TIDMKINO

RNS Number : 8267U

Kinovo PLC

28 November 2023

28 November 2023

Kinovo Plc

("Kinovo" or the "Group")

Interim Results

Strong H1 Performance

Ongoing Execution of Strategic Initiatives

Kinovo plc (AIM:KINO), the specialist property services group

that delivers compliance and sustainability solutions, announces

its unaudited Interim Results for the six months ended 30 September

2023 (the "Period").

Financial highlights (Continuing Operations):

-- Revenue increased by 2% to GBP30.3 million (H1 2023: GBP29.8 million)

-- Gross profit up 9% from GBP7.71 million to GBP8.40 million

-- Gross margin increas ed by 1.8ppt to 27.7% (H1 2023: 25.9%)

-- Adjusted EBITDA up 21% to GBP2.9 million (H1 2023: GBP2.4 million)

-- Operating profit increased by 47% to GBP2.7 million (H1 2023: GBP1.9 million)

-- Basic earnings per share increased 43% to 3.08p from 2.16p in H1 2023

-- Cash conversion of 92% during the period (H1 2023: 130%)

-- Net cash of GBP1.0 million (H1 2023, net debt: GBP56,000)

Operating highlights:

-- A favourable mix of works, operational efficiencies and lower

non-underlying costs delivered increased gross margin

-- Three-year visible revenues increased to GBP157.0 million (FY

2023: GBP146.4 million) with 95% of revenues recurring

-- Regulation attributable revenues increased to 61% of the

Group's total revenues (H1 2023: 54%), due to legislation drivers,

delivering growth of 15% in Regulation revenues

-- Regeneration attributable revenues increase to 26% of the

Group's total revenues (H1 2023: 25%) with growth of 8%

-- Renewables down to GBP3.87 million in the period from GBP6.29

million but is expected to reverse in H2

-- Electrical services leads the Group's service performance,

accounting for 47% of total revenues and delivering 20% growth

-- Numerous successful placements on major frameworks and

subsequent direct awards provide a strong pipeline of

opportunities

-- Further strategic investment in the Business Development and

Renewables teams to accelerate organic growth momentum

-- Satellite office established in Dereham, Norfolk following

the strong interest in our services in the East of England, which

further consolidates our geographic position

-- Our year two Carbon Net Zero Strategic Report has been

released with our maiden ESG Impact Report to be published in

December 2023

Discontinued operations, DCB (Kent) Limited ("DCB"):

-- Work has progressed substantially on seven of the nine

projects; five are on track to be completed in December 2023 with

the other two are expected to be completed by the end of the FY24

financial year

-- On one of the remaining two projects the construction partner

entered into administration in October 2023, leading to a

terminable event for the contract.

-- Constructive negotiations continue with the final project

which is now currently scheduled to complete in early 2026

-- As previously announced, project amendments and additional

remedial costs have together resulted in an additional pre-tax

provision of GBP0.46 million as at the half year. However, these

estimates may change as we move towards completion of the projects

and we will update the market with any further material changes if

or when they may occur

Outlook:

-- The second half has started well, with revenues expected to

pick up further in the second half of the year, albeit at more

normalised margins, as part of the Group's traditional heavier

second half weighting

-- Ongoing execution of strategic initiatives under the three

key pillars of Regulation, Regeneration and Renewables continues to

strengthen our position and create opportunities for all service

divisions

-- At least seven of nine DCB projects expected to be completed

during the current financial year

-- The Group is trading in line with the Board's expectations

for the full year and is well positioned to continue its growth

trajectory

Unaudited Unaudited Audited

6 months 6 months 12 months

to to to

30 September 30 September 31 March

2023 2022 2023

GBP 000 GBP 000 GBP 000

------------------------------------------- -------------- -------------- -----------

Continuing operations

Income statement

Revenue 30,337 29,761 62,670

Gross profit 8,399 7,711 16,472

Gross margin 27.7% 25.9% 26.3%

EBITDA(1) (excluding effect of lease

payments) 3,199 2,630 6,013

Adjusted EBITDA(2) (including effect

of lease payments) 2,911 2,396 5,474

Operating profit 2,745 1,873 4,809

Underlying operating profit(3) 2,800 2,311 5,297

Underlying profit before taxation(4) 2,633 2,099 4,896

Profit after taxation 1,918 1,344 3,713

Basic earnings per share(5) 3.08 2.16 5.97

Adjusted earnings per share(6) 3.17 2.87 6.76

Cash flow

Net cash generated from operating

activities 2,959 2,466 5,488

Adjusted net cash generated from

operating activities(7) 2,686 3,119 5,865

Adjusted operating cash conversion(8)

(%) 92% 130% 107%

Financial position

Cash and cash equivalents 1,157 1,721 1,322

Term and other loans (114) (1,777) (177)

Net cash/(debt)(9) 1,043 (56) 1,145

Net assets/(liabilities) 1,055 (2,294) (652)

Discontinued operations (see note

11)

Loss on disposal (343) (3,486) (4,261)

Net cash absorbed by operating activities (2,601) (1,652) (2,750)

1. Earnings before interest, taxation, depreciation and

amortisation ("EBITDA") and excluding non-underlying items, as set

out in the financial review.

2. To align with internal reporting, Adjusted EBITDA is stated

after the effect of a charge for lease payments, as set out in the

financial review.

3. Underlying operating profit is stated before charging

non-underlying items as set out in note 4.

4. Underlying profit before taxation is stated after finance

costs and before charging non-underlying items as set out in the

financial review.

5. Basic earnings per share is the profit after tax divided by

the weighted average number of ordinary shares.

6. Adjusted earnings per share is the profit before deducting

non-underlying items after tax divided by the weighted average

number of ordinary shares.

7. Net cash generated from operating activities before tax and

after lease payments in the period ended 30 September 2023. It is

also adjusted to reflect the payment of deferred HMRC payments to

normal terms. Further analysis is set out in the financial

review.

8. Adjusted net cash generated from operating activities divided

by Adjusted EBITDA, as set out in the financial review.

9. Net cash/(debt) includes term and other loans, and cash net

of overdraft, and excludes lease obligations.

David Bullen, Chief Executive Officer of Kinovo, commented:

"I am pleased to report another strong period of growth for

Kinovo, with revenue and profits both increasing during the half

year. The business continues to benefit from our strategic

repositioning, concentrating our service offering, as well as

external legislative drivers, while our framework placings

represent a significant growth opportunity and will enable further

diversification of our services.

