TIDMRSG

RNS Number : 7938R

Resolute Mining Limited

31 October 2023

31 October 2023

Quarterly Activities Report

For the Quarter ending 30 September 2023 ('Q3 2023', 'September

Quarter' or 'the Quarter')

Highlights

-- Total Recordable Injury Frequency Rate (TRIFR) increased to

1.55 from 0.79 in Q2 2023 as a result of eight recordable injuries

during the quarter.

-- Quarterly production (gold poured) of 74,056 ounces (oz) (Q2

2023: 84,372oz) driven by a weak quarter from Syama Oxide due to

issues stemming from the high-carbon pocket of Tabakoroni ore. Mako

and Syama Sulphide performed in line with expectations.

-- All-In Sustaining Cost (AISC) of $1,459/oz in Q3 2023, a 2%

decrease from June Quarter mainly due to the realisation of the

ongoing cost reduction initiatives which was offset by the

reduction in gold poured in the Quarter.

-- Quarterly gold sales of 76,524oz at an average realised gold

price of $1,917/oz (Q2 2023: 84,907oz at an average realised gold

price of $1,922/oz).

-- Cash generation of $8.6 million excluding debt and interest

payments and working capital movements.

-- Quarterly capital expenditure of $16.3 million (Q2 2023:

$18.6 million) with non-sustaining capital of $8.9 million,

sustaining capital expenditure of $4.6 million and exploration

spend of $2.8 million.

-- Net Cash of $2.2 million (up from a Net Debt position of

$17.2 million in June Quarter), including Cash and Bullion of $78.0

million. Available liquidity (Cash, Bullion and undrawn RCF) of

$158.0 million.

-- Full-year guidance has been revised down to 330,000 -

340,000oz from our initial guidance of 350,000oz due to mining

lower grades at Syama Oxide which has impacted yearly

production.

-- AISC guidance has been maintained at $1,480/oz.

-- Capital Expenditure guidance has been reduced to $70 million,

excluding Phase 1 Expansion capital, from the original guidance of

$88 million.

-- Syama North's Measured and Indicated Resources increased by

47% to 2.7 Moz grading 3.0g/t, from 1.86 Moz grading 3.0g/t,

following the infill diamond and RC drilling campaign conducted in

the first half of 2023. A Reserve Update is expected in the

December Quarter.

-- Released three-year production and cost forecast for Syama

and Mako operations showing total group gold production from 2024

to 2026 exceeding 1 Moz and group AISC reducing by over

$200/oz.

Note: Unless otherwise stated, all dollar figures are United

States dollars ($).

Resolute Mining Limited (Resolute, the Company or the Group)

(ASX/LSE: RSG), is pleased to present its Quarterly Activities

Report for the period ended 30 September 2023.

Terry Holohan, CEO and Managing Director, commented,

"It has been a tougher than expected Quarter for Resolute at the

Syama Oxide operation as a shift in mine plan due to the

high-carbon pocket of Tabakoroni ore encountered in Q2 continued to

affect the operation. Mako and Syama Sulphide performed in line as

expected for the quarter . In Q4 we expect an improvement at both

Syama operations and a similar performance at Mako. This has been

reflected in our revised guidance of 330,000 - 340,000oz which we

released along with our three-year forecast.

We ended the Quarter with 74,056 oz of gold poured and an AISC

of $1,459/oz which was in line with our expectations and

pleasingly, despite the reduction in gold production, a decrease

from the prior Quarter ($1,489/oz). This is demonstrative of our

committed focus on sustainably reducing costs across the group

started to pick up momentum.

The release of our three-year forecast during the Quarter shows

the Company's exciting organic growth path to increase ounces and

improve margins across the Group. The Syama North Phase I Expansion

project should enable stable gold production in excess of 260,000oz

per year with the flexibility of having two reliable sources of

ore. At Mako, we have two extremely strong years ahead of us with

production around 135,000oz per year at very healthy margins.

Despite the tough Quarter the company continued to generate

healthy cash flow as net debt improved by $19.4 million bringing us

as predicted into a positive net cash position. This speaks to the

realization of the cost reduction activities and robustness of our

operations.

Exploration continues at Mako to extend the mine's life - which

we are increasingly confident of being able to do. Lastly, our

focus for the remainder of 2023 is on continued sustainable

reduction in costs across the Resolute Group and an increased gold

production in the final Quarter."

