TIDMLBOW

RNS Number : 4392O

ICG-Longbow Snr Sec UK Prop DebtInv

03 October 2023

This announcement is released by ICG-Longbow Senior Secured UK

Property Debt Investments Limited and contains inside information

for the purposes of the UK version of the Market Abuse Regulation

(EC No. 594/2014).

ICG-Longbow Senior Secured UK Property Debt Investments

Limited

Interim Report And

Unaudited Condensed Interim Financial Statements

For the six months ended 31 July 2023

ICG-Longbow Senior Secured UK Property Debt Investments Limited

("the Company") is pleased to announce the released of its Interim

Financial Statements for the six months ended 31 July 2023 which

will shortly be available on the Company's website at

(ww.lbow.co.uk) where further information on the Company can also

be found. The interim financial statements are also available for

viewing on the National Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

All capitalised terms are defined in the Glossary of Capitalised

Defined Terms unless separately defined.

Financial Highlights

Key Developments

-- The Company is continuing to pursue an orderly realisation of

its assets, although delays are occurring due to difficult market

conditions. During the period, the Company returned GBP6.67 million

of shareholder capital, equating to 5.50 pence per ordinary

share.

-- After period end, a further GBP9.00 million of shareholder

capital was returned, equating to 7.40 pence per ordinary share. As

at the date of this report, the Company has now returned capital of

44.90 pence per ordinary share to shareholders, equating to

GBP54.46 million in total.

-- Dividends were declared and paid totalling 0.50 pence per

ordinary share for the six-month period to 31 July 2023.

-- The Company is taking decisive action to seek to realise its

remaining investments. As at the date of this report, all remaining

loans other than Northlands are subject to formal enforcement

processes.

-- The Company has increased ECL provisions by GBP17.38 million to GBP21.32 million.

- GBP5.13 million in respect of the Southport loan, increasing

the total provision to GBP7.42 million.

- GBP10.59 million in respect of the RoyaleLife loan, increasing

the total provision to GBP12.22 million.

- GBP1.66 million in respect of the Affinity loan, increasing

the total provision to GBP1.68 million.

-- Total loans outstanding at amortised cost plus interest

receivable, excluding ECL adjustments, amount to GBP65.93 million

as at 31 July 2023.

Performance

-- NAV of GBP 55.37 million as at 31 July 2023 after ECL

adjustments of GBP(21.32 million) (31 January 2023: GBP77.35

million after ECL adjustments of GBP(3.94 million)).

-- NAV per share as at 31 July of 45.64 pence and 38.24 pence

following capital repayment on 1 September 2023.

-- (Loss)/profit after tax of GBP(14.71) million for the six

months ended 31 July 2023 (31 July 2022: GBP 2.73 million).

-- (Loss)/Earnings per share for the period of (12.13) pence (31 July 2022: 2.25 pence).

Dividend

-- Total dividends paid and declared for the period ended 31

July 2023 of 0.50 pence per share (31 July 2022: 2.1 pence per

share), comprising an interim dividend of 0.50 pence per share paid

in respect of quarter ended 31 January 2023.

Investment Portfolio

-- As at 31 July 2023, the Company's investment portfolio

comprised of four loans with an aggregate principal balance of

GBP57.97 million, and a carrying value after provision for ECL of

GBP44.61 million (31 January 2023: five loans with an aggregate

principal balance of GBP67.44 million, and a carrying value of

GBP68.96 million).

-- Weighted average portfolio LTV as at 31 July 2023 was 99.4% (31 January 2023: 80.9%).

*Unless stated otherwise, loan balances are stated gross of ECL

provisions for impairment. A comparison to the carrying value of

the loans is set out in Note 5 to the accounts.

Corporate Summary

Investment Objective

In line with the revised Investment Objective and Policy

approved by shareholders at the Extraordinary General Meeting in

January 2021, the Company is undertaking an orderly realisation of

its investments.

Structure

The Company is a non-cellular company limited by shares

incorporated in Guernsey on 29 November 2022 under the Companies

Law. The Company's registration number is 55917, and it has been

registered with the GFSC as a registered closed-ended collective

investment scheme. The Company's ordinary shares were admitted to

the premium segment of the FCA's official List and to trading on

the Main Market of the London Stock Exchange as part of its IPO

which completed on 5 February 2013. The issued capital comprises

the Company's ordinary shares denominated in Pounds Sterling.

Following the dissolution of ICG Longbow Senior Debt S.A. on 18

January 2022, the Company assumed the assets and liabilities of its

former subsidiary.

Investment Manager

The Company has appointed ICG Alternative Investment Limited as

external discretionary investment manager, under the Alternative

Investment Fund Managers Directive (AIFMD), within a remit set by

the Board.

Chairman's Statement

Introduction

On behalf of the Board, I present the Unaudited Interim

Financial Statements for the Company for the six months ended 31

July 2023.

There is no doubt that this half year period has been difficult

for the Company as it seeks to secure timely exits from its

remaining portfolio of investments in what are extremely

challenging market conditions. Through the Investment Manager, the

Company has taken decisive action on all its remaining positions to

seek to accelerate realisations. Shareholders will be aware that

all three of the major remaining investments are now subject to

enforcement processes to assist in procuring appropriate exits.

Following the further deterioration in market conditions during the

period, and in light of the enforcement actions being taken,

significant additional impairment provisions have been made against

these remaining loans. Detailed updates on the loan positions are

provided below and in the Investment Manager's Report.

Current UK economic and property market conditions are not

conducive to quick or easy asset sales. The sustained rise in UK

interest rates, up four percentage points in a little over a year,

has dramatically reduced liquidity in property and finance markets

as well as affecting asset prices in many property sectors. The

value of property transactions in the first half of 2023 was over

50% lower than the same period in the prior year, and 37% below the

10-year average. Hotel sales in the first half were at their lowest

levels for over a decade. More recently, the data has trended

weaker again: Colliers International reports that property

investment transactions in July were less than GBP1bn, the lowest

monthly level since 2008.

An illiquid and distressed market with few buyers is clearly not

helpful for any seller. Compounding the problem are finance

markets, where lenders are struggling with reduced interest

coverage on new or maturing loans, and borrowers are facing all-in

rates that often cannot be accretive to returns.

It is not clear how long it may take for liquidity to improve

but it seems unlikely to be soon. The few buyers that exist are

opportunistic, under no pressure to acquire assets and demand steep

discounts. Accordingly, the environment for the Company to exit its

remaining investments is expected to remain extremely challenging

in the near term.

Portfolio

The Company received partial repayments of the Northlands loan

during the period, totalling over GBP9.0 million in aggregate.

Following further partial repayments after the period end, the

remaining balance is GBP0.1 million, plus a modest amount of

interest and fees, and is expected to be repaid in full in the near

term through further property sales.

We have already notified shareholders of the challenges

experienced in the Company's RoyaleLife investment and, since our

last report, administrators were appointed over all of the

property-holding vehicles securing the Company's loan. The Board is

aware that administrators have also been called in over many other

entities within the wider Royale group, as other secured creditors

have taken action to protect their positions in the same manner as

the Company.

Shareholders will recall that the Company's loan is a part of a

wider structure of lending to Royale. The Investment Manager, on

behalf of the Company and its co-lenders, together with the

administrator, is in discussion with credible parties who have

expressed interest in acquiring the properties, but the complexity

of the structure and various hurdles associated with the prior

sponsor mean that challenges remain. We appreciate that it is

frustrating for shareholders that we are unable to provide more

details at this time due to necessary confidentiality. However, I

wish to assure you that every effort is being made by the Board,

Investment Manager and advisers to effect a good outcome. The

valuation applied in these interim financial statements reflects

the uncertainty.