The second half has started well and we are trading in line with

the Board's expectations for the full year, and remain confident

that we have the right strategy to drive growth and realise

Kinovo's significant potential. I am satisfied with the progress

made on the DCB projects, with seven of the nine due to be

completed this financial year. We continue to prioritise investing

in our people, we have motivated teams and we are confident in our

long-term success."

Enquiries

Kinovo plc

Sangita Shah, Chair +44 (0)20 7796 4133

David Bullen, Chief Executive Officer (via Hudson Sandler)

Canaccord Genuity Limited (Nominated Adviser

and Sole Broker) +44 (0)20 7523 8000

Adam James

Andrew Potts

Harry Rees

Hudson Sandler (Financial PR) +44 (0)20 7796 4133

Dan de Belder

Harry Griffiths

Chair's statement

Overview

I am pleased to report a strong first half of the financial year

for Kinovo's continuing business, with revenue and profits

continuing to rise. The business continues to benefit from our

strategic repositioning, as well as key external legislative

drivers providing a significant boost to our three-year visible

revenues. The Regulation and Regeneration pillars grow from

strength to strength, while the Renewables pillar was temporarily

affected by administrative bottlenecks at a number of clients,

causing delays to planned works. These works are expected to

commence during H2.

As a result of a more favourable mix of works, actions taken

internally to boost operational efficiency and lower non-underlying

costs, EBITDA grew by 21% during the half year to GBP2.91 million,

with operating profit increasing by 46% to GBP2.75 million. We have

a healthy balance sheet at period-end and are pleased to be in a

net cash position compared to net debt of GBP0.06 million in the

prior year.

Discontinued Operations

The executive management team have shown a dogged determination

and commitment to resolve the situation regarding DCB Kent ("DCB"),

our former construction division. The team has made significant

progress to the portfolio of projects we are legally obliged to

complete, with five of the nine projects due to be completed during

December 2023, and a further two by the end of this financial year.

The executive team are working diligently to manage the risks

related to these projects and as at the half year, provisioned an

incremental GBP0.46m, as previously announced. As we draw to

practical completion on these projects, the market will, of course,

be updated with any further material increases should they

arise.

Fully resolving the projects relating to DCB's discontinued

operations remains the key priority for the Board which will leave

the Group to focus entirely on growth.

Outlook

In spite of the challenging macroeconomic outlook, I remain

optimistic in terms of Kinovo's prospects and potential for growth.

We have a strong underlying business, with considerable demand

supplemented by internal actions and legislation.

As ever, our people are our key assets and I am pleased to

report that David Bullen has maintained his momentum and commitment

to continue to invest in our people.

The second half has started well and the Group continues to

trade in line with the Board's expectations in terms of the

continuing business and the Board is confident in increasing

shareholder value and delivering the long-term strategy of the

business.

Sangita Shah

Non-Executive Chair

28 November 2023

Chief Executive Officer's review

Overview & Financial performance

The first half marked another important period for Kinovo as we

accelerated organic growth and continued to develop our three key

operational pillars of Regulation, Regeneration and Renewables.

Revenue increased 2% to GBP30.34 million (H1 2023: GBP29.76

million), despite some planned works being delayed and only

commencing in the latter part of H1 due to clients' administrative

bottlenecks, which will play into the traditional heavier second

half weighting.

There was a marked increase in profitability due to a more

favourable mix of higher margin works, as well as continuing

operational efficiencies and lower non-underlying costs. Gross

profits grew 9% to GBP8.40 million (H1 2023: GBP7.71 million) and

gross margins increased to 27.7% (H1 2023: 25.9%). This led to

EBITDA growth of 21% to GBP2.91 million (H1 2023: GBP2.40 million),

while operating profit grew by 46% to GBP2.75 million (H1 2023:

GBP1.87 million). The Group ended the Period with a cash balance of

GBP1.16 million and a net cash position of GBP1.04 million (H1

2023: gross cash of GBP1.72 million and net debt of GBP0.06

million).

Operational Review & Growth Drivers

Our H1 performance benefitted from strategic internal actions

and investments as well as the continued effects of legislative

drivers, namely the Building Safety Act, Fire Safety Act and

changes to the Electrical Wiring Legislation. Our strategic

repositioning, which focuses our range of works around the three

pillars mentioned above, has been a catalyst for accelerating

organic growth. We also continue to invest in our people, and

during the Period have supplemented our Renewables pillar and

expanded the Business Development team.

Within the three pillars, revenue attributable to Regulation

increased to 61% (H1 2023: 54%), growing 15% to GBP18.60 million,

and Regeneration attributable revenues increased to 26% (H1 2023:

25%), growing 8% to GBP7.86 million, both benefitting from the

legislative drivers referenced above. The Renewables pillar

decreased its attributable revenues to GBP3.87 million to 13% in H1

2024 (H1 2023: 21%), due to clients' administrative bottlenecks and

a deliberate run down on the private works stream. Positively, the

Company achieved an uplift in direct awards for the Renewables

pillar of approximately GBP7.5 million granted during the Period

and post-Period end which will start to be realised in H2. The

Renewables pillar represents a significant growth opportunity for

the Group, with Kinovo adding key hires including a Lead Assessor,

Technical Coordinator and Resident Liaison Officer to increase our

capabilities and strengthen the offering to capitalise on this

opportunity.

In revenue terms, Mechanical works generated GBP6.14 million,

representing 20% of total revenue, Electrical works contributed

GBP14.23 million, 47% of total revenue, driven by the legislative

drivers mentioned above and Building Services works were GBP9.96

million, representing 33% of total revenue. The inflow of

workstreams commencing in the latter part of H1 as well as the

mobilisation of new workstreams during the period is expected to

reflect positively across the three pillars as well as the three

service divisions in the full year.