Investor and analyst conference call

Resolute will host a conference call for investors, analysts,

and media on Tuesday, 31 October 2023, to discuss the Company's

Quarterly Activities Report for the period ending 30 September

2023. This call will conclude with a question-and-answer

session.

Conference Call (pre-registration required)

Conference Call: 8:00pm (AEST, Sydney) / 9:00am (GMT,

London)

Pre-Registration Link:

https://www.netroadshow.com/events/login?show=d0dfc841&confId=57253

Participants will receive a calendar invite with dial-in details

once the pre-registration process is complete.

A presentation, to accompany the call, will be available for

download on the Company's website:

https://www.rml.com.au/investors/presentations/ .

Operations Overview

Refer to the Appendix for Resolute's production and costs for

the September 2023 Quarter.

Environmental Social Governance

Resolute's TRIFR as at 30 September 2023 was 1.55, an increase

compared to the previous Quarter due to eight recordable injuries

during the quarter. Resolute recorded no significant environmental

incidents, regulatory non-compliances, or grievances in Q3 2023. We

were successfully audited as compliant with the Responsible Gold

Mining Principles at both Mako and Syama in Q3. Group-wide climate

change and human rights risk assessments are ongoing at both sites,

and we are actively engaging with ESG Rating agencies to improve

the Company's ratings over 2023.

Syama, Mali

Syama Sulphide

Syama sulphide gold production for the Quarter was 34,805oz at

an AISC of $1,401/oz. The operational performance is set out in the

table below.

Ore volumes mined increased by 10% to 575kt while the mined

grade decreased to 2.32g/t from 2.88g/t. This was in line with

expectation as the focus on development during the Quarter was

predominantly on hanging wall slots to open additional draw points

amenable to the optimal transverse mining. As a result of this

development, over Q4 we expect to have access to higher grades

areas as well as higher tonnages.

Ore processed was 586kt at a head grade of 2.39g/t which was an

11% increase in tonnes processed and 18% decrease in head grade

processed compared to Q2. Despite the increase in throughput, gold

production was 10% lower than previous quarter due to lower grades

mined and delivered to the plant. In Q4 we expect increased head

grades as higher grade stopes are accessed.

Capital expenditure was $6.5 million for the Quarter, a decrease

of $2.5 million from the previous Quarter. The expenditure in the

Quarter was made up of $3.4 million of capital items, namely the

Fluoseal Return Duct replacement on the Roaster Plant, ongoing

replacement parts for the sulphide plant crushers and other

mechanical parts. Additionally, the sulphide operation incurred

$2.4 million of capitalised waste and $0.7 million of exploration

costs .

AISC increased from $1,373/oz to $1,401/oz due to lower grade

mined and milled despite increased plant throughput and stable

plant recovery. The lower grade mined was due to the scheduled

focus on low-grade zones to provide access to better area for

mining in the last quarter of the year.

Syama Oxide

Syama Oxide gold production for the Quarter was 11,664oz at an

AISC of $1,478/oz. The operational performance is set out in the

table below.

Ore tonnes mined decreased due to reduced equipment utilisation

caused by bogging due to the clayey nature of the pits and the

suspension of mining from the Tabakoroni pit due to the high carbon

content. Ore tonnes were mainly sourced from the A21 and Paysans

pits. Recoveries improved as the processing of high-carbon ore was

precluded. The December Quarter is expected to have higher mined

tonnages albeit at a lower grade.

The oxide operations produced 11,664oz, a decrease of 25%

compared to the prior Quarter a combination of lower grade

materials and the expected seasonal reduction in tonnages treated

due to the wet season. We are expecting a stronger December Quarter

with a higher tonnage and head grade.

Capital expenditure at $0.7 million decreased significantly in

comparison to the prior Quarter and was made up entirely of

capitalised waste. AISC decreased by 22% from $1,892/oz to

$1,478/oz mainly due lower sustaining capital expenditure, as well

as the realisation of the ongoing cost reduction initiatives.

Mako, Senegal

Mako gold production for the Quarter was 27,587oz at an AISC of

$1,407/oz. The operational performance for Mako is set out in the

table below.

Ore mined at Mako was as expected, less than the June Quarter as

the mining area was changed due to access. In Q4, we expect a lower

mined tonnage at a higher grade given the successful completion of

the Stage 7 cut-back.

