TIDMSCIR

RNS Number : 0831O

Scirocco Energy PLC

29 September 2023

29 September 2023

Scirocco Energy plc

("Scirocco" or "the Company")

Interim Results

Scirocco Energy plc (AIM: SCIR), the AIM investing company

targeting attractive assets within the European sustainable energy

and circular economy markets, is pleased to announce its unaudited

interim results for the six months ended 30 June 2023.

Period Highlights:

-- In line with the Investing Policy approved at AGM in July

2021, the Company continued to support Energy Acquisitions Group

Limited ("EAG"), where Scirocco has a 50% ownership interest, to

identify additional investment opportunities building on the

acquisition by EAG of 100% of Greenan Generation Limited ("GGL")

and associated 0.5 MWe Anaerobic Digestion ("AD") plant located in

County Londonderry, Northern Ireland. AD is a process that creates

biogas, a renewable energy source that will help the UK deliver on

its decarbonization commitments

-- During the period, GGL has seen lower average wholesale power

prices than the same period in 2022 and experienced reduced

operational uptime driven by an intermittent fault. These effects

were partially offset by higher ROC payments linked to inflation

adjustments

-- Revenue for H1 2023 was GBP574k compared to GBP544k for the

same period in 2022, an increase of 5.5% year on year.

-- EBITDA for H1 2023 was GBP151k compared to GBP202k for the

same period in 2022 reflecting lower average wholesale prices and

operational interruptions and a general increase to the plant

service and feedstock contracts.

-- The Company continued to engage with Tanzanian government

authorities to progress the completion of the divestment of its 25%

working interest in the Ruvuma asset following the agreement with

ARA Petroleum Tanzania announced on 31(st) August 2022. The total

consideration for the sale is up to $16 million:

-- Initial consideration of US$3 million payable on completion

of the sale, which is expected during October 2023;

-- US$3 million payable upon final investment decision being

taken by the parties to the Ruvuma Asset Production Sharing

Agreement or the JOA as the case may be, which given progress made

to date at the asset is expected to be received by year end

2023;

-- Deferred consideration of up to US$8 million payable in the

form of a 25% net revenue share from the point when Ruvuma

commences delivery of gas to the gas buyer;

-- Contingent consideration of US$2 million payable on gross

production reaching a level equal to or greater than 50Bcf.

-- The Company announced on 2 March 2023 that significant

progress had been achieved by the operator APT to deliver first gas

from the Ruvuma field by the end of 2023;

-- The approval process has taken longer than originally

anticipated and the Company announced on 25 May 2023 that it had

agreed with its counterparty APT to extend the longstop date to 31

August 2023 to provide additional time to achieve the necessary

government consents;

-- The Prolific Basins financing facility outstanding balance

was settled in full during the period through cash instalments paid

in connection with the Amendment and Repayment plan announced on 11

October 2022. The facility is now fully repaid;

-- The Company disposed of part of its remaining shareholding in

Helium One realizing c. GBP142k in proceeds during the period;

-- As part of an ongoing focus on ensuring that the Company has

the correct board composition to support the implementation of the

investment policy Muir Miller and Don Nicolson submitted their

notice to step down from the board and Niall Roberts, a candidate

recommended by the Company's largest shareholder GP Jersey was

appointed to the board on 1(st) March 2023 and Matt Bower, GP

Jersey's appointed representative, was appointed to the board on

27(th) April 2023;

-- Continued the Company's focus on cost discipline and cash

preservation in order to deliver completion of Ruvuma; and

-- Held cash at 30 June 2023 of GBP295k

Post Period Highlights:

-- On 12 July 2023 the Company provided an operational update

regarding the Ruvuma asset noting the significant progress made by

the JV in the development of the Ruvuma license which provides

improved clarity regarding the timing of contingent payments under

the sale arrangements between ARA Petroleum Tanzania and

Scirocco.

-- On 3 August 2023, The Company announced that it had received

the tax clearance certificate relating to the Ruvuma transaction

from the Tanzanian Revenue Authority.

-- The company successfully recovered 1 million Helium One

shares which had been "trapped" after Pello Capital entered

administration in October 2022. These shares were sold during

August 2023 delivering net proceeds of c. GBP75k.

-- On 29 August 2023, the Company announced that whilst

significant progress had been made delivering the necessary

approvals from the relevant Tanzanian government authorities it had

agreed with its counterparty APT to extend the longstop for the

Ruvuma transaction to 30 September 2023 to allow sufficient time to

achieve the final approval from the Minster of Energy.

-- On 28 September 2023, the Company announced that whilst it

was actively engaged with Tanzanian government authorities

including the Ministry of Energy to deliver the necessary approvals

required to complete the transaction, it had agreed with its

counterparty APT to extend the longstop for the Ruvuma transaction

to 20 October 2023 to allow sufficient time to achieve the final

approval from the Minister of Energy.

Commenting on the Interim Results, Alastair Ferguson,

Non-Executive Chairman said:

The first half of 2023 has seen the Company continue to focus on

selling its legacy natural resources assets to provide capital to

invest within target assets in the European sustainable energy and

circular economy markets.

Although the sale of its legacy interest in Ruvuma has taken

longer than originally anticipated to complete, we are now focused

on delivering completion. The proceeds of the divestment - both at

completion and any future contingent payments - will be available

for reinvestment in assets which comply with the company's

investment policy.

With the imminent completion of the Ruvuma sale, the company is

expected to accrue cash resources over the coming months supporting

new investment activities.

We now look forward to engaging with stakeholders to deliver the

investment plan going forward."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR").

For further information:

Scirocco Energy plc +44 (0) 20 7466

Tom Reynolds, CEO 5000

Strand Hanson Limited, Nominated Adviser +44 (0) 20 7409

Ritchie Balmer / James Spinney / Robert Collins 3494

WH Ireland Limited, Broker +44 (0) 207 220

Harry Ansell / Katy Mitchell 1666

Buchanan, Financial PR +44 (0) 20 7466

Ben Romney / Barry Archer / George Pope 5000

Chairman's statement

Introduction

I am pleased to be providing this statement in my capacity as

Non-Executive Chairman of Scirocco. At the end of 2022, the Company

had navigated a challenging year where it secured an agreement to

sell its principle legacy asset - Ruvuma - and engaged with

stakeholders about the implications of this linked to its new

investment policy. The terms of that agreement resulted in a firm

consideration for Scirocco, with contingent elements taking the

total consideration up to a potential $16m of proceeds. This was a

transformative event for the Company, realizing value from a legacy

investment that no longer fit within Scirocco's agreed investment

policy, and providing cash that could be deployed into low-risk,

cash generative opportunities in line with the stated strategy.

Since then the Company has been focused on delivering the

completion of the Ruvuma divestment and also tidying up legacy

issues such as the repayment of the Prolific Basins facility, the

recovery and sale of its remaining shares in Helium One and

evolution of the composition of the board.

