TIDMICON

RNS Number : 8380R

Iconic Labs PLC

31 October 2023

31 October 2023

Iconic Labs PLC

("Iconic" or the "Company")

Full Year Results for the Year ended 30 June 2023

Iconic Labs PLC (LSE: ICON), today announces its audited

financial results for the year ended 30 June 2023.

Copies of the Annual Report and Accounts for the year ended 30

June 2023 will shortly be sent to shareholders and available on the

Company's website: https://www.iconiclabs.co.uk/documents/ .

Period Highlights

-- Finalised terms with the European High Growth Opportunities

Securitisation Fund ("EHGOSF") and Linton under the Settlement

Deed

-- Finalised terms of Creditors Voluntary Arrangement ("CVA") with Joint Administrators

-- Finalised terms with EHGOSF of the Financing Facility

-- Suspension of the listing in the Company's Ordinary Shares lifted by the FCA

Post-Period Highlights

-- August 2023, Prospectus published to provide the Company with

the ability to issue further Ordinary Shares under the Prospectus

Regulation Rules

-- September 2023, 83,256 Ordinary Shares issued to all creditors under the CVA

-- October 2023, Iconic successfully completed and satisfied all

conditions of, and consequently exited, the CVA

Financial Highlights

-- Profit of GBP4,680,143 (FY 22: loss of GBP762,107) although

attributable to the writing back of the creditor balance

-- Revenue of GBPNil (FY 22: GBP26,823)

-- Total assets held as of 30 June 2023 GBP50,244 (FY 22: GBP6)

-- Group liabilities of GBP3,778,621 (FY 22: GBP8,938,526)

-- Iconic maintains a limited amount of cash on its account as

it relies entirely at this time on the EHGOSF financing facility to

meet its operational expenditures

Brad Taylor, Chief Executive Officer of Iconic Labs,

commented:

"For Iconic, 2023 has been a transformational year. We have

successfully steered the Company through administration and

financial restructuring, positioning ourselves for future growth.

As we stand at this pivotal juncture, I wish to highlight our

commitment to advancing our strategic objectives and seizing growth

opportunities.

"We look forward to this next year with confidence as we focus

on generating shareholder value."

For any further information or enquiries please contact:

Iconic Labs Tel: +44 (0) 7462 156238

Brad Taylor, Chief Executive ir@iconiclabs.co.uk

Officer

Novum Securities Limited Tel: +44 (0) 20 7399 9400

David Coffman / Daniel

Harris

Yellow Jersey PR Tel: +44 (0) 20 3004 9512

Sarah Hollins

Annabelle Wills iconic@yellowjerseypr.com

Bessie Elliot

CHIEF EXECUTIVE OFFICER'S REPORT

I am pleased to present the audited accounts of Iconic Labs PLC

and its subsidiaries (together, "Iconic" or the "Company") for the

twelve months ended 30 June 2023. A significant amount of the

information contained in these audited accounts can be found in the

Company's Prospectus published on 8 August 2023, but several

updates are also included.

Over the past twelve months, we have made strong progress in

restructuring and stabilising the Company amid challenging

circumstances, including:

(i) Negotiated settlements of all outstanding disputes;

(ii) Finalised and satisfied all conditions of the Company

Voluntary Arrangement ("CVA") which was approved with the Joint

Administrators at a creditors' meeting on 22 September 2022;

(iii) Agreed financing terms with European High Growth

Opportunities Securitization Fund ("EHGOSF") and Linton Capital LLP

("Linton"), requiring the Company to issue GBP750,000 in

convertible notes to EHGOSF and GBP750,000 to Linton pursuant to

the terms of the Deed of Issuance and Subscription dated 23 August

2022 (the "Settlement Deed");

(iv) Finalised the terms of a new financing facility on 28

September 2022 with EHGOSF pursuant to which EHGOSF would provide

Iconic with up to GBP3 million by subscribing for up to 3,000 Loan

Notes each with a par value of GBP1,000 (the "Financing Facility"),

convertible into Ordinary Shares in the Company with Warrants

attached; and

(v) Lifted the suspension of the listing of the Company's

ordinary shares ("Ordinary Shares") and as a result shareholders

were able to trade the Company's shares on the London Stock

Exchange from 24 January 2023.

As part of the requirements for the Company's successful exit

from administration and lifting the suspension of the Company's

listing, the Company published a Prospectus on 8 August 2023 to

provide the Company with the ability to issue further Ordinary

Shares under the Prospectus Regulation Rules as follows:

(i) Up to 1,674,130,609 Ordinary Shares to be issued to

unsecured creditors under the CVA;

(ii) Up to 45,045,045,045 Ordinary Shares to be issued to EHGOSF

to convert GBP750,000 in convertible notes, and to Linton Capital

to convert GBP750,000 in convertible notes under the Settlement

Deed;

(iii) Up to 80,180,180,180 Ordinary Shares to be issued to

EHGOSF to satisfy GBP2,670,000 in unconverted drawdowns and certain

fees pursuant to the Financing Facility;

(iv) Up to 36,038,525,658 Ordinary Shares to be issued to EHGOSF

to satisfy the exercise of its Warrants under the Financing

Facility; and

(vi) Up to 22,027,027,027 Ordinary Shares to be issued to Ott

Ventures s.r.o and/or Ott Ventures USA, Inc. under the Management

Services Agreement for outstanding fees as set out in the 2022

Accounts totalling, to date, GBP690,000 and a further GBP125,000 in

part lieu of fees for the balance of the calendar year, being in

aggregate GBP815,000.

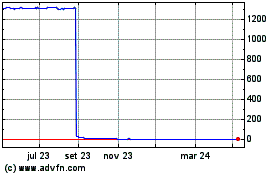

Since the suspension of the listing was lifted, EHGOSF has

converted GBP530,000, at the year end, of convertibles notes under

the Financing Facility resulting in the Company issuing a total of

8,901,668,621 Ordinary Shares of GBP0.00001 each and 2,236,616

Ordinary Shares of GBP0.1 each, post consolidation, to EHGOSF. In

addition, the Company has also issued 6,458,946,078 Warrants to

EHGOSF.

The Company held its Annual General Meeting ("AGM") on 25 August

2023 at which all resolutions were duly passed, including a

resolution for the consolidation of the Company's Ordinary Shares

on a 10,000 for 1 basis, such that every 10,000 Ordinary Shares of

GBP0.00001 each were consolidated into 1 Ordinary Share of GBP0.1

each in nominal value. The primary objective of the consolidation

was to reduce the number of Ordinary Shares, with the intention of

creating a higher share price per Ordinary Share in the capital of

the Company, which we believe will make the Company and the

Ordinary Shares more attractive to a broader range of

investors.

Since the publication of the Prospectus and the AGM, the Company

was pleased to announce that it had satisfied the final condition

to bring the CVA to a successful conclusion when it issued 83,256

Ordinary Shares of GBP0.1 each to the creditors under the CVA. As

of 21 September 2023, all documents concluding the CVA had been

filed with, and accepted by, Companies House.

Emergence and Growth Vision

We are proud to report that the Company has successfully

navigated the challenges of administration and financial

restructuring and is now poised to seek revenue-generating advisory

services as it continues to search for a suitable acquisition

target that will most likely take the form of a reverse takeover.

As digital evolution shapes our future, the Company is eyeing

opportunities in online media, artificial intelligence, big data

gathering, processing and analysis sectors with which it can enter

into advisory services contracts. Our intent is to support

companies, especially in their infancy, that have crafted

innovative products and captured markets but are inhibited by

various growth constraints. We possess the executive acumen to

steer these entities, building robust systems and strategies that

propel them towards long-term success.

