TIDMMBO

RNS Number : 1728O

MobilityOne Limited

29 September 2023

29 September 2023

MobilityOne Limited

("MobilityOne", the "Company" or the "Group")

Unaudited interim results for the six months ended 30 June

2023

MobilityOne (AIM: MBO), the e-commerce infrastructure payment

solutions and platform provider, announces its unaudited interim

results for the six months ended 30 June 2023.

Highlights:

-- Revenue increased by 7.2% to GBP121.5 million (H1 2022:

GBP113.4 million) due to higher sales for the Group's mobile phone

prepaid airtime reload and bill payment business in Malaysia;

-- Profit after tax of GBP5,117 (H1 2022: profit after tax of GBP0.34 million);

-- Cash and cash equivalents (including fixed deposits) at 30

June 2023 of GBP3.42 million (30 June 2022: GBP4.72 million);

-- The Group is cautious on the outlook for the remainder of

2023, taking into consideration rising interest rates and expenses

including, but not limited to, higher administrative expenses,

higher infrastructure and marketing costs as well as lower gross

profit margins for the Group's products and services; and

-- For future growth, the Group will continue to invest and

enhance its research and development capabilities as well as form

partnerships or to undertake acquisitions in complementary

businesses, as applicable.

For further information, contact:

MobilityOne Limited +6 03 89963600

Dato' Hussian A. Rahman, CEO www.mobilityone.com.my

har@mobilityone.com.my

Allenby Capital Limited

(Nominated Adviser and Broker) +44 20 3328 5656

Nick Athanas / Vivek Bhardwaj

About the Group:

MobilityOne is one of the leading virtual distributors of mobile

prepaid reload and bill payment services in Malaysia. With

connections to various service providers across industries such as

banking, telecommunications, utilities, government agencies, and

transportation, the Group operates through multiple distribution

channels including mobile wallets, e-commerce sites, EDC terminals,

automated teller machines, kiosks, and internet & mobile

banking. Holding licenses in regulated spaces including acquiring,

e-money, remittance and lending, the Group offers a range of

services to the market, including wallet, internet, and

terminal-based payment services, white label e-money, remittance,

lending, and custom fintech ecosystems for communities. The Group's

flexible, scalable technology platform enables cash, debit card,

and credit card transactions from multiple devices while providing

robust control and monitoring of product and service

distribution.

For more information, refer to our website at

www.mobilityone.com.my

Chairman's statement

The Group's revenue increased by 7.2% to GBP121.5 million (H1

2022: revenue of GBP113.4 million) i n the first six months of 2023

as a result of higher sales from the Group's main products and

services in Malaysia, namely the mobile phone prepaid airtime

reload and bill payment business through the Group's banking

channels (i.e. mobile banking and internet banking), electronic

data capture ("EDC") terminals and third parties' e-wallet

applications. Notwithstanding the higher sales, the Group

registered a lower profit after t ax of GBP5,117 in the first six

months of 2023 (H1 2022: profit after tax of GBP0.34 million)

mainly due to a reduction in gross profit margin in the period

under review to 5.08% (H1 2022: gross profit margin of 5.52%),

higher administrative expenses and higher finance costs.

The Group's other businesses such as its international

remittance services, EDC terminals sales and services, e-money and

lending in Malaysia as well as the e-payment solutions activities

in Brunei continued to remain small. The Group did not record any

sales in the Philippines in the first six months of 2023.

As at 30 June 2023, the Group had cash and cash equivalents

(including fixed deposits) of GBP3.42 million (30 June 2022: cash

and cash equivalents of GBP4.72 million) while the secured loans

and borrowings from financial institutions increased to GBP4.14

million (30 June 2022: GBP2.89 million).

Current trading and outlook

The Group's business activities are still predominately

concentrated in Malaysia. Other than the Group's main business

activities of mobile phone prepaid airtime reload and bill payment

in Malaysia, the Group's other businesses are expected to remain

insignificant in 2023. As reported by the Central Bank of Malaysia

in August 2023, the Malaysian economy grew by 2.9% in the second

quarter of 2023 weighed mainly by slower external demand. Domestic

demand remained the key driver of growth, supported by private

consumption and investment. With the challenging global

environment, the Malaysian economy is projected to expand close to

the lower end of the 4.0% to 5.0% range in 2023. Growth will

continue to be supported by domestic demand amid improving

employment and income as well as implementation of multi-year

projects.

