TIDMRGL

RNS Number : 8584S

Regional REIT Limited

09 November 2023

9 November 2023

REGIONAL REIT Limited

("Regional REIT", the "Group" or the "Company")

Q3 2023 Trading Update, Dividend Declaration & ESG

Update

6.2% uplift in rent renewal income

Regional REIT Limited (LSE: RGL), the regional property

specialist, is pleased to announce a trading update for the period

from 1 July 2023 to 30 September 2023 and a dividend declaration

for the third quarter of 2023. Additionally, the Group provides an

update on its positive ESG progress, with a notable strengthening

of its EPC and GRESB rating.

Q3 2023 Trading Update

The Group continued to trade well during the period under review

and has made good progress, completing a number of lease renewals

during the quarter. Retention remained high with 73.2%(*) of units

up for renewal let to the same tenants. Renewals achieved a 6.2%

uplift in rental income.

Since 1 January 2023, the Group has exchanged on 56 leases to

new tenants totalling 96,355 sq. ft. and GBP1.6m per annum ("pa")

of rental income when fully occupied, achieving a rental uplift of

11.3% against December 2022 ERVs. Of this total, 13 leases have

been exchanged since 30 June 2023, totalling 25,859 sq. ft. and

will provide GBP0.4m pa of additional rental income.

Including the letting announced on 31 October 2023 at Norfolk

House to Global Banking School Ltd the year-to-date total let space

amounted to 125,738 sq. ft., providing GBP2.1m pa of additional

rental income.

* Includes tenants that are currently holding over, lease

renewals, and the acquisition of new replacement tenants.

Portfolio Highlights as at 30 September 2023:

-- 150 properties, 1,533 units and 1,021 tenants, totalling

c.GBP752.9m(**) of gross property assets value

-- Offices (by value) were 92.9% of the portfolio (31 December

2022: 91.8%), Retail 3.5% (31 December 2022: 3.6%), Industrial 2.1%

(31 December 2022: 3.1%) and Other 1.5% (31 December 2022:

1.4%)

-- Group cost of debt (incl. hedging) 3.5% pa (31 December 2022:

3.5% pa) - 100% fixed and hedged ensuring the maximum cost of debt

will not exceed 3.5%

-- Rent roll of GBP68.0m (30 June 2023: GBP69.8); ERV GBP88.7m (30 June 2023: GBP88.9m)

-- England & Wales represented 83.5% (31 December 2022:

83.3%) of the portfolio with the remainder in Scotland

-- EPRA Occupancy (by ERV) 80.7% versus 82.5% as at 30 June

2023; 30 September 2023 like-for-like (versus 30 September 2022)

EPRA occupancy was 80.7% (85.5%)

-- Average lot size c. GBP5.0m (31 December 2022: c. GBP5.1m)

-- Net loan-to-value ratio c. 52.6%(**) (30 June 2023: 51.9%)

-- Weighted average debt duration 3.8 years, with the earliest

borrowing maturity date being August 2024

-- Cash and cash equivalent balances GBP32.6m (31 December 2022: GBP50.1m)

-- Gross borrowings GBP428.5m (31 December 2022; GBP440.8m)

** Gross property assets value based upon Colliers valuations as

at 30 June 2023, adjusted for subsequent acquisitions, disposals

and capital expenditure in the period.

Q3 2023 Dividend Declaration

As previously indicated, the Company is pleased to declare that

it will pay a dividend of 1.20 pence per share ("pps") for the

period 1 July 2023 to 30 September 2023, (1 July 2022 to 30

September 2022: 1.65pps). The entire dividend will be paid as a

REIT property income distribution ("PID").

Shareholders have the option to invest their dividend in a

Dividend Reinvestment Plan ("DRIP"), and more details can be found

on the Company's website

https://www.regionalreit.com/investors/investors-dividend/dividend-reinvestment-plan

.

The key dates relating to this dividend are:

Ex-dividend date 16 November 2023

Record date 17 November 2023

-----------------

Last day for DRIP election 19 December 2023

-----------------

Payment date 12 January 2024

-----------------

Further to the announcement made on the 12 September 2023, the

Board will target a dividend of 5.25pps for the full year 2023

(2022: 6.6pps), which equates to an annualised dividend yield of

19.2% at the closing price per share on 8 November 2023.

ESG Update

During the quarter the portfolio EPC ratings continued to

improve, and the Company remains on target to achieve EPC B rating

by 2030 in accordance with current guidelines.