In order to try to accelerate a repayment, the Investment

Manager appointed a receiver over the asset securing the Affinity

loan in September 2023. From an occupational perspective, the

property's performance continues to be robust with interest covered

in full by rental income. However, despite a lengthy period on the

market for sale there have been no formal bids and it is hoped that

a receivership-led sale will prompt renewed interest from potential

buyers.

The hotel asset securing the Southport loan continues to trade

under the administrator and has been profitable in the year to date

despite the dramatic increases in energy and labour costs faced by

hoteliers. The property was placed under conditional offer for sale

by the administrator. However, after period end, the buyer withdrew

owing to obstacles encountered in discharging some of its specific

conditions for purchase. It is disappointing that the anticipated

transaction failed to complete but this is reflective of current

property market conditions.

To try to generate further interest, a new joint selling agent

has been brought in and both agents are now actively re-marketing

the property, pointing to the potential for the asset to benefit

from the proposed new Marine Lake Events Centre, due for completion

in 2026, which will adjoin the hotel and where works started in

August 2023.

We are acutely aware of the delays to loan redemptions

encountered to date and the desire of shareholders to see capital

returned to them at the earliest opportunity.

Valuation and Impairment

As discussed in more detail in the notes to the accounts, and in

the context of the current property market conditions, we have

reviewed the valuation of the Company's remaining investments based

on the latest property valuations, but also the desired short

timeframe for returning capital to Investors.

The Company has recent valuations on all of the assets securing

the three main loans. Adoption of these valuations, as the Company

has often done in the past, would have reflected a much lower

impairment charge than that now applied and, in the case of

Affinity, a notable equity buffer. However, in recognition of

current property market conditions, we developed alternative,

negative scenarios and probability weighted each. This conclusion,

now adopted in these accounts, might be viewed as "realistically

pessimistic" but reflects considerable uncertainty in terms of

eventual disposal values and timing. Accordingly, readers'

attention is also drawn to the stress analysis discussed in note 4

(iv) to the accounts which illustrates the potential impact of any

further deterioration in the market.

Revenue and Profitability

Income from the loan portfolio for the period totalled GBP0.89

million (31 July 2022: GBP3.61 million) as the Company's loan

portfolio continued to reduce and interest recognition was

suspended on certain of the loans. After accounting for

impairments, the Company realised a loss for the period of

(GBP14.71) million (31 July 2022: profit of GBP2.73 million).

Earnings per share for the period were negative 12.13 pence (31

July 2022: positive 2.25 pence), again reflecting additional

expected credit losses recognised against the remaining portfolio

loans. Details of these additional provisions are set out in the

notes to the condensed accounts.

Dividend and Return of Capital

The Company paid a 0.50 pence per share dividend in May 2023,

covering the three months to 31 January 2023. It did not declare a

dividend for the quarter ended 31 April 2023 and will not declare a

dividend for the quarter ended 31 July 2023.

As previously reported to shareholders, the Company will only

look to declare dividends when cashflow and profits prudently

allow. Currently the Board does not envisage that these conditions

will be met.

The repayment of capital of GBP6.67 million or 5.50 pence per

ordinary share, declared on 26 January 2023, was paid during the

period.

After the period end and following the substantial repayment at

par of the Northlands loan, a further return of capital of

approximately GBP9.00 million or 7.40 pence per ordinary share to

shareholders was made on 1 September 2023.

NAV and Share Price Performance

The Company's NAV reduced to GBP55.37 million as at 31 July 2023

(31 January 2023: GBP77.35 million), as a result of the partial

repayment of the Northlands loan during the period and recognising

the additional ECL provisions in the period.

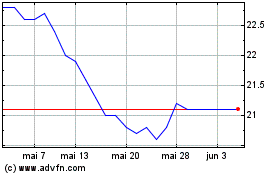

The Company's share price ended the period at 36.1 pence per

share, down from 52.25 pence as at 31 January 2023, during which

time 5.5 pence per share has been returned to shareholders through

capital repayments. The share price reflected, at period end, a

20.9% discount to the Company's NAV.

Outlook

Property market conditions in the UK remain extremely

challenging with very limited liquidity in many sectors. Where debt

is available, pricing is often simply not accretive to borrower

returns, with the result that bids, where they are made at all, are

often not palatable to sellers. Bid-ask spreads remain wide in many

sectors, and consequently transaction volumes are low.

This presents particular challenges for the Company as it seeks

to realise its final investments. With a very limited number of

active buyers in the market, many open market sale processes are

resulting in no credible bids being forthcoming as buyers seek out

the most distressed seller to maximise their future returns.

Consequently, any suggestion that a sale is forced or

time-sensitive tends to lead to low bid levels for assets, as

buyers test the seller's resolve.

The Board expects to have to make difficult choices in the

coming period. The stated investment objective of the Company is to

conduct an orderly realisation of its assets, and the Board and

Investment Manager continue to actively seek to accelerate

repayments as far as they are able. Decisive action has been taken

on all the three major investments to step in and oversee

management of the assets and control sales processes. The

acceleration of these processes does need to be balanced against

the potential value to be realised.

The Board shares shareholders' frustration with the ongoing

delays in realising loans, combined with the disappointment of

having to recognise further impairment provisions. Regrettably

there is no easy way for the Board, Investment Manager or any other

party to accelerate realisations in a market with such a limited

buyer pool. As a result, the continued focus is on actively

managing the remaining assets to protect and enhance value, to

control costs and to continue to seek the optimal recovery

possible.

Jack Perry

Chairman

2 October 2023

Investment Manager's Report

Summary

As at 31 July 2023 the Company had four investments remaining,

the three largest of which (Affinity, Southport and RoyaleLife) are

being managed and realised through enforcement processes. This

report provides a summary update on the realisation process for

each investment, and steps being taken by ICG Real Estate to secure

those outcomes.

Company Performance

During the period, the Company received a series of partial

repayments of the Northlands loan, following sales of certain of

the portfolio properties as the sponsor works towards full

repayment. These payments totalled GBP9.0 million in aggregate.

At the period end, the Company had GBP11.3 million of cash, of

which GBP9.0 million was returned to shareholders in September

2023. The balance is sufficient to cover all the Company's expected

working capital needs while maintaining a prudent liquidity

buffer.

Portfolio

Portfolio statistics 31 July 2023 31 July 2022

Number of loan investments 4 5

-------------- --------------

Aggregate principal advanced (1) GBP57,967,370 GBP74,749,557

-------------- --------------

Aggregate carrying value after ECL GBP44,612,344 GBP77,976,950

-------------- --------------

Cash held GBP11,348,746 GBP3,068,145

-------------- --------------

Investment Update

Southport

The Company's Southport hotel loan continues to be run by the

administrator, while maintaining the same local management team.

Trading at the hotel is seasonal, with revenues strongest from

April to October. Despite the administration, the hotel has

continued to trade profitably albeit it is clear that the

uncertainty around the long term future of the business has been

and may continue to be a drag on results in the near term.

Moreover, given the impact of administration and advisory costs, no

interest payments are expected in the near term.