With the imminent completion of Ruvuma the Company now expects

to accrue cash over the coming months as a result of contingent

payments linked to progress of the development of Ruvuma towards

first gas - transforming the balance sheet and providing liquidity

to deliver the Company's long-term growth objectives.

As I have said previously, the Board is committed to grow value

for all shareholders by the most appropriate investment of Company

resources on a risk adjusted basis. With the completion of Ruvuma I

look forward to engaging with shareholders to agree and progress

towards this objective, ensuring stakeholder alignment as we embark

on the next chapter of the Company's story.

Strategy and Business Development

With the progress made in divesting legacy assets the Board

restates Scirocco's objective to build a portfolio of cash

generative assets within the following three core areas:

-- Energy - assets which generate energy for sale through

sustainable or renewable means in the form of biogas or electrical

power;

-- Circular - assets which recover a valuable component of an

industrial, municipal or agricultural waste stream for re-use,

generally reducing the system carbon footprint in parallel; and

-- Vector - assets involved in the storage, transmission, or

delivery of energy within a low carbon context.

The Board believes it will offer Shareholders and investors

exposure to an asset portfolio with an attractive risk/reward

profile within the sustainable energy ecosystem. Over time, the

Board believes shareholder value can be delivered through

operational improvement, driving improved profitability;

reinvestment of cash flow to fund further acquisition; the periodic

refinancing of the portfolio as it grows, supporting lower cost

asset finance; and ultimately the payment of a regular

dividend.

Outlook

During the first half of 2023 the primary focus within Scirocco

has been on delivering the completion of the sale of the Company's

Ruvuma interest to APT. In addition, the team have continued to

work with EAG on the development of the AD portfolio including

support on due diligence on one asset. We believe that Scirocco's

experience of working with EAG ratifies our investment thesis and

shows how the Company can work with investee companies to grow

value.

We look forward to assessing the range of opportunities open to

the Company taking account of its expected cash position going

through the remainder of 2023 and into 2024 and engaging with

shareholders/stakeholders to agree the optimal path to creating

value.

Alastair Ferguson

Non-Executive Chairman

Date: 29 September 2023

Investment Update

Energy Acquisitions Group Limited

The Company invested in EAG in September 2021 to support the

acquisition of Greenan Generation Limited ("GGL").

Financial

In H1 2023 the revenue received for the period by GGL totalled

GBP574k (unaudited). This compares to the same period in 2022 where

revenue was GBP544k (unaudited). EBITDA for H1 2023 was

GBP151k.

The lower EBITDA level was driven by an intermittent fault with

the incoming power line causing ancillary equipment to fail. This

resulted in lower uptime, lower power export and increased costs

for repair works. The issue has now been addressed and preventative

investments made to ensure this will not re-occur.

Operational

During H1 2023, Greenan experienced a mix bag in terms of

performance, primarily due to an intermittent frequency fluctuation

issue between April and June. This had the effect of causing

failures in pumps, drives and ancillary control panels on the

Greenan plant. The incoming power supply from the DNO substation

was found to be the fault, and subsequently, Greenan has undertaken

an electrical futureproofing scheme to ensure that all of its

panels and drives are protected from frequency fluctuations in

future. This period saw substantial upgrade work to electrical

infrastructure including:

-- All incoming cable upgraded to armored cable;

-- All drives protected with voltage and frequency fluctuation devices; and

-- Upgrade and replacement of auger, pump and mixer drives in main control panel.

During H1 2023, electricity pricing to Greenan stabilized around

GBP90 per MWhr, a significant average reduction from GBP163 per

MWhr in the same period last year. Turnover for the H1 2023 was

GBP574k with corresponding EBITDA of GBP151k. April, May and June

had average operational efficiencies of 81% but otherwise

efficiencies in the period have been strong at over 95%.

Given the electrical upgrade works carried out, it is not

expected that any underperformance due to electrical failures or

complications will be repeated.

Business Development

Throughout H1 2023, EAG identified a number of investable

projects which met its investment criteria. Due to the extended

time to complete the Ruvuma divestment and the absence of a

suitable authority to issue shares to raise investment capital,

Scirocco is unable to support further investment until the

completion of Ruvuma is delivered. As a result the Company is aware

that EAG has engaged with other prospective investors who can

support further acquisitions.

Helium One

At 1 January 2023 Scirocco held 2,906,088 shares in Helium One,

1 million of which were the subject of ongoing recovery discussions

with the Pello Capital administrator, Evelyn Partners.

Within the period, 1,906,088 shares in Helium One were sold for

an average price of 7.5p/share.

After the end of the period 1,000,000 shares in Helium One were

delivered to Scirocco following consultation with Evelyn Partners

pursuant to the options exercised by the Company in 2021. These

shares were sold during August 2023 at an average price of

7.5p/share delivering net proceeds of c. GBP75,000.

Scirocco's remaining holding in Helium One is nil shares.

Tom Reynolds

Chief Executive Officer

Date: 29 September 2023

Principal risks and uncertainties

The principal risks facing the Company were set out in the

Company's Annual Report and Accounts to 31 December 2022

As the investment policy is implemented, the Company's risk

profile will continue to evolve due to its exposure to different

assets and markets, and a full statement of risks will be published

in subsequent Annual Report and Accounts.

On behalf of the board

Alastair Ferguson

Non-Executive Chairman

Date: 29 September 2023

Directors' responsibilities

The Directors are responsible for preparing the Interim Report

in accordance with applicable law and regulations.

Company law requires the Directors to prepare Company financial

statements for each financial year. Under AIM Rules for Companies

of the London Stock Exchange they are required to prepare the

Company financial statements in accordance with International

Financial Reporting Standards in conformity with the requirements

of the Companies Act 2006. Under company law the Directors must not

approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the

Company and of the profit or loss of the Company for that period.

The Directors are also required to prepare financial statements in

accordance with the rules of the London Stock Exchange for

companies trading securities on AIM.

Company law requires the Directors to prepare Company financial

statements for each financial year. Under AIM Rules for Companies

of the London Stock Exchange they are required to prepare the

Company financial statements in accordance with International

Financial Reporting Standards (IFRSs) in conformity with the

Companies Act 2006.

In preparing these financial statements, the Directors are

required to:

-- select suitable accounting policies and then apply them consistently;

-- make judgements and accounting estimates that are reasonable, relevant and reliable;

-- state whether they have been prepared in accordance with IFRS; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the company will

continue in business.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements comply with the requirements of the

Companies Act 2006. They are also responsible for safeguarding the

assets of the Company and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

Website publication

The Directors are responsible for ensuring the annual report and

the financial statements are made available on the Company's

website. Financial statements are published on the Company's

website in accordance with legislation in the United Kingdom

governing the preparation and dissemination of financial

statements, which may vary from legislation in other jurisdictions.