Another considerable growth driver for the Group is our

framework placings, which we are confident will enable us to

further enhance our top line growth, diversify our client base and

broaden our mix of works. During the Period, we announced the award

of additional significant framework wins under the following:

-- Eastern Procurement Limited's Asset Improvement and

Sustainability Framework with a maximum aggregate estimated value

across the relevant contractors of GBP156 million over 4 years;

-- a place on The Greener Futures Partnership's ("GFP")

Decarbonisation Framework with a maximum aggregate value across the

relevant contractors of GBP252 million over 7 years;

-- 3 lots of The Hyde Group's Alternative Heating Servicing and

Maintenance Services and Metering and Billing Services Framework

with a maximum aggregate estimated value across the relevant

contractors of GBP132 million over 4 years; and

-- a place on the National Housing Maintenance Forum Heating

Services Framework for domestic heating appliances and servicing,

maintenance, and installations worth a maximum aggregate value

across the relevant contractors of GBP300 million over 4 years

During the Period and post-period end, the Group has won tenders

as well as demonstrating the value of being placed on frameworks

with direct award wins with a total contract value of GBP56 million

over a maximum of eight years. These wins have broadened our client

range as well as introduce new workstreams, including a number of

direct award wins secured in the East of England. Both of these

achievements are in line with the objectives to deliver our growth

strategy, with wins ranging from a direct award for GBP4.8 million

through The GFP Decarbonisation Framework to retrofit approximately

200 properties over the next 18 months, through to an introductory

direct award from Great Yarmouth Borough Council for GBP0.3 million

for a damp and mould and retrofit works project over 4 months.

This momentum demonstrates the resilience and robustness of

visible earnings outlook with three-year visible revenues

increasing from GBP146.4 million to GBP157.0 million, with 95%

recurring. GBP66 million of the visible revenue is expected to be

recognised in FY24.

The Group is making positive progress, and to accelerate our

organic growth, we have invested further in our Business

Development Team with a new Bid Manager and Estimator.

In line with our objective to consolidate our geographic

position, the strong interest in our services in the East of

England has resulted in a number of direct awards through

frameworks, facilitating the establishment of a satellite office in

Dereham, Norfolk, to enable us to service the area more effectively

and efficiently. Our newly recruited Renewables team will be based

in Dereham, whilst offering support to the rest of the Group.

ESG & Social Value

Sustainability and driving social value are integral to our

corporate identity and embedded in our culture, underpinning each

of our three pillars. We continue to invest in our sustainability

offering as a business and, during the Period, we have been

developing our maiden ESG Impact Report, which will be released

next month. We also published our year-two Net Zero Report earlier

this month, which provides our pathway to reach an 81% reduction in

Scope 1, 2 and 3 emissions and our commitment to become Net Zero by

2040. We have offset all Scope 1 and 2 emissions since 2022 in

pursuit of being carbon neutral within our own operational

boundary, and we commit to maintaining this by offsetting all

future emissions.

Developing our people, offering career progression and

apprenticeship opportunities is extremely important to us, with

apprentices representing 14% of our total employees. Training

apprentices is a fundamental part of our professional development

programme, enabling us to upskill young and local people while also

mitigating the potential impacts of supply issues within our

subcontractor base as we grow.

We have continued to develop our people, providing 1,781 hours

of in-house training, including Carbon Literacy training to our

Management Team. We have introduced an Employee Assistance

Programme offering specialist help, support, and advice to all our

staff around their wellbeing and general health. We also introduced

a "volunteer day" programme across the Group, where employees are

encouraged to participate in community initiatives, providing a

dual benefit of contributing to personal development, whilst

cultivating a culture of giving back.

Our social value proposition has also been developed in

collaboration with clients and we focus our initiatives on the

needs within local areas. We encourage those who face barriers to

employment to join us and have visited local prisons to offer

advice on getting back to work and sharing opportunities available

within the Group. We have also signed up to the Armed Forces

Covenant Pledge to acknowledge and understand the needs of the

Armed Forces community.

Discontinued Operations

We continue to progress the legacy projects relating to our

former construction division, DCB. We expect seven of the nine

total projects to be completed during the current financial year,

five of which we remain confident of being completed in December.

The expected costs to complete these seven projects have increased

by GBP0.20 million and will be updated with the final account

reconciliations as the projects draw to a close.

Of the two remaining projects, one had been delayed due to

ongoing negotiations with the construction partner, a UK

housebuilder. The construction partner has fallen into

administration just after the period end which has led to a

terminable event for the contract between DCB's administrators and

the construction partner and a resulting cessation of discussions

with Kinovo. The Group is awaiting the next steps from the

administrators to clarify and confirm the Group's position. In

these interim results, and as previously announced, additional

associated costs on this project, including legal fees, amounting

to GBP0.26 million has been provided. Additional costs of GBP0.2

million on the seven projects and the project in administration

together comprise the GBP0.46 million increase in the total costs

to complete which has been provided at 30 September 2023. The total

net pre-tax cost to complete the DCB projects is now estimated to

be GBP5.72 million.

We remain in an active dialogue with the client regarding the

final project, which is now currently scheduled to complete in

early 2026 and we will update the market in due course on all

material matters relating to the DCB projects if or when they may

occur.

Outlook

We are optimistic regarding Kinovo's growth potential, believing

that there are significant opportunities for top and bottom-line

growth resulting from the ongoing effects of our strategic

repositioning and the external legislative drivers which will

continue to increase demand for our works. The framework placings

will also continue to broaden out our client base as we diversify

our range of works.

We continue to prioritise internal initiatives that will further

drive this growth, namely investments in our employees, teams and

capabilities. Our people are our greatest asset, and we will

continue to invest in their professional development as a matter of

priority.

I am satisfied with how the DCB projects are progressing and

look forward to putting the majority behind us this calendar year.

The team has worked tirelessly in dealing with this difficult

situation for Kinovo, and I wish to thank them for their roles in

allowing us to begin to put the issue behind us.

The second half has started well and the Group is trading in

line with the Board's expectations for the full year and is well

positioned to continue its exciting growth trajectory. We have an

excellent business with talented and motivated teams, and a market

proposition that will enable us to continue strengthening our

position in our existing geographies.

David Bullen

Chief Executive Officer

28 November 2023

Financial review

Trading review

In the six-month period to 30 September 2023, Kinovo has

continued to deliver a strong trading result and cash generation

from its continuing operations.

Adjusted EBITDA (after the effect of a charge for lease

payments) increased by 21% to GBP2.91 million (H1 2023: GBP2.40

million) with operating profit from continuing operations

delivering GBP2.75 million (H1 2023: GBP1.87 million), an increase

of 47%.

Profit before taxation for continuing operations was GBP2.58

million (H1 2023: GBP1.66 million), an increase of 55% and basic

earnings per share were up 43% to 3.08p (H1 2023: 2.16p).

A number of expected planned works were delayed in the first

half due to our clients' administrative bottlenecks with revenues

increasing 2% to GBP30.34 million (2023: GBP29.76 million) whilst

increased margins delivered an increase in gross profit of 9% to

GBP8.40 million (2023: GBP7.71 million). As the planned works

progress and our new contract wins are fully mobilised, revenues

are expected to pick up in the second half of the year, albeit at

more normalised margins, strengthening the traditional second half

weighting.