Ore processed decreased by 2% in the Quarter to 536kt from 546kt

but in line with expectation. The scheduled mill relining shutdown

which was expected at the end of the Quarter has now been deferred

to the next Quarter. As expected, the head grade decreased to

1.75g/t from 1.91g/t in Q2 2023 due to the blending of lower-grade

stockpile on account of decreased tonnes mined. In Q4 we expect

lower tonnes to be processed due to the re-line which will be

offset by a return to higher head-grades.

Capital expenditure of $7.1 million in the Quarter increased

over the previous Quarter. The spend in the Quarter was mainly due

to $5.8 million in capitalised waste incurred due to waste

stripping campaign at the Stage 7 phase of the pit. In addition to

this, $1.3 million was spent in relation to the newly commissioned

Oxygen plant and sparging system for the CIL as well as

modifications to the power station which was acquired at the

beginning of the year.

AISC increased to $1,407/oz from $1,311/oz in the previous

Quarter due to the volume effect of reduction in production.

Exploration

Total exploration expenditure year to date was $13.7 million,

with drilling programs continuing in Mali and Senegal throughout

the Quarter. Total exploration spend for the September Quarter was

$4.6 million. This was made up of $2.8 million of capital mainly

focused on drilling at Syama North, and $1.8 million of exploration

expense which was evenly split between exploration targets in

Guinea and near-mine targets in Senegal.

Syama Exploration

A report on mineral exploration results and an updated Mineral

Resource Estimate (MRE) for Syama North was announced on 4

September 2023.

Since the Syama North MRE update ASX announcement on 19 January

this year, diamond and RC drilling has continued throughout with

two drill rigs concentrating on converting the large proportion of

inferred resources to indicated category.

The majority of the drilling focussed on achieving a nominal 50

x 50m pattern required for Indicated classification on areas of the

resource which optimised during initial open pit engineering

studies. As part of the drilling program additional deeper diamond

drillholes were also completed to extend the three north plunging

mineralised shoots. Results from this drilling campaign were in

line with expectations with ore grade intervals seen in most

holes.

The wide zone of gold mineralisation located in the centre of

the A21 area which has been previously described in ASX

announcements 30 August 2022 and 19 January 2023 was consolidated

with infill drilling this Quarter. Excellent wide intersections

continued down plunge to the north and drill lines were added to

extend this zone of mineralisation.

Drilling from the Quartz Vein Hill area continued to return high

grade intersections which would likely be of sufficient tenor for

underground mining following the initial open pit operation.

The Syama North gold deposit remains open down-dip over the

entire 6km strike length. Diamond drilling is ongoing and expected

to continue throughout the remainder of 2023 to extend and increase

Mineral Resource confidence in the deposit.

Syama North Mineral Resource Estimate

The Syama North Mineral Resource Estimation was updated in

August 2023 using wireframe constrained Ordinary Kriged estimation

methodology, with identical parameters to the previous estimate

published in January 2023.

The Global Mineral Resources at Syama North is now estimated at

37.9 million tonnes at 2.9g/t Au for 3.5 million ounces at a

cut-off grade of 1g/t Au. Resource classification is shown below in

Table 5.

The strategy of converting Inferred to Indicated Mineral

Resources was very successful with now 28.3Mt containing 2.7Moz in

the Measured and Indicated Category a 47% increase over the

previous MRE released in January 2023.

The total Mineral Resource has increased by 11.3% over the

previous estimate driven entirely by an increase in volume of gold

mineralisation.

We are expecting a Syama North Reserve update during the

December Quarter

Senegal Exploration

Exploration activities continued in Senegal with drilling

programs carried out on the Tomboronkoto Joint Venture and the

Laminia Joint Venture both of which are located within 10km of the

Petowal processing complex. Results from the drilling at

Tomboronkoto are encouraging with a detailed report expected to be

announced during the December Quarter.

Guinea Exploration

During the first half of 2023 exploration RC drilling at the

Mansala Prospect intersected encouraging gold mineralisation in

several holes over a strike length of one kilometre. Follow up RC

drilling is expected to commence in Q4 2023 after the cessation of

the rainy season.

Three-Year Forecast

During the Quarter the Company provided operational forecast for

the Syama mine and Mako mine for the three years of 2024 to

2026.

