TIDMRBD

RNS Number : 5622W

Reabold Resources PLC

13 December 2023

13 December 2023

Reabold Resources plc

("Reabold" or the "Company")

Publication of Circular and Notice of Requisitioned General

Meeting

As announced on 22 November 2023, Reabold received a Requisition

Notice (the "Requisition Notice") from Pershing Nominees Limited

("Pershing"), which owns approximately 7.79% of the Company's

issued share capital on behalf of thirteen beneficial shareholders

(the "Requisitioning Shareholders"), requesting the Board to

convene a general meeting under section 303 of the Companies Act

2006 as amended ("Act"), to consider resolutions which, taken

together, remove the entire current board of directors and replace

them with four new directors of their own choosing.

Accordingly, the Company has today published a circular to

Shareholders (the "Circular") in response to the Requisition Letter

and a Notice of General Meeting (the "Notice") convening the

requisitioned General Meeting for Shareholders which is to be held

at 8th Floor, The Broadgate Tower, 20 Primrose Street, London EC2A

2EW at 10:00am on 10 January 2023.

Extracts from the Circular are available below. A copy of the

Circular and Notice will shortly be made available to view at

www.reabold.com .

The Board Unanimously Recommends Shareholders VOTE AGAINST ALL

Resolutions for, inter alia, the following reasons:

1. The Requisitioning Shareholders are, once again, attempting

to gain control of Reabold, its operational asset base and its

cash, without paying a control premium.

2. The Board believes that the motives of the Requisitioning

Shareholders cannot be trusted and the Board has multiple examples

of Kamran Sattar attempting to extract value from Shareholders for

self-serving gains.

3. The Requisitioning Shareholders have conducted themselves in

a manner that the Board considers to be unprofessional, and the

Board condemns the decision to force the Company to commit further

valuable time and resources to yet another proxy battle.

4. The Board believes this second requisition for a general

meeting is vexatious in nature and serves only to disrupt and

impede the Board and Reabold.

5. The Board finds it concerning that the Requisitioning

Shareholders have not proposed a clear strategy for Reabold and its

assets.

6. The Board is concerned that there is a potential conflict of

interest with respect to the proposed CEO, Andrea Cattaneo (who is

the current CEO & President of Zenith Energy) and another

Proposed Director, José Ramón López-Portillo Romano (the current

Chairman of Zenith Energy). Zenith Energy is listed on the Main

Market of the London Stock Exchange and is a competitor of

Reabold.

7. The Requisitioning Shareholders state that they are

dissatisfied with the Company's strategy, yet in previous

communications with the Company, Kamran Sattar communicated his

alignment with the strategy, and his desire to publish a joint

statement of support for the Board on 12 October 2023.

8. The Board believes the Requisitioning Shareholders have

proved that they are not aligned with ALL Shareholders and has

evidence that they want control of the Company and its assets and

are acting in a self-serving manner.

9. Should the Requisitioning Shareholders be successful in

removing the entire existing Board, which is currently compliant

with the QCA Code's guidelines, the corporate governance standards

of Reabold would be jeopardised.

A statement from the Board of Reabold:

"It is the Board's view that the requisitioned general meeting

is an opportunistic attempt to, once again, seize control of the

Company and its assets without paying a control premium to all

shareholders.

"The Board believes the motives of the Requisitioning

Shareholders cannot be trusted and that the timing of the

Requisition Letter is not coincidental; it is in fact

opportunistic. The first requisition coincided with the first

tranche payment due from Shell for the sale of Corallian. This

second requisition coincides with the subsequent GBP5.2 million

received from Shell on 5 December 2023 and GBP4.4 million expected

in the coming months. The timing is such that the Proposed

Directors would be in control of a well-funded company should the

Resolutions be duly passed, and the Board strongly believes that

the Requisitioning Shareholders and Proposed Directors are using

this requisitioned general meeting as a way of attempting to take

control of your Company, your cash and your assets.

"Of significant concern to the Company is the fact that Kamran

Sattar and Portillion have invested approximately GBP2.7 million

and are interested in 40% of Daybreak Oil & Gas, with Reabold

holding a 42% interest. Given Mr. Sattar's significant interest in

Daybreak, the Board fears that Mr Sattar has a strong motive to

take control of Reabold in order to prioritise the Company's cash

resources towards Daybreak ahead of investments in West Newton and

Colle Santo, and making capital returns to Shareholders. Daybreak

is not a capital priority for the current Board, which the Board

believes is a source of frustration to Mr Sattar and Portillion.

Mr. Sattar has proposed, to the management of Reabold, that Reabold

acquires Mr Sattar and Portillion's interest in Daybreak.

"We continue to develop our portfolio of assets, and over the

next twelve months we expect to see progress towards the first

horizontal well at West Newton, the continued development of the

Colle Santo project in Italy, and the execution of capital returns

to Shareholders. Replacing the Board of Reabold with Proposed

Directors that do not possess the same level of experience and

understanding could significantly derail the development of these

assets at a crucial time for the Company and its shareholders."

Capitalised terms used herein but not otherwise defined shall

have the same meaning given to them in the Circular being posted to

shareholders today.

For further information, contact:

Reabold Resources plc c/o Camarco

Sachin Oza +44 (0) 20 3757

Stephen Williams 4980

Strand Hanson Limited - Nominated +44 (0) 20 7409

& Financial Adviser 3494

James Spinney

James Dance

Rob Patrick

Stifel Nicolaus Europe Limited +44 (0) 20 7710

- Joint Broker 7600

Callum Stewart

Simon Mensley

Ashton Clanfield

Cavendish - Joint Broker +44 (0) 20 7220

Barney Hayward 0500

Camarco

Billy Clegg

Rebecca Waterworth +44 (0) 20 3757

Sam Morris 4980

Notes to Editors

Reabold Resources plc has a diversified portfolio of

exploration, appraisal and development oil & gas projects.

Reabold's strategy is to invest in low-risk, near-term projects

which it considers to have significant valuation uplift potential,

with a clear monetisation plan, where receipt of such proceeds will

be returned to shareholders and re-invested into further growth

projects. This strategy is illustrated by the recent sale of the

undeveloped Victory gas field to Shell, the proceeds of which are

being returned to shareholders and re-invested.