Gay Star News ("GSN"): A Promising Asset

Our immediate objectives centre around GSN, which we acquired in

2019 for GBP33,000 through our subsidiary Nuuco Media Limited.

GSN's potential continues to be evident from its strong foothold in

the LGBTQ+ media realm. Despite past fiscal adversities, the

resilience and promise of GSN's brand have always shone through.

Our goal is to amplify this potential and fortify GSN's position in

the market, with Greencastle MM LLP's expertise. The partnership

terms with Greencastle ensure a balanced growth trajectory, keeping

the best interests of both parties in mind.

We aim to position GSN as a leading LGBTQ+ hub for diverse

content. The future growth of GSN lies in our ability to produce

and curate valuable content. By doing so, we expect to see a steady

rise in engagements and subscriptions. Our primary competition

comprises renowned publications like Pink News, Gay Times, and

Attitude. The expansion of GSN's operations into Europe is also on

the horizon, as we target a growth of 50,000 subscribers by the end

of 2023 and a long-term vision of 1 million subscribers by

2024.

M&A and Funding

We are actively exploring acquisition opportunities to further

enhance shareholder value. It is worth noting that the

consideration for any such moves would primarily be in the form of

company equity. Our management, spearheaded by me, is actively

overseeing this initiative.

In conclusion, while the path ahead is competitive, I am

confident that with the administration and financial restructuring

behind us, we can now turn the page and begin a new chapter for the

Company as we continue to implement our plan towards generating

shareholder value.

Bradley Taylor

Chief Executive Officer

30 October 2023

STRATEGIC REPORT

INTRODUCTION

This is the sixth set of financial statements prepared by

Iconic. This Strategic Report should also be read in conjunction

with the Chief Executive Officer's statement together with the

Prospectus published on 8 August 2023.

Principal Activities and Business Review

Iconic is a media and technology business focused on the

identification, acquisition and growth of technology-driven

companies in the online media, artificial intelligence, and big

data gathering, processing and analysis sectors.

Iconic's sole asset is Gay Star News ("GSN"), an online media

platform dedicated to the LGBTQ+ community, which Iconic intends to

continue developing with strategic partners.

PRINCIPAL RISKS AND UNCERTAINTIES

The following risks are considered by the Board to be the most

significant to the business:

Revenue, Profitability and Funding Risk

Iconic currently only has one asset, GSN, which is not

cash-generative and otherwise currently generates no revenues

including from consultancy. The Company is therefore reliant upon

the Financing Facility with EHGOSF for its sole source of working

capital.

The Financing Facility is subject to a number of conditions

("Conditions") including in particular:

-- The shares of Iconic trade on the Main Market of the London Stock Exchange;

-- The closing market price of the Shares for each of the ten

consecutive trading days falling immediately prior to the relevant

closing date must be at least higher than 150% of the nominal value

of Iconic's shares;

-- The average daily value traded of Iconic's shares (excluding

5% of the data points from the top and excluding 5% of the data

points from the bottom of the data set) for the 20 trading days

immediately prior to the applicable closing date must be at least

GBP10,000;

-- From the fifth drawdown tranche onwards, Iconic having published a Prospectus;

-- No binding commitment has been entered into by Iconic

pursuant to which a change of control in Iconic would occur;

-- No occurrence that constitutes an event of default having occurred and is continuing;

-- The Board having the required authority;

(1) For the allotment and issue of at least 200% of such number

of Shares as would be required upon conversion of all outstanding

Notes together with the Notes to be issued pursuant to the relevant

drawdown notice calculated by dividing the aggregate principal

amount of all such Notes by the Closing VWAP as of the date of such

drawdown notice; and

(2) To deviate from the Shareholders' pre-emption and/or

preferential subscription right (as applicable) with respect to

such number of Shares; and

-- No payment is due by the Company to EHGOSF (or any of its

Affiliates) and no delivery of Shares (or certificates evidencing

such Shares) resulting from a conversion of Notes or exercise of

any Warrants by EHGOSF (or any of its Affiliates) is

outstanding.

Iconic maintains a limited amount of cash on its account as it

relies entirely at this time on the EHGOSF financing facility to

meet its operational expenditures. There currently remains

approximately GBP1.75 million available for drawdown under the

Financing Facility. The expected ordinary course cash burn of the

business is approximately GBP100,000 per month for the next 12

months.

However, it is possible that in the future certain of these

conditions may not be met, some of which are outside the control of

the Company, although it is not currently known when this may

happen. As a result, in the event any such condition is not met,

the Company may not be in a position to further drawdown on the

Financing Facility. Although the Directors would endeavour to

pursue certain options to mitigate the consequence of such breach

there is no certainty that any such options could be achieved

either in part or at all. In such an event the Company would need

to wind down its operations, realise any assets and may enter

administration, if and to the extent there are creditors of the

Company who cannot be paid. In such an event, the Company would no

longer manage the affairs of the Company or the realisation of its

assets. As a result of either winding down the business or entering

into administration, the Ordinary Shares would be cancelled from

the Official List and Shareholders may receive little or no value

for their Ordinary Shares.

Dilution and Pricing Risk

If EHGOSF exercises its full rights under the Financing Facility

for conversion of Loan Notes and Warrants into Shares, this could

result in a significant holding in the Company by EHGOSF. However,

EHGOSF's strategy is generally to sell shares in the market as soon

as practicable following the exercise of such rights and in any

event under the Financing Facility, inter alia, EHGOSF cannot hold

more than 29.9% of the Company. Accordingly, there is a risk that

should the Company seek to drawdown under the Loan Notes and EHGOSF

thereafter exercise and sell Shares in significant amounts over a

lengthy period, this could have a material negative impact on the

price of the Shares.

Key Executive Risk

Given the wholesale change in the Board of Directors and

executive team in February and March of 2021, coupled with the

complexity of the restructuring, administration, CVA, and lifting

of the trading suspension, there is a risk of Iconic not being able

to retain key executives, which could adversely affect Iconic's

operating and financial performance. Retaining and motivating

Bradley Taylor (Chief Executive Officer) and David Štýbr (Executive

Director) is a critical component of the future success of the

business. Without the participation of these key executives, it is

unlikely that the execution of the CVA, continued trading of the

Company, and financing with EHGOSF can continue.

Copycat Website

A copycat website, www.gaystarnews.co.uk ("Copycat Website") was

registered on 19 October 2022. Whilst it is not currently seeking

to compete with the 'Gay Star News' brand created more than a

decade ago, the operator of the Copycat Website has refused to

deliver up the website. The Company has alerted the operators that

any use of the Gay Star News brand will constitute passing off and

breach of copyright but there is no certainty of a positive

resolution to this dispute. If this dispute is not resolved, and

the Copycat Website is not delivered up, it could result in lost

website traffic and therefore a loss of revenue to the Company.

The Company is dependent upon advertising agencies to implement

its growth strategy

The Company seeks to access a number of advertising agencies to

implement its growth strategies. In the event that these do not

wish to engage with the Company this could significantly impact the

Company's ability to implement its growth strategies and/or could

adversely impact profits.