The maintenance and integrity of the Company's website is the

responsibility of the Directors. The Directors' responsibility also

extends to the ongoing integrity of the financial statements

contained therein.

CONDENSED INTERIM STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME

Six months Six months

ended ended

Notes 30 June 2023 30 June 2022

(Unaudited) (Unaudited)

Continuing operations GBP 000 GBP 000

Administrative expenses 6 (971) (733)

Share of loss from joint venture (40) -

Loss before investment activities (1,011) (733)

Interest income 5 73 65

Gain on disposal of shares 8 16 57

Costs to sell investments (27) (30)

Exchange gain/(loss) 136 72

Fair value through profit and

loss (21) 27

------------ ------------

(Loss)/profit on ordinary activities

before taxation (834) (542)

Income tax expense

- -

------------ ------------

Total comprehensive (loss)/profit

for the period from continuing

operations (834) (542)

------------ ------------

Discontinued operations

Profit/(loss) recognised on

classification as held for sale 9 221 1,314

------------ ------------

Profit/(loss) for the period

from discontinuing operations 221 1,314

------------ ------------

Profit and total comprehensive

income for the period (613) 772

------------ ------------

Total comprehensive income

attributable to owners of the

parent (613) 772

------------ ------------

Earnings per share (pence)

Basic 10 (0.07) 0.10

Diluted 0.10

Earnings per share from continuing 10

operations

Basic (0.09) (0.07)

Diluted

10

Earnings per share from discontinued

operations

Basic 0.02 0.17

Diluted 0.02 0.17

------------ ------------

CONDENSED INTERIM STATEMENT OF FINANCIAL POSITION

As at As at

Notes 30 June 2023 31 December

2022

(Unaudited) (Audited)

GBP 000 GBP 000

Non-current assets

Loan receivable from related party 1,522 1,448

Investment in joint venture 13 - 40

------------ -----------

Total non-current assets 1,522 1,488

Current assets

Trade and other receivables 15 134 210

Cash and cash equivalents 295 750

Financial assets at fair value

through profit or loss 11 58 273

Assets held for sale 14 11,445 10,715

------------ -----------

Total current assets 11,932 11,948

------------ -----------

Total assets 13,454 13,436

------------ -----------

Current liabilities

Trade and other payables 16 487 224

Liabilities held for sale 14 3,478 3,110

Total current liabilities 3,965 3,334

------------ -----------

Net current assets 7,967 8,614

------------ -----------

Total liabilities 3,965 3,334

------------ -----------

Net assets 9,489 10,102

============ ===========

Equity

Share capital 17 1,801 1,801

Deferred share capital 17 1,831 1,831

Share premium reserve 18 38,408 38,408

Share-based payments 19 2,071 2,071

Retained earnings (34,622) (34,009)

------------ -----------

Total equity 9,489 10,102

============ ===========

CONDENSED STATEMENT OF CHANGES IN EQUITY

Deferred Share Share-based Retained Total

Share capital share premium payments earnings

capital

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

------------------------- -------------- -------------- ---------------- --------------- -----------

Balance at 31

December 2021 1,518 2,729 38,155 1,941 (29,194) 15,149

Profit for the

period - - - - 772 772

Credit to

equity for

equity-settled

share-based

payments - - - 119 - 119

------------------------- -------------- -------------- ---------------- --------------- -----------

Balance at 30

June 2022 1,518 2,729 38,155 2,060 (28,422) 16,040

------------------------- -------------- -------------- ---------------- --------------- -----------

Loss for the

period - - - - (5,587) (5,587)

Issue of share

capital 283 - 253 - - 536

Consideration

received for

shares

to be issued - (898) - - - (898)

Credit to

equity for

equity-settled

share-based

payments - - - 11 - 11

Balance at 31

December 2022 1,801 1,831 38,408 2,071 (34,009) 10,102

------------------------- -------------- -------------- ---------------- --------------- -----------

Profit for the

period - - - - (613) (613)

Balance at 30

June 2023 1,801 1,831 38,408 2,071 (34,622) 9,489

------------------------- -------------- -------------- ---------------- --------------- -----------

CONDENSED INTERIM STATEMENT OF CASH FLOWS

Six months Six months

ended ended

30 June 2023 30 June 2022

(Unaudited) (Unaudited)

GBP 000 GBP 000

Cash flows from operating activities

Cash absorbed by continuing operations

25 (487) (580)

Interest paid (20) -

Net cash outflow from operating activities (507) (580)

------------------------------ -----------------------------------

Cash flows from investing activities

Cash movements in relation to assets

held for sale (509) (381)

Proceeds from disposal of investments 193 -

Loan granted to related party - (70)

------------------------------ -----------------------------------

Net cash (outflow)/inflow from investing

activities (316) (451)

------------------------------ -----------------------------------

Cash flows from financing activities

368 -

Proceeds of long-term borrowings

------------------------------ -----------------------------------

368 -

Net cash (outflow)/inflow from financing

activities

------------------------------ -----------------------------------

Net (decrease)/increase in cash and

cash equivalents (455) (1,031)

------------------------------ -----------------------------------

Cash and cash equivalents at beginning

of period 750 2,059

------------------------------ -----------------------------------

Cash and cash equivalents at end of

period 295 1,028

============================== ===================================

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION

1 BASIS OF PREPARATION

The financial information has been prepared under the historical

cost convention and on a going concern basis and in accordance with

International Financial Reporting Standards and as applied in

accordance with the provisions of the Companies Act 2006. The

principal accounting policies adopted by the Company are set out

below.

The condensed interim financial information for the period ended

30 June 2023 has not been audited or reviewed in accordance with

the International Standard on Review Engagements 2410 issued by the

Auditing Practices Board. The figures were prepared using

applicable accounting policies and practices consistent with those

adopted in the statutory accounts for the year ended 31 December

2022. The figures for the year ended 31 December 2022 have been

extracted from these accounts, which have been delivered to the

Registrar of Companies, and contained an unqualified audit

report.

The condensed interim financial information contained in this

document does not constitute statutory accounts. In the opinion of

the Directors the financial information for this period fairly

presents the financial position, result of operations and cash

flows for this period.

This Interim Financial Report was approved by the Board of

Directors on 29 September 2023.

Statement of compliance

These condensed company interim financial statements have been

prepared in accordance with International Financial Reporting

Standards (IFRS) as adopted by the European Union with the

exception of International Accounting Standard ('IAS') 34 - Interim

Financial Reporting. Accordingly, the interim financial statements

do not include all of the information or disclosures required in

the annual financial statements and should be read in conjunction

with the Company's 2022 annual financial statements.

2 ADOPTION OF NEW AND REVISED STANDARDS

The accounting policies adopted in the preparation of the

interim financial statements are consistent with those followed in

the preparation of the Company's annual financial statements for

the year ended 31 December 2022, except for the adoption of new

standards effective as of 1 January 2023. The Company has not early

adopted any standard, interpretation or amendment that has been

issued but is not yet effective.