Over the next three-years we are expected to see strong growth

from the Syama Sulphide operations, with the mine exceeding

260,000oz per year by 2026 as the underground Sub-Level Cave

performance further improves and the Phase I Expansion project

ramps up.

At Mako, following the successful cut-back completion over 2023,

both 2024 and 2025 will increase profitability with production

between 130,000-140,000oz per year at an AISC reducing to

US$1,100-1,200/oz from approximately $1,450/oz.

Revised 2023 Guidance

During the September Quarter, the Company also updated the

market of its 2023 Guidance. Mako and Syama sulphide operations

continue to perform according to their respective schedules,

however the Syama oxide operations have not performed to plan as a

result of mining lower grade ores therefore impacting production.

This has resulted in overall gold production being revised down

from our target of 350,000oz to a range of 330,000-340,000oz for

the year.

Group AISC guidance for 2023 remains unchanged at US$1,480/oz,

due to the implementation of sustainable cost reduction initiatives

put in place over 2023 across all aspects of the Group. Capital

expenditures for 2023 are expected to be approximately US$70

million, excluding the Phase 1 Expansion capital, down from the

previous guidance of US$88 million.

Syama Phase I Expansion

During the Quarter, the production mix, mine design and mine

schedule were optimised to maximise cash flow over the project

life. Capital cost estimates were finalised, and early procurement

of long lead items commenced.

Corporate

Quarterly Cash and Bullion Movements and Balance Sheet

(*Included in Operating Cash flows are $3.4 million of

royalties, $4.2 million of VAT and taxes, and movements in

Bullion.)

Chart 1: Quarterly Cash and Bullion Movements

The average realised gold price achieved for the Quarter was

$1,917/oz which was below the average spot price of $1,928/oz.

During the September Quarter a scheduled $25 million principal

repayment was made on the Term Loan Facility reducing the

outstanding balance to $25 million.

Net debt at 30 June 2023 of $17.2 million decreased by $19.4

million to a Net Cash position of $2.2 million at 30 September

2023. Available liquidity of $158.0 million ($165.7 million in

prior Quarter) including cash of $63.5 million, bullion of $14.5

million, and undrawn RCF of $80.0 million. Total borrowings at 30

September 2023 were $75.8 million, comprising $25.0 million on the

Term Loan Facility and $50.8 million on the overdraft facilities in

Mali.

Hedging

At 30 September 2023, Resolute's forward sales commitments

were:

As well as the above, the Company has in place 12,000oz of zero

cost collars maturing in the March 2024 Quarter. These comprise put

options at an average strike price of $1,600/oz and call options

with an average strike price of $1,873/oz.

Resolute maintains a policy of discretionary hedging in

compliance with its funding obligations, requiring a minimum of 30%

of the next six months of forecast production to be hedged.

About Resolute

Resolute Mining (ASX/LSE: RSG) is an African gold miner,

developer, and explorer with more than 30 years of experience

across Australia and Africa. To date the Company has produced over

nine million ounces of gold. It currently operates the Syama Gold

Mine in Mali and the Mako Gold Mine in Senegal. Resolute's gold

production and cost guidance for 2023 is 330,000-340,000oz at an

AISC of $1,480/oz.

Through all its activities, sustainability is the core value at

Resolute. This means that protecting the environment, providing a

safe and productive working environment for employees, uplifting

host communities, and practicing good corporate governance are

non-negotiable priorities. Resolute's commitment to sustainability

and good corporate citizenship has been cemented through its

adoption of and adherence to the Responsible Gold Mining Principles

(RGMPs). This framework, which sets out clear expectations for

consumers, investors, and the gold supply chain as to what

constitutes responsible gold mining, is an initiative of the World

Gold Council of which Resolute has been a full member since 2017.

The Company is on track to reach full compliance with these RGMPs

in 2023.

Appendix

September 2023 Quarter Production and Costs (unaudited)

Year-to-date 2023 Production and Costs (unaudited)

ASX Listing Rule 5.23 Mineral Resources

This announcement contains estimates of Resolute's mineral

resources. The information in this Quarterly that relates to the

mineral resources of Resolute has been extracted from reports

entitled 'Over Three Moz Mineral Resource at Syama North' announced

on 19 January 2023 and is available to view on Resolute's website

(www.rml.com.au) and www.asx.com (Resolute Announcement).