Regulation of the internet and e-commerce is rapidly evolving

and changes could adversely affect the Company's business

Regulation of the internet and e-commerce is rapidly evolving

and there are an increasing number of directly applicable laws and

regulations. It is possible that additional laws and regulations

may be enacted with respect to the internet, covering issues such

as user privacy, law enforcement, pricing, taxation, content

liability, copyright protection and quality of products and

services. The adoption of new laws and regulations could have a

material adverse effect on the Company's business, results of

operations and financial condition. In particular, digital

advertising is subject to complex regulation. The regulations vary

by jurisdiction of operation and are subject to continuous change,

and compliance with such regulations and other legal requirements

may be burdensome and costly. Changes to existing regulations could

lead to increased costs or otherwise affect the Company's ability

to generate revenues in a jurisdiction, for example, if a

distribution channel ceases operations due to a change in existing

regulation. In addition, the Company may face increased compliance

costs and regulatory scrutiny each time it expands its operations

into a new jurisdiction. In addition, any enquiries made, or

proceedings initiated, by individuals or any regulator may lead to

negative publicity and potential liability for the Company, which

could have a material adverse effect on the business, results of

operations and financial condition of the Company.

Global Economic Risk

The online media and publishing, technology, artificial

intelligence, and data gathering, processing, and analytics sectors

are susceptible to adverse developments in the global economy and

particularly the UK economy where Iconic is located. The continual

uncertainty over the war in Ukraine, the high inflationary

environment and the threat of global recession, for example, may

continue to delay spending by potential clients which may have a

negative effect on the demand for services which could affect

Iconic's revenues.

Potential Unrecorded Legacy Liabilities

As evidenced by the administration and disputes involving

various key parties, there were significant legacy issues that

predated management's arrival. Following the exit from

administration and the entering into of confidential settlement

agreements with various parties, the Directors consider that it is

unlikely that there are any material unknown liabilities of Iconic,

however there is the potential for unknown creditors to emerge

which would increase the liabilities of the Company.

The Company will be dependent on the strength of its brand and

its reputation and on developing these further and would suffer if

this were not possible for any reason

A strong brand and reputation are vital to the Company's growth

strategies. Brand strength and awareness is important to generate

new and subsequently retain custom. The management team are in the

process of developing the brand and reputation but there can be no

assurances that this will be successful. The actions of

competitors, negative publicity involving the Company's management

or any of its employees, a lack of sufficient funds or other

factors may all adversely impact the brand or reputation. These in

turn may have a materially adverse effect on the Company's

business, prospects for growth and/or financial position.

Inability to contract with customers on the most favourable

terms

The Company enters into contracts with a wide variety of

companies, many of whom possess greater negotiating leverage than

is currently available to the Company. The Company may be required

to tolerate terms which are less favourable than might be

anticipated, and which may also be governed by the laws of other

jurisdictions, and this could intensify if the number of

competitors increases, thereby potentially giving existing or

prospective customers more options. Furthermore, if the Company

enters into more onerous terms than it would ideally enter into, it

may risk not being able to satisfy those terms. Breaching onerous

terms or failing to secure the best commercial terms possible could

have a material impact on the Company's business revenue, financial

condition and profitability.

Access to further capital

Part of the Company's growth strategy is to identify and acquire

similar businesses that are of a smaller scale and which are

well-priced. In the longer term, the Company is intending to grow

the business organically and continue to identify and acquire

similar businesses, albeit the Company anticipates such future

acquisitions to be of a larger scale than those the Company is

looking to make in the near term. The Company's longer term growth

strategy may require additional funds in order to respond to

business challenges, enhance existing services and complete any

future acquisitions.

Accordingly, the Company may need to engage in equity or debt

financings to secure additional funds. If the Company raises

additional funds through further issues of equity or convertible

debt securities, existing shareholders could suffer significant

dilution, and any new equity securities could have rights,

preferences, and privileges superior to those of current

shareholders. Any debt financing secured by the Company in the

future could involve restrictive covenants relating to its capital

raising activities and other financial and operational matters,

which may make it more difficult for the Company to obtain

additional capital and to pursue business opportunities, including

potential acquisitions. In addition, the Company may not be able to

obtain additional financing on terms favourable to it, if at all.

If the Company is unable to obtain adequate financing or financing

on terms satisfactory to it, when required, its ability to continue

to support its business growth and to respond to business

challenges could be significantly limited or could affect its

financial viability.

Financial Risk Management

The Board monitors the internal risk management function across

Iconic and advises on all relevant risk issues. There is regular

communication with internal departments, external advisors and

regulators. Iconic's policies on financial instruments and the

risks pertaining to those instruments are set out in the accounting

policies in note 1 of the financial statements.

Financial Review

Iconic made a profit in the 2023 financial year of GBP4,768,623

(2022 - loss of GBP762,107), which is attributable to the writing

back of creditor balances previously mentioned in the Chief

Executive Officer's Report.

The revenue of the Group in the year was GBPNil (2022 -

GBP26,823). Administrative expenses decreased by GBP4,972,509 in

the year, mainly due to the writing back of creditors balances

which are no longer due.

At 30 June 2023, Iconic held total assets of GBP50,244 (2022 -

GBP6), this is relating to the amounts held as cash at bank. The

Group had liabilities of GBP3,690,141 at the balance sheet date

(2022 - GBP8,938,526), a decrease of GBP5,248,385.

Key Performance Indicators

The business is focused on the areas of cash management and

operating results.

Iconic has identified the following key performance indicators

which the Directors will use to measure success against the

business plan:

-- Gross revenue growth

-- EBITDA growth

-- Market value

BOARD COMPOSITION

As at the 30 June 2023, the Board was comprised as follows:

Number of Percentage Number of senior Number in executive management Percentage

board members of the board positions on of executive

the board (CEO, management

CFO, SID and

Chair)

Men 3 75% 100% 2 100%

=============== ============== ================= =============================== ==============

Women 1 25% 0 0 0

=============== ============== ================= =============================== ==============

FUTURE DEVELOPMENT AND STRATEGY

Market Trends

The Directors closely follow the trends and developments in the

online media and publishing, technology, artificial intelligence,

and big data gathering, processing, and analytics sectors. We see

the shift continuing towards leaner online companies that can scale

rapidly, operate internationally with an inexpensive footprint, and

provide a broad array of services across various sectors through

the effective use of information and video gathering, data mining,

just-in-time processing, and online collaboration technology.

While the administration paused Iconic's ability to conduct

transactions in these sectors, the Directors nevertheless continue

to follow these market trends and are well positioned now that

Iconic has exited administration to take advantage of opportunities

in these areas.

Company Strategy

We aim to position Gay Star News as a leading LGBTQ+ hub for

diverse content. The future growth of GSN lies in our ability to

produce and curate valuable content.

In addition, the Directors have identified numerous players in

the sectors of interest, many of which have technological or

operational advantages, but are unable to grow and scale rapidly or

internationally for various reasons including the fragmented,

localised, and isolated nature of their business models. We believe

there is a significant opportunity to support, acquire, and

integrate these companies into Iconic given the Directors'

international capabilities and strategic growth expertise.

Going concern

The Board's assessment of going concern and the key

considerations thereto are set out in our Corporate Governance

Report.

Capital Structure

Details of the Ordinary Shares of the Company are shown in note

10. The Company has a class of Ordinary Shares with a nominal value

of GBP0.00001 per share, which were consolidated and divided into

Ordinary Shares of GBP0.1 each on 25 August 2023, and a class of

Deferred Shares of GBP0.00249 per share, both of which carry no

fixed income. Each holder of Ordinary Shares is entitled to receive

Iconic's Annual Report and audited financial statements, to attend

and speak or appoint proxies and to exercise voting rights at

Iconic's general meetings.

The Company's Articles of Association (the "Articles") do not

have any specific restrictions on the transfer of shares or

restrictions on voting rights, and there are no limitations on

holding such shares. Other than the obligations contained in the

Financing Facility, the Settlement Deed, and the CVA, the Directors

are not aware of any agreement between Iconic shareholders that may

result in restrictions on the transfer of securities or on voting

rights.