In the first quarter of 2023 the property was under conditional

offer for sale to a large trade buyer. However, after the period

end the proposed sale fell away as the purchaser was unable to

satisfy themselves that that all conditions could be met in a

reasonable timeframe and, despite significant diligence costs,

withdrew from the process.

As a consequence, and to reinvigorate the sales process, through

the administrator the Investment Manager has appointed a new joint

selling agent for the property. The two in-place agents are now

actively remarketing the asset to interested parties, pointing to

the potential for the asset to benefit from the proposed new Marine

Lake Events Centre, which will adjoin the hotel and where works

started in August 2023. The local council hopes to open the centre

in 2026 and forecasts it will bring over half a million new

visitors to the town each year.

After period end, and following a request from the

administrator, the Company prudently determined to provide a GBP0.3

million working capital facility to allow for continued investment

in the asset during this sales process.

RoyaleLife

The RoyaleLife investment has been challenging. As disclosed in

the Financial Statements as at 31 January 2023 and subsequent RNS

announcements, the sponsor group behind the RoyaleLife loan was

undergoing severe liquidity issues as a result of a slowdown in

sales during, and following, the Covid-19 pandemic. Whilst sales

resumed, the borrower was significantly behind its original

business plan, and no longer able to fully support its

operations.

As a result, and following a winding up petition issued by a

third party creditor against some entities within the structure,

the Company, acting together with its co-lenders, appointed an

administrator over three group companies in May 2023, and over the

remainder of the borrower structure in August 2023. The Company is

aware that administrators have also been appointed by other lenders

and creditors over other parts of the Royale group.

Prior to the appointment of the administrator, the Investment

Manager had been in discussion with the borrower to restructure its

loans and see fresh equity injected into the platform to

re-activate the sales program. Since the appointment a number of

parties have come forward and expressed an interest in acquiring

the business or some, or all, of the sites. These include a number

of highly credible, well-capitalised parties with experience in the

sector and smaller local operators. The Investment Manager and

administrator are continuing discussions with these parties and

seeking a whole business exit as a priority, however the underlying

portfolio and operations are complex, and no certainty can be given

at this stage that these negotiations will lead to a satisfactory

outcome, or when such an outcome might be achieved, and

consequently all options are being pursued.

In parallel with these discussions the Investment Manager, on

behalf of the Company and its co-lenders, continues to work with

the administrator and advisors to stabilise the operations across

the portfolio and has recently completed a partial restructure of

the Investment in order to bring in a new operator and preserve

value in the underlying property security.

Affinity

The office property securing the Affinity loan remains well

occupied and we are aware of several existing tenants seeking to

renew leases as well as active interest for the limited remaining

vacant space at the property. Average rents in the building are in

the region of GBP22 per sq ft with the most recent lettings at over

GBP25 per sq ft and new deals under discussion at still higher

levels. These represent a material discount to prime Bristol office

rents in excess of GBP40 per sq ft. Net income from the asset

continues to cover interest in full, at a 10.5% rate, and

additional default interest is being accrued.

The disconnect between the positive occupational conditions and

the investment market appetite remains stark. The asset was on the

market for sale throughout the reporting period and despite a

number of inspections by potential buyers the ongoing lack of

investor demand for regional offices has hampered the sales effort

and no formal bids have been forthcoming. In terms of market

competition, we are aware that in Q2 2023, there were 16 competing

Bristol office assets being offered to the market as well as

several further buildings available to buy off-market. There is a

similar pattern in other UK regional cities.

Nonetheless, the Investment Manager is seeking to use every tool

to try to accelerate the sales process and in September 2023

appointed a receiver over the asset with the aim of re-invigorating

the marketing and flushing out potential buyers to try and achieve

a realisation.

Northlands

The Northlands loan has been largely repaid through the sale of

newly built residential properties and the break-up of the

commercial portfolio on which it is secured. As at 31 July 2023,

the outstanding loan balance was GBP0.09 million with a further

GBP0.43 million of accrued interest and exit fees outstanding.

Default interest continues to be charged.

Investment Portfolio Summary as at 31 July 2023

Book Book

Balance Value Value Current

outstanding after per share LTV

Project Region Sector (GBPm)(2) ECL (GBPm) (p) (%)

South

Affinity West Office 17.30 15.99 13.2 85.9%

Southport North

(1) West Hotel 15.20 9.38 7.7 121.6%

Northlands London Mixed use 0.09 0.52 0.4 7.1%

RoyaleLife National Residential 25.38 18.72 15.4 95.6%

Total / weighted average 57.97 44.61 36.7 99.4%

------------- ------------ ----------- --------

(1) LTV reflects balance outstanding before adjustment for ECL.

(2) Balance outstanding excludes accrued interest. A comparison

to the carrying value of the loans is set out in Note 5 to the

accounts.

Economy and Financial Market Update

The reporting period brought a constant stream of mixed economic

signals, leaving participants watchful for a clear turning point in

markets. While the September meeting of the Bank of England's

Monetary Policy Committee kept rates stable, previously the UK had

seen 14 successive interest rate rises, with inflation stubbornly

high, and 'core' inflation now at over 6% per annum. Despite a

gradual decline in inflation in recent months, markets remain

nervous of a period of sustained 'higher for longer' interest rates

ahead to control inflation.

The UK is seeing continued wage growth. Private sector nominal

wage growth remained above expectations at 8.1% in July, higher

than in the US or Europe. This contrasts with a gradual increase in

unemployment, standing at 4.3% in July, up from 3.7% in January

2023. After the period end, real wage growth turned positive, as

higher wage settlements took effect in a period of reducing

inflation rates.

Consensus independent GDP forecasts published by the UK Treasury

remain marginally positive for 2023 & 2024 at 0.3% and 0.6%

respectively, and inflation rates are expected to ease to 4.5% at

end of 2023 (albeit still above target levels). Public sector net

borrowing remains elevated at GBP130bn, greater than 2022, however

lower than pandemic year peaks.

Occupational Demand/Supply

While many high profile corporate names advocate for an

increased return to the office, occupational demand across the big

six office markets in H1 2023 was approximately 20% down on the

five year average, measured by take up. The majority of leasing

took place in the capital, though Central London vacancy ticked

upward to 9.2%, driven by speculative completions. The flight to

quality - a trend of occupiers seeking the best buildings -

continues across all of the UK's regional markets, with regional H1

leasing down 13% year-on-year, but Grade A stock accounting for

only 25% of regional stock available.

Industrial take up also dropped in H1, at 12.5m sq ft, being

half of the last three years' average, and the lowest H1 since

2013. A contributing factor was a drop in 'big box logistic' deals,

with the average deal size dropping to 50,000 sq ft. Demand for

second hand space is said to be bouncing back, and agents'

requirements indices suggest H2 will bring greater take up.

UK consumer confidence improved in the reporting period, albeit

remaining negative and losing some of its earlier gains in July as

inflation data showed to be persistently high, leading to

expectations of further interest rate rises. Agency data indicated

retail leases signed were down c. 30% in the first half of 2023,

with retail rents in Q2 also dropping again for the first time

since 2021, potentially due to the side effects of persistent

inflation. Hotel markets reported a more favourable operating

environment, with average daily rates (ADR) 23% ahead of 2019 over

the first six months of the year, and occupancy up year on year and

only slightly lagging 2019 on a trailing 12 month basis. Gross

operating profit per available room (GOPPAR) in H1 2023 had fully

recovered to 2019 levels, although hotels continue to face cost

pressures ranging from energy to staffing.