LETTER FROM THE CHAIRMAN

REABOLD RESOURCES PLC

Directors: Registered Office:

Jeremy Samuel Edelman The Broadgate Tower

Michael Craig Felton 8(th) Floor

Marcos Estanislao Mozetic 20 Primrose Street

Sachin Sharad Oza London

Anthony John Samaha EC2A 2EW

Stephen Anthony Williams

13 December 2023

Dear Shareholder,

NOTICE OF REQUISITIONED GENERAL MEETING

The Board considers the Resolutions proposed by Pershing, on

behalf of the Requisitioning Shareholders, to be an opportunistic

attempt to gain control of YOUR company without paying a control

premium

The Board recommends Shareholders VOTE AGAINST ALL the

Resolutions at the General Meeting

1. Introduction

As announced by the Company on 22 November 2023, Reabold

received a requisition letter (the "Requisition Letter") from

Pershing Nominees Limited ("Pershing"), on behalf of Kamran Sattar,

Stephen Pycroft, Napsbury Holdings Ltd, Lagan Holdings Ltd, Brendan

Kerr, Michael Lagan, Kevin Lagan, John Patrick Keehan, Keltbray

Ltd, Majithia S, Sheikh B, Asim Sarwar and Roman Teslya (the

"Requisitioning Shareholders"), pursuant to section 303 of the

Companies Act, requesting the Board to convene a general meeting of

Shareholders.

The Resolutions to be put to Shareholders at the General Meeting

comprise the removal of all six of the existing Directors of the

Company, the removal of any director appointed to the Company

subsequent to the date of the Requisition Letter, and the

appointment of four new directors proposed by the Requisitioning

Shareholders.

The Board regrets to inform Shareholders that they will have to

engage with another Requisition procedure from Pershing, which it

considers unnecessary and vexatious in nature. These procedures

take up significant management time, as well as generating

significant unnecessary costs for Reabold. The focus of management

and the Directors should be on delivering value from the various

activities being undertaken by the Company, including, but not

limited to, the Rathlin funding/farmout process currently underway

with Hannam & Partners and its investment in LNEnergy.

Following several failed attempts, the Board believes that the

Requisitioning Shareholders are once again trying to gain control

of Reabold, its operational asset base and its cash, without

compensating Shareholders appropriately or paying a control

premium.

The Board also believes that the Proposed Directors are not

appropriate for the Company and include individuals with a track

record of value destruction as public company board directors in

some instances, or no public board experience that we are aware of.

Two of the Proposed Directors have potential conflicts of interest

with Reabold and the other two Proposed Directors were voted by

Shareholders not to be appointed to the Board at the last

requisitioned general meeting in November 2022.

The purpose of this letter is to provide Shareholders with

details of the Resolutions and to explain why the Board strongly

believes that these Resolutions are not in the best interests of

the Company. The Board unanimously recommends that you VOTE AGAINST

ALL the Resolutions.

PLEASE DO NOT ABSTAIN FROM VOTING - YOUR VOTE IS NEEDED

A statement from the Board of Reabold:

"Firstly, the Board would like to express its sincere regret

that, little more than one year on from the previous requisition

from Pershing Nominees Limited, Shareholders will once again have

to engage in a requisition of a general meeting. The Board

considers certain of the Requisitioning Shareholders' actions to be

unprofessional and condemns the decision to drag the Company into

another proxy battle for the personal interests of a small number

of individuals.

"The Board believes that the current management team is

delivering on its strategy, with the Company currently holding

significant stakes in two of the largest onshore undeveloped gas

discoveries in Western Europe and remains focused on developing

Western gas assets in response to the European gas crisis. Since

the Company's restructuring in 2017, the management team has built

a substantial portfolio of upstream assets with highly active

drilling operations relative to other small cap oil and gas

companies.

"The Board is unanimous in its view that the Requisitioning

Shareholders are, once again, trying to gain control of Reabold,

its operational asset base and its cash, without paying a control

premium. In March this year, one of the Proposed Directors, Kamran

Sattar, via Portillion, made an unsolicited indicative offer for

the Company, which was deliberately leaked by Mr. Sattar via a

media outlet prior to approaching the Company. Portillion did not

make a firm offer for the Company and therefore brought no value to

Shareholders; rather it consumed management's time and the

Company's cash resources dealing with the regulatory implications

and workstreams.

"It is the Board's view that this leaked expression of interest

clearly shows that Mr. Sattar sees the intrinsic value of the

Company and its assets, but does not possess either the desire or

the means to make a firm offer to acquire Reabold and seemingly did

not seek appropriate professional advice in relation to the matter.

In line with the key fiduciary responsibility of the Board, we

would of course engage in any discussion regarding a reasonable and

bone fide offer for the Company, but the Board does not intend to

cede control without ALL Shareholders being compensated

appropriately and the bidder going through the proper process to

make a realistic offer for the Company at a recommendable

premium.

"The Board believes the motives of the Requisitioning

Shareholders cannot be trusted and that the timing of the

Requisition Letter is not coincidental; it is in fact

opportunistic. The first requisition coincided with the first

tranche payment due from Shell for the sale of Corallian. This

second requisition coincides with the subsequent GBP5.2 million

received from Shell on 5 December 2023 and GBP4.4 million expected

in the coming months. The timing is such that the Proposed

Directors would be in control of a well-funded company should the

Resolutions be duly passed, and the Board strongly believes that

the Requisitioning Shareholders and Proposed Directors are using

this requisitioned general meeting as a way of attempting to take

control of your Company, your cash and your assets.

"The Board has serious concerns about all four Proposed

Directors, which include individuals with a track record of

significant value destruction as public company board directors in

some instances, or no public board experience that we are aware of.

Additionally, two of the Proposed Directors' appointments were

voted down by Shareholders at the last requisitioned general

meeting in November 2022. Two of the Proposed Directors currently

sit on the board of Zenith Energy - a competitor to Reabold, which

poses a potential conflict of interest which may result in

operational, governance and regulatory issues should such Proposed

Directors be appointed to the Board.