As part of the Group's business plans for long-term growth, the

Group has the following initiatives:

(1) Proposed disposal of OneShop Retail Sdn Bhd ("1Shop") and

proposed joint venture with Super Apps Holdings Sdn Bhd ("Super

Apps")

On 19 October 2022, MobilityOne Sdn Bhd ("M1 Malaysia"), the

Group's wholly-owned subsidiary in Malaysia, entered into a Share

Sale Agreement with Super Apps for the proposed disposal by M1

Malaysia of a 60% shareholding in the Group's wholly-owned non-core

subsidiary 1Shop to Super Apps (together the "Proposed Disposal").

Concurrently, M1 Malaysia entered into a Joint-Venture cum

Shareholders Agreement with Super Apps and 1Shop (together the

"Proposed Joint Venture"). The Proposed Disposal and Proposed Joint

Venture are inter-conditional in order to establish a new joint

venture to expand the Group's e-products and services business

initially in Malaysia.

The Proposed Disposal is subject to the completion of a merger

exercise between Technology & Telecommunication Acquisition

Corporation ("TETE") and Super Apps (together the "Merger

Exercise") .

Pursuant to the terms of the Proposed Disposal and subject to

the completion of the Merger Exercise, the Group is expected to

receive cash proceeds of RM40.0 million (c. GBP7.53 million) and

RM20.0 million (c. GBP3.76 million) within 14 days and 180 days

respectively of completion of the Merger Exercise.

A draft proxy statement has been filed by Tete Technologies Inc,

a wholly-owned subsidiary of TETE, on 2 August 2023 ("TETE Proxy

Filing") with the United States Securities and Exchange Commission

("SEC"). An extraordinary general meeting will be convened in due

course by TETE once the TETE Proxy Filing is in complete form and

approved by the SEC. The Company will release further announcements

as and when appropriate.

There can be no guarantee that t he Proposed Disposal and

Proposed Joint Venture can be completed as they are conditional on

the completion of the Merger Exercise, which is out of the Group's

control. The completion of the Proposed Disposal and Proposed Joint

Venture are expected to positively contribute to the future growth

of the Group.

(2) Money transfer business via SWIFT network

To expand the Group's money transfer business via the Society

for Worldwide Interbank Financial Telecommunication ("SWIFT")

network, the Group continues to work with a bank in Malaysia on the

integration process due to the migration of messaging standards

within the SWIFT network while waiting for the Central Bank of

Malaysia's approval, the timings of which continue to remain

uncertain. The Company will make the relevant announcement on the

arrangement with SWIFT as and when is appropriate.

(3) UK electronic money institution application

On 11 May 2023, the Company announced that M1 Tech Limited ("M1

Tech"), the Group's wholly-owned subsidiary in the UK, had

withdrawn its application to the Financial Conduct Authority (the

"FCA"), the financial regulatory body in the UK, for authorisation

as an electronic money institution to provide e-money services in

the UK (the "FCA Application"). This follows receipt of further

feedback from the FCA requesting further information in relation to

certain disclosures relating to M1 Tech's proposed business plan.

The Group is reviewing its proposed business plan to expand its

business in the UK and its options in relation to submitting a

further revised FCA application in due course which addresses the

FCA's latest feedback. The Company will release further

announcements as and when appropriate.

(4) New joint venture to explore business opportunities from the Kingdom of Saudi Arabia

On 26 June 2023, M1 Malaysia entered into a joint venture cum

shareholders agreement with Syed Faisal Algadrie Bin Syed Hassan to

incorporate Qube Nexus Sdn Bhd, Malaysia to explore any suitable

business opportunities from the Kingdom of Saudi Arabia. Any

material developments in relation to new business opportunities

will be announced in due course.

(5) Proposed acquisition of Hati International Sdn Bhd ("Hati")

via Sincere Acres Sdn Bhd ("Sincere")

On 29 September 2023, M1 Malaysia entered into a share sale

agreement with United Flagship Development Sdn Bhd ("Vendor") to

acquire a 49% equity interest in Sincere for a total cash

consideration of RM30.0 million (c. GBP5.217 million) to be paid to

the Vendor in two tranches (the "Proposed Acquisition"). The first

tranche, representing RM2.0 million (c. GBP0.348 million), has been

paid to the Vendor using M1 Malaysia's existing cash resources. The

second tranche, representing the balance of RM28.0 million (c.