Rating 30 June 2023 30 September Movement %

% 2023 %

B plus and Exempt 26.4 34.2 +780bps

------------- ------------- -----------

C 33.2 31.0 (220)bps

------------- ------------- -----------

D 26.1 22.5 (360)bps

------------- ------------- -----------

E and below 14.3 12.3 (200)bps

------------- ------------- -----------

Excluding Scotland:

Rating 30 June 2023 30 September Movement %

% 2023 %

B plus and Exempt 28.4 34.1 +570bps

------------- ------------- -----------

C 33.7 32.4 (130)bps

------------- ------------- -----------

D 26.7 23.0 (370)bps

------------- ------------- -----------

E and below 11.2 10.5 (70)bps

------------- ------------- -----------

Following the assessment by Global Real Estate Sustainability

Benchmark ("GRESB"), the Group has increased its score noticeably

to 66 in 2023 from 60 in 2022, achieving two Green Star status. The

Company continues to improve and embed ESG processes throughout its

operations and looks forward to announcing continued improvements

to the rating for 2024.

A full update on the Company's ESG progress will be provided in

the annual report and accounts, which is due to be published in

2024, including the development of the Company's pathway to net

zero carbon.

Rental Collection Update

As at 3 November 2023, the Company had collected 95.9 % of the

rent due for Q3 2023. This comprised rent received of 95.4%,

monthly rents of 0.5% and agreed collection plans of 0.0%.

Rent received from 1 January 2023 to 3 November 2023 amounted to

98.1%, comprising of rent received of 97.9%, monthly rents of 0.2%

and agreed collection plans of 0.0%. The rent received of 98.1%

compares favourably with the equivalent period in 2022 of

97.2%.

Outlook

During the period under review, the challenging economic

backdrop and inflationary environment remained evident with a

subdued investment market; and though positive leasing momentum

continued across the portfolio, the time to completion remains

elongated.

In the near term, the Board remains focused upon a controlled

disposal programme, to reduce the LTV back to the Company's

long-term target of 40%, whilst maintaining the quarterly

dividend.

Stephen Inglis, CEO of London & Scottish Property Investment

Management, Asset Manager commented:

"The Company has performed robustly in the period, against a

backdrop of a volatile market conditions, and continued headwind

for the commercial office market.

"We again achieved strong rent collection and lease retention

for the quarter, highlighting the strength and diversity of our

tenant base; and although, completions were elongated we achieved

an average uplift of 6.2% in rental income, providing an additional

GBP0.4m of rental income per annum.

We continue to remain committed to a programme of asset sales to

reduce net borrowings back to the Company's long term c.40% LTV

target."

Summary of Activity in the Quarter to 30 September 2023:

The Group undertook several asset management projects,

generating new lettings and maintaining and improving income

through lease renewals and re-gears:

-- Eagle Court, Birmingham - Virgin Media Ltd. renewed its lease

to April 2033, with the option to break in 2028, at a rental income

of GBP791,784 pa (GBP18.00/ sq. ft.) on 43,988 sq. ft. of

space.

-- Victory House, Chatham, Kent - Lloyds Bank Plc renewed its

lease to June 2028, with the option to break in 2026, at a rental

income of GBP548,298 pa (GBP11.34/ sq. ft.) on 48,372 sq. ft. of

space.

-- Lightyear, Glasgow Airport, Glasgow - Rolls-Royce has let

15,116 sq. ft. of office space to August 2033, with an option to

break in 2028, at a rental income of GBP264,530 pa (GBP17.50/ sq.

ft.).

-- Southgate Park, Peterborough - Virgin Media Ltd. renewed its

lease to April 2033, with the option to break in 2028, at a rental

income of GBP143,745 pa (GBP15.00/ sq. ft.) on 9,583 sq. ft. of

space.

-- Salamander Quay, Bankside, Harefield - Alcatel IP Networks

Limited renewed its lease to October 2033, with the option to break

in 2028, at a rental income of GBP136,000 pa (GBP20.12/ sq. ft.) on

6,759 sq. ft. of space.

-- 15 Davy Court, Rugby - Morris Homes (Midlands) Ltd. renewed

its lease to July 2028, with no option to break prior to the lease

expiry, at a rental income of GBP123,050 pa (GBP12.19/ sq. ft.) on

10,092 sq. ft. of space.

-- Oakland House, Manchester - Please Hold (UK) Ltd. renewed its

lease to the end of August 2024, at a rental income of GBP110,050

pa (GBP10.00/ sq. ft.) on 11,005 sq. ft. of space.

-- Manchester Green, Manchester - Assetz SME Capital Ltd.

continued its commitment to existing lease (14,937 sq. ft.),

guaranteeing a rental income of GBP272,600 pa (GBP18.25/ sq. ft.)

to September 2027.

-- Vantage Point, Edinburgh - Adobe Systems Europe Ltd.

continued its commitment to existing lease (13,328 sq. ft.),

guaranteeing a rental income of GBP199,920 pa (GBP15.00/ sq. ft.)

to July 2028.

-- Miller Court, Tewkesbury - Amiosec Ltd. continued its

commitment to existing lease (10,070 sq. ft.), guaranteeing a

rental income of GBP151,050 pa (GBP15.00/ sq. ft.) to August

2025.