Property Investment Market

H1 2023 saw investment volumes remaining depressed across the

board. Total commercial property investment volumes at c. GBP15bn

were 55% down on H1 2022, reflecting an overall buyer-seller

pricing mismatch, with no buyers under pressure to trade and a lack

of forced sellers at current pricing. Successive interest rate

rises and debt pricing are further fuelling transaction hesitation.

The MSCI All Property index remained close to neutral over the

reporting period, showing 1.2% growth with increased rental income

offsetting declining capital values.

While the lack of deals makes average prime yields difficult to

ascertain in many sectors or sub-markets, prime London office

yields appeared to hold firm in July 2023, at 4.0% in the West End,

and 5.0% in the City, whilst provincial yields continued to move

slightly out in H1 2023 to c. 6.25%. Q2 2023 London office

investment volumes were 38% below Q1, dipping to only GBP1.44bn,

despite Q1's strong performance at GBP2.3bn.

The industrial investment market showed an inverse trend,

registering a much stronger Q2 2023 at GBP2.1bn, following a weaker

start to the year. Half year volumes more closely reflected

pre-pandemic volumes however, at only 54% of 2022's bumper H1.

Demand was focused on the regions, with 50% of Q2 investment in the

North West, driven by heavyweight Blackstone's acquisition of two

of the region's best-known industrial estates for c. GBP480m. Prime

industrial yields stood at c. 5.0%, far from their peak however

still tight.

Within the retail market, shopping centres continued to

struggle, with retail parks and food stores anchoring the market.

Food stores have been one of the most resilient sectors over the

last 12 months, with prime yields stabilising at 5.00%. H1

transactions were also inflated by a number of supermarket

portfolios, including the Sainsbury's Reversion Portfolio trading

twice in the period (GBP427m combined).

A lack of transactional evidence in the hotel market has also

led to uncertainty about yields, with the H1 total of GBP1.3bn the

lowest since 2012. Three quarters of all sales were in the regions,

69% of hotels transacting had less than 100 keys and 80% were

sub-GBP25m lot sizes. Those assets that are trading appear to be

modest in scale.

Finance Markets

Net UK bank lending to commercial property has been positive for

five consecutive months since March, although there has been a fall

back of development financing this year. This positive position,

contrasted with dropping investment volumes, signals borrowers and

lenders have been working through a backlog of refinancings. The

proportion of total bank debt secured on commercial property

remained stable at 7.1%.

Lower LTVs persist for new lending and, together with market

wide valuation adjustments, have left a significant debt funding

gap for sponsors, i.e. the difference between historic or in-place

debt levels and those available in the market today. This is

estimated at GBP16.3bn for the UK between now and 2026.

Furthermore, in the next four and half years, around 80% of

outstanding commercial real estate debt is due for repayment.

The industry is still grappling with the cost of debt

outstripping valuation yields in many sectors, with the result that

interest coverage levels are low, and, in many cases, debt is no

longer accretive to returns. Lenders do have appetite to lend

however this is at increasingly conservative levels and often

higher credit margins than borrowers may be used to. We are also

aware that many lenders have limited or no appetite for retail and

office properties.

Portfolio Outlook

The data clearly suggests that property market conditions will

remain difficult for sellers for the immediate future with some

relief expected in 2024 as core inflation and interest rates are

forecast to begin to fall, and economic growth begins to

return.

Through the appointment of receivers and administrators, the

Investment Manager and the Company are now better placed to control

the repayment of the Affinity and Southport loans via marketing and

ultimate sale of the underlying properties but will continue to

work with the respective property managers and operators in the

meantime to maximise performance, and protection and enhancement of

income.

Whilst the companies operating the residential parks securing

the RoyaleLife loan are also in administration, the operations are

more complex and the Company will continue to work with its

co-lenders, the administrator and their advisors first to stabilise

operations and protect value, and secondly to secure an exit that

will enable the Company to wind-up.

As discussed in this report, all potential routes to exit are

being explored and progressed, however the complex nature of the

business and niche sector in which it operates may present

additional challenges to realising full value in the near term.

There are likely to be difficult decisions required as the

Company balances the level of recovery with the speed of

realisation and cost of running the Company through to its ultimate

liquidation.

ICG Real Estate

2 October 2023

Directors' Responsibilities Statement

The Directors are responsible for preparing this Interim

Financial Report in accordance with applicable law and regulations.

The Directors confirm that to the best of their knowledge:

-- The Unaudited Condensed Interim Financial Statements have

been prepared in accordance with IAS 34 Interim Financial Reporting

as adopted by the EU; and

-- The Chairman's Statement and Investment Manager's Report

include a fair review of the information required by:

(i) DTR 4.2.7R of the Disclosure Guidance and Transparency

Rules, being an indication of important events that have occurred

during the first six months of the financial year and their impact

on the Unaudited Condensed Interim Financial Statements; and a

description of the principal risks and uncertainties for the

remaining six months of the year; and

(ii) DTR 4.2.8R of the Disclosure Guidance and Transparency

Rules, being related party transactions that have taken place in

the first six months of the financial year and that have materially

affected the financial position and performance of the entity

during that period; and any changes in the related party

transactions described in the last Annual Report and Financial

Statements that could do so.

On behalf of the Board

Jack Perry

Chairman

2 October 2023

Principal Risks and Uncertainties

The Company invests primarily in UK commercial real estate loans

of a fixed rate nature; as such, it is exposed to the performance

of the borrower and the underlying property on which its loans are

secured.

The principal risks and uncertainties of the Company were

identified in detail in the Annual Report and Financial Statements

for the year ended 31 January 2023.

In addition to regular risk reviews, emerging risks are

considered as they arise, to assess any potential impact on the

Company and to determine whether any actions are required.

As a result of such risks emerging, the Audit and Risk Committee

regularly reviews its assessment of the key risks faced by the

Company, which are currently identified as the following:

-- The inability to secure the sale or refinancing of an

underlying property will frustrate the timely repayment of

capital;

-- Imprecision of valuations will impact the Company's ability

to accurately determine collateral values and to appropriately

consider the potential impairment of any particular investment;

-- A further deterioration in property market conditions or

liquidity could likely result in a further reduction in shareholder

value;

-- Portfolio diversification: the effect on the Company of

challenges experienced on the smaller number of remaining

investments is magnified and could lead to increased volatility in

cash flows or net asset values;

-- Some of the Company's costs are fixed and will therefore

consume a greater proportion of the Company's revenues as the

Company shrinks, which will impact the amount of funds available

for distribution to shareholders;

-- Complications with the liquidation process could affect timing of the final distribution to shareholders.