GBP4.869 million) (the "Second Tranche"), is required to be paid by

M1 Malaysia by 8 March 2024 (the "Second Tranche Payment Date"). It

is envisaged that the Second Tranche will be paid by the Group

using M1 Malaysia's existing cash resources.

While the Second Tranche Payment Date can be extended for up to

a further 6 months ("Extended Second Tranche Payment Date"), any

payment in relation to the Second Tranche made after the Second

Tranche Payment Date will be subject to an interest charge of 10%

per annum. The balance amount payable for the Second Tranche

(including any interest charge if the payment is made after the

Second Tranche Payment Date) shall be reduced by RM1.0 million (c.

GBP0.174 million) when the payment is made by the Extended Second

Tranche Payment Date.

While the Proposed Acquisition is not subject to any conditions

precedent, both parties have agreed to complete the Proposed

Acquisition by 4 October 2023.

Sincere is an investment holding company with its sole business

activity comprising of owning a 100% equity interest in Hati, an

operating company in Malaysia. Hati is a healthcare information

systems provider in Malaysia focused on healthcare software

development and information technology. T hrough the use of cloud

service platforms and software system solutions, Hati has developed

a product suite comprising of hospital information systems,

clinical information systems, business intelligence platforms and

Internet of Things (IoT)/Artificial Intelligence (AI) enabled

platforms .

The Proposed Acquisition will result in a number of synergistic

benefits for both the Group and Hati. The Proposed Acquisition is

anticipated to enable the Group to vertically integrate its

existing electronic payment systems and services with Hati's suite

of existing products to support payment methods such as credit

cards, debit cards and eWallets via online payments and over the

counter payments. In addition, the Proposed Acquisition will result

in Hati being able to utilise the Group's infrastructure and

engineering know-how to automate electronic billing and

invoicing.

Following completion of the Proposed Acquisition, and as part of

the Group's long-term growth strategy, the Group intends to develop

a payment system that integrates the Group's e-claims and

e-payments services with insurance companies thereby resolving cash

flow issues typically faced by hospitals and clinics. The Group

also intends to explore potential collaborations with the Group's

telecommunication partners in order to enable Hati's real-time

IoT/AI enabled healthcare devices to operate over 5G cellular

networks. The above proposed developments will also contribute to

the Group expanding its customers base for its existing electronic

payment systems and services.

In addition, the Proposed Acquisition will enable the Group to

amongst other benefits, diversify its existing business activities

into the growing healthcare information systems industry.

Further details on the Proposed Acquisition can be found in the

announcement released by the Group on 29 September 2023.

Notwithstanding that the Malaysia economy is expected to grow in

2023 as well as the demand for the Group's mobile phone prepaid

products , t he Group is cautious on the outlook for the remainder

of 2023, taking into consideration rising interest rates and

expenses including, but not limited to, higher administrative

expenses, higher infrastructure and marketing costs as well as

other related expenses . In addition, in order to maintain or grow

the Group's businesses, the Group's gross profit margins for its

products and services have been impacted. For future growth, the

Group will continue to invest and enhance its research and

development as the backbone to support the business and technology

advancement as well as to form partnerships or to undertake

acquisitions in complementary businesses, as applicable.

Abu Bakar bin Mohd Taib (Chairman)

29 September 2023

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHS PERIODED 30 JUNE 2023

Six months Six months Financial

year

Ended Ended Ended

30 June 30 June 31 Dec 2022

2023 2022

Unaudited Unaudited Audited

CONTINUING OPERATIONS GBP GBP GBP

Revenue 121,529,982 113,355,113 233,761,671

Cost of sales (115,358,166) (107,103,390) (221,010,827)

-------------- -------------- -------------------

GROSS PROFIT 6,171,816 6,251,723 12,750,844

Other operating income 40,165 92,839 183,426

Administration expenses (5,914,978) (5,549,417) (11,940,311)

Other operating expenses (174,821) (209,083) (304,196)

Net loss on financial instruments - - (273,642)

OPERATING PROFIT 122,182 586,062 416,121

Finance costs (116,268) (63,501) (137,143)

PROFIT BEFORE TAX 5,914 522,561 278,978

Tax (797) (184,356) (262,350)

-------------- -------------- -------------------

PROFIT FROM CONTINUING

OPERATIONS 5,117 338,205 16,628

============== ============== ===================

Attributable to:

Owners of the parent 1,056 338,842 23,857

Non-controlling interest 4,061 (637) (7,229)

--------------

5,117 338,205 16,628

============== ============== ===================

EARNINGS PER SHARE

Basic earnings per share

(pence) 0.001 0.319 0.022

Diluted earnings per share

(pence) 0.001 0.301 0.021

PROFIT FOR THE PERIOD/YEAR 5,117 338,205 16,628

OTHER COMPREHENSIVE PROFIT/(LOSS)

Foreign currency translation (624,236) 296,985 354,322

TOTAL COMPREHENSIVE PROFIT/(LOSS)

FOR THE PERIOD/YEAR (619,119) 635,190 370,950

==============

Total comprehensive profit/loss

attributable to:

Owners of the parent (624,438) 636,224 378,832

Non-controlling interest 5,319 (1,034) (7,882)

(619,119) 635,190 370,950

============== ============== ===================

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

At At At

30 June 2023 30 June 2022 31 Dec 2022

Unaudited Unaudited Audited

GBP GBP GBP

Assets

Non-current assets

Intangible assets 192,622 421,863 214,180

Property, plant and equipment 900,093 1,180,684 1,122,194

Right-of-use assets 144,414 191,759 182,935

Development cost 280,379 - -

Trade and other receivables 905,758 - 228,050

Other investment 11,045 12,144 12,281

2,434,311 1,806,450 1,759,640

------------- ------------- ------------

Current assets

Inventories 2,280,346 3,162,123 3,189,901

Trade and other receivables 3,277,551 3,015,416 2,179,785

Tax recoverable 254,391 169,179 183,321

Fixed deposits 1,604,051 1,603,471 1,768,584

Cash and cash equivalents 1,813,504 3,114,703 3,246,588

------------- ------------- ------------

9,229,843 11,064,892 10,568,179

------------- ------------- ------------

Total Assets 11,664,154 12,871,342 12,327,819

============= ============= ============

Shareholders' equity

Equity attributable to

equity holders of the Company

Called up share capital 2,657,470 2,657,470 2,657,470

Share premium 909,472 909,472 909,472

Reverse acquisition reserve 708,951 708,951 708,951

Foreign currency translation

reserve 422,188 990,089 1,047,682

Accumulated profit/ (losses) (92,710) 221,219 (93,766)

------------- ------------- ------------

Shareholders' equity 4,605,371 5,487,201 5,229,809

Non-controlling interest (9,792) (8,263) (15,111)

------------- ------------- ------------

Total Equity 4,595,579 5,478,938 5,214,698

------------- ------------- ------------

Liabilities

Non-current liabilities

Loans and borrowings

- secured 195,166 225,171 221,697

Lease liabilities 15,007 74,047 98,450

Deferred tax liabilities 13,926 44,782 15,484

224,099 344,000 335,631

Current liabilities

Trade and other payables 2,775,077 4,063.714 2,947,056

Amount due to directors 2,403 176,457 66,855

Loans and borrowings

- secured 3,943,085 2,668,243 3,647,482

Lease liabilities 123,063 108,810 105,316

Tax payables 848 31,180 10,781

6,844,476 7,048,404 6,777,490

------------- ------------- ------------

Total Liabilities 7,068,575 7,392,404 7,113,121

------------- ------------- ------------

Total Equity and Liabilities 11,664,154 12,871,342 12,327,819

============= ============= ============

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTH PERIODED 30 JUNE 2023

Non-Distributable Distributable

Foreign

Reverse Currency Non-

Share Share Acquisition Translation Accumulated Controlling Total

Capital Premium Reserve Reserve Profit/(Losses) Total Interest Equity

GBP GBP GBP GBP GBP GBP GBP GBP

As at 1 January

2022 2,657,470 909,472 708,951 692,707 (117,623) 4,850,977 (7,229) 4,843,748

Foreign currency

translation - - - 297,382 - 297,382 (397) 296,985

Profit for the

period - - - - 338,842 338,842 (637) 338,205

----------- --------- ------------ ------------ ---------------- ----------- ------------ ------------

As at 30 June

2022 2,657,470 909,472 708,951 990,089 221,219 5,487,201 (8,263) 5,478,938

=========== ========= ============ ============ ================ =========== ============ ============

