial statements for

the year ended 31 December 2022.

Statutory accounts for the year ended 31 December 2022 have been

delivered to the Registrar of Companies.

8. Share buybacks

The Company did not buy back any ordinary shares during the

first six months of the year but may consider making further ad hoc

share buybacks going forward at the discretion of the Board and

subject to the shareholder authorities approved at the 2023 Annual

General Meeting.

The half-yearly report and this announcement will be available

shortly on the Company's website www.churchill1795.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFEAADIVLIV

(END) Dow Jones Newswires

September 14, 2023 02:00 ET (06:00 GMT)

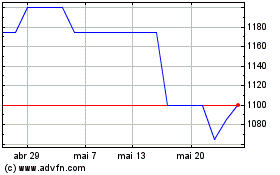

Churchill China (LSE:CHH)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Churchill China (LSE:CHH)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024