Condensed Statement of Comprehensive Income

FOR THE SIX-MONTH PERIOD TO 31 JULY 2023

1 February 2023 to 1 February 2022 to 1 February 2022 to

31 July 2023 31 July 2022 31 January 2023

GBP GBP GBP

Notes (Unaudited) (Unaudited) (Audited)

----------------------------------------------- ------ ------------------- ------------------- -------------------

Income

Income from loans 1,060,573 3,611,439 7,136,574

Other fee income from loans - - 133,051

Income from cash and cash equivalents 29,280 - 2,864

Total income 1,089,853 3,611,439 7,272,489

----------------------------------------------- ------ ------------------- ------------------- -------------------

Expenses

Investment Management fees 9 369,261 519,039 761,047

Other expenses 10 310,566 280,736 451,438

Directors' remuneration 9 80,000 80,000 160,000

Finance costs - - -

ECL provision on financial assets 4 15,039,979 - 3,940,181

Total expenses 15,799,806 879,775 5,312,666

----------------------------------------------- ------ ------------------- ------------------- -------------------

(Loss)/Profit for the period/year before tax (14,709,953) 2,731,664 1,959,823

----------------------------------------------- ------ ------------------- ------------------- -------------------

Taxation charge - - -

(Loss)/Profit for the period/year after tax (14,709,953) 2,731,664 1,959,823

----------------------------------------------- ------ ------------------- ------------------- -------------------

Total comprehensive (expense)/income for the

period/year (14,709,953) 2,731,664 1,959,823

----------------------------------------------- ------ ------------------- ------------------- -------------------

Basic and diluted (Loss)/Earnings per Share

(pence) 5 (12.13) 2.25 1.62

----------------------------------------------- ------ ------------------- ------------------- -------------------

All items within the above statement have been derived from

discontinuing activities on the basis of the orderly realisation of

the Company's assets.

The Company has no recognised gains or losses for either period

other than those included in the results above, therefore no

separate statement of other comprehensive income has been

prepared.

The accompanying notes form an integral part of these Interim

Financial Statements.

Condensed Statement of Financial Position

As at 31 July 2023

31 July 2023 31 January 2023 31 July 2022

GBP GBP GBP

Notes ( Unaudited ) ( Audited ) (Unaudited)

-------------------------------------- ------ -------------- -------------------------------------- --------------

Assets

Loans advanced at amortised cost 4 44,612,344 68,963,675 77,976,950

Cash and cash equivalents 11,348,746 43,435 3,068,145

Trade and other receivables 13,193 9,209,494 529,620

-------------------------------------- ------ -------------- -------------------------------------- --------------

Total assets 55,974,283 78,216,604 81,574,715

-------------------------------------- ------ -------------- -------------------------------------- --------------

Liabilities

Trade and other payables 607,452 861,653 1,021,864

-------------------------------------- ------ -------------- -------------------------------------- --------------

Total liabilities 607,452 861,653 1,021,864

-------------------------------------- ------ -------------- -------------------------------------- --------------

Net assets 55,366,831 77,354,951 80,552,851

-------------------------------------- ------ -------------- -------------------------------------- --------------

Equity

Share capital 6 73,626,766 80,298,419 80,298,422

Retained (loss)/earnings (18,259,935) (2,943,468) 254,429

-------------------------------------- ------ -------------- -------------------------------------- --------------

Total equity attributable to the

owners of the Company 55,366,831 77,354,951 80,552,851

-------------------------------------- ------ -------------- -------------------------------------- --------------

Number of ordinary shares in issue at

period/year end 6 121,302,779 121,302,779 121,302,779

-------------------------------------- ------ -------------- -------------------------------------- --------------

Net Asset Value per ordinary share

(pence) 5 45.64 63.77 66.41

-------------------------------------- ------ -------------- -------------------------------------- --------------

The Interim Financial Statements were approved by the Board of

Directors on 2 October 2023 and signed on their behalf by:

Jack Perry Fiona Le Poidevin

Chairman Director

The accompanying notes form an integral part of these Interim

Financial Statements.

Condensed Statement of Changes in Equity

For the SIX-MONTH period to 31 July 2023

Number Ordinary Share B Share Retained

Notes of shares capital capital (loss) Total

GBP GBP GBP GBP

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

As at 1

February

2023 121,302,779 80,298,419 - (2,943,468) 77,354,951

Loss for

the

period - - - (14,709,953) (14,709,953)

Dividends

paid 7 - - - (606,514) (606,514)

B Shares

issued

February

2023 6 121,302,779 (6,671,653) 6,671,653 - -

B Shares

redeemed

&

cancelled

February

2023 6 (121,302,779) - (6,671,653) - (6,671,653)

As at 31

July 2023 121,302,779 73,626,766 - (18,259,935) 55,366,831

=========== ====== =================================== ==================== ========================== ======================= ====================

For the SIX-MONTH period to 31 July 2022

Number Ordinary Share B Share Retained

Notes of shares capital capital earnings Total

GBP GBP GBP GBP

(Unaudited) (Unaudited) (Unaudited) (Unaudited)

As at 1

February

2022 121,302,779 87,576,589 - 191,426 87,768,015

Profit for

the year - - - 2,731,664 2,731,664

Dividends

paid 7 - - - (2,668,661) (2,668,661)

B Shares

issued

May 2022 6 121,302,779 (7,278,167) 7,278,167 - -

B Shares

redeemed

&

cancelled

May 2022 6 (121,302,779) - (7,278,167) - (7,278,167)

As at 31

July 2022 121,302,779 80,298,422 - 254,429 80,552,851

=========== ====== ======================= ==================== ========================== ================== ====================

The accompanying notes form an integral part of these Interim

Financial Statements.

Condensed Statement of Cash Flows

For the SIX-MONTH period to 31 July 2023

1 February 2023 to 1 February 2022 to 1 February 2022 to

31 July 2023 31 July 2022 31 January 2023

GBP GBP GBP

Notes (Unaudited) (Unaudited) (Audited)

----------------------------------------------- ------ ------------------- ------------------- -------------------

Cash flows generated from operating activities

(Loss)/Profit for the period/year (14,709,953) 2,731,664 1,959,823

Adjustments for non-cash items and working

capital movements:

Movement in other receivables 30,242 (27,135) 459,050

Movement in other payables and accrued

expenses (254,201) 228,641 68,430

Loan amortisation 14,875,644 (513,291) 1,193,484

----------------------------------------------- ------

(58,268) 2,419,879 3,680,787

Loans advanced, less arrangement fees (8,400) (162,434) (487,610)

Arrangement fees received - - 64,740

Loans repaid at par 4 9,484,087 5,956,304 13,523,240

------

Net loans repaid less arrangement fees 9,475,687 5,793,870 13,100,370

----------------------------------------------- ------ ------------------- ------------------- -------------------

Net cash generated from operating activities 9,417,419 8,213,749 16,781,157

----------------------------------------------- ------ ------------------- ------------------- -------------------

Cash flows used in financing activities

Dividends paid 7 (606,514) (2,668,661) (5,094,717)

Return of Capital paid 6 (6,671,653) (7,278,167) (7,278,170)

-------------------

Net cash used in financing activities (7,278,167) (9,946,828) (12,372,887)

----------------------------------------------- ------ ------------------- ------------------- -------------------

Net movement in cash and cash equivalents 2,139,252 (1,733,079) 4,408,270

Cash and cash equivalents at the start of the

period/year 9,209,494 4,801,224 4,801,224

Cash and cash equivalents at the end of the

period/year 11,348,746 3,068,145 9,209,494

----------------------------------------------- ------ ------------------- ------------------- -------------------

The accompanying notes form an integral part of these Interim

Financial Statements.

Notes to the Unaudited Condensed Interim Financial

Statements

For the six-month period to 31 July 2023

1. General information

ICG-Longbow Senior Secured UK Property Debt Investments Limited

is a non-cellular company limited by shares and was incorporated in

Guernsey under the Companies Law on 29 November 2012 with

registered number 55917 as a closed-ended investment company. The

registered office address is Floor 2, Trafalgar Court, Les Banques,

St Peter Port, Guernsey, GY1 4LY.