No person has any special rights of control over Iconic's share

capital and all issued shares are fully paid.

The appointment and replacement of Directors and the powers of

the Directors are governed by the Articles, the Quoted Companies

Alliance Corporate Governance Code, the Companies Act 2006 and

related legislation. The powers of the Directors are described in

the Corporate Governance Report.

Environmental Issues

As far as the Directors are aware, Iconic's business activities

do not cause a direct and disproportionate adverse effect on the

environment.

Employee Matters

As of 30 June 2023, and continuing through the fourth quarter of

2023, Iconic does not have any employees and its management is

being conducted primarily by Bradley Taylor and David Štýbr who

have worked with the Joint Administrators and creditors to

restructure the Company and exit administration, resolve all

outstanding disputes, and get the trading suspension on Iconic's

shares lifted.

Social, Community and Human Rights Issues

Iconic seeks to achieve the highest ethical standards and

behaviours in conducting its business, with integrity, openness,

diversity and inclusiveness being a priority.

We have adopted a formal equal opportunities policy which is

contained in our employee handbook. The aim of the policy is to

ensure no job applicant, employee or worker is discriminated

against either directly or indirectly on the grounds of race, sex,

disability, sexual orientation, gender reassignment; marriage or

civil partnership; pregnancy or maternity; religion or belief or

age.

SECTION 172 STATEMENT

Section 172 of the Companies Act 2006 requires directors to take

into consideration the interests of stakeholders and other matters

in their decision making. The directors continue to have regard to

the interests of Iconic's personnel and other stakeholders, the

impact of its activities on the community, the environment and its

reputation for good business conduct, when making decisions. In

this context, acting in good faith and fairly, the directors

consider what is most likely to promote the success of Iconic for

its members in the long term. We explain in this annual report, and

below, how the board engages with stakeholders.

Relations with key stakeholders such as employees, shareholders

and suppliers are considered in more detail in our Corporate

Governance Report.

The Directors are aware of their responsibilities to promote the

success of Iconic in accordance with section 172 of the Companies

Act 2006. To ensure Iconic was operating in line with good

corporate practice, all Directors received refresher training on

the scope and application of section 172 in writing. This

encouraged the Board to reflect on how Iconic engages with its

stakeholders and opportunities for enhancement in the future. A

section 172 notice has been included with the Board papers since

this date. As required, Iconic's Company Secretary will provide

support to the Board to help ensure that sufficient consideration

is given to issues relating to the matters set out in

s172(1)(a)-(f).

The Board regularly reviews Iconic's principal stakeholders and

how It engages with them. This is achieved through information

provided by management and by direct engagement with stakeholders

themselves. We aim to work responsibly with our stakeholders,

including suppliers. The Board has recently reviewed its

anti-corruption and anti-bribery, equal opportunities and

whistleblowing policies.

The key events and Board decisions made in the year are set out

below:

23 August 2022 - Finalised terms with EHGOSF and Linton under

the Settlement Deed.

22 September 2022 - Finalised terms of CVA with Joint

Administrators.

28 September 2022 - Finalised the terms with EHGOSF of the

Financing Facility.

14 December 2022 - Confirmation of Marija Hrebac to the Board of

Directors following regulatory checks.

22 December 2022 - Publication of Annual Financial Report

2021.

3 January 2023 - Publication of Annual Financial Report

2022.

25 January 2023 - FCA lifted the suspension of the listing in

the Company's Ordinary Shares.

20 February 2023 - Confirmation of Emmanuel Blouin to the Board

of Directors following regulatory checks.

23 February 2023 - Approval for the conversion of the Ott

Companies' outstanding GBP365,000 success fee plus GBP125,000 in

monthly management fees and any further outstanding monthly

management fees following the publication of the Prospectus into

new Ordinary Shares.

31 March 2023 - Approval of Interim Accounts for the six months

ended 31 December 2022.

8 August 2023 - Publication of Prospectus.

25 August 2023 - AGM held and Ordinary Shares Consolidated.

15 September 2023 - 83,256 Ordinary Shares issued to all

creditors under the CVA.

12 October 2023 - Documents terminating CVA filed with and

accepted by Companies House.

Bradley Taylor

Director

30 October 2023

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 30 JUNE 2023

Notes Year ended Year ended

30 June 30 June

2023 2022

GBP GBP

Continuing operations

Revenue - 26,823

Gross profit - 26,823

Administrative expenses 3 4,768,579 (203,930)

Direct costs incurred in connection

with EHGOF financing facility 3 - (585,000)

Other operating income 44 -

Operating Profit / (Loss) 4,768,623 (762,107)

Profit / (Loss) before taxation 4,768,623 (762,107)

Taxation 5 - -

---------- ----------

Profit / (Loss) for the period from

continuing operations 4,768,623 (762,107)

Profit / (Loss) for the period 4,768,623 (762,107)

Total comprehensive profit / (loss)

for the period 4,768,623 (762,107)

========== ==========

Loss per ordinary share 6

Basic and diluted

* from continuing operations (0.00) (0.00)

(0.00) (0.00)

* from discontinued operations

========== ==========

The profit for the year and total comprehensive profit for the year

are wholly attributable to the equity holders of the parent.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

30 June 30 June

2023 2022

Notes GBP GBP

Assets

Non-current assets

Intangible assets 7 1 1

Total non-current assets 1 1

------------ ------------

Current assets

Cash and cash equivalents 9 50,243 5

------------ ------------

50,243 5

------------ ------------

Total assets 50,244 6

============ ============

Equity

Share capital 10 4,539,523 4,450,506

Share premium 11 8,341,761 7,900,778

Retained deficit 11 (16,521,181) (21,289,804)

------------ ------------

(3,639,897) (8,938,520)

Liabilities

Current liabilities

Trade and other payables 12 1,750,141 6,523,526

Loans and borrowings 13 1,940,000 2,415,000

3,690,141 8,938,526

------------ ------------

Total liabilities 3,690,141 8,938,526

------------ ------------

Total equity and liabilities 50,244 6

============ ============

The financial statements of Iconic Labs plc were approved by the

Board and authorised for issue on 30 October 2023. They were signed

on its behalf by:

Bradley Taylor

Director

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 JUNE 2023

Share Share Retained Total

capital premium deficit Equity

GBP GBP GBP GBP

Balance at 30 June 2021 4,450,506 7,900,778 (20,527,697) (8,176,413)

--------- --------- ------------ -----------

Loss for the period - - (762,107) (762,107)

Total comprehensive loss for

the period - - (762,107) (762,107)

--------- --------- ------------

Transactions with owners:

Balance at 30 June 2022 4,450,506 7,900,778 (21,289,804) (8,938,520)

--------- --------- ------------ -----------

Profit for the year - - 4,768,623 4,768,623

Foreign exchange translation - - - -

--------- --------- ------------ -----------

Total comprehensive loss for

the year - - 4 ,768,623 4,768,623

--------- --------- ------------ -----------

Transactions with owners:

Issue of shares 89,017 440,983 - 530,000

Cost of placings - - - -

--------- --------- ------------ -----------

Total contribution by and distribution

to owners 89,017 440,983 - 530,000

(3,639,897

Balance at 30 June 2023 4,539,523 8,341,761 (16,521,181) )

========= ========= ============ ===========

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE YEARED 30 JUNE 2023

Year ended Year ended

30 June 30 June

2023 2022

Notes GBP GBP

Cash flows from operating activities

Total comprehensive profit /

(loss) for the period 4,768,623 (762,107)