Underlying Administrative expenses of GBP5.6 million in the

Period have increased GBP0.2 million (4%) compared to GBP5.40

million in the prior Period.

Kinovo continues to progress the fulfilment of its commitments

on the DCB construction projects as set out in the Chief Executive

Officer review and below. Discontinued operations include a full

provision for the estimated costs to complete the projects which,

before tax, has increased by GBP0.46 million in the period.

As a result of the discontinued operations provision, the Group

has reported a total profit for the period of GBP1.56 million (H1

2023: loss GBP2.14 million).

The Adjusted EBITDA on continuing operations of GBP2.91 million

(H1 2023: GBP2.40 million) in the period is considered by the Board

to be a key Alternative Performance Measure ("APM") as it is the

basis upon which the underlying management information is prepared

and the performance of the business assessed by the Board.

Adjusted EBITDA is calculated as earnings before interest,

taxation, depreciation and amortisation, excluding non-underlying

items and is stated after the effect of a charge for lease

payments.

A reconciliation of EBITDA (excluding lease payments) and

Adjusted EBITDA (including a charge for lease payments) for

continuing operations is set out below:

Unaudited Unaudited Audited

6 months ended 6 months ended year

30 September 2023 30 September 2022 ended

31 March

2023

Continuing operations GBP'000 GBP'000 GBP'000

Profit before tax 2,578 1,661 4,408

Add back: non-underlying items 55 438 488

Underlying profit before tax 2,633 2,099 4,896

Adjustments for items not included

in EBITDA:

Finance costs 167 212 401

Depreciation of property, plant and

equipment 69 64 131

Depreciation of right-of-use assets 274 222 513

Amortisation of software costs 56 33 72

EBITDA (excluding a charge for lease

payments) 3,199 2,630 6,013

Adjustment for lease payments (288) (234) (539)

------- ------------------ ---------

Adjusted EBITDA 2,911 2,396 5,474

------- ------------------ ---------

Non-underlying items

Non-underlying items are considered by the Board to be either

exceptional in size, one-off in nature or non-trading related items

and are represented by the following, and as set out in note 4.

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Continuing activities

Amortisation of customer relationships - 383 385

Share based payment charge 55 55 103

Total 55 438 488

------------- ------------- ---------

Customer relationship intangible fixed asset was fully amortised

at 30 September 2022.

Cash flow performance

Adjusted net cash generated from continuing operating activities

in the period was GBP2.68 million (H1 2023: GBP3.12 million)

delivering an Adjusted operating cash conversion of 92% (H1 2023:

130%).

Adjusted operating cash conversion is calculated as cash

generated from continuing operations (after lease payments) of

GBP2.69 million (H1 2023: GBP2.23 million), adjusted for the

effects of deferred HMRC repayments of GBPnil (H1 2023: GBP0.89

million), in the period; divided by Adjusted EBITDA of GBP2.91

million (H1 2023: GBP2.40 million), as set out below;

Continuing operations Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Cash flow from operating activities

per condensed consolidated statement

of cash flows 358 814 2,738

Adjustment for cash absorbed by discontinued

operations 2,601 1,652 2,750

------------- ------------- ---------

Net cash generated from continuing

operating activities 2,959 2,466 5,488

Less operating lease payments (273) (234) (510)

Net cash generated from continuing

activities (after lease payments) 2,686 2,232 4,978

Adjustment for deferred HMRC payments - 887 887

------------- ------------- ---------

Adjusted net cash generated from

continuing operating activities 2,686 3,119 5,865

------------- ------------- ---------

Adjusted EBITDA (as above) 2,911 2,396 5,474

------------- ------------- ---------

Adjusted operating cash conversion 92% 130% 107%

------------- ------------- ---------

In the year ended 31 March 2023, the Group received accelerated

receipts of GBP0.40 million relating to future periods which

improved cash conversion in FY23. If the receipts were allocated to

the correct periods cash conversion in FY23 and for the 6-month

period to 30 September 2023 would be 100% and 106%

respectively.

By arrangement with HMRC, VAT liabilities of GBP887,000 were

deferred at 31 March 2022 and were fully repaid by 1 September

2022.

Discontinued operations

Following its rebranding and strategic review, Kinovo determined

that DCB Kent Limited (DCB), the Company's construction business

was non-core and initiated a process to dispose of the business

which was completed in January 2022.

The terms of the disposal included certain working capital

commitments. The business entered administration in May 2022 and

Kinovo retained commitments under parent company guarantees, signed

prior to the disposal of DCB, to complete its' construction

projects.

The total net cost of the commitment to complete the DCB

construction projects was estimated to be GBP5.3 million at 31

March 2023, which was provided in full at that date.

In the 6-month period to 30 September 2023 the Group has

continued to fulfil its commitments on seven of the nine projects

which are expected to be completed during the current financial

year. Two projects were in ongoing discussions at the time of the

publication of the Group Report and Accounts in July 2023. The

client on one of these projects subsequently entered into

administration in October 2023 which led to a terminable event.

Discussions continue on the further final project to conclude a

mutually acceptable solution for all parties. As a consequence of

the administration of the client on one of the projects and

additional costs to complete forecast on other projects, an

additional provision of GBP457,000 (post tax GBP343,000) has been

booked at 30 September 2023. Total pre-tax net costs to complete

are now expected to be GBP5.72 million.

The outstanding provision for the completion costs of the

projects amounts to GBP1.33 million at 30 September 2023. The

provision for the net costs to complete the DCB projects have been

presented as discontinued operations.

Cash outflow in the 6-month period to 30 September 2023 relating

to the discontinued operations amounted to GBP2.60 million (H1 FY

23: GBP1.65 million including GBP1.23 million in respect of working

capital contributions made to DCB prior to it entering

administration and accrued at 31 March 2022). In the year ended 31

March 2023 cash outflow relating to the discontinued operations

amounted to GBP2.75 million including the working capital

contributions referenced above.

Net debt

There has been a continuing focus on cash management in the

period. In the six-month period to 30 September 2023, the Group

held a net cash balance of GBP1.04 million compared to net debt of

GBP56,000 at 30 September 2022. The net cash position is comparable

to the year end and is after the absorption of GBP2.60 million cash

relating to the fulfilment of legacy DCB project commitments.