-- Southgate Park, Peterborough - Linden Ltd. continued its

commitment to existing lease (9,816 sq. ft.), guaranteeing a rental

income of GBP130,108 pa (GBP13.25/ sq. ft.) to June 2028.

-- Mere Grange, St Helens - Portico Day Nurseries Ltd. continued

its commitment to existing lease (6,181 sq. ft.), guaranteeing a

rental income of GBP96,240 pa (GBP15.57/ sq. ft.) to July 2027.

Sales

Total disposals in the three months to 30 September 2023

amounted to GBP2.1m (before costs), reflecting a net initial yield

of 7.2% and in line with the 30 June 2023 valuation.

Subsequent Events summary post 30 September 2023:

Since the quarter end, the Group has successfully completed the

following lettings and sales:

Lettings

-- Columbus House, Coventry - Shell Energy Retail Ltd. has taken

assignment of lease and renewed for a further two years from

January 2024, at a rental income of GBP908,500 pa (GBP17.06/ sq.

ft.) on 53,253 sq. ft. of space.

-- Norfolk House, Birmingham - Existing tenant Global Banking

School Ltd. has let an additional 29,383 sq. ft. of space at a

rental income of GBP558,277 (19.00/ sq. ft.). The lease is to

December 2037, with a break option in 2032 to be coterminous with

the existing lease of ground, first and third floors.

-- 133 Finnieston Street, Glasgow - Anderson, Anderson &

Brown LLP has let 19,829 sq. ft. of office space to September 2033,

with an option to break in 2028, at a rental income of GBP356,922

pa (GBP18.00/ sq. ft.).

Sales

Additionally, announced separately today Venlaw and Elmbank

Gardens, Glasgow has been sold for GBP6.25m, 26.3% above the June

valuation. The 51,775 sq. ft. of office space comprises of 23

individual units let on 13 separate leases. The purchaser intends

to redevelop the office space for student and residential use.

This sale brings our total disposals to GBP26.0m in the

financial year to date (before costs) equating to 2% above their

last valuation.

Forthcoming Events

22 February 2024 Q4 2023 Dividend Declaration and Portfolio

Valuation

26 March 2024 Full year 2023 Preliminary Results Announcement

22 May 2024 May 2024 Trading Update and Outlook Announcement

Q1 2024 Dividend Declaration Announcement

23 May 2024 Annual General Meeting

Note: All dates are provisional and subject to change

- ENDS -

Enquiries:

Regional REIT Limited

Press enquiries through Buchanan

ARA Europe Private Markets Limited Tel: +44 (0) 20 7845 6100

Investment Adviser to the Group

Adam Dickinson, Investor Relations, Regional REIT Limited

London & Scottish Property Investment Management Tel: +44 (0) 141 248 4155

Asset Manager to the Group

Stephen Inglis

Buchanan Communications Tel: +44 (0) 20 7466 5000

Financial PR

Charles Ryland, Henry Wilson, George Beale

About Regional REIT

Regional REIT Limited ("Regional REIT" or the "Company") and its

subsidiaries (the "Group") is a United Kingdom ("UK") based real

estate investment trust that launched in November 2015. It is

managed by London & Scottish Property Investment Management

Limited, the Asset Manager, and ARA Europe Private Markets Limited,

the Investment Adviser.

Regional REIT's commercial property portfolio is comprised

wholly of income producing UK assets and comprises, predominantly

of offices located in the regional centres outside of the M25

motorway. The portfolio is geographically diversified, with 150

properties, 1,021 tenants as at 30 September 2023, with a valuation

of c.GBP752.9m.

Regional REIT pursues its investment objective by investing in,

actively managing and disposing of regional core and core plus

property assets. It aims to deliver an attractive total return to

its Shareholders, targeting greater than 10% per annum, with a

strong focus on income supported by additional capital growth

prospects.

The Company's shares were admitted to the Official List of the

UK's Financial Conduct Authority and to trading on the London Stock

Exchange on 6 November 2015. For more information, please visit the

Group's website at

www.regionalreit.com .

Cautionary Statement

This document has been prepared solely to provide additional

information to Shareholders to assess the Group's performance in

relation to its operations and growth potential. The document

should not be relied upon by any other party or for any other

reason. Any forward looking statements made in this document are

done so by the Directors in good faith based on the information

available to them up to the time of their approval of this

document. However, such statements should be treated with caution

due to the inherent uncertainties, including both economic and

business risk factors, underlying any such forward-looking

information.

ESMA Legal Entity Identifier ("LEI"): 549300D8G4NKLRIKBX73

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVNKFBPFBDDPDK

(END) Dow Jones Newswires

November 09, 2023 02:00 ET (07:00 GMT)

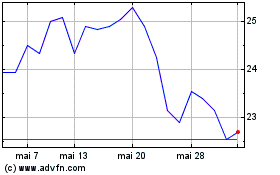

Regional Reit (LSE:RGL)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Regional Reit (LSE:RGL)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025