(Profit)/Loss from sale of tangible - -

assets

Net write back of loan notes (915,000) -

Depreciation - -

Finance costs - -

3,853,623 (762,107)

Decrease/(increase) in trade

and other receivables - 103,126

(Decrease)/increase in trade

and other payables (4,773,385) 642,057

(Decrease) in provisions - (34,000)

------------ -----------

Operating cash flows used by continuing

activities (919,762) (50,924)

Operating cash flows generated from/(used - -

by) discontinued operations

------------ -----------

Net cash used in operating activities (919,762) (50,924)

Cash flows from financing activities

Issue of share capital 10 - -

Issue of share premium - -

Cash flows from issue of convertible

loan notes 13 970,000 -

Financing cash flows from continuing 970,000 -

activities

Financing cash flows used by discontinued - -

operations

Net cash flows from financing activities 970,000 -

Net increase/(decrease) in cash

and cash equivalents 50,238 (50,924)

Cash and cash

equivalents at

beginning

of period 5 50,929

Cash and cash equivalents at period

end 9 50,243 5

------------ -----------

COMPANY STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023

30 June 30 June

2023 2022

Notes GBP GBP

Non-current assets

Investments 8 1 2

Non-current assets 1 2

------------ ------------

Current assets

Cash and cash equivalents 9 50,243 -

------------ ------------

50,243 -

------------ ------------

Total assets 50,244 2

============ ============

Equity

Share capital 10 4,539,523 4,450,506

Share premium 11 8,341,761 7,900,778

Retained deficit 11 (16,521,181) (21,289,344)

------------ ------------

(3,639,897) (8,938,060)

Current liabilities

Trade and other payables 12 1,750,141 6,523,062

Loans and borrowings 13 1,940,000 2,415,000

------------ ------------

3,690,141 8,938,062

------------ ------------

Total liabilities 3,690,141 8,938,062

------------

Total equity and liabilities 50,244 2

============ ============

The Company's profit and total comprehensive profit for the year

ended 30 June 2023 was GBP4,768,163 (30 June 2022: GBP1,403,138

loss).

COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 30 JUNE 2023

Share Share premium Retained Total

capital GBP deficit equity

GBP GBP GBP

Balance at 30 June 2021 4,450,506 7,900,778 (19,886,206) (7,534,922)

--------- --------------- ------------- -----------

Loss for the period - - (1,403,138) (1,403,138)

--------- --------------- ------------- -----------

Total comprehensive loss for

period - - (1,403,138) (1,403,138)

--------- --------------- ------------- -----------

Transactions with owners

Balance at 30 June 2022 4,450,506 7,900,778 (21,289,344) (8,938,060)

Profit for the year - - 4,768,163 4,768,163

--------- --------------- ------------- -----------

Total comprehensive profit

for year - - 4,768,163 4,768,163

--------- --------------- ------------- -----------

Transactions with owners

Issue of shares 89,017 440,983 - 530,000

Cost of placings - - - -

--------- --------------- ------------- -----------

Total contributions by and

distributions to owners 89,017 440,983 - 530,000

--------- --------------- ------------- -----------

Balance at 30 June 2023 4,539,523 8,341,761 (16,521,181) (3,639,897)

========= =============== ============= ===========

NOTES TO THE FINANCIAL STATEMENTS

FOR THE YEARED 30 JUNE 2023

1. Accounting Policies

Basis of preparation

These financial statements have been prepared in accordance with

International Financial Reporting Standards as adopted by the

European Union ("adopted IFRS") and with those parts of the

Companies Act 2006 applicable to companies preparing their accounts

under adopted IFRS.

These consolidated financial statements are presented in Pounds

Sterling ('GBP'), which is considered by the directors to be the

functional and presentation currency.

The Company's individual statement of comprehensive income has

been omitted from the Group's annual financial statements having

taken advantage of the exemption not to disclose under Section

408(3) of the Companies Act 2006.

Going concern

The Directors consider it is appropriate to prepare the Iconic

financial statements on the basis that that they are able to

continue to operate for a period of at least 12 months from the

date of approving these financial statements.

As noted in the Strategic Report when making this assessment the

Directors have prepared forecasts which consider the expected level

of expenditure over the course of the review period together with

the anticipated revenues arising from the new business and

acquisitions completed shortly after the period end. Key to the

compilation of the forecasts central to the Directors' assessment

of going concern are the following factors:

-- The Group is at an early stage of development and is not

currently profitable. Despite strong confidence in its business

plan and forecasts, the Directors recognise there is a risk that it

may require more funding but not be able to find agreement with a

funding partner.

-- The Group has only recently exited administration and the

Board is working diligently to ensure compliance with the terms of

the CVA and also to get the Group relisted as soon as possible.

Basis of consolidation

The Group financial statements consolidate those of the parent

company and all of its subsidiaries. Subsidiaries are entities

controlled by the Group. The parent company controls a subsidiary

if it has power over the investee to significantly direct the

activities, exposure, or rights, to variable returns from its

involvement with the investee, and the ability to use its power

over the investee to affect the amount of the investors' returns.

The financial statements of subsidiaries are included in the

consolidated financial statements from the date that control

commences until the date that control ceases.

The results of subsidiaries acquired or disposed in the period

are included in the consolidated income statement from the

effective date of acquisition or up to the effective date of

disposal, as appropriate. All intra-group transactions, balances,

income and expenses are eliminated on consolidation.

The results and net assets of subsidiaries whose accounts are

denominated in foreign currencies are retranslated into Sterling at

average rates and year-end rates respectively.

Where the Group has the power to participate in (but not

control) the financial and operating policy decisions of another

entity, it is classified as an associate. Associates are initially

recognised in the consolidated statement of financial position at

cost. Subsequently associates are accounted for using the equity

method, where the Group's share of post-acquisition profits and

losses and other comprehensive income is recognised in the

consolidated statement of profit and loss and other comprehensive

income (except for losses in excess of the Group's investment in

the associate unless there is an obligation to make good those

losses).

Business combinations

The Group applies the acquisition method of accounting for

business combinations. The consideration transferred by the Group

to obtain control of a subsidiary is calculated as the sum of the

acquisition date fair values of assets transferred, liabilities

incurred and equity interests issued by the Group. Acquisition

costs are expensed as incurred.

Revenue recognition

Revenue represents the amount of consideration to which the

Group expects to be entitled in exchange for the provision of its

services to the client, net of discounts and sales taxes.

The Group uses the five-step model as prescribed under IFRS15 on

the Group's revenue transaction. This included the identification

of the contract, identification of the performance obligations,

determination of the transaction price, allocation of the

transaction price to the performance obligations and recognition of

revenue. The point of recognition arises when the Group satisfies

the performance obligation by transferring control of a promised

service to the customer which could occur over time or at a point

in time. Provision is made for all foreseeable losses where the

Company believes that a contract will deem to be unprofitable, or a

client fails to remunerate the Company for services provided.

Sale of Services

Revenue that has been billed to the client, but which is yet to

be paid is accrued within trade receivables.

Foreign currency

Transactions in foreign currencies are translated to the

respective functional currencies of Group entities at exchange

rates at the dates of the transactions. Monetary assets and

liabilities denominated in foreign currencies at the reporting date

are retranslated to the functional currency at the exchange rate at

that date.

Non-monetary items in a foreign currency that are measured based

on historical cost are translated using the exchange rate at the

date of the transaction.

Foreign currency differences arising on retranslation are

recognised in the statement of comprehensive income.