For the purposes of ASX Listing Rule 5.23, Resolute confirms

that it is not aware of any new information or data that materially

affects the information included in the Resolute Announcement and,

in relation to the estimates of Resolute's ore reserves and mineral

resources, that all material assumptions and technical parameters

underpinning the estimates in the Resolute Announcement continue to

apply and have not materially changed. Resolute confirms that the

form and context in which the Competent Person's findings are

presented have not been materially modified from that

announcement.

ASX Listing Rule 5.19 Production Targets

The information in this announcement that relates to production

targets of Resolute has been extracted from the report entitled

'Group Three-Year Forecast and Update to 2023 Guidance' announced

on 13 October 2023 and are available to view on the Company's

website (www.rml.com.au) and www.asx.com (Resolute Production

Announcement).

For the purposes of ASX Listing Rule 5.19, Resolute confirms

that all material assumptions underpinning the production target,

or the forecast financial information derived from the production

target, in the Resolute Production Announcement continue to apply

and have not materially changed.

Cautionary Statement about Forward-Looking Statements

This announcement contains certain "forward-looking statements"

including statements regarding our intent, belief, or current

expectations with respect to Resolute's business and operations,

market conditions, results of operations and financial condition,

and risk management practices. The words "likely", "expect", "aim",

"should", "could", "may", "anticipate", "predict", "believe",

"plan", "forecast" and other similar expressions are intended to

identify forward-looking statements. Indications of, and guidance

on, future earnings, anticipated production, life of mine and

financial position and performance are also forward-looking

statements. These forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause

Resolute's actual results, performance and achievements or industry

results to differ materially from any future results, performance

or achievements, or industry results, expressed or implied by these

forward-looking statements. Relevant factors may include (but are

not limited to) changes in commodity prices, foreign exchange

fluctuations and general economic conditions, increased costs and

demand for production inputs, the speculative nature of exploration

and project development, including the risks of obtaining necessary

licences and permits and diminishing quantities or grades of

reserves, political and social risks, changes to the regulatory

framework within which Resolute operates or may in the future

operate, environmental conditions including extreme weather

conditions, recruitment and retention of personnel, industrial

relations issues and litigation.

Forward-looking statements are based on Resolute's good faith

assumptions as to the financial, market, regulatory and other

relevant environments that will exist and affect Resolute's

business and operations in the future. Resolute does not give any

assurance that the assumptions will prove to be correct. There may

be other factors that could cause actual results or events not to

be as anticipated, and many events are beyond the reasonable

control of Resolute. Readers are cautioned not to place undue

reliance on forward-looking statements, particularly in the

significantly volatile and uncertain current economic climate.

Forward-looking statements in this document speak only at the date

of issue. Except as required by applicable laws or regulations,

Resolute does not undertake any obligation to publicly update or

revise any of the forward-looking statements or to advise of any

change in assumptions on which any such statement is based. Except

for statutory liability which cannot be excluded, each of Resolute,

its officers, employees and advisors expressly disclaim any

responsibility for the accuracy or completeness of the material

contained in these forward-looking statements and excludes all

liability whatsoever (including in negligence) for any loss or

damage which may be suffered by any person as a consequence of any

information in forward-looking statements or any error or

omission.

Authorised by Mr Terry Holohan, Managing Director and Chief

Executive Officer

Contact

Resolute Public Relations

Matthias O'Toole Howes, Jos Simson / Emily Moss, Tavistock

Corporate Development and Investor resolute@tavistock.co.uk

Relations Manager +44 207 920 3150 / +44 7788

Matthias.otoolehowes@resolutemining.com 554 035

+44 203 3017 620

Corporate Broker

Jennifer Lee, Berenberg

+44 20 3753 3040

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUAAAROVURORA

(END) Dow Jones Newswires

October 31, 2023 03:00 ET (07:00 GMT)

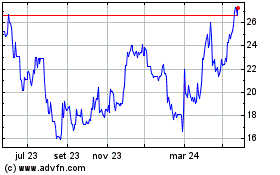

Resolute Mining (LSE:RSG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

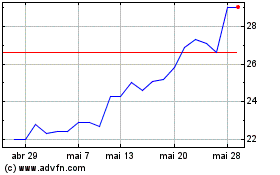

Resolute Mining (LSE:RSG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025