"Should the Requisitioning Shareholders be successful in

removing the entire existing Board, which is currently compliant

with the QCA Code's guidelines, the corporate governance standards

of Reabold would be jeopardised.

"Once again, the Requisitioning Shareholders have not proposed a

coherent, alternative strategy for Reabold and its assets. The

Board disputes the notion that the Proposed Directors possess a

better understanding of, and better relationships with, key

stakeholders critical to the successful implementation of the

Company's business strategy.

"The Board believes that the Proposed Directors are acting in a

self-serving manner by trying to extract value from Shareholders

and are not acting in the best interest of all Shareholders of

Reabold. If the Requisitioning Shareholders or Zenith Energy want

to gain control of your Company, they need to compensate

Shareholders appropriately and pay a control premium. The Board

would seriously consider any proposal which is credible and funded,

at an appropriate valuation, in-line with its statutory and

fiduciary duties."

The Board recommends that Shareholders VOTE AGAINST ALL

Resolutions at the General Meeting

The Board believes that the Resolutions being proposed at the

General Meeting, requisitioned by Pershing on behalf of the

Requisitioning Shareholders, are NOT in the best interests of the

Company and Shareholders as a whole and unanimously recommends that

you VOTE AGAINST ALL of the Resolutions at the General Meeting.

2. Reasons why the Board recommends you to VOTE AGAINST ALL the Resolutions

a. The Requisitioning Shareholders are, once again, attempting

to gain control of Reabold, its operational asset base and its

cash, without paying a control premium.

In-line with its duties, the Board would consider any reasonable

bona fide offer for the Company by the Requisitioning Shareholders,

but the Board will not cede control of the Company without ALL

Shareholders being compensated appropriately and being paid a

control premium. The Board believes that the timing of this action

is opportunistically linked to the GBP5.2 million second cash

payment from Shell, received on 5 December 2023, and the third cash

payment of GBP4.4 million that is expected in the coming months

from the sale of the Company's Corallian assets to Shell, such that

the Proposed Directors would be in control of a well-funded

Company, should the Resolutions be duly passed.

On 26 October 2023, Kamran Sattar enquired of the Board when the

deadline for the incoming Shell payment was; eight days later, the

Company learnt that a draft of the Requisition Letter had been

leaked to the media by Mr. Sattar, albeit the Company notes that

the notice was itself deficient and required significant revision

prior to being resubmitted.

Kamran Sattar and Portillion have invested approximately GBP2.7

million and are interested in 40% of Daybreak Oil & Gas, with

Reabold holding a 42% interest. Given Mr. Sattar's significant

interest in Daybreak, the Board fears that Mr Sattar has a strong

motive to take control of Reabold in order to prioritise the

Company's cash resources towards Daybreak ahead of investments in

West Newton and Colle Santo, and making capital returns to

Shareholders. Daybreak is not a capital priority for the current

Board, which the Board believes is a source of frustration to Mr

Sattar and Portillion. Mr. Sattar had previously proposed, to the

management of Reabold, that Reabold acquires Mr Sattar and

Portillion's interest in Daybreak.

b. The Board believes that the motives of the Requisitioning

Shareholders cannot be trusted and the Board has multiple examples

of Kamran Sattar attempting to extract value from Shareholders for

self-serving gains:

i) On 20 April 2023, Mr. Sattar contacted the Company with a

proposal to procure the sale of certain web domains, which included

website addresses bearing Reabold's name and the website he had set

up for the first requisition attempt, to the Company for

GBP100,000. Mr. Sattar claimed that this sum represented the costs

incurred by him for the previous requisition. The Company did not

engage in what it considered to be an irresponsible use of

Reabold's cash resources. Mr. Sattar then followed up with a

much-reduced offer of "GBP20,000 - GBP25,000", on 12 October 2023

and a further revised offer of GBP30,000 on 20 October 2023 (see

also paragraph 2 g below). The Company declined this offer from Mr.

Sattar and a previous undated invalid requisition letter was leaked

to the media on 3 November 2023.

ii) In March 2023, four months after failing to pass any of the

proposed resolutions at the requisitioned general meeting in

November 2022, Kamran Sattar made an unsolicited, indicative offer

for the Company on behalf of Portillion SPV O&G, which was

initially leaked by Mr. Sattar to the media (along with materially

misleading statements about the terms of the offer and its status)

before approaching the Company. The Company was obliged to make an

announcement pursuant to the Takeover Code, thereby commencing an

offer period and had to allocate significant resources, including

cash, to comply with all applicable regulatory and legislative

requirements.

Portillion's leaked possible offer was not supported by any

meaningful engagement, save for a rudimentary email and the Board

believes that the approach was not made following a diligent and

prudent process. The possible offer subsequently received was

proposed to be at a 10% premium to Reabold's prevailing share

price, which the Board considered to materially undervalue the

Company's investment portfolio and business as a whole.

The act of leaking such information regarding a potential bid

for a company subject to the Takeover Code is in contravention of

the strict confidentiality provisions set out in the Takeover Code.

The unprofessional nature of these actions is compounded by the

fact that misleading information about the possible offer price and

the status of the possible offer was leaked to media outlets. The

Board notes that such behaviour may constitute a potential breach

of the UK Market Abuse Regulation, which prohibits certain

activities that comprise market manipulation (in particular the

dissemination of false or misleading information).

Portillion confirmed that it did not intend to make a firm offer

28 days later. It is the Board's view that this early stage and

under-prepared expression of interest shows that Mr. Sattar sees

the intrinsic value of the Company and its assets, but does not

possess either the desire or the means to make a firm offer. The

Board considers this Requisition to represent yet another attempt

to gain control of the Company without paying a premium.

c. The Requisitioning Shareholders have conducted themselves in

a manner that the Board considers to be unprofessional, and the

Board condemns the decision to force the Company to commit further

valuable resources to yet another disorganised proxy battle.