Set out below is an analysis of net debt:

Unaudited Unaudited Audited

at 30 September at 30 at 31

2023 September March

2022 2023

GBP'000 GBP'000 GBP'000

Net debt/(cash) (1,157) (1,721) (1,322)

HSBC term loan - 1,534 -

HSBC mortgage 114 171 143

Other term loan - 72 34

---------------- ---------- -------

Net debt/(cash) (1,043) 56 (1,145)

---------------- ---------- -------

During the period the Group repaid GBP63,000 (H1 FY23: GBP1.07

million) of borrowings being, GBP29,000 (H1 FY23: GBP28,000) on the

HSBC mortgage and GBP34,000 (H1 FY23: GBP37,000) on the legacy

Funding Circle Term loan, which was fully repaid in September 2023.

GBP1.00 million was repaid on the HSBC Term loan in the six-month

period to 30 September 2022. The Term loan was fully repaid at 31

March 2023.

The Group also has an on-demand overdraft facility of GBP2.50

million which was undrawn at 30 September 2023. The facility was

renewed in September 2023 and interest is charged at 3% above Bank

of England Base rate. At the same time the Group also renewed a

purchasing card facility of GBP6.0 million with HSBC which is

reported within trade creditors. Both facilities expire at 31 May

2024 to enable the further ordinary course renewal of these

facilities to be completed prior to approval of the financial

statements for the year ending 31 March 2024.

Due to increases in the Bank of England Base Rate, HSBC have

amended their standard terms on their purchasing card product,

reducing credit terms by 30 days. In alignment with the renewal of

our facilities a payment will be made to reflect the new terms in

May 2024. The payment will be dependent on the phasing of spend on

the purchasing card but this is expected to be approximately GBP1.4

million and the facility (currently GBP6.0 million) will reduce by

a commensurate amount at the same time.

Dividends

No final dividend was paid for the year ended 31 March 2023 and

no interim dividend is currently recommended for the year ending 31

March 2024. It remains the Board's priority to fulfil the

completion of the DCB projects and strengthen the balance sheet and

to resume the payment of a dividend as soon as financial conditions

allow.

Clive Lovett

Group Finance Director

28 November 2023

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the six-month period ended 30 September 2023 (unaudited)

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Continuing operations

Revenue 30,337 29,761 62,670

Cost of sales (21,938) (22,050) (46,198)

Gross Profit 8,399 7,711 16,472

Underlying administrative expenses (5,599) (5,400) (11,175)

------------- ------------- -----------

Operating profit before non-underlying

items 2,800 2,311 5,297

Non-underlying administrative expenses

Amortisation of customer relationships - (383) (385)

Share based payment charge (55) (55) (103)

Total non-underlying administrative

expenses (note 4) (55) (438) (488)

Operating profit 2,745 1,873 4,809

Finance cost (167) (212) (401)

Profit before tax 2,578 1,661 4,408

Income tax expense (note 10) (660) (317) (695)

------------- ------------- -----------

Total profit from continuing operations

for the period 1,918 1,344 3,713

Discontinued operations

Loss for the period (note 11) (343) (3,486) (4,261)

Total comprehensive income/(loss)

for the period attributable to the

equity holders of the parent company 1,575 (2,142) (548)

============= ============= ===========

Earnings per share from continuing

operations (note 6)

Basic (pence) 3.08 2.16 5.97

Diluted (pence) 3.05 2.16 5.92

Earnings/(loss) per share (note 6)

Basic (pence) 2.53 (3.45) (0.88)

Diluted (pence) 2.50 (3.43) (0.88)

There are no items of other comprehensive income for the

period.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 September 2023 (unaudited)

Unaudited Unaudited Audited

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Assets

Non-current assets

Intangible fixed assets 4,478 4,393 4,511

Property plant and equipment 1,066 1,069 1,062

Right-of-use-assets 875 696 929

------------- ------------- ---------

Total non-current assets 6,419 6,158 6,502

------------- ------------- ---------

Current assets

Inventories 2,823 3,528 2,438

Deferred tax asset 64 783 610

Trade and other receivables 11,807 11,988 11,087

Cash and cash equivalents 1,157 1,721 1,322

------------- ------------- ---------

Total current assets 15,851 18,020 15,457

------------- ------------- ---------

Total assets 22,270 24,178 21,959

============= ============= =========

Equity and liabilities attributable

to equity holders of the parent company

Issued share capital and reserves

Share capital (note 8) 6,278 6,213 6,213

Own shares (850) (850) (850)

Share premium 9,289 9,245 9,245

Share based payment reserve 136 65 113

Merger reserve (248) (248) (248)

Retained earnings (13,550) (16,719) (15,125)

Total equity 1,055 (2,294) (652)

------------- ------------- ---------

Non-current liabilities

Borrowings (note 7) 57 114 86

Lease liabilities 457 384 491

514 498 577

------------- ------------- ---------

Current liabilities

Borrowings (note 7) 57 1,663 91

Lease liabilities 433 324 452

Trade and other payables 18,877 19,987 18,013

Provisions (note 11) 1,334 4,000 3,478

20,701 25,974 22,034

------------- ------------- ---------

Total equity and liabilities 22,270 24,178 21,959

============= ============= =========

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the six-month period ended 30 September 2023 (unaudited)

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Net cash generated from operating

activities (note 5) 358 814 2,738

------------- ------------- -----------

Cash flow from investing activities

Purchase of property, plant and equipment (75) (27) (90)

Purchase of intangible assets (22) (8) (188)

Net cash used in investing activities (97) (35) (278)

------------- ------------- -----------

Cash flow from financing activities

Issue of new share capital for SIP 77 - -

Repurchase of own shares for SIP - (64) (64)

Repayment of borrowings (63) (1,065) (2,666)

Interest paid (167) (212) (401)

Principal payments of leases (273) (221) (511)

Net cash used in financing activities (426) (1,562) (3,642)

------------- ------------- -----------

Net decrease in cash and cash equivalents (165) (783) (1,182)

Cash and cash equivalents at beginning

of period/year 1,322 2,504 2,504

Cash and cash equivalents at end

of period/year 1,157 1,721 1,322

============= ============= ===========

The condensed consolidated statement

of cash flows includes all activities

of the Group. Cash flows from discontinued

operations are set out in note 11.

