TIDMGRIT

RNS Number : 9836M

GRIT Investment Trust PLC

19 September 2023

GRIT Investment Trust plc

'GRIT' or 'the Company'

Half-year results for the six months ended 30 June 2023

Chairman's statement

The last six months have seen a continued increase in interest

rates and high inflation in the UK. The economic uncertainties in

global capital markets largely associated with the Russia-Ukraine

conflict, have continued. However, this challenging economic

background has presented a number of opportunities to the Company's

board in its pursuit of a suitable reverse takeover target.

Set out below is the interim statement covering the six months

ended 30 June 2023. A loss of GBP83,000 is being reported for the

six months ended 30 June 2023 compared to a loss of GBP89,000 for

the six months ended 30 June 2022. The board continues to manage

costs carefully in an effort to preserve shareholder value.

Salient events

Completion of Creditors Voluntary Arrangement

In May 2023 the Company announced that the Creditors Voluntary

Arrangement ("CVA") was successfully completed following the

approval of the Company's variation to creditors to bring the CVA

to an early conclusion. The CVA creditors received a total of

83.06p in the GBP1, which compared favourably to the 20p in the

GBP1 in the original CVA proposal. The completion of the CVA is an

important step forward for the Company which can now plan a future

free of its historical debts.

Share Capital Reorganisation and Conversion of the outstanding

CULNs

A share capital reorganisation was approved at the Company's AGM

in June resulting in each existing ordinary share of 2.5p be

sub-divided into one ordinary share of 0.1p and one deferred share

of 2.4p. Resolutions were also passed at the AGM to enable the

Company to issue 11,472,175 New Ordinary Shares in connection with

the conversion of the outstanding CULN's and issue up to an

additional 120,000,000 New Ordinary Shares for cash.

Strategy of the new Board

Whilst the Company is still an Investment Trust, it continues to

seek to acquire a business which would result in a Reverse

Takeover. This will enable the Company to achieve an appropriate

listing on a public market and it is envisaged that the

announcement of any such proposed transaction would result in the

suspension of the Company's shares from trading on the Official

List. If an RTO transaction can be achieved the Board believes it

will provide a platform for the future growth of the Company and a

positive outcome for shareholders.

Richard Lockwood

Chairman

20 September 2023

Enquiries:

GRIT Investment Trust plc

Martin Lampshire

Tel: +44 (0) 20 3198 2554

Peterhouse Capital Limited

Lucy Williams/Duncan Vasey

Tel: +44 (0)20 7469 0930

Income Statement

Revenue Capital Total

Unaudited Unaudited Unaudited

-------------------------------------- ------ ---------- ---------- ----------

Notes GBP'000 GBP'000 GBP'000

-------------------------------------- ------ ---------- ---------- ----------

Six months ended 30 June 2023

Profit on disposal of investments - - -

Other income - - -

Other expenses (83) - (83)

-------------------------------------- ------ ---------- ---------- ----------

Net return before finance costs

and taxation (83) - (83)

Interest payable and similar charges - - -

-------------------------------------- ------ ---------- ---------- ----------

Net return on ordinary activities

before taxation (83) - (83)

Tax on ordinary activities - - -

-------------------------------------- ------ ---------- ---------- ----------

Net return attributable to equity

shareholders (83) - (83)

-------------------------------------- ------ ========== ========== ==========

Profit (loss) per ordinary share 3 (0.52p) - (0.52p)

-------------------------------------- ------ ---------- ---------- ----------

Six months ended 30 June 2022

Profit on disposal of investments - - -

Other income 96 - 96

Other expenses (153) - (153)

-------------------------------------- ------ ---------- ---------- ----------

Net return before finance costs

and taxation (57) - (57)

Interest payable and similar charges (32) - (32)

-------------------------------------- ------ ---------- ---------- ----------

Net return on ordinary activities

before taxation (89) - (89)

Tax on ordinary activities - - -

-------------------------------------- ------ ---------- ---------- ----------

Net return attributable to equity

shareholders (89) (89)

-------------------------------------- ------ ========== ========== ==========

Profit (loss) per ordinary share 3 (0.56p) - (0.56p)

-------------------------------------- ------ ---------- ---------- ----------

Year ended 31 December 2022

Profit on disposal of investments - - -

Other income 96 - 96

Other expenses (212) - (212)

-------------------------------------- ------ ---------- ---------- ----------

Net return before finance costs

and taxation (116) - (116)

Interest payable and similar charges (39) - (39)

-------------------------------------- ------ ---------- ---------- ----------

Net return on ordinary activities

before taxation (155) - (155)

Tax on ordinary activities - - -

-------------------------------------- ------ ---------- ---------- ----------

Net return attributable to equity

shareholders (155) - (155)

-------------------------------------- ------ ========== ========== ==========

Profit (loss) per ordinary share 3 (2.35p) - (2.35p)

-------------------------------------- ------ ---------- ---------- ----------

The 'total' column of this statement represents the Company's

profit and loss account, prepared in accordance with IFRS. All

revenue and capital items in this statement derive from continuing

operations. All of the profit for the period is attributable to the

owners of the Company.