The Board deeply regrets to inform Shareholders that they will

have to engage with another disorganised proxy attack from the

Requisitioning Shareholders. As a professionally run public

company, Reabold does not want to be involved in another "soap

opera" proxy battle of this nature, which will be a serious

distraction from the Company's strategy. The unprofessional nature

of the requisition is evidenced by the actions of the

Requisitioning Shareholders to date, including:

-- the leaking of a draft invalid requisition notice to the

media and internet message boards on 3 November 2023, prior to it

being sent to the Company, which required the Company to make an

announcement in response to media speculation and confirming that

the Company had not received any form of communication from, or on

behalf of, the Requisitioning Shareholders with regard to a

requisition;

-- the Requisitioning Shareholders sending an invalid

requisition notice to the Company by email on 7 November 2023,

which was materially deficient and therefore invalid (see the

Company's announcement of 14 November 2023);

-- the Requisitioning Shareholders eventually delivering the

Requisition Letter after business hours on 21 November 2023

(despite the letter being dated 15 November 2023) which contained

materially different resolutions to those contained in the invalid

requisition notice of 7 November 2023; and

-- the apparent dissemination of false or misleading information

about the Company, its assets and the Requisition on internet

message boards by users that claim to be in direct dialogue with

Kamran Sattar.

The Board and the Company's advisers are currently reviewing the

nature of the media and internet leaks to date (and similar other

actions by certain of the Requisitioning Shareholders, such as that

detailed in paragraph 2 b ii) above). The Board is concerned that

these actions are not only inappropriate from certain individuals

purporting to be suitable directors of an AIM-quoted company but

that they may also constitute market abuse.

The amateurism is typical of the Requisitioning Shareholders'

approaches to Reabold and the Board believes it has resulted in

certain institutional Shareholders exiting their position in the

Company, who consider the approach taken by the Requisitioning

Shareholders to be below the standards of business within which

they operate.

Kamran Sattar has attempted shareholder activism before and

deployed similar tactics. The Board notes the announcement made by

Bushveld Minerals Limited on 10 October 2023, stating that there

had been market speculation regarding Kamran Sattar and

Portillion's intention to call a general meeting of shareholders in

order to effect boardroom changes; however, Mr. Sattar subsequently

confirmed in writing that he no longer intended to requisition a

general meeting. The Board considers this to demonstrate the lack

of coherence in Mr. Sattar's approach to shareholder activism,

which Reabold has also had to contend with. His disregard for

confidentiality and public market conduct through his activist

approaches, which have repeatedly been leaked through media outlets

and internet message boards, is a major cause for concern.

The Board notes that both Portillion and Kamran Sattar are

regulated by the Financial Conduct Authority and is therefore

astounded at the unprofessional approach to these serious matters

relating to market conduct, some of which impact directly on

shareholder value, where many of these campaigns seem to be carried

out without appropriate professional advice.

d. The Board believes this second requisition for a general

meeting is vexatious in nature and serves only to disrupt and

impede the Board and Reabold.

The Board believes that the second requisition procedure is

motivated by the Requisitioning Shareholders' desire to derive

personal benefits, gain publicity for themselves and create a

nuisance for the Board. The unsuccessful requisition of November

2022 was a serious and costly distraction for the Company and its

Shareholders . The Company will again be forced to commit

significant time and resources to managing the proxy battle, which

could instead be deployed to further deliver on the Company's

growth strategy.

The Requisition Letter is inflammatory and contains

unsubstantiated and false allegations throughout, which the Board

responds to in full below.

e. The Board finds it concerning that the Requisitioning

Shareholders have not proposed a clear strategy for Reabold and its

assets.

The Requisitioning Shareholders have not proposed a coherent,

alternative strategy to run the Company. The Board would like to

flag that, in the Requisition Letter, the Proposed Directors plan

to recommend that GBP3 million be returned to Shareholders if the

requisition is successful. Reabold has already stated its intention

to distribute GBP4 million to Shareholders now that it has received

the second tranche of funds from Shell, the mechanism of which is

to be determined upon consultation with Shareholders. The Board

questions the intent behind the Requisitioning Shareholders'

actions and believes that the group wishes to take control of the

Company as the further tranches of cash arrive from the sale of

Corallian to Shell.

The Board's strategy is to replicate its success with Corallian

and make considerable further distributions from future

monetisation events to return cash to Shareholders.

f. The Board is concerned that there is a potential conflict of

interest with respect to the proposed CEO, Andrea Cattaneo (who is

the current CEO & President of Zenith Energy) and another

Proposed Director, José Ramón López-Portillo Romano (the current

Chairman of Zenith Energy). Zenith Energy is listed on the Main

Market of the London Stock Exchange and is a competitor of

Reabold.

Andrea Cattaneo is currently CEO & President and sits on the

board of Zenith Energy, a competitor company to Reabold and a

company in which Mr Cattaneo is a significant shareholder

(according to Zenith's most recent annual report). The Board sees

this as a potential conflict of interest which could result in

regulatory and governance issues. There has not been any

announcement from Zenith communicating that Mr. Cattaneo is

stepping down or looking for an alternative role.

The Board therefore fails to understand how the Requisitioning

Shareholders' proposed CEO will be able to devote sufficient time

to Reabold whilst also acting as CEO for Zenith Energy. The Board

considers this particularly perplexing given that the

Requisitioning Shareholders have explicitly stated that "it is

unfathomable the executives can devote sufficient time to the

Company whilst having directorship commitments for numerous other

companies," whilst the only directorship roles that Mr. Oza and Mr.

Williams hold are non-executive and on the boards of Reabold's

investee companies. The Board also notes that the voting guidelines

from proxy advisers ISS and Glass Lewis in relation to

"overboarding" - i.e. the concept that directors should not serve

on too many listed company boards - recommend a maximum number of

five board mandates. Under those guidelines, executive director

roles count as triple mandates and, therefore, if elected to

Reabold's Board as CEO, Mr Cattaneo would hold the equivalent of

six mandates.

Mr. Romano currently also sits on the board of Zenith Energy,

which represents another conflict of interest and potential

corporate governance issues. He has acted as Zenith's Chairman

since 2017.