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six-month period ended 30 September 2023 (unaudited)

Issued Share Own shares Share based Merger Retained Total

share premium payment reserve earnings equity

capital reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 April

2023 6,213 9,245 (850) 113 (248) (15,125) (652)

Profit and total comprehensive

income for the period - - - - - 1,575 1,575

Issue of share capital

for SIP 65 44 - (32) - - 77

Share based payment

charge - - - 55 - - 55

Balance at 30 September

2023 6,278 9,289 (850) 136 (248) (13,550) 1,055

======== ======== ========== =========== ======== ========= =======

For the six-month period ended 30 September 2022 (unaudited)

Balance at 1 April

2022 6,213 9,245 (850) 74 (248) (14,577) (143)

Loss and total comprehensive

loss for the period - - - - - (2,142) (2,142)

Share based payment

charge - - - 55 - - 55

Purchase of own shares

for SIP - - - (64) - - (64)

Balance at 30 September

2022 6,213 9,245 (850) 65 (248) (16,719) (2,294)

For the year ended 31 March 2023

Balance at 1 April

2022 6,213 9,245 (850) 74 (248) (14,577) (143)

Loss and total comprehensive

loss for the year - - - - - (548) (548)

Share based payment

charge - - - 103 - - 103

Purchase of own shares

for SIP - - - (64) - - (64)

Balance at 31 March

2023 6,213 9,245 (850) 113 (248) (15,125) (652)

======== ======== ========== =========== ======== ========= =======

NOTES TO THE INTERIM STATEMENT

1. Basis of preparation

Kinovo Plc and its subsidiaries (together "the Group") operate

in the mechanical, electrical and general building services

industries. The Group is a public company operating on the AIM

market of the London Stock Exchange (AIM) and is incorporated and

domiciled in England and Wales (registered number 09095860). The

address of its registered office is 201 Temple Chambers, 3-7 Temple

Avenue, London EC4Y 0DT. The Company was incorporated on 20 June

2014.

These interim financial statements of the Group have been

prepared on a going concern basis under the historical cost

convention, and in accordance with UK adopted Accounting Standards,

the International Financial Reporting Interpretations Committee

("IFRIC") interpretations issued by the International Accounting

Standards Boards ("IASB") that are effective or issued and early

adopted as at the time of preparing these financial statements and

in accordance with the provisions of the Companies Act 2006. The

Group has adopted all of the new and revised standards and

interpretations issued by the IASB and the International Financial

Reporting Interpretations Committee ("IFRIC") of the IASB, as they

have been adopted by the United Kingdom, that are relevant to its

operations and effective for accounting periods beginning on 1

April 2022.

The interim financial information does not include all the

information and disclosures required in the annual financial

statements and should be read in conjunction with the Group's

annual financial statements, being the statutory financial

statements for Kinovo Plc as at 31 March 2023, which have been

prepared in accordance with IFRIC of the IASB as adopted by the

United Kingdom.

The interim financial information for the six months ended 30

September 2023 do not comprise statutory accounts within the

meaning of Section 434 of the Companies Act 2006. The interim

financial information has not been audited.

Significant accounting policies

The accounting policies adopted in the preparation of the

interim financial information is consistent with those expected to

be adopted in the preparation of the Group's annual financial

statements for the year ending 31 March 2024.

Going concern

The Directors have adopted the going concern basis in preparing

these interim financial statements.

The continuing business traded strongly in the first six months

of the financial year with adjusted EBITDA 21% ahead of the prior

period. The Group has secured a number of new direct awards in the

period, has a robust pipeline of opportunities and is well placed

on several framework agreements to secure additional contracts in

future periods.

At 30 September 2023 the Group had a cash balance of GBP1.16

million and a net cash position of GBP1.04 million, with only

GBP0.12 million of borrowings remaining, relating to a historic

mortgage loan.

In September 2023, the GBP2.5 million overdraft facility, which

is undrawn at 30 September 2023, and the GBP6.0 million purchasing

card facility, which is reported within trade creditors, were

renewed to 31 May 2024. This will enable the further ordinary

course renewal of these facilities to be completed prior to

approval of the financial statements for the year ending 31 March

2024.

During FY22 Kinovo disposed of its non-core construction based

subsidiary DCB (Kent) Limited ("DCB"). On 16 May 2022, DCB filed

for administration and as at the date of the interim financial

statements Kinovo has limited expectation of recovery of amounts

owed under the terms of the disposal of DCB. Kinovo had residual

commitments under various Parent Company Guarantees ("PCG's") for

the DCB construction projects and under the terms of the PCG's,

Kinovo is responsible for the completion of the projects.

There are nine projects in total. Seven projects are expected to

be completed by the end of the financial year, with five of these

expected to be complete in December 2023. The client on one of the

two remaining contracts went into administration in October 2023

which has led to a terminable event. Positive negotiations continue

on the final project.

Three of the nine DCB contracts originally had performance

bonds, which were indemnified by Kinovo plc, totalling GBP2.10

million. Only one bond, amounting to GBP860,000, remains

outstanding to resolve. Discussions continue on the final project

associated with the performance bond with an expectation that a

positive outcome for both parties will be agreed. Kinovo has

engaged with the insurer, underwriter and client and although the

outstanding bond could have been called at any time since DCB

entered into administration, it is recognised by all parties that

positive negotiations are ongoing to identify a satisfactory

solution.

For the year ended 31 March 2023 the Group recognised a pre-tax

loss of GBP5.26 million relating to the expected net cost to

complete the nine projects, with GBP0.96 million of anticipated

recoveries to be recognised, in future periods, when they have been

realised. Additional project liabilities, which have been

recognised in the interim financial statements, have increased the

expected pre-tax net costs to complete the projects by GBP0.46

million to GBP5.72 million.

During the period the Group funded GBP2.60 million net costs on

the projects and at 30 September 2023 the outstanding costs to

complete provision was GBP1.33 million.

In assessing the Group's ability to continue as a going concern,

the Board reviews and approves the 12-month budget and longer-term

strategic plan, including forecasts of cash flows. In building

these budgets and forecasts, the Board has considered the expected

remaining net costs to complete the DCB construction projects and

the market challenges of supply chain inflation and material and

labour availability on the trading of the Group.

The Directors expect that a combination of the cash generated by

the continuing business together with the available cash and bank

facilities will enable Kinovo to fund the remaining costs to

complete the construction projects and continue to drive the growth

of the core operations.

After taking into account the above factors and possible

sensitivities in trading performance, the Board has reasonable

expectation that Kinovo plc and the Group as a whole have adequate

resources to continue in operational existence for the foreseeable

future.

For these reasons, the Board continues to adopt the going

concern basis in preparing the consolidated financial statements.

Accordingly, these accounts do not include any adjustments to the

carrying amount or classification of assets and liabilities that

would result if the Group were unable to continue as a going

concern.