IFRS 17 Insurance contracts

IAS 1 and IFRS Practice Statement 2 Disclosure of accounting policies

IAS 8 (Amendments) Definition of accounting estimates

IAS 12 (Amendments) Deferred tax related to assets and

liabilities arising from a single transaction

IFRS 16 (Amendments) Liability in a Sale and Leaseback

IAS 1 (Amendments) Classification of liabilities as current or

non-current - deferral of effective date

IAS 1 (Amendments) Non-current liabilities with covenants

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

3 CRITICAL ACCOUNTING ESTIMATES AND JUDGEMENTS

The Company makes estimates and assumptions regarding the

future. Estimates and judgements are continually evaluated based on

historical experience and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances. In the future, actual experience may differ from

these estimates and assumptions. The estimates and assumptions that

have a significant risk of causing a material adjustment to the

carrying amounts of assets and liabilities within the next

financial period are discussed below.

Share-based payments (note 17)

The Company utilised an equity-settled share-based remuneration

scheme for employees. Employee services received, and the

corresponding increase in equity, are measured by reference to the

fair value of the equity instruments at the date of grant,

excluding the impact of any non-market vesting conditions. The fair

value of share options is estimated by using Black-Scholes

valuation method as at the date of grant. The assumptions used in

the valuation are described in note 17 and include, among others,

the expected volatility, expected life of the options and number of

options expected to vest.

Recoverability of trade receivables (note 14)

The Company considers the recoverability of trade receivables to

be a key area of judgement. The Company considers trade receivables

to be credit impaired once there is evidence a loss has been

incurred. An expected credit loss is calculated on an annual basis.

The Directors believe that the debtor is still recoverable based on

their knowledge of the market in Tanzania and historical evidence

of similar receivables being paid. The Directors have recognised

the asset as they believe they are still legally entitled to

receive it. The Tanzanian Government have a history of building up

receivables with other companies and billing them at a future

date.

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

4 OPERATING SEGMENTS

Based on risks and returns, the Directors consider that the

primary reporting format is by business segment. The Directors

consider that there are two business segments:

-- Head office support from the UK

-- Discontinued operations on its investments in Tanzania

Continuing Discontinued

Operations Operations

6 months to 30 June 2023 UK Tanzania Total

GBP000 GBP000 GBP000

Administrative expenses (971) - (971)

Share of loss in joint venture (40) - (40)

Interest income 73 - 73

Other gains and losses 125 221 346

Fair value through profit and

loss (21) - (21)

Profit/(loss) from operations

per reportable segment (834) 221 (613)

============ ============= =======

Additions to non-current assets 74 - 74

Reportable segment assets 1,935 11,445 13,380

Reportable segment liabilities 487 3,478 3,965

6 months to 30 June 2022 Continuing Discontinuing

Operations Operations

UK Tanzania Total

GBP000 GBP000 GBP000

Administrative expenses (733) - (733)

Interest income 65 - 65

Other gains and losses 99 1,314 1,413

Fair value through profit and

loss 27 - 27

Profit/(loss) from operations

per reportable segment (542) 1,314 772

============ ============== ========

Additions to non-current assets 27 - 27

Reportable segment assets 3,078 13,295 16,373

Reportable segment liabilities (202) (166) (368)

An operating segment is a distinguishable component of the

Company that engages in business activities from which it may earn

revenues and incur expenses, whose operating results are regularly

reviewed by the Company's chief operating decision maker to make

decisions about the allocation of resources and assessment of

performance and about which discrete financial information is

available.

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

5 REVENUE

6 months 6 months

to to

30 June 30 June

2023 2022

GBP000 GBP000

Other significant

revenue

Interest income 73 65

Trade receivables accrue interest for non-payment. Outstanding

debtors accrue interest at a rate in accordance with the joint

venture agreement and are generally on terms of 30 days. In 2023,

there is a provision of GBPnil (June 2022: GBPnil) for expected

credit losses on trade receivables.

Interest income relates to interest charged on outstanding

invoices.

6 EXPENSES BY NATURE

6 months 6 months

to 30 June to 30 June

2023 2022

GBP000 GBP000

Continuing operations

Fees payable to the Company's auditor for

the audit of the Company's financial statements (31) (22)

Professional, legal, and consulting fees (430) (291)

AIM related costs including

investor relations (31) (44)

Accounting-related services (98) (73)

Travel and subsidence (2) (7)

Office and administrative

expenses (64) (9)

Other expenses (107) -

Share-based payments - (119)

Directors' remuneration (173) (133)

Wages and salaries and other related costs (35) (35)

(971) (733)

============ ============

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

7 EMPLOYEES

6 months 6 months

to to

30 June 30 June

2023 2022

Average number of employees (excluding executive

directors): 1 1

========= =========

6 months 6 months

to to

30 June 30 June

2023 2022

(unaudited) (unaudited)

GBP000 GBP000

Their aggregate remuneration comprised:

Wages and salaries 22 22

============== ==============

6 months 6 months

to to

30 June 30 June

2023 2022

(unaudited) (unaudited)

GBP000 GBP000

Directors' remuneration 173 133

============== ==============

Salary and Share-based Termination Total

fees payments payments

GBP000 GBP000 GBP000 GBP000

Period ended 30 June 2023

Alastair Ferguson 38 - - 38

Tom Reynolds 75 - - 75

Donald Nicolson 25 - - 25

Muir Miller 20 - - 20

Niall Roberts 8 - - 8

Matt Bower 7 - - 7

----------- ------------ ------------ -------

173 - - 173

=========== ============ ============ =======

Salary and Share-based Termination Total

fees payments payments

GBP000 GBP000 GBP000 GBP000

Period ended 30 June 2022

Alastair Ferguson 37 25 - 62

Tom Reynolds 75 25 - 100

Donald Nicolson 13 37 - 50

Muir Miller 8 20 - 28

Douglas Rycroft - 12 - 12

Niall Roberts - - - -

Matt Bower - - - -

----------- ------------ ------------ -------

133 119 - 252

=========== ============ ============ =======

From February 2020, the Directors opted to defer their salaries

with payments resuming from 2022. Shares in lieu of salary will be

issued for deferred amounts (note 17).

No directors received pension contributions in H1 2023 or

2022.

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

8 OTHER GAINS AND LOSSES

6 months 6 months

to to

30 June 30 June

2023 2022

GBP000 GBP000

Gain on disposal of Helium One shares 16 57

16 57

========= =========

9 DISCONTINUED OPERATIONS

The Company has a 25% interest in a high-quality development

project in Tanzania which the Directors are actively seeking to

divest. This stake has been valued at $16m and operations relating

to this stake are detailed below.