As at 1 July 2022 2,657,470 909,472 708,951 990,089 221,219 5,487,201 (8,263) 5,478,938

Foreign currency

translation - - - 57,593 - 57,593 (256) 57,337

Profit/(Loss) for

the period - - - - (314,985) (314,985) (6,592) (321,577)

----------- --------- ------------ ------------ ---------------- ----------- ------------ ------------

As at 31 Dec 2022 2,657,470 909,472 708,951 1,047,682 (93,766) 5,229,809 (15,111) 5,214,698

=========== ========= ============ ============ ================ =========== ============ ============

As at 1 January

2023 2,657,470 909,472 708,951 1,047,682 (93,766) 5,229,809 (15,111) 5,214,698

Foreign currency

translation - - - (625,494) - (625,494) 1,258 (624,236)

Profit for the

period - - - - 1,056 1,056 4,061 5,117

----------- --------- ------------ ------------ ---------------- ----------- ------------ ------------

As at 30 June

2023 2,657,470 909,472 708,951 422,188 (92,710) 4,605,371 (9,792) 4,595,579

=========== ========= ============ ============ ================ =========== ============ ============

Share capital is the amount subscribed for shares at nominal

value.

Share premium represents the excess of the amount subscribed for

share capital over the nominal value of the respective shares net

of share issue expenses.

The reverse acquisition reserve relates to the adjustment

required by accounting for the reverse acquisition in accordance

with IFRS 3.

The Company's assets and liabilities stated in the Statement of

Financial Position were translated into Pound Sterling (GBP) using

the closing rate as at the Statement of Financial Position date and

the income statements were translated into GBP using the average

rate for that period. All resulting exchange differences are taken

to the foreign currency translation reserve within equity.

Retained earnings represent the cumulative earnings of the Group

attributable to equity shareholders.

Non-controlling interests represent the share of ownership of

subsidiary companies outside the Group.

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTH PERIODED 30 JUNE 2023

Six months Six months Financial

year

Ended Ended ended

30 June 30 June 31 Dec 2022

2023 2022

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows used in operating

activities

Cash used in operations (816,961) (205,386) (614,763)

Interest paid (116,414) (63,501) (137,143)

Interest received 14,580 11,221 35,933

Tax paid (99,165) (287,340) (421,991)

Tax refund - 5,470 5,532

-----------

Net cash used in operating activities (1,017,960) (539,536) (1,132,432)

----------- ---------- -----------

Cash flows used in investing

activities

Purchase of property, plant and

equipment (9,876) (306,614) (390,056)

Addition in right-of-use assets (23,641) - -

Addition in other investment - - (12,281)

Increase in development cost (280,379) - -

Proceeds from disposal of property,

plant & equipment 163 8,370 8,465

Net cash used in investing activities (313,733) (298,244) (393,872)

----------- ---------- -----------

Cash flows from financing activities

Net change of banker acceptance 662,713 607,556 1,562,937

Repayment of lease liabilities (45,186) (53,825) (111,144)

Repayment of term loan (4,218) (4,038) (9,615)

Net cash from financing activities 613,309 549,693 1,442,178

----------- ---------- -----------

Decrease in cash and cash equivalents (718,384) (288,087) (84,126)

Effect of foreign exchange rate

changes (879,233) 340,737 433,774

Cash and cash equivalents at

beginning of period/year 5,015,172 4,665,524 4,665,524

Cash and cash equivalents at

end of period/year 3,417,555 4,718,174 5,015,172

=========== ========== ===========

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. Basis of preparation

The Group's interim financial statements for the six months

ended 30 June 2023 were authorised for issue by the Board of

Directors on 29 September 2023.

The interim financial statements are unaudited and have been

prepared in accordance with International Financial Reporting

Standards (IFRSs and IFRIC interpretations) issued by the International

Accounting Standards Board (IASB), as adopted by the European

Union, and with those parts of the Companies (Jersey) Law 1991

applicable to companies preparing their financial statements

under IFRS. It has been prepared in accordance with IAS 34 "Interim

Financial Reporting" and does not include all of the information

required for full annual financial statements. The financial

statements have been prepared under the historical cost convention.

Full details of the accounting policies adopted, which are consistent

with those disclosed in the Company's 2022 Annual Report, will

be included in the audited financial statements for the year

ending 31 December 2023.