No operations were acquired or discontinued in the year.

A Statement of Other Comprehensive Income is not required as all

gains and losses of the Company have been reflected in the above

Income Statement.

Balance Sheet

As at As at As at

30 June 31 December 30 June

2023 2022 2022

Unaudited Audited Unaudited

---------------------------------- ------ ---------- ------------- ----------

Notes GBP'000 GBP'000 GBP'000

---------------------------------- ------ ---------- ------------- ----------

Fixed assets

Investments - - -

---------------------------------- ------ ---------- ------------- ----------

- - -

---------------------------------- ------ ---------- ------------- ----------

Current assets

Debtors 24 140 137

Cash at bank and on deposit 19 66 187

---------------------------------- ------ ---------- ------------- ----------

43 206 324

Creditors: amounts falling due

within one year

Other creditors (107) (271) (330)

Convertible unsecured loan notes (370) - -

Net current (liabilities) assets (434) (65) (6)

---------------------------------- ------ ---------- ------------- ----------

Creditors: amounts falling due

after one year

Convertible unsecured loan notes - (445) (692)

---------------------------------- ------ ---------- ------------- ----------

Net (liabilities) assets (434) (510) (698)

---------------------------------- ------ ========== ============= ==========

Capital and reserves

Called up share capital 833 758 504

Share premium 36,922 36,922 36,922

Capital reserve (32,697) (32,697) (32,697)

Revenue reserve (5,560) (5,561) (5,495)

Other reserve 68 68 68

---------------------------------- ------ ========== ============= ==========

Equity shareholders' funds (434) (510) (698)

---------------------------------- ------ ========== ============= ==========

Net asset value per share 4 (2.38p) (3.36p) (13.86p)

---------------------------------- ------ ---------- ------------- ----------

Statement of Changes in Share

Equity Share premium Capital Revenue Other

capital account reserve reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- --------- --------- --------- ----------- -------- ------------

For the 6 months to 30 June 2023

(unaudited)

Balance at 31 December 2022 758 36,922 (32,697) (5,561) 68 (510)

Issue of shares 75 - - - - 75

Return on ordinary activities

after taxation - - - 1 - 1

--------- --------- --------- ----------- -------- ------------

Balance at 30 June 2023 833 36,922 (32,697) (5,560) 68 (434)

------------------------------- ========= ========= ========= =========== ======== ============

For the 6 months to 30 June

2022 (unaudited)

------------------------------------------ -------- --------- ------- ------------- ---- --------

Balance at 31 December 2021 504 36,922 (32,697) (5,406) 68 (609)

Issue of shares - - - - - -

Return on ordinary activities

after taxation - - - (89) - (89)

--------- --------- --------- ----------- -------- ------------

Balance at 30 June 2022 504 36,922 (32,697) (5,495) 68 (698)

------------------------------- ========= ========= ========= =========== ======== ============

The revenue reserve represents the amount of the Company's

reserves distributable by way of dividend.

Cash Flow Statement

Six months ended

30 June

----------------------------------------------

2023 2022

Unaudited Unaudited

-------------------------------------------------- ------------------------- -------------------

GBP'000 GBP'000

-------------------------------------------------- ------------------------- -------------------

(Loss)/profit before finance costs and

taxation (83) (57)

Adjustments for:

Conclusion of Company Voluntary Arrangement 84 -

Operating cash flows before movements

in working capital 1 (57)

Operating activities

(Increase)/Decrease in other receivables 116 (137)

(Decrease)/increase in other payables (164) (107)

Net cash outflow from operating activities (47) (301)

-------------------------------------------------- ------------------------- -------------------

Investing activities

Proceeds from the sale of investment - -

-------------------------------------------------- ------------------------- -------------------

Net cash inflow from investing activities - -

-------------------------------------------------- ------------------------- -------------------

Financing activities

Issue of shares - -

Net cash inflow from financing activities - -

-------------------------------------------------- ------------------------- -------------------

Increase/(decrease) in cash and cash equivalents (47) (301)

Net cash at the start of the period 66 488

-------------------------------------------------- ------------------------- -------------------

Net cash at the end of the period 19 187

-------------------------------------------------- ------------------------- -------------------

The accompanying notes are an integral part of the financial

statements.