The results of the discontinued business, which have been

included in the income statement, balance sheet and cash flow

statement, were as follows:

6 months 6 months

to to

30 June 30 June

2023 2022

GBP000 GBP000

Impairment credit on fair value revaluation 221 1,314

Net profit/(loss) attributable to discontinuation 221 1,314

========= =========

The profit after tax on disposal of the assets held for sale is

made up as follows:

GBP000

Fair value less costs to sell 7,986

Net book value of assets disposed:

Intangible assets (18,877)

Oil and gas properties (380)

Loan to ARA Petroleum 3,292

Decommissioning provision 166

Impairment on fair value revaluation at 31

December 2022 8,034

---------

(7,765)

---------

Impairment on fair value revaluation at 30

June 2023 221

=========

Earnings per share impact from discontinued operations:

6 months 6 months

to to

30 June 30 June

2023 2022

GBP000 GBP000

Basic and diluted impact (pence) 0.02 0.17

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

9 DISCONTINUED OPERATIONS (CONTINUED)

Cash flow statement

6 months 6 months

to to

30 June 30 June

2023 2022

GBP000 GBP000

Net cash flows from investing activities (509) (381)

--------- ---------

Total cash flows from discontinued operations (509) (381)

========= =========

10 EARNINGS PER SHARE

The calculation of earnings per share is based on the loss after

taxation divided by the weighted average number of shares in issue

during the period:

Six months Six months

to to

30 June 2023 30 June

2022

(Unaudited) (Unaudited)

Weighted average number of ordinary shares

for basic profit/loss per share (000) 900,496 758,790

Weighted average number of ordinary shares

for diluted profit/loss per share (000) 1,022,703 758,790

GBP000 GBP000

Earnings

Continuing operations

(Loss)/profit for the period from continued

operations (834) (542)

============ ===========

Discontinued operations

Profit/(loss) for the period from discontinued

operations 221 1,314

============ ===========

Basic earnings per share (pence)

From continuing operations (0.09) (0.07)

From discontinuing operations 0.02 0.17

------------ -----------

(0.07) 0.10

Diluted earnings per share (pence)

From continuing operations - -

From discontinuing operations 0.02 0.17

------------ -----------

As the inclusion of the potential ordinary shares would result

in a decrease in the loss per share, they are anti-dilutive and, as

such, a diluted loss per share is not included.

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

11 INVESTMENTS

Quoted Equity Investments

Cost 30 June 31 December

2023 2022

GBP000 GBP000

Quoted equity investments 58 206

Unquoted equity investments - 67

------- -----------

58 273

------- -----------

The quoted investments in the current year relate to an equity

investment held in Helium One Ltd, a company incorporated in the

British Virgin Islands. Their subsidiaries hold helium mining

licenses across Tanzania.

The shares held have been valued at the mark-to-market value of

5.75p per share at 30 June 2023. During the period to 30 June 2023,

the Company disposed of 1,906,088 shares. On disposal of the shares

the investment was revalued to the mark-to-market value on the

various dates of disposal and a subsequent gain or loss

recognised.

Unquoted Equity Investments

Cost GBP000

At 1 January 2022 125

Remeasurement (58)

------

At 31 December 2022 67

Disposal

------

At 31 December and 30 June 2023 (67)

Carrying amount

At 30 June 2023 -

======

The unquoted investments in the current period relate to an

equity investment held in Corallian Energy Limited, a company

incorporated in England which holds interests in oil and gas basins

in the United Kingdom.

12 SUBSIDIARIES

Details of the company's subsidiaries at 30 June 2023 are as

follows:

Name of undertaking Registered office Principal activities Class % held

of shares Direct

held

Scirocco Energy 1 Park Row, Leeds, United Dormant Holding

International Limited Kingdom, LS1 5AB Company Ordinary 100.00

Scirocco Energy 1 Park Row, Leeds, United Investment Holding

(UK) Limited Kingdom, LS1 5AB Company Ordinary 100.00

The results of all subsidiaries are included within the

consolidated results of Scirocco Energy plc.

Under section 479A of the Companies Act 2006, Scirocco Energy

PLC agrees that Scirocco Energy (UK) Limited is exempt from audit.

Under section 479C, Scirocco Energy PLC guarantees all outstanding

liabilities for the subsidiary.

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

13 JOINT VENTURES

The Group has a 50% (2022: 50%) interest in joint venture,

Energy Acquisitions Group Limited, a company incorporated in

Northern Ireland. The primary activity of Energy Acquisitions Group

Limited is to acquire and finance renewable energy assets in the

United Kingdom.

The Group's interest in EAG is accounted for using the equity

method in the consolidated financial statements. Summarized

financial information of the joint venture, and reconciliation with

the carrying amount of the investment in the consolidated financial

statements at 30 June 2022 are set out below:

Name of undertaking Registered office Principal activities Class % held

of shares Direct

held

32 Lodge Road, Coleraine, Investment in

Energy Acquisitions Northern Ireland, BT52 renewable energy

Group Limited 1NB assets Ordinary 50.00

Energy Acquisitions Group Limited consolidated summary statement

of financial position (unaudited)

2023 2022

GBP000 GBP000

Non-current assets 3,039 2,960

Current assets 493 593

Current liabilities (98) (113)

Non-current liabilities (3,290) (3,360)

The following amounts have been included

in the amounts above

Cash and cash equivalents 223 326

Current financial liabilities (98) (113)

Non-current financial liabilities (3,290) (3,360)

Net assets (100%) 144 80

Group share of net assets (50%) 72 40

Energy Acquisitions Group Limited consolidated summary profit

and loss account (unaudited)

2023 2022

GBP000 GBP000

Revenue 574 1,414

Direct costs (318) (561)

Overhead and administrative expenses (205) (297)

Interest payable and similar expenses (135) (334)

Profit for the financial year (84) 222

========================= ========

The following amounts have been included

in the amounts above

Depreciation and amortization 33 62

Interest income - -

Interest expense 135 334

Income tax expense - -

There were no dividends received from the joint venture during

the year and there are no dividends forecast.

The joint venture had no contingent liabilities or commitments

as at 30 June 2023 and 2022. The financial statements of the JV are

prepared for the same reporting period as the Group. When

necessary, adjustments are made to bring the accounting policies in

line with those of the Group. Presentation of the summarized

financial information has been made on the basis of the Joint

Venture's published financial statements.

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

14 ASSETS AND LIABILITIES CLASSIFIED AS HELD FOR SALE

30 June 2023 31 December

2022

GBP000 GBP000

Intangible assets 11,445 10,714

Total assets classified as held for

sale 11,445 10,714

========================== ============

Loan 3,312 2,944

Decommissioning provision 166 166

-------------------------- ------------

3,478 3,110

========================== ============

At the date of authorization of these interim financial

statements, it was determined that a sale would be highly probable,

following the approval of shareholders at the general meeting on 29

June 2022.

15 TRADE AND OTHER RECEVIABLES

30 June 2023 31 December

2022

GBP000 GBP000

Other receivables 91 96

Less provision for expected credit losses - -

-------------------------- ------------

91 96

VAT recoverable 32 74

Prepayments 11 40

134 210

========================== ============

The Directors consider that the carrying amount of trade and

other receivables approximates to their fair value.