Publication of non-statutory financial statements

The results for the six months ended 30 September 2023 and 30

September 2022 are unaudited and have not been reviewed by the

auditor. Statutory accounts for the year ended 31 March 2023 were

filed with the Registrar of Companies in August 2023.

The interim financial information has been prepared on the basis

of the same accounting policies as published in the audited

financial statements for the year ended 31 March 2023. The annual

financial statements of the Group are prepared in accordance with

International Financial Reporting Standards and International

Financial Reporting Interpretations Committee ("IFRIC")

pronouncements as adopted by the United Kingdom. Comparative

figures for the year ended 31 March 2023 have been extracted from

the statutory financial statements for that period.

2. Corporate governance, principal risks and uncertainties

The Corporate Governance Report included with our Annual Report

and Financial Statements for 2023 detailed how we embrace

governance. The Kinovo Board recognise the importance of sound

corporate governance commensurate with the size and nature of the

Company and the interests of its shareholders.

The Quoted Companies Alliance has published a corporate

governance code for small and mid-sized quoted companies, which

includes a standard of minimum best practice for AIM companies, and

recommendations for reporting corporate governance matters (the

"QCA Code"). Kinovo has adopted the QCA Code.

The nature of the principal risks and uncertainties faced by the

Group have not changed significantly from those set out within the

Kinovo Plc annual report and accounts for the year ended 31 March

2023.

3. Segmental analysis

The Board of Directors has determined an operating management

structure aligned around the three core activities of the Group,

being Mechanical services, Building services and Electrical

services. Operating profit before non-underlying items has been

identified as the key performance measure. The following is an

analysis of the performance by segment for continuing

operations:

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

Continuing operations GBP'000 GBP'000 GBP'000

Mechanical services 6,140 7,524 15,022

Building services 9,965 10,389 19,686

Electrical services 14,232 11,848 27,962

Total revenue 30,337 29,761 62,670

Reconciliation of operating profit before non-underlying items

to profit before taxation from continuing operations:

Unaudited Unaudited Audited

6 months 6 months year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Continuing operations

Mechanical services 556 740 1,527

Building services 859 816 1,494

Electrical services 2,340 1,585 4,099

Unallocated central costs (955) (830) (1,823)

Operating profit before non-underlying

items 2,800 2,311 5,297

Amortisation of acquisition intangibles - (383) (385)

Share based payment charge (55) (55) (103)

Operating profit 2,745 1,873 4,809

Finance cost (167) (212) (401)

Profit before tax 2,578 1,661 4,408

Only the Group Consolidated Statement of Comprehensive Income is

regularly reviewed by the chief operating decision maker and

consequently no segment assets or liabilities are disclosed under

IFRS 8.

4. Non-underlying items

Operating profit includes the following items which are

considered by the Board to be exceptional in size, one off in

nature or non-trading related.

Note Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Amortisation of customer relationships (a) - 383 385

Share based payment charge (b) 55 55 103

55 438 488

------------- ------------- -----------

All non-underlying items have been charged to other operating

expenses.

(a) Amortisation of customer relationships

Amortisation of acquisition intangibles was nil for the period

(H1 2023: GBP0.38 million) and, in the prior periods related to

amortisation of the customer relationships identified by the

Directors on the acquisition of Purdy.

(b) Share based payment charge

A number of share option schemes are in place and new options

have been granted during the period relating to the Share Incentive

Plan amounting to 290,602 (H1 2023: 289,954) Ordinary shares and

CSOP nil (H1 2023: 50,000). The share based payment charge has been

separately identified as it is a non-cash expense.

5. Cash flows from operating activities

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Profit/(loss) before income tax 2,121 (2,643) (852)

Adjusted for:

Net finance cost 167 212 401

Depreciation 344 287 645

Amortisation of intangible assets 56 416 457

Share based payments 55 55 103

Movement in receivables (720) (1,364) (461)

Movement in payables and provisions (1,280) 4,925 2,428

Movement in inventories (385) (1,074) 17

Net cash from operating activities* 358 814 2,738

------------- ------------- -----------

* Includes all activities of the Group.

Cash flows from discontinued operations

are set out in note 11

6. Earnings/(loss) per share

The calculation of basic earnings per share is based on the

result attributable to shareholders divided by the weighted average

number of ordinary shares in issue during the year. Diluted

earnings per share is calculated under the same method adjusted for

the weighted average share options outstanding during the period as

well as ordinary shares in issue.

Basic earnings per share amounts are calculated by dividing net

profit for the year or period attributable to ordinary equity

holders of the parent by the weighted average number of ordinary

shares outstanding during the year.

Basic and diluted earnings per share is calculated as

follows:

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Profit/(loss) used in calculating basic

and diluted earnings

per share

Continuing operations 1,918 1,344 3,713

Total operations 1,575 (2,142) (548)

Weighted average number of shares for

the purpose of basic earnings per share 62,269,270 62,137,757 62,137,757

Weighted average number of shares for

the purpose of diluted earnings per

share 62,978,446 62,264,963 62,689,167

Continuing operations

Basic earnings per share (pence) 3.08 2.16 5.97

Diluted earnings per share (pence) 3.05 2.16 5.92

Total operations

Basic earnings/(loss) per share (pence) 2.53 (3.45) (0.88)

Diluted earnings/(loss) per share (pence) 2.50 (3.43) (0.88)

Details of loss per share for discontinued

operations are set out in note 11.

Adjusted earnings per share

Profit after tax is stated after deducting non-underlying items

totalling GBP0.06 million (H1 2023: GBP0.44 million).

Non-underlying items are either exceptional in size, one off in

nature or non-trading related. These are shown separately on the

face of the Consolidated Statement of Comprehensive Income.

The calculation of adjusted basic and adjusted diluted earnings

per share is based on the result attributable to shareholders,

adjusted for non-underlying items, divided by the weighted average

number of ordinary shares in issue during the year.