2. Basis of consolidation

The consolidated statement of comprehensive income and statement

of financial position include financial statements of the Company

and its subsidiaries made up to 30 June 2023.

3. Nature of financial information

The unaudited interim financial information for the six months

ended 30 June 2023 does not constitute statutory accounts under

the meaning of Section 435 of the Companies Act 2006. The comparative

figures for the year ended 31 December 2022 are extracted from

the audited statutory financial statements. Full audited financial

statements of the Group in respect of that financial year prepared

in accordance with IFRS, which we received an unqualified audit

opinion, have been delivered to the Registrar of Companies.

4. Functional and presentation currency

(i) Functional and presentation currency

Items included in the financial statements of each of the Group's

entities are measured using the currency of the primary economic

environment in which the entity operates (the functional currency).

The functional currency of the Group is Ringgit Malaysia (RM).

The consolidated financial statements are presented in Pound

Sterling (GBP), which is the Company's presentational currency

as this is the currency used in the country in which the entity

is listed.

Assets and liabilities are translated into Pound Sterling (GBP)

at foreign exchange rates ruling at the Statement of Financial

Position date. Results and cash flows are translated into Pound

Sterling (GBP) using average rates of exchange for the period.

(ii) Transactions and balances

Foreign currency transactions are translated into the functional

currency using exchange rates prevailing at the dates of the

transactions. Foreign exchange gains and losses resulting from

the settlement of such transactions and from the translation

at year/period-end exchange rates of monetary assets and liabilities

denominated in foreign currencies are recognised in the statement

of comprehensive income.

The financial information set out below has been translated

at the following rates:

Exchange rate (RM: GBP)

At Statement Average for

of Financial year/

Position date Period

Period ended 30 June

2023 5.88 5.50

Period ended 30 June

2022 5.35 5.54

Year ended 31 December

2022 5.29 5.43

5. Segmental analysis

The Group has three operating segments as follows:

(a) Telecommunication services and electronic commerce solutions;

(b) Hardware and services; and

(c) Remittance services and others.

No segmental analysis of assets and capital expenditure are presented

as they are mostly unallocated items which comprise corporate

assets and liabilities. No geographical segment information is

presented as more than 95% of the Group's revenue was generated

in Malaysia.

Telecommunication

services and Hardware Remittance Elimination Total

Group electronic and services

commerce services and others

solutions

6 months ended 30 GBP GBP GBP GBP GBP

June 2023

==================== ================== ========== =========== ============ ============

Segment revenue:

Sales to external

customers 121,242,999 279,339 92,511 (84,867) 121,529,982

-------------------- ------------------ ---------- ----------- ------------ ------------

121,242,999 279,339 92,511 (84,867) 121,529,982

-------------------- ------------------ ---------- ----------- ------------ ------------

Profit before tax 5,914 - - - 5,914

Tax (797) - - - (797)

-------------------- ------------------ ---------- ----------- ------------ ------------

Profit for the

period 5,117 - - - 5,117

-------------------- ------------------ ---------- ----------- ------------ ------------

Non-cash

expenses/(income)*

Depreciation of

property, plant

and equipment 127,350 - - - 127,350

Amortisation of - - - - -

intangible assets

Amortisation of

right-of-use

assets 47,471 - - - 47,471

Unrealised loss on

forex 2,707 - - - 2,707

177,528 - - - 177,528

-------------------- ------------------ ---------- ----------- ------------ ------------

Group

6 months ended 30

June 2022

==================== ================== ========== =========== ============ ============

Segment revenue:

Sales to external

customers 112,494,543 959,051 56,692 (155,173) 113,355,113

-------------------- ------------------ ---------- ----------- ------------ ------------

112,494,543 959,051 56,692 (155,173) 113,355,113

-------------------- ------------------ ---------- ----------- ------------ ------------

Profit before tax 522,561 - - - 522,561

Tax (184,356) - - (184,356)

-------------------- ------------------ ---------- ----------- ------------ ------------

Profit for the

period 338,205 - - - 338,205

-------------------- ------------------ ---------- ----------- ------------ ------------

Non-cash

expenses/(income)*

Depreciation of

property, plant

and equipment 132,115 - - - 132,115

Amortisation of

intangible assets 33,384 - - - 33,384

Amortisation of

right-of-use

assets 43,584 - - - 43,584

--------------------

209,083 - - - 209,083

-------------------- ------------------ ---------- ----------- ------------ ------------