16 TRADE AND OTHER PAYABLES

30 June 2023 31 December

2022

GBP000 GBP000

Trade payables 100 38

Accruals 384 65

Other payables 3 121

------------------------- ------------

487 224

========================= ============

The Directors consider that the carrying amount of trade

payables approximates to their fair value.

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

17 SHARE CAPITAL

Number of Nominal value

shares

GBP000

a) Called up, allotted, issued and fully

paid: Ordinary shares of 0.2 pence each

As at 31 December 2021 758,787,925 1,518

24 January 2022 - placing for cash at

0.72 pence 20,465,467 40

18 March 2022 - placing for cash at 0.54

pence 28,490,028 57

6 May 2022 - placing for cash at 0.46

pence 17,459,747 35

21 July 2022 - placing for cash at 0.28

pence 30,369,291 61

27 September 2022 - placing for cash

at 0.20 pence 44,923,630 90

----------------- --------------

At 31 December 2022 and 30 June 2023 900,496,088 1,801

================= ==============

30 June 2023 31 December

GBP000 2022

GBP000

b) Deferred shares

At beginning of the period 1,831 2,729

Shares not issued moved to deferred share

capital - 19

Issue of new shares - (556)

Cash settlement of shares not issued - (180)

Reclassify shares not issued as current

liability (181)

----------------- --------------

1,831 1,831

================= ==============

c) Total share options in issue

During the period no incentive options were granted (2022: nil).

As at June 30 2022 there were 51,419,781 incentive options in issue

(2022: 51,419,781).

During the period there were no share options in lieu of salary

and/or fees due to the relevant option holders were granted (2022:

10,193.284). As at 30 June 2023 there were 54,246,990 share options

in lieu of salary and/or fees in issue (2022: 44,053,706).

d) Total warrants in issue

All warrants lapsed in the prior year and no warrants were

issued, cancelled or exercised during the period (2022: no warrants

were issued).

18 SHARE PREMIUM ACCOUNT

30 June 2023 31 December

GBP000 2022

GBP000

At beginning of the period 38,408 38,399

Issue of new shares - 253

38,408 38,408

============ ===========

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

19 SHARE BASED PAYMENT

The Company has opted to remunerate the Directors for the period

to 30 June 2022 by a grant of an option over the Ordinary Shares of

the capital of the Company as detailed in the deed of option

grants. The life of the options is 18 months. There were 3

executive directors and 2 non-executive directors who are members

of the plan. The following table summarizes the expense recognized

in the Statement of Comprehensive Income since the options were

granted.

30 June 2023 31 December

2022

GBP000 GBP000

Directors' options - 32

Incentive options - 87

Credit to equity for equity-settled share-based

payments - 119

========================= ============

During June 2020 (and the height of the Covid-19 pandemic) the

Company sought to put in place a strategy that would help to

conserve the Company's cash position in the near term and to

maximise alignment between the Board, Management team and

Shareholders.

Accordingly, the Company proposed to grant nominal cost options

over new Ordinary Shares of 0.2p (GBP0.002) to Directors and select

members of the Management Team ("the Director Options"). The award

of Director Options ceased in August 2022 and the total options

issued up to this date were 70,787,245.

In 2021, members of the Management Team were also awarded

options over Ordinary Shares with an exercise price of 1.3p

(GBP0.013) ("the Incentive Options"), which was approximately a 24%

premium to the closing mid-market price of the Company's Ordinary

Shares on 26June 2020. Each Incentive Option is ordinarily

exercisable on the 3rd anniversary of the grant date (being 30 June

2023), except in the event of specified corporate events or,

exceptionally, if the option holder leaves as a 'good leaver'. No

further Incentive Options were awarded in the period ended June

2023 or in the year ended December 2022.

The Company used the Black-Scholes model to determine the value

of the incentive options and the inputs. There were no incentive

share options for the period ended 30 June 2023. The value of the

options and the inputs for the period ended 30 June 2023 were as

follows:

Issue 30 June 2020

Incentive options

Share price at grant (pence) 1.09

Exercise price at grant (pence) 1.30

Expected volatility (%) 84.42

Expected life (years) 6

Risk free rate (%) 0.17

Expected dividends (pence) nil

Expected volatility was determined using the Company's share

price for the preceding 3 years.

The total share-based payment expense in the period for the

Company was GBPnil in relation to the issue of incentive options

(2022: GBP86,806) and GBPnil finance charges in relation to

warrants (2022: GBPnil).

The Incentive Options granted represent approximately 6.8% of

the Company's issued share capital (excluding warrants issued to

Prolific Basins LLC). The Board has retained additional headroom

for additional Incentive Options as it recognises that the future

performance of the Company will be dependent on its ability to

retain the services of key executives.

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

20 FINANCIAL INSTRUMENTS

Categories of financial instruments

The following table combines information about:

-- Classes of financial instruments based on their nature and characteristics; and

-- The carrying amounts of financial instruments

30 June 2023 31 December

2022

GBP000 GBP000

Financial assets at amortised cost

Other debtors 91 96

Prepayments 11 40

Cash and cash equivalents 295 750

Loan receivable from related party 1,522 1,448

1,919 2,334

========================= =============

Book value Fair value Book value Fair value

30 June 30 June 2023 31 Dec 2022 31 Dec 2022

2023

GBP000 GBP000 GBP000 GBP000

Financial assets at fair

value

Non-current investment -

Helium One 58 58 206 206

Non-current investment -

Corallian Energy Limited - - 67 67

58 58 273 273

=========== ========================= ============= =============

30 June 2023 31 December

2022

GBP000 GBP000

Financial liabilities at amortised cost

Trade payables 100 38

Accruals 384 65

Other payables 3 121

487 224

========================= ============

The table below analyses financial instruments carried at fair

value, by valuation method.

Fair values are categorized into different levels in a fair

value hierarchy based on the inputs used in the valuation

techniques as follows:

-- Level 1: quoted prices (unadjusted) in active markets for identical assets or liabilities.

-- Level 2: inputs other than quoted prices included in Level 1

that are observable for the asset or liability, either directly

(i.e., as prices) or indirectly (i.e., derived from prices).

-- Level 3: inputs for the asset or liability that are not based

on observable market data (unobservable inputs).

The fair values for the Company's assets and liabilities are not

materially different from their carrying values in the financial

statements.

The following table presents the Company's financial assets that

are measured at fair value:

Level Level Level 3 Total

1 2

GBP000 GBP000 GBP000 GBP000

Non-current investment

- Helium One 58 - - 58

58 - - 58

======= ======= ======== =======

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

20 FINANCIAL INSTRUMENTS (CONTINUED)

The Company does not have any liabilities measured at fair

value. There have been no transfers in to or transfers out of fair

value hierarchy levels in the period.

