Braveheart Investment Group plc Investment update -- Paraytec Limited (3032Q)

17 Outubro 2023 - 3:00AM

UK Regulatory

TIDMBRH

RNS Number : 3032Q

Braveheart Investment Group plc

17 October 2023

17 October 2023

Braveheart Investment Group plc

("Braveheart" or the "Company")

Investment update - Paraytec Limited

Braveheart Investment Group (AIM: BRH), announces an update on a

company within its investment portfolio, Paraytec Limited

("Paraytec").

Paraytec develops high performance specialist detectors for the

analytical and life sciences instrumentation markets. Its rapid

test instrument ("CX300") is being developed for identifying cancer

and pathogens, including viruses.

Paraytec has provided the Company with the following update on

its work in the development of potential use cases for the CX300 by

Professor Carl Smythe's team at Sheffield University:

The CX300 instrument has been successfully tested in the in the

detection of Adeno-associated viruses, which are used in gene

therapy. This is important because virus-like particles ("VLPs")

such as adeno-associated viruses are used to encapsulate the new

gene and deliver it into the body.

Paraytec has now delivered its first instrument to the Gene

Therapy Innovation and Manufacturing Centre ("GTIMC") in Sheffield,

for 'industrial' testing in GTIMC's research and development lab.

The target is to market the CX300 for use by all gene therapy

manufacturers for in-process assessment of the quality of their

adeno-associated virus products during research, development and,

in due course, manufacturing.

Patient safety is absolutely critical to both producers and

regulators. VLPs are capsids (very small biological capsules) and

are used to carry modified DNA that will perform the gene therapy

into a patient's body. The aim is to use the CX300 to measure

attributes of VLPs that are critical to the efficacy and safety

including: (i) absolute and relative values of bound and free

nucleic acid; (ii) concentrations and empty/full ratios for AAV

capsids; and (iii) aggregation levels. All of these can be very

harmful to patients if outside specification.

Manufacture of VLPs in a GMP setting is very expensive and takes

days or weeks per batch. Product testing during production is

limited because of the 'sealed' GMP environment. Current analytical

methods are not well suited to testing these materials during all

the stages of VLP manufacture. Hence, there is currently little

opportunity for in-line feedback of product quality to allow

process control changes during a production run.

As previously reported, Paraytec collaborated with the following

European producers of VLPs: GSK, Medimmune and FUJIFILM Diosynth

Biotechnologies, in a project called NEXUS. These partners

confirmed a strong need for in-line VLP analysis and Paraytec

demonstrated its expertise in the analysis of aggregation in VLPs.

Paraytec will continue to enhance the CX300 instrument to detect

the ratio of full/empty capsids, a critical quality attribute to be

determined both during production and following purification.

Gene therapy medicine is a rapidly growing market, forecast to

grow from US$3.611 billion in 2020 to US$11.769 billion by 2027 at

a CAGR of 18.39%(1) . Leading companies making acquisitions in the

gene therapy market include: Elli Lilly, Cytiva, Thermo Scientific,

Novartis, Pfizer and many others.

(1)

https://www.researchandmarkets.com/reports/5716732/global-gene-therapy-market-forecasts-from-2022?gclid=Cj0KCQjw1aOpBhCOARIsACXYv-e24eXPjMVltcDaTKSwqQACxk0J9myR5mo8FrHXaTTMFQUtu11ZOe0aAnduEALw_wcB

Paraytec has confirmed that its programme to apply the CX300

technology to a test for the rapid diagnosis of bacteraemia causing

sepsis is proceeding on schedule. Paraytec's target is to

demonstrate Proof of Concept of an instrument for the rapid

detection of bacteria in a blood sample, before the end of the

year. I f bacteria are present, the CX300 is expected to report

whether these bacteria are classed as Gram-positive or

Gram-negative.

The Directors of Paraytec believe that such a test will greatly

help clinicians identify the likely source of infection, allowing

clinicians to immediately target the best antibiotic treatment,

since those used to treat Gram-positive or Gram-negative bacteria

are different.

Braveheart holds a 100% equity interest in Paraytec. In

addition, it has provided unsecured interest free loans to Paraytec

totalling GBP1,155,200 as at 31 March 2023.

For further information:

Braveheart Investment Group plc Tel: 01738 587555

Trevor Brown CEO

Viv Hallam, Executive Director

Allenby Capital Limited (Nominated Adviser Tel: 020 3328 5656

and Joint Broker)

James Reeve / George Payne

Peterhouse Capital Limited (Joint Broker) Tel: 020 7469 0936

Duncan Vasey / Lucy Williams

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDBBDGBUBDGXL

(END) Dow Jones Newswires

October 17, 2023 02:00 ET (06:00 GMT)

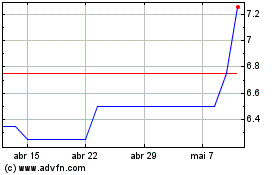

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Braveheart Investment (LSE:BRH)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024