Group

Financial year

ended 31 Dec 2022

-------------------- ------------------ ---------- ----------- ------------ ------------

Segment revenue:

Sales to external

customers 230,754,843 3,296,531 - (289,703) 233,761,671

-------------------- ------------------ ---------- ----------- ------------ ------------

230,754,843 3,296,531 - (289,703) 233,761,671

-------------------- ------------------ ---------- ----------- ------------ ------------

Profit before tax 278,978 - - - 278,978

Tax (262,350) - - - (262,350)

-------------------- ------------------ ---------- ----------- ------------ ------------

Profit for the

period 16,628 - - - 16,628

-------------------- ------------------ ---------- ----------- ------------ ------------

Non-cash

expenses/(income)*

Depreciation of

property, plant

and equipment 282,260 - - - 282,260

Amortisation of

intangible assets 68,051 - - - 68,051

Amortisation of

right-of-use

assets 132,580 - - - 132,580

Bad debt written

off 5,622 - - - 5,622

488,513 - - - 488,513

-------------------- ------------------ ---------- ----------- ------------ ------------

*The disclosure for non-cash expenses has not been split according

to the different segments as the cost to obtain such information

is excessive and provides very little by way of information.

6. Taxation

Taxation on the income statement for the financial period comprises

current and deferred tax. Current tax is the expected amount

of taxes payable in respect of the taxable profit for the financial

period and is measured using the tax rates that have been enacted

at the Statement of Financial Position date.

Deferred tax is recognised on the liability method for all temporary

differences between the carrying amount of an asset or liability

in the Statement of Financial Position and its tax base at the

Statement of Financial Position date. Deferred tax liabilities

are recognised for all taxable temporary differences and deferred

tax assets are recognised for all deductible temporary differences,

unused tax losses and unused tax credits to the extent that it

is probable that future taxable profit will be available against

which the deductible temporary differences, unused tax losses

and unused tax credits can be utilised. Deferred tax is not recognised

if the temporary difference arises from goodwill or negative

goodwill or from the initial recognition of an asset or liability

in a transaction which is not a business combination and at the

time of the transaction, affects neither accounting profit nor

taxable profit.

Deferred tax assets and liabilities are measured at the tax rates

that are expected to apply to the period when the asset is realised

or the liability is settled, based on the tax rates that have

been enacted or substantively enacted by the Statement of Financial

Position date. The carrying amount of a deferred tax asset is

reviewed at each Statement of Financial Position date and is

reduced to the extent that it becomes probable that sufficient

future taxable profit will be available.

Deferred tax is recognised in the income statement, except when

it arises from a transaction which is recognised directly in

equity, in which case the deferred tax is also charged or credited

directly in equity, or when it arises from a business combination

that is an acquisition, in which case the deferred tax is included

in the resulting goodwill or negative goodwill.

7 Earnings per share

The basic earnings per share is calculated by dividing the profit

in the six month period ended 30 June 2023 of GBP 1,056 (30 June

2022: profit of GBP338,842 and year ended 31 December 2022: profit

of GBP23,857) attributable to owners of the parent by the number

of ordinary shares outstanding at 30 June 2023 of 106,298,780

(30 June 2022: 106,298,780 and 31 December 2022: 106,298,780).

The diluted earnings per share for the six month period ended

30 June 2023 is calculated using the number of shares adjusted

to assume the exercise of all dilutive potential ordinary shares

of 112,623,648- on 5 December 2014, the Company granted share

options of 10,600,000 shares at 2.5p to directors and certain

employees of the Group. Share options of 2,000,000 shares have

lapsed due to resignation of employees and no options have been

exercised.

8. Reconciliation of profit before tax to cash generated from operations

Six months Six months Financial

year

ended Ended ended

30 June 2023 30 June 2022 31 Dec 2022

Unaudited Unaudited Audited

GBP GBP GBP

Cash flow from operating

activities

Profit before tax 5,914 522,561 278,978

------------- ------------- ------------

Adjustments for:

Amortisation of intangible

assets - 33,384 68,051

Amortisation of right-of-use

assets 47,471 43,584 132,580

Bad debt written off - - 5,622

Depreciation of property,

plant and equipment 127,350 132,115 282,260

Gain on disposal of property,

plant & equipment (156) (8,090) (8,464)