Furthermore, the Board's concern about potential conflicts of

interest in relation to Mr. Cattaneo and Mr. Romano (who are the

two most senior officers on the Board of Zenith) is not merely

theoretical. Zenith has previously made an offer to acquire a

substantial interest in Daybreak Oil and Gas and, although a

transaction was never executed, the Board believes this puts the

motives of the Requisitioning Shareholders into question,

suggesting that they want to gain control of Reabold's assets

without paying a control premium.

Zenith's share price has depreciated over 65% year-to-date to

3.20p and has seen value destruction of 97% since the company

listed on the London Stock Exchange in 2017 at a price of 101.25p,

under Mr. Cattaneo and Mr. Romano's leadership.

g. The Requisitioning Shareholders state that they are

dissatisfied with the Company's strategy, yet in previous

communications with the Company, Kamran Sattar communicated his

alignment with the strategy, and his desire to publish a joint

statement of support for the Board on 12 October 2023.

In a meeting between Kamran Sattar, Stephen Williams and Sachin

Oza on 12 October 2023, Mr. Sattar stated his support for the

Company's strategy and, un-prompted, expressed his willingness to

support Reabold's management and cooperate with the Company. He

stated: "If we want, I will be happy to make a statement. I think

it's potentially time to do so if we can jointly just put to rest

or at ease [ Shareholders ] that Portillion are supporting Reabold

and are happy to support management at Reabold, and not looking to

do any requisition or takeover of the business, after speaking with

the board [we are] supportive."

Following that meeting, the Company and its retained PR advisers

prepared a draft joint statement which the Company sent to Mr.

Sattar on 20 October 2023 for his review and comment. Mr. Sattar

replied on the same day and stated that any joint statement would

be subject to the Company "covering our costs and website of

GBP30,000". The Company did not accept those conditions.

The Board is concerned that Mr. Sattar's inconsistent messaging

and vacillating support for Reabold's strategy represents a more

general lack of reliability and coherence and is further evidence

of a lack of professionalism and credibility. It is also telling

that the Requisition was submitted shortly after Reabold declined

to make payments to Portillion in exchange for websites bearing the

Company's name.

h. The Board believes the Requisitioning Shareholders have

proved that they are not aligned with ALL Shareholders and has

evidence that they want control of the Company and its assets and

are acting in self-serving manner.

As a reminder to Shareholders, in October 2022, certain of the

Requisitioning Shareholders attempted to gain control of the

Corallian North Sea exploration assets which Reabold bought for

GBP250,000. Kamran Sattar and Cathal Friel offered Corallian

GBP500,000 after an agreement had already been entered into with

Reabold.

They also tried to reduce the conversion price of convertible

loan notes that were issued to the group from GBP3.20 to GBP1.50

which would have been to the detriment of ALL other Reabold

Shareholders by devaluing the sale of Corallian to Shell. The Board

believes that the relationship established with Shell will be

beneficial to the Company in the medium to long term due to future

potential transactions and that the last-minute convertible loan

note changes, proposed by Portillion, potentially undermined

Reabold's reputation as a creditable counterparty in the

industry.

i. Should the Requisitioning Shareholders be successful in

removing the entire existing Board, which is currently compliant

with the QCA Code's guidelines, the corporate governance standards

of Reabold would be jeopardised.

Mr. Andrea Cattaneo is the CEO and President of Zenith and has

been proposed by the Requisitioning Shareholders to also be the CEO

of Reabold. The nominated CEO holding another CEO role at a

competitor is a clear governance failing. Not only does this mean

that his external time commitments would be very demanding, but he

could not possibly be acting in the best interests of Reabold while

serving as an executive director of a competitor. The Board also

notes that, for the purposes of the ISS and Glass Lewis

overboarding guidelines, Mr Cattaneo would hold the equivalent of

six board mandates against the recommended maximum of five

mandates. The fact that two of the Proposed Directors are also on

the Board of Zenith Energy compromises their independence,

particularly as Zenith is a competitor of Reabold and it is not

clear what their intentions are in relation to the two

companies.

It should also be noted that a significant conflict of interest

would arise should Kamran Sattar be appointed to the Board as he

represents the other major shareholder in Daybreak where his

investment company, Portillion and Kamran Sattar personally, have a

40% holding. As a result, he may be conflicted and could

potentially have competing interests to those of the Shareholders.

The Board considers this unacceptable.

The Board reminds Shareholders that two of the Proposed

Directors were previously proposed to be appointed to the Board in

November 2022 at a requisitioned general meeting, however

Shareholders voted not to elect Francesca Yardley and Kamran Sattar

to the Board by a majority of 75.19% and 75.20%, respectively. The

relationship the Requisitioning Shareholders have with Ms Yardley

is not clear and it is possible that, if each of the nominees are

elected, the Board could have insufficient independence and thus

breach the QCA Code.

We also note that the Board has been unable to find any UK

public company director experience for Mr. Sattar or Ms.

Yardley.

The existing Board comprises two executive directors and four

non-executive directors, two of which are considered to be

independent, which provides the Company with a balanced board, a

strong level of independence and appropriate executive function,

which is supported by a non-board level Chief Financial Officer.

Indeed, the Board is committed to achieving high levels of

corporate governance as set out in detail in its annual corporate

governance statement which is available on the Company's

website.

Should all the Resolutions be duly passed, the Board expects

that Reabold's standards of corporate governance would be hampered.

The Company currently complies with the QCA Code's 10 principles

which assign great responsibilities to the board of directors. The

QCA Code contains a list of requirements, including that a board

should have a clear view on a company's purpose and strategy, that

a board understands the needs of its stakeholders, that a board

identify risks facing the company, and that a board be comprised of

at least two independent non-executive directors. The Company's

governance structure could be harmed if the proposed Resolutions

are passed, and we do not believe that this is in the best interest

of the Company or its Shareholders.

3. Why the criticism of the Board by the Requisitioning

Shareholders should be dismissed out of hand.

In various letters and exclusive press briefings, the Board

notes a plethora of criticism and allegations by the Requisitioning

Shareholders and Proposed Directors. Set out as follows is the

Board's response to various of these allegations.