Financial instruments in level 1

The fair value of financial instruments traded in active markets

is based on quoted market prices at the reporting date. A market is

regarded as active if quoted prices are readily and regularly

available from an exchange, dealer, broker, industry group, pricing

service, or regulatory agency, and those prices represent actual

and regularly occurring market transactions on an arm's length

basis. The quoted market price used for financial assets held by

the Company is the current bid price.

Financial instruments in level 2

The fair value of financial instruments that are not traded in

an active market is determined by using valuation techniques. These

valuation techniques maximize the use of observable market data

where it is available and rely as little as possible on entity

specific estimates. If all significant inputs required to fair

value an instrument are observable, the instrument is included in

level 2. No investments are valued using level 2 inputs in the

period.

Financial instruments in level 3

If one or more of the significant inputs is not based on

observable market data, the instrument is included in level 3.

Following the guidance of IFRS 9, these financial instruments have

been assessed to determine the fair value of the instrument. In

their assessment, the Directors have considered both external and

internal indicators to decide whether an impairment charge must be

made or whether there needs to be a fair value uplift on the

instrument.

The carrying value of the Company's financial assets and

liabilities measured at amortised cost are approximately equal to

their fair value. The Company is exposed through its operations to

one or more of the following financial risks:

-- Fair value or cash flow interest rate risk

-- Foreign currency risk

-- Liquidity risk

-- Credit risk

-- Market risk

-- Expected credit losses

Policy for managing these risks is set by the Board. The policy

for each of the above risks is described in more detail below.

Fair value and cash flow interest rate risk

Generally, the Company has a policy of holding debt at a

floating rate. The Directors will revisit the appropriateness of

this policy should the Company's operations change in size or

nature. Operations are not permitted to borrow long-term from

external sources locally.

Foreign currency risk

Foreign exchange risk arises because the Company has operations

located in various parts of the world whose functional currency is

not the same as the functional currency in which the Company's

investments are operating. The Company's net assets are exposed to

currency risk giving rise to gains or losses on retranslation into

sterling. Only in exceptional circumstances will the Company

consider hedging its net investments in overseas operations as

generally it does not consider that the reduction in volatility in

net assets warrants the cash flow risk created from such hedging

techniques.

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

20 FINANCIAL INSTRUMENTS (CONTINUED)

The Company's exposure to foreign currency risk at the end of

the reporting period is summarized below.

30 June 2023 31 December

2022

$000 $000

USD USD

Trade and other receivables 115 116

Cash and cash equivalents 372 878

Trade and other payables - -

Net exposure 487 994

============= ============

Sensitivity analysis

As shown in the table above, the Company is primarily exposed to

changes in the GBP:USD exchange rate through its cash balance held

in USD and trading balances. The table below shows the impact in

GBP on pre-tax profit/loss of a 10% increase/decrease in the

GBP:USD exchange rate, holding all other variables constant.

30 June 2023 31 December

2022

GBP000 GBP000

GBP:USD exchange rate increases 10% 32 136

GBP:USD exchange rate decreases 10% (30) (69)

Liquidity risk

The liquidity risk of each entity is managed centrally by the

treasury function. Each operation has a facility with treasury, the

amount of the facility being based on budgets. The budgets are set

locally and agreed by the Board annually in advance, enabling the

cash requirements to be anticipated. Where facilities of the Group

need to be increased, approval must be sought from the finance

Director. Where the amount of the facility is above a certain

level, agreement of the Board is needed.

All surplus cash is held centrally to maximize the returns on

deposits through economies of scale. The type of cash instrument

used, and its maturity date will depend on the forecast cash

requirements.

The table below analyses the Company's financial liabilities

into relevant maturity groupings based on their contractual

maturities. The amounts presented are the undiscounted cash

flows.

Less than 6 to 12 Between Between

6 months months 1 and 2 years 2 and 5 years

GBP000 GBP000 GBP000 GBP000

30 June 2023

Trade and other payables 487 - - -

Total 487 - - -

========== ======== =============== ===============

31 December 2022

Trade and other payables 224 - - -

Total 224 - - -

====

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

20 FINANCIAL INSTRUMENTS (CONTINUED)

Credit risk

The Company is mainly exposed to credit risk from credit sales.

It is Company policy, implemented locally, to assess the credit

risk of new customers before entering contracts. Such credit

ratings are taken into account by local business practices.

The Company does not enter into complex derivatives to manage

credit risk, although in certain isolated cases may take steps to

mitigate such risks if it is sufficiently concentrated.

Market risk

As the Company invests in listed companies, the market risk will

be that of finding suitable investments for the Company to invest

in and the returns that those investments will yield given the

markets in which investments are made.

Expected credit losses

Allowances are recognized as required under the IFRS 9

impairment model and continue to be carried until there are

indicators that there is no reasonable expectation of recovery.

For trade and other receivables which do not contain a

significant financing component, the Company applies the simplified

approach. This approach requires the allowance for expected credit

losses to be recognized at an amount equal to lifetime expected

credit losses. For other debt financial assets, the Company applies

the general approach to providing for expected credit losses as

prescribed by IFRS 9, which permits for the recognition of an

allowance for the estimated expected loss resulting from default in

the subsequent 12-month period. Exposure to credit loss is

monitored on a continual basis and, where material, the allowance

for expected credit losses is adjusted to reflect the risk of

default during the lifetime of the financial asset should a

significant change in credit risk be identified.

Most the Company's financial assets are expected to have a low

risk of default. A review of the historical occurrence of credit

losses indicates that credit losses are insignificant due to the

size of the Company's clients and the nature of the services

provided. The outlook for the oil and gas industry is not expected

to result in a significant change in the Company's exposure to

credit losses. As lifetime expected credit losses are not expected

to be significant the Company has opted not to adopt the practical

expedient available under IFRS 9 to utilize a provision matrix for

the recognition of lifetime expected credit losses on trade

receivables. Allowances are calculated on a case-by-case basis

based on the credit risk applicable to individual

counterparties.

Exposure to credit risk is continually monitored to identify

financial assets which experience a significant change in credit

risk. In assessing for significant changes in credit risk the

Company makes use of operational simplifications permitted by IFRS

9. The Company considers a financial asset to have low credit risk

if the asset has a low risk of default; the counterparty has a

strong capacity to meet its contractual cash flow obligations in

the near term; and no adverse changes in economic or business

conditions have been identified which in the longer term may, but

will not necessarily, reduce the ability of the counterparty to

fulfil its contractual cash flow obligations. Where a financial

asset becomes more than 30 days past its due date additional

procedures are performed to determine the reasons for non-payment

to identify if a change in the exposure to credit risk has

occurred.

