TIDMAIRE

RNS Number : 5939T

Alternative Income REIT PLC

15 November 2023

15 November 2023

Alternative Income REIT plc

(the "Company" or "Group")

RESULT OF ANNUAL GENERAL MEETING

The Board of Alternative Income REIT plc is pleased to announce

that at the Company's Annual General Meeting held today, all

resolutions were passed on a show of hands.

Resolutions 1 to 10 (inclusive) were proposed as ordinary

resolutions and resolutions 11 to 14 (inclusive) were proposed as

special resolutions. The proxy votes received prior to the meeting

were as follows:

Resolution Votes % Votes % Total Total Votes

For* Against votes validly votes cast Withheld**

cast as % of

issued

share capital

To receive and adopt the

audited financial

statements

of the Company for the

financial

1 year ended 30 June 2023 25,276,814 99.96 9,181 0.04 25,285,995 31.41 31,462

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To approve the

Directors'

2 Remuneration Report 24,634,076 99.74 64,558 0.26 24,698,634 30.68 618,823

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To approve the

Directors'

3 Remuneration Policy 25,145,991 99.60 100,558 0.40 25,246,549 31.36 70,908

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To elect Simon Bennett

as

4 a director 25,236,441 99.86 36,608 0.14 25,273,049 31.40 44,408

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To re-elect Stephanie

Eastment

5 as a director 25,235,215 99.85 37,834 0.15 25,273,049 31.40 44,408

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To re-elect Adam Smith

as

6 a director 24,659,441 97.57 613,608 2.43 25,273,049 31.40 44,408

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To re-appoint Moore

Kingston

Smith LLP as independent

7 auditor of the Company 25,214,650 99.82 46,484 0.18 25,261,134 31.38 56,323

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To authorise the Audit

Committee

to determine the

auditor's

8 remuneration 25,276,305 99.93 18,690 0.07 25,294,995 31.42 22,462

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To approve the Company's

9 dividend policy 25,284,814 99.96 9,181 0.04 25,293,995 31.42 23,462

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To authorise the

directors

10 to allot shares 25,129,892 99.37 158,605 0.63 25,288,497 31.41 28,960

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To authorise the

disapplication

of pre-emption rights up

11 to 10% 24,924,295 98.56 363,202 1.44 25,287,497 31.41 29,960

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To authorise the

disapplication

of pre-emption rights up

to a further 10% in

connection

with an acquisition or

specified

12 capital investments 24,965,632 98.71 325,865 1.29 25,291,497 31.42 25,960

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To authorise the Company

to purchase its own

13 shares 25,252,947 99.80 51,050 0.20 25,303,997 31.43 13,460

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

To authorise the calling

of general meetings,

other

than an annual general

meeting,

on not less than 14

clear

14 days' notice 24,662,553 97.51 630,583 2.49 25,293,136 31.42 24,321

------------------------- ----------- ------ ---------- ----- --------------- --------------- ------------

* Any discretionary votes have been included in the "For"

totals.

**A vote withheld is not a vote in law and is not counted in the

calculation of the votes for or against a resolution.

Every shareholder has one vote for every Ordinary Share held. As

at 15 November 2023, the share capital of the Company consisted of

80,500,000 Ordinary Shares of GBP0.01 each with voting rights. The

Company does not hold any shares in Treasury.

The full text of all the resolutions can be found in the Notice

of Annual General Meeting dated 9 October 2023, a copy of which is

available on the Company's website at

https://www.alternativeincomereit.com/investors/reporting-centre/

In accordance with Listing Rule 9.6.2 copies of all the

resolutions passed, other than ordinary business, will be submitted

to the National Storage Mechanism and will shortly be available for

inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

ENQUIRIES

Alternative Income REIT PLC

S imon Bennett - Chai rman via H/Advisors Maitland below

M7 Real Estate Ltd

Richard Croft

Jane Blore 020 3657 5500

Panmure Gordon (UK) Limited 020 7886 2500

Alex Collins

Tom Scrivens

H/Advisors Maitland (Communications

Advisor) 07747 113 930 / 020 7379 5151

James Benjamin aire-maitland@h-advisors.global

Rachel Cohen

The Company's LEI is 213800MPBIJS12Q88F71.

Further information on Alternative Income REIT PLC is available

at www.alternativeincomereit.com (1) .

(1) Neither the content of the Company's website, nor the

content on any website accessible from hyperlinks on its website or

any other website, is incorporated into, or forms part of, this

announcement nor, unless previously published on a Regulatory

Information Service, should any such content be relied upon in

reaching a decision as to whether or not to acquire, continue to

hold, or dispose of, securities in the Company.

NOTES

Alternative Income REIT PLC aims to generate a sustainable,

secure and attractive income return for shareholders from a

diversified portfolio of UK property investments, predominately in

alternative and specialist sectors. The majority of the assets in

the Group's portfolio are let on long leases which contain index

linked rent review provisions.

The Company's asset manager is M7 Real Estate Limited ("M7"). M7

is a leading specialist in the pan-European, regional,

multi-tenanted real estate market. It has over 230 employees in 14

countries and territories. The team manages over 610 assets with a

value of circa EUR6.9 billion (at 30 September 2023).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

RAGFFDFLIEDSEIF

(END) Dow Jones Newswires

November 15, 2023 10:00 ET (15:00 GMT)

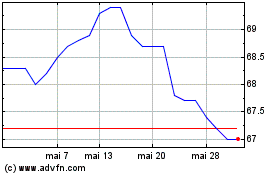

Alternative Income Reit (LSE:AIRE)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Alternative Income Reit (LSE:AIRE)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025