Allegation

"The Requisitioning Shareholders are dissatisfied by the

announced sale of Corallian, having expected a significantly higher

valuation to be achieved based on a previously stated valuation of

Corallian of GBP190 million."

Response

Corallian was sold for GBP32.0 million which was significantly

above book value, with GBP12.7 million net to Reabold. Reabold

acquired Corallian's remaining six licences for a total

consideration of GBP250,000, whilst it invested only GBP7.5 million

(net) across the entire Corallian portfolio. Reabold never guided

to a sale price for Corallian, and to talk about expectations of a

higher price is considered to be misleading.

The sale of Corallian was achieved as a result of an extremely

thorough process run over several months which tested the market,

and the best offer was accepted and subsequently the deal

successfully executed. According to the Company's analysis, the

sale price is more than 50% higher than trading values of North Sea

peer companies with similar undeveloped assets, and c.30% higher

than comparable North Sea transactions for undeveloped assets. This

was despite selling into a crowded market, with many competing

asset packages for sale in the North Sea.

The Corallian sale is proof of the business model and strategy,

achieving monetisation of investments, giving the Company financial

flexibility to make a distribution to Shareholders and progress the

strategy from a re-capitalised footing, which is now being

disrupted by another general meeting requisition.

Certain of the Requisitioning Shareholders attempted to prevent

Reabold retaining ownership of the six non-Victory Corallian

licences and even attempted to circumvent Reabold acquiring these

assets by offering GBP500,000 (a 100% premium to the acquisition

price achieved by your Board) to Corallian for the assets. This

would have deprived Shareholders of the value we expect to create

from these assets.

Allegation

"The Requisitioning Shareholders are dissatisfied by the

performance and time taken at West Newton; its valuation accretion

has only occurred because of current energy prices."

Response

The Company continues to make meaningful progress at West

Newton.

The Environmental Agency permit for the use of oil-based

drilling fluids at the West Newton B-2 well was approved on 27

September 2023 and a horizontal well is planned for H1 2024.

Reabold is fully funded for its share of the next West Newton

well.

There has been substantial progress at West Newton since Reabold

invested in November 2018, including:

-- Two wells drilled;

-- Gross 2C unrisked recoverable resource of 197.6 bcf of sales

gas at an 86% geological chance of success underpinning the strong

commercial and economic case for West Newton;

-- CPR estimates a prospective resource of 363.7 bcf of sales

gas at a 43% geological chance of success;

-- Extensive work done by, inter alia, Applied Petroleum

Technology, CoreLab N.V. and RPS Group to:

o Model flow potential from West Newton wells; and

o Inform the drilling and completion method to achieve good well

productivity;

-- Engagement with various regulatory bodies including securing

planning permission for drilling further wells at West Newton.

Allegation

"The view of the requisitioning shareholders is that the

regulatory/administrative route in relation to the Colle Santo

project is very complicated - the first development plan was

rejected and the operator has been waiting for the production

concession since 2009. In addition, the proximity to the "Bomba"

lake dam makes the Colle Santo project potentially sensitive in

terms of public safety."

Response

The Board welcomes the opportunity to put the record straight

with regards to the Colle Santo project, which has already seen

significant progress with its approval process.

On 5 September 2023, the Abruzzo regional government confirmed

its agreement with, and intention to approve, by decree, the Early

Production Programme for the Colle Santo gas field, allowing early

revenue generation from the Colle Santo project. LNEnergy, a

company in which Reabold holds a 26.1% interest, signed a letter of

Intent with a major Italian Engineering, Procurement and

Construction ("EPC") company, Italfluid, for a micro-LNG plant in

Italy, which would result in a significant reduction in upfront

capex to get the field to production.

The Colle Santo project is particularly exciting for Reabold

because:

-- It has minimal sub-surface risk, and is development ready

with no additional drilling required;

-- The regulatory landscape is clearly changing in Italy, and

verbal confirmation has been received from the regional government

for an early production system;

-- The project is valuable for energy security and the energy

transition in Italy, which is increasingly driving the national

government's agenda;

-- Reabold enjoys an excellent relationship with the important

Italian EPC company, Italfluid, which is acting as contract

operator for the whole project; and

-- LNEnergy believes that the field has the potential to

generate an estimated EUR11-12m of gross post-tax free cash flow

per annum.

The first development plan rejected in 2021 is very different to

the new development plan submitted by LNEnergy for the development

of the project, with a significant reduction in footprint relative

to the original proposal submitted by Forest Oil. The revised Colle

Santo project concept includes:

-- Focus on micro-LNG, a transition fuel which has a central

role in the EU's net zero energy plan;

-- Production of only two existing wells with no further

drilling; the previous development plan had up to five wells;

-- Reduction of natural gas extraction below 50%, with only

40,800 LNG tons/year; the previous development plan projected gas

production of 650,000 Smc/d maximum;

-- No construction of a 21 km natural gas pipeline from the

Municipality of Bomba to the Industrial Park of Atessa pipeline as

previously planned, and no connection to the SNAM network;

-- Liquefied gas delivered by road transport limited to 6-7 tankers per day;

-- On-site CO(2) capture and liquefaction; g as produced will be

converted to micro-LNG directly onsite using a small modular

micro-LNG processing unit; and

-- Emissions halved compared to the previous project proposal.

On 1 December 2023, the Italian Government approved a decree to

boost the country's renewable energy production and energy security

at the meeting of the Council of Ministers held on 27 November

2023. The decree provided incentives to build plants for energy

production from renewable sources, such as the liquefaction of

natural gas; the release of new licences for the exploitation of

gas fields aimed at providing gas to industries with high gas

consumption, at competitive prices; incentives for LNG terminals

and incentives for carbon dioxide storage programmes. Given the

focus on micro-LNG in the new development plan submitted by

LNEnergy, the Board believes that the regulatory environment in

Italy for the approval of the Colle Santo project is looking

increasingly promising.