Taxation

The tax expense represents the sum of the tax currently payable

and deferred tax. The tax currently payable is based on taxable

profit for the year. Taxable profit differs from net profit as

reported in the income statement because it excludes items of

income or expense that are taxable or deductible in other years and

it further excludes items that are never taxable or deductible.

Deferred tax is the tax expected to be payable or recoverable on

temporary differences between the carrying amounts of assets and

liabilities in the financial statements and the corresponding tax

bases used in the computation of taxable profit, and is accounted

for using the balance sheet liability method. Deferred tax

liabilities are generally recognised for all taxable temporary

differences and deferred tax assets are recognised to the extent

that it is probable that taxable profits will be available against

which deductible temporary differences can be utilised. Such assets

and liabilities are not recognised if the temporary difference

arises from goodwill or from the initial recognition (other than in

a business combination) of other assets and liabilities in a

transaction that affects neither the tax profit nor the accounting

profit.

Deferred tax liabilities are recognised for taxable temporary

differences arising on investments in subsidiaries and associates,

and interests in joint ventures, except where the Group is able to

control the reversal of the temporary difference and it is probable

that the temporary difference will not reverse in the foreseeable

future.

The carrying amount of deferred tax assets is reviewed at each

reporting date and reduced to the extent that it is no longer

probable that sufficient taxable profits will be available to allow

all or part of the asset to be recovered.

Deferred tax is measured on an undiscounted basis using the tax

rates that are expected to apply in the period when the liability

is settled or the asset is realised. Deferred tax is charged or

credited in the income statement, except when it relates to items

charged or credited directly to equity, in which case the deferred

tax is also dealt with in equity.

Intangible fixed assets

Intangible assets comprise capitalised computer software which

are initially recognised at cost.

Amortisation is provided so as to write off their carrying value

over their expected useful economic lives. It is provided at the

following rates:

Computer Software 33% straight line basis

Intangible assets also comprise intellectual property which is

initially measured at cost. The useful economic life of the asset

is considered to be such that any amortisation charge would be

immaterial to the financial statements. The directors have

therefore decided that an annual impairment review rather than an

systematic amortisation is more appropriate for this asset.

Impairment of non-current assets

At each reporting date the Group reviews the carrying amounts of

its property, plant and equipment and intangible assets to

determine whether there is any indication that those assets have

suffered an impairment loss. If any such indication exists, the

recoverable amount of the asset is estimated in order to determine

the extent of the impairment loss (if any).

If the recoverable amount of an asset is estimated to be less

than its carrying amount, the carrying amount of the asset is

reduced to its recoverable amount. An impairment loss is recognised

as an expense immediately, unless the relevant asset is carried at

a revalued amount, in which case the impairment loss is treated as

a revaluation decrease.

Financial assets

Financial assets are recognised when the Group becomes a party

to the contractual provisions of the financial asset.

Financial assets are derecognised when the contractual rights to

the cash flows from the financial assets expire, or when the

financial asset and substantially all of the risks and rewards are

transferred.

The financial assets of the Group are initially measured at fair

value adjusted for transaction costs (where applicable).

Financial assets are classified into the following

categories:

- Amortised cost

- Fair value through profit or loss (FVTPL)

- Fair value through other comprehensive income (FVOCI)

The classification is determined by both:

- The Group's business model for managing the financial asset

- The contractual cash flow characteristics of the financial asset

All income and expenses relating to financial assets that are

recognised in profit or loss are presented within finance costs and

finance income.

Financial assets are measured at amortised cost if the assets

meet the following conditions (and are not designated as

FVTPL):

- They are held within a business model whose objective is to

hold the financial assets and collect its contractual cash

flows

- The contractual terms of the financial assets give rise to

cash flows that are solely payments of principal and interest on

the principal amount outstanding

After initial recognition, these are measured at amortised cost

using the effective interest method. Discounting is omitted where

its effect is immaterial. The Group's cash and cash equivalents,

trade and other receivables fall into this category.

An impairment loss in respect of a financial asset measured at

amortised cost is calculated as the difference between its carrying

amount and the present value of the estimated future cash flows

discounted at the asset's original effective interest rate. Losses

are recognised in profit or loss and reflected in an allowance

against trade and other receivables. When an event occurring after

the impairment was recognised causes the amount of impairment loss

to decrease, the decrease in impairment loss is reversed through

profit or loss.

Trade and other receivables

The group makes use of a simplified approach in accounting for

trade and other receivables and records the loss allowance as

lifetime expected credit losses. These are the expected shortfalls

in contractual cash flows, considering the potential for default at

any point during the life of the financial instrument. In

calculating, the Group uses its historical experience, external

indicators and forward-looking information to calculate the

expected credit losses using a provision matrix.

The Group assesses impairment of trade and other receivables on

a collective basis.

Cash and cash equivalents

Cash and cash equivalents comprise cash balances and call

deposits. These are initially and subsequently recorded at fair

value.

Financial liabilities

The Group's principal financial liabilities include trade and

other payables, leases and convertible debt none of which would be

classified as fair value through profit or loss.

Therefore, these financial liabilities are classified as

financial liabilities at amortised cost, as defined below:

Other financial liabilities include the following items:

-- Borrowings are initially recognised at fair value net of any

transaction costs directly attributable to the issue of the

instrument. Such interest-bearing liabilities are subsequently

measured at amortised cost using the effective interest method,

which ensures that any interest expense over the period to

repayment is at a constant rate on the balance of the liability

carried in the statement of financial position. Interest expense in

this context includes initial transaction costs and premium payable

on redemption, as well as any interest or coupon payable while the

liability is outstanding.

-- Trade payables and other short-term monetary liabilities,

which are initially recognised at fair value and subsequently

carried at amortised cost using the effective interest method.

Convertible loan notes

Convertible loan notes issued by the Group comprise loan notes

that can be converted to ordinary shares at the option of the

holder.

The liability component of the convertible loan notes is

recognised on the date of inception and is determined using a

market interest rate for an equivalent non-convertible instrument.

The equity element is recognised as the difference between the

value of the financial instrument as a whole and the value of the

liability component. Any directly attributable transaction costs

are allocated to the equity and liability components in proportion

to their initial carrying amounts.

Subsequently, the liability component of a compound financial

instrument is measured at amortised cost using the effective

interest rate method.

Leased assets

The company applies IFRS 16 Leases. Accordingly leases are all

accounted for in the same manner:

-- A right of use asset and lease liability is recognised on the

statement of financial position, initially measured at the present

value of future lease payments;

-- Depreciation of right-of-use assets and interest on lease

liabilities are recognised in the statement of comprehensive

income;

-- The total amount of cash paid is recognised in the statement

of cash flows, split between payments of principal (within

financing activities) and interest (also within financing

activities)

The initial measurement of the right of use asset and lease

liability takes into account the value of lease incentives such as

rent free periods.

The costs of leases of low value items and those with a short

term at inception are recognised as incurred.

Share capital

The Group's ordinary shares are classified as equity

instruments.

Changes in accounting standards, amendments and

interpretations

At the date of authorisation of the financial statements, the

following amendments to Standards and Interpretations issued by the

IASB that are effective for an annual period that begins on or

after 1 January 2022. These have not had any material impact on the

amounts reported for the current and prior periods.