The Company's shares were admitted to the Premium Segment of the

Official List and to trading on the Main Market of the London Stock

Exchange on 5 February 2013.

The unaudited condensed financial statements comprise the

financial statements of the Company as at 31 July 2023.

In line with the revised Investment Objective and Policy

approved by shareholders in the Extraordinary General Meeting in

January 2021, the Company is undertaking an orderly realisation of

its investments. As sufficient funds become available the Board

returns capital to shareholders, taking account of the Company's

working capital requirements and funding commitments.

ICG Alternative Investment Limited is the external discretionary

investment manager.

2. Accounting policies

a) Basis of preparation

The Interim Financial Statements included in this Interim

Report, have been prepared in accordance with IAS 34 'Interim

Financial Reporting', as adopted by the EU, and the Disclosure and

Transparency Rules of the FCA.

The Interim Financial Statements have not been audited or

reviewed by the Company's Auditor.

The Interim Financial Statements do not include all the

information and disclosures required in the Annual Report and

Financial Statements and should be read in conjunction with the

Company's Annual Report and Financial Statements for the year ended

31 January 2023, which are available on the Company's website

(www.lbow.co.uk). The Annual Report and Financial Statements have

been prepared in accordance with IFRS as adopted by the EU.

Other than as set out above, the same accounting policies and

methods of computation have been followed in the preparation of

these Interim Financial Statements as in the Annual Report and

Financial Statements for the year ended 31 January 2023.

There were no new standards or interpretations effective for the

first time for periods beginning on or after 1 January 2023 that

had a significant effect on the Company's financial statements.

Furthermore, none of the amendments to standards that are effective

from 1 January 2023, had a significant effect on the Company's

interim condensed financial statements. It is not anticipated that

any standard which is not yet effective, will have a material

impact on the Company's financial position or on the performance of

the Company's statements.

b) Going concern

The Directors, at the time of approving the Financial

Statements, are required to satisfy themselves that they have a

reasonable expectation that the Company has adequate resources to

continue in operational existence for the foreseeable future and

whether there is any threat to the going concern status of the

Company. At the EGM of the Company on 14 January 2021, following a

recommendation from the Board published in a circular on 16

December 2020, shareholders voted by the requisite majority in

favour of a change to the Company's Objectives and Investment

Policy which would lead to an orderly realisation of the Company's

assets and a return of capital to shareholders.

It is intended that the investments will be realised over time

and the Directors expect that some investments will be held past

the formal maturity date of the last loan, currently due for

repayment by the end of 2023. The Company may take actions with the

consequence of accelerating or delaying repayment in order to

optimise shareholder's returns in the context of the Company's size

and position at that time.

Whilst the Directors are satisfied that the Company has adequate

resources to continue in operation throughout the remaining

realisation period and to meet all liabilities as they fall due,

given the Company is now in a managed wind down, the Directors

consider it appropriate to adopt a basis other than going concern

in preparing the financial statements.

In the absence of a ready secondary market in real estate loans

by which to assess market value, the basis of valuation for

investments is amortised cost net of impairment, recognising the

anticipated realisable value of each investment in the orderly wind

down of the Company. In accordance with the Company's IFRS 9 Policy

there has been a change in the carrying value of some investments

following the increase of the lifetime ECL allowances on the stage

three loans, as detailed in Note 4. No material adjustments have

arisen solely as a result of ceasing to apply the going concern

basis.

c) Segmental reporting

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision-maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the Board of Directors as a whole.

The key measure of performance used by the Board to assess the

Company's performance and to allocate resources is the total return

on the Company's Net Asset Value, as calculated under IFRS, and

therefore no reconciliation is required between the measure of

profit or loss used by the Board and that contained in the

Financial Statements.

For management purposes, the Company is organised into one main

operating segment, being the provision of a diversified portfolio

of UK commercial property backed senior debt investments.

The majority of the Company's income is derived from loans

secured on commercial and residential property in the United

Kingdom.

Due to the Company's nature, it has no employees.

The Company's results do not vary significantly during reporting

periods as a result of seasonal activity.

3. Critical accounting judgements and estimates in applying the

Company's accounting policies

The preparation of the Financial Statements under IFRS requires

management to make judgements, estimates and assumptions that

affect the application of policies and reported amounts of assets

and liabilities, income and expenses. The estimates and associated

assumptions are based on historical experience and other factors

that are believed to be reasonable under the circumstances,

including the Company's timeframe for orderly realisation of

investments in order to return capital to shareholders. These

factors help form the basis of making judgements about carrying

values of assets and liabilities that are not readily apparent from

other sources. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimate is revised if the revision affects

only that period or in the period of the revision and future

periods if the revision affects both current and future

periods.

Critical judgements

In assessing the ECL, the Board has made critical judgements in

relation to the staging of the loans and assessments which impact

the loss given default. In assessing whether the loans have

incurred a significant increase in credit risk the Investment

Manager, on behalf of the Board, assesses the credit risk attaching

to each of the loans and the realisable value of the underlying

property on which the loans are secured. Realisable value is an

estimate informed by third party valuations, but also taking into

consideration property market liquidity, availability of debt

funding and the timeframes in which the Company is seeking to

return capital to its shareholders.

The Company has adopted the Investment Manager's Internal credit

rating methodology and has used its loss experience to benchmark

investment performance and potential impairment for Stage 1, Stage

2 and Stage 3 loans under IFRS 9 considering both probability of

default and loss given default. It is noted that the Company's

remaining loans are either past due or have a residual contractual

maturity of less than one year.

In the case of past due loans, the Investment Manager and the

Board will also take into consideration the likely repayment term

of such loans and of actions taken to repay such loans.

Consequently, a loan which is past due, but otherwise performing,

may continue to be assessed as Stage 1 where there is an active

repayment plan in place, or supporting evidence that the loan can

be repaid in full and the Company has given a period of forbearance

whilst reserving its rights to, or charging, default interest.

The sustained rise in UK interest rates, up four percentage

points in a little over a year, has dramatically reduced liquidity

in property and finance markets as well as affecting asset prices

in many property sectors. As a result, the number of UK commercial

property transactions in the first half of 2023 was over 50% lower

than the same period in the prior year, and 37% below the 10-year

average. Hotel sales in the first half were at their lowest levels

for over a decade. More recently, the data has trended weaker:

Colliers International reports that investment transactions in July

were less than GBP1bn, the lowest level since 2008.

Against this backdrop the Investment Manager and Board agree

that, other than the Northlands loan, all remaining investments

have a heightened credit risk. At the reporting date all three

loans are subject to enforcement action and, in the absence of an

active and liquid property market, are considered as Stage 3 assets

with a material risk of credit loss.

Critical accounting estimates

The measurement of both the initial and ongoing ECL allowance

for loan receivables measured at amortised cost is an area that

requires the use of significant assumptions about credit behaviour

such as the ability of borrowers to refinance; the likelihood of

them defaulting; the realisable value of the secured properties;

and the resulting losses. In assessing the probability of default

and ECL, the Board has taken note of the experience and loss

history of the Investment Manager which may not be indicative of

future losses in changing market conditions. The default

probabilities are based on a number of factors including rental

income trends, interest cover and LTV headroom and sectoral trends

which the Investment Manager believes to be a good predictor of the

probability of default, in accordance with recent market studies of

European commercial real estate loans.