Allegation

"The Requisitioning Shareholders are dissatisfied by the

Company's Board having failed to capitalise on the downtrend in oil

prices to acquire any producing assets to secure the future of the

business."

Response

Buying and operating producing assets is not part of the

Company's strategy nor investing policy, which has been

continuously articulated to and supported by Shareholders. The

Board does not know if acquiring producing assets would be part of

the strategy of the Requisitioning Shareholders, as they have not

set out a clear strategy for Reabold and its assets.

Allegation

"Each Co-CEO was paid an annual fee of GBP242k and a bonus of

GBP50k in 2022, and an annual fee of GBP231k and a bonus of GBP50k

in 2021. Meanwhile the loss for the year (before foreign exchange

realisations) was GBP45k in 2022, GBP2.675 in 2021 and 2.668m in

2020."

Response

This is inaccurate.

The GBP242,000 figure refers to salary and pension. Both the

Co-CEOs were paid a salary of GBP231,000 in 2021 and 2022 and were

not paid a bonus. The last bonus that was paid related to the

Company's performance in 2020. Neither Co-CEO has received a bonus

for either the 2021 or 2022 performance year. Please see below an

extract and notes from remuneration report from the Company's 2022

annual report below:

Executive Directors' pay for the year ended 31 December 2022

Sachin Stephen Anthony Sachin Stephen Anthony

Oza Williams Samaha(b) Oza Williams Samaha

Co-CEO Co-CEO FD Co-CEO Co-CEO FD

2022 2022 2022 2021 2021 2021

------------------- ----------- ----------- ----------- ----------- ----------- ----------

Salary GBP230,875 GBP230,875 GBP50,000 GBP230,875 GBP230,875 GBP73,333

Annual bonus(a) Nil Nil Nil GBP50,000 GBP50,000 Nil

Benefits Nil Nil Nil Nil Nil Nil

Pension GBP11,419 GBP11,419 GBP1,250 GBP11,419 GBP11,419 Nil

Performance shares Nil Nil Nil Nil Nil Nil

------------------- ----------- ----------- ----------- ----------- ----------- ----------

Total remuneration GBP242,294 GBP242,294 GBP51,250 GBP292,294 GBP292,294 GBP73,333

Notes:

(a) The annual bonus paid in 2021 related to the 2020

performance year. From 2022, annual bonuses are accrued in the year

in which they are earned.

(b) Anthony Samaha resigned as finance director on 30 June

2022

Sachin Oza's and Stephen Williams' salaries were not increased

in 2022. No bonuses were awarded for either the 2022 or 2021

performance year (see note a above). The Directors receive no

benefits from the Company apart from the pension contributions

shown in the table above and the directors are not paid by any

investee company where they sit on the board as a Reabold

representative. The Directors have never been awarded Ordinary

Shares as part of share option plans.

Reabold's total general and administrative expenses for the 2022

financial year was GBP1.7 million which is below the average of its

peers.

Regarding executive remuneration, Reabold has a remuneration

committee chaired by a senior independent non-executive Director in

line with the QCA Corporate Governance Code. All remuneration

payable to Directors is decided by the remuneration committee. In

2023, the committee engaged with BDO LLP to design the Company's

incentive package, which includes share options and bonuses. Share

option plans do not pay unless targets are met, and base salaries

were benchmarked by the Company's remuneration committee in 2021.

The executive Directors did not take a pay rise in 2022 despite the

inflationary environment.

Reabold's executive team's remuneration is comparatively lower

than peers of similar market capitalisation, as demonstrated

below:

Company Reabold Sound Deltic Union United Challenger

market capitalisation GBP11.1m Energy Energy Jack Oil Oil & Gas Energy

plc plc plc plc Group plc

GBP15.2m GBP20.7m GBP21.0m GBP4.1m GBP12.1m

Executive

Team Remuneration

2022 GBP535,838 GBP1,090,000 GBP905,190 GBP407,083 $833,209 $800,000

------------ -------------- ------------ ------------ ----------- -----------

Allegation

"an example showing the failure of the Company's current

management and their strategy is the Daybreak Oil & Gas

transaction for which Kamran Sattar and his group brought two

lucrative offers but the Company's management were unaware of these

offers despite having a board representative for the Company's

interest."

Response

Reabold is aware that the party that made offers to invest in

Daybreak Oil and Gas was Zenith.

Reabold management met with Andrea of Zenith on three occasions

prior to the offers made by Zenith to invest in Daybreak notably

the written offer on 7 June 2023. These meetings were on 27 April,

30 May and 2 June 2023. Reabold management attempted to follow up

on Zenith's interest in Daybreak on 26 July and 1 August 2023, but

received no intent to engage.

Reabold, through its significant equity holding, would be

supportive of any genuinely value accretive transaction involving

Daybreak.

The Board also wishes to correct the false statement that

Reabold has a board representative on the board of Daybreak. There

is no representative from Reabold on the board of Daybreak, a point

that had been repeatedly made to Kamran Sattar during a meeting on

12 October 2023.

Allegation

"The reason why hardly any other companies divide this role is

because of the need for clear leadership, which the Company is

devoid of."

Response

The management team consists of only three people (two Co-CEOs

and a CFO) and through these three positions, all functions of the

business are covered.

Sachin Oza and Stephen Williams provide complimentary and broad

skill sets ranging across technical understanding of the asset

base, business development, M&A, financial management, strategy

and stakeholder engagement, as well as the day to day running of

the business.

A number of similar public companies have larger management

teams carrying out these activities, whilst Reabold has always

maintained a focus on being as lean as possible, only taking on a

full time CFO last year.

Managing an asset base like the one within the Reabold

portfolio, as well as driving forward new investments and projects,

requires a significant amount of skill, experience and effort. The

Board considers the team to match these demanding requirements.

The fact that Sachin and Stephen both have the title of Co-CEO

reflects the collaborative nature of decision making within

Reabold. Out of this comes the innovative approach that Reabold has

taken to building a business, and a huge amount has been achieved

in a relatively short period of time.

Allegation

"Stephen Williams holds external directorships unrelated to the

Company...it is unfathomable the executives can devote sufficient

time to the Company whilst having directorship commitments for

numerous other companies."