Notes

1. Interim Results

These condensed financial statements have been prepared in

accordance with International Financial Reporting Standards

('IFRS') and IAS 34 'Interim Financial Reporting' as adopted by the

UK and the accounting policies set out in the statutory accounts of

the Company for the year ended 31 December 2022. The condensed

financial statements do not include all of the information required

for a complete set of IFRS financial statements and should be read

in conjunction with the financial statements of the Company for the

year ended 31 December 2022, which were prepared in accordance with

UK-adopted international accounting standards. There have been no

significant changes to management judgements and estimates.

2. Going Concern Basis of Accounting

At the time of approving the financial statements, the directors

have a reasonable expectation that the company has adequate

resources to continue in operational existence for the foreseeable

future. Thus, the directors continue to adopt the going concern

basis of accounting in preparing the financial statements.

3. Return per Ordinary Share

The revenue loss per ordinary share for the six months ended 30

June 2023 is based on a net loss after taxation of GBP83,000 and on

a weighted average of 15,838,260 ordinary shares in issue during

the period.

The capital loss per ordinary share for the six months ended 30

June 2023 is based on a net capital profit after taxation of GBPNil

and on a weighted average of 15,838,260 ordinary shares in issue

during the period.

4. Net Asset Value per Ordinary Share

The net asset value per ordinary share is based on net

liabilities of GBP434,000 (31 December 2022: net liabilities of

GBP510,000) and on 18,198,295 (31 December 2022: 15,196,857)

ordinary shares, being the number of ordinary shares in issue at

the period end.

5. Related Party Transactions

The Board of Directors is considered to be a related party. The

Directors of the Company received fees for their services. Total

fees for the six months to 30 June 2023 were GBPNil (six months

ended 30 June 2022: GBP10,000) At 30 June 2023 directors were owed

GBPNil (30 June 2022: GBP60,370).

5. Post Balance Sheet Events

Events since the balance sheet date are fully described in the

outgoing Chairman's statement.

Interim Report Statement

The Company's auditor PKF Littlejohn LLP, has not audited or

reviewed the Interim Report to 30 June 2023 pursuant to the

Auditing Practices Board guidance on 'Review of Interim Financial

Information'. These are not full statutory accounts in terms of

Section 434 of the Companies Act 2006 and are unaudited. Statutory

accounts for the year ended 31 December 2022, which received an

unqualified audit report and which did not contain a statement

under Section 498 of the Companies Act 2006, have been lodged with

the Registrar of Companies. No full statutory accounts in respect

of any period after 31 December 2022 have been reported on by the

Company's auditor or delivered to the Registrar of Companies.

Directors' Statement of Principal Risks and Uncertainties

The risks, and the way in which they are managed, are described

in more detail in the Strategic Report contained within the Annual

Report and Financial Statements for the year ended 31 December

2022. In the opinion of the Directors the Company's principal risks

and uncertainties have not changed materially since the date of

that report and did not change materially for the rest of the

Company's financial reporting period to 31 December 2022.

Statement of Directors' Responsibilities in Respect of the

Interim Report

We confirm that to the best of our knowledge:

-- the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting' and gives a

true and fair view of the assets, liabilities, financial position

and loss of the Company;

-- the Chairman's Statement and Executive Director's Review

(together constituting the Interim Management Report) include a

fair review of the information required by the Disclosure Guidance

and Transparency Rules ('DTR') 4.2.7R, being an indication of

important events that have occurred during the first six months of

the year and their impact on the financial statements; and

-- other than directors' remuneration, there have been no

related party transactions that materially affected the financial

position or performance of the Company during the period.

On behalf of the Board

Richard Lockwood

Chairman

20 September 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCGDCBGBDGXC

(END) Dow Jones Newswires

September 20, 2023 02:00 ET (06:00 GMT)

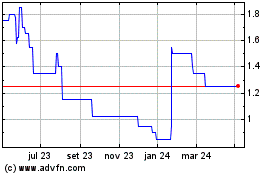

Grit Investment (LSE:GRIT)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Grit Investment (LSE:GRIT)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025