Impairment loss on trade

receivables - - 282,535

Impairment loss on others

receivables - - 3,403

Impairment loss on goodwill - - 177,546

Interest expenses 116,414 63,501 137,143

Interest income (14,580) (11,221) (35,933)

Reversal on impairment

loss on trade receivable - - (5,061)

Unrealised loss/(gain)

on forex 2,707 - (22,279)

Operating profit before

working capital changes 285,120 775,834 1,296,381

(Increase)/Decrease in

inventories 909,555 (43,552) (71,330)

(Increase)/Decrease in

receivables (1,775,475) 150,139 474,252

Increase in amount due

to Directors &

Shareholder - - (121,754)

Amount due to/by related - 52,030 -

company

Decrease in payables (236,161) (1,139,837) (2,192,312)

------------- ------------- ------------

Cash used in operations (816,961) (205,386) (614,763)

============= ============= ============

9. Contingent liabilities

In the period under review, corporate guarantees of RM27.0

million (GBP4.59 million) (H1 2022: RM27.0 million (GBP5.04

million) were given to a licensed bank by the Company for credit

facilities granted to a subsidiary company.

10. Significant accounting policies

The interim consolidated financial statements have been prepared

applying the same accounting policies that were applied in

the preparation of the Company's published consolidated financial

statements for the year ended 31 December 2022 except for

the adoption of new and amended reporting standards, which

are effective for periods commencing on or after 1 January

2023. Various amendments to standards and interpretations

of standards are effective for periods commencing on or after

1 January 2023 as detailed in the 2022 Annual Report, none

of which have any impact on reported results.

Amortisation of intangible assets

Software is amortised over its estimated useful life. Management

estimated the useful life of this asset to be within 10 years.

Changes in the expected level of usage and technological development

could impact the economic useful life therefore future amortisation

could be revised.

The Group determines whether goodwill is impaired at least

on an annual basis. This requires an estimation of the value-in-use

of the cash generating units ("CGU") to which goodwill is

allocated. Estimating a value-in-use amount requires management

to make an estimation of the expected future cash flows from

the CGU and also to choose a suitable discount rate in order

to calculate the present value of those cash flows.

The research and development costs are amortised on a straight-line

basis over the life span of the developed assets. Management

estimated the useful life of these assets to be within 5 years.

Changes in the technological developments could impact the

economic useful life and the residual values of these assets,

therefore future amortisation charges could be revised.

Impairment of goodwill on consolidation

The Group's cash flow projections include estimates of sales.

However, if the projected sales do not materialise there is

a risk that the value of goodwill would be impaired.

The Directors have carried out a detailed impairment review

in respect of goodwill. The Group assesses at each reporting

date whether there is an indication that an asset may be impaired,

by considering cash flows forecasts. The cash flow projections

are based on the assumption that the Group can realise projected

sales. A prudent approach has been applied with no residual

value being factored. At the period end, based on these assumptions

there was no indication of impairment of the value of goodwill

or of development costs.

Research and development costs

All research costs are recognised in the income statement

as incurred.

Expenditure incurred on projects to develop new products is

capitalised and deferred only when the Group can demonstrate

the technical feasibility of completing the intangible asset

so that it will be available for use or sale, its intention

to complete and its ability to use or sell the asset, how

the asset will generate future economic benefits, the availability

of resources to complete the project and the ability to measure

reliably the expenditure during the development. Product development

expenditures which do not meet these criteria are expensed

when incurred.

Development costs, considered to have finite useful lives,

are stated at cost less any impairment losses and are amortised

through other operating expenses in the income statement using

the straight-line basis over the commercial lives of the underlying

products not exceeding 5 years. Impairment is assessed whenever

there is an indication of impairment and the amortisation

period and method are also reviewed at least at each Statement

of Financial Position date.

11. Dividends

The Company has not proposed or declared an interim dividend.

12. Interim report

This interim financial statement will, in accordance with Rule

26 of the AIM Rules for Companies, be available shortly on

the Company's website at www.mobilityone.com.my .

-Ends-

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VKLBLXKLZBBB

(END) Dow Jones Newswires

September 29, 2023 04:42 ET (08:42 GMT)

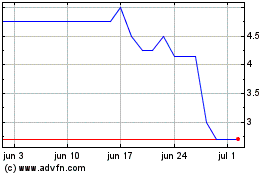

Mobilityone (LSE:MBO)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Mobilityone (LSE:MBO)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024