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Continuing operations

Profit after tax 1,918 1,344 3,713

Add back:

Amortisation of acquisition intangible

assets - 383 385

Share based payment charge 55 55 103

1,973 1,782 4,201

------------- ------------------ ---------------------

Weighted average number of shares

for the purpose of basic adjusted

earnings per share 62,269,270 62,137,757 62,137,757

Weighted average number of shares

for the purpose of diluted adjusted

earnings per share 62,978,446 62,264,963 62,689,167

Continuing operations

Basic adjusted earnings per share

(pence) 3.17 2.87 6.76

Diluted adjusted earnings per share

(pence) 3.13 2.86 6.70

7. Borrowings

Unaudited Unaudited Audited

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

Non-current borrowings

Bank and other borrowings;

Term loans - - -

Mortgage loan 57 114 86

Other loans - - -

------------- ------------- ---------

Total non-current borrowings 57 114 86

------------- ------------- ---------

Current borrowings;

Bank and other borrowings;

Term loans - 1,534 -

Mortgage loans 57 57 57

Other loans - 72 34

Total current borrowings - 1,663 91

------------- ------------- ---------

Bank and other borrowings;

Term loans - 1,534 -

Mortgage loans 114 171 143

Other loans - 72 34

Total borrowings 114 1,777 177

------------- ------------- ---------

The fair value of the borrowings outstanding as at 30 September

2023 is not materially different to its carrying value since

interest rates applicable on the loans are close to market

rates.

8. Share capital

Ordinary shares of GBP0.10 each Unaudited Unaudited Audited

30 September 30 September 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

At the beginning of the period 6,213 6,213 6,213

Issued in the period 65 - -

At the end of the period 6,278 6,213 6,213

------------- ------------- ---------

Number of shares Unaudited Unaudited Audited

30 September 30 September 31 March

2023 2022 2023

At the beginning of the period 62,137,757 62,137,757 62,137,757

Issued in the period 650,457 - -

At the end of the period 62,788,214 62,137,757 62,137,757

------------- ------------- ----------

In August 2023 the Company issued 650,457 of shares to allocate

to members of the SIP scheme. 23.5p was paid for 330,753 of these

shares, for a total consideration of GBP77,727. This was allocated

as GBP33,075 of share capital and GBP44,652 of share premium. The

remaining 319,704 were a share based payment for the members of the

scheme, and therefore 10p per share (a total amount of GBP31,970)

was transferred to share capital from the share based payment

reserve as consideration for these. No share capital was issued in

the prior periods.

9. Dividends

The Company did not pay a final dividend for the year ended 31

March 2023 (2022: nil pence). The Board do not recommend an interim

dividend for the year ending 31 March 2024.

10. Taxation

The income tax charge for the six months ended 30 September 2023

is calculated based upon the effective tax rates expected to apply

to the Group for the full year of 25% (2023: 19%). Differences

between the estimated effective rate and the statutory rate of 25%

are due to non-deductible expenses.

11. Discontinued operations

(a) Description

Following the disposal of the non-core DCB Kent Ltd (DCB) in

January 2022, the business subsequently entered administration in

May 2022, as detailed in the Kinovo plc 2023 annual report. Under

parent company guarantees, signed prior to the disposal of DCB,

Kinovo has a commitment to complete the DCB construction projects.

The Kinovo plc 2023 annual report set out the expected net costs to

complete the projects amounting to GBP5.26 million.

Kinovo had residual commitments under various parent company

guarantees for the DCB construction projects and working capital

support. Under the terms of the parent company guarantees, Kinovo

is responsible for the completion of the projects.

The activities of DCB are presented as discontinued

operations.

There are nine projects in total and six are now operating under

new contracts and another is being completed directly by the

client. All these projects are expected to be completed by the end

of the financial year, with five of these expected to be complete

in December 2023. The client on one of the two remaining contracts

went into administration in October 2023 which led to a terminable

event. Positive negotiations continue on the final project.

Three of the nine DCB contracts originally had performance

bonds, which were indemnified by Kinovo plc, totalling GBP2.10

million. Only one bond, amounting to GBP860,000, remains

outstanding to resolve. Discussions continue on the final project

associated with the performance bond with an expectation that a

positive outcome for both parties will be agreed. Kinovo has

engaged with the insurer, underwriter and client and although the

outstanding bond could have been called at any time since DCB

entered into administration, it is recognised by all parties that

positive negotiations are ongoing to identify a satisfactory

solution.

For the year ended 31 March 2023 the Group recognised a pre-tax

loss of GBP5.26 million relating to the expected net cost to

complete the nine projects, with GBP0.96 million of anticipated

recoveries to be recognised, in future periods, when they have been

realised. Additional project liabilities, which have been

recognised in the interim financial statements, have increased the

expected pre-tax net costs to complete the projects by GBP457,000

to GBP5.72 million.

During the period the Group funded GBP2.60 million net costs on

the projects and at 30 September 2023 the outstanding costs to

complete provision was GBP1.33 million.

(b) Financial performance and cash flow information from

discontinued operations

Unaudited Unaudited Audited

6 months 6 months Year ended

to to 31 March

30 September 30 September 2023

2023 2022

GBP'000 GBP'000 GBP'000

Revenue 2,069 - 532

Cost of sales (2,526) (4,304) (5,792)

Loss before taxation (457) (4,304) (5,260)

Income tax credit 114 818 999

------------- ------------- -----------

Loss for the period/year (343) (3,486) (4,261)

------------- ------------- -----------

Operating profit excludes allocation

of Corporate costs in accordance with

IFRS 5, which states that only costs

clearly identifiable as directly relating

to the discontinued operations can

be included.

Loss per share from discontinued

operations

Basic (pence) (0.55) (5.61) (6.86)

Diluted (pence) (0.55) (5.61) (6.86)

Cash flows from discontinued operations

Net cash outflow from operating activities (2,601) (1,652) (2,750)

Net cash outflow from investing activities - - -

Net cash outflow from financing activities - - -

------------- ------------- -----------

Net reduction in cash generated by

the subsidiary (2,601) (1,652) (2,750)

------------- ------------- -----------

12. Forward-Looking statements

This report contains certain forward-looking statements with

respect to the financial condition of Kinovo Plc. These statements

involve risk and uncertainty because they relate to events and

depend on circumstances that will occur in the future. There could

be a number of factors which influence the actual results and

developments. These could impact on the forward-looking statements

included in this report.

13. Interim Report

Copies of this Interim Report will be available to download from

the investor relations section on the Group's website

www.kinovoplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KDLFLXFLXFBK

(END) Dow Jones Newswires

November 28, 2023 02:00 ET (07:00 GMT)

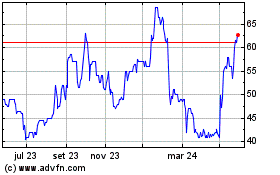

Kinovo (LSE:KINO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

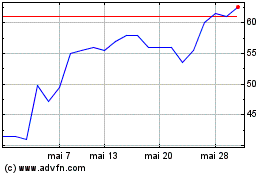

Kinovo (LSE:KINO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025