Response

The Board disputes the validity of this statement. Stephen

Williams does not hold external directorships unrelated to the

Company.

The Board would like to point out that, with associate or

investee companies, it is standard practice to have executives

stand as a director, to provide critical influence over decision

making and investments, to protect Reabold's interests. The board

believes that Shareholders would expect such representation.

The Board does not believe that these are conflicting interests,

as Sachin Oza and Stephen Williams are on these boards as Reabold's

representatives, which is a key aspect of the oversight Reabold

maintains on its investments.

Stephen Williams is a director of Rathlin Energy (UK) Limited

and Sachin Oza of Danube Petroleum Limited and in both cases, they

declined to take a director fee. The modest fees that are payable

by Rathlin and Danube (which are in line with the fees paid to the

other directors of those companies) in respect of these board

positions are paid to Reabold and not to the individuals.

The Board is concerned at the apparent lack of understanding

that the Requisitioning Shareholders have demonstrated over the

Company they are proposing to take control of.

The Board would like to point out the contradictory nature of

the Requisitioning Shareholders' statement above, noting that the

Requisitioning Shareholders' proposed CEO is the CEO &

President of another listed company, Zenith Energy, and one of the

other proposed directors is currently Chairman of that same

company, a competitor of Reabold.

Allegation

"Since 2 Jan 2023 the Company's share price, and ultimately its

market capitalisation, has deteriorated from GBP0.064".

Response

Since 2 January 2023, Reabold's share price performance has been

in line with the FTSE AIM All-Share Energy index, despite the

Company's shares currently trading at a 74% discount to NAV, as at

the Last Practicable Date.

The Board believes the value of the Company will be realised in

time, but the recent share price performance is a frustration for

the management team. The Board is working hard to address this in

terms of more regular communications with Shareholders and

engagement with advisors.

The Board continues to be disappointed with the disconnect

between the Company's share price and the net asset value of the

Company and believes that the net asset value of the Company will

grow as it continues to implement its strategy.

The Company embarked on a share buyback programme, in April

2023, in part, to acknowledge the NAV to share price gap and

address Reabold's share price performance.

Allegation

"[Strategy should be to] align senior management positions with

stakeholders by the appointment of directors who have meaningful

stakes in the Company"

Response

The Directors of Reabold own a combined total of 3.22% of the

Company. In contrast, Kamran Sattar holds an interest of 1.63%. As

Directors of the Company, management review and consider buying

opportunities on a regular basis.

4. Action to be taken by Shareholders

Shareholders will find enclosed with this letter a Form of Proxy

for use at the General Meeting. The Form of Proxy should be

completed and returned in accordance with the instructions printed

on it so as to arrive at Neville Registrars Limited, by email to

info@nevilleregistrars.co.uk, by post or by hand (during normal

business hours and by appointment only) at the following address:

Neville Registrars Limited, Neville House, Steelpark Road,

Halesowen B62 8HD as soon as possible and in any event not later

than 10:00 a.m. on 8 January 2024.

Shareholders who hold their shares through CREST and who wish to

appoint a proxy for the General Meeting or any adjournment(s)

thereof may do so by using the CREST proxy voting service in

accordance with the procedures set out in the CREST manual. CREST

personal members or other CREST sponsored members, and those CREST

members who have appointed a voting service provider, should refer

to that CREST sponsor or voting service provider(s), who will be

able to take the appropriate action on their behalf. Proxies

submitted via CREST must be received by the Registrar (ID: 7RA11)

by not later than 10:00 a.m. on 8 January 2024.

5. Recommendation

The Board Recommends Shareholders VOTE AGAINST ALL Resolutions

at the General Meeting

For the reasons noted above, the Board unanimously consider that

the Resolutions are not in the best interests of the Company. The

Directors will be voting against the Resolutions in respect of

their own beneficial holdings. The Directors hold 334,204,685

Ordinary Shares in aggregate, representing approximately 3.22% of

the issued share capital of the Company as at the Last Practicable

Date. The Board therefore strongly recommends that Shareholders

VOTE AGAINST ALL the Resolutions being proposed at the General

Meeting.

6. Due diligence on Proposed Directors

Any appointments to the board of an AIM company are subject to

the satisfactory completion of regulatory due diligence and

appropriateness checks by the Company's Nominated Adviser, which

require the provision of relevant documentation from any proposed

director. None of the Proposed Directors put forward as part of the

Requisition has yet been subject to full due diligence, or been

approved by Strand Hanson, the Company's Nominated Adviser. Strand

Hanson has commenced this process in line with its requirements

under the AIM Rules for Companies and the AIM Rules for Nominated

Advisers. Strand Hanson has not yet received from the Proposed

Directors all the requisite information required to undertake its

due diligence process.

Should the outstanding information requested from the Proposed

Directors not be provided within a sufficient period to allow

Strand Hanson to make an informed assessment of the proposed

appointees by the time of the General Meeting, including engaging

external third party due diligence reports to be commissioned (as

required), or should Strand Hanson determine that any of the

Proposed Directors are not suitable to act as directors of the

Company, Strand Hanson may be forced to consider its position as

nominated adviser to the Company. In the event that Strand Hanson

were to resign as nominated adviser, the Company's ordinary shares

would be suspended from trading immediately and, in accordance with

AIM Rule 1, the Company would then have one month to replace Strand

Hanson as nominated adviser, failing which the Company's admission

to trading on AIM would be cancelled.

Yours faithfully

Jeremy Edelman

Chairman

For any shareholder questions to the Company in relation to the

information in this document, please use the following contact

details:

Telephone: +44 (0) 20 3781 8331

Email: reabold@camarco.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

CIRUUAUROBUUAUA

(END) Dow Jones Newswires

December 13, 2023 02:00 ET (07:00 GMT)

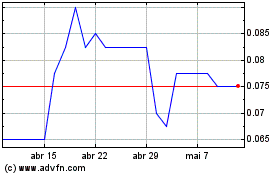

Reabold Resources (LSE:RBD)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Reabold Resources (LSE:RBD)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024