Standard or Interpretation Effective

Date

Annual improvements to IFRS Standards 2018-2020 1 January

2022

IAS 37 - Onerous Contracts 1 January

2022

IAS 16 - Property, Plant and Equipment 1 January

2022

IFRS 3 - Reference to the Conceptual Framework 1 January

2022

IFRS 9 Annual Improvements to IFRS Standards 1 January

2018-2020 Cycle 2022

New and revised Standards and Interpretations in issue but not

yet effective

At the date of authorisation of these financial statements, the

Company has not early adopted any of the following amendments to

Standards and Interpretations that have been issued but are not yet

effective:

Standard or Interpretation Effective

Date

IAS 1 - Disclosure of Accounting Policies 1 January

2023

IAS 1 Amendments regarding the classification 1 January

of liabilities 2023

IAS 1 Amendments to defer the effective date 1 January

of the January 2020 amendments 2023

IAS 8 - Amendments regarding the definition 1 January

of accounting estimates 2023

IAS 12 - Deferred Tax Arising from a Single 1 January

Transaction 2023

IFRS 17 - Insurance Contracts 1 January

2023

As yet, none of these have been endorsed for use in the UK and

will not be adopted until such time as endorsement is confirmed.

The Directors do not expect any material impact as a result of

adopting standards and amendments listed above in the financial

year they become effective.

2. Critical Accounting Estimates and Judgements

The group makes certain estimates and assumptions regarding the

future. Estimates and judgements are continually evaluated based on

historical experience and other factors, including expectations of

future events that are believed to be reasonable under the

circumstances. In the future, actual experience may differ from

these estimates and assumptions. Significant management judgements

are as follows:

Legacy Issues

-- Due to the change in the Board, key management and operations

of the Group that took place in March 2021, it is possible that

there are unrecorded liabilities relating to discontinued

activities about which the Board are unaware. The Board have

undertaken, to the extent possible, a thorough review of the

creditor position of the Parent Company and the Group, with a core

focus on the legacy business operations. Notwithstanding the

Board's assessment, there is a residual risk unforeseen liabilities

may arise. However, due to the publicity around the new business,

shutting down the old one and drawing down on the EHGOSF facility,

a number of claims were made against the company. Since the period

end, no additional creditors have made a claim against the Group or

the Parent Company. While it is important to consider these

liabilities in these accounts the Board have however made a

judgment that the risk of unrecorded actual or contingent

liabilities is now low.

-- The Group's former Board under through its Cellplan

subsidiary was promoting bespoke stem cell medical insurance and

launched a website to market the product. After due enquiry, the

new Board is not aware that any such policies were issued. There

does however remain a residual risk that policies may have been

issued. The board consider that the incidence and financial impact

is now low.

3. Profit/(Loss) from Operations

Year ended Year ended

30 June 30 June

2023 2022

GBP GBP

The loss for the period is stated after charging:

Auditors remuneration - audit services 30,000 50,000

Expenses by nature: GBP GBP

Legal and professional fees 772,578 (7,102)

Consultancy fees 433,368 255,254

Other supplies and external services 112,957 86,027

Total operating expenses 1,348,903 334,179

------------

Creditors written off (6,117,482) -

Impairment of loans - (130,249)

------------ ----------

Total administrative expenses (4,768,579) 203,930

------------ ----------

Direct costs in connection with

EHGOSF financing facility - 585,000

Other penalties - -

------------ ----------

(4,768,579) 788,930

------------ ----------

4. Staff Costs

No wages were paid during this year or the

previous year.

Employee Numbers

The average number of staff employed by the group during the

period amounted to:

General and administration 3 4

3 4

---

Key management personnel compensation

Key management personnel are those persons having authority and

responsibility for planning, directing and controlling the

activities, and are the directors of the company.

Remuneration of the directors and highest paid director is shown

in the Remuneration Committee Report.

5. Taxation

Year ended Year ended

30 June 30 June

2023 2022

GBP GBP

Current tax - -

----------- -----------

Total current tax - -

----------- -----------

The reason for the difference between the actual tax charge for

the period and the standard rate of corporation tax in the United

Kingdom applied to losses for the period are as follows:

Year ended Year ended

30 June 30 June

2023 2022

GBP GBP

Profit/(Loss) before taxation 4,768,623 (762,107)

Tax using the parent company's domestic tax

rate of 19% (2022: 19%) 906,038 (144,800)

Effects of:

(Utilisation of)/unrelieved tax losses and

other deductions arising in the period (906,038) 144,800

Expenses not deductible for taxation purposes - -

Total tax charged in the income statement - -

-------------

The deferred taxation attributable to losses arising in the year

and for losses carried forward has not been recognised in these

accounts due to the uncertainty over whether this will be

recovered.

6. Loss per share

Year ended Year ended

30 June 30 June 2022

2023 GBP

GBP

Numerator

Profit/(Loss) for the period 4,768,623 (762,107)

Denominator

Weighted average number of ordinary shares

used in basic EPS 46,306,916,660 37,405,248,039

Basic and diluted loss per share (0.00) (0.00)

* continuing operations (0.00) (0.00)

* discontinued operations

--------------- -------------------

7. Intangible Assets

Intellectual

Property Total

GBP GBP

Cost

Balance at 30 June 2022 21,600 21,600

Additions - -

------------

Balance at 30 June 2023 21,600 21,600

------------ -------

Amortisation

Balance at 30 June 2022 21,599 21,599

Impairment - -

Balance at 30 June 2023 21,599 21,599

------------ -------

Carrying amounts

Balance at 30 June 2023 1 1

============ =======

Balance at 30 June 2022 1 1

============ =======

8. Investments

Company

30 June 30 June

2023 2022

GBP GBP

Investments in subsidiaries 1 2

1 2

=========== ===========

Subsidiaries as at 30 June 2023:

Country of Nature of

Entity Registered incorporation business Notes

office

address

------------------------- ------------------------ ------------------------- ----------------------- ------------------

WideCells International 7 Bell Yard, United Holding (c)

Limited London, Kingdom company (d)

WC2A 2JR

WideCells Rua Da Casa Portugal Trading (a)

Portugal Branca, company

SA 97 Coimbra

3030-109,

Portugal

WideCells Calle Spain In (a)

Espana Castillo de liquidation

SL Fuensaldana,

4, 28232

Las Rozas,

Madrid

CellPlan 7 Bell Yard, United Dormant (a)

Limited London, Kingdom company (d)

WC2A 2JR

CellPlan Edificio Portugal Dormant (b)

International Tower Plaza company (d)

Lda Rotunda Eng,

Edgar

Cardoso, no.

23,

11 F,

4400-676

Vila

Nova de

Gaia,

Portugal

Nuuco Media 7 Bell Yard, United Dormant (c)

Limited London, Kingdom company (d)

WC2A 2JR

Notes: (a) 100% owned by WideCells International Limited (b)

100% owned by CellPlan Limited

(c) 100% owned by Iconic Labs plc (d) Ordinary Shares Held

9. Cash and cash equivalents

Group

30 June 30 June

2023 2022

GBP GBP

Cash at bank available on demand 50,243 5

Bank overdraft - -

-------- --------

Total cash and cash equivalents 50,243 5

-------- --------

Company

30 June 30 June

2023 2022

GBP GBP

Cash at bank available on demand 50,243 -

Total cash and cash equivalents 50,243 -

--------

10. Company Share Capital

30 June 2023 30 June 2022

Number GBP Number GBP

Authorised, allotted

and fully paid - classified

as equity

Ordinary shares of

GBP0.00001

each 46,306,916,660 463,069 37,405,248,039 374,052

Deferred shares of

GBP0.00249

each 1,637,129,905 4,076,454 1,637,129,905 4,076,454

-------------------------- ---------- ------------------------------- ------------

Total 47,944,046,565 4,539,523 39,042,377,944 4,450,506

-------------------------- ---------- ------------------------------- ------------

At 30 June 2023, the Company had 46,306,916,660 Ordinary shares

of GBP0.00001 in issue.