In line with the Company's investment strategy at the time, all

loans benefited from significant LTV headroom at origination, with

business plans designed to deliver further value increases over

time. This combined with tight covenants had enabled the Investment

Manager to manage risk over the term of the loans. Following the

change in Investment Strategy to one of orderly wind down, the

Investment Manager and the Board have placed greater emphasis on

the source and delivery of repayment over the residual term of each

loan when assessing valuation of the Company's loans and the risk

of capital loss.

The Board's valuation of Stage 3 assets (those loans considered

to have a material risk of credit loss), is first informed by third

party property valuations and supporting comparative transactional

evidence. The Investment Manager and the Board will then overlay

property level cashflows, expected sales costs and other factors

considered necessary to achieve exits within the target timeframes

for returning capital to shareholders.

Since the Russian invasion of Ukraine in February 2022, UK

inflation has been rising, and UK monetary policy has tightened.

Inflation and therefore interest rate expectations have remained

high driven by rising fuel and food costs and, more recently, wage

settlements. These factors have combined to make the UK's economic

outlook less certain, with GDP growth of less than 1% per annum

forecast for the next two years.

As such, investor confidence in the UK commercial property

markets is low as reflected by market transaction volumes discussed

above. Higher inflation and interest rates are also now beginning

to impact consumer spending patterns and filter through to house

prices.

All of the Company's Stage 3 assets were either past due or

subject to enforcement action in the form of administration or

receivership at the reporting date. As a result, the Company has

considered the likelihood of achieving sales at the most recent

third-party valuation or at discounts to reflect the current lack

of liquidity in the relevant property sector and the Company's

target timeframes and the probability of such outcomes. These

probabilities and discounts are further informed by prospective

purchasers' offers or expressions of interest where properties have

been marketed.

In arriving at the investment valuations, the Investment Manager

has overlayed the expected costs of sale and exit timeframes to

determine a weighted average valuation of each loan under the

expected interest rate method and, thereby, the expected credit

loss for each loan that may result.

Revenue recognition is considered a significant accounting

judgement and estimate that the Directors make in the process of

applying the Company's accounting policies. In respect of the

Company's Stage 3 loans, Interest Income will be recognised through

in the Statement of Comprehensive Income as and when it is

received. In view of the trading conditions of the Southport hotel

and liquidity challenges facing the RoyaleLife loan, the Directors

consider it unlikely that interest payments will be received in the

near term. The Affinity loan is also a Stage 3 asset, however the

property remains well occupied and the Directors expect interest

will continue to be paid in full and such receipts will be

recognised as and when received.

Following the period end, the remaining companies within the

RoyaleLife loan's security structure were placed into

administration, and a partial restructure of the investment has

taken place. These actions have been taken together with the

Company's co-lenders in order to preserve the value of the

underlying property security, to stabilise operations and to

protect corporate cashflows. The property securing the Affinity

loan was placed into receivership following the period end and is

now being remarketed for sale. The properties and companies

securing the Southport Hotel loan were placed into administration

in September 2022.

4. Loans advanced

(i) Loans advanced

1 February 2023 to 31 July 2023 1 February 2022 to 31 January 2023

GBP GBP

Loans Advanced: 65,932,533 72,903,856

Less: Expected Credit Losses (21,320,189) ( 3,940,181 )

44,612,344 68,963,675

================================ ===================================

31 July 2023 31 July 2023 31 January 2023 31 January 2023

Fair value (at amortised Fair value (at amortised

Principal advanced cost) Principal advanced cost)

GBP GBP GBP GBP

Northlands 85,389 517,935 9,561,076 9,829,286

Affinity 17,299,963 17,667,277 17,299,963 17,774,436

Southport 15,200,000 16,799,773 15,200,000 15,988,651

RoyaleLife 25,382,017 30,947,548 25,382,017 29,311,483

57,967,369 65,932,533 67,443,056 72,903,856

------------------- ------------------------------ ------------------- ------------------------------

(ii) Valuation considerations

As noted above, the Company is now in the process of an orderly

wind down. It had been the intention of the Investment Manager and

Directors to hold loans through to their repayment date, and seek a

borrower led repayment in order to maximise value for the

shareholders. Economic and property market conditions have not

enabled this, with commercial property transactions in some sectors

at their lowest levels for 15 years.

The carrying value amounts of the loans, recorded at amortised

cost in the Financial Statements have been adjusted for expected

credit losses. For further information regarding the status of each

loan and the associated risks see the Investment Manager's

Report.

Amortised cost is calculated using the effective interest rate

method which takes into account all contractual terms (including

arrangement and exit fees) that are an integral part of the loan

agreement. As these fees are taken into account when determining

initial net carrying value, their recognition in profit or loss is

effectively spread over the life of the loan.

As loans have fallen past due and enforcement actions have been

taken, the Directors have reassessed the likelihood and timing of

receipt of such exit fees in the context of the current underlying

property value and weak market conditions.

Each property on which investments are secured was subject to an

independent, third-party valuation at the time the investment was

entered into and updated valuations are obtained as deemed

appropriate. All investments are made on a hold to maturity basis.

Each investment is being closely monitored including a review of

the performance of the underlying property security.

Third party property valuations are typically based on the

specific particulars of the property (rent, Weighted Average

Unexpired Lease Term (WAULT), vacancy, condition and location) and

assume a normal marketing period and sales process. Valuers

benchmark against comparative evidence from recent transactions in

similar properties.

Other than the Northlands loan, the remaining Investments are

considered to be Stage 3 assets and were at period end, or are now,

subject to enforcement action. Accordingly, the carrying value of

each loan has been reviewed and further provisions for expected

credit loss raised. The carrying value of each Stage 3 investment

has been calculated to reflect the net present value of the

expected net proceeds from, and timing of, exit under a range of

scenarios reflecting the latest property valuation, the cost of

disposal (including enforcement action taken), and potential

discount to valuation that a willing buyer may offer in the current

market for a purchase out of administration/receivership in an

accelerated process.

(iii) IFRS 9 - Impairment of Financial Assets

As discussed above, during 2023 the UK commercial property

market has experienced a period of historically low transaction

volumes, as buyers adjust their pricing in order to generate target

returns in a higher interest rate environment with uncertain

occupational demand in many sectors. Conversely, unless forced,

sellers are inclined to hold properties where they can in the

expectation of improved liquidity as the economic outlook

stabilises and medium-term interest rates fall. In this context,

valuation and, therefore, the ECL of each investment has been

recalculated based on the underlying property performance and

valuations together with any sales/marketing experience to date and

is discussed further below.

The internal credit rating of each loan as at 31 July 2023 has

been reviewed. One loan was identified as a Stage 3 asset at 31

January 2023, and the loan has remained a Stage 3 asset, with an

ECL provision of GBP7,418,760 (31 January 2023: GBP2,288,651). Of

the two loans that were identified as Stage 2 assets at 31 January

2023, RoyaleLife is now identified as a Stage 3 asset, with an ECL

provision of GBP12,224,576 (31 January 2023: GBP1,638,828).

Affinity is also now identified as a Stage 3 asset, with an ECL

provision of GBP1,676,853 (31 January 2023: GBP12,702).

