Advanced Oncotherapy PLC Update on Financing and Current Financial Position (8855Q)

23 Outubro 2023 - 3:04AM

UK Regulatory

TIDMAVO

RNS Number : 8855Q

Advanced Oncotherapy PLC

23 October 2023

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information for the purposes of Regulation 11 of the Market Abuse

(Amendment) (EU Exit) Regulations 2019/310. With the publication of

this announcement, this information is now considered to be in the

public domain.

23 October 2023

ADVANCED ONCOTHERAPY PLC

("Advanced Oncotherapy", "AVO" or the "Company")

Update on Financing Discussions and Current Financial

Position

On 17 July 2023 Advanced Oncotherapy (AIM: AVO), the developer

of next-generation proton therapy systems for cancer treatment,

announced that it was exploring a recapitalisation plan aimed at

providing a longer-term funding solution to support the commercial

development of the LIGHT technology in a capital-intensive

industry. Further to this announcement, and the subsequent

announcement issued on 29 September 2023, the Company provides the

following update in relation to its financing discussions and

current financial position.

The Company has recently signed a non-binding term sheet with a

third-party (the "Investor"). Under this envisaged transaction (the

"Financing Transaction"), the Investor is expected to provide

funding of up to c.$80 million which is intended to meet the

Company's cashflow requirements through to the European

certification of the LIGHT System. The treatment of first patients

with LIGHT is now targeted for 2024 with certification of the LIGHT

System to follow thereafter. The form and terms of this Financing

Transaction will be subject to agreement on definitive

documentation, satisfaction of conditions precedent and the

obtaining of all requisite approvals and consents. It is

anticipated the Financing Transaction will be a mixture of equity

and debt financing. Discussions are progressing and further

announcements on the Financing Transaction will be made at the

appropriate time.

As previously announced the Company has been working on bridge

financing to alleviate the Company's immediate financing needs.

Discussions on bridge financing are ongoing and as part of these

arrangements, the Company has raised GBP200,000 via a short-term

four-month unsecured loan agreement with a new investor which

carries interest at a rate of 1.25% p.m. In addition, the Company

has raised GBP150,000 from an existing investor under its secured

convertible loan note agreement. The terms are the same as those

that were first announced on 1 March 2023. The Company continues to

carefully manage its creditors whilst it aims to finalise the

Financing Transaction.

As of 19 October 2023 the Company held cash of approximately

GBP200,000. The current liabilities of the Company include GBP22

million owed to trade and other unsecured creditors and GBP39

million of financial debt . If the Financing Transaction proceeds,

it is expected that a significant portion of current liabilities

and financial debt will be converted into equity.

Whilst the board of the Company is hopeful of a satisfactory

outcome, there can be no certainty that the Financing Transaction

will proceed. Without access to the additional capital which is

proposed to be provided by the Investor, the Company is unlikely to

be able to continue to trade and would very likely become insolvent

and be placed into administration.

Update on Formal Sale Process

The Company announced on 18 April 2023 the commencement of a

strategic review and formal sale process under the Takeover Code

(the "Formal Sale Process"). Whilst the Financing Transaction has

been the Company's primary focus, the Company remains in

discussions under the Formal Sale Process with strategic players in

the radiotherapy sector. There can be no certainty that any offer

will be made for the Company, or even proposed, or as to the terms

of any proposal or offer that may be made.

Other implications of the Takeover Code

Under Rule 21 of the Takeover Code, whilst the Company remains

in receipt of an approach from or in discussions with potential

offerors, as defined in the Takeover Code, certain elements of the

Financing Transaction may constitute frustrating action under Rule

21 of the Takeover Code. Accordingly, should this still be

relevant, the Company will seek either consent from any potential

offeror or will seek the approval of shareholders at a General

Meeting to implement such elements of the Financing

Transaction.

In addition, as set out in the announcement of 17 July 2023, the

implementation of certain aspects of the Financing Transaction

might require the granting by the Panel on Takeovers and Mergers of

a waiver of certain obligations under Rule 9 of the Takeover Code

and the approval of independent shareholders of the Company at a

general meeting of such a waiver.

Advanced Oncotherapy Plc www.avoplc.com

Dr. Michael Sinclair, Executive Chairman Tel: +44 (0) 20 3617

8728

Nicolas Serandour, CEO

WH Ireland Limited (Financial adviser) Tel: +44 (0) 20 7220

1666

Antonio Bossi / James Bavister AVOPLC@whirelandcm.com

Allenby Capital Limited (Nomad and

Joint Broker)

Nick Athanas / Piers Shimwell (Corporate Tel: +44 (0) 20 3328

Finance) 5656

Amrit Nahal / Matt Butlin (Sales

& Corporate Broking)

SI Capital Ltd (Joint Broker)

Nick Emerson Tel: +44 (0) 1483

413 500

Jon Levinson Tel: +44 (0) 20 3871

4066

About Advanced Oncotherapy Plc www.avoplc.com

Advanced Oncotherapy Plc, a UK headquartered company with

offices in London, Geneva, The Netherlands and in the USA, is a

provider of particle therapy with protons that harnesses the best

in modern technology. Advanced Oncotherapy's team "ADAM," based in

Geneva, focuses on the development of a proprietary proton

accelerator called, Linac Image Guided Hadron Technology (LIGHT).

LIGHT's compact configuration delivers proton beams in a way that

facilitates greater precision and electronic control.

Advanced Oncotherapy Plc will offer healthcare providers

affordable systems that will enable them to treat cancer with

innovative technology as well as expected lower treatment-related

side effects.

Advanced Oncotherapy Plc continually monitors the market for any

emerging improvements in delivering proton therapy and actively

seeks working relationships with providers of these innovative

technologies. Through these relationships, the Company will remain

the prime provider of an innovative and cost-effective system for

particle therapy with protons.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDMTBMTMTJTTRJ

(END) Dow Jones Newswires

October 23, 2023 02:04 ET (06:04 GMT)

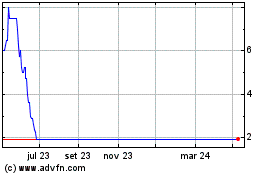

Advanced Oncotherapy (LSE:AVO)

Gráfico Histórico do Ativo

De Mar 2025 até Abr 2025

Advanced Oncotherapy (LSE:AVO)

Gráfico Histórico do Ativo

De Abr 2024 até Abr 2025