As at 30 June 2023 the Company had 1,637,129,905 Deferred Shares

of GBP0.00249 each.

In accordance with the Companies Act 2006, the company has no

limit on its authorised share capital.

The holders of Ordinary shares have full voting, dividend and

capital distribution rights. The Ordinary shares do not confer any

rights of redemption.

On or following the occurrence of a change of control the

receipts from the acquirer shall be applied to the holders of the

Ordinary shares pro rata to their respective holdings.

Ordinary shares and Deferred Shares are recorded as equity.

At 30 June 2023 the Company had issued 6,125,000,000 warrants to

EHGOSF at a strike price of GBP0.00003 per share. All warrants

remain outstanding at the year end date.

11. Reserves

The following describes the nature and purpose of each reserve

within equity:

Reserve Description and purpose

Share premium Amount subscribed for share

capital in excess of nominal

value

Retained deficit All other net gains and losses

and transactions with owners

(e.g. dividends) not recognised

elsewhere

12. Trade and other payables

Group

30 June 30 June

2023 2022

GBP GBP

Trade payables 1,704,142 809,844

Other payables - 5,574,562

Accruals 45,999 139,120

Tax and social security - -

-------------- --------------

Total 1,750,141 6,523,526

-------------- --------------

Book values approximate to fair values at 30 June 2023 and 30

June 2022.

Company

30 June 30 June

2023 2022

GBP GBP

Trade payables 1,704,142 809,380

Other payables - 5,574,562

Accruals 45,999 139,120

Tax and social security - -

---------- ----------

1,750,141 6,523,062

---------- ----------

Book values approximate to fair values at 30 June 2023 and 30

June 2022.

13. Loans and borrowings

Group

30 June 30 June

2023 2022

Current GBP GBP

Convertible loans 1,940,000 2,415,000

---------- ----------

Total 1,940,000 2,415,000

---------- ----------

Book values approximate to fair values at 30 June 2023 and 30

June 2022.

During the year, as part of the settlement agreements, EHGOSF

agreed to cancel the outstanding convertible loan agreements and

warrants in exchange for new convertible loan notes of GBP750,000,

and in addition, GBP750,000 in new convertible loan notes were

issued to Linton Capital. These remain unconverted at the end of

the year. These convertible loan notes are secured by relevant

legal charges over the assets of the Company.

Also during the year, the Company entered into a financing

facility with EHGOSF for the issue of up to GBP3m of further

convertible loan notes. At the year end the Company had drawn down

GBP1,030,000 of the facility of which GBP530,000 had been converted

into shares and fees of GBP60,000 had been deducted. This facility

is unsecured.

Company

30 June 30 June

2023 2022

Current GBP GBP

Convertible loans 1,940,000 2,415,000

Total 1,940,000 2,415,000

----------

14. Provisions

30 June 30 June

2023 2022

GBP GBP

Provisions brought forward - 34,000

Provision reversed in the year - (34,000)

-------- ---------

Provisions carried forward - -

-------- ---------

15. Financial Instruments - Risk Management

The Group is exposed through its operations to the following

financial risks:

-- Credit risk

-- Market risk

-- Liquidity risk

In common with other businesses, the group is exposed to risks

that arise from use of financial instruments. This note describes

the group's objectives, policies and processes for managing those

risks and the methods used to measure them.

The principal financial instruments used by the group, from

which the financial instrument risks arise, are as follows:

-- Cash and cash equivalents

-- Trade and other payables

-- Loans and borrowings

A summary of the financial instruments held by category is

provided below:

-- Financial assets - amortised cost

-- Financial liabilities - amortised cost

Group:

2023 2022

GBP GBP

Cash and cash equivalents 50,243 5

Trade and other receivables - -

--------- -----

Total financial assets - amortised cost 50,243 5

--------- -----

2023 2022

GBP GBP

Trade and other payables 1,750,141 6,523,526

Loans and borrowings 1,940,000 2,415,000

---------- ----------

Total liabilities - amortised cost 3,690,141 8,938,526

---------- ----------

Company: 2023 2022

GBP GBP

Cash and cash equivalents 50,243 -

Trade and other receivables - -

------- -----

Total financial assets - amortised cost 50,243 -

------- -----

2023 2022

GBP GBP

Trade and other payables 1,750,141 6,523,062

Loans and borrowings 1,940,000 2,415,000

---------- ----------

Total liabilities - amortised cost 3,690,141 8,938,062

---------- ----------

The Board has overall responsibility for the determination of

the Group's risk management objectives and policies.

The overall objective of the Board is to set policies that seek

to reduce risk as far as possible without unduly affecting the

Groups' competitiveness and flexibility. Further details regarding

these policies are set out below:

Credit risk

Credit risk is the risk of financial loss to the Group if a

counterparty to the financial instrument fails to meet its

contractual obligations. It is Group policy to assess the credit

risk of new customers before entering into contracts.

Credit risk also arises from cash and cash equivalents and

deposits with banks and financial institutions. For banks and

financial institutions, only independently rated parties with high

credit status are accepted.

The Group does not enter into derivatives to manage credit

risk.

Cash in bank

Group

2023 2022

GBP GBP

Cash held at Wise Payments Limited 50,243 5

Total financial assets 50,243 5

-------

Company

2023 2022

GBP GBP

Cash held at Wise Payments Limited 50,243 -

Total financial assets 50,243 -

-------

Market risk

Foreign exchange risk

Foreign exchange risk arises because the Group has operations in

Portugal and Spain, whose functional currency is not the same as

the functional currency of the Group. The Group's net assets

arising from such overseas operations are exposed to currency risk

resulting in gains or losses on retranslation into sterling.

As of 30 June 2023, the Group's exposure to foreign exchange

risk was not material as the overseas operations had been

discontinued.

Liquidity risk

Liquidity risk arises from the Group's management of working

capital. It is the risk that the Group will encounter difficulty in

meeting its financial obligations as they fall due.

The Board will continue to monitor long term cash projections

and will consider raising funds as required.

The following table sets out the contractual maturities

(representing undiscounted contractual cash-flows) of financial

liabilities:

Group:

Between Between Between Over

Up to 3 and 1 and 2 and 5 years

3 months 12 2 5 years GBP

2023 GBP months years GBP

GBP GBP

Trade and other payables 1,750,141 - - - -

Borrowings 1,940,000 - - - -

Total 3,690,141 - - - -

----------- -------- -------- ---------

Between Between Between Over

Up to 3 and 1 and 2 and 5 years

3 months 12 2 5 years GBP

2022 GBP months years GBP

GBP GBP

Trade and other payables 6,523,526 - - - -

Borrowings 2,415,000 - - - -

Total 8,938,526 - - - -

----------- -------- -------- ---------

More details in regard to the line items are included in the

respective notes:

-- Trade and other payables - note 12

-- Loan and borrowings - note 13

At the balance sheet date, the Group had liabilities due for

settlement within 3 months of GBP3,690,141, compared to a cash

balance of GBP50,243. Since the year end, the Group has negotiated

settlements on all outstanding disputes, finalised a CVA with the

Joint Administrators and the critical, preferential, secured, and

unsecured creditors and agreed to financing terms with EHGOSF to

support the Company.

GBP1,940,000 of borrowings re convertible loan notes which are

to be settled by way of an issue of share capital.

The Group monitors capital which comprises all components of

equity (i.e. share capital, share premium and accumulated

deficit).

The directors are aware of the need for the Group to obtain

capital in order to fund the growth of the business and are in