As at 31 July 2023

Stage 1 Stage 2 Stage 3 Total

Principal advanced 85,389 - 57,881,980 57,967,369

-------- -------- ------------- -------------

Gross carrying

value 517,935 - 65,414,598 65,932,533

Less ECL allowance - - (21,320,189) (21,320,189)

-------- -------- ------------- -------------

517,935 - 44,094,409 44,612,344

-------- -------- ------------- -------------

As at 31 January 2023

Stage 1 Stage 2 Stage 3 Total

Principal advanced 9,561,076 42,681,981 15,200,000 67,443,056

------------------------- ------------ ------------ ------------

Gross carrying

value 9,829,286 47,085,919 15,988,651 72,903,856

Less ECL allowance - (1,651,530) (2,288,651) (3,940,181)

------------------------- ------------ ------------ ------------

9,829,286 45,434,389 13,700,000 68,963,675

------------------------- ------------ ------------ ------------

The Northlands loan has been largely repaid through the sale of

newly built residential properties and the break-up of the

commercial portfolio on which it is secured. As at 31 July 2023,

the outstanding loan balance was GBP85,737 with a further

GBP432,198 of accrued interest and exit fees outstanding. Two

further property sales have completed since period end with

proceeds applied against interest, and the loan is expected to be

fully repaid from a series of further property sales which are

currently under offer. As a result, the look-through LTV is below

10% and the loan is expected to repay in full.

The Southport hotel was placed into administration in September

2022, following a failed marketing and refinancing exercise by the

sponsor. The hotel has continued to trade throughout this period

and, following a refreshed marketing process, was placed under

conditional offer in the first quarter of 2023. The purchaser has

not been able to satisfy themselves that all conditions could be

met in a reasonable timeframe and, despite significant diligence

costs, withdrew from the process following period end. The property

was last valued in late March 2023 at GBP12.5 million. The hotel

has been brought back to the market and new bids are being

solicited. The Company has provided a working capital facility to

the administrator. Whilst trading has been profitable, it is

insufficient to meet administrative and advisor costs and no

interest payments are expected. Based on an expected remarketing

period, sales and administration costs and the likelihood of

achieving valuation in the current market environment, a further

ECL of GBP5,130,109 has been recognised in the period.

Occupational demand for the Affinity office property has

remained strong, with discussion underway in respect of the only

remaining vacant space. Interest at 10.5% has been paid in full and

further default interest is being accrued. The borrower engaged an

agent to sell the property in February 2023 but, despite a number

of inspections, no formal offer has been forthcoming. After a

period of forbearance, the Company appointed a receiver over the

property in September 2023 who has re-engaged with the sales agent

to re-launch the property. The property was last valued in April

2023 at GBP20.15 million representing an LTV of 85.8%. The regional

office market remains difficult as investors contemplate the

ongoing occupational demand, with changing working practices

following the Covid-19 pandemic. The Investment Manager and Board

have adopted a probability-based approach to achieving full

valuation and discounts thereto, whilst taking into account the

full costs of receivership and eventual sale. As a result, the

Company has made a provision for ECL of GBP1,676,853 against the

carrying value of the loan.

As disclosed in the Financial Statements as at 31 January 2023

and subsequent RNS announcements, the sponsor group behind the

RoyaleLife loan was undergoing severe liquidity issues as a result

of a slowdown in sales during, and following, the Covid-19

pandemic. Whilst sales resumed, the borrower was circa 2 years

behind its original business plan, and no longer able to fully

support its operations. As a result, and following a winding up

petition issued by a third party creditor against some entities

within the structure, the Company, acting together with its

co-lenders, appointed an administrator over three group companies

in May 2023, and over the remainder of the borrower structure in

August 2023.

The Investment Manager on behalf of the lenders continues to

work with the administrator and advisors to stabilise the park

operations and has recently completed a partial restructure in

order to bring in a new operator and preserve value in the

underlying property security.

The Investment Manager is in discussion with a number of parties

who have expressed an interest in acquiring the borrower group and

these discussions are continuing. The property valuations have been

updated since period end and following the appointment of the

administrator. Based upon this, the Company's current exposure is

at 95.6% LTV, an increase from 72.4% as at January 2023. As

previously reported, the borrower group is not expected to service

interest in the near term and, at the lower valuation, exit fees in

excess of GBP4 million are no longer likely to be received. In

valuing the investment, the Investment Manager and Board have

considered a number of scenarios based on discussions in hand and a

full workout and have discounted the projected cashflow in each

scenario to the reporting date. As a result, the Board has

increased the ECL from GBP1,638,828 to GBP12,224,576, which

includes a provision for impairment against exit fees previously

recognised under the amortised cost accounting policy, as well as

the accrued default interest.

A reconciliation of the ECL allowance is presented as

follows:

Expected Credit

Loss Allowances

Movement in ECL

At 31 January Allowance during

2023 period At 31 July 2023

------------ ----------------- ------------------ ----------------

GBP GBP GBP

------------ ----------------- ------------------ ----------------

Affinity (12,702) (1,664,151) (1,676,853)

Southport (2,288,651) (5,130,109) (7,418,760)

RoyaleLife (1,638,828) (10,585,748) (12,224,576)

(3,940,181) (17,380,008) (21,320,189)

------------ ----------------- ------------------ ----------------

(iv) IFRS 9 Impairment - Stress Analysis

The carrying values of the remaining investments above

contemplate sales in a difficult market and have been adjusted for

expected credit losses, making allowance for the potential impact

sales out of receivership/administration on the properties'

underlying liquidity and attractiveness to buyers, as well as the

timeframe in which the Company is seeking to realise its

investments.

Other than the Northlands loan, the remaining loans are subject

to enforcement processes, which may be an additional factor in the

liquidity of and buyer pools for the subject assets. Following the

additional provision for ECL, all three of those loans are held at

100% LTV. Two of the loans (Southport and RoyaleLife) are secured

against operating assets which brings additional complexity for

buyers when compared to, say, single tenant investment properties

and, in the case of RoyaleLife, operates in a new and emerging

sector of retirement living.

The Investment Manager and the Board have considered the impact

of a further 10%, 20% and 30% reduction in the underlying property

values, broadly reflecting a one, two and three stage credit

deterioration as previously presented, and recalculated its

probability weighted valuations on this basis. The impact of these

further declines in property values on the portfolio as a whole is

set out below.

Stress test impact on Expected Credit Loss at 31 July 2023

31 July 2023 31 July 2022

-------------- -------------

One grade deterioration GBP3,685,000 GBP236,000

in credit rating

--------------

Two grade deterioration GBP8,124,000 GBP857,000

in credit rating

--------------

Three grade deterioration GBP12,562,000 GBP3,023,000

in credit rating

--------------

All efforts continue to be made by the Investment Manager and

the Board to crystalise the value in the remaining investments in a

reasonable time frame in order to return capital to shareholders

and proceed to the liquidation of the Company. However, as

discussed above, in the current market many properties for sale are

not receiving any bids, even where they are considered distressed,

and the limited number of buyers active in the market are seeking

out the maximum distress in order achieve best relative value and

maximise their potential returns. Accordingly, the timing of the

final realisation of the Company's remaining assets cannot be

predicted with certainty.

5. Earnings per share and Net Asset Value per share

(Loss)/Earnings per share

1 February 2023 1 February 2022

to 31 July 2023 to 31 July 2022

(Loss)/Profit for the period after tax (GBP) (14,709,953) 2,731, 664

Weighted average number of ordinary shares in issue 121,302,779 121,302,779

---------------- ----------------

Basic and diluted (Loss)/EPS (pence) (12.13) 2.25

The calculation of basic and diluted (Loss)/Earnings per share

is based on the (loss)/profit for the period and on the weighted