Should a significant change in the exposure to credit risk be

identified the allowance for expected credit losses is increased to

reflect the risk of expected default in the lifetime of the

financial asset. The Company continually monitors for indications

that a financial asset has become credit impaired with an allowance

for credit impairment recognised when the loss is incurred. Where a

financial asset becomes more than 90 days past its due date,

additional procedures are performed to determine the reasons for

non-payment to identify if the asset has become credit

impaired.

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

20 FINANCIAL INSTRUMENTS (CONTINUED)

The Company considers an asset to be credit impaired once there

is evidence that a loss has been incurred. In addition to

recognizing an allowance for expected credit loss, the Company

monitors for the occurrence of events that have a detrimental

impact on the recoverability of financial assets. Evidence of

credit impairment includes, but is not limited to, indications of

significant financial difficulty of the counterparty, a breach of

contract or failure to adhere to payment terms, bankruptcy or

financial reorganization of a counterparty or the disappearance of

an active market for the financial asset. A financial asset is only

written off when there is no reasonable expectation of

recovery.

The Company employs the simplified approach to make an estimate

of ECL. There are no outstanding balances as at 30 June 2023

resulting in an ECL of GBPnil in the current year.

21 RELATED PARTY TRANSACTIONS

The only transactions between the Company and related parties

are between the parent and its subsidiaries, relating to a loan

from parent to Scirocco (UK) limited, and interest charged on this

loan. Details of Director's remuneration, being key personnel, are

given in note 7. The company did not enter into any other

transactions with entities having shared or related directors

during the periods presented.

22 ULTIMATE CONTROLLING PARTY

In the opinion of the Directors there is no controlling

party.

23 COMMITMENTS

As at 30 June 2023, the Company had no material commitments (31

December 2022: GBPnil).

24 RETIREMENT BENEFIT SCHEME

The Company operates only the basic pension plan required under

UK legislation, contributions thereto during the period amounted to

GBPnil (31 December 2022: nil).

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

25 CASH GENERATED BY OPERATIONS

30 June 2023 30 June 2022

GBP000 GBP000

Profit/(loss) for the period from continuing

operations (834) (542)

Profit/(loss) for the period for discontinuing

operations 221 1,314

Adjustments for:

Finance costs - -

Exchange movement 2 -

Revaluation of investments to mark-to-market

value 22 (81)

(Profit)/loss on fair value revaluation

of available for sale assets (221) (1,314)

Interest accrued on loan to related party (73) (65)

Equity settled share-based payment expense - 119

Share of loss in joint venture 40

Movements in working capital:

(Increase)/decrease in trade and other

receivables 76 (35)

Increase in trade and other payables 280 24

Cash absorbed by operations (487) (580)

========================= ===================

26 EVENTS AFTER THE REPORTING DATE

Ruvuma Operations Update

On 12 July 2023 the Company provided an operational update

regarding the Ruvuma asset noting the significant progress made by

the JV in the development of the Ruvuma license which provides

improved clarity regarding the timing of contingent payments under

the sale arrangements between ARA Petroleum Tanzania and

Scirocco.

Highlights:

-- Following analysis of the results of the initial 3D seismic

processing and interpretation, the JV partners have chosen a new

optimal target location of the Chikumbi-1 well ("CH-1"). The

Tanzanian authorities have given provisional approval of the new

CH-1 well pad location and final written approval is expected

imminently.

-- The full processing of the 3D seismic data is now complete.

Given the vast volume of data acquired, interpretation is now due

to be completed in Q4 2023, which may result in a full revision of

gas reserve and resource potential for the field.

-- A well-workover of the Ntorya-1 well ("NT-1"), to enable

rapid tie-in to the gas production facilities and bring the well

into early production requires the use of a drilling rig and

remains scheduled to run after the drilling of CH-1.

-- The Gas Sales Agreement ("GSA") in respect of the Ntorya Gas

Field has now been agreed among the JV partners and the Tanzania

Petroleum Development Corporation ("TPDC"). Signing of the GSA will

take place upon approval by the Attorney General's Office.

-- The Field Development Plan ("FDP") for the development of the

Ntorya Area has now been approved by all parties.

-- The Development Licence for the Ntorya Area has been approved

by all relevant Tanzanian authorities and has been submitted to the

Cabinet of Ministers for final authorisation.

NOTES TO CONDENSED INTERIM FINANCIAL INFORMATION (CONTINUED)

26 EVENTS AFTER THE REPORTING DATE (CONTINUED)

-- The Tanzanian authorities have continued with the necessary

workstreams to progress the construction of the export pipeline

from Ntorya to the Madimba Gas Plant to accommodate gas, according

to recent public reports, by December 2023.

-- APT recently received the first shipment of long lead items,

including tubulars, required for the spudding of the CH-1 well.

-- The two-week well-testing programme on the Ntorya-2 well

("NT-2"), designed to provide additional information required for

the design of in-field processing facilities, and originally

scheduled for late March 2023, is now expected to run in the coming

months.

Ruvuma Transaction Update - Tax Clearance Received

On 3 August 2023, The Company announced that it had received

confirmation from the Tanzania Revenue Authority ("TRA") of the

assessed tax liability of c. GBP150k, which was in line with the

Company's expectations, and which has now been paid by the Company.

The TRA issued a Tax Clearance Certificate to Scirocco on 3rd

August 2023 representing a major milestone towards final

completion.

Scirocco then wrote to the Tanzanian Minister for Energy to

obtain the final approval of the transfer of the licence interest

to APT. On receipt of this approval, all conditions precedent to

the transaction will be satisfied and Scirocco and its counterparty

ARA Petroleum Tanzania can proceed to complete the transaction by

the amended long stop date.

Ruvuma Transaction Update - longstop date extension

On 29 August 2023, the Company announced that whilst significant

progress had been made delivering the necessary approvals from the

relevant Tanzanian government authorities it had agreed with its

counterparty APT to extend the longstop for the Ruvuma transaction

to 30 September 2023 to allow sufficient time to achieve the final

approval from the Minister of Energy.

Helium One Shares Recovered and Sold

During August 2023, the Company successfully recovered 1 million

Helium One shares which had been "trapped" after Pello Capital

entered administration in October 2022. These shares were sold

during August 2023 delivering net proceeds of c. GBP75k.

Ruvuma Transaction Update - longstop date extension

On 28 September 2023, the Company announced that whilst

significant progress had been made delivering the necessary

approvals from the relevant Tanzanian government authorities it had

agreed with its counterparty APT to extend the longstop for the

Ruvuma transaction to 20 October 2023 to allow sufficient time to

achieve the final approval from the Minister of Energy.

27 A COPY OF THIS INTERIM STATEMENT IS AVAILABLE ON THE

COMPANY'S WEBSITE: www.sciroccoenergy.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFVIAEITFIV

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

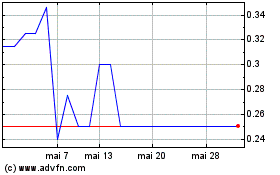

Scirocco Energy (LSE:SCIR)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Scirocco Energy